|

|

市場調査レポート

商品コード

1520994

免疫療法薬の世界市場:市場規模、シェア、動向:タイプ別、用途別、投与経路別、エンドユーザー別、地域別 - 2029年までの予測Immunotherapy Drugs Market Size, Share & Trends by Type, Application, Route of Administration, End User - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 免疫療法薬の世界市場:市場規模、シェア、動向:タイプ別、用途別、投与経路別、エンドユーザー別、地域別 - 2029年までの予測 |

|

出版日: 2024年07月19日

発行: MarketsandMarkets

ページ情報: 英文 335 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

免疫療法薬は、免疫反応を増強したり、免疫系の調節機構を調整したりすることで、病気の原因となる物質や細胞を効果的に標的にして排除できるように設計されています。

免疫療法薬の市場規模は、2024年の2,853億米ドルから2029年には5,806億米ドルに成長し、CAGRは15.3%になると予測されています。この成長は、抗体工学の技術進歩、臨床がん治療における抗体療法の需要増加、個別化医薬品や標的療法への嗜好の高まりなどが背景にあります。しかし、市場は抗体治療薬の開発に伴う複雑さなどの課題に直面しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2022年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント | タイプ別、用途別、投与経路別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ |

タイプ別では、抗体医薬、阻害剤、インターフェロン&インターロイキン、がんワクチン、その他の免疫療法薬(オンコリティックウイルス療法、T細胞療法など)に分けられます。抗体医薬が大きなシェアを占めています。がん罹患率の増加、生物学的療法の採用拡大、研究開発への投資拡大、政府の支援政策などが市場成長を促進すると予想されます。

免疫療法薬市場は用途別に、がん、自己免疫疾患・炎症性疾患、血液学、骨学、神経学、眼科、皮膚科、心血管疾患を含むその他の用途に分類されます。2023年にはがんが最大の市場シェアを占めました。がん罹患率の上昇、生物学的療法の採用の増加、研究開発投資の大幅な増加、有利な政府政策などが、予測期間中の市場成長を促進すると予想されます。免疫療法薬セクターの企業は、新たな治療法の開発、戦略的共同研究、がんの免疫療法治療法を模索するための臨床研究への投資強化を通じて、イノベーションを実証しています。こうした取り組みは、がんと闘う免疫系の能力を高め、新たな希望と患者の転帰の改善をもたらすことを目的としています。

投与経路に基づき、免疫療法薬市場は静脈内投与、皮下投与、その他の投与経路(硝子体内投与、筋肉内投与)に大別されます。2023年には、静脈内投与が免疫療法薬市場で最大のシェアを占めました。また、このセグメントは予測期間中に最も高いCAGRで成長すると予測されています。この大きなシェアと高い成長率は、血流に直接投与されるため、がんや自己免疫疾患などいくつかの疾患に対して迅速かつ安定した治療効果が得られることから、静脈内投与ルートへの選好が高まっていることに起因しています。

当レポートでは、世界の免疫療法薬市場について調査し、タイプ別、用途別、投与経路別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- バリューチェーン分析

- サプライチェーン分析

- 価格分析

- エコシステム分析

- 特許分析

- 技術分析

- 投資と資金調達のシナリオ

- 2024年~2025年の主な会議とイベント

- ケーススタディ分析

- 規制状況

第6章 免疫療法薬市場(タイプ別)

- イントロダクション

- 抗体医薬品

- 阻害薬

- インターフェロンとインターロイキン

- がんワクチン

- その他

第7章 免疫療法薬市場(用途別)

- イントロダクション

- がん

- 自己免疫疾患および炎症性疾患

- 血液

- 骨

- 神経

- その他

第8章 免疫療法薬市場(投与経路別)

- イントロダクション

- 静脈内投与

- 皮下投与

- その他

第9章 免疫療法薬市場(エンドユーザー別)

- イントロダクション

- 病院

- 長期療養施設

- その他

第10章 免疫療法薬市場(地域別)

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東

- アフリカ

第11章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 企業評価と財務指標

- ブランド/製品比較

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- MERCK & CO., INC.

- JOHNSON & JOHNSON SERVICES, INC.

- F. HOFFMANN-LA ROCHE LTD.

- ASTRAZENECA

- PFIZER INC.

- AMGEN INC.

- NOVARTIS AG

- ELI LILLY AND COMPANY

- SANOFI

- BRISTOL-MYERS SQUIBB COMPANY

- GILEAD SCIENCES, INC.

- TAKEDA PHARMACEUTICAL COMPANY LIMITED

- TEVA PHARMACEUTICAL INDUSTRIES LTD.

- ABBVIE INC.

- GSK PLC

- その他の企業

- IMMUNOCORE HOLDINGS PLC

- ASTELLAS PHARMA INC.

- GENMAB A/S

- MACROGENICS, INC.

- FERRING BV

- Y-MABS THERAPEUTICS, INC.

- BIOGEN

- KYOWA KIRIN CO., LTD.

- SWEDISH ORPHAN BIOVITRUM AB

- BOEHRINGER INGELHEIM INTERNATIONAL GMBH

第13章 付録

List of Tables

- TABLE 1 IMMUNOTHERAPY DRUGS MARKET: INCLUSIONS & EXCLUSIONS

- TABLE 2 IMMUNOTHERAPY DRUGS MARKET: RISK ANALYSIS

- TABLE 3 GLOBAL INFLATION RATE PROJECTIONS, 2021-2028 (% GROWTH)

- TABLE 4 IMMUNOTHERAPY DRUGS MARKET: IMPACT ANALYSIS

- TABLE 5 NUMBER OF APPROVED PRODUCTS BY US FDA/EMA, 2015-2023

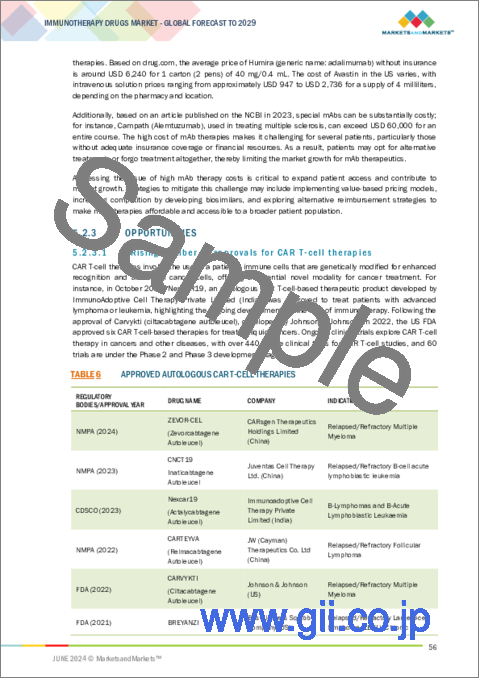

- TABLE 6 APPROVED AUTOLOGOUS CAR T-CELL THERAPIES

- TABLE 7 IMMUNOTHERAPY DRUGS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 8 AVERAGE COST RANGE OF IMMUNOTHERAPY DRUGS, BY KEY PLAYER, 2021-2023

- TABLE 9 INDICATIVE PRICE OF ANTIBODY THERAPEUTICS, BY ROUTE OF ADMINISTRATION

- TABLE 10 INDICATIVE PRICE OF IMMUNOTHERAPY DRUGS, BY REGION

- TABLE 11 IMMUNOTHERAPY DRUGS MARKET: ROLE IN ECOSYSTEM (SUPPLY AND DEMAND SIDES)

- TABLE 12 IMMUNOTHERAPY DRUGS MARKET: MAJOR INVESTMENTS AND FUNDING, JANUARY 2021-MAY 2024

- TABLE 13 IMMUNOTHERAPY DRUGS MARKET: LIST OF KEY CONFERENCES & EVENTS, JANUARY 2024-DECEMBER 2025

- TABLE 14 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 IMMUNOTHERAPY DRUGS MARKET, BY TYPE, 2022-2029 (USD BILLION)

- TABLE 20 IMMUNOTHERAPY DRUGS MARKET, BY TYPE, 2022-2029 (UNITS)

- TABLE 21 ANTIBODY DRUGS MARKET, BY REGION, 2022-2029 (USD BILLION)

- TABLE 22 NORTH AMERICA: ANTIBODY DRUGS MARKET, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 23 EUROPE: ANTIBODY DRUGS MARKET, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 24 ASIA PACIFIC: ANTIBODY DRUGS MARKET, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 25 LATIN AMERICA: ANTIBODY DRUGS MARKET, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 26 MIDDLE EAST: ANTIBODY DRUGS MARKET, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 27 GCC COUNTRIES: ANTIBODY DRUGS MARKET, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 28 INHIBITOR DRUGS MARKET, 2022-2029 (USD BILLION)

- TABLE 29 NORTH AMERICA: INHIBITOR DRUGS MARKET, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 30 EUROPE: INHIBITOR DRUGS MARKET, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 31 ASIA PACIFIC: INHIBITOR DRUGS MARKET, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 32 LATIN AMERICA: INHIBITOR DRUGS MARKET, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 33 MIDDLE EAST: INHIBITOR DRUGS MARKET, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 34 GCC COUNTRIES: INHIBITOR DRUGS MARKET, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 35 INTERFERONS & INTERLEUKINS MARKET, BY REGION, 2022-2029 (USD BILLION)

- TABLE 36 NORTH AMERICA: INTERFERONS & INTERLEUKINS MARKET, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 37 EUROPE: INTERFERONS & INTERLEUKINS MARKET, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 38 ASIA PACIFIC: INTERFERONS & INTERLEUKINS MARKET, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 39 LATIN AMERICA: INTERFERONS & INTERLEUKINS MARKET, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 40 MIDDLE EAST: INTERFERONS & INTERLEUKINS MARKET, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 41 GCC COUNTRIES: INTERFERONS & INTERLEUKINS MARKET, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 42 CANCER VACCINES MARKET, BY REGION, 2022-2029 (USD BILLION)

- TABLE 43 NORTH AMERICA: CANCER VACCINES MARKET, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 44 EUROPE: CANCER VACCINES MARKET, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 45 ASIA PACIFIC: CANCER VACCINES MARKET, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 46 LATIN AMERICA: CANCER VACCINES MARKET, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 47 MIDDLE EAST: CANCER VACCINES MARKET, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 48 GCC COUNTRIES: CANCER VACCINES MARKET, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 49 OTHER IMMUNOTHERAPY DRUGS MARKET, BY REGION, 2022-2029 (USD BILLION)

- TABLE 50 NORTH AMERICA: OTHER IMMUNOTHERAPY DRUGS MARKET, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 51 EUROPE: OTHER IMMUNOTHERAPY DRUGS MARKET, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 52 ASIA PACIFIC: OTHER IMMUNOTHERAPY DRUGS MARKET, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 53 LATIN AMERICA: OTHER IMMUNOTHERAPY DRUGS MARKET, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 54 MIDDLE EAST: OTHER IMMUNOTHERAPY DRUGS MARKET, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 55 GCC COUNTRIES: OTHER IMMUNOTHERAPY DRUGS MARKET, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 56 IMMUNOTHERAPY DRUGS MARKET, BY APPLICATION, 2022-2029 (USD BILLION)

- TABLE 57 IMMUNOTHERAPY DRUGS MARKET FOR CANCER, BY REGION, 2022-2029 (USD BILLION)

- TABLE 58 NORTH AMERICA: IMMUNOTHERAPY DRUGS MARKET FOR CANCER, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 59 EUROPE: IMMUNOTHERAPY DRUGS MARKET FOR CANCER, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 60 ASIA PACIFIC: IMMUNOTHERAPY DRUGS MARKET FOR CANCER, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 61 LATIN AMERICA: IMMUNOTHERAPY DRUGS MARKET FOR CANCER, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 62 MIDDLE EAST: IMMUNOTHERAPY DRUGS MARKET FOR CANCER, BY REGION, 2022-2029 (USD BILLION)

- TABLE 63 GCC COUNTRIES: IMMUNOTHERAPY DRUGS MARKET FOR CANCER, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 64 IMMUNOTHERAPY DRUGS MARKET FOR AUTOIMMUNE & INFLAMMATORY DISEASES, BY REGION, 2022-2029 (USD BILLION)

- TABLE 65 NORTH AMERICA: IMMUNOTHERAPY DRUGS MARKET FOR AUTOIMMUNE & INFLAMMATORY DISEASES, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 66 EUROPE: IMMUNOTHERAPY DRUGS MARKET FOR AUTOIMMUNE & INFLAMMATORY DISEASES, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 67 ASIA PACIFIC: IMMUNOTHERAPY DRUGS MARKET FOR AUTOIMMUNE & INFLAMMATORY DISEASES, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 68 LATIN AMERICA: IMMUNOTHERAPY DRUGS MARKET FOR AUTOIMMUNE & INFLAMMATORY DISEASES, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 69 MIDDLE EAST: IMMUNOTHERAPY DRUGS MARKET FOR AUTOIMMUNE & INFLAMMATORY DISEASES, BY REGION, 2022-2029 (USD BILLION)

- TABLE 70 GCC COUNTRIES: IMMUNOTHERAPY DRUGS MARKET FOR AUTOIMMUNE & INFLAMMATORY DISEASES, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 71 IMMUNOTHERAPY DRUGS MARKET FOR HEMATOLOGY, BY REGION, 2022-2029 (USD BILLION)

- TABLE 72 NORTH AMERICA: IMMUNOTHERAPY DRUGS MARKET FOR HEMATOLOGY, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 73 EUROPE: IMMUNOTHERAPY DRUGS MARKET FOR HEMATOLOGY, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 74 ASIA PACIFIC: IMMUNOTHERAPY DRUGS MARKET FOR HEMATOLOGY, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 75 LATIN AMERICA: IMMUNOTHERAPY DRUGS MARKET FOR HEMATOLOGY, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 76 MIDDLE EAST: IMMUNOTHERAPY DRUGS MARKET FOR HEMATOLOGY, BY REGION, 2022-2029 (USD BILLION)

- TABLE 77 GCC COUNTRIES: IMMUNOTHERAPY DRUGS MARKET FOR HEMATOLOGY, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 78 IMMUNOTHERAPY DRUGS MARKET FOR OSTEOLOGY, BY REGION, 2022-2029 (USD BILLION)

- TABLE 79 NORTH AMERICA: IMMUNOTHERAPY DRUGS MARKET FOR OSTEOLOGY, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 80 EUROPE: IMMUNOTHERAPY DRUGS MARKET FOR OSTEOLOGY, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 81 ASIA PACIFIC: IMMUNOTHERAPY DRUGS MARKET FOR OSTEOLOGY, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 82 LATIN AMERICA: IMMUNOTHERAPY DRUGS MARKET FOR OSTEOLOGY, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 83 MIDDLE EAST: IMMUNOTHERAPY DRUGS MARKET FOR OSTEOLOGY, BY REGION, 2022-2029 (USD BILLION)

- TABLE 84 GCC COUNTRIES: IMMUNOTHERAPY DRUGS MARKET FOR OSTEOLOGY, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 85 IMMUNOTHERAPY DRUGS MARKET FOR NEUROLOGY, BY REGION, 2022-2029 (USD BILLION)

- TABLE 86 NORTH AMERICA: IMMUNOTHERAPY DRUGS MARKET FOR NEUROLOGY, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 87 EUROPE: IMMUNOTHERAPY DRUGS MARKET FOR NEUROLOGY, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 88 ASIA PACIFIC: IMMUNOTHERAPY DRUGS MARKET FOR NEUROLOGY, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 89 LATIN AMERICA: IMMUNOTHERAPY DRUGS MARKET FOR NEUROLOGY, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 90 MIDDLE EAST: IMMUNOTHERAPY DRUGS MARKET FOR NEUROLOGY, BY REGION, 2022-2029 (USD BILLION)

- TABLE 91 GCC COUNTRIES: IMMUNOTHERAPY DRUGS MARKET FOR NEUROLOGY, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 92 IMMUNOTHERAPY DRUGS MARKET FOR OTHER APPLICATIONS, BY REGION, 2022-2029 (USD BILLION)

- TABLE 93 NORTH AMERICA: IMMUNOTHERAPY DRUGS MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 94 EUROPE: IMMUNOTHERAPY DRUGS MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 95 ASIA PACIFIC: IMMUNOTHERAPY DRUGS MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 96 LATIN AMERICA: IMMUNOTHERAPY DRUGS MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 97 MIDDLE EAST: IMMUNOTHERAPY DRUGS MARKET FOR OTHER APPLICATIONS, BY REGION, 2022-2029 (USD BILLION)

- TABLE 98 GCC COUNTRIES: IMMUNOTHERAPY DRUGS MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 99 IMMUNOTHERAPY DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2022-2029 (USD BILLION)

- TABLE 100 IMMUNOTHERAPY DRUGS MARKET FOR INTRAVENOUS ROUTE OF ADMINISTRATION, BY REGION, 2022-2029 (USD BILLION)

- TABLE 101 NORTH AMERICA: IMMUNOTHERAPY DRUGS MARKET FOR INTRAVENOUS ROUTE OF ADMINISTRATION, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 102 EUROPE: IMMUNOTHERAPY DRUGS MARKET FOR INTRAVENOUS ROUTE OF ADMINISTRATION, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 103 ASIA PACIFIC: IMMUNOTHERAPY DRUGS MARKET FOR INTRAVENOUS ROUTE OF ADMINISTRATION, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 104 LATIN AMERICA: IMMUNOTHERAPY DRUGS MARKET FOR INTRAVENOUS ROUTE OF ADMINISTRATION, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 105 MIDDLE EAST: IMMUNOTHERAPY DRUGS MARKET FOR INTRAVENOUS ROUTE OF ADMINISTRATION, BY REGION, 2022-2029 (USD BILLION)

- TABLE 106 GCC COUNTRIES: IMMUNOTHERAPY DRUGS MARKET FOR INTRAVENOUS ROUTE OF ADMINISTRATION, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 107 IMMUNOTHERAPY DRUGS MARKET FOR SUBCUTANEOUS ROUTE OF ADMINISTRATION, BY REGION, 2022-2029 (USD BILLION)

- TABLE 108 NORTH AMERICA: IMMUNOTHERAPY DRUGS MARKET FOR SUBCUTANEOUS ROUTE OF ADMINISTRATION, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 109 EUROPE: IMMUNOTHERAPY DRUGS MARKET FOR SUBCUTANEOUS ROUTE OF ADMINISTRATION, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 110 ASIA PACIFIC: IMMUNOTHERAPY DRUGS MARKET FOR SUBCUTANEOUS ROUTE OF ADMINISTRATION, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 111 LATIN AMERICA: IMMUNOTHERAPY DRUGS MARKET FOR SUBCUTANEOUS ROUTE OF ADMINISTRATION, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 112 MIDDLE EAST: IMMUNOTHERAPY DRUGS MARKET FOR SUBCUTANEOUS ROUTE OF ADMINISTRATION, BY REGION, 2022-2029 USD BILLION)

- TABLE 113 GCC COUNTRIES: IMMUNOTHERAPY DRUGS MARKET FOR SUBCUTANEOUS ROUTE OF ADMINISTRATION, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 114 IMMUNOTHERAPY DRUGS MARKET FOR OTHER ROUTES OF ADMINISTRATION, BY REGION, 2022-2029 (USD BILLION)

- TABLE 115 NORTH AMERICA: IMMUNOTHERAPY DRUGS MARKET FOR OTHER ROUTES OF ADMINISTRATION, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 116 EUROPE: IMMUNOTHERAPY DRUGS MARKET FOR OTHER ROUTES OF ADMINISTRATION, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 117 ASIA PACIFIC: IMMUNOTHERAPY DRUGS MARKET FOR OTHER ROUTES OF ADMINISTRATION, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 118 LATIN AMERICA: IMMUNOTHERAPY DRUGS MARKET FOR OTHER ROUTES OF ADMINISTRATION, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 119 MIDDLE EAST: IMMUNOTHERAPY DRUGS MARKET FOR OTHER ROUTES OF ADMINISTRATION, BY REGION, 2022-2029 (USD BILLION)

- TABLE 120 GCC COUNTRIES: IMMUNOTHERAPY DRUGS MARKET FOR OTHER ROUTES OF ADMINISTRATION, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 121 IMMUNOTHERAPY DRUGS MARKET, BY END USER, 2022-2029 (USD BILLION)

- TABLE 122 IMMUNOTHERAPY DRUGS MARKET FOR HOSPITALS, BY REGION, 2022-2029 (USD BILLION)

- TABLE 123 NORTH AMERICA: IMMUNOTHERAPY DRUGS MARKET FOR HOSPITALS, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 124 EUROPE: IMMUNOTHERAPY DRUGS MARKET FOR HOSPITALS, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 125 ASIA PACIFIC: IMMUNOTHERAPY DRUGS MARKET FOR HOSPITALS, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 126 LATIN AMERICA: IMMUNOTHERAPY DRUGS MARKET FOR HOSPITALS, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 127 MIDDLE EAST: IMMUNOTHERAPY DRUGS MARKET FOR HOSPITALS, BY REGION, 2022-2029 (USD BILLION)

- TABLE 128 GCC COUNTRIES: IMMUNOTHERAPY DRUGS MARKET FOR HOSPITALS, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 129 IMMUNOTHERAPY DRUGS MARKET FOR LONG-TERM CARE FACILITIES, BY REGION, 2022-2029 (USD BILLION)

- TABLE 130 NORTH AMERICA: IMMUNOTHERAPY DRUGS MARKET FOR LONG-TERM CARE FACILITIES, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 131 EUROPE: IMMUNOTHERAPY DRUGS MARKET FOR LONG-TERM CARE FACILITIES, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 132 ASIA PACIFIC: IMMUNOTHERAPY DRUGS MARKET FOR LONG-TERM CARE FACILITIES, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 133 LATIN AMERICA: IMMUNOTHERAPY DRUGS MARKET FOR LONG-TERM CARE FACILITIES, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 134 MIDDLE EAST: IMMUNOTHERAPY DRUGS MARKET FOR LONG-TERM CARE FACILITIES, BY REGION, 2022-2029 (USD BILLION)

- TABLE 135 GCC COUNTRIES: IMMUNOTHERAPY DRUGS MARKET FOR LONG-TERM CARE FACILITIES, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 136 IMMUNOTHERAPY DRUGS MARKET FOR OTHER END USERS, BY REGION, 2022-2029 (USD BILLION)

- TABLE 137 NORTH AMERICA: IMMUNOTHERAPY DRUGS MARKET FOR OTHER END USERS, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 138 EUROPE: IMMUNOTHERAPY DRUGS MARKET FOR OTHER END USERS, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 139 ASIA PACIFIC: IMMUNOTHERAPY DRUGS MARKET FOR OTHER END USERS, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 140 LATIN AMERICA: IMMUNOTHERAPY DRUGS MARKET FOR OTHER END USERS, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 141 MIDDLE EAST: IMMUNOTHERAPY DRUGS MARKET FOR OTHER END USERS, BY REGION, 2022-2029 (USD BILLION)

- TABLE 142 GCC COUNTRIES: IMMUNOTHERAPY DRUGS MARKET FOR OTHER END USERS, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 143 IMMUNOTHERAPY DRUGS MARKET, BY REGION, 2022-2029 (USD BILLION)

- TABLE 144 NORTH AMERICA: IMMUNOTHERAPY DRUGS MARKET, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 145 NORTH AMERICA: IMMUNOTHERAPY DRUGS MARKET, BY TYPE, 2022-2029 (USD BILLION)

- TABLE 146 NORTH AMERICA: IMMUNOTHERAPY DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2022-2029 (USD BILLION)

- TABLE 147 NORTH AMERICA: IMMUNOTHERAPY DRUGS MARKET, BY APPLICATION, 2022-2029 (USD BILLION)

- TABLE 148 NORTH AMERICA: IMMUNOTHERAPY DRUGS MARKET, BY END USER, 2022-2029 (USD BILLION)

- TABLE 149 US: IMMUNOTHERAPY DRUGS MARKET, BY TYPE, 2022-2029 (USD BILLION)

- TABLE 150 US: IMMUNOTHERAPY DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2022-2029 (USD BILLION)

- TABLE 151 US: IMMUNOTHERAPY DRUGS MARKET, BY APPLICATION, 2022-2029 (USD BILLION)

- TABLE 152 US: IMMUNOTHERAPY DRUGS MARKET, BY END USER, 2022-2029 (USD BILLION)

- TABLE 153 CANADA: IMMUNOTHERAPY DRUGS MARKET, BY TYPE, 2022-2029 (USD BILLION)

- TABLE 154 CANADA: IMMUNOTHERAPY DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2022-2029 (USD BILLION)

- TABLE 155 CANADA: IMMUNOTHERAPY DRUGS MARKET, BY APPLICATION, 2022-2029 (USD BILLION)

- TABLE 156 CANADA: IMMUNOTHERAPY DRUGS MARKET, BY END USER, 2022-2029 (USD BILLION)

- TABLE 157 EUROPE: IMMUNOTHERAPY DRUGS MARKET, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 158 EUROPE: IMMUNOTHERAPY DRUGS MARKET, BY TYPE, 2022-2029 (USD BILLION)

- TABLE 159 EUROPE: IMMUNOTHERAPY DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2022-2029 (USD BILLION)

- TABLE 160 EUROPE: IMMUNOTHERAPY DRUGS MARKET, BY APPLICATION, 2022-2029 (USD BILLION)

- TABLE 161 EUROPE: IMMUNOTHERAPY DRUGS MARKET, BY END USER, 2022-2029 (USD BILLION)

- TABLE 162 GERMANY: IMMUNOTHERAPY DRUGS MARKET, BY TYPE, 2022-2029 (USD BILLION)

- TABLE 163 GERMANY: IMMUNOTHERAPY DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2022-2029 (USD BILLION)

- TABLE 164 GERMANY: IMMUNOTHERAPY DRUGS MARKET, BY APPLICATION, 2022-2029 (USD BILLION)

- TABLE 165 GERMANY: IMMUNOTHERAPY DRUGS MARKET, BY END USER, 2022-2029 (USD BILLION)

- TABLE 166 UK: IMMUNOTHERAPY DRUGS MARKET, BY TYPE, 2022-2029 (USD BILLION)

- TABLE 167 UK: IMMUNOTHERAPY DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2022-2029 (USD BILLION)

- TABLE 168 UK: IMMUNOTHERAPY DRUGS MARKET, BY APPLICATION, 2022-2029 (USD BILLION)

- TABLE 169 UK: IMMUNOTHERAPY DRUGS THERAPEUTICS MARKET, BY END USER, 2022-2029 (USD BILLION)

- TABLE 170 FRANCE: IMMUNOTHERAPY DRUGS MARKET, BY TYPE, 2022-2029 (USD BILLION)

- TABLE 171 FRANCE: IMMUNOTHERAPY DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2022-2029 (USD BILLION)

- TABLE 172 FRANCE: IMMUNOTHERAPY DRUGS MARKET, BY APPLICATION, 2022-2029 (USD BILLION)

- TABLE 173 FRANCE: IMMUNOTHERAPY DRUGS MARKET, BY END USER, 2022-2029 (USD BILLION)

- TABLE 174 ITALY: IMMUNOTHERAPY DRUGS MARKET, BY TYPE, 2022-2029 (USD BILLION)

- TABLE 175 ITALY: IMMUNOTHERAPY DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2022-2029 (USD BILLION)

- TABLE 176 ITALY: IMMUNOTHERAPY DRUGS MARKET, BY APPLICATION, 2022-2029 (USD BILLION)

- TABLE 177 ITALY: IMMUNOTHERAPY DRUGS MARKET, BY END USER, 2022-2029 (USD BILLION)

- TABLE 178 SPAIN: IMMUNOTHERAPY DRUGS MARKET, BY TYPE, 2022-2029 (USD BILLION)

- TABLE 179 SPAIN: IMMUNOTHERAPY DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2022-2029 (USD MILLION)

- TABLE 180 SPAIN: IMMUNOTHERAPY DRUGS MARKET, BY APPLICATION, 2022-2029 (USD BILLION)

- TABLE 181 SPAIN: IMMUNOTHERAPY DRUGS MARKET, BY END USER, 2022-2029 (USD BILLION)

- TABLE 182 REST OF EUROPE: IMMUNOTHERAPY DRUGS MARKET, BY TYPE, 2022-2029 (USD BILLION)

- TABLE 183 REST OF EUROPE: IMMUNOTHERAPY DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2022-2029 (USD BILLION)

- TABLE 184 REST OF EUROPE: IMMUNOTHERAPY DRUGS MARKET, BY APPLICATION, 2022-2029 (USD BILLION)

- TABLE 185 REST OF EUROPE: IMMUNOTHERAPY DRUGS MARKET, BY END USER, 2022-2029 (USD BILLION)

- TABLE 186 ASIA PACIFIC: IMMUNOTHERAPY DRUGS MARKET, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 187 ASIA PACIFIC: IMMUNOTHERAPY DRUGS MARKET, BY TYPE, 2022-2029 (USD BILLION)

- TABLE 188 ASIA PACIFIC: IMMUNOTHERAPY DRUGS, BY ROUTE OF ADMINISTRATION, 2022-2029 (USD BILLION)

- TABLE 189 ASIA PACIFIC: IMMUNOTHERAPY DRUGS MARKET, BY APPLICATION, 2022-2029 (USD BILLION)

- TABLE 190 ASIA PACIFIC: IMMUNOTHERAPY DRUGS MARKET, BY END USER, 2022-2029 (USD BILLION)

- TABLE 191 CHINA: IMMUNOTHERAPY DRUGS MARKET, BY TYPE, 2022-2029 (USD BILLION)

- TABLE 192 CHINA: IMMUNOTHERAPY DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2022-2029 (USD BILLION)

- TABLE 193 CHINA: IMMUNOTHERAPY DRUGS MARKET, BY APPLICATION, 2022-2029 (USD BILLION)

- TABLE 194 CHINA: IMMUNOTHERAPY DRUGS MARKET, BY END USER, 2022-2029 (USD BILLION)

- TABLE 195 JAPAN: IMMUNOTHERAPY DRUGS MARKET, BY TYPE, 2022-2029 (USD BILLION)

- TABLE 196 JAPAN: IMMUNOTHERAPY DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2022-2029 (USD BILLION)

- TABLE 197 JAPAN: IMMUNOTHERAPY DRUGS MARKET, BY APPLICATION, 2022-2029 (USD BILLION)

- TABLE 198 JAPAN: IMMUNOTHERAPY DRUGS MARKET, BY END USER, 2022-2029 (USD BILLION)

- TABLE 199 INDIA: IMMUNOTHERAPY DRUGS MARKET, BY TYPE, 2022-2029 (USD BILLION)

- TABLE 200 INDIA: IMMUNOTHERAPY DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2022-2029 (USD BILLION)

- TABLE 201 INDIA: IMMUNOTHERAPY DRUGS MARKET, BY APPLICATION, 2022-2029 (USD BILLION)

- TABLE 202 INDIA: IMMUNOTHERAPY DRUGS MARKET, BY END USER, 2022-2029 (USD BILLION)

- TABLE 203 SOUTH KOREA: IMMUNOTHERAPY DRUGS MARKET, BY TYPE, 2022-2029 (USD BILLION)

- TABLE 204 SOUTH KOREA: IMMUNOTHERAPY DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2022-2029 (USD BILLION)

- TABLE 205 SOUTH KOREA: IMMUNOTHERAPY DRUGS MARKET, BY APPLICATION, 2022-2029 (USD BILLION)

- TABLE 206 SOUTH KOREA: IMMUNOTHERAPY DRUGS MARKET, BY END USER, 2022-2029 (USD BILLION)

- TABLE 207 AUSTRALIA: IMMUNOTHERAPY DRUGS MARKET, BY TYPE, 2022-2029 (USD BILLION)

- TABLE 208 AUSTRALIA: IMMUNOTHERAPY DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2022-2029 (USD BILLION)

- TABLE 209 AUSTRALIA: IMMUNOTHERAPY DRUGS MARKET, BY APPLICATION, 2022-2029 (USD BILLION)

- TABLE 210 AUSTRALIA: IMMUNOTHERAPY DRUGS MARKET, BY END USER, 2022-2029 (USD BILLION)

- TABLE 211 REST OF ASIA PACIFIC: IMMUNOTHERAPY DRUGS MARKET, BY TYPE, 2022-2029 (USD BILLION)

- TABLE 212 REST OF ASIA PACIFIC: IMMUNOTHERAPY DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2022-2029 (USD BILLION)

- TABLE 213 REST OF ASIA PACIFIC: IMMUNOTHERAPY DRUGS MARKET, BY APPLICATION, 2022-2029 (USD BILLION)

- TABLE 214 REST OF ASIA PACIFIC: IMMUNOTHERAPY DRUGS MARKET, BY END USER, 2022-2029 (USD BILLION)

- TABLE 215 LATIN AMERICA: IMMUNOTHERAPY DRUGS MARKET, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 216 LATIN AMERICA: IMMUNOTHERAPY DRUGS MARKET, BY TYPE, 2022-2029 (USD BILLION)

- TABLE 217 LATIN AMERICA: IMMUNOTHERAPY DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2022-2029 (USD BILLION)

- TABLE 218 LATIN AMERICA: IMMUNOTHERAPY DRUGS MARKET, BY APPLICATION, 2022-2029 (USD BILLION)

- TABLE 219 LATIN AMERICA: IMMUNOTHERAPY DRUGS MARKET, BY END USER, 2022-2029 (USD BILLION)

- TABLE 220 BRAZIL: IMMUNOTHERAPY DRUGS MARKET, BY TYPE, 2022-2029 (USD BILLION)

- TABLE 221 BRAZIL: IMMUNOTHERAPY DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2022-2029 (USD BILLION)

- TABLE 222 BRAZIL: IMMUNOTHERAPY DRUGS MARKET, BY APPLICATION, 2022-2029 (USD BILLION)

- TABLE 223 BRAZIL: IMMUNOTHERAPY DRUGS MARKET, BY END USER, 2022-2029 (USD BILLION)

- TABLE 224 REST OF LATIN AMERICA: IMMUNOTHERAPY DRUGS MARKET, BY TYPE, 2022-2029 (USD BILLION)

- TABLE 225 REST OF LATIN AMERICA: IMMUNOTHERAPY DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2022-2029 (USD BILLION)

- TABLE 226 REST OF LATIN AMERICA: IMMUNOTHERAPY DRUGS MARKET, BY APPLICATION, 2022-2029 (USD BILLION)

- TABLE 227 REST OF LATIN AMERICA: IMMUNOTHERAPY DRUGS MARKET, BY END USER, 2022-2029 (USD BILLION)

- TABLE 228 MIDDLE EAST: IMMUNOTHERAPY DRUGS MARKET, BY REGION, 2022-2029 (USD BILLION)

- TABLE 229 MIDDLE EAST: IMMUNOTHERAPY DRUGS MARKET, BY TYPE, 2022-2029 (USD BILLION)

- TABLE 230 MIDDLE EAST: IMMUNOTHERAPY DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2022-2029 (USD BILLION)

- TABLE 231 MIDDLE EAST: IMMUNOTHERAPY DRUGS MARKET, BY APPLICATION, 2022-2029 (USD BILLION)

- TABLE 232 MIDDLE EAST: IMMUNOTHERAPY DRUGS MARKET, BY END USER, 2022-2029 (USD BILLION)

- TABLE 233 GCC COUNTRIES: IMMUNOTHERAPY DRUGS MARKET, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 234 GCC COUNTRIES: IMMUNOTHERAPY DRUGS MARKET, BY TYPE, 2022-2029 (USD BILLION)

- TABLE 235 GCC COUNTRIES: IMMUNOTHERAPY DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2022-2029 (USD BILLION)

- TABLE 236 GCC COUNTRIES: IMMUNOTHERAPY DRUGS MARKET, BY APPLICATION, 2022-2029 (USD BILLION)

- TABLE 237 GCC COUNTRIES: IMMUNOTHERAPY DRUGS MARKET, BY END USER, 2022-2029 (USD BILLION)

- TABLE 238 SAUDI ARABIA: IMMUNOTHERAPY DRUGS MARKET, BY TYPE, 2022-2029 (USD BILLION)

- TABLE 239 SAUDI ARABIA: IMMUNOTHERAPY DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2022-2029 (USD BILLION)

- TABLE 240 SAUDI ARABIA: IMMUNOTHERAPY DRUGS MARKET, BY APPLICATION, 2022-2029 (USD BILLION)

- TABLE 241 SAUDI ARABIA: IMMUNOTHERAPY DRUGS MARKET, BY END USER, 2022-2029 (USD BILLION)

- TABLE 242 UAE: IMMUNOTHERAPY DRUGS MARKET, BY TYPE, 2022-2029 (USD BILLION)

- TABLE 243 UAE: IMMUNOTHERAPY DRUGS MARKET, BY ROUTE OF ADMINISTRATION,

022-2029 (USD BILLION)

- TABLE 244 UAE: IMMUNOTHERAPY DRUGS MARKET, BY APPLICATION, 2022-2029 (USD BILLION)

- TABLE 245 UAE: IMMUNOTHERAPY DRUGS MARKET, BY END USER, 2022-2029 (USD BILLION)

- TABLE 246 REST OF GCC COUNTRIES: IMMUNOTHERAPY DRUGS MARKET, BY TYPE, 2022-2029 (USD BILLION)

- TABLE 247 REST OF GCC COUNTRIES: IMMUNOTHERAPY DRUGS, BY ROUTE OF ADMINISTRATION, 2022-2029 (USD BILLION)

- TABLE 248 REST OF GCC COUNTRIES: IMMUNOTHERAPY DRUGS MARKET, BY APPLICATION, 2022-2029 (USD BILLION)

- TABLE 249 REST OF GCC COUNTRIES: IMMUNOTHERAPY DRUGS MARKET, BY END USER, 2022-2029 (USD BILLION)

- TABLE 250 REST OF MIDDLE EAST: IMMUNOTHERAPY DRUGS MARKET, BY TYPE, 2022-2029 (USD BILLION)

- TABLE 251 REST OF MIDDLE EAST: IMMUNOTHERAPY DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2022-2029 (USD BILLION)

- TABLE 252 REST OF MIDDLE EAST: IMMUNOTHERAPY DRUGS MARKET, BY APPLICATION, 2022-2029 (USD BILLION)

- TABLE 253 REST OF MIDDLE EAST: IMMUNOTHERAPY DRUGS THERAPEUTICS MARKET, BY END USER, 2022-2029 (USD BILLION)

- TABLE 254 AFRICA: IMMUNOTHERAPY DRUGS MARKET, BY TYPE, 2022-2029 (USD BILLION)

- TABLE 255 AFRICA: IMMUNOTHERAPY DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2022-2029 (USD BILLION)

- TABLE 256 AFRICA: IMMUNOTHERAPY DRUGS MARKET, BY APPLICATION, 2022-2029 (USD BILLION)

- TABLE 257 AFRICA: IMMUNOTHERAPY DRUGS MARKET, BY END USER, 2022-2029 (USD BILLION)

- TABLE 258 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN IMMUNOTHERAPY DRUGS MARKET

- TABLE 259 IMMUNOTHERAPY DRUGS MARKET: DEGREE OF COMPETITION

- TABLE 260 IMMUNOTHERAPY DRUGS MARKET: TYPE FOOTPRINT

- TABLE 261 IMMUNOTHERAPY DRUGS MARKET: APPLICATION FOOTPRINT

- TABLE 262 IMMUNOTHERAPY DRUGS MARKET: ROUTE OF ADMINISTRATION FOOTPRINT

- TABLE 263 IMMUNOTHERAPY DRUGS MARKET: REGION FOOTPRINT

- TABLE 264 IMMUNOTHERAPY DRUGS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 265 IMMUNOTHERAPY DRUGS MARKET: COMPETITIVE BENCHMARKING OF KEY START UPS/SMES

- TABLE 266 IMMUNOTHERAPY DRUGS MARKET: PRODUCT APPROVALS, JANUARY 2021-MAY 2024

- TABLE 267 IMMUNOTHERAPY DRUGS MARKET: DEALS, JANUARY 2021-MAY 2024

- TABLE 268 IMMUNOTHERAPY DRUGS MARKET: OTHER DEVELOPMENTS, JANUARY 2021-MAY 2024

- TABLE 269 MERCK & CO., INC.: COMPANY OVERVIEW

- TABLE 270 MERCK & CO., INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 271 MERCK & CO., INC.: PRODUCT APPROVALS, JANUARY 2021-MAY 2024

- TABLE 272 MERCK & CO., INC.: DEALS, JANUARY 2021-MAY 2024

- TABLE 273 JOHNSON & JOHNSON SERVICES, INC.: COMPANY OVERVIEW

- TABLE 274 JOHNSON & JOHNSON SERVICES, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 275 JOHNSON & JOHNSON SERVICES, INC.: PRODUCT APPROVALS, JANUARY 2021-MAY 2024

- TABLE 276 JOHNSON & JOHNSON SERVICES, INC.: DEALS, JANUARY 2021-MAY 2024

- TABLE 277 JOHNSON & JOHNSON SERVICES, INC.: EXPANSIONS, JANUARY 2021-MAY 2024

- TABLE 278 F. HOFFMANN-LA ROCHE LTD.: COMPANY OVERVIEW

- TABLE 279 F. HOFFMANN-LA ROCHE LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 280 F. HOFFMANN-LA ROCHE LTD.: PRODUCT APPROVALS, JANUARY 2021-MAY 2024

- TABLE 281 F. HOFFMANN-LA ROCHE LTD.: DEALS, JANUARY 2021-MAY 2024

- TABLE 282 ASTRAZENECA: COMPANY OVERVIEW

- TABLE 283 ASTRAZENECA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 284 ASTRAZENECA: PRODUCT APPROVALS, JANUARY 2021-MAY 2024

- TABLE 285 ASTRAZENECA: DEALS, JANUARY 2021-MAY 2024

- TABLE 286 ASTRAZENECA: EXPANSIONS, JANUARY 2021-MAY 2024

- TABLE 287 PFIZER INC.: COMPANY OVERVIEW

- TABLE 288 PFIZER INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 289 PFIZER INC.: PRODUCT APPROVALS, JANUARY 2021-MAY 2024

- TABLE 290 PFIZER INC.: DEALS, JANUARY 2021-MAY 2024

- TABLE 291 AMGEN INC.: COMPANY OVERVIEW

- TABLE 292 AMGEN INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 293 AMGEN INC.: PRODUCT APPROVALS, JANUARY 2021-MAY 2024

- TABLE 294 AMGEN INC.: EXPANSIONS, JANUARY 2021-MAY 2024

- TABLE 295 NOVARTIS AG: COMPANY OVERVIEW

- TABLE 296 NOVARTIS AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 297 NOVARTIS AG: PRODUCT APPROVALS, JANUARY 2021-MAY 2024

- TABLE 298 NOVARTIS AG: DEALS, JANUARY 2021-MAY 2024

- TABLE 299 ELI LILLY AND COMPANY: COMPANY OVERVIEW

- TABLE 300 ELI LILLY AND COMPANY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 301 ELI LILLY AND COMPANY: PRODUCT APPROVALS, JANUARY 2021-MAY 2024

- TABLE 302 ELI LILLY AND COMPANY.: DEALS, JANUARY 2021-MAY 2024

- TABLE 303 SANOFI: COMPANY OVERVIEW

- TABLE 304 SANOFI: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 305 SANOFI: PRODUCT APPROVALS, JANUARY 2021-MAY 2024

- TABLE 306 SANOFI: DEALS, JANUARY 2021-MAY 2024

- TABLE 307 BRISTOL-MYERS SQUIBB COMPANY: COMPANY OVERVIEW

- TABLE 308 BRISTOL-MYERS SQUIBB COMPANY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 309 BRISTOL-MYERS SQUIBB COMPANY: PRODUCT APPROVALS, JANUARY 2021-MAY 2024

- TABLE 310 BRISTOL-MYERS SQUIBB COMPANY: DEALS, JANUARY 2021-MAY 2024

- TABLE 311 GILEAD SCIENCES, INC.: COMPANY OVERVIEW

- TABLE 312 GILEAD SCIENCES, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 313 GILEAD SCIENCES, INC.: PRODUCT APPROVALS, JANUARY 2021-MAY 2024

- TABLE 314 GILEAD SCIENCES, INC.: DEALS, JANUARY 2021-MAY 2024

- TABLE 315 GILEAD SCIENCES, INC.: OTHER DEVELOPMENTS, JANUARY 2021-MAY 2024

- TABLE 316 TAKEDA PHARMACEUTICAL COMPANY LIMITED: COMPANY OVERVIEW

- TABLE 317 TAKEDA PHARMACEUTICAL COMPANY LIMITED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 318 TAKEDA PHARMACEUTICAL COMPANY LIMITED: PRODUCT APPROVALS, JANUARY 2021-MAY 2024

- TABLE 319 TAKEDA PHARMACEUTICAL COMPANY LIMITED: DEALS, JANUARY 2021-MAY 2024

- TABLE 320 TEVA PHARMACEUTICAL INDUSTRIES LTD.: COMPANY OVERVIEW

- TABLE 321 TEVA PHARMACEUTICAL INDUSTRIES LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 322 TEVA PHARMACEUTICAL INDUSTRIES LTD.: DEALS, JANUARY 2021-MAY 2024

- TABLE 323 ABBVIE INC.: COMPANY OVERVIEW

- TABLE 324 ABBVIE INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 325 ABBVIE INC.: PRODUCT APPROVALS, JANUARY 2021-MAY 2024

- TABLE 326 ABBVIE INC.: DEALS, JANUARY 2021-MAY 2024

- TABLE 327 GSK PLC: COMPANY OVERVIEW

- TABLE 328 GSK PLC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 329 GSK PLC: PRODUCT APPROVALS, JANUARY 2021-MAY 2024

- TABLE 330 GSK PLC: DEALS, JANUARY 2021-MAY 2024

- TABLE 331 GSK PLC: OTHER DEVELOPMENTS, JANUARY 2021-MAY 2024

- TABLE 332 IMMUNOCORE HOLDINGS PLC: COMPANY OVERVIEW

- TABLE 333 ASTELLAS PHARMA INC.: COMPANY OVERVIEW

- TABLE 334 GENMAB A/S: COMPANY OVERVIEW

- TABLE 335 MACROGENICS, INC.: COMPANY OVERVIEW

- TABLE 336 FERRING BV: COMPANY OVERVIEW

- TABLE 337 Y-MABS THERAPEUTICS, INC.: COMPANY OVERVIEW

- TABLE 338 BIOGEN: COMPANY OVERVIEW

- TABLE 339 KYOWA KIRIN CO., LTD.: COMPANY OVERVIEW

- TABLE 340 SWEDISH ORPHAN BIOVITRUM AB: COMPANY OVERVIEW

- TABLE 341 BOEHRINGER INGELHEIM INTERNATIONAL GMBH: COMPANY OVERVIEW

List of Figures

- FIGURE 1 IMMUNOTHERAPY DRUGS MARKET: SEGMENTS COVERED

- FIGURE 2 IMMUNOTHERAPY DRUGS MARKET: REGIONS COVERED

- FIGURE 3 IMMUNOTHERAPY DRUGS MARKET: YEARS CONSIDERED

- FIGURE 4 IMMUNOTHERAPY DRUGS MARKET: RESEARCH DESIGN

- FIGURE 5 IMMUNOTHERAPY DRUGS MARKET: BREAKDOWN OF PRIMARIES

- FIGURE 6 IMMUNOTHERAPY DRUGS MARKET SIZE ESTIMATION (SUPPLY-SIDE ANALYSIS), 2023

- FIGURE 7 MARKET SIZE ESTIMATION: COMPANY REVENUE ANALYSIS-BASED ESTIMATION, 2023

- FIGURE 8 MARKET SIZE VALIDATION FROM PRIMARY SOURCES

- FIGURE 9 IMMUNOTHERAPY DRUGS MARKET: CAGR PROJECTIONS

- FIGURE 10 IMMUNOTHERAPY DRUGS MARKET: ANALYSIS OF DEMAND-SIDE DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 11 DATA TRIANGULATION METHODOLOGY

- FIGURE 12 IMMUNOTHERAPY DRUGS MARKET, BY TYPE, 2024 VS. 2029 (USD BILLION)

- FIGURE 13 IMMUNOTHERAPY DRUGS MARKET, BY APPLICATION, 2024 VS. 2029 (USD BILLION)

- FIGURE 14 IMMUNOTHERAPY DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2024 VS. 2029 (USD BILLION)

- FIGURE 15 IMMUNOTHERAPY DRUGS MARKET, BY END USER, 2024 VS. 2029 (USD BILLION)

- FIGURE 16 IMMUNOTHERAPY DRUGS MARKET: REGIONAL SNAPSHOT

- FIGURE 17 TECHNOLOGICAL ADVANCEMENTS IN ANTIBODY ENGINEERING TO DRIVE MARKET

- FIGURE 18 US AND ANTIBODY DRUGS SEGMENT COMMANDED LARGEST MARKET SHARE IN 2023

- FIGURE 19 ANTIBODY DRUGS TO DOMINATE NORTH AMERICAN MARKET DURING STUDY PERIOD

- FIGURE 20 IMMUNOTHERAPY DRUGS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 IMMUNOTHERAPY DRUGS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 22 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS OF IMMUNOTHERAPY DRUGS

- FIGURE 23 KEY BUYING CRITERIA FOR HOSPITALS AND LONG-TERM CARE FACILITIES

- FIGURE 24 IMMUNOTHERAPY DRUGS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 25 IMMUNOTHERAPY DRUGS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 26 AVERAGE SELLING PRICE TREND OF IMMUNOTHERAPY DRUGS, BY KEY PLAYER

- FIGURE 27 IMMUNOTHERAPY DRUGS MARKET: ECOSYSTEM MAP

- FIGURE 28 PATENT APPLICATIONS FOR IMMUNOTHERAPY DRUGS (JANUARY 2012-DECEMBER 2023)

- FIGURE 29 NORTH AMERICA: IMMUNOTHERAPY DRUGS MARKET SNAPSHOT

- FIGURE 30 ASIA PACIFIC: IMMUNOTHERAPY DRUGS MARKET SNAPSHOT

- FIGURE 31 REVENUE ANALYSIS OF KEY PLAYERS IN IMMUNOTHERAPY DRUGS MARKET (2021-2023)

- FIGURE 32 MARKET SHARE ANALYSIS OF KEY PLAYERS IN IMMUNOTHERAPY DRUGS MARKET (2023)

- FIGURE 33 IMMUNOTHERAPY DRUGS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 34 IMMUNOTHERAPY DRUGS MARKET: COMPANY FOOTPRINT

- FIGURE 35 IMMUNOTHERAPY DRUGS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 36 EV/EBITDA OF KEY PLAYERS

- FIGURE 37 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY PLAYERS

- FIGURE 38 IMMUNOTHERAPY DRUGS MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 39 MERCK & CO., INC.: COMPANY SNAPSHOT (2023)

- FIGURE 40 JOHNSON & JOHNSON SERVICES, INC.: COMPANY SNAPSHOT (2023)

- FIGURE 41 F. HOFFMANN-LA ROCHE LTD.: COMPANY SNAPSHOT (2023)

- FIGURE 42 ASTRAZENECA: COMPANY SNAPSHOT (2023)

- FIGURE 43 PFIZER INC.: COMPANY SNAPSHOT (2023)

- FIGURE 44 AMGEN INC.: COMPANY SNAPSHOT (2023)

- FIGURE 45 NOVARTIS AG: COMPANY SNAPSHOT (2023)

- FIGURE 46 ELI LILLY AND COMPANY.: COMPANY SNAPSHOT (2023)

- FIGURE 47 SANOFI: COMPANY SNAPSHOT (2023)

- FIGURE 48 BRISTOL-MYERS SQUIBB COMPANY: COMPANY SNAPSHOT (2023)

- FIGURE 49 GILEAD SCIENCES, INC.: COMPANY SNAPSHOT (2023)

- FIGURE 50 TAKEDA PHARMACEUTICAL COMPANY LIMITED: COMPANY SNAPSHOT (2023)

- FIGURE 51 TEVA PHARMACEUTICAL INDUSTRIES LTD.: COMPANY SNAPSHOT (2023)

- FIGURE 52 ABBVIE INC.: COMPANY SNAPSHOT (2023)

- FIGURE 53 GSK PLC: COMPANY SNAPSHOT (2023)

Immunotherapy drugs are designed to enhance the immune response or modulate the immune system's regulatory mechanisms, thereby enabling the body to effectively target and eliminate disease-causing agents or cellsThe immunotherapy drugs market is projected to grow from USD 285.3 billion in 2024 to USD 580.6 billion by 2029, reflecting a compound annual growth rate (CAGR) of 15.3%. This growth is driven by technological advancements in antibody engineering, increasing demand for antibody therapies in clinical cancer treatment, and a growing preference for personalized medicines and targeted therapies. However, the market faces challenges such as the complexities involved in developing antibody therapeutics.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | Type, Application, Route of Administration, End User, And Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

The Antibody drugs segment maintains major market share in the forecast period.

Based on type, the immunotherapy drugs market is divided into antibody drugs, inhibitor drugs, interferons & interleukins, cancer vaccines, and other immunotherapy drugs, which include oncolytic virus therapy and t-cell therapy. Antibody drugs hold the major market share. Increasing cancer incidence, the growing adoption of biological therapies, heightened investment in R&D, and supportive government policies are anticipated to propel market growth.

The Cancer segment is anticipated to dominate Immunotherapy Drugs Market through 2023-2029.

Based on applications, the immunotherapy drugs market is divided into cancer, autoimmune & inflammatory diseases, hematology, osteology, neurology, and other applications, including ophthalmology, dermatology, and cardiovascular diseases. Cancer commanded the largest market share in 2023. Elevated cancer rates, increased adoption of biological therapies, substantial R&D investment, and favorable government policies are expected to drive market growth during the forecast period. Companies in the immunotherapy drugs sector are exemplifying innovation through the development of new therapies, strategic collaborations, and enhanced spending on clinical research to explore immunotherapy treatments for cancer. These efforts aim to boost the immune system's capability to fight cancer, offering new hope and improved patient outcomes.

The Intravenous Route segment is anticipated to grow at the fastest pace throughout the forecast period.

Based on the route of administration, the immunotherapy drugs market is broadly segmented into intravenous, subcutaneous, and other routes of administration (intravitreal and intramuscular). In 2023, the intravenous route of administration segment accounted for the largest share of the immunotherapy drugs market. This segment is also expected to grow at the highest CAGR during the forecast period. The large share and high growth rate are attributed to the growing preference for intravenous routes owing to its direct delivery into the bloodstream, ensuring rapid and consistent therapeutic effects for several conditions, including cancer and autoimmune diseases.

Hospitals segment generated the highest revenue in 2024 in the market.

Based on end users, the immunotherapy drugs market is broadly segmented into hospitals, long-term care facilities, and other end users (specialty care centers). In 2023, the hospitals segment commanded the largest share of the immunotherapy drugs market. Hospitals extensively use mAbs for their targeted therapy, rapid diagnostic applications, and efficacy in treating several disease indications, including cancer, autoimmune disorders, and infectious diseases.

The North America accounted for the largest share in the immunotherapy drugs market.

In 2023, North America accounted for the largest share of the global immunotherapy drugs market. The growth in the North American market can be attributed to rising immunotherapy research, the expansion of the healthcare sector, growing cancer prevalence, and the increasing approval and adoption of immunotherapy drugs for treating cancer and other chronic diseases. North America has witnessed significant growth in medical research advancements, growing clinical trials, and the developing biopharmaceutical industry. With increased research-driven activities and a high prevalence of cancer and chronic diseases, the demand for immunotherapies in North America is expected to rise significantly.

Breakdown of supply-side primary interviews by company type, designation, and region:

- By Respondent: Supply Side (70%), Demand side (30%)

- By Designation: C-level (55%), Director-level (20%), and Others (25%)

- By Region: North America (50%), Europe (20%), AsiaPacific (20%), and Rest of the World(10%)

List of Companies Profiled in the Report

- Merck & Co., Inc. (US)

- Johnson & Johnson Services, Inc. (US)

- F. Hoffman-La Roche Ltd. (Switzerland)

- Pfizer Inc. (US)

- AstraZeneca (UK)

- Novartis AG (Switzerland)

- Amgen Inc. (US)

- Gilead Sciences, Inc. (UK)

- Bristol-Myers Squibb Company (US)

- Eli Lilly and Company (US)

- Sanofi (France)

- Takeda Pharmaceutical Company Limited (Japan)

- Teva Pharmaceutical Industries Ltd (Israel)

- GSK PLC (US)

- Abbvie Inc. (US)

Research Coverage

This report studies the Immunotherapy Drugs market based on type, application, route of administration, end user, and region. The report also analyzes factors (such as drivers, restraints, opportunities, and challenges) affecting the market growth. It evaluates the opportunities and challenges in the market for stakeholders and provides details of the competitive landscape for market leaders. The report also studies micro markets with respect to their growth trends, prospects, and contributions to the total Immunotherapy Drugs market. The report forecasts the revenue of the market segments with respect to four major regions.

Reasons to Buy the Report:

The report provides insights on the following pointers:

- Market Drivers: The key factors driving the overall market growth are technological advancements in antibody engineering, Increased demand for antibody therapies in clinical cancer treatment, and Growing demand for personalized medicines and targeted therapies

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the Immunotherapy Drugs market.

- Market Penetration: Comprehensive information on Immunotherapy Drugs offered by the top 15 players in the market. The report analyzes the Immunotherapy Drugs market by Type, Application, Route of Administration, End User and Region

- Market Development: Comprehensive information about lucrative emerging markets. The report analyzes the markets for various products/types of Immunotherapy Drugs across key geographic regions.

- Market Diversification: Exhaustive information about untapped geographies, recent developments, and investments in the Immunotherapy Drugs market

- Competitive Assessment: In-depth assessment of market shares and strategies of the leading players in the Immunotherapy Drugs market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 SEGMENTS COVERED

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

- 1.5.1 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Objectives of secondary research

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primaries

- 2.1.1 SECONDARY DATA

- 2.2 MARKET ESTIMATION METHODOLOGY

- 2.2.1 COMPANY REVENUE ANALYSIS (BOTTOM-UP APPROACH)

- 2.2.2 INSIGHTS FROM PRIMARY EXPERTS

- 2.3 MARKET GROWTH RATE PROJECTIONS

- 2.4 DATA TRIANGULATION

- 2.5 STUDY ASSUMPTIONS

- 2.6 RISK ANALYSIS

- 2.7 IMPACT OF ECONOMIC RECESSION ON IMMUNOTHERAPY DRUGS MARKET

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 IMMUNOTHERAPY DRUGS MARKET OVERVIEW

- 4.2 NORTH AMERICA: IMMUNOTHERAPY DRUGS MARKET, BY TYPE AND COUNTRY (2023)

- 4.3 NORTH AMERICA: IMMUNOTHERAPY DRUGS MARKET, BY TYPE, 2024 VS. 2029 (USD BILLION)

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Technological advancements in antibody engineering

- 5.2.1.2 Increasing demand for antibody therapeutics in clinical cancer treatment

- 5.2.1.3 Growing demand for personalized medicines and targeted therapies

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stringent regulatory approval process for immunotherapy drugs

- 5.2.2.2 High cost of monoclonal antibody therapeutics

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising number of approvals for CAR T-cell therapies

- 5.2.3.2 Increasing collaborations among pharmaceutical companies, CROs, CDMOs, and academic institutes

- 5.2.4 CHALLENGES

- 5.2.4.1 Complexities in development of antibody therapeutics

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 KEY BUYING CRITERIA

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE OF IMMUNOTHERAPY DRUGS, BY KEY PLAYER

- 5.7.2 AVERAGE COST RANGE OF IMMUNOTHERAPY DRUGS, BY KEY PLAYER, 2021-2023

- 5.7.3 INDICATIVE PRICE OF ANTIBODY THERAPEUTICS, BY ROUTE OF ADMINISTRATION

- 5.7.4 INDICATIVE PRICE OF IMMUNOTHERAPY DRUGS, BY REGION

- 5.8 ECOSYSTEM ANALYSIS

- 5.8.1 ROLE IN ECOSYSTEM (SUPPLY AND DEMAND SIDES)

- 5.9 PATENT ANALYSIS

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 Gene editing

- 5.10.1.2 High-throughput screening

- 5.10.1.3 Next-generation sequencing

- 5.10.2 COMPLEMENTARY TECHNOLOGIES

- 5.10.2.1 Nanotechnology

- 5.10.2.2 Artificial intelligence

- 5.10.1 KEY TECHNOLOGIES

- 5.11 INVESTMENT & FUNDING SCENARIO

- 5.11.1 MAJOR INVESTMENTS AND FUNDING

- 5.11.2 OTHER INVESTMENTS AND FUNDING

- 5.12 KEY CONFERENCES & EVENTS, 2024-2025

- 5.13 CASE STUDY ANALYSIS

- 5.13.1 CASE STUDY 1: EFFICACY OF KEYTRUDA IN CANCER TREATMENT

- 5.13.2 CASE STUDY 2: EFFECTIVE USE OF LYNPARZA IN PROSTATE CANCER TREATMENT

- 5.13.3 CASE STUDY 3: CLINICAL TRIALS OF ORPATHYS (SAVOLITINIB)

- 5.14 REGULATORY LANDSCAPE

- 5.14.1 REGULATORY ANALYSIS

- 5.14.1.1 North America

- 5.14.1.1.1 US

- 5.14.1.1.2 Canada

- 5.14.1.2 Europe

- 5.14.1.2.1 Germany

- 5.14.1.2.2 UK

- 5.14.1.2.3 Rest of Europe

- 5.14.1.3 Asia Pacific

- 5.14.1.3.1 China

- 5.14.1.3.2 Japan

- 5.14.1.3.3 South Korea

- 5.14.1.3.4 Australia

- 5.14.1.1 North America

- 5.14.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.2.1 North America

- 5.14.2.2 Europe

- 5.14.2.3 Asia Pacific

- 5.14.2.4 Latin America

- 5.14.2.5 Middle East & Africa

- 5.14.1 REGULATORY ANALYSIS

6 IMMUNOTHERAPY DRUGS MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 ANTIBODY DRUGS

- 6.2.1 ROBUST CLINICAL PIPELINE OF ANTIBODY THERAPEUTICS TO SUPPORT MARKET GROWTH

- 6.3 INHIBITOR DRUGS

- 6.3.1 INCREASED FOCUS ON DEVELOPMENT OF TARGET MEDICINES AND COMBINATION THERAPIES TO FUEL MARKET GROWTH

- 6.4 INTERFERONS & INTERLEUKINS

- 6.4.1 INCREASED FOCUS ON R&D AND DEVELOPMENT OF NEW IMMUNOTHERAPY DRUGS TO AUGMENT MARKET GROWTH

- 6.5 CANCER VACCINES

- 6.5.1 RISING FOCUS ON RESEARCH ACTIVITIES AND CLINICAL TRIALS TO SPUR MARKET GROWTH

- 6.6 OTHER IMMUNOTHERAPY DRUGS

7 IMMUNOTHERAPY DRUGS MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 CANCER

- 7.2.1 LARGE R&D SPENDING AND HIGH GOVERNMENT INVESTMENTS TO DRIVE MARKET

- 7.3 AUTOIMMUNE & INFLAMMATORY DISEASES

- 7.3.1 ADVANCEMENTS IN MOLECULAR ENGINEERING AND INTRODUCTION OF BIOLOGICAL DRUGS TO PROPEL MARKET GROWTH

- 7.4 HEMATOLOGY

- 7.4.1 INCREASED R&D IN CELL-BASED THERAPIES, MONOCLONAL ANTIBODIES, AND IMMUNE CHECKPOINT INHIBITORS TO AID MARKET GROWTH

- 7.5 OSTEOLOGY

- 7.5.1 GROWING INCIDENCE OF OSTEOPOROSIS-RELATED FRACTURES TO DRIVE MARKET

- 7.6 NEUROLOGY

- 7.6.1 ADVANCEMENTS IN NEUROLOGICAL DRUG DEVELOPMENT TO BOOST MARKET GROWTH

- 7.7 OTHER APPLICATIONS

8 IMMUNOTHERAPY DRUGS MARKET, BY ROUTE OF ADMINISTRATION

- 8.1 INTRODUCTION

- 8.2 INTRAVENOUS ROUTE OF ADMINISTRATION

- 8.2.1 DIRECT DELIVERY OF THERAPEUTIC DOSAGE TO PROPEL MARKET GROWTH

- 8.3 SUBCUTANEOUS ROUTE OF ADMINISTRATION

- 8.3.1 ENHANCED PATIENT ADHERENCE AND LOW HEALTHCARE COSTS TO AID MARKET GROWTH

- 8.4 OTHER ROUTES OF ADMINISTRATION

9 IMMUNOTHERAPY DRUGS MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 HOSPITALS

- 9.2.1 AVAILABILITY OF ADVANCED HEALTHCARE INFRASTRUCTURE AND EXPERTISE TO AUGMENT MARKET GROWTH

- 9.3 LONG-TERM CARE FACILITIES

- 9.3.1 SPECIALIZED CARE AND CONTINUOUS MONITORING FOR PATIENTS WITH CHRONIC HEALTH CONDITIONS TO DRIVE MARKET

- 9.4 OTHER END USERS

10 IMMUNOTHERAPY DRUGS MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: RECESSION IMPACT

- 10.2.2 US

- 10.2.2.1 US to dominate North American immunotherapy drugs market during forecast period

- 10.2.3 CANADA

- 10.2.3.1 Rising government initiatives for research on regenerative medicine to drive market

- 10.3 EUROPE

- 10.3.1 EUROPE: RECESSION IMPACT

- 10.3.2 GERMANY

- 10.3.2.1 Increasing investments in healthcare research to fuel market growth

- 10.3.3 UK

- 10.3.3.1 Favorable government initiatives and high R&D investments to propel market growth

- 10.3.4 FRANCE

- 10.3.4.1 Increasing adoption of immunotherapy drugs and growing focus on healthcare R&D to augment market growth

- 10.3.5 ITALY

- 10.3.5.1 Strong focus on clinical research and stringent government regulations to propel market growth

- 10.3.6 SPAIN

- 10.3.6.1 Favorable government initiatives to spur market growth

- 10.3.7 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: RECESSION IMPACT

- 10.4.2 CHINA

- 10.4.2.1 Less-stringent regulatory framework and high incidence of cancer to drive market

- 10.4.3 JAPAN

- 10.4.3.1 Rising geriatric population and increasing government support to augment market growth

- 10.4.4 INDIA

- 10.4.4.1 Increasing prevalence of cancer and rising government healthcare investments to aid market growth

- 10.4.5 SOUTH KOREA

- 10.4.5.1 Strong biopharmaceutical sector and favorable government initiatives to support market growth

- 10.4.6 AUSTRALIA

- 10.4.6.1 High prevalence of cancer and increased expenditure on health services to propel market growth

- 10.4.7 REST OF ASIA PACIFIC

- 10.5 LATIN AMERICA

- 10.5.1 LATIN AMERICA: RECESSION IMPACT

- 10.5.2 BRAZIL

- 10.5.2.1 Developed healthcare infrastructure and unified public health system to fuel market growth

- 10.5.3 REST OF LATIN AMERICA

- 10.6 MIDDLE EAST

- 10.6.1 MIDDLE EAST: RECESSION IMPACT

- 10.6.2 GCC COUNTRIES

- 10.6.2.1 Saudi Arabia

- 10.6.2.1.1 Increasing focus on R&D and growing government support to spur market growth

- 10.6.2.2 UAE

- 10.6.2.2.1 Technological advancements and increased government focus on healthcare to support market growth

- 10.6.2.3 Rest of GCC Countries

- 10.6.2.1 Saudi Arabia

- 10.6.3 REST OF MIDDLE EAST

- 10.7 AFRICA

- 10.7.1 INCREASING HEALTHCARE FUNDING AND RISING INCIDENCE OF CANCER TO DRIVE MARKET

- 10.7.2 AFRICA: RECESSION IMPACT

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGY/RIGHT TO WIN

- 11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN IMMUNOTHERAPY DRUGS MARKET

- 11.3 REVENUE ANALYSIS

- 11.4 MARKET SHARE ANALYSIS

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 11.5.5.1 Company footprint

- 11.5.5.2 Type footprint

- 11.5.5.3 Application footprint

- 11.5.5.4 Route of administration footprint

- 11.5.5.5 Region footprint

- 11.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 11.7 COMPANY VALUATION & FINANCIAL METRICS

- 11.8 BRAND/PRODUCT COMPARISON

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT APPROVALS

- 11.9.2 DEALS

- 11.9.3 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 MERCK & CO., INC.

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Services/Solutions offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product approvals

- 12.1.1.3.2 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses & competitive threats

- 12.1.2 JOHNSON & JOHNSON SERVICES, INC.

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Services/Solutions offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product approvals

- 12.1.2.3.2 Deals

- 12.1.2.3.3 Expansions

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses & competitive threats

- 12.1.3 F. HOFFMANN-LA ROCHE LTD.

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Services/Solutions offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product approvals

- 12.1.3.3.2 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses & competitive threats

- 12.1.4 ASTRAZENECA

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Services/Solutions offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product approvals

- 12.1.4.3.2 Deals

- 12.1.4.3.3 Expansions

- 12.1.5 PFIZER INC.

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Services/Solutions offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product approvals

- 12.1.5.3.2 Deals

- 12.1.6 AMGEN INC.

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Services/Solutions offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product approvals

- 12.1.6.3.2 Expansions

- 12.1.7 NOVARTIS AG

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Services/Solutions offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product approvals

- 12.1.7.3.2 Deals

- 12.1.8 ELI LILLY AND COMPANY

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Services/Solutions offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product approvals

- 12.1.8.3.2 Deals

- 12.1.9 SANOFI

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Services/Solutions offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Product approvals

- 12.1.9.3.2 Deals

- 12.1.10 BRISTOL-MYERS SQUIBB COMPANY

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Services/Solutions offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product approvals

- 12.1.10.3.2 Deals

- 12.1.11 GILEAD SCIENCES, INC.

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Services/Solutions offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Product approvals

- 12.1.11.3.2 Deals

- 12.1.11.3.3 Other developments

- 12.1.12 TAKEDA PHARMACEUTICAL COMPANY LIMITED

- 12.1.12.1 Business overview

- 12.1.12.2 Products/Services/Solutions offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Product approvals

- 12.1.12.3.2 Deals

- 12.1.13 TEVA PHARMACEUTICAL INDUSTRIES LTD.

- 12.1.13.1 Business overview

- 12.1.13.2 Products/Services/Solutions offered

- 12.1.13.3 Recent developments

- 12.1.13.3.1 Deals

- 12.1.14 ABBVIE INC.

- 12.1.14.1 Business overview

- 12.1.14.2 Products/Services/Solutions offered

- 12.1.14.3 Recent developments

- 12.1.14.3.1 Product approvals

- 12.1.14.3.2 Deals

- 12.1.15 GSK PLC

- 12.1.15.1 Business overview

- 12.1.15.2 Products/Services/Solutions offered

- 12.1.15.3 Recent developments

- 12.1.15.3.1 Product approvals

- 12.1.15.3.2 Deals

- 12.1.15.3.3 Other developments

- 12.1.1 MERCK & CO., INC.

- 12.2 OTHER PLAYERS

- 12.2.1 IMMUNOCORE HOLDINGS PLC

- 12.2.2 ASTELLAS PHARMA INC.

- 12.2.3 GENMAB A/S

- 12.2.4 MACROGENICS, INC.

- 12.2.5 FERRING BV

- 12.2.6 Y-MABS THERAPEUTICS, INC.

- 12.2.7 BIOGEN

- 12.2.8 KYOWA KIRIN CO., LTD.

- 12.2.9 SWEDISH ORPHAN BIOVITRUM AB

- 12.2.10 BOEHRINGER INGELHEIM INTERNATIONAL GMBH

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS