|

|

市場調査レポート

商品コード

1225758

リテールオートメーションの世界市場 - 予測(2023年~2028年)Retail Automation Market - Forecasts from 2023 to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| リテールオートメーションの世界市場 - 予測(2023年~2028年) |

|

出版日: 2023年01月20日

発行: Knowledge Sourcing Intelligence

ページ情報: 英文 148 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

世界のリテールオートメーションの市場規模は、2021年の83億7,000万米ドルから2028年までに218億7,300万米ドルに達し、CAGRで14.71%の成長が予測されています。

当レポートでは、世界のリテールオートメーション市場について調査分析し、市場力学、セグメント分析、地域分析、企業プロファイルなどを提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場促進要因

- 市場抑制要因

- 市場機会

- ポーターのファイブフォース分析

- 業界バリューチェーン分析

第5章 リテールオートメーション市場の分析:タイプ別

- イントロダクション

- 手動操作端末

- 無人端末

第6章 リテールオートメーション市場の分析:製品別

- イントロダクション

- POS端末

- RFID、バーコード

- 倉庫ロボット

- 自動コンベアー

- 自動保管、検索システム

- 電子棚札

- 無人搬送車

- その他

第7章 リテールオートメーション市場の分析:業界別

- イントロダクション

- 輸送・ロジスティクス

- 食品・飲料

- ハイパーマーケット・スーパーマーケット

- 医療・製薬業界

- 燃料ステーション

- 自動車

- その他

第8章 リテールオートメーション市場の分析:コンポーネント別

- イントロダクション

- ハードウェア

- POSシステム

- 自動販売機

- バーコードスキャナー

- セルフレジシステム

- その他

- ソフトウェア

- POSソフトウェア

- eコマース管理ソフトウェア

- 従業員管理

- 小売管理ソフトウェア

- 決済処理ソフトウェア

- 在庫管理ソフトウェア

- その他

第9章 リテールオートメーション市場の分析:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- アルゼンチン

- その他

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- その他

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- イスラエル

- その他

- アジア太平洋

- 中国

- 日本

- 韓国

- インド

- インドネシア

- タイ

- 台湾

- その他

第10章 競合環境と分析

- 主な企業と戦略の分析

- 新興企業と市場の収益性

- 合併・買収・合意・提携

- ベンダーの競争力マトリックス

第11章 企業プロファイル

- Zebra Technologies Corporation

- Honeywell International Inc.

- Fujitsu Ltd.

- RapidPricer B.V.

- Toshiba Global Commerce Solution

- Xerox Corporation

- ECR Software Corporation

- Diebold Nixdorf, Incorporated

- NCR Corporation

- Datalogic S.p.A

The retail automation market is estimated to grow at a CAGR of 14.71% to reach a market size of US$21.873 billion in 2028 from US$8.370 billion in 2021.

Retail automation, using advanced technologies, provides merchants and users with flexible and uncomplicated solutions. The advantages of automated products, such as controllable company platforms, effective product supply chains, and faster sales processes, are increasing their demand. The primary factors impacting the desire for automated services in the retail sector include visual merchandising, processing steps, and big data. Effective automated goods and programs that expedite the sales process, enhance the efficiency of product delivery, and establish conveniently accessible business platforms can aid in the worldwide evolution of the retail automation industry.

Additionally, retailers worldwide are simplifying workflows to enhance their business processes since it gives transparency and insight into the supply chain. As a result, more techniques, such as digitalization, are being adopted to fuel the growth of the worldwide retail automation market throughout the forecast period. Due to all these factors tech companies are extending their operations and enhancing their strategies which have been lucrative for the market's profitability.

Technological developments with advanced analytics and data will drive market growth.

As manual methods take more time and reduce human reliance, merchants may use automation to extend their distribution channels, stock, and customer presence. Moreover, automation improves the business's agility and functionality, allowing it to respond to demands more precisely and effectively. Hence, during the projected period, the incorporation of advanced analytics with automation solutions is likely to give significant opportunities in the retail business. Analytical automation's capacity to make judgments based on studied data is expected to help retailers achieve a competitive advantage in the market. Thus, the study of consumer purchasing habits is projected to fuel the retail automation market in the upcoming years. The surge of analytics and data transformation operations in retail, such as recommendation systems, represents an additional possibility for global market participants to considerably enhance their income.

Furthermore, the increased use of automation technology by key companies like as Walmart and Amazon is projected to fuel the retail automation industry in the United States. The changes in consumer tastes also have a role in adoption. Due to all these developments made by the companies and the implementation of robotics and artificial intelligence in the retail sector, the market is anticipated to witness a huge surge during the projected period.

Market Developments:

- NCR Corporation, one of the major corporate technology providers of software, hardware, and services for banks, shops, restaurants, and small businesses, acquired Freshop Inc in January 2021. This purchase integrated e-commerce into NCR Corporation's premier retail core POS technology, allowing merchants to better serve their customers' demands.

- Focal Systems, the world leader in retail automation, announced its entry into the UK retail sector in November 2022, having joined the British Retail Consortium (BRC) in August and opening its first office in Europe. Focal Systems, the creators of the "Self-Driving Store" Operating System (FocalOS), employs its industry-leading AI technology to assist retailers in improving profitability, increasing sustainability, and providing better customer service.

- In April 2022, the Chinese retail behemoth debuted two next-generation robotic stores in the Netherlands under the brand name Ochama. Ochama's omnichannel venture marks the Chinese retailer's first push into the region's physical outlets. Using modern supply chain management and high-tech robotic automation technologies.

Further, there are many developments in the Food and business industry, due to which the demand for automation is expected to grow.

In January 2021, Diebold Nixdorf has launched the DN Series EASY, a new family of self-service products that were developed to meet the most urgent demands of retailers: boosting store productivity, improving the shopping experience for customers, and reducing expenses. In December 2022, the renowned fast food business McDonald's opened an automated outlet in Texas, which is a first in and of itself. The restaurant allows customers to order food without utilizing a kiosk or a smartphone app. Without any human interaction, customers will receive their orders on the conveyor belt. The restaurant lacks any seating or set-ups for eating inside because it is intended to be a "grab and go" establishment.

The North American region constitutes a significant share of the retail automation market.

Based on geography, the retail automation market is segmented into North America, South America, Europe, the Middle East and Africa, and Asia Pacific. The market for is growing significantly in the North American region mainly due to the presence of key market players and rapidly advancing technological changes in the region. In countries like the United States, the increased adoption of automation technology by major companies like Walmart and Amazon is anticipated to fuel the retail automation industry in the region. Considering the current e-commerce growth, digital payment is expected to overtake other forms of payment as Americans' preferred method of payment. According to Digimarc research, 88% of American adults prefer quicker checkout choices to slower checkout times and large waits. This certain trend is expected to increase the adoption of self-checkout systems in the region.

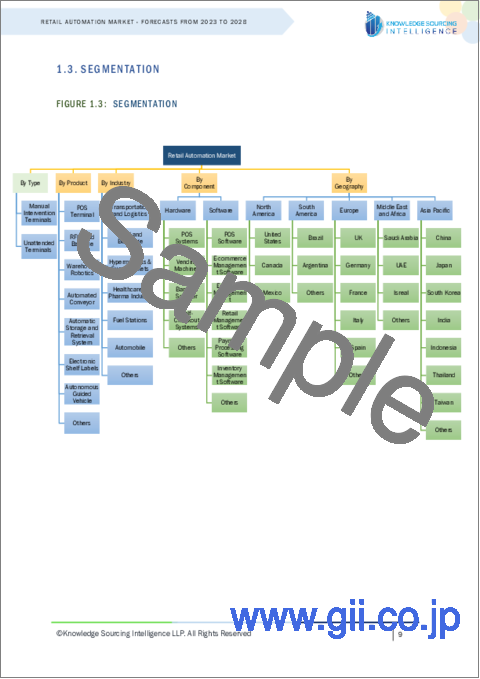

Market Segmentation:

- By Type

Manual Intervention Terminals

Unattended Terminals

- By Product

POS Terminal

RFID and Barcode

Warehouse Robotics

Automated Conveyor

Automatic Storage And Retrieval System

Electronic Shelf Labels

Autonomous Guided Vehicle

Others

- By Industry

o

- Transportation And Logistics

- Food And Beverage

- Hypermarkets & Supermarkets

- Healthcare & Pharma Industry

- Fuel Stations

- Automobile

- Others

- By Component

Hardware

- Pos Systems

- Vending Machines

- Barcode Scanner

- Self-Checkout Systems

- Others

Software

- Pos Software

- E-Commerce Management Software

- Employee Management

- Retail Management Software

- Payment Processing Software

- Inventory Management Software

- Others

- By Geography

North America

- United States

- Canada

- Mexico

South America

- Brazil

- Argentina

- Others

Europe

- UK

- Germany

- France

- Italy

- Spain

- Others

The Middle East and Africa (MEA)

- Saudi Arabia

- UAE

- Israel

- Others

Asia Pacific

- China

- Japan

- South Korea

- India

- Indonesia

- Thailand

- Taiwan

- Others

TABLE OF CONTENTS

1. INTRODUCTION

- 1.1. Market Overview

- 1.2. Market Definition

- 1.3. Market Segmentation

2. RESEARCH METHODOLOGY

- 2.1. Research Data

- 2.2. Assumptions

3. EXECUTIVE SUMMARY

- 3.1. Research Highlights

4. MARKET DYNAMICS

- 4.1. Market Drivers

- 4.2. Market Restraints

- 4.3. Market Opportunities

- 4.4. Porter's Five Forces Analysis

- 4.4.1. Bargaining Power of Suppliers

- 4.4.2. Bargaining Power of Buyers

- 4.4.3. Threat of New Entrants

- 4.4.4. Threat of Substitutes

- 4.4.5. Competitive Rivalry in the Industry

- 4.5. Industry Value Chain Analysis

5. RETAIL AUTOMATION MARKET ANALYSIS, BY TYPE

- 5.1. Introduction

- 5.2. Manual Intervention Terminals

- 5.3. Unattended Terminals

6. RETAIL AUTOMATION MARKET ANALYSIS, BY PRODUCT

- 6.1. Introduction

- 6.2. POS Terminal

- 6.3. RFID and Barcode

- 6.4. Warehouse Robotics

- 6.5. Automated Conveyor

- 6.6. Automatic Storage and Retrieval System

- 6.7. Electronic Shelf Labels

- 6.8. Autonomous Guided Vehicle

- 6.9. Others

7. RETAIL AUTOMATION MARKET ANALYSIS, BY INDUSTRY

- 7.1. Introduction

- 7.2. Transportation and Logistics

- 7.3. Food and Beverage

- 7.4. Hypermarkets & Supermarkets

- 7.5. Healthcare & Pharma Industry

- 7.6. Fuel Stations

- 7.7. Automobile

- 7.8. Others

8. RETAIL AUTOMATION MARKET ANALYSIS, BY COMPONENT

- 8.1. Introduction

- 8.2. Hardware

- 8.2.1. POS Systems

- 8.2.2. Vending Machines

- 8.2.3. Barcode Scanner

- 8.2.4. Self-Checkout Systems

- 8.2.5. Others

- 8.3. Software

- 8.3.1. POS Software

- 8.3.2. E-commerce Management Software

- 8.3.3. Employee Management

- 8.3.4. Retail Management Software

- 8.3.5. Payment Processing Software

- 8.3.6. Inventory Management Software

- 8.3.7. Others

9. RETAIL AUTOMATION MARKET ANALYSIS, BY GEOGRAPHY

- 9.1. Introduction

- 9.2. North America

- 9.2.1. United States

- 9.2.2. Canada

- 9.2.3. Mexico

- 9.3. South America

- 9.3.1. Brazil

- 9.3.2. Argentina

- 9.3.3. Others

- 9.4. Europe

- 9.4.1. UK

- 9.4.2. Germany

- 9.4.3. France

- 9.4.4. Italy

- 9.4.5. Spain

- 9.4.6. Others

- 9.5. The Middle East and Africa (MEA)

- 9.5.1. Saudi Arabia

- 9.5.2. UAE

- 9.5.3. Israel

- 9.5.4. Others

- 9.6. Asia Pacific

- 9.6.1. China

- 9.6.2. Japan

- 9.6.3. South Korea

- 9.6.4. India

- 9.6.5. Indonesia

- 9.6.6. Thailand

- 9.6.7. Taiwan

- 9.6.8. Others

10. COMPETITIVE ENVIRONMENT AND ANALYSIS

- 10.1. Major Players and Strategy Analysis

- 10.2. Emerging Players and Market Lucrativeness

- 10.3. Mergers, Acquisitions, Agreements, and Collaborations

- 10.4. Vendor Competitiveness Matrix

11. COMPANY PROFILES

- 11.1. Zebra Technologies Corporation

- 11.2. Honeywell International Inc.

- 11.3. Fujitsu Ltd.

- 11.4. RapidPricer B.V.

- 11.5. Toshiba Global Commerce Solution

- 11.6. Xerox Corporation

- 11.7. ECR Software Corporation

- 11.8. Diebold Nixdorf, Incorporated

- 11.9. NCR Corporation

- 11.10. Datalogic S.p.A