|

|

市場調査レポート

商品コード

1709842

航空コネクタの世界市場規模、シェア、動向分析レポート:航空機別、用途別、タイプ別、地域別展望と予測、2024年~2031年Global Aviation Connector Market Size, Share & Trends Analysis Report By Aircraft (Commercial Aircraft, Military Aircraft, and Business & General Aviation Aircraft), By Application, By Type, By Regional Outlook and Forecast, 2024 - 2031 |

||||||

|

|||||||

| 航空コネクタの世界市場規模、シェア、動向分析レポート:航空機別、用途別、タイプ別、地域別展望と予測、2024年~2031年 |

|

出版日: 2025年04月02日

発行: KBV Research

ページ情報: 英文 291 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

航空コネクタの世界市場規模は、予測期間中に6.8%のCAGRで市場成長し、2031年までに85億7,000万米ドルに達すると予想されています。

しかし、航空コネクタは耐久性、信頼性、安全性の基準を満たすために、広範な試験を必要とします。これには、熱サイクル試験、振動試験、電磁干渉評価などが含まれます。これらの試験手順は製造リードタイムとコストを増加させ、航空コネクタは標準的な産業用コネクタよりも高価になります。結論として、これらのコネクタに関連する高コストは、特に価格に敏感な市場において、制約となる可能性があります。

タイプの見通し

タイプ別に見ると、市場はPCBコネクタ、光ファイバーコネクタ、高出力コネクタ、高速コネクタ、RFコネクタなどに分類されます。高出力コネクタセグメントは、2023年に市場シェアの24%を獲得しました。これらのコネクタは、推進力、航空電子機器、照明、配電網など、航空機の重要なシステムへの電力供給に不可欠です。電気航空機やハイブリッド電気航空機の普及と、より効率的な電力管理システムの進歩により、高出力コネクタの需要は大幅に増加しています。過酷な条件下でも耐久性と信頼性を維持しながら大電流負荷に対応できる能力を持つ高出力コネクタは、現代の航空用途に不可欠な存在となっています。

航空機の見通し

航空機に基づいて、市場は民間航空機、軍用機、ビジネス・一般航空機に分類されます。ビジネス・一般航空機セグメントは、2023年に市場における17%の収益シェアを記録しました。プライベートジェット所有者の増加、チャーター便の需要増加、そして高級航空旅行への投資増加が、このセグメントの拡大に貢献しています。ビジネス・一般航空機には、ナビゲーション、コックピット制御システム、衛星通信、そして高度な客室電子機器用の専用コネクタが必要です。さらに、高速データトランスミッションや軽量で耐久性のあるコネクタなどの最先端技術の統合により、これらの航空機の運用効率と安全性が向上し、市場の成長を牽引しています。

用途の見通し

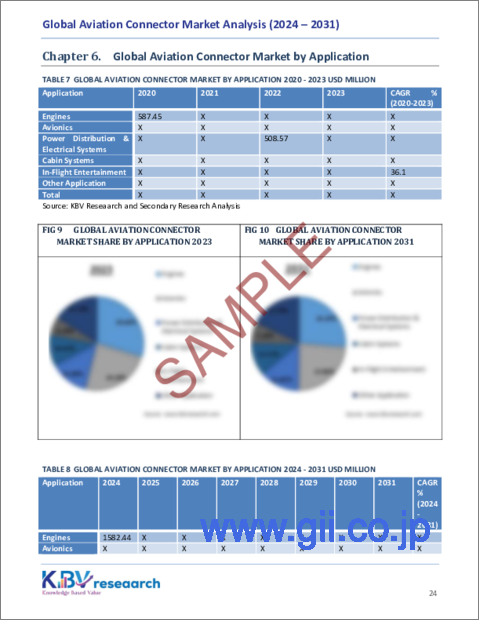

用途別に見ると、市場は航空電子機器、エンジン、配電・電気システム、機内エンターテインメント、客室システム、その他に分類されます。エンジンセグメントは、2023年に市場収益シェアの30%を占めました。航空機エンジンは、効率的な電力トランスミッション、センサー統合、リアルタイムの性能監視を確保するために、耐久性と信頼性の高いコネクタを必要としています。燃費効率と高性能を兼ね備えた航空機エンジンへの需要の高まりにより、極端な温度、振動、過酷な環境条件に耐えられる高度な航空コネクタの採用が促進されています。また、予知保全やデジタルエンジンヘルスモニタリングシステムへの注目の高まりも、このセグメントにおける高品質コネクタの需要を牽引しています。

地域の見通し

地域別に見ると、市場は北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカで分析されています。北米セグメントは、2023年に市場における収益シェアの34%を記録しました。この優位性は、この地域における大手航空機メーカー、防衛関連企業、航空技術企業の強力なプレゼンスによって推進されています。特に米国は、軍用航空、民間航空機の生産、そして航空宇宙技術革新への多額の投資により、市場において重要な役割を果たしています。さらに、先進航空電子機器、次世代航空機システムの導入拡大、そして航空会社や防衛機関による新型航空機の調達増加により、高性能航空コネクタの需要が高まっています。

目次

第1章 市場範囲と調査手法

- 市場の定義

- 目的

- 市場範囲

- セグメンテーション

- 調査手法

第2章 市場要覧

- 主要なハイライト

第3章 市場概要

- イントロダクション

- 概要

- 市場構成とシナリオ

- 概要

- 市場に影響を与える主要な要因

- 市場促進要因

- 市場抑制要因

- 市場機会

- 市場の課題

第4章 競合分析-世界

- 市場シェア分析、2023年

- ポーターファイブフォース分析

第5章 世界の航空コネクタ市場:航空機別

- 世界の民間航空機市場:地域別

- 世界の軍用機市場:地域別

- 世界のビジネス・一般航空機市場:地域別

第6章 世界の航空コネクタ市場:用途別

- 世界のエンジン市場:地域別

- 世界の航空電子機器市場:地域別

- 世界の配電・電気システム市場:地域別

- 世界のキャビンシステム市場:地域別

- 世界の機内エンターテイメント市場:地域別

- 世界のその他の用途市場:地域別

第7章 世界の航空コネクタ市場:タイプ別

- 世界の光ファイバコネクタ市場:地域別

- 世界の高速コネクタ市場:地域別

- 世界のPCBコネクタ市場:地域別

- 世界のRFコネクタ市場:地域別

- 世界の高電力コネクタ市場:地域別

- 世界のその他のタイプ市場:地域別

第8章 世界の航空コネクタ市場:地域別

- 北米

- 北米の市場:国別

- 米国

- カナダ

- メキシコ

- その他北米地域

- 北米の市場:国別

- 欧州

- 欧州の市場:国別

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

- イタリア

- その他欧州地域

- 欧州の市場:国別

- アジア太平洋

- アジア太平洋の市場:国別

- 中国

- 日本

- インド

- 韓国

- シンガポール

- マレーシア

- その他アジア太平洋

- アジア太平洋の市場:国別

- ラテンアメリカ、中東・アフリカ

- ラテンアメリカ、中東・アフリカの市場:国別

- ブラジル

- アルゼンチン

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- ナイジェリア

- その他ラテンアメリカ、中東・アフリカ地域

- ラテンアメリカ、中東・アフリカの市場:国別

第9章 企業プロファイル

- Amphenol Corporation

- TE Connectivity Ltd

- GE Vernova Group

- Eaton Corporation PLC

- Smiths Group PLC

- Molex, LLC(Koch Industries, Inc)

- ITT Inc

- Bel Fuse, Inc

- Rosenberger Hochfrequenztechnik GmbH

- Radiall SA

第10章 航空コネクタ市場の成功必須条件

LIST OF TABLES

- TABLE 1 Global Aviation Connector Market, 2020 - 2023, USD Million

- TABLE 2 Global Aviation Connector Market, 2024 - 2031, USD Million

- TABLE 3 Global Aviation Connector Market by Aircraft, 2020 - 2023, USD Million

- TABLE 4 Global Aviation Connector Market by Aircraft, 2024 - 2031, USD Million

- TABLE 5 Global Commercial Aircraft Market by Region, 2020 - 2023, USD Million

- TABLE 6 Global Commercial Aircraft Market by Region, 2024 - 2031, USD Million

- TABLE 7 Global Military Aircraft Market by Region, 2020 - 2023, USD Million

- TABLE 8 Global Military Aircraft Market by Region, 2024 - 2031, USD Million

- TABLE 9 Global Business & General Aviation Aircraft Market by Region, 2020 - 2023, USD Million

- TABLE 10 Global Business & General Aviation Aircraft Market by Region, 2024 - 2031, USD Million

- TABLE 11 Global Aviation Connector Market by Application, 2020 - 2023, USD Million

- TABLE 12 Global Aviation Connector Market by Application, 2024 - 2031, USD Million

- TABLE 13 Global Engines Market by Region, 2020 - 2023, USD Million

- TABLE 14 Global Engines Market by Region, 2024 - 2031, USD Million

- TABLE 15 Global Avionics Market by Region, 2020 - 2023, USD Million

- TABLE 16 Global Avionics Market by Region, 2024 - 2031, USD Million

- TABLE 17 Global Power Distribution & Electrical Systems Market by Region, 2020 - 2023, USD Million

- TABLE 18 Global Power Distribution & Electrical Systems Market by Region, 2024 - 2031, USD Million

- TABLE 19 Global Cabin Systems Market by Region, 2020 - 2023, USD Million

- TABLE 20 Global Cabin Systems Market by Region, 2024 - 2031, USD Million

- TABLE 21 Global In-Flight Entertainment Market by Region, 2020 - 2023, USD Million

- TABLE 22 Global In-Flight Entertainment Market by Region, 2024 - 2031, USD Million

- TABLE 23 Global Other Application Market by Region, 2020 - 2023, USD Million

- TABLE 24 Global Other Application Market by Region, 2024 - 2031, USD Million

- TABLE 25 Global Aviation Connector Market by Type, 2020 - 2023, USD Million

- TABLE 26 Global Aviation Connector Market by Type, 2024 - 2031, USD Million

- TABLE 27 Global Fiber Optic Connectors Market by Region, 2020 - 2023, USD Million

- TABLE 28 Global Fiber Optic Connectors Market by Region, 2024 - 2031, USD Million

- TABLE 29 Global High-speed Connectors Market by Region, 2020 - 2023, USD Million

- TABLE 30 Global High-speed Connectors Market by Region, 2024 - 2031, USD Million

- TABLE 31 Global PCB Connectors Market by Region, 2020 - 2023, USD Million

- TABLE 32 Global PCB Connectors Market by Region, 2024 - 2031, USD Million

- TABLE 33 Global RF Connectors Market by Region, 2020 - 2023, USD Million

- TABLE 34 Global RF Connectors Market by Region, 2024 - 2031, USD Million

- TABLE 35 Global High-power Connectors Market by Region, 2020 - 2023, USD Million

- TABLE 36 Global High-power Connectors Market by Region, 2024 - 2031, USD Million

- TABLE 37 Global Other Type Market by Region, 2020 - 2023, USD Million

- TABLE 38 Global Other Type Market by Region, 2024 - 2031, USD Million

- TABLE 39 Global Aviation Connector Market by Region, 2020 - 2023, USD Million

- TABLE 40 Global Aviation Connector Market by Region, 2024 - 2031, USD Million

- TABLE 41 North America Aviation Connector Market, 2020 - 2023, USD Million

- TABLE 42 North America Aviation Connector Market, 2024 - 2031, USD Million

- TABLE 43 North America Aviation Connector Market by Aircraft, 2020 - 2023, USD Million

- TABLE 44 North America Aviation Connector Market by Aircraft, 2024 - 2031, USD Million

- TABLE 45 North America Commercial Aircraft Market by Country, 2020 - 2023, USD Million

- TABLE 46 North America Commercial Aircraft Market by Country, 2024 - 2031, USD Million

- TABLE 47 North America Military Aircraft Market by Country, 2020 - 2023, USD Million

- TABLE 48 North America Military Aircraft Market by Country, 2024 - 2031, USD Million

- TABLE 49 North America Business & General Aviation Aircraft Market by Country, 2020 - 2023, USD Million

- TABLE 50 North America Business & General Aviation Aircraft Market by Country, 2024 - 2031, USD Million

- TABLE 51 North America Aviation Connector Market by Application, 2020 - 2023, USD Million

- TABLE 52 North America Aviation Connector Market by Application, 2024 - 2031, USD Million

- TABLE 53 North America Engines Market by Country, 2020 - 2023, USD Million

- TABLE 54 North America Engines Market by Country, 2024 - 2031, USD Million

- TABLE 55 North America Avionics Market by Country, 2020 - 2023, USD Million

- TABLE 56 North America Avionics Market by Country, 2024 - 2031, USD Million

- TABLE 57 North America Power Distribution & Electrical Systems Market by Country, 2020 - 2023, USD Million

- TABLE 58 North America Power Distribution & Electrical Systems Market by Country, 2024 - 2031, USD Million

- TABLE 59 North America Cabin Systems Market by Country, 2020 - 2023, USD Million

- TABLE 60 North America Cabin Systems Market by Country, 2024 - 2031, USD Million

- TABLE 61 North America In-Flight Entertainment Market by Country, 2020 - 2023, USD Million

- TABLE 62 North America In-Flight Entertainment Market by Country, 2024 - 2031, USD Million

- TABLE 63 North America Other Application Market by Country, 2020 - 2023, USD Million

- TABLE 64 North America Other Application Market by Country, 2024 - 2031, USD Million

- TABLE 65 North America Aviation Connector Market by Type, 2020 - 2023, USD Million

- TABLE 66 North America Aviation Connector Market by Type, 2024 - 2031, USD Million

- TABLE 67 North America Fiber Optic Connectors Market by Country, 2020 - 2023, USD Million

- TABLE 68 North America Fiber Optic Connectors Market by Country, 2024 - 2031, USD Million

- TABLE 69 North America High-speed Connectors Market by Country, 2020 - 2023, USD Million

- TABLE 70 North America High-speed Connectors Market by Country, 2024 - 2031, USD Million

- TABLE 71 North America PCB Connectors Market by Country, 2020 - 2023, USD Million

- TABLE 72 North America PCB Connectors Market by Country, 2024 - 2031, USD Million

- TABLE 73 North America RF Connectors Market by Country, 2020 - 2023, USD Million

- TABLE 74 North America RF Connectors Market by Country, 2024 - 2031, USD Million

- TABLE 75 North America High-power Connectors Market by Country, 2020 - 2023, USD Million

- TABLE 76 North America High-power Connectors Market by Country, 2024 - 2031, USD Million

- TABLE 77 North America Other Type Market by Country, 2020 - 2023, USD Million

- TABLE 78 North America Other Type Market by Country, 2024 - 2031, USD Million

- TABLE 79 North America Aviation Connector Market by Country, 2020 - 2023, USD Million

- TABLE 80 North America Aviation Connector Market by Country, 2024 - 2031, USD Million

- TABLE 81 US Aviation Connector Market, 2020 - 2023, USD Million

- TABLE 82 US Aviation Connector Market, 2024 - 2031, USD Million

- TABLE 83 US Aviation Connector Market by Aircraft, 2020 - 2023, USD Million

- TABLE 84 US Aviation Connector Market by Aircraft, 2024 - 2031, USD Million

- TABLE 85 US Aviation Connector Market by Application, 2020 - 2023, USD Million

- TABLE 86 US Aviation Connector Market by Application, 2024 - 2031, USD Million

- TABLE 87 US Aviation Connector Market by Type, 2020 - 2023, USD Million

- TABLE 88 US Aviation Connector Market by Type, 2024 - 2031, USD Million

- TABLE 89 Canada Aviation Connector Market, 2020 - 2023, USD Million

- TABLE 90 Canada Aviation Connector Market, 2024 - 2031, USD Million

- TABLE 91 Canada Aviation Connector Market by Aircraft, 2020 - 2023, USD Million

- TABLE 92 Canada Aviation Connector Market by Aircraft, 2024 - 2031, USD Million

- TABLE 93 Canada Aviation Connector Market by Application, 2020 - 2023, USD Million

- TABLE 94 Canada Aviation Connector Market by Application, 2024 - 2031, USD Million

- TABLE 95 Canada Aviation Connector Market by Type, 2020 - 2023, USD Million

- TABLE 96 Canada Aviation Connector Market by Type, 2024 - 2031, USD Million

- TABLE 97 Mexico Aviation Connector Market, 2020 - 2023, USD Million

- TABLE 98 Mexico Aviation Connector Market, 2024 - 2031, USD Million

- TABLE 99 Mexico Aviation Connector Market by Aircraft, 2020 - 2023, USD Million

- TABLE 100 Mexico Aviation Connector Market by Aircraft, 2024 - 2031, USD Million

- TABLE 101 Mexico Aviation Connector Market by Application, 2020 - 2023, USD Million

- TABLE 102 Mexico Aviation Connector Market by Application, 2024 - 2031, USD Million

- TABLE 103 Mexico Aviation Connector Market by Type, 2020 - 2023, USD Million

- TABLE 104 Mexico Aviation Connector Market by Type, 2024 - 2031, USD Million

- TABLE 105 Rest of North America Aviation Connector Market, 2020 - 2023, USD Million

- TABLE 106 Rest of North America Aviation Connector Market, 2024 - 2031, USD Million

- TABLE 107 Rest of North America Aviation Connector Market by Aircraft, 2020 - 2023, USD Million

- TABLE 108 Rest of North America Aviation Connector Market by Aircraft, 2024 - 2031, USD Million

- TABLE 109 Rest of North America Aviation Connector Market by Application, 2020 - 2023, USD Million

- TABLE 110 Rest of North America Aviation Connector Market by Application, 2024 - 2031, USD Million

- TABLE 111 Rest of North America Aviation Connector Market by Type, 2020 - 2023, USD Million

- TABLE 112 Rest of North America Aviation Connector Market by Type, 2024 - 2031, USD Million

- TABLE 113 Europe Aviation Connector Market, 2020 - 2023, USD Million

- TABLE 114 Europe Aviation Connector Market, 2024 - 2031, USD Million

- TABLE 115 Europe Aviation Connector Market by Aircraft, 2020 - 2023, USD Million

- TABLE 116 Europe Aviation Connector Market by Aircraft, 2024 - 2031, USD Million

- TABLE 117 Europe Commercial Aircraft Market by Country, 2020 - 2023, USD Million

- TABLE 118 Europe Commercial Aircraft Market by Country, 2024 - 2031, USD Million

- TABLE 119 Europe Military Aircraft Market by Country, 2020 - 2023, USD Million

- TABLE 120 Europe Military Aircraft Market by Country, 2024 - 2031, USD Million

- TABLE 121 Europe Business & General Aviation Aircraft Market by Country, 2020 - 2023, USD Million

- TABLE 122 Europe Business & General Aviation Aircraft Market by Country, 2024 - 2031, USD Million

- TABLE 123 Europe Aviation Connector Market by Application, 2020 - 2023, USD Million

- TABLE 124 Europe Aviation Connector Market by Application, 2024 - 2031, USD Million

- TABLE 125 Europe Engines Market by Country, 2020 - 2023, USD Million

- TABLE 126 Europe Engines Market by Country, 2024 - 2031, USD Million

- TABLE 127 Europe Avionics Market by Country, 2020 - 2023, USD Million

- TABLE 128 Europe Avionics Market by Country, 2024 - 2031, USD Million

- TABLE 129 Europe Power Distribution & Electrical Systems Market by Country, 2020 - 2023, USD Million

- TABLE 130 Europe Power Distribution & Electrical Systems Market by Country, 2024 - 2031, USD Million

- TABLE 131 Europe Cabin Systems Market by Country, 2020 - 2023, USD Million

- TABLE 132 Europe Cabin Systems Market by Country, 2024 - 2031, USD Million

- TABLE 133 Europe In-Flight Entertainment Market by Country, 2020 - 2023, USD Million

- TABLE 134 Europe In-Flight Entertainment Market by Country, 2024 - 2031, USD Million

- TABLE 135 Europe Other Application Market by Country, 2020 - 2023, USD Million

- TABLE 136 Europe Other Application Market by Country, 2024 - 2031, USD Million

- TABLE 137 Europe Aviation Connector Market by Type, 2020 - 2023, USD Million

- TABLE 138 Europe Aviation Connector Market by Type, 2024 - 2031, USD Million

- TABLE 139 Europe Fiber Optic Connectors Market by Country, 2020 - 2023, USD Million

- TABLE 140 Europe Fiber Optic Connectors Market by Country, 2024 - 2031, USD Million

- TABLE 141 Europe High-speed Connectors Market by Country, 2020 - 2023, USD Million

- TABLE 142 Europe High-speed Connectors Market by Country, 2024 - 2031, USD Million

- TABLE 143 Europe PCB Connectors Market by Country, 2020 - 2023, USD Million

- TABLE 144 Europe PCB Connectors Market by Country, 2024 - 2031, USD Million

- TABLE 145 Europe RF Connectors Market by Country, 2020 - 2023, USD Million

- TABLE 146 Europe RF Connectors Market by Country, 2024 - 2031, USD Million

- TABLE 147 Europe High-power Connectors Market by Country, 2020 - 2023, USD Million

- TABLE 148 Europe High-power Connectors Market by Country, 2024 - 2031, USD Million

- TABLE 149 Europe Other Type Market by Country, 2020 - 2023, USD Million

- TABLE 150 Europe Other Type Market by Country, 2024 - 2031, USD Million

- TABLE 151 Europe Aviation Connector Market by Country, 2020 - 2023, USD Million

- TABLE 152 Europe Aviation Connector Market by Country, 2024 - 2031, USD Million

- TABLE 153 Germany Aviation Connector Market, 2020 - 2023, USD Million

- TABLE 154 Germany Aviation Connector Market, 2024 - 2031, USD Million

- TABLE 155 Germany Aviation Connector Market by Aircraft, 2020 - 2023, USD Million

- TABLE 156 Germany Aviation Connector Market by Aircraft, 2024 - 2031, USD Million

- TABLE 157 Germany Aviation Connector Market by Application, 2020 - 2023, USD Million

- TABLE 158 Germany Aviation Connector Market by Application, 2024 - 2031, USD Million

- TABLE 159 Germany Aviation Connector Market by Type, 2020 - 2023, USD Million

- TABLE 160 Germany Aviation Connector Market by Type, 2024 - 2031, USD Million

- TABLE 161 UK Aviation Connector Market, 2020 - 2023, USD Million

- TABLE 162 UK Aviation Connector Market, 2024 - 2031, USD Million

- TABLE 163 UK Aviation Connector Market by Aircraft, 2020 - 2023, USD Million

- TABLE 164 UK Aviation Connector Market by Aircraft, 2024 - 2031, USD Million

- TABLE 165 UK Aviation Connector Market by Application, 2020 - 2023, USD Million

- TABLE 166 UK Aviation Connector Market by Application, 2024 - 2031, USD Million

- TABLE 167 UK Aviation Connector Market by Type, 2020 - 2023, USD Million

- TABLE 168 UK Aviation Connector Market by Type, 2024 - 2031, USD Million

- TABLE 169 France Aviation Connector Market, 2020 - 2023, USD Million

- TABLE 170 France Aviation Connector Market, 2024 - 2031, USD Million

- TABLE 171 France Aviation Connector Market by Aircraft, 2020 - 2023, USD Million

- TABLE 172 France Aviation Connector Market by Aircraft, 2024 - 2031, USD Million

- TABLE 173 France Aviation Connector Market by Application, 2020 - 2023, USD Million

- TABLE 174 France Aviation Connector Market by Application, 2024 - 2031, USD Million

- TABLE 175 France Aviation Connector Market by Type, 2020 - 2023, USD Million

- TABLE 176 France Aviation Connector Market by Type, 2024 - 2031, USD Million

- TABLE 177 Russia Aviation Connector Market, 2020 - 2023, USD Million

- TABLE 178 Russia Aviation Connector Market, 2024 - 2031, USD Million

- TABLE 179 Russia Aviation Connector Market by Aircraft, 2020 - 2023, USD Million

- TABLE 180 Russia Aviation Connector Market by Aircraft, 2024 - 2031, USD Million

- TABLE 181 Russia Aviation Connector Market by Application, 2020 - 2023, USD Million

- TABLE 182 Russia Aviation Connector Market by Application, 2024 - 2031, USD Million

- TABLE 183 Russia Aviation Connector Market by Type, 2020 - 2023, USD Million

- TABLE 184 Russia Aviation Connector Market by Type, 2024 - 2031, USD Million

- TABLE 185 Spain Aviation Connector Market, 2020 - 2023, USD Million

- TABLE 186 Spain Aviation Connector Market, 2024 - 2031, USD Million

- TABLE 187 Spain Aviation Connector Market by Aircraft, 2020 - 2023, USD Million

- TABLE 188 Spain Aviation Connector Market by Aircraft, 2024 - 2031, USD Million

- TABLE 189 Spain Aviation Connector Market by Application, 2020 - 2023, USD Million

- TABLE 190 Spain Aviation Connector Market by Application, 2024 - 2031, USD Million

- TABLE 191 Spain Aviation Connector Market by Type, 2020 - 2023, USD Million

- TABLE 192 Spain Aviation Connector Market by Type, 2024 - 2031, USD Million

- TABLE 193 Italy Aviation Connector Market, 2020 - 2023, USD Million

- TABLE 194 Italy Aviation Connector Market, 2024 - 2031, USD Million

- TABLE 195 Italy Aviation Connector Market by Aircraft, 2020 - 2023, USD Million

- TABLE 196 Italy Aviation Connector Market by Aircraft, 2024 - 2031, USD Million

- TABLE 197 Italy Aviation Connector Market by Application, 2020 - 2023, USD Million

- TABLE 198 Italy Aviation Connector Market by Application, 2024 - 2031, USD Million

- TABLE 199 Italy Aviation Connector Market by Type, 2020 - 2023, USD Million

- TABLE 200 Italy Aviation Connector Market by Type, 2024 - 2031, USD Million

- TABLE 201 Rest of Europe Aviation Connector Market, 2020 - 2023, USD Million

- TABLE 202 Rest of Europe Aviation Connector Market, 2024 - 2031, USD Million

- TABLE 203 Rest of Europe Aviation Connector Market by Aircraft, 2020 - 2023, USD Million

- TABLE 204 Rest of Europe Aviation Connector Market by Aircraft, 2024 - 2031, USD Million

- TABLE 205 Rest of Europe Aviation Connector Market by Application, 2020 - 2023, USD Million

- TABLE 206 Rest of Europe Aviation Connector Market by Application, 2024 - 2031, USD Million

- TABLE 207 Rest of Europe Aviation Connector Market by Type, 2020 - 2023, USD Million

- TABLE 208 Rest of Europe Aviation Connector Market by Type, 2024 - 2031, USD Million

- TABLE 209 Asia Pacific Aviation Connector Market, 2020 - 2023, USD Million

- TABLE 210 Asia Pacific Aviation Connector Market, 2024 - 2031, USD Million

- TABLE 211 Asia Pacific Aviation Connector Market by Aircraft, 2020 - 2023, USD Million

- TABLE 212 Asia Pacific Aviation Connector Market by Aircraft, 2024 - 2031, USD Million

- TABLE 213 Asia Pacific Commercial Aircraft Market by Country, 2020 - 2023, USD Million

- TABLE 214 Asia Pacific Commercial Aircraft Market by Country, 2024 - 2031, USD Million

- TABLE 215 Asia Pacific Military Aircraft Market by Country, 2020 - 2023, USD Million

- TABLE 216 Asia Pacific Military Aircraft Market by Country, 2024 - 2031, USD Million

- TABLE 217 Asia Pacific Business & General Aviation Aircraft Market by Country, 2020 - 2023, USD Million

- TABLE 218 Asia Pacific Business & General Aviation Aircraft Market by Country, 2024 - 2031, USD Million

- TABLE 219 Asia Pacific Aviation Connector Market by Application, 2020 - 2023, USD Million

- TABLE 220 Asia Pacific Aviation Connector Market by Application, 2024 - 2031, USD Million

- TABLE 221 Asia Pacific Engines Market by Country, 2020 - 2023, USD Million

- TABLE 222 Asia Pacific Engines Market by Country, 2024 - 2031, USD Million

- TABLE 223 Asia Pacific Avionics Market by Country, 2020 - 2023, USD Million

- TABLE 224 Asia Pacific Avionics Market by Country, 2024 - 2031, USD Million

- TABLE 225 Asia Pacific Power Distribution & Electrical Systems Market by Country, 2020 - 2023, USD Million

- TABLE 226 Asia Pacific Power Distribution & Electrical Systems Market by Country, 2024 - 2031, USD Million

- TABLE 227 Asia Pacific Cabin Systems Market by Country, 2020 - 2023, USD Million

- TABLE 228 Asia Pacific Cabin Systems Market by Country, 2024 - 2031, USD Million

- TABLE 229 Asia Pacific In-Flight Entertainment Market by Country, 2020 - 2023, USD Million

- TABLE 230 Asia Pacific In-Flight Entertainment Market by Country, 2024 - 2031, USD Million

- TABLE 231 Asia Pacific Other Application Market by Country, 2020 - 2023, USD Million

- TABLE 232 Asia Pacific Other Application Market by Country, 2024 - 2031, USD Million

- TABLE 233 Asia Pacific Aviation Connector Market by Type, 2020 - 2023, USD Million

- TABLE 234 Asia Pacific Aviation Connector Market by Type, 2024 - 2031, USD Million

- TABLE 235 Asia Pacific Fiber Optic Connectors Market by Country, 2020 - 2023, USD Million

- TABLE 236 Asia Pacific Fiber Optic Connectors Market by Country, 2024 - 2031, USD Million

- TABLE 237 Asia Pacific High-speed Connectors Market by Country, 2020 - 2023, USD Million

- TABLE 238 Asia Pacific High-speed Connectors Market by Country, 2024 - 2031, USD Million

- TABLE 239 Asia Pacific PCB Connectors Market by Country, 2020 - 2023, USD Million

- TABLE 240 Asia Pacific PCB Connectors Market by Country, 2024 - 2031, USD Million

- TABLE 241 Asia Pacific RF Connectors Market by Country, 2020 - 2023, USD Million

- TABLE 242 Asia Pacific RF Connectors Market by Country, 2024 - 2031, USD Million

- TABLE 243 Asia Pacific High-power Connectors Market by Country, 2020 - 2023, USD Million

- TABLE 244 Asia Pacific High-power Connectors Market by Country, 2024 - 2031, USD Million

- TABLE 245 Asia Pacific Other Type Market by Country, 2020 - 2023, USD Million

- TABLE 246 Asia Pacific Other Type Market by Country, 2024 - 2031, USD Million

- TABLE 247 Asia Pacific Aviation Connector Market by Country, 2020 - 2023, USD Million

- TABLE 248 Asia Pacific Aviation Connector Market by Country, 2024 - 2031, USD Million

- TABLE 249 China Aviation Connector Market, 2020 - 2023, USD Million

- TABLE 250 China Aviation Connector Market, 2024 - 2031, USD Million

- TABLE 251 China Aviation Connector Market by Aircraft, 2020 - 2023, USD Million

- TABLE 252 China Aviation Connector Market by Aircraft, 2024 - 2031, USD Million

- TABLE 253 China Aviation Connector Market by Application, 2020 - 2023, USD Million

- TABLE 254 China Aviation Connector Market by Application, 2024 - 2031, USD Million

- TABLE 255 China Aviation Connector Market by Type, 2020 - 2023, USD Million

- TABLE 256 China Aviation Connector Market by Type, 2024 - 2031, USD Million

- TABLE 257 Japan Aviation Connector Market, 2020 - 2023, USD Million

- TABLE 258 Japan Aviation Connector Market, 2024 - 2031, USD Million

- TABLE 259 Japan Aviation Connector Market by Aircraft, 2020 - 2023, USD Million

- TABLE 260 Japan Aviation Connector Market by Aircraft, 2024 - 2031, USD Million

- TABLE 261 Japan Aviation Connector Market by Application, 2020 - 2023, USD Million

- TABLE 262 Japan Aviation Connector Market by Application, 2024 - 2031, USD Million

- TABLE 263 Japan Aviation Connector Market by Type, 2020 - 2023, USD Million

- TABLE 264 Japan Aviation Connector Market by Type, 2024 - 2031, USD Million

- TABLE 265 India Aviation Connector Market, 2020 - 2023, USD Million

- TABLE 266 India Aviation Connector Market, 2024 - 2031, USD Million

- TABLE 267 India Aviation Connector Market by Aircraft, 2020 - 2023, USD Million

- TABLE 268 India Aviation Connector Market by Aircraft, 2024 - 2031, USD Million

- TABLE 269 India Aviation Connector Market by Application, 2020 - 2023, USD Million

- TABLE 270 India Aviation Connector Market by Application, 2024 - 2031, USD Million

- TABLE 271 India Aviation Connector Market by Type, 2020 - 2023, USD Million

- TABLE 272 India Aviation Connector Market by Type, 2024 - 2031, USD Million

- TABLE 273 South Korea Aviation Connector Market, 2020 - 2023, USD Million

- TABLE 274 South Korea Aviation Connector Market, 2024 - 2031, USD Million

- TABLE 275 South Korea Aviation Connector Market by Aircraft, 2020 - 2023, USD Million

- TABLE 276 South Korea Aviation Connector Market by Aircraft, 2024 - 2031, USD Million

- TABLE 277 South Korea Aviation Connector Market by Application, 2020 - 2023, USD Million

- TABLE 278 South Korea Aviation Connector Market by Application, 2024 - 2031, USD Million

- TABLE 279 South Korea Aviation Connector Market by Type, 2020 - 2023, USD Million

- TABLE 280 South Korea Aviation Connector Market by Type, 2024 - 2031, USD Million

- TABLE 281 Singapore Aviation Connector Market, 2020 - 2023, USD Million

- TABLE 282 Singapore Aviation Connector Market, 2024 - 2031, USD Million

- TABLE 283 Singapore Aviation Connector Market by Aircraft, 2020 - 2023, USD Million

- TABLE 284 Singapore Aviation Connector Market by Aircraft, 2024 - 2031, USD Million

- TABLE 285 Singapore Aviation Connector Market by Application, 2020 - 2023, USD Million

- TABLE 286 Singapore Aviation Connector Market by Application, 2024 - 2031, USD Million

- TABLE 287 Singapore Aviation Connector Market by Type, 2020 - 2023, USD Million

- TABLE 288 Singapore Aviation Connector Market by Type, 2024 - 2031, USD Million

- TABLE 289 Malaysia Aviation Connector Market, 2020 - 2023, USD Million

- TABLE 290 Malaysia Aviation Connector Market, 2024 - 2031, USD Million

- TABLE 291 Malaysia Aviation Connector Market by Aircraft, 2020 - 2023, USD Million

- TABLE 292 Malaysia Aviation Connector Market by Aircraft, 2024 - 2031, USD Million

- TABLE 293 Malaysia Aviation Connector Market by Application, 2020 - 2023, USD Million

- TABLE 294 Malaysia Aviation Connector Market by Application, 2024 - 2031, USD Million

- TABLE 295 Malaysia Aviation Connector Market by Type, 2020 - 2023, USD Million

- TABLE 296 Malaysia Aviation Connector Market by Type, 2024 - 2031, USD Million

- TABLE 297 Rest of Asia Pacific Aviation Connector Market, 2020 - 2023, USD Million

- TABLE 298 Rest of Asia Pacific Aviation Connector Market, 2024 - 2031, USD Million

- TABLE 299 Rest of Asia Pacific Aviation Connector Market by Aircraft, 2020 - 2023, USD Million

- TABLE 300 Rest of Asia Pacific Aviation Connector Market by Aircraft, 2024 - 2031, USD Million

- TABLE 301 Rest of Asia Pacific Aviation Connector Market by Application, 2020 - 2023, USD Million

- TABLE 302 Rest of Asia Pacific Aviation Connector Market by Application, 2024 - 2031, USD Million

- TABLE 303 Rest of Asia Pacific Aviation Connector Market by Type, 2020 - 2023, USD Million

- TABLE 304 Rest of Asia Pacific Aviation Connector Market by Type, 2024 - 2031, USD Million

- TABLE 305 LAMEA Aviation Connector Market, 2020 - 2023, USD Million

- TABLE 306 LAMEA Aviation Connector Market, 2024 - 2031, USD Million

- TABLE 307 LAMEA Aviation Connector Market by Aircraft, 2020 - 2023, USD Million

- TABLE 308 LAMEA Aviation Connector Market by Aircraft, 2024 - 2031, USD Million

- TABLE 309 LAMEA Commercial Aircraft Market by Country, 2020 - 2023, USD Million

- TABLE 310 LAMEA Commercial Aircraft Market by Country, 2024 - 2031, USD Million

- TABLE 311 LAMEA Military Aircraft Market by Country, 2020 - 2023, USD Million

- TABLE 312 LAMEA Military Aircraft Market by Country, 2024 - 2031, USD Million

- TABLE 313 LAMEA Business & General Aviation Aircraft Market by Country, 2020 - 2023, USD Million

- TABLE 314 LAMEA Business & General Aviation Aircraft Market by Country, 2024 - 2031, USD Million

- TABLE 315 LAMEA Aviation Connector Market by Application, 2020 - 2023, USD Million

- TABLE 316 LAMEA Aviation Connector Market by Application, 2024 - 2031, USD Million

- TABLE 317 LAMEA Engines Market by Country, 2020 - 2023, USD Million

- TABLE 318 LAMEA Engines Market by Country, 2024 - 2031, USD Million

- TABLE 319 LAMEA Avionics Market by Country, 2020 - 2023, USD Million

- TABLE 320 LAMEA Avionics Market by Country, 2024 - 2031, USD Million

- TABLE 321 LAMEA Power Distribution & Electrical Systems Market by Country, 2020 - 2023, USD Million

- TABLE 322 LAMEA Power Distribution & Electrical Systems Market by Country, 2024 - 2031, USD Million

- TABLE 323 LAMEA Cabin Systems Market by Country, 2020 - 2023, USD Million

- TABLE 324 LAMEA Cabin Systems Market by Country, 2024 - 2031, USD Million

- TABLE 325 LAMEA In-Flight Entertainment Market by Country, 2020 - 2023, USD Million

- TABLE 326 LAMEA In-Flight Entertainment Market by Country, 2024 - 2031, USD Million

- TABLE 327 LAMEA Other Application Market by Country, 2020 - 2023, USD Million

- TABLE 328 LAMEA Other Application Market by Country, 2024 - 2031, USD Million

- TABLE 329 LAMEA Aviation Connector Market by Type, 2020 - 2023, USD Million

- TABLE 330 LAMEA Aviation Connector Market by Type, 2024 - 2031, USD Million

- TABLE 331 LAMEA Fiber Optic Connectors Market by Country, 2020 - 2023, USD Million

- TABLE 332 LAMEA Fiber Optic Connectors Market by Country, 2024 - 2031, USD Million

- TABLE 333 LAMEA High-speed Connectors Market by Country, 2020 - 2023, USD Million

- TABLE 334 LAMEA High-speed Connectors Market by Country, 2024 - 2031, USD Million

- TABLE 335 LAMEA PCB Connectors Market by Country, 2020 - 2023, USD Million

- TABLE 336 LAMEA PCB Connectors Market by Country, 2024 - 2031, USD Million

- TABLE 337 LAMEA RF Connectors Market by Country, 2020 - 2023, USD Million

- TABLE 338 LAMEA RF Connectors Market by Country, 2024 - 2031, USD Million

- TABLE 339 LAMEA High-power Connectors Market by Country, 2020 - 2023, USD Million

- TABLE 340 LAMEA High-power Connectors Market by Country, 2024 - 2031, USD Million

- TABLE 341 LAMEA Other Type Market by Country, 2020 - 2023, USD Million

- TABLE 342 LAMEA Other Type Market by Country, 2024 - 2031, USD Million

- TABLE 343 LAMEA Aviation Connector Market by Country, 2020 - 2023, USD Million

- TABLE 344 LAMEA Aviation Connector Market by Country, 2024 - 2031, USD Million

- TABLE 345 Brazil Aviation Connector Market, 2020 - 2023, USD Million

- TABLE 346 Brazil Aviation Connector Market, 2024 - 2031, USD Million

- TABLE 347 Brazil Aviation Connector Market by Aircraft, 2020 - 2023, USD Million

- TABLE 348 Brazil Aviation Connector Market by Aircraft, 2024 - 2031, USD Million

- TABLE 349 Brazil Aviation Connector Market by Application, 2020 - 2023, USD Million

- TABLE 350 Brazil Aviation Connector Market by Application, 2024 - 2031, USD Million

- TABLE 351 Brazil Aviation Connector Market by Type, 2020 - 2023, USD Million

- TABLE 352 Brazil Aviation Connector Market by Type, 2024 - 2031, USD Million

- TABLE 353 Argentina Aviation Connector Market, 2020 - 2023, USD Million

- TABLE 354 Argentina Aviation Connector Market, 2024 - 2031, USD Million

- TABLE 355 Argentina Aviation Connector Market by Aircraft, 2020 - 2023, USD Million

- TABLE 356 Argentina Aviation Connector Market by Aircraft, 2024 - 2031, USD Million

- TABLE 357 Argentina Aviation Connector Market by Application, 2020 - 2023, USD Million

- TABLE 358 Argentina Aviation Connector Market by Application, 2024 - 2031, USD Million

- TABLE 359 Argentina Aviation Connector Market by Type, 2020 - 2023, USD Million

- TABLE 360 Argentina Aviation Connector Market by Type, 2024 - 2031, USD Million

- TABLE 361 UAE Aviation Connector Market, 2020 - 2023, USD Million

- TABLE 362 UAE Aviation Connector Market, 2024 - 2031, USD Million

- TABLE 363 UAE Aviation Connector Market by Aircraft, 2020 - 2023, USD Million

- TABLE 364 UAE Aviation Connector Market by Aircraft, 2024 - 2031, USD Million

- TABLE 365 UAE Aviation Connector Market by Application, 2020 - 2023, USD Million

- TABLE 366 UAE Aviation Connector Market by Application, 2024 - 2031, USD Million

- TABLE 367 UAE Aviation Connector Market by Type, 2020 - 2023, USD Million

- TABLE 368 UAE Aviation Connector Market by Type, 2024 - 2031, USD Million

- TABLE 369 Saudi Arabia Aviation Connector Market, 2020 - 2023, USD Million

- TABLE 370 Saudi Arabia Aviation Connector Market, 2024 - 2031, USD Million

- TABLE 371 Saudi Arabia Aviation Connector Market by Aircraft, 2020 - 2023, USD Million

- TABLE 372 Saudi Arabia Aviation Connector Market by Aircraft, 2024 - 2031, USD Million

- TABLE 373 Saudi Arabia Aviation Connector Market by Application, 2020 - 2023, USD Million

- TABLE 374 Saudi Arabia Aviation Connector Market by Application, 2024 - 2031, USD Million

- TABLE 375 Saudi Arabia Aviation Connector Market by Type, 2020 - 2023, USD Million

- TABLE 376 Saudi Arabia Aviation Connector Market by Type, 2024 - 2031, USD Million

- TABLE 377 South Africa Aviation Connector Market, 2020 - 2023, USD Million

- TABLE 378 South Africa Aviation Connector Market, 2024 - 2031, USD Million

- TABLE 379 South Africa Aviation Connector Market by Aircraft, 2020 - 2023, USD Million

- TABLE 380 South Africa Aviation Connector Market by Aircraft, 2024 - 2031, USD Million

- TABLE 381 South Africa Aviation Connector Market by Application, 2020 - 2023, USD Million

- TABLE 382 South Africa Aviation Connector Market by Application, 2024 - 2031, USD Million

- TABLE 383 South Africa Aviation Connector Market by Type, 2020 - 2023, USD Million

- TABLE 384 South Africa Aviation Connector Market by Type, 2024 - 2031, USD Million

- TABLE 385 Nigeria Aviation Connector Market, 2020 - 2023, USD Million

- TABLE 386 Nigeria Aviation Connector Market, 2024 - 2031, USD Million

- TABLE 387 Nigeria Aviation Connector Market by Aircraft, 2020 - 2023, USD Million

- TABLE 388 Nigeria Aviation Connector Market by Aircraft, 2024 - 2031, USD Million

- TABLE 389 Nigeria Aviation Connector Market by Application, 2020 - 2023, USD Million

- TABLE 390 Nigeria Aviation Connector Market by Application, 2024 - 2031, USD Million

- TABLE 391 Nigeria Aviation Connector Market by Type, 2020 - 2023, USD Million

- TABLE 392 Nigeria Aviation Connector Market by Type, 2024 - 2031, USD Million

- TABLE 393 Rest of LAMEA Aviation Connector Market, 2020 - 2023, USD Million

- TABLE 394 Rest of LAMEA Aviation Connector Market, 2024 - 2031, USD Million

- TABLE 395 Rest of LAMEA Aviation Connector Market by Aircraft, 2020 - 2023, USD Million

- TABLE 396 Rest of LAMEA Aviation Connector Market by Aircraft, 2024 - 2031, USD Million

- TABLE 397 Rest of LAMEA Aviation Connector Market by Application, 2020 - 2023, USD Million

- TABLE 398 Rest of LAMEA Aviation Connector Market by Application, 2024 - 2031, USD Million

- TABLE 399 Rest of LAMEA Aviation Connector Market by Type, 2020 - 2023, USD Million

- TABLE 400 Rest of LAMEA Aviation Connector Market by Type, 2024 - 2031, USD Million

- TABLE 401 key information - Amphenol Corporation

- TABLE 402 Key information -TE Connectivity Ltd.

- TABLE 403 Key Information - GE Vernova Group

- TABLE 404 Key Information - Eaton Corporation PLC

- TABLE 405 Key Information - Smiths Group PLC

- TABLE 406 Key Information - Molex, LLC

- TABLE 407 Key Information - ITT Inc.

- TABLE 408 Key information - Bel Fuse, Inc.

- TABLE 409 Key Information - Rosenberger Hochfrequenztechnik GmbH

- TABLE 410 Key Information - Radiall SA

LIST OF FIGURES

- FIG 1 Methodology for the research

- FIG 2 Global Aviation Connector Market, 2020 - 2031, USD Million

- FIG 3 Key Factors Impacting Aviation Connector Market

- FIG 4 Market Share Analysis, 2023

- FIG 5 Porter's Five Forces Analysis - Aviation Connector Market

- FIG 6 Global Aviation Connector Market share by Aircraft, 2023

- FIG 7 Global Aviation Connector Market share by Aircraft, 2031

- FIG 8 Global Aviation Connector Market by Aircraft, 2020 - 2031, USD Million

- FIG 9 Global Aviation Connector Market share by Application, 2023

- FIG 10 Global Aviation Connector Market share by Application, 2031

- FIG 11 Global Aviation Connector Market by Application, 2020 - 2031, USD Million

- FIG 12 Global Aviation Connector Market share by Type, 2023

- FIG 13 Global Aviation Connector Market share by Type, 2031

- FIG 14 Global Aviation Connector Market by Type, 2020 - 2031, USD Million

- FIG 15 Global Aviation Connector Market share by Region, 2023

- FIG 16 Global Aviation Connector Market share by Region, 2031

- FIG 17 Global Aviation Connector Market by Region, 2020 - 2031, USD Million

- FIG 18 North America Aviation Connector Market, 2020 - 2031, USD Million

- FIG 19 North America Aviation Connector Market share by Aircraft, 2023

- FIG 20 North America Aviation Connector Market share by Aircraft, 2031

- FIG 21 North America Aviation Connector Market by Aircraft, 2020 - 2031, USD Million

- FIG 22 North America Aviation Connector Market share by Application, 2023

- FIG 23 North America Aviation Connector Market share by Application, 2031

- FIG 24 North America Aviation Connector Market by Application, 2020 - 2031, USD Million

- FIG 25 North America Aviation Connector Market share by Type, 2023

- FIG 26 North America Aviation Connector Market share by Type, 2031

- FIG 27 North America Aviation Connector Market by Type, 2020 - 2031, USD Million

- FIG 28 North America Aviation Connector Market share by Country, 2023

- FIG 29 North America Aviation Connector Market share by Country, 2031

- FIG 30 North America Aviation Connector Market by Country, 2020 - 2031, USD Million

- FIG 31 Europe Aviation Connector Market, 2020 - 2031, USD Million

- FIG 32 Europe Aviation Connector Market share by Aircraft, 2023

- FIG 33 Europe Aviation Connector Market share by Aircraft, 2031

- FIG 34 Europe Aviation Connector Market by Aircraft, 2020 - 2031, USD Million

- FIG 35 Europe Aviation Connector Market share by Application, 2023

- FIG 36 Europe Aviation Connector Market share by Application, 2031

- FIG 37 Europe Aviation Connector Market by Application, 2020 - 2031, USD Million

- FIG 38 Europe Aviation Connector Market share by Type, 2023

- FIG 39 Europe Aviation Connector Market share by Type, 2031

- FIG 40 Europe Aviation Connector Market by Type, 2020 - 2031, USD Million

- FIG 41 Europe Aviation Connector Market share by Country, 2023

- FIG 42 Europe Aviation Connector Market share by Country, 2031

- FIG 43 Europe Aviation Connector Market by Country, 2020 - 2031, USD Million

- FIG 44 Asia Pacific Aviation Connector Market, 2020 - 2031, USD Million

- FIG 45 Asia Pacific Aviation Connector Market share by Aircraft, 2023

- FIG 46 Asia Pacific Aviation Connector Market share by Aircraft, 2031

- FIG 47 Asia Pacific Aviation Connector Market by Aircraft, 2020 - 2031, USD Million

- FIG 48 Asia Pacific Aviation Connector Market share by Application, 2023

- FIG 49 Asia Pacific Aviation Connector Market share by Application, 2031

- FIG 50 Asia Pacific Aviation Connector Market by Application, 2020 - 2031, USD Million

- FIG 51 Asia Pacific Aviation Connector Market share by Type, 2023

- FIG 52 Asia Pacific Aviation Connector Market share by Type, 2031

- FIG 53 Asia Pacific Aviation Connector Market by Type, 2020 - 2031, USD Million

- FIG 54 Asia Pacific Aviation Connector Market share by Country, 2023

- FIG 55 Asia Pacific Aviation Connector Market share by Country, 2031

- FIG 56 Asia Pacific Aviation Connector Market by Country, 2020 - 2031, USD Million

- FIG 57 LAMEA Aviation Connector Market, 2020 - 2031, USD Million

- FIG 58 LAMEA Aviation Connector Market share by Aircraft, 2023

- FIG 59 LAMEA Aviation Connector Market share by Aircraft, 2031

- FIG 60 LAMEA Aviation Connector Market by Aircraft, 2020 - 2031, USD Million

- FIG 61 LAMEA Aviation Connector Market share by Application, 2023

- FIG 62 LAMEA Aviation Connector Market share by Application, 2031

- FIG 63 LAMEA Aviation Connector Market by Application, 2020 - 2031, USD Million

- FIG 64 LAMEA Aviation Connector Market share by Type, 2023

- FIG 65 LAMEA Aviation Connector Market share by Type, 2031

- FIG 66 LAMEA Aviation Connector Market by Type, 2020 - 2031, USD Million

- FIG 67 LAMEA Aviation Connector Market share by Country, 2023

- FIG 68 LAMEA Aviation Connector Market share by Country, 2031

- FIG 69 LAMEA Aviation Connector Market by Country, 2020 - 2031, USD Million

- FIG 70 SWOT Analysis: Amphenol Corporation

- FIG 71 SWOT Analysis: TE Connectivity Ltd.

- FIG 72 SWOT Analysis: GE Vernova Group

- FIG 73 SWOT Analysis: Eaton Corporation PLC

- FIG 74 SWOT Analysis: Smiths Group plc

- FIG 75 SWOT Analysis: Molex, LLC

- FIG 76 SWOT Analysis: Rosenberger Hochfrequenztechnik GmbH

The Global Aviation Connector Market size is expected to reach $8.57 billion by 2031, rising at a market growth of 6.8% CAGR during the forecast period.

RF (radio frequency) connectors are essential for commercial and military aircraft's seamless communication and radar systems. The growing need for secure and high-frequency signal transmission in avionics, satellite communication, and navigation systems has fuelled the demand for RF connectors. Thus, the RF connectors segment held 12% revenue share in the market in 2023. With advancements in wireless technology and increasing investments in next-generation aerospace communication systems, the RF connector segment is poised for continued growth in the aviation industry.

As airlines focus on improving sustainability and reducing carbon emissions, the demand for lightweight and durable connectors is expected to rise. Governments and regulatory bodies worldwide enforce stringent environmental regulations that encourage the adoption of fuel-efficient aircraft technologies. Aviation connectors that support energy efficiency and weight reduction align with these sustainability goals, making them a crucial component in modern aircraft design and development. Moreover, the increasing adoption of autonomous and AI-powered aircraft systems is fuelling the demand for high-speed connectors. Advanced flight management systems, predictive maintenance solutions, and automated cockpit interfaces rely on real-time data processing, necessitating robust and efficient connectors. In conclusion, the growing demand for lightweight and high-durability connectors for enhanced fuel efficiency drives the market's growth.

However, aviation connectors require extensive testing to meet durability, reliability, and safety standards. This includes thermal cycling, vibration tests, and electromagnetic interference assessments. These testing procedures increase manufacturing lead times and costs, making aviation connectors more expensive than standard industrial connectors. In conclusion, the high costs associated with these connectors can act as a restraint, particularly for price-sensitive markets.

Type Outlook

Based on type, the market is characterized by PCB connectors, fiber optic connectors, high-power connectors, high-speed connectors, RF connectors, and others. The high-power connectors segment procured 24% revenue share in the market in 2023. These connectors are essential for powering critical aircraft systems, including propulsion, avionics, lighting, and electrical distribution networks. The rising adoption of electric and hybrid-electric aircraft and advancements in more efficient power management systems have significantly increased the demand for high-power connectors. Their ability to handle high current loads while maintaining durability and reliability in extreme conditions makes them indispensable for modern aviation applications.

Aircraft Outlook

On the basis of aircraft, the market is classified into commercial aircraft, military aircraft, and business & general aviation aircraft. The business & general aviation aircraft segment recorded 17% revenue share in the market in 2023. The rising number of private jet owners, increased demand for chartered flights, and growing investments in luxury air travel have contributed to the expansion of this segment. Business and general aviation aircraft require specialized connectors for navigation, cockpit control systems, satellite communications, and advanced cabin electronics. Furthermore, the integration of cutting-edge technologies, such as high-speed data transmission and lightweight, durable connectors, has enhanced these aircraft's operational efficiency and safety, driving market growth.

Application Outlook

By application, the market is divided into avionics, engines, power distribution & electrical systems, in-flight entertainment, cabin systems, and others. The engines segment witnessed 30% revenue share in the market in 2023. Aircraft engines require highly durable and reliable connectors to ensure efficient power transmission, sensor integration, and real-time performance monitoring. The increasing demand for fuel-efficient and high-performance aircraft engines has driven the adoption of advanced aviation connectors that can withstand extreme temperatures, vibrations, and harsh environmental conditions. The growing focus on predictive maintenance and digital engine health monitoring systems has also fuelled this segment's demand for high-quality connectors.

Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment recorded 34% revenue share in the market in 2023. This dominance is driven by the region's strong presence of leading aircraft manufacturers, defense contractors, and aviation technology companies. The U.S., in particular, plays a critical role in the market due to its significant investments in military aviation, commercial aircraft production, and aerospace innovation. Additionally, the rising adoption of advanced avionics, next-generation aircraft systems, and increasing procurement of new aircraft by airlines and defense agencies has fuelled the demand for high-performance aviation connectors.

List of Key Companies Profiled

- Amphenol Corporation

- TE Connectivity Ltd.

- General Electric Company

- Eaton Corporation plc

- Smiths Group PLC

- Molex, LLC (Koch Industries, Inc.)

- ITT Inc.

- Bel Fuse, Inc.

- Rosenberger Hochfrequenztechnik GmbH

- Radiall SA

Global Aviation Connector Market Report Segmentation

By Aircraft

- Commercial Aircraft

- Military Aircraft

- Business & General Aviation Aircraft

By Application

- Engines

- Avionics

- Power Distribution & Electrical Systems

- Cabin Systems

- In-Flight Entertainment

- Other Application

By Type

- Fiber Optic Connectors

- High-speed Connectors

- PCB Connectors

- RF Connectors

- High-power Connectors

- Other Type

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Chapter 1. Market Scope & Methodology

- 1.1 Market Definition

- 1.2 Objectives

- 1.3 Market Scope

- 1.4 Segmentation

- 1.4.1 Global Aviation Connector Market, by Aircraft

- 1.4.2 Global Aviation Connector Market, by Application

- 1.4.3 Global Aviation Connector Market, by Type

- 1.4.4 Global Aviation Connector Market, by Geography

- 1.5 Methodology for the research

Chapter 2. Market at a Glance

- 2.1 Key Highlights

Chapter 3. Market Overview

- 3.1 Introduction

- 3.1.1 Overview

- 3.1.1.1 Market Composition and Scenario

- 3.1.1 Overview

- 3.2 Key Factors Impacting the Market

- 3.2.1 Market Drivers

- 3.2.2 Market Restraints

- 3.2.3 Market Opportunities

- 3.2.4 Market Challenges

Chapter 4. Competition Analysis - Global

- 4.1 Market Share Analysis, 2023

- 4.2 Porter Five Forces Analysis

Chapter 5. Global Aviation Connector Market by Aircraft

- 5.1 Global Commercial Aircraft Market by Region

- 5.2 Global Military Aircraft Market by Region

- 5.3 Global Business & General Aviation Aircraft Market by Region

Chapter 6. Global Aviation Connector Market by Application

- 6.1 Global Engines Market by Region

- 6.2 Global Avionics Market by Region

- 6.3 Global Power Distribution & Electrical Systems Market by Region

- 6.4 Global Cabin Systems Market by Region

- 6.5 Global In-Flight Entertainment Market by Region

- 6.6 Global Other Application Market by Region

Chapter 7. Global Aviation Connector Market by Type

- 7.1 Global Fiber Optic Connectors Market by Region

- 7.2 Global High-speed Connectors Market by Region

- 7.3 Global PCB Connectors Market by Region

- 7.4 Global RF Connectors Market by Region

- 7.5 Global High-power Connectors Market by Region

- 7.6 Global Other Type Market by Region

Chapter 8. Global Aviation Connector Market by Region

- 8.1 North America Aviation Connector Market

- 8.1.1 North America Aviation Connector Market by Aircraft

- 8.1.1.1 North America Commercial Aircraft Market by Country

- 8.1.1.2 North America Military Aircraft Market by Country

- 8.1.1.3 North America Business & General Aviation Aircraft Market by Country

- 8.1.2 North America Aviation Connector Market by Application

- 8.1.2.1 North America Engines Market by Country

- 8.1.2.2 North America Avionics Market by Country

- 8.1.2.3 North America Power Distribution & Electrical Systems Market by Country

- 8.1.2.4 North America Cabin Systems Market by Country

- 8.1.2.5 North America In-Flight Entertainment Market by Country

- 8.1.2.6 North America Other Application Market by Country

- 8.1.3 North America Aviation Connector Market by Type

- 8.1.3.1 North America Fiber Optic Connectors Market by Country

- 8.1.3.2 North America High-speed Connectors Market by Country

- 8.1.3.3 North America PCB Connectors Market by Country

- 8.1.3.4 North America RF Connectors Market by Country

- 8.1.3.5 North America High-power Connectors Market by Country

- 8.1.3.6 North America Other Type Market by Country

- 8.1.4 North America Aviation Connector Market by Country

- 8.1.4.1 US Aviation Connector Market

- 8.1.4.1.1 US Aviation Connector Market by Aircraft

- 8.1.4.1.2 US Aviation Connector Market by Application

- 8.1.4.1.3 US Aviation Connector Market by Type

- 8.1.4.2 Canada Aviation Connector Market

- 8.1.4.2.1 Canada Aviation Connector Market by Aircraft

- 8.1.4.2.2 Canada Aviation Connector Market by Application

- 8.1.4.2.3 Canada Aviation Connector Market by Type

- 8.1.4.3 Mexico Aviation Connector Market

- 8.1.4.3.1 Mexico Aviation Connector Market by Aircraft

- 8.1.4.3.2 Mexico Aviation Connector Market by Application

- 8.1.4.3.3 Mexico Aviation Connector Market by Type

- 8.1.4.4 Rest of North America Aviation Connector Market

- 8.1.4.4.1 Rest of North America Aviation Connector Market by Aircraft

- 8.1.4.4.2 Rest of North America Aviation Connector Market by Application

- 8.1.4.4.3 Rest of North America Aviation Connector Market by Type

- 8.1.4.1 US Aviation Connector Market

- 8.1.1 North America Aviation Connector Market by Aircraft

- 8.2 Europe Aviation Connector Market

- 8.2.1 Europe Aviation Connector Market by Aircraft

- 8.2.1.1 Europe Commercial Aircraft Market by Country

- 8.2.1.2 Europe Military Aircraft Market by Country

- 8.2.1.3 Europe Business & General Aviation Aircraft Market by Country

- 8.2.2 Europe Aviation Connector Market by Application

- 8.2.2.1 Europe Engines Market by Country

- 8.2.2.2 Europe Avionics Market by Country

- 8.2.2.3 Europe Power Distribution & Electrical Systems Market by Country

- 8.2.2.4 Europe Cabin Systems Market by Country

- 8.2.2.5 Europe In-Flight Entertainment Market by Country

- 8.2.2.6 Europe Other Application Market by Country

- 8.2.3 Europe Aviation Connector Market by Type

- 8.2.3.1 Europe Fiber Optic Connectors Market by Country

- 8.2.3.2 Europe High-speed Connectors Market by Country

- 8.2.3.3 Europe PCB Connectors Market by Country

- 8.2.3.4 Europe RF Connectors Market by Country

- 8.2.3.5 Europe High-power Connectors Market by Country

- 8.2.3.6 Europe Other Type Market by Country

- 8.2.4 Europe Aviation Connector Market by Country

- 8.2.4.1 Germany Aviation Connector Market

- 8.2.4.1.1 Germany Aviation Connector Market by Aircraft

- 8.2.4.1.2 Germany Aviation Connector Market by Application

- 8.2.4.1.3 Germany Aviation Connector Market by Type

- 8.2.4.2 UK Aviation Connector Market

- 8.2.4.2.1 UK Aviation Connector Market by Aircraft

- 8.2.4.2.2 UK Aviation Connector Market by Application

- 8.2.4.2.3 UK Aviation Connector Market by Type

- 8.2.4.3 France Aviation Connector Market

- 8.2.4.3.1 France Aviation Connector Market by Aircraft

- 8.2.4.3.2 France Aviation Connector Market by Application

- 8.2.4.3.3 France Aviation Connector Market by Type

- 8.2.4.4 Russia Aviation Connector Market

- 8.2.4.4.1 Russia Aviation Connector Market by Aircraft

- 8.2.4.4.2 Russia Aviation Connector Market by Application

- 8.2.4.4.3 Russia Aviation Connector Market by Type

- 8.2.4.5 Spain Aviation Connector Market

- 8.2.4.5.1 Spain Aviation Connector Market by Aircraft

- 8.2.4.5.2 Spain Aviation Connector Market by Application

- 8.2.4.5.3 Spain Aviation Connector Market by Type

- 8.2.4.6 Italy Aviation Connector Market

- 8.2.4.6.1 Italy Aviation Connector Market by Aircraft

- 8.2.4.6.2 Italy Aviation Connector Market by Application

- 8.2.4.6.3 Italy Aviation Connector Market by Type

- 8.2.4.7 Rest of Europe Aviation Connector Market

- 8.2.4.7.1 Rest of Europe Aviation Connector Market by Aircraft

- 8.2.4.7.2 Rest of Europe Aviation Connector Market by Application

- 8.2.4.7.3 Rest of Europe Aviation Connector Market by Type

- 8.2.4.1 Germany Aviation Connector Market

- 8.2.1 Europe Aviation Connector Market by Aircraft

- 8.3 Asia Pacific Aviation Connector Market

- 8.3.1 Asia Pacific Aviation Connector Market by Aircraft

- 8.3.1.1 Asia Pacific Commercial Aircraft Market by Country

- 8.3.1.2 Asia Pacific Military Aircraft Market by Country

- 8.3.1.3 Asia Pacific Business & General Aviation Aircraft Market by Country

- 8.3.2 Asia Pacific Aviation Connector Market by Application

- 8.3.2.1 Asia Pacific Engines Market by Country

- 8.3.2.2 Asia Pacific Avionics Market by Country

- 8.3.2.3 Asia Pacific Power Distribution & Electrical Systems Market by Country

- 8.3.2.4 Asia Pacific Cabin Systems Market by Country

- 8.3.2.5 Asia Pacific In-Flight Entertainment Market by Country

- 8.3.2.6 Asia Pacific Other Application Market by Country

- 8.3.3 Asia Pacific Aviation Connector Market by Type

- 8.3.3.1 Asia Pacific Fiber Optic Connectors Market by Country

- 8.3.3.2 Asia Pacific High-speed Connectors Market by Country

- 8.3.3.3 Asia Pacific PCB Connectors Market by Country

- 8.3.3.4 Asia Pacific RF Connectors Market by Country

- 8.3.3.5 Asia Pacific High-power Connectors Market by Country

- 8.3.3.6 Asia Pacific Other Type Market by Country

- 8.3.4 Asia Pacific Aviation Connector Market by Country

- 8.3.4.1 China Aviation Connector Market

- 8.3.4.1.1 China Aviation Connector Market by Aircraft

- 8.3.4.1.2 China Aviation Connector Market by Application

- 8.3.4.1.3 China Aviation Connector Market by Type

- 8.3.4.2 Japan Aviation Connector Market

- 8.3.4.2.1 Japan Aviation Connector Market by Aircraft

- 8.3.4.2.2 Japan Aviation Connector Market by Application

- 8.3.4.2.3 Japan Aviation Connector Market by Type

- 8.3.4.3 India Aviation Connector Market

- 8.3.4.3.1 India Aviation Connector Market by Aircraft

- 8.3.4.3.2 India Aviation Connector Market by Application

- 8.3.4.3.3 India Aviation Connector Market by Type

- 8.3.4.4 South Korea Aviation Connector Market

- 8.3.4.4.1 South Korea Aviation Connector Market by Aircraft

- 8.3.4.4.2 South Korea Aviation Connector Market by Application

- 8.3.4.4.3 South Korea Aviation Connector Market by Type

- 8.3.4.5 Singapore Aviation Connector Market

- 8.3.4.5.1 Singapore Aviation Connector Market by Aircraft

- 8.3.4.5.2 Singapore Aviation Connector Market by Application

- 8.3.4.5.3 Singapore Aviation Connector Market by Type

- 8.3.4.6 Malaysia Aviation Connector Market

- 8.3.4.6.1 Malaysia Aviation Connector Market by Aircraft

- 8.3.4.6.2 Malaysia Aviation Connector Market by Application

- 8.3.4.6.3 Malaysia Aviation Connector Market by Type

- 8.3.4.7 Rest of Asia Pacific Aviation Connector Market

- 8.3.4.7.1 Rest of Asia Pacific Aviation Connector Market by Aircraft

- 8.3.4.7.2 Rest of Asia Pacific Aviation Connector Market by Application

- 8.3.4.7.3 Rest of Asia Pacific Aviation Connector Market by Type

- 8.3.4.1 China Aviation Connector Market

- 8.3.1 Asia Pacific Aviation Connector Market by Aircraft

- 8.4 LAMEA Aviation Connector Market

- 8.4.1 LAMEA Aviation Connector Market by Aircraft

- 8.4.1.1 LAMEA Commercial Aircraft Market by Country

- 8.4.1.2 LAMEA Military Aircraft Market by Country

- 8.4.1.3 LAMEA Business & General Aviation Aircraft Market by Country

- 8.4.2 LAMEA Aviation Connector Market by Application

- 8.4.2.1 LAMEA Engines Market by Country

- 8.4.2.2 LAMEA Avionics Market by Country

- 8.4.2.3 LAMEA Power Distribution & Electrical Systems Market by Country

- 8.4.2.4 LAMEA Cabin Systems Market by Country

- 8.4.2.5 LAMEA In-Flight Entertainment Market by Country

- 8.4.2.6 LAMEA Other Application Market by Country

- 8.4.3 LAMEA Aviation Connector Market by Type

- 8.4.3.1 LAMEA Fiber Optic Connectors Market by Country

- 8.4.3.2 LAMEA High-speed Connectors Market by Country

- 8.4.3.3 LAMEA PCB Connectors Market by Country

- 8.4.3.4 LAMEA RF Connectors Market by Country

- 8.4.3.5 LAMEA High-power Connectors Market by Country

- 8.4.3.6 LAMEA Other Type Market by Country

- 8.4.4 LAMEA Aviation Connector Market by Country

- 8.4.4.1 Brazil Aviation Connector Market

- 8.4.4.1.1 Brazil Aviation Connector Market by Aircraft

- 8.4.4.1.2 Brazil Aviation Connector Market by Application

- 8.4.4.1.3 Brazil Aviation Connector Market by Type

- 8.4.4.2 Argentina Aviation Connector Market

- 8.4.4.2.1 Argentina Aviation Connector Market by Aircraft

- 8.4.4.2.2 Argentina Aviation Connector Market by Application

- 8.4.4.2.3 Argentina Aviation Connector Market by Type

- 8.4.4.3 UAE Aviation Connector Market

- 8.4.4.3.1 UAE Aviation Connector Market by Aircraft

- 8.4.4.3.2 UAE Aviation Connector Market by Application

- 8.4.4.3.3 UAE Aviation Connector Market by Type

- 8.4.4.4 Saudi Arabia Aviation Connector Market

- 8.4.4.4.1 Saudi Arabia Aviation Connector Market by Aircraft

- 8.4.4.4.2 Saudi Arabia Aviation Connector Market by Application

- 8.4.4.4.3 Saudi Arabia Aviation Connector Market by Type

- 8.4.4.5 South Africa Aviation Connector Market

- 8.4.4.5.1 South Africa Aviation Connector Market by Aircraft

- 8.4.4.5.2 South Africa Aviation Connector Market by Application

- 8.4.4.5.3 South Africa Aviation Connector Market by Type

- 8.4.4.6 Nigeria Aviation Connector Market

- 8.4.4.6.1 Nigeria Aviation Connector Market by Aircraft

- 8.4.4.6.2 Nigeria Aviation Connector Market by Application

- 8.4.4.6.3 Nigeria Aviation Connector Market by Type

- 8.4.4.7 Rest of LAMEA Aviation Connector Market

- 8.4.4.7.1 Rest of LAMEA Aviation Connector Market by Aircraft

- 8.4.4.7.2 Rest of LAMEA Aviation Connector Market by Application

- 8.4.4.7.3 Rest of LAMEA Aviation Connector Market by Type

- 8.4.4.1 Brazil Aviation Connector Market

- 8.4.1 LAMEA Aviation Connector Market by Aircraft

Chapter 9. Company Profiles

- 9.1 Amphenol Corporation

- 9.1.1 Company Overview

- 9.1.2 Financial Analysis

- 9.1.3 Segmental and Regional Analysis

- 9.1.4 Research & Development Expenses

- 9.1.5 SWOT Analysis

- 9.2 TE Connectivity Ltd.

- 9.2.1 Company Overview

- 9.2.2 Financial Analysis

- 9.2.3 Segmental and Regional Analysis

- 9.2.4 Research & Development Expense

- 9.2.5 SWOT Analysis

- 9.3 GE Vernova Group

- 9.3.1 Company Overview

- 9.3.2 Financial Analysis

- 9.3.3 Segmental and Regional Analysis

- 9.3.4 Research & Development Expenses

- 9.3.5 SWOT Analysis

- 9.4 Eaton Corporation PLC

- 9.4.1 Company Overview

- 9.4.2 Financial Analysis

- 9.4.3 Segmental and Regional Analysis

- 9.4.4 Research & Development Expense

- 9.4.5 SWOT Analysis

- 9.5 Smiths Group PLC

- 9.5.1 Company Overview

- 9.5.2 Financial Analysis

- 9.5.3 Segmental and Regional Analysis

- 9.5.4 Research & Development Expenses

- 9.5.5 SWOT Analysis

- 9.6 Molex, LLC (Koch Industries, Inc.)

- 9.6.1 Company Overview

- 9.6.2 SWOT Analysis

- 9.7 ITT Inc.

- 9.7.1 Company Overview

- 9.7.2 Financial Analysis

- 9.7.3 Segmental and Regional Analysis

- 9.7.4 Research & Development Expenses

- 9.8 Bel Fuse, Inc.

- 9.8.1 Company Overview

- 9.8.2 Financial Analysis

- 9.8.3 Regional & Segmental Analysis

- 9.8.4 Research & Development Expenses

- 9.9 Rosenberger Hochfrequenztechnik GmbH

- 9.9.1 Company Overview

- 9.9.2 SWOT Analysis

- 9.10. Radiall SA

- 9.10.1 Company Overview