|

|

市場調査レポート

商品コード

1103946

TIM3阻害剤市場:臨床試験と市場の機会(2028年)TIM3 Inhibitors Drug Clinical Trials & Market Opportunity Insight 2028 |

||||||

| TIM3阻害剤市場:臨床試験と市場の機会(2028年) |

|

出版日: 2022年07月01日

発行: KuicK Research

ページ情報: 英文 111 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 図表

- 目次

当レポートでは、TIM3阻害剤市場について調査し、市場の概要とともに、臨床試験動向、企業別、適応症別、相別動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

第1章 TIM3-新たな免疫チェックポイント

- TIM3阻害剤のイントロダクション

- TIM3の構造と生物学

第2章 癌併用免疫療法の標的としてのTIM3

第3章 開発中の新たなTIM3阻害剤

第4章 TIM3阻害剤の作用機序

第5章 癌バイオマーカーとしてのTIM3の可能性

- 診断バイオマーカーとしてのTIM3

- 予後バイオマーカーとしてのTIM3

第6章 TIM3療法を対象とした治療アプローチ

- 小分子免疫療法

- モノクローナル抗体

- 二重特異性抗体

第7章 世界のTIM3阻害剤の臨床試験概要

- 企業別

- 国別

- 患者セグメント/病期別

- 相別

第8章 世界のTIM3阻害剤の臨床試験、企業別、適応症別、相別

- 前臨床

- 第I相

- 第I/II相

- 第II相

- 第II/III相

- 第III相

第9章 癌におけるTIM3標的療法の適用

- 骨髄性白血病

- 黒色腫

- 肺癌

- 頭頸部癌

第10章 TIM3療法の将来の展望

- 臨床予測

- 将来の市場機会

第11章 競合情勢

- Agenus

- AstraZeneca

- Aurigene

- BeiGene

- BrightPath Therapeutics

- Bristol Myers Squibb

- Chia Tai Tianqing Pharmaceutical Group

- Curis

- Eli Lilly

- GlaxoSmithKline

- HanAll Biopharma

- Incyte Corporation

- Ligand Pharmaceuticals

- Neologics Bio

- Novartis

- Roche

- Sutro Biopharma

- Symphogen

- TrueBinding

List of Figures

- Figure 1-1: Structure of TIM-3

- Figure 4-1: Mechanism of Action of Anti-TIM-3 Antibodies

- Figure 4-2: Sabatolimab - Mechanism of Action

- Figure 7-1: Global - Number of TIM3 Inhibitors Drugs in Clinical Trials by Company, 2022 till 2028

- Figure 7-2: Global - Number of TIM3 Inhibitors Drugs in Clinical Trials by Country, 2022 till 2028

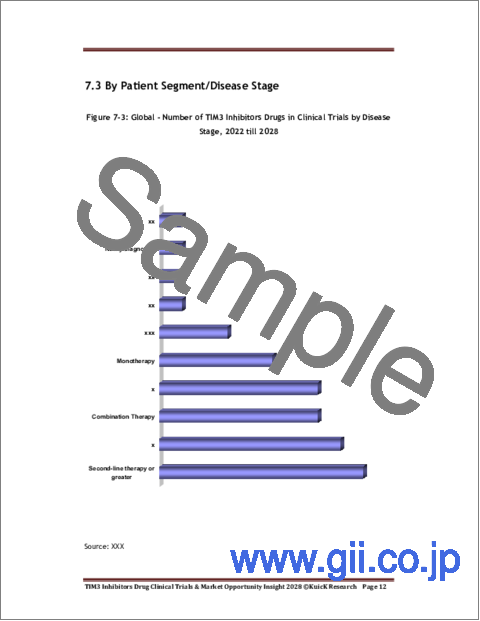

- Figure 7-3: Global - Number of TIM3 Inhibitors Drugs in Clinical Trials by Disease Stage, 2022 till 2028

- Figure 7-4: Global - Number of TIM3 Inhibitors Drugs in Clinical Trials by Phase, 2022 till 2028

- Figure 10-1: Global - TIM3 Inhibitor Market Opportunity by Approval Time (US$ Million), 2024 - 2028

“TIM3 Inhibitors Drug Clinical Trials & Market Opportunity Insight 2028” Report Highlights:

- Insight on Emerging TIM3 Inhibitors in Development As Monotherapy & combination Therapy

- Future Market Opportunity Insight From First Drug Approval: 2024 - 2028

- Insight On TIM3 Inhibitors Drug In clinical Trials: > 15 Drugs

- TIM3 Inhibitors Drug In Clinical Trials Insight By Country, Company, Indication

- Comprehensive Clinical Insight On Biomarker Identified During Clinical Trials

- TIM3 Targeted Therapy Application By Various Cancers

Cancer immunotherapy is novel approach which harnesses the potential of immune system to target tumor cells. Subsequently, the entrance of immune checkpoint including cytotoxic T-lymphocyte antigen 4 (CTLA-4) and programmed cell death-1 (PD-1) and its ligand (PD-L1) have shown huge potential in the treatment of cancer. However, despite these promising long-term responses, the majority of patients failed to respond to immune checkpoint blockade, demonstrating primary resistance. Additionally, many of these patients who initially respond to treatment eventually experience relapse secondary to acquired resistance. Recent studies have identified several new immune checkpoint targets, like lymphocyte activation gene-3 (LAG-3), T cell immunoglobulin and mucin-domain containing-3 (TIM-3), T cell immunoglobulin and ITIM domain (TIGIT), V-domain Ig suppressor of T cell activation (VISTA), and so on.

More recently TIM3 has emerged as potential immune checkpoint inhibitor in the management of cancer. TIM-3 is regulatory of both innate and adaptive immune response and is expressed on multiple tumor types including effector T cells, monocytes, natural killer cells, and dendritic cells. Apart from this, TIM-3 has been shown to promote immune tolerance, and overexpression of TIM-3 is associated with more advanced stage and poor prognosis of disease. Owing to this, pharmaceutical companies have designed novel TIM-3 inhibitors across wide range of cancers.

The promising preclinical data has encouraged pharmaceutical companies to develop clinical pipeline of monoclonal antibodies targeting TIM-3 as an alternate to target cancers. Currently, several anti-TIM-3 monoclonal antibodies have been developed which have shown encouraging response in clinical trials. However, studies have supported the fact that combined blockade of PD-1 and TIM-3 pathways synergistically improved the CD8 T cell response and viral control. The advancement in the field of biotechnology and their encouraging response in combination therapy have led to development of bispecific antibodies. Currently, only a few bispecific antibodies have been developed, however with the advancement in the field of genetic engineering, it is expected that bispecific antibodies will emerge as shining star in TIM-3 therapy owing to several benefits associated with them.

The pipeline for novel TIM-3 inhibitors is highly concentrated and is expected to flourish in market during the forthcoming years. Cobolimab developed by Tesaro Therapeutics is one of the advanced stage TIM-3 inhibitors which are currently being evaluated in phase-II clinical trial. Recent data has shown that anti-TIM-3 antibody cobolimab is well-tolerated as monotherapy and in combination with the PD-1 inhibitor dostarlimab. Based on this encouraging data, company is translating the drug into late stage clinical trials for the management of solid tumors. Apart from this, several others drugs are under development including MBG453, Sym-023, BMS-986258, AZD7789, INCAGN02390, and others which are also present in initial stages of clinical development.

US is currently dominating the global market development for TIM3 Drugs driven by large number of ongoing clinical trials and presence of pharmaceutical companies which actively invest in this segment. Apart from this, US FDA also grants several special designations to expedite the drug development and approval process. For instance in 2021, US FDA granted fast track designation for sabatolimab (MBG453) for the treatment of adult patients with myelodysplastic syndromes (MDS) in combination with hypomethylating agents.

The global TIM-3 inhibitor market is expected to surpass US$ 1 Billion by 2028 driven by first drug approval expected to be launch by 2024. Surge in prevalence of cancer across geographies, high demand for targeted therapeutics for cancer management, development of favorable reimbursement policies, and rise in awareness of TIM-3 immune checkpoint inhibitors for the management of cancer due to positive results in combination therapy are the major factors boosting the growth of market. In addition, surge in geriatric population and increase in technological advancements in screening and diagnosing cancer will supplement the market growth during the forecast period.

Table of Contents

1. TIM3 - Emerging Immune Checkpoint

- 1.1 Introduction to TIM3 Inhibitor

- 1.2 Structure & Biology of TIM3

2. TIM3 as Cancer Combination Immunotherapy Target

3. Emerging TIM3 Inhibitors in Development

4. TIM3 Inhibitor Mechanism of Action

- 4.1 General Mechanism

- 4.2 Sabatolimab Proposed Mechanism of Action

5. Potential of TIM3 as Cancer Biomarker

- 5.1 TIM3 as Diagnostic Biomarker

- 5.2 TIM3 as Prognostic Biomarker

6. TIM3 Therapy Targeted Therapeutic Approach

- 6.1 Small Molecule Immunotherapy

- 6.2 Monoclonal Antibodies

- 6.3 Bispecific Antibodies

7. Global TIM3 Inhibitors Drugs Clinical Trials Overview

- 7.1 By Company

- 7.2 By Country

- 7.3 By Patient Segment/Disease Stage

- 7.4 By Phase

8. Global TIM3 Inhibitors Drugs Clinical Trials By Company, Indication & Phase

- 8.1 Preclinical

- 8.2 Phase-I

- 8.3 Phase-I/II

- 8.4 Phase-II

- 8.5 Phase-II/III

- 8.6 Phase-III

9. Application of TIM3 Targeted Therapy in Cancer

- 9.1 Myeloid Leukemia

- 9.2 Melanoma

- 9.3 Lung Cancer

- 9.4 Head & Neck Cancer

10. TIM3 Therapy Future Perspective

- 10.1 Clinical Forecast

- 10.2 Future Market Opportunity

11. Competitive Landscape

- 11.1 Agenus

- 11.2 AstraZeneca

- 11.3 Aurigene

- 11.4 BeiGene

- 11.5 BrightPath Therapeutics

- 11.6 Bristol Myers Squibb

- 11.7 Chia Tai Tianqing Pharmaceutical Group

- 11.8 Curis

- 11.9 Eli Lilly

- 11.10 GlaxoSmithKline

- 11.11 HanAll Biopharma

- 11.12 Incyte Corporation

- 11.13 Ligand Pharmaceuticals

- 11.14 Neologics Bio

- 11.15 Novartis

- 11.16 Roche

- 11.17 Sutro Biopharma

- 11.18 Symphogen

- 11.19 TrueBinding