|

|

市場調査レポート

商品コード

1557254

細胞株開発の世界市場-2024年から2029年までの予測Global Cell Line Development Market - Forecasts from 2024 to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 細胞株開発の世界市場-2024年から2029年までの予測 |

|

出版日: 2024年08月13日

発行: Knowledge Sourcing Intelligence

ページ情報: 英文 140 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

細胞株開発市場は予測期間中に13.37%のCAGRで成長し、2024年の42億9,700万米ドルから2029年には80億4,700万米ドルに達すると予測されています。

細胞株は、培養を長期間維持できる細胞集団として定義されます。細胞株開発は、細胞機構が治療用タンパク質を製造する技術です。これにより、生物医療研究者はコスト効率の良い規模で薬剤を最適化し、生産することができます。

細胞株開発市場成長の主要促進要因の一つは、医薬品・医療市場の拡大です。世界の医薬品・医療製品の成長により、メーカーはより費用対効果の高い医薬品を開発し、商業市場に進出することが可能になります。Eurostatは、この地域の医薬品・医薬品の輸入額は2022年の約1,200億米ドル(1,120億ユーロ)から2023年には約1,287億米ドル(1,190億ユーロ)に増加すると述べています。この輸入において、ベルギーはこの地域で最大の医薬品・医薬品の輸入国となり、約281億米ドル(260億ユーロ)を輸入し、2023年にはドイツが216億米ドル(200億ユーロ)、オランダが173億米ドル(160億ユーロ)でこれに続きます。

さらに、細胞株開発市場は、世界の細胞ベースワクチン開発の研究プログラムの高まりに後押しされ、急速に拡大すると予想されます。これは、予測期間中、市場に好影響を与えると予想されます。さらに、抗体に関する進歩の増加により、世界的に細胞株開発サービスの必要性がさらに高まると予想されます。

細胞株開発市場促進要因

- モノクローナル抗体とワクチンの需要の増加が細胞株開発市場を押し上げると予想されます。

モノクローナル抗体は、研究所で開発された抗体の変種で、免疫系の細胞に対する攻撃を模倣することもできる代用抗体として機能します。細胞株開発プロセスは、モノクローナル抗体やワクチンのような多様な生物学的製品の効果的なエンジニアリングと生産を記載しています。がん、COVID-19、エボラ出血熱などの致命的な疾患の世界の症例の増加は、モノクローナル抗体の成長を後押しし、細胞株開発の世界市場規模を成長させると予測されています。

世界の疾病例の増加に伴い、ワクチンに対する世界の要求も大幅に増加しています。World Integrated Trade Solutionによると、2023年のベルギーのヒト医療用ワクチンの輸入総額は124億3,300万米ドルで、米国が約92億7,400万米ドル、EUが73億7,600万米ドルと続きます。2023年の中国とドイツの輸入額は、それぞれ約62億2,500万米ドルと46億6,500万米ドルでした。

細胞株開発市場抑制要因

- 高い投資コストが細胞株開発市場の成長を阻害する可能性があります。

世界の細胞株開発市場は、インフラへの高い投資コストによる課題に直面しています。さらに、細胞培養研究施設を立ち上げるには、設備、クリーンルーム施設、品質管理機器、有能な労働力、継続的なトレーニングプログラム、徹底的な試験と文書化などに多額の投資が必要となります。優秀な研究者、技術者、専門家の雇用と確保にはコストがかかり、規制上の前提条件を満たすには、さらに多大な時間と資金が必要となります。全体として、これらのコストは細胞株開発市場の成長にとって大きな課題となっています。

細胞株開発市場の地理的展望

- 米国が大きな市場シェアを占めると予想されます。

米国などの新興経済諸国は、細胞株開発市場の予測期間中に大きな成長を占めると予測されています。これは、研究開発イニシアチブの高まりと先進プロセスへの投資の増加によるものです。

さらに、米国では企業によるバイオシミラーに関する研究への投資が増加しており、今後数年間は細胞株の大量生産に対する需要が高まると考えられます。例えば、2024年に米国食品医薬品局(USFDA)はBkemv(eculizumab-aeeb)を2つの希少疾患の治療として初の交換可能なバイオシミラーとして承認しました。同様に、同局は組換えタンパク質や治療用タンパク質を含む様々なタンパク質を毎年認可しています。このことは、ワクチン、バイオシミラー、医薬品、治療用タンパク質に対する要求が高まっていることを示しており、この地域における細胞株開発の拡大を後押しします。

さらに、業界各社による発展は、長期的な市場発展に寄与すると期待されています。例えば、米国の主要企業の一つであるBerkeley Lights, Inc.は2023年、細胞株開発(CLD)用の新しい光流体システムであるBeacon Selectの発売を発表しました。同製品は2チップのビーコンシステムであり、科学者は1つのプラットフォームを使って1回のランで培養、クローニング、トップクローンの選択を行うことができます。これは、中小規模のバイオファーマやその他のCRO/CDMOに最適です。

さらに、CIRM(カリフォルニア再生医療研究所)は2024年4月の会議で、様々な臨床プログラムに約8,900万米ドルを投資すると発表しました。このような介入は細胞株開発市場に弾みをつけ、予測期間中の細胞ベースワクチンの新興国市場に有利な状況をもたらすと期待されます。

細胞株開発主要市場参入企業:

- Lonza-Lonzaは細胞株開発サービスを提供する世界リーダーの一社です。同社は35年以上の経験を有し、GMP製造から採取した800以上の細胞株を保有しています。同社は、あらゆる分子フォーマットに対する細胞株開発(CLD)サービス一式を提供しています。同社は、哺乳類細胞培養プロセスの開発サービスの提供に努めています。また、最適化・検証サービスも提供しており、小規模から大規模ラボまで、あらゆるバイオ医薬品開発者のニーズに応えています。

- Biofactura-Biofacturaは、バイオ医薬品製造のための安定したNS0細胞株の迅速な作製を支援するバイオマニュファクチャリングプラットフォームを提供しています。同社はバイオシミラーとバイオディフェンスに力を入れており、バイオ製造の迅速化のためのStableFast(TM)プラットフォームなどの革新的技術を提供しています。

- KBI Biopharma-KBI Biopharmaは、世界的にプレミアムな高度哺乳類細胞株開発の主要企業のひとつとみなされています。同社は欧州と米国で数多くの施設を運営し、効果的な生産のための先進的な技術革新に注力しています。

目次

第1章 イントロダクション

- 市場概要

- 市場の定義

- 調査範囲

- 市場セグメンテーション

- 通貨

- 前提条件

- 基準年と予測年のタイムライン

- 利害関係者にとっての主要メリット

第2章 調査手法

- 調査デザイン

- 調査プロセス

第3章 エグゼクティブサマリー

- 主要調査結果

第4章 市場力学

- 市場促進要因

- 市場抑制要因

- ポーターのファイブフォース分析

- 業界バリューチェーン分析

- アナリストビュー

第5章 細胞株開発の世界市場:タイプ別

- イントロダクション

- 組み換え細胞株

- ハイブリドーマ

- 連続細胞株

- 一次細胞株

第6章 細胞株開発の世界市場:供給源別

- イントロダクション

- 哺乳類細胞株開発

- 非哺乳類細胞株開発

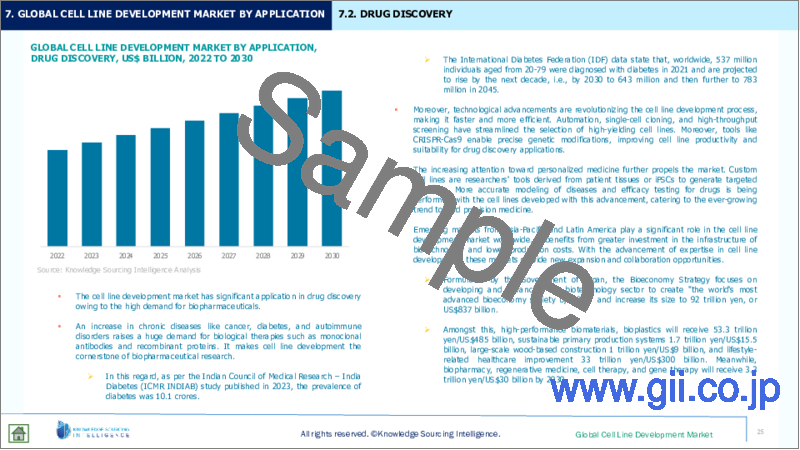

第7章 細胞株開発の世界市場:用途別

- イントロダクション

- 創薬

- 研究

- その他

第8章 細胞株開発の世界市場:地域別

- イントロダクション

- 北米

- タイプ別

- 供給源別

- 用途別

- 国別

- 南米

- タイプ別

- 供給源別

- 用途別

- 国別

- 欧州

- タイプ別

- 供給源別

- 用途別

- 国別

- 中東・アフリカ

- タイプ別

- 供給源別

- 用途別

- 国別

- アジア太平洋

- タイプ別

- 供給源別

- 用途別

- 国別

第9章 競合環境と分析

- 主要企業と戦略分析

- 新興参入企業とマーキーの収益性

- 合併、買収、合意とコラボレーション

- 競合ダッシュボード

第10章 企業プロファイル

- Lonza

- Biofactura

- WuXi AppTec

- KBI Biopharma

- ATUM

- Fusion Antibodies plc

- Selexis

- In Vivo

- Celonic AG

- Merck KGaA

- Imgenex India

- Bhat Biotech

- Premas Biotech

- Aragen Life Science

- Chitose Group

The global cell line development market is projected to grow at a CAGR of 13.37% over the forecast period, from US$4.297 billion in 2024 to reach US$8.047 billion by 2029.

The cell line is defined as the population of cells that can be maintained in culture for a longer period. Cell line development is the technique through which the cellular machinery manufactures therapeutic proteins. This enables biomedical researchers to optimize and produce drugs at a cost-efficient scale.

One of the major drivers for the global cell line development market growth can be the expanding pharmaceutical and medicine market. Global pharmaceutical and medicine product growth will enable manufacturers to develop more cost-effective drugs to advance in the commercial market. The Eurostat stated that the region's medicine and pharmaceutical products imports increased from about US$120 billion (Euro 112 billion) in 2022 to about US$128.7 billion (Euro 119 billion) in 2023. In this import, Belgium became the biggest importer of medicinal and pharmaceutical products in the region, importing about US$28.1 billion (Euro 26 billion), followed by Germany and the Netherlands at US$21.6 billion (Euro 20 billion) and US$17.3 billion (Euro 16 billion) respectively, in 2023.

Additionally, the global cell line development market is expected to expand rapidly, fueled by rising research programs for cell-based vaccine development worldwide. This is expected to have a favorable market influence during the projected period. Further, the increase in advancement related to antibodies is expected to further elevate the necessity for cell line development services worldwide.

GLOBAL CELL LINE DEVELOPMENT MARKET DRIVERS:

- An increase in the demand for monoclonal antibodies and vaccines is expected to boost the global cell line development market.

Monoclonal antibodies are the variants of antibodies developed in research laboratories to work as substitute antibodies, which can also mimic the immune system's attack on cells. The cell line development process provides effective engineering and production of diverse biological products, such as monoclonal antibodies and vaccines. The increase in the worldwide cases of deadly diseases, such as cancer, COVID-19, Ebola, and others, is predicted to bolster the growth of monoclonal antibodies, growing the global market size of cell line development.

With the increase in disease cases globally, the worldwide requirement for vaccines has grown substantially. The World Integrated Trade Solution stated that in 2023, Belgium's total import of vaccines for human medicine accounted for US$12.433 billion, followed by the US at about US$9.274 billion and the EU at US$7.376 billion. The imports of China and Germany in 2023 accounted for about US$6.225 billion and US$4.665 billion, respectively.

GLOBAL CELL LINE DEVELOPMENT MARKET RESTRAINTS:

- High investment costs could hinder the global cell line development market's growth.

The worldwide cell line development market faces challenges due to high investment costs in infrastructure. Moreover, setting up a cell culture research facility requires significant investments in equipment, cleanroom facilities, quality control equipment, a talented workforce, persistent training programs, and thorough testing and documentation. Hiring and retaining profoundly qualified researchers, engineers, and professionals is costly, and meeting regulatory prerequisites moreover requires noteworthy time and monetary resources. Overall, these costs substantially challenge the global cell line development market's growth.

Global Cell Line Development Market Geographical Outlook

- The United States region is anticipated to have a significant market share.

Developed economies such as the United States are anticipated to account for significant growth during the projected cell line development market period. This is owing to the rising research and development initiatives coupled with increased investment in advanced processes in the country.

Additionally, the increasing investment in research regarding biosimilars by companies in the United States will drive demand for cell line large-scale production in the coming years. For instance, in 2024, the US Food and Drug Administration (USFDA) approved Bkemv (eculizumab-aeeb) as the first interchangeable biosimilar for the treatment of two rare diseases. Similarly, the administration authorizes various proteins annually, including recombinant and therapeutic proteins. This shows the increasing requirement for vaccines, biosimilars, pharmaceuticals, and therapeutic proteins that will boost the expansion of cell line development in the region.

Moreover, the major developments in the market by industry players are expected to contribute to its long-term development. For instance, in 2023, Berkeley Lights, Inc., one of the leading companies in the United States, announced the launch of Beacon Select, the new optofluidic system for cell line development (CLD). The product is a two-chip beacon system that enables scientists to culture, clone, and select the top clone in a single run using a single platform. This is ideally most suitable for small to mid-sized biopharma set-ups and other CROs/CDMOs as well.

Moreover, CIRM (California Institute of Regenerative Medicine) announced an investment of around US$89 million in various clinical programs in its 2024 April meeting. Such interventions are expected to provide impetus for the cell line development market and thereby also provide favorable ground for advancement in cell-based vaccines in the forecast period.

Global Cell Line Development Key Market Players:

- Lonza- Lonza is among the global leaders providing cell line development services. The company has over 35 years of experience, with over 800 cell lines taken from GMP manufacturing. It delivers a complete suite of cell line development (CLD) services for any molecular format. The company strives to provide services for the development of mammalian cell culture processes. It also covers the optimization and validation services to fulfill the needs of all biopharma drug developers, small to large laboratories, among others

- Biofactura- Biofactura offers its biomanufacturing Platform, which helps rapidly generate stable NS0 cell lines for biopharmaceutical manufacturing. The company strongly focuses on biosimilars and biodefense, providing innovative technology such as StableFast(TM) platform for faster biomanufacturing. The company's experienced group, with a robust track record in the industry, guarantees effective and viable production.

- KBI Biopharma - KBI Biopharma is regarded as one of the leading players in premium advanced mammalian cell line development worldwide. The company operates numerous facilities in Europe and the US, focusing on progressed innovations for effective production.

Market Segmentation:

Global Cell Line Development Market is segmented and analyzed as below:

By Type

- Recombinant Cell Lines

- Hybridomas

- Continuous Cell Lines

- Primary Cell Lines

By Source

- Mammalian Cell Line Development

- Non-Mammalian Cell Line Development

By Application

- Drug discovery

- Research

- Others

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Others

TABLE OF CONTENTS

1. INTRODUCTION

- 1.1. Market Overview

- 1.2. Market Definition

- 1.3. Scope of the Study

- 1.4. Market Segmentation

- 1.5. Currency

- 1.6. Assumptions

- 1.7. Base and Forecast Years Timeline

- 1.8. Key benefits for the stakeholders

2. RESEARCH METHODOLOGY

- 2.1. Research Design

- 2.2. Research Process

3. EXECUTIVE SUMMARY

- 3.1. Key Findings

4. MARKET DYNAMICS

- 4.1. Market Drivers

- 4.2. Market Restraints

- 4.3. Porter's Five Forces Analysis

- 4.3.1. Bargaining Power of Suppliers

- 4.3.2. Bargaining Power of Buyers

- 4.3.3. Threat of New Entrants

- 4.3.4. Threat of Substitutes

- 4.3.5. Competitive Rivalry in the Industry

- 4.4. Industry Value Chain Analysis

- 4.5. Analyst view

5. GLOBAL CELL LINE DEVELOPMENT MARKET BY TYPE

- 5.1. Introduction

- 5.2. Recombinant Cell Lines

- 5.3. Hybridomas

- 5.4. Continuous Cell Lines

- 5.5. Primary Cell Lines

6. GLOBAL CELL LINE DEVELOPMENT MARKET BY SOURCE

- 6.1. Introduction

- 6.2. Mammalian Cell Line Development

- 6.3. Non-Mammalian Cell Line Development

7. GLOBAL CELL LINE DEVELOPMENT MARKET BY APPLICATION

- 7.1. Introduction

- 7.2. Drug Discovery

- 7.3. Research

- 7.4. Others

8. GLOBAL CELL LINE DEVELOPMENT MARKET BY GEOGRAPHY

- 8.1. Introduction

- 8.2. North America

- 8.2.1. By Type

- 8.2.2. By Source

- 8.2.3. By Application

- 8.2.4. By Country

- 8.2.4.1. USA

- 8.2.4.2. Canada

- 8.2.4.3. Mexico

- 8.3. South America

- 8.3.1. By Type

- 8.3.2. By Source

- 8.3.3. By Application

- 8.3.4. By Country

- 8.3.4.1. Brazil

- 8.3.4.2. Argentina

- 8.3.4.3. Others

- 8.4. Europe

- 8.4.1. By Type

- 8.4.2. By Source

- 8.4.3. By Application

- 8.4.4. By Country

- 8.4.4.1. United Kingdom

- 8.4.4.2. Germany

- 8.4.4.3. France

- 8.4.4.4. Spain

- 8.4.4.5. Others

- 8.5. Middle East and Africa

- 8.5.1. By Type

- 8.5.2. By Source

- 8.5.3. By Application

- 8.5.4. By Country

- 8.5.4.1. Saudi Arabia

- 8.5.4.2. Israel

- 8.5.4.3. Others

- 8.6. Asia Pacific

- 8.6.1. By Type

- 8.6.2. By Source

- 8.6.3. By Application

- 8.6.4. By Country

- 8.6.4.1. Japan

- 8.6.4.2. China

- 8.6.4.3. India

- 8.6.4.4. South Korea

- 8.6.4.5. Indonesia

- 8.6.4.6. Others

9. COMPETITIVE ENVIRONMENT AND ANALYSIS

- 9.1. Major Players and Strategy Analysis

- 9.2. Emerging Players and Markey Lucrativeness

- 9.3. Mergers, Acquisitions, Agreements, and Collaborations

- 9.4. Competitive Dashboard

10. COMPANY PROFILES

- 10.1. Lonza

- 10.2. Biofactura

- 10.3. WuXi AppTec

- 10.4. KBI Biopharma

- 10.5. ATUM

- 10.6. Fusion Antibodies plc

- 10.7. Selexis

- 10.8. In Vivo

- 10.9. Celonic AG

- 10.10. Merck KGaA

- 10.11. Imgenex India

- 10.12. Bhat Biotech

- 10.13. Premas Biotech

- 10.14. Aragen Life Science

- 10.15. Chitose Group