|

|

市場調査レポート

商品コード

1349507

同種CARの特許情勢の分析(2023年)Allogeneic CAR Patent Landscape Analysis 2023 |

||||||

|

|||||||

| 同種CARの特許情勢の分析(2023年) |

|

出版日: 2023年09月21日

発行: KnowMade

ページ情報: 英文 PDF > 120 Slides, Excel file: 416 Patent Families

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

同種CAR、自家CAR-T細胞より迅速で安価な治療法

細胞・遺伝子治療のパイプラインは、臨床開発と同様に急速に進行しています。FDAによると、細胞・遺伝子治療のIND申請数は2017年から2倍超に増加しています。現在、100を超える臨床試験が進行中ですが、その数はこのテーマへの関心の高さと企業にとっての経済的利害を反映してさらに増加しています。しかし現在までのところ、欧米の市場にはまだ製品がありませんが、主な特許に対する特許意義申立がすでにいくつか開始されており、米国企業を中心とする数社が同種CAR分野に新規参入しています。

当レポートでは、同種CARの特許情勢を調査し、400を超える特許のデータべースや、公開済み特許の時系列推移、特許出願国、特許の法的ステータスなどの情報を提供しています。

目次

イントロダクション

エグゼクティブサマリー

特許情勢の概要

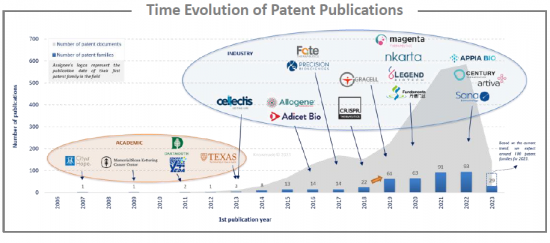

- 特許公開の時系列推移

- もっとも特許の多い出願者のランキング

- IPの主要企業の特許取得活動

- 主な現在のIP保有者のマッピング

- 主な特許受託者の時系列推移

新規参入企業

- スタートアップ企業

- 既存企業

提携

主な出願者のIPポジション

- 特許出願者のIPリーダーシップ

- 特許出願者の可能性を阻害するIPの先行技術

- 主な特許

- 特許ポートフォリオの強度指標

主なEP特許意義申立

特許のセグメンテーション

- 定義

- 主な受託者:技術別

- 細胞

- 細胞の由来

- 遺伝子編集ツール

- 治療領域

主要企業のIPプロファイル

- 概要、主な特許、臨床試験

- Adicet Bio

- Allogene Therapeutics

- Cellectis

- CRISPR Therapeutics

- Fate Therapeutics

- Gracell

- Precision Biosciences

調査手法

KnowMadeのプレゼンテーション

連絡先

Report's Key Features:

- PDF>120 slides

- Excel database containing all patents analyzed in the report (>400 patent families), including segmentations + hyperlink to updated online database (legal status, documents etc.)

- IP trends, including time evolution of published patents, countries of patent filings and patents' legal status

- Ranking of main patent assignees

- Key players' IP position and relative strength of their patent portfolios

- Analysis of collaborations and EP patent oppositions.

- Segmentation: cells (T cells, NK, other), cells origin (PBMC from peripheral blood, iPSC, cord blood & placenta), gene editing tools (CRISPR, TALEN, ZFN, Meganuclease, other) and therapeutic area (hematological malignancies , solid tumor).

Allogeneic CAR, a faster and less expensive therapy than autologous CAR-T cells

The pipeline for cell and gene therapies has been increasing at a rapid rate as are clinical developments. According to the FDA, the number of investigational new drug applications for cell and gene therapies has more than doubled since 2017. To manage this influx, in March 2023, the Office of Therapeutic Products was established as the first super office at the FDA's Center for Biologics Evaluation and Research. Chimeric antigen receptor (CAR) cell therapies are one of the major, and perhaps, best known, components of cell and gene therapies. CAR therapies, mainly to treat cancer, are immune cells engineered to express a chimeric receptor directed against tumor antigens. Currently, there are 2 main types of CAR therapies: autologous (patient-derived) and allogeneic (from healthy donor). Allogeneic CAR are produced from third-party healthy immune cells which confers many advantages. First, allogeneic CAR treatment enables the process to be done in 10 to 11 days versus a minimum of three weeks with autologous CAR therapy. This accelerated process eliminates the need for bridging therapy therefore allowing better results. Second, a high number of CAR immune cells can be produced from a single donor enabling an industrialized manufacturing processes. Moreover, CAR products can be standardized thanks to the production of batches of cryopreserved immune cells. This industrialization also leads to a reduction of manufacturing cost and ultimately reduces the price of treatments. However, allogeneic CAR can generate graft-versus-host disease, which is life-threatening. To overcome this major problem, companies and academics develop several approaches such as the use of various immune cells (e.g., NK, macrophage), the use of induced pluripotent stem cells or umbilical cord blood as source of immune cells or gene editing tools (e.g., CRISPR, TALEN). Currently, more than 100 clinical trials are in progress, but this number increases, reflecting the interest in this topic as well as the economic stakes for companies. However, to date, there is still no product on the European and United States markets, but some patent oppositions have already been initiated against key patents, and several newcomers, mainly American, are entering the allogeneic CAR field. In this evolving context, it is crucial to understand the intellectual property position and strategy of these different players. Such knowledge can help detect business risks and opportunities, anticipate emerging technologies, and enable strategic decisions to strengthen market position.

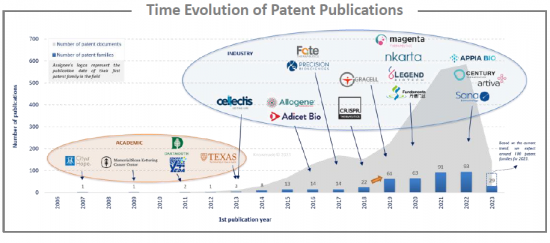

The analysis of the time evolution of patent publications shows that interest in allogeneic CAR began in the late 2000s. However, in 2017, for the 1st time, two autologous CAR therapies have been approved by the FDA: KYMRIAH™ (tisagenlecleucel) from Novartis and YESCARTA™ (Axicabtagene Ciloleucel) from Kite Pharma, a Gilead company. These two therapies are CD19-directed genetically modified autologous T cell immunotherapies. This event allowed the CAR technology to fully develop and led to a significant increase in the number of patent families published since 2019 in allogeneic CAR area.

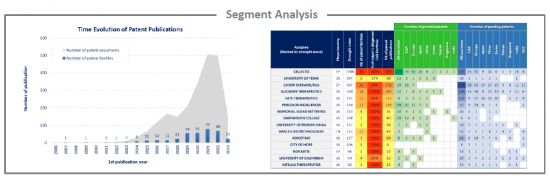

Analysis by segment

Allogeneic CAR have been investigated and the selected patent families labeled according to technologies to which they relate. This IP landscape features the following 4 types of segmentation: cells (T cells, NK, other), cells origin (PBMC from peripheral blood, iPSC, cord blood & placenta), gene editing tools (CRISPR, TALEN, ZFN, Meganuclease, other) and therapeutic areas (hematological malignancies , solid tumor).

EP oppositions

Currently, there is few EP oppositions which reflects the novelty of allogeneic CAR technology. Most of the proceedings are recent, having been filed in the past 5 years, and are still pending. For each opposed patent, the application date, assignee, opponent, opposition year, and results are detailed.

Identifying the companies that have recently emerged in the IP landscape

Among the players owning patent families related to allogeneic CAR, 31 newcomers were identified. These companies are either start-up firms (8) or established companies (23) developing their first technology in the field. Most IP newcomers are based in the U.S. and in Asia. It is possible that one of these innovative companies could become one of the next healthcare unicorns that the big corporations will be tempted to acquire.

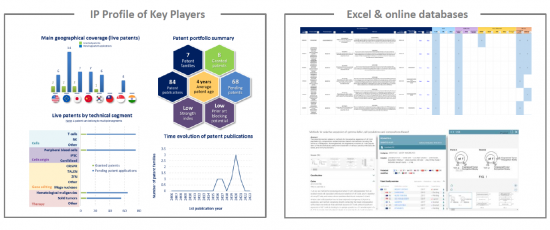

IP profile of key players

This IP study includes a selection and description of main players. The patent portfolio analysis of main players includes a description of the assignee, patent portfolio description, time evolution of patent publication, main geographical coverage and live patents by technical segment. This IP profile overview is followed by the description of the technological content of their key patents and by a table with its clinical trials.

Moreover, the report also includes an Excel database with the 416 patent families analyzed in this study. This useful patent database allows for multi-criteria searches and includes patent publication numbers, hyperlinks to the original documents, priority dates, titles, abstracts, patent assignees, each patent's current legal status and segmentation.

TABLE OF CONTENTS

INTRODUCTION

- CAR therapy

- Scope of the report

- Reading guide

- Main patent assignees

EXECUTIVE SUMMARY

PATENT LANDSCAPE OVERVIEW

- Time evolution of patent publications

- Ranking of most prolific patent applicants

- Patenting activity of IP leading companies

- Mapping of main current IP holders

- Time evolution of main patent assignees

NEWCOMERS

- Startup companies

- Established companies

COLLABORATIONS

IP POSITION OF MAIN APPLICANTS

- IP leadership of patent applicants

- IP prior art blocking potential of patent applicants

- Key patents

- Strength index of patent portfolios

MAIN EP PATENT OPPOSITIONS

PATENT SEGMENTATION

- Definition

- Main assignees by technology

- Cells

- Cells origin

- Gene editing tool

- Therapeutic area

IP PROFILE OF KEY PLAYERS

- Overview, key patents & clinical trials of:

- Adicet Bio

- Allogene Therapeutics

- Cellectis

- CRISPR Therapeutics

- Fate Therapeutics

- Gracell

- Precision Biosciences

METHODOLOGY

- Patent search, selection and analysis

- Search strategy

- Terminologies for patent analysis

- Strength and blocking potential