|

|

市場調査レポート

商品コード

1647864

航空コネクター市場- 世界の産業規模、シェア、動向、機会、予測、セグメント、タイプ別、用途別、プラットフォーム別、地域別、競合、2020年~2030年Aviation Connectors Market - Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Type, By Application, By Platform, By Region, & Competition, 2020-2030F |

||||||

カスタマイズ可能

|

|||||||

| 航空コネクター市場- 世界の産業規模、シェア、動向、機会、予測、セグメント、タイプ別、用途別、プラットフォーム別、地域別、競合、2020年~2030年 |

|

出版日: 2025年01月31日

発行: TechSci Research

ページ情報: 英文 180 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

航空コネクターの世界市場規模は2024年に57億5,000万米ドル、予測期間中のCAGRは4.8%で2030年には76億2,000万米ドルに達すると予測されています。

航空コネクター市場は、航空技術の近代化に不可欠な軽量・高性能コネクタの需要増加により、2020年から2030年にかけて大幅な成長が見込まれています。主な成長要因としては、高度なアビオニクスシステム、堅牢なエンジン制御ソリューション、乗客の安全性と快適性を高める効率的な客室設備に対するニーズの高まりが挙げられます。航空コネクターは、着陸装置、アビオニクス、エンジン制御、客室設備などの用途で重要な部品として機能します。市場は、PCB、光ファイバー、ハイパワー、高速、RFコネクターなど、特定の運用要件に対応する主要なタイプに区分されます。固定翼と回転翼のプラットフォーム、民間と軍用の両航空セクターの拡大が原動力。航空宇宙技術革新への投資の増加は、コネクタの小型化と信頼性向上への焦点と相まって、市場をさらに強化しています。地域別では、北米が先進的な航空宇宙インフラを背景に技術革新と実装をリードしており、アジア太平洋地域は航空需要と国防支出の増加によって後押しされています。

| 市場概要 | |

|---|---|

| 予測期間 | 2026-2030 |

| 市場規模:2024年 | 57億5,000万米ドル |

| 市場規模:2030年 | 76億2,000万米ドル |

| CAGR:2025年~2030年 | 4.8% |

| 急成長セグメント | エンジン制御システム |

| 最大市場 | 北米 |

市場促進要因

先進アビオニクス・システムの採用増加

民間航空機の増加および航空機の近代化

軽量でエネルギー効率の高い航空機部品の需要

主な市場課題

厳しい規制基準

高い初期投資と開発コスト

サプライチェーンの混乱

主要市場動向

スマートコネクターの統合

小型化と軽量化

光ファイバーコネクターの採用

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 COVID-19が世界の航空コネクター市場に与える影響

第5章 世界の航空コネクター市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- タイプ別(PCB、光ファイバー、高出力、高速、RFコネクタ、その他)

- 用途別(着陸装置、航空電子機器、客室設備、エンジン制御システム、その他)

- プラットフォーム別(固定翼、回転翼)

- 地域別

- 上位5社、その他(2024)

- 世界の航空コネクター市場マッピング&機会評価

- タイプ別

- 用途別

- プラットフォーム別

- 地域別

第6章 北米の航空コネクター市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- タイプ別

- 用途別

- プラットフォーム別

- 国別

第7章 欧州・CISの航空コネクター市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- タイプ別

- 用途別

- プラットフォーム別

- 国別

第8章 アジア太平洋地域の航空コネクター市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- タイプ別

- 用途別

- プラットフォーム別

- 国別

第9章 中東・アフリカの航空コネクター市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- タイプ別

- 用途別

- プラットフォーム別

- 国別

第10章 南米の航空コネクター市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- タイプ別

- 用途別

- プラットフォーム別

- 国別

第11章 市場力学

- 促進要因

- 課題

第12章 SWOT

- 強み

- 弱み

- 機会

- 脅威

第13章 市場動向と発展

第14章 競合情勢

- 企業プロファイル

- Amphenol Corporation.

- TE Connectivity plc.

- Carlisle Interconnect Technologies.

- Esterline Corporation.

- Bel Fuse Inc.

- Eaton Corporation plc.

- ITT Corporation.

- Smiths Group plc.

- Radiall S.A.

- Rosenberger Hochfrequenztechnik GmbH & Co. KG.

第15章 戦略的提言/行動計画

- 主要な重点分野

- 対象タイプ

- 対象アプリケーション

- 対象地域

第16章 調査会社について・免責事項

Global aviation connectors market was valued at USD 5.75 Billion in 2024 and is expected to reach USD 7.62 Billion by 2030 with a CAGR of 4.8% during the forecast period. The aviation connectors market is poised for substantial growth from 2020 to 2030, driven by the increasing demand for lightweight, high-performance connectors essential for modernizing aviation technology. Key growth factors include the rising need for advanced avionics systems, robust engine control solutions, and efficient cabin equipment to enhance passenger safety and comfort. Aviation connectors serve as critical components across applications such as landing gear, avionics, engine control, and cabin equipment. The market is segmented into key types, including PCB, fiber optic, high power, high-speed, and RF connectors, which cater to specific operational requirements. Fixed-wing and rotary-wing platforms, driven by the expansion of both commercial and military aviation sectors. Increasing investments in aerospace innovations, coupled with a focus on miniaturization and enhanced reliability of connectors, further bolster the market. Geographically, North America leads innovation and implementation due to its advanced aerospace infrastructure, while the Asia-Pacific region is fueled by rising air travel demand and defense spending.

| Market Overview | |

|---|---|

| Forecast Period | 2026-2030 |

| Market Size 2024 | USD 5.75 Billion |

| Market Size 2030 | USD 7.62 Billion |

| CAGR 2025-2030 | 4.8% |

| Fastest Growing Segment | Engine Control Systems |

| Largest Market | North America |

Market Drivers

Increased Adoption of Advanced Avionics Systems

The widespread integration of advanced avionics systems in aircraft is a primary driver for the aviation connectors market. Modern avionics systems demand connectors capable of handling complex electrical and data transmission needs while maintaining reliability under extreme conditions. These systems, encompassing navigation, communication, and monitoring technologies, require connectors that ensure uninterrupted operation. As air traffic grows and international regulations emphasize safety and efficiency, airlines and defense operators are increasingly investing in next-generation avionics. This trend is particularly evident in the commercial and military aviation sectors, where the focus on real-time data sharing, flight efficiency, and situational awareness has heightened the demand for cutting-edge connectors.

Growth in Commercial Air Travel and Fleet Modernization

The global surge in commercial air travel is a significant factor driving the aviation connectors market. Emerging economies, characterized by rising disposable incomes and expanding middle-class populations, are witnessing a robust increase in passenger traffic. In 2024, U.S. airlines operated over 27,000 flights daily, carrying approximately 2.7 million passengers to and from nearly 80 countries. This robust activity underscores the sector's substantial contribution to the U.S. economy, accounting for 5% of the GDP, equivalent to USD 1.45 trillion. To accommodate this growth, airlines are expanding their fleets and modernizing existing aircraft with fuel-efficient and technologically advanced models. This transition necessitates high-speed, lightweight connectors capable of supporting advanced electrical systems. Additionally, the recovery of the tourism industry post-COVID-19 has spurred aircraft production, further bolstering connector demand. Leading aircraft manufacturers are ramping up production, with aviation connectors becoming a critical component of their supply chains.

Demand for Lightweight and Energy-Efficient Aircraft Components

The aviation industry's commitment to sustainability and energy efficiency has led to a heightened focus on lightweight aircraft components. Aviation connectors are specifically designed to offer minimal weight without compromising performance, aligning with the industry's carbon reduction goals. This trend is particularly relevant for electric and hybrid-electric aircraft, where optimized electrical systems are essential for achieving operational efficiency. The push for lightweight solutions extends across all aircraft systems, driving innovation in connector materials and designs to meet the stringent requirements of modern aviation. As airlines prioritize sustainability and fuel economy, the adoption of lightweight aviation connectors is set to rise significantly.

Key Market Challenges

Stringent Regulatory Standards

Aviation connectors must comply with rigorous certification standards, including MIL-SPEC, DO-160, and others. Meeting these standards involves extensive testing, leading to increased time-to-market and development costs. Smaller manufacturers, in particular, face challenges in balancing compliance with competitive pricing.

High Initial Investment and Development Costs

Developing advanced aviation connectors requires significant investment in research, testing, and manufacturing. High costs associated with raw materials such as gold, copper, and advanced composites further exacerbate the challenge. For small- and medium-sized enterprises, these financial barriers limit market entry and expansion opportunities.

Supply Chain Disruptions

The global supply chain for aviation components has been adversely impacted by geopolitical tensions and post-pandemic recovery challenges. Disruptions in the availability of key raw materials and electronic components have delayed production cycles, affecting both manufacturers and end-users.

Key Market Trends

Integration of Smart Connectors

Smart connectors with embedded sensors and diagnostic capabilities are revolutionizing the aviation sector. These connectors are designed to monitor key performance metrics such as temperature, electrical current, and signal integrity in real time. By providing actionable data, they enable predictive maintenance, allowing operators to address potential issues before they lead to costly failures or unplanned downtime. For instance, smart connectors can detect abnormalities in electrical systems or degradation in signal quality, ensuring optimal aircraft performance. Their integration reduces the need for manual inspections, enhances system reliability, and minimizes maintenance costs. These connectors are especially valuable in critical systems like avionics, where continuous performance is essential for safety and efficiency. As aviation technology becomes increasingly complex, the demand for smart connectors is expected to rise, driven by the need for real-time data and enhanced operational efficiency.

Miniaturization and Lightweighting

Miniaturization and lightweighting have become critical trends in aviation connector design as the industry focuses on improving fuel efficiency and reducing overall weight. Miniaturized connectors are engineered to deliver high-speed data transfer and robust electrical performance in a compact form factor, making them ideal for space-constrained environments like unmanned aerial vehicles (UAVs) and advanced avionics. Lightweight connectors reduce the aircraft's overall mass, contributing directly to lower fuel consumption and carbon emissions. Advanced materials like composites and lightweight alloys are often used to achieve these designs without compromising durability. For next-generation aircraft, where advanced electronic systems play a crucial role, miniaturized and lightweight connectors enable efficient system integration while meeting stringent aviation standards. This trend aligns with the industry's emphasis on sustainable aviation and the need for components that balance performance and weight efficiency.

Adoption of Fiber Optic Connectors

Fiber optic connectors are becoming a cornerstone in modern aviation due to their ability to handle high-speed data transmission with exceptional reliability. Unlike traditional connectors, fiber optic solutions can transmit large volumes of data over long distances with minimal signal loss or electromagnetic interference. This capability is particularly critical in advanced avionics systems, which require seamless communication between various aircraft subsystems. Additionally, inflight entertainment systems leverage fiber optic connectors to deliver high-definition content and uninterrupted internet services to passengers. The connectors' lightweight properties further enhance their suitability for aviation applications, where weight savings are paramount. As aircraft systems evolve to incorporate more sophisticated communication and monitoring technologies, fiber optic connectors provide the high bandwidth and reliability needed to support these advancements. Their adoption is expected to grow as airlines and manufacturers prioritize cutting-edge technology and passenger experience.

Segmental Insights

Type Insights

RF connectors hold a dominant position in the aviation connectors market, primarily due to their essential role in avionics and communication systems. These connectors are designed to handle high-frequency signals with exceptional reliability and precision, making them indispensable in transmitting and receiving data across various aircraft systems. From radar and navigation systems to satellite communications and electronic warfare applications, RF connectors provide seamless connectivity in mission-critical operations. The aviation industry relies heavily on RF connectors because of their ability to maintain signal integrity even in extreme environmental conditions, such as high vibrations, temperature fluctuations, and electromagnetic interference. Their robust construction ensures durability and performance under demanding operational scenarios, making them ideal for both commercial and military aircraft. One of the key drivers behind the prominence of RF connectors is the increasing adoption of advanced avionics systems and the integration of sophisticated communication technologies. For instance, modern aircraft utilize high-frequency systems for real-time data sharing, situational awareness, and passenger connectivity, all of which require reliable RF connectors. Moreover, with the growing demand for unmanned aerial vehicles (UAVs) and next-generation aircraft, the need for compact yet high-performing RF connectors has surged. As the aviation industry continues to evolve, RF connectors are expected to remain a cornerstone due to their versatility, reliability, and ability to support the industry's push toward more advanced and connected systems. Their dominance in the market underscores their critical importance in ensuring seamless communication and operational efficiency in aviation.

Regional Insights

North America, particularly the United States, maintains its dominance in the global aerospace industry due to a combination of several key factors. First and foremost, the region benefits from a robust and established aerospace sector, with companies like Boeing, Lockheed Martin, and Northrop Grumman leading in the design, development, and production of advanced aircraft, satellites, and defense systems. This is further supported by significant government investments, particularly from the U.S. Department of Defense, which consistently allocates high budgets for defense spending and research into next-generation aviation technologies. Additionally, the region's focus on technological advancements, including the development of autonomous systems, artificial intelligence, and cutting-edge propulsion technologies, keeps North America at the forefront of innovation. Its strong ecosystem of defense contractors, academic institutions, and public-private partnerships accelerates the transition of research into practical, deployable technologies, further enhancing the competitiveness of the industry. North America is home to a substantial defense and commercial market, supported by global demand for both military and civilian aviation products. The region's strategic position in global geopolitics, combined with its technological leadership, ensures its continued dominance in the aerospace sector, making it a key player in both aviation systems and the future of space exploration.

Key Market Players

- Amphenol Corporation

- TE Connectivity plc

- Carlisle Interconnect Technologies

- Esterline Corporation

- Bel Fuse Inc.

- Eaton Corporation plc

- ITT Corporation

- Smiths Group plc

- Radiall S.A.

Rosenberger Hochfrequenztechnik GmbH & Co. KGReport Scope:

In this report, the global aviation connectors market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:

Aviation Connectors Market, By Platform:

- Fixed Wing

- Rotary Wing

Aviation Connectors Market, By Type:

- PCB

- Fiber Optic

- High Power

- High Speed

- RF Connectors

- Others

Aviation Connectors Market, By Application:

- Self-defense Management System

- Landing Gear

- Avionics

- Cabin Equipment

- Engine Control Systems

- Others

Aviation Connectors Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe & CIS

- France

- Germany

- Spain

- Russia

- Italy

- United Kingdom

- Belgium

- Asia-Pacific

- China

- Japan

- India

- Indonesia

- Thailand

- Australia

- South Korea

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

- South America

- Brazil

- Argentina

- Colombia

Competitive Landscape

Company Profiles: Detailed analysis of the major companies presents in the global aviation connectors market.

Available Customizations:

Global Aviation Connectors market report with the given market data, TechSci Research offers customizations according to a company's specific needs. The following customization options are available for the report:

Company Information

Detailed analysis and profiling of additional market players (up to five).

Table of Contents

1. Introduction

- 1.1. Market Overview

- 1.2. Key Highlights of the Report

- 1.3. Market Coverage

- 1.4. Market Segments Covered

- 1.5. Research Tenure Considered

2. Research Methodology

- 2.1. Objective of the Study

- 2.2. Baseline Methodology

- 2.3. Key Industry Partners

- 2.4. Major Association and Secondary Sources

- 2.5. Forecasting Methodology

- 2.6. Data Triangulation & Validation

- 2.7. Assumptions and Limitations

3. Executive Summary

- 3.1. Market Overview

- 3.2. Market Forecast

- 3.3. Key Regions

- 3.4. Key Segments

4. Impact of COVID-19 on Global Aviation Connectors Market

5. Global Aviation Connectors Market Outlook

- 5.1. Market Size & Forecast

- 5.1.1. By Value

- 5.2. Market Share & Forecast

- 5.2.1. By Type Market Share Analysis (PCB, Fiber Optic, High Power, High Speed, RF Connectors, Others)

- 5.2.2. By Application Market Share Analysis (Landing Gear, Avionics, Cabin Equipment, Engine Control Systems, Others)

- 5.2.3. By Platform Market Share Analysis (Fixed Wing, Rotary Wing)

- 5.2.4. By Regional Market Share Analysis

- 5.2.4.1. North America Market Share Analysis

- 5.2.4.2. Europe & CIS Market Share Analysis

- 5.2.4.3. Asia-Pacific Market Share Analysis

- 5.2.4.4. Middle East & Africa Market Share Analysis

- 5.2.4.5. South America Market Share Analysis

- 5.2.5. By Top 5 Companies Market Share Analysis, Others (2024)

- 5.3. Global Aviation Connectors Market Mapping & Opportunity Assessment

- 5.3.1. By Type Market Mapping & Opportunity Assessment

- 5.3.2. By Application Market Mapping & Opportunity Assessment

- 5.3.3. By Platform Market Mapping & Opportunity Assessment

- 5.3.4. By Regional Market Mapping & Opportunity Assessment

6. North America Aviation Connectors Market Outlook

- 6.1. Market Size & Forecast

- 6.1.1. By Value

- 6.2. Market Share & Forecast

- 6.2.1. By Type Market Share Analysis

- 6.2.2. By Application Market Share Analysis

- 6.2.3. By Platform Market Share Analysis

- 6.2.4. By Country Market Share Analysis

- 6.2.4.1. United States Aviation Connectors Market Outlook

- 6.2.4.1.1. Market Size & Forecast

- 6.2.4.1.1.1. By Value

- 6.2.4.1.2. Market Share & Forecast

- 6.2.4.1.2.1. By Type Market Share Analysis

- 6.2.4.1.2.2. By Application Market Share Analysis

- 6.2.4.1.2.3. By Platform Market Share Analysis

- 6.2.4.2. Canada Aviation Connectors Market Outlook

- 6.2.4.2.1. Market Size & Forecast

- 6.2.4.2.1.1. By Value

- 6.2.4.2.2. Market Share & Forecast

- 6.2.4.2.2.1. By Type Market Share Analysis

- 6.2.4.2.2.2. By Application Market Share Analysis

- 6.2.4.2.2.3. By Platform Market Share Analysis

- 6.2.4.3. Mexico Aviation Connectors Market Outlook

- 6.2.4.3.1. Market Size & Forecast

- 6.2.4.3.1.1. By Value

- 6.2.4.3.2. Market Share & Forecast

- 6.2.4.3.2.1. By Type Market Share Analysis

- 6.2.4.3.2.2. By Application Market Share Analysis

- 6.2.4.3.2.3. By Platform Market Share Analysis

- 6.2.4.1. United States Aviation Connectors Market Outlook

7. Europe & CIS Aviation Connectors Market Outlook

- 7.1. Market Size & Forecast

- 7.1.1. By Value

- 7.2. Market Share & Forecast

- 7.2.1. By Type Market Share Analysis

- 7.2.2. By Application Market Share Analysis

- 7.2.3. By Platform Market Share Analysis

- 7.2.4. By Country Market Share Analysis

- 7.2.4.1. France Aviation Connectors Market Outlook

- 7.2.4.1.1. Market Size & Forecast

- 7.2.4.1.1.1. By Value

- 7.2.4.1.2. Market Share & Forecast

- 7.2.4.1.2.1. By Type Market Share Analysis

- 7.2.4.1.2.2. By Application Market Share Analysis

- 7.2.4.1.2.3. By Platform Market Share Analysis

- 7.2.4.2. Germany Aviation Connectors Market Outlook

- 7.2.4.2.1. Market Size & Forecast

- 7.2.4.2.1.1. By Value

- 7.2.4.2.2. Market Share & Forecast

- 7.2.4.2.2.1. By Type Market Share Analysis

- 7.2.4.2.2.2. By Application Market Share Analysis

- 7.2.4.2.2.3. By Platform Market Share Analysis

- 7.2.4.3. Spain Aviation Connectors Market Outlook

- 7.2.4.3.1. Market Size & Forecast

- 7.2.4.3.1.1. By Value

- 7.2.4.3.2. Market Share & Forecast

- 7.2.4.3.2.1. By Type Market Share Analysis

- 7.2.4.3.2.2. By Application Market Share Analysis

- 7.2.4.3.2.3. By Platform Market Share Analysis

- 7.2.4.4. Russia Aviation Connectors Market Outlook

- 7.2.4.4.1. Market Size & Forecast

- 7.2.4.4.1.1. By Value

- 7.2.4.4.2. Market Share & Forecast

- 7.2.4.4.2.1. By Type Market Share Analysis

- 7.2.4.4.2.2. By Application Market Share Analysis

- 7.2.4.4.2.3. By Platform Market Share Analysis

- 7.2.4.5. Italy Aviation Connectors Market Outlook

- 7.2.4.5.1. Market Size & Forecast

- 7.2.4.5.1.1. By Value

- 7.2.4.5.2. Market Share & Forecast

- 7.2.4.5.2.1. By Type Market Share Analysis

- 7.2.4.5.2.2. By Application Market Share Analysis

- 7.2.4.5.2.3. By Platform Market Share Analysis

- 7.2.4.6. United Kingdom Aviation Connectors Market Outlook

- 7.2.4.6.1. Market Size & Forecast

- 7.2.4.6.1.1. By Value

- 7.2.4.6.2. Market Share & Forecast

- 7.2.4.6.2.1. By Type Market Share Analysis

- 7.2.4.6.2.2. By Application Market Share Analysis

- 7.2.4.6.2.3. By Platform Market Share Analysis

- 7.2.4.7. Belgium Aviation Connectors Market Outlook

- 7.2.4.7.1. Market Size & Forecast

- 7.2.4.7.1.1. By Value

- 7.2.4.7.2. Market Share & Forecast

- 7.2.4.7.2.1. By Type Market Share Analysis

- 7.2.4.7.2.2. By Application Market Share Analysis

- 7.2.4.7.2.3. By Platform Market Share Analysis

- 7.2.4.1. France Aviation Connectors Market Outlook

8. Asia-Pacific Aviation Connectors Market Outlook

- 8.1. Market Size & Forecast

- 8.1.1. By Value

- 8.2. Market Share & Forecast

- 8.2.1. By Type Market Share Analysis

- 8.2.2. By Application Market Share Analysis

- 8.2.3. By Platform Market Share Analysis

- 8.2.4. By Country Market Share Analysis

- 8.2.4.1. China Aviation Connectors Market Outlook

- 8.2.4.1.1. Market Size & Forecast

- 8.2.4.1.1.1. By Value

- 8.2.4.1.2. Market Share & Forecast

- 8.2.4.1.2.1. By Type Market Share Analysis

- 8.2.4.1.2.2. By Application Market Share Analysis

- 8.2.4.1.2.3. By Platform Market Share Analysis

- 8.2.4.2. Japan Aviation Connectors Market Outlook

- 8.2.4.2.1. Market Size & Forecast

- 8.2.4.2.1.1. By Value

- 8.2.4.2.2. Market Share & Forecast

- 8.2.4.2.2.1. By Type Market Share Analysis

- 8.2.4.2.2.2. By Application Market Share Analysis

- 8.2.4.2.2.3. By Platform Market Share Analysis

- 8.2.4.3. India Aviation Connectors Market Outlook

- 8.2.4.3.1. Market Size & Forecast

- 8.2.4.3.1.1. By Value

- 8.2.4.3.2. Market Share & Forecast

- 8.2.4.3.2.1. By Type Market Share Analysis

- 8.2.4.3.2.2. By Application Market Share Analysis

- 8.2.4.3.2.3. By Platform Market Share Analysis

- 8.2.4.4. Indonesia Aviation Connectors Market Outlook

- 8.2.4.4.1. Market Size & Forecast

- 8.2.4.4.1.1. By Value

- 8.2.4.4.2. Market Share & Forecast

- 8.2.4.4.2.1. By Type Market Share Analysis

- 8.2.4.4.2.2. By Application Market Share Analysis

- 8.2.4.4.2.3. By Platform Market Share Analysis

- 8.2.4.5. Thailand Aviation Connectors Market Outlook

- 8.2.4.5.1. Market Size & Forecast

- 8.2.4.5.1.1. By Value

- 8.2.4.5.2. Market Share & Forecast

- 8.2.4.5.2.1. By Type Market Share Analysis

- 8.2.4.5.2.2. By Application Market Share Analysis

- 8.2.4.5.2.3. By Platform Market Share Analysis

- 8.2.4.6. Australia Aviation Connectors Market Outlook

- 8.2.4.6.1. Market Size & Forecast

- 8.2.4.6.1.1. By Value

- 8.2.4.6.2. Market Share & Forecast

- 8.2.4.6.2.1. By Type Market Share Analysis

- 8.2.4.6.2.2. By Application Market Share Analysis

- 8.2.4.6.2.3. By Platform Market Share Analysis

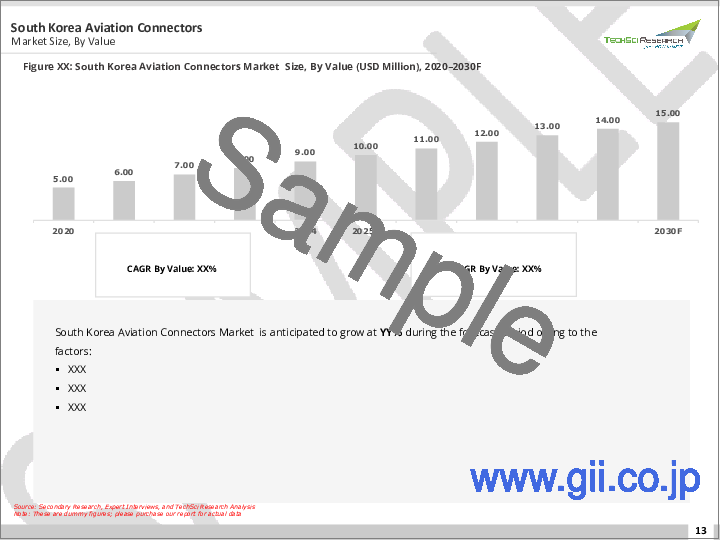

- 8.2.4.7. South Korea Aviation Connectors Market Outlook

- 8.2.4.7.1. Market Size & Forecast

- 8.2.4.7.1.1. By Value

- 8.2.4.7.2. Market Share & Forecast

- 8.2.4.7.2.1. By Type Market Share Analysis

- 8.2.4.7.2.2. By Application Market Share Analysis

- 8.2.4.7.2.3. By Platform Market Share Analysis

- 8.2.4.1. China Aviation Connectors Market Outlook

9. Middle East & Africa Aviation Connectors Market Outlook

- 9.1. Market Size & Forecast

- 9.1.1. By Value

- 9.2. Market Share & Forecast

- 9.2.1. By Type Market Share Analysis

- 9.2.2. By Application Market Share Analysis

- 9.2.3. By Platform Market Share Analysis

- 9.2.4. By Country Market Share Analysis

- 9.2.4.1. South Africa Aviation Connectors Market Outlook

- 9.2.4.1.1. Market Size & Forecast

- 9.2.4.1.1.1. By Value

- 9.2.4.1.2. Market Share & Forecast

- 9.2.4.1.2.1. By Type Market Share Analysis

- 9.2.4.1.2.2. By Application Market Share Analysis

- 9.2.4.1.2.3. By Platform Market Share Analysis

- 9.2.4.2. Saudi Arabia Aviation Connectors Market Outlook

- 9.2.4.2.1. Market Size & Forecast

- 9.2.4.2.1.1. By Value

- 9.2.4.2.2. Market Share & Forecast

- 9.2.4.2.2.1. By Type Market Share Analysis

- 9.2.4.2.2.2. By Application Market Share Analysis

- 9.2.4.2.2.3. By Platform Market Share Analysis

- 9.2.4.3. UAE Aviation Connectors Market Outlook

- 9.2.4.3.1. Market Size & Forecast

- 9.2.4.3.1.1. By Value

- 9.2.4.3.2. Market Share & Forecast

- 9.2.4.3.2.1. By Type Market Share Analysis

- 9.2.4.3.2.2. By Application Market Share Analysis

- 9.2.4.3.2.3. By Platform Market Share Analysis

- 9.2.4.4. Turkey Aviation Connectors Market Outlook

- 9.2.4.4.1. Market Size & Forecast

- 9.2.4.4.1.1. By Value

- 9.2.4.4.2. Market Share & Forecast

- 9.2.4.4.2.1. By Type Market Share Analysis

- 9.2.4.4.2.2. By Application Market Share Analysis

- 9.2.4.4.2.3. By Platform Market Share Analysis

- 9.2.4.1. South Africa Aviation Connectors Market Outlook

10. South America Aviation Connectors Market Outlook

- 10.1. Market Size & Forecast

- 10.1.1. By Value

- 10.2. Market Share & Forecast

- 10.2.1. By Type Market Share Analysis

- 10.2.2. By Application Market Share Analysis

- 10.2.3. By Platform Market Share Analysis

- 10.2.4. By Country Market Share Analysis

- 10.2.4.1. Brazil Aviation Connectors Market Outlook

- 10.2.4.1.1. Market Size & Forecast

- 10.2.4.1.1.1. By Value

- 10.2.4.1.2. Market Share & Forecast

- 10.2.4.1.2.1. By Type Market Share Analysis

- 10.2.4.1.2.2. By Application Market Share Analysis

- 10.2.4.1.2.3. By Platform Market Share Analysis

- 10.2.4.2. Argentina Aviation Connectors Market Outlook

- 10.2.4.2.1. Market Size & Forecast

- 10.2.4.2.1.1. By Value

- 10.2.4.2.2. Market Share & Forecast

- 10.2.4.2.2.1. By Type Market Share Analysis

- 10.2.4.2.2.2. By Application Market Share Analysis

- 10.2.4.2.2.3. By Platform Market Share Analysis

- 10.2.4.3. Colombia Aviation Connectors Market Outlook

- 10.2.4.3.1. Market Size & Forecast

- 10.2.4.3.1.1. By Value

- 10.2.4.3.2. Market Share & Forecast

- 10.2.4.3.2.1. By Type Market Share Analysis

- 10.2.4.3.2.2. By Application Market Share Analysis

- 10.2.4.3.2.3. By Platform Market Share Analysis

- 10.2.4.1. Brazil Aviation Connectors Market Outlook

11. Market Dynamics

- 11.1. Drivers

- 11.2. Challenges

12. SWOT

- 12.1. Strength

- 12.2. Weakness

- 12.3. Opportunities

- 12.4. Threats

13. Market Trends & Developments

14. Competitive Landscape

- 14.1. Company Profiles

- 14.1.1. Amphenol Corporation.

- 14.1.1.1. Company Details

- 14.1.1.2. Product

- 14.1.1.3. Financials (As Per Availability)

- 14.1.1.4. Key Market Focus & Geographical Presence

- 14.1.1.5. Recent Developments

- 14.1.1.6. Key Management Personnel

- 14.1.2. TE Connectivity plc.

- 14.1.2.1. Company Details

- 14.1.2.2. Product

- 14.1.2.3. Financials (As Per Availability)

- 14.1.2.4. Key Market Focus & Geographical Presence

- 14.1.2.5. Recent Developments

- 14.1.2.6. Key Management Personnel

- 14.1.3. Carlisle Interconnect Technologies.

- 14.1.3.1. Company Details

- 14.1.3.2. Product

- 14.1.3.3. Financials (As Per Availability)

- 14.1.3.4. Key Market Focus & Geographical Presence

- 14.1.3.5. Recent Developments

- 14.1.3.6. Key Management Personnel

- 14.1.4. Esterline Corporation.

- 14.1.4.1. Company Details

- 14.1.4.2. Product

- 14.1.4.3. Financials (As Per Availability)

- 14.1.4.4. Key Market Focus & Geographical Presence

- 14.1.4.5. Recent Developments

- 14.1.4.6. Key Management Personnel

- 14.1.5. Bel Fuse Inc.

- 14.1.5.1. Company Details

- 14.1.5.2. Product

- 14.1.5.3. Financials (As Per Availability)

- 14.1.5.4. Key Market Focus & Geographical Presence

- 14.1.5.5. Recent Developments

- 14.1.5.6. Key Management Personnel

- 14.1.6. Eaton Corporation plc.

- 14.1.6.1. Company Details

- 14.1.6.2. Product

- 14.1.6.3. Financials (As Per Availability)

- 14.1.6.4. Key Market Focus & Geographical Presence

- 14.1.6.5. Recent Developments

- 14.1.6.6. Key Management Personnel

- 14.1.7. ITT Corporation.

- 14.1.7.1. Company Details

- 14.1.7.2. Product

- 14.1.7.3. Financials (As Per Availability)

- 14.1.7.4. Key Market Focus & Geographical Presence

- 14.1.7.5. Recent Developments

- 14.1.7.6. Key Management Personnel

- 14.1.8. Smiths Group plc.

- 14.1.8.1. Company Details

- 14.1.8.2. Product

- 14.1.8.3. Financials (As Per Availability)

- 14.1.8.4. Key Market Focus & Geographical Presence

- 14.1.8.5. Recent Developments

- 14.1.8.6. Key Management Personnel

- 14.1.9. Radiall S.A.

- 14.1.9.1. Company Details

- 14.1.9.2. Product

- 14.1.9.3. Financials (As Per Availability)

- 14.1.9.4. Key Market Focus & Geographical Presence

- 14.1.9.5. Recent Developments

- 14.1.9.6. Key Management Personnel

- 14.1.10. Rosenberger Hochfrequenztechnik GmbH & Co. KG.

- 14.1.10.1. Company Details

- 14.1.10.2. Product

- 14.1.10.3. Financials (As Per Availability)

- 14.1.10.4. Key Market Focus & Geographical Presence

- 14.1.10.5. Recent Developments

- 14.1.10.6. Key Management Personnel

- 14.1.1. Amphenol Corporation.

15. Strategic Recommendations/Action Plan

- 15.1. Key Focus Areas

- 15.1.1. Target Type

- 15.1.2. Target Application

- 15.1.3. Target Region