|

|

市場調査レポート

商品コード

1395578

自動車用BMS(自動車用バッテリー管理システム)の世界市場規模、シェア、産業動向分析レポート:コンポーネント別、バッテリータイプ別、用途別、トポロジー別、地域別展望と予測、2023年~2030年Global Automotive Battery Management System Market Size, Share & Industry Trends Analysis Report By Component (Hardware, and Software), By Battery Type (Lithium-ion, Lead-acid), By Application, By Topology, By Regional Outlook and Forecast, 2023 - 2030 |

||||||

|

|||||||

| 自動車用BMS(自動車用バッテリー管理システム)の世界市場規模、シェア、産業動向分析レポート:コンポーネント別、バッテリータイプ別、用途別、トポロジー別、地域別展望と予測、2023年~2030年 |

|

出版日: 2023年11月30日

発行: KBV Research

ページ情報: 英文 296 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

自動車用BMS(自動車用バッテリー管理システム)市場規模は2030年までに166億米ドルに達すると予測され、予測期間中のCAGRは19.8%の市場成長率で上昇する見込みです。

KBV Cardinalマトリックスに掲載された分析によると、自動車用BMS市場では、株式会社東芝とLG Energy Solutionsが先行しています。2023年10月、LGエナジー・ソリューションと北米トヨタ(米国での自動車販売、マーケティング、流通を担当)は供給契約を締結しました。この提携は、LGエナジー・ソリューションがトヨタの米国組立バッテリー電気自動車にリチウムイオン電池モジュールを供給するものです。Sensata Technologies Holdings PLC、Futavis Gmbh、Leclanche S.A.などの企業が、この市場における主要なイノベーターです。

市場成長要因

技術革新の拡大

固体電池や新しいリチウムイオン電池の開発など、電池化学における技術革新は、より高いエネルギー密度、より速い充電能力、より長いサイクル寿命を提供します。BMSは、これらの高度な電池化学を管理し最適化するために適応しています。AIと機械学習がBMS技術に統合され、予知保全、リアルタイム診断、インテリジェントエネルギー管理が可能になっています。これらの技術革新により、バッテリーの性能予測の精度が向上し、安全性が高まります。BMS技術が進歩すれば、自動車の電動化とエネルギー貯蔵ソリューションの統合において極めて重要な役割を果たし、市場が拡大します。

バッテリーの航続距離と性能の向上

BMS技術は、バッテリーパックに蓄えられたエネルギーを効率的に管理するために不可欠です。この最適化により、エネルギーが効果的に使用され、エネルギーの無駄が削減され、1回の充電で走行距離が最大化されるため、航続距離の延長が可能になります。回生ブレーキとエネルギー回生システムは、EVの性能向上に不可欠な要素です。BMS技術は、制動時のエネルギーの回収と蓄積を制御・管理し、車両の航続距離をさらに伸ばすのに役立ちます。BMSシステムは、バッテリーの充電状態(SoC)をリアルタイムで監視します。BMS技術は、ドライバーにリアルタイムのデータとフィードバックを提供し、ドライバーが航続距離を最大化するための運転習慣やルート計画について十分な情報を得た上で意思決定できるよう支援します。以上のような要因が市場成長の原動力となると思われます。

市場抑制要因

様々なバッテリー技術の複雑さ

リン酸リチウムイオン(LiFePO4)、リチウムコバルト酸化物(LiCoO2)、リチウムマンガン酸化物(LiMn2O4)、ソリッドステートなど、さまざまな電池化学には、それぞれに合わせたBMS戦略が必要です。各化学物質は電圧、温度、経時特性が異なるため、BMS設計はより複雑になります。バッテリーの化学的性質が異なれば、電圧範囲や充放電特性も異なります。BMSシステムは、安全で効率的な動作を保証するために、これらの変動を管理できなければなりません。バッテリー技術にはさまざまな温度要件があります。BMSの性能と安全性を損なう可能性のある外部脅威から保護するためには、強固なサイバーセキュリティ対策を確保することが重要です。以上の要因が市場成長の妨げとなります。

コンポーネントの展望

コンポーネント別に見ると、市場はハードウェアとソフトウェアに区分されます。ソフトウェアセグメントは、市場でかなりの収益シェアを獲得しています。ソフトウェアコンポーネントは、電気自動車(EV)、ハイブリッド車、その他の用途におけるバッテリーパックの効率的で安全な動作を保証します。BMSソフトウェアは、様々なセンサーやハードウェア部品からのデータを収集、分析、解釈し、リアルタイムで意思決定を行い、車両オペレーターやメーカーに情報を提供する役割を担っています。同市場のソフトウェアコンポーネントは、バッテリーパックの性能、安全性、寿命を最適化する上で不可欠です。

バッテリータイプの展望

バッテリータイプ別に見ると、市場はリチウムイオン、鉛蓄電池、その他に分類されます。2022年には、リチウムイオンセグメントが市場で最大の収益シェアを記録しました。リチウムイオン電池は、その卓越したエネルギー密度、出力対重量比、最小限の自己放電により、電気自動車の標準的な選択肢となっています。しかし、その安全性と耐久性を確保するためには、バッテリーと車両の効率と安全性を正確に監視する必要があるため、BMSは自動車用バッテリーの組み立てにおいて重要な役割を果たしています。BMSは、バッテリーの健全性、充電状態、電圧、電流、環境温度など、EVのリチウムイオンバッテリーの性能を監視・制御するために不可欠です。したがって、BMSはリチウムイオン電池の進化を可能にする不可欠な要素です。

用途の展望

用途別に見ると、市場は乗用車、商用車、その他に区分されます。商用車セグメントは、2022年の市場でかなりの収益シェアを獲得しました。商用車セグメントには主に電気バスと電気トラックが含まれます。近年、電気輸送の採用が増加しています。世界経済はネット・ゼロ・エミッションを目標に掲げ、世界各国は電気自動車にシフトしています。世界の都市商業輸送で最も重要な輸送手段のひとつがバスです。民間企業、公共機関、非営利団体では、電気バスや電気客車を利用するケースが増えています。今後数年間は、ネット・ゼロ・エミッション目標により、商用車の普及が進むと予測されます。

トポロジーの展望

トポロジーに基づき、市場はモジュール型、集中型、分散型に分類されます。2022年には、モジュール型セグメントがシステム市場で最も高い収益シェアを獲得しました。モジュール型BMSの設計は拡張性を容易にします。異なるバッテリーパックのサイズ、化学物質、または構成に対応するために、モジュールを追加または削除することができます。この柔軟性は、様々な車種が異なるバッテリーサイズを必要とするEV市場において特に有益です。冗長性は、モジュール式トポロジーを通して、バックアップモジュールを設置することで達成できます。モジュールが故障した場合、冗長モジュールがバッテリーの継続的な監視と管理を確実に引き継ぐことができます。モジュラー・アプローチは、BMSコンポーネントの車両アーキテクチャへの統合を簡素化します。各モジュールは明確に定義されたインターフェイスを持つことができ、他の車両システムとの接続や通信が容易になります。

地域別展望

地域別に見ると、市場は北米、欧州、アジア太平洋、LAMEAで分析されます。欧州地域は、2022年の市場で大きな収益シェアを獲得しました。新興の電気自動車部門は、同地域のリチウムイオン電池セル/パックやBMSなどの関連部品の製造にプラスの影響を与えています。欧州には自動車メーカーも多いです。e-モビリティのトレンドの高まりに伴い、この地域では電気自動車用バッテリーの大規模なニーズが生まれています。こうした要因がこの地域の市場成長を後押ししています。さらに、この地域における自動車用BMSの需要は、大手自動車メーカーの製造適性の存在によるものです。

目次

第1章 市場範囲と調査手法

- 市場の定義

- 目的

- 市場範囲

- セグメンテーション

- 調査手法

第2章 市場要覧

- 主なハイライト

第3章 市場概要

- イントロダクション

- 概要

- 市場構成とシナリオ

- 概要

- 市場に影響を与える主な要因

- 市場促進要因

- 市場抑制要因

第4章 競合分析-世界

- KBV Cardinal Matrix

- 最近の業界全体の戦略的展開

- パートナーシップ、コラボレーション、および契約

- 製品の発売と製品の拡大

- 買収と合併

- 市場シェア分析、2022年

- 主要成功戦略

- 主な戦略

- 主要な戦略的動き

- ポーターのファイブフォース分析

第5章 世界の自動車用BMS市場:コンポーネント別

- 世界のハードウェア市場:地域別

- 世界のソフトウェア市場:地域別

第6章 世界の自動車用BMS市場:バッテリータイプ別

- 世界のリチウムイオン市場:地域別

- 世界の鉛酸市場:地域別

- 世界のその他の市場:地域別

第7章 世界の自動車用BMS市場:用途別

- 世界の乗用車市場:地域別

- 世界の商用車市場:地域別

- 世界のその他の市場:地域別

第8章 世界の自動車用BMS市場:トポロジー別

- 世界のモジュール型市場:地域別

- 世界の集中型市場:地域別

- 世界の分散型市場:地域別

第9章 世界の自動車用BMS市場:地域別

- 北米

- 北米の市場:国別

- 米国

- カナダ

- メキシコ

- その他北米地域

- 北米の市場:国別

- 欧州

- 欧州の市場:国別

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

- イタリア

- その他欧州地域

- 欧州の市場:国別

- アジア太平洋

- アジア太平洋の市場:国別

- 中国

- 日本

- インド

- 韓国

- シンガポール

- マレーシア

- その他アジア太平洋地域

- アジア太平洋の市場:国別

- ラテンアメリカ・中東・アフリカ

- ラテンアメリカ・中東・アフリカの市場:国別

- ブラジル

- アルゼンチン

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- ナイジェリア

- その他ラテンアメリカ・中東・アフリカ地域

- ラテンアメリカ・中東・アフリカの市場:国別

第10章 企業プロファイル

- Eberspacher Gruppe GmbH & Co KG

- Sensata Technologies Holdings PLC

- AVL List GmbH

- LG Energy Solution Ltd

- Ficosa International, SA

- Leclanche SA

- Toshiba Corporation

- Nuvation Energy(Nuvation Research Corporation)

- Futavis GmbH(Deutz AG)

- Elithion, Inc

第11章 市場の成功必須条件

LIST OF TABLES

- TABLE 1 Global Automotive Battery Management System Market, 2019 - 2022, USD Million

- TABLE 2 Global Automotive Battery Management System Market, 2023 - 2030, USD Million

- TABLE 3 Partnerships, Collaborations and Agreements- Automotive Battery Managment System Market

- TABLE 4 Product Launches And Product Expansions- Automotive Battery Managment System Market

- TABLE 5 Acquisition and Mergers- Automotive Battery Managment System Market

- TABLE 6 Global Automotive Battery Management System Market by Component, 2019 - 2022, USD Million

- TABLE 7 Global Automotive Battery Management System Market by Component, 2023 - 2030, USD Million

- TABLE 8 Global Hardware Market by Region, 2019 - 2022, USD Million

- TABLE 9 Global Hardware Market by Region, 2023 - 2030, USD Million

- TABLE 10 Global Software Market by Region, 2019 - 2022, USD Million

- TABLE 11 Global Software Market by Region, 2023 - 2030, USD Million

- TABLE 12 Global Automotive Battery Management System Market by Battery Type, 2019 - 2022, USD Million

- TABLE 13 Global Automotive Battery Management System Market by Battery Type, 2023 - 2030, USD Million

- TABLE 14 Global Lithium-ion Market by Region, 2019 - 2022, USD Million

- TABLE 15 Global Lithium-ion Market by Region, 2023 - 2030, USD Million

- TABLE 16 Global Lead-acid Market by Region, 2019 - 2022, USD Million

- TABLE 17 Global Lead-acid Market by Region, 2023 - 2030, USD Million

- TABLE 18 Global Others Market by Region, 2019 - 2022, USD Million

- TABLE 19 Global Others Market by Region, 2023 - 2030, USD Million

- TABLE 20 Global Automotive Battery Management System Market by Application, 2019 - 2022, USD Million

- TABLE 21 Global Automotive Battery Management System Market by Application, 2023 - 2030, USD Million

- TABLE 22 Global Passenger Vehicles Market by Region, 2019 - 2022, USD Million

- TABLE 23 Global Passenger Vehicles Market by Region, 2023 - 2030, USD Million

- TABLE 24 Global Commercial Vehicles Market by Region, 2019 - 2022, USD Million

- TABLE 25 Global Commercial Vehicles Market by Region, 2023 - 2030, USD Million

- TABLE 26 Global Others Market by Region, 2019 - 2022, USD Million

- TABLE 27 Global Others Market by Region, 2023 - 2030, USD Million

- TABLE 28 Global Automotive Battery Management System Market by Topology, 2019 - 2022, USD Million

- TABLE 29 Global Automotive Battery Management System Market by Topology, 2023 - 2030, USD Million

- TABLE 30 Global Modular Market by Region, 2019 - 2022, USD Million

- TABLE 31 Global Modular Market by Region, 2023 - 2030, USD Million

- TABLE 32 Global Centralized Market by Region, 2019 - 2022, USD Million

- TABLE 33 Global Centralized Market by Region, 2023 - 2030, USD Million

- TABLE 34 Global Distributed Market by Region, 2019 - 2022, USD Million

- TABLE 35 Global Distributed Market by Region, 2023 - 2030, USD Million

- TABLE 36 Global Automotive Battery Management System Market by Region, 2019 - 2022, USD Million

- TABLE 37 Global Automotive Battery Management System Market by Region, 2023 - 2030, USD Million

- TABLE 38 North America Automotive Battery Management System Market, 2019 - 2022, USD Million

- TABLE 39 North America Automotive Battery Management System Market, 2023 - 2030, USD Million

- TABLE 40 North America Automotive Battery Management System Market by Component, 2019 - 2022, USD Million

- TABLE 41 North America Automotive Battery Management System Market by Component, 2023 - 2030, USD Million

- TABLE 42 North America Hardware Market by Country, 2019 - 2022, USD Million

- TABLE 43 North America Hardware Market by Country, 2023 - 2030, USD Million

- TABLE 44 North America Software Market by Country, 2019 - 2022, USD Million

- TABLE 45 North America Software Market by Country, 2023 - 2030, USD Million

- TABLE 46 North America Automotive Battery Management System Market by Battery Type, 2019 - 2022, USD Million

- TABLE 47 North America Automotive Battery Management System Market by Battery Type, 2023 - 2030, USD Million

- TABLE 48 North America Lithium-ion Market by Country, 2019 - 2022, USD Million

- TABLE 49 North America Lithium-ion Market by Country, 2023 - 2030, USD Million

- TABLE 50 North America Lead-acid Market by Country, 2019 - 2022, USD Million

- TABLE 51 North America Lead-acid Market by Country, 2023 - 2030, USD Million

- TABLE 52 North America Others Market by Country, 2019 - 2022, USD Million

- TABLE 53 North America Others Market by Country, 2023 - 2030, USD Million

- TABLE 54 North America Automotive Battery Management System Market by Application, 2019 - 2022, USD Million

- TABLE 55 North America Automotive Battery Management System Market by Application, 2023 - 2030, USD Million

- TABLE 56 North America Passenger Vehicles Market by Country, 2019 - 2022, USD Million

- TABLE 57 North America Passenger Vehicles Market by Country, 2023 - 2030, USD Million

- TABLE 58 North America Commercial Vehicles Market by Country, 2019 - 2022, USD Million

- TABLE 59 North America Commercial Vehicles Market by Country, 2023 - 2030, USD Million

- TABLE 60 North America Others Market by Country, 2019 - 2022, USD Million

- TABLE 61 North America Others Market by Country, 2023 - 2030, USD Million

- TABLE 62 North America Automotive Battery Management System Market by Topology, 2019 - 2022, USD Million

- TABLE 63 North America Automotive Battery Management System Market by Topology, 2023 - 2030, USD Million

- TABLE 64 North America Modular Market by Country, 2019 - 2022, USD Million

- TABLE 65 North America Modular Market by Country, 2023 - 2030, USD Million

- TABLE 66 North America Centralized Market by Country, 2019 - 2022, USD Million

- TABLE 67 North America Centralized Market by Country, 2023 - 2030, USD Million

- TABLE 68 North America Distributed Market by Country, 2019 - 2022, USD Million

- TABLE 69 North America Distributed Market by Country, 2023 - 2030, USD Million

- TABLE 70 North America Automotive Battery Management System Market by Country, 2019 - 2022, USD Million

- TABLE 71 North America Automotive Battery Management System Market by Country, 2023 - 2030, USD Million

- TABLE 72 US Automotive Battery Management System Market, 2019 - 2022, USD Million

- TABLE 73 US Automotive Battery Management System Market, 2023 - 2030, USD Million

- TABLE 74 US Automotive Battery Management System Market by Component, 2019 - 2022, USD Million

- TABLE 75 US Automotive Battery Management System Market by Component, 2023 - 2030, USD Million

- TABLE 76 US Automotive Battery Management System Market by Battery Type, 2019 - 2022, USD Million

- TABLE 77 US Automotive Battery Management System Market by Battery Type, 2023 - 2030, USD Million

- TABLE 78 US Automotive Battery Management System Market by Application, 2019 - 2022, USD Million

- TABLE 79 US Automotive Battery Management System Market by Application, 2023 - 2030, USD Million

- TABLE 80 US Automotive Battery Management System Market by Topology, 2019 - 2022, USD Million

- TABLE 81 US Automotive Battery Management System Market by Topology, 2023 - 2030, USD Million

- TABLE 82 Canada Automotive Battery Management System Market, 2019 - 2022, USD Million

- TABLE 83 Canada Automotive Battery Management System Market, 2023 - 2030, USD Million

- TABLE 84 Canada Automotive Battery Management System Market by Component, 2019 - 2022, USD Million

- TABLE 85 Canada Automotive Battery Management System Market by Component, 2023 - 2030, USD Million

- TABLE 86 Canada Automotive Battery Management System Market by Battery Type, 2019 - 2022, USD Million

- TABLE 87 Canada Automotive Battery Management System Market by Battery Type, 2023 - 2030, USD Million

- TABLE 88 Canada Automotive Battery Management System Market by Application, 2019 - 2022, USD Million

- TABLE 89 Canada Automotive Battery Management System Market by Application, 2023 - 2030, USD Million

- TABLE 90 Canada Automotive Battery Management System Market by Topology, 2019 - 2022, USD Million

- TABLE 91 Canada Automotive Battery Management System Market by Topology, 2023 - 2030, USD Million

- TABLE 92 Mexico Automotive Battery Management System Market, 2019 - 2022, USD Million

- TABLE 93 Mexico Automotive Battery Management System Market, 2023 - 2030, USD Million

- TABLE 94 Mexico Automotive Battery Management System Market by Component, 2019 - 2022, USD Million

- TABLE 95 Mexico Automotive Battery Management System Market by Component, 2023 - 2030, USD Million

- TABLE 96 Mexico Automotive Battery Management System Market by Battery Type, 2019 - 2022, USD Million

- TABLE 97 Mexico Automotive Battery Management System Market by Battery Type, 2023 - 2030, USD Million

- TABLE 98 Mexico Automotive Battery Management System Market by Application, 2019 - 2022, USD Million

- TABLE 99 Mexico Automotive Battery Management System Market by Application, 2023 - 2030, USD Million

- TABLE 100 Mexico Automotive Battery Management System Market by Topology, 2019 - 2022, USD Million

- TABLE 101 Mexico Automotive Battery Management System Market by Topology, 2023 - 2030, USD Million

- TABLE 102 Rest of North America Automotive Battery Management System Market, 2019 - 2022, USD Million

- TABLE 103 Rest of North America Automotive Battery Management System Market, 2023 - 2030, USD Million

- TABLE 104 Rest of North America Automotive Battery Management System Market by Component, 2019 - 2022, USD Million

- TABLE 105 Rest of North America Automotive Battery Management System Market by Component, 2023 - 2030, USD Million

- TABLE 106 Rest of North America Automotive Battery Management System Market by Battery Type, 2019 - 2022, USD Million

- TABLE 107 Rest of North America Automotive Battery Management System Market by Battery Type, 2023 - 2030, USD Million

- TABLE 108 Rest of North America Automotive Battery Management System Market by Application, 2019 - 2022, USD Million

- TABLE 109 Rest of North America Automotive Battery Management System Market by Application, 2023 - 2030, USD Million

- TABLE 110 Rest of North America Automotive Battery Management System Market by Topology, 2019 - 2022, USD Million

- TABLE 111 Rest of North America Automotive Battery Management System Market by Topology, 2023 - 2030, USD Million

- TABLE 112 Europe Automotive Battery Management System Market, 2019 - 2022, USD Million

- TABLE 113 Europe Automotive Battery Management System Market, 2023 - 2030, USD Million

- TABLE 114 Europe Automotive Battery Management System Market by Component, 2019 - 2022, USD Million

- TABLE 115 Europe Automotive Battery Management System Market by Component, 2023 - 2030, USD Million

- TABLE 116 Europe Hardware Market by Country, 2019 - 2022, USD Million

- TABLE 117 Europe Hardware Market by Country, 2023 - 2030, USD Million

- TABLE 118 Europe Software Market by Country, 2019 - 2022, USD Million

- TABLE 119 Europe Software Market by Country, 2023 - 2030, USD Million

- TABLE 120 Europe Automotive Battery Management System Market by Battery Type, 2019 - 2022, USD Million

- TABLE 121 Europe Automotive Battery Management System Market by Battery Type, 2023 - 2030, USD Million

- TABLE 122 Europe Lithium-ion Market by Country, 2019 - 2022, USD Million

- TABLE 123 Europe Lithium-ion Market by Country, 2023 - 2030, USD Million

- TABLE 124 Europe Lead-acid Market by Country, 2019 - 2022, USD Million

- TABLE 125 Europe Lead-acid Market by Country, 2023 - 2030, USD Million

- TABLE 126 Europe Others Market by Country, 2019 - 2022, USD Million

- TABLE 127 Europe Others Market by Country, 2023 - 2030, USD Million

- TABLE 128 Europe Automotive Battery Management System Market by Application, 2019 - 2022, USD Million

- TABLE 129 Europe Automotive Battery Management System Market by Application, 2023 - 2030, USD Million

- TABLE 130 Europe Passenger Vehicles Market by Country, 2019 - 2022, USD Million

- TABLE 131 Europe Passenger Vehicles Market by Country, 2023 - 2030, USD Million

- TABLE 132 Europe Commercial Vehicles Market by Country, 2019 - 2022, USD Million

- TABLE 133 Europe Commercial Vehicles Market by Country, 2023 - 2030, USD Million

- TABLE 134 Europe Others Market by Country, 2019 - 2022, USD Million

- TABLE 135 Europe Others Market by Country, 2023 - 2030, USD Million

- TABLE 136 Europe Automotive Battery Management System Market by Topology, 2019 - 2022, USD Million

- TABLE 137 Europe Automotive Battery Management System Market by Topology, 2023 - 2030, USD Million

- TABLE 138 Europe Modular Market by Country, 2019 - 2022, USD Million

- TABLE 139 Europe Modular Market by Country, 2023 - 2030, USD Million

- TABLE 140 Europe Centralized Market by Country, 2019 - 2022, USD Million

- TABLE 141 Europe Centralized Market by Country, 2023 - 2030, USD Million

- TABLE 142 Europe Distributed Market by Country, 2019 - 2022, USD Million

- TABLE 143 Europe Distributed Market by Country, 2023 - 2030, USD Million

- TABLE 144 Europe Automotive Battery Management System Market by Country, 2019 - 2022, USD Million

- TABLE 145 Europe Automotive Battery Management System Market by Country, 2023 - 2030, USD Million

- TABLE 146 Germany Automotive Battery Management System Market, 2019 - 2022, USD Million

- TABLE 147 Germany Automotive Battery Management System Market, 2023 - 2030, USD Million

- TABLE 148 Germany Automotive Battery Management System Market by Component, 2019 - 2022, USD Million

- TABLE 149 Germany Automotive Battery Management System Market by Component, 2023 - 2030, USD Million

- TABLE 150 Germany Automotive Battery Management System Market by Battery Type, 2019 - 2022, USD Million

- TABLE 151 Germany Automotive Battery Management System Market by Battery Type, 2023 - 2030, USD Million

- TABLE 152 Germany Automotive Battery Management System Market by Application, 2019 - 2022, USD Million

- TABLE 153 Germany Automotive Battery Management System Market by Application, 2023 - 2030, USD Million

- TABLE 154 Germany Automotive Battery Management System Market by Topology, 2019 - 2022, USD Million

- TABLE 155 Germany Automotive Battery Management System Market by Topology, 2023 - 2030, USD Million

- TABLE 156 UK Automotive Battery Management System Market, 2019 - 2022, USD Million

- TABLE 157 UK Automotive Battery Management System Market, 2023 - 2030, USD Million

- TABLE 158 UK Automotive Battery Management System Market by Component, 2019 - 2022, USD Million

- TABLE 159 UK Automotive Battery Management System Market by Component, 2023 - 2030, USD Million

- TABLE 160 UK Automotive Battery Management System Market by Battery Type, 2019 - 2022, USD Million

- TABLE 161 UK Automotive Battery Management System Market by Battery Type, 2023 - 2030, USD Million

- TABLE 162 UK Automotive Battery Management System Market by Application, 2019 - 2022, USD Million

- TABLE 163 UK Automotive Battery Management System Market by Application, 2023 - 2030, USD Million

- TABLE 164 UK Automotive Battery Management System Market by Topology, 2019 - 2022, USD Million

- TABLE 165 UK Automotive Battery Management System Market by Topology, 2023 - 2030, USD Million

- TABLE 166 France Automotive Battery Management System Market, 2019 - 2022, USD Million

- TABLE 167 France Automotive Battery Management System Market, 2023 - 2030, USD Million

- TABLE 168 France Automotive Battery Management System Market by Component, 2019 - 2022, USD Million

- TABLE 169 France Automotive Battery Management System Market by Component, 2023 - 2030, USD Million

- TABLE 170 France Automotive Battery Management System Market by Battery Type, 2019 - 2022, USD Million

- TABLE 171 France Automotive Battery Management System Market by Battery Type, 2023 - 2030, USD Million

- TABLE 172 France Automotive Battery Management System Market by Application, 2019 - 2022, USD Million

- TABLE 173 France Automotive Battery Management System Market by Application, 2023 - 2030, USD Million

- TABLE 174 France Automotive Battery Management System Market by Topology, 2019 - 2022, USD Million

- TABLE 175 France Automotive Battery Management System Market by Topology, 2023 - 2030, USD Million

- TABLE 176 Russia Automotive Battery Management System Market, 2019 - 2022, USD Million

- TABLE 177 Russia Automotive Battery Management System Market, 2023 - 2030, USD Million

- TABLE 178 Russia Automotive Battery Management System Market by Component, 2019 - 2022, USD Million

- TABLE 179 Russia Automotive Battery Management System Market by Component, 2023 - 2030, USD Million

- TABLE 180 Russia Automotive Battery Management System Market by Battery Type, 2019 - 2022, USD Million

- TABLE 181 Russia Automotive Battery Management System Market by Battery Type, 2023 - 2030, USD Million

- TABLE 182 Russia Automotive Battery Management System Market by Application, 2019 - 2022, USD Million

- TABLE 183 Russia Automotive Battery Management System Market by Application, 2023 - 2030, USD Million

- TABLE 184 Russia Automotive Battery Management System Market by Topology, 2019 - 2022, USD Million

- TABLE 185 Russia Automotive Battery Management System Market by Topology, 2023 - 2030, USD Million

- TABLE 186 Spain Automotive Battery Management System Market, 2019 - 2022, USD Million

- TABLE 187 Spain Automotive Battery Management System Market, 2023 - 2030, USD Million

- TABLE 188 Spain Automotive Battery Management System Market by Component, 2019 - 2022, USD Million

- TABLE 189 Spain Automotive Battery Management System Market by Component, 2023 - 2030, USD Million

- TABLE 190 Spain Automotive Battery Management System Market by Battery Type, 2019 - 2022, USD Million

- TABLE 191 Spain Automotive Battery Management System Market by Battery Type, 2023 - 2030, USD Million

- TABLE 192 Spain Automotive Battery Management System Market by Application, 2019 - 2022, USD Million

- TABLE 193 Spain Automotive Battery Management System Market by Application, 2023 - 2030, USD Million

- TABLE 194 Spain Automotive Battery Management System Market by Topology, 2019 - 2022, USD Million

- TABLE 195 Spain Automotive Battery Management System Market by Topology, 2023 - 2030, USD Million

- TABLE 196 Italy Automotive Battery Management System Market, 2019 - 2022, USD Million

- TABLE 197 Italy Automotive Battery Management System Market, 2023 - 2030, USD Million

- TABLE 198 Italy Automotive Battery Management System Market by Component, 2019 - 2022, USD Million

- TABLE 199 Italy Automotive Battery Management System Market by Component, 2023 - 2030, USD Million

- TABLE 200 Italy Automotive Battery Management System Market by Battery Type, 2019 - 2022, USD Million

- TABLE 201 Italy Automotive Battery Management System Market by Battery Type, 2023 - 2030, USD Million

- TABLE 202 Italy Automotive Battery Management System Market by Application, 2019 - 2022, USD Million

- TABLE 203 Italy Automotive Battery Management System Market by Application, 2023 - 2030, USD Million

- TABLE 204 Italy Automotive Battery Management System Market by Topology, 2019 - 2022, USD Million

- TABLE 205 Italy Automotive Battery Management System Market by Topology, 2023 - 2030, USD Million

- TABLE 206 Rest of Europe Automotive Battery Management System Market, 2019 - 2022, USD Million

- TABLE 207 Rest of Europe Automotive Battery Management System Market, 2023 - 2030, USD Million

- TABLE 208 Rest of Europe Automotive Battery Management System Market by Component, 2019 - 2022, USD Million

- TABLE 209 Rest of Europe Automotive Battery Management System Market by Component, 2023 - 2030, USD Million

- TABLE 210 Rest of Europe Automotive Battery Management System Market by Battery Type, 2019 - 2022, USD Million

- TABLE 211 Rest of Europe Automotive Battery Management System Market by Battery Type, 2023 - 2030, USD Million

- TABLE 212 Rest of Europe Automotive Battery Management System Market by Application, 2019 - 2022, USD Million

- TABLE 213 Rest of Europe Automotive Battery Management System Market by Application, 2023 - 2030, USD Million

- TABLE 214 Rest of Europe Automotive Battery Management System Market by Topology, 2019 - 2022, USD Million

- TABLE 215 Rest of Europe Automotive Battery Management System Market by Topology, 2023 - 2030, USD Million

- TABLE 216 Asia Pacific Automotive Battery Management System Market, 2019 - 2022, USD Million

- TABLE 217 Asia Pacific Automotive Battery Management System Market, 2023 - 2030, USD Million

- TABLE 218 Asia Pacific Automotive Battery Management System Market by Component, 2019 - 2022, USD Million

- TABLE 219 Asia Pacific Automotive Battery Management System Market by Component, 2023 - 2030, USD Million

- TABLE 220 Asia Pacific Hardware Market by Country, 2019 - 2022, USD Million

- TABLE 221 Asia Pacific Hardware Market by Country, 2023 - 2030, USD Million

- TABLE 222 Asia Pacific Software Market by Country, 2019 - 2022, USD Million

- TABLE 223 Asia Pacific Software Market by Country, 2023 - 2030, USD Million

- TABLE 224 Asia Pacific Automotive Battery Management System Market by Battery Type, 2019 - 2022, USD Million

- TABLE 225 Asia Pacific Automotive Battery Management System Market by Battery Type, 2023 - 2030, USD Million

- TABLE 226 Asia Pacific Lithium-ion Market by Country, 2019 - 2022, USD Million

- TABLE 227 Asia Pacific Lithium-ion Market by Country, 2023 - 2030, USD Million

- TABLE 228 Asia Pacific Lead-acid Market by Country, 2019 - 2022, USD Million

- TABLE 229 Asia Pacific Lead-acid Market by Country, 2023 - 2030, USD Million

- TABLE 230 Asia Pacific Others Market by Country, 2019 - 2022, USD Million

- TABLE 231 Asia Pacific Others Market by Country, 2023 - 2030, USD Million

- TABLE 232 Asia Pacific Automotive Battery Management System Market by Application, 2019 - 2022, USD Million

- TABLE 233 Asia Pacific Automotive Battery Management System Market by Application, 2023 - 2030, USD Million

- TABLE 234 Asia Pacific Passenger Vehicles Market by Country, 2019 - 2022, USD Million

- TABLE 235 Asia Pacific Passenger Vehicles Market by Country, 2023 - 2030, USD Million

- TABLE 236 Asia Pacific Commercial Vehicles Market by Country, 2019 - 2022, USD Million

- TABLE 237 Asia Pacific Commercial Vehicles Market by Country, 2023 - 2030, USD Million

- TABLE 238 Asia Pacific Others Market by Country, 2019 - 2022, USD Million

- TABLE 239 Asia Pacific Others Market by Country, 2023 - 2030, USD Million

- TABLE 240 Asia Pacific Automotive Battery Management System Market by Topology, 2019 - 2022, USD Million

- TABLE 241 Asia Pacific Automotive Battery Management System Market by Topology, 2023 - 2030, USD Million

- TABLE 242 Asia Pacific Modular Market by Country, 2019 - 2022, USD Million

- TABLE 243 Asia Pacific Modular Market by Country, 2023 - 2030, USD Million

- TABLE 244 Asia Pacific Centralized Market by Country, 2019 - 2022, USD Million

- TABLE 245 Asia Pacific Centralized Market by Country, 2023 - 2030, USD Million

- TABLE 246 Asia Pacific Distributed Market by Country, 2019 - 2022, USD Million

- TABLE 247 Asia Pacific Distributed Market by Country, 2023 - 2030, USD Million

- TABLE 248 Asia Pacific Automotive Battery Management System Market by Country, 2019 - 2022, USD Million

- TABLE 249 Asia Pacific Automotive Battery Management System Market by Country, 2023 - 2030, USD Million

- TABLE 250 China Automotive Battery Management System Market, 2019 - 2022, USD Million

- TABLE 251 China Automotive Battery Management System Market, 2023 - 2030, USD Million

- TABLE 252 China Automotive Battery Management System Market by Component, 2019 - 2022, USD Million

- TABLE 253 China Automotive Battery Management System Market by Component, 2023 - 2030, USD Million

- TABLE 254 China Automotive Battery Management System Market by Battery Type, 2019 - 2022, USD Million

- TABLE 255 China Automotive Battery Management System Market by Battery Type, 2023 - 2030, USD Million

- TABLE 256 China Automotive Battery Management System Market by Application, 2019 - 2022, USD Million

- TABLE 257 China Automotive Battery Management System Market by Application, 2023 - 2030, USD Million

- TABLE 258 China Automotive Battery Management System Market by Topology, 2019 - 2022, USD Million

- TABLE 259 China Automotive Battery Management System Market by Topology, 2023 - 2030, USD Million

- TABLE 260 Japan Automotive Battery Management System Market, 2019 - 2022, USD Million

- TABLE 261 Japan Automotive Battery Management System Market, 2023 - 2030, USD Million

- TABLE 262 Japan Automotive Battery Management System Market by Component, 2019 - 2022, USD Million

- TABLE 263 Japan Automotive Battery Management System Market by Component, 2023 - 2030, USD Million

- TABLE 264 Japan Automotive Battery Management System Market by Battery Type, 2019 - 2022, USD Million

- TABLE 265 Japan Automotive Battery Management System Market by Battery Type, 2023 - 2030, USD Million

- TABLE 266 Japan Automotive Battery Management System Market by Application, 2019 - 2022, USD Million

- TABLE 267 Japan Automotive Battery Management System Market by Application, 2023 - 2030, USD Million

- TABLE 268 Japan Automotive Battery Management System Market by Topology, 2019 - 2022, USD Million

- TABLE 269 Japan Automotive Battery Management System Market by Topology, 2023 - 2030, USD Million

- TABLE 270 India Automotive Battery Management System Market, 2019 - 2022, USD Million

- TABLE 271 India Automotive Battery Management System Market, 2023 - 2030, USD Million

- TABLE 272 India Automotive Battery Management System Market by Component, 2019 - 2022, USD Million

- TABLE 273 India Automotive Battery Management System Market by Component, 2023 - 2030, USD Million

- TABLE 274 India Automotive Battery Management System Market by Battery Type, 2019 - 2022, USD Million

- TABLE 275 India Automotive Battery Management System Market by Battery Type, 2023 - 2030, USD Million

- TABLE 276 India Automotive Battery Management System Market by Application, 2019 - 2022, USD Million

- TABLE 277 India Automotive Battery Management System Market by Application, 2023 - 2030, USD Million

- TABLE 278 India Automotive Battery Management System Market by Topology, 2019 - 2022, USD Million

- TABLE 279 India Automotive Battery Management System Market by Topology, 2023 - 2030, USD Million

- TABLE 280 South Korea Automotive Battery Management System Market, 2019 - 2022, USD Million

- TABLE 281 South Korea Automotive Battery Management System Market, 2023 - 2030, USD Million

- TABLE 282 South Korea Automotive Battery Management System Market by Component, 2019 - 2022, USD Million

- TABLE 283 South Korea Automotive Battery Management System Market by Component, 2023 - 2030, USD Million

- TABLE 284 South Korea Automotive Battery Management System Market by Battery Type, 2019 - 2022, USD Million

- TABLE 285 South Korea Automotive Battery Management System Market by Battery Type, 2023 - 2030, USD Million

- TABLE 286 South Korea Automotive Battery Management System Market by Application, 2019 - 2022, USD Million

- TABLE 287 South Korea Automotive Battery Management System Market by Application, 2023 - 2030, USD Million

- TABLE 288 South Korea Automotive Battery Management System Market by Topology, 2019 - 2022, USD Million

- TABLE 289 South Korea Automotive Battery Management System Market by Topology, 2023 - 2030, USD Million

- TABLE 290 Singapore Automotive Battery Management System Market, 2019 - 2022, USD Million

- TABLE 291 Singapore Automotive Battery Management System Market, 2023 - 2030, USD Million

- TABLE 292 Singapore Automotive Battery Management System Market by Component, 2019 - 2022, USD Million

- TABLE 293 Singapore Automotive Battery Management System Market by Component, 2023 - 2030, USD Million

- TABLE 294 Singapore Automotive Battery Management System Market by Battery Type, 2019 - 2022, USD Million

- TABLE 295 Singapore Automotive Battery Management System Market by Battery Type, 2023 - 2030, USD Million

- TABLE 296 Singapore Automotive Battery Management System Market by Application, 2019 - 2022, USD Million

- TABLE 297 Singapore Automotive Battery Management System Market by Application, 2023 - 2030, USD Million

- TABLE 298 Singapore Automotive Battery Management System Market by Topology, 2019 - 2022, USD Million

- TABLE 299 Singapore Automotive Battery Management System Market by Topology, 2023 - 2030, USD Million

The Global Automotive Battery Management System Market size is expected to reach $16.6 billion by 2030, rising at a market growth of 19.8% CAGR during the forecast period.

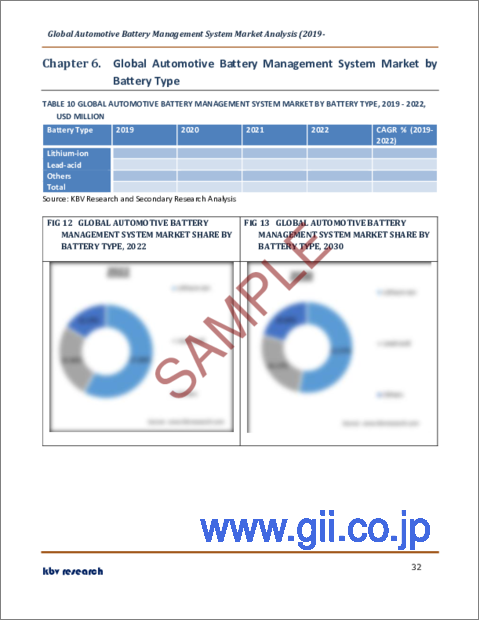

Continuous advancements in battery technology, particularly lithium-ion batteries, have improved energy density, faster charging, and longer battery life. Consequently, the lithium-ion segment would generate approximately 52.96% share of the market by 2030. BMS technology is indispensable in electric vehicles. Lithium-ion batteries offer an impressive combination of energy density and power, allowing for extended driving ranges and efficient energy utilization, which is critical in the rapidly growing electric vehicle (EV) segment. Additionally, their adaptability to various vehicle sizes and types, from compact cars to large SUVs, positions them as a versatile and scalable solution, cementing their status as the go-to choose for automakers striving to meet the evolving demands of the Automotive BMS market.

The major strategies followed by the market participants are Partnerships, Collaborations & Agreements as the key developmental strategy to keep pace with the changing demands of end users. For instance, In August, 2023, Leclanche SA entered into partnership with Medha Group, a renowned provider of vehicle traction systems and associated electronics in Hyderabad, India. Within this partnership, Leclanche SA will supply its Li-ion battery pack solutions, including the INT-53 and INT-39 high-energy battery packs, to Medha for various projects involving railway auxiliary and maintenance vehicles. Additionally, In February, 2023, LG Energy Solutions joined forces with Freudenberg SE, a global supplier, manufacturer, and service partner for the automotive and general industry sectors. The partnership involves a multiyear agreement for the provision of lithium-ion battery cell modules. This collaboration enhances capacity and supply reliability for these vital markets.

Based on the Analysis presented in the KBV Cardinal matrix; Toshiba Corporation and LG Energy Solutions are the forerunners in the Automotive Battery Managment System Market. In October, 2023, LG Energy Solution and Toyota North America, a division of Toyota Corporation responsible for U.S. vehicle sales, marketing, and distribution, have entered into a supply agreement. This collaboration entails the provision of lithium-ion battery modules by LG Energy Solution for Toyota's U.S.-assembled battery electric vehicles. Companies such as Sensata Technologies Holdings PLC., Futavis Gmbh, Leclanche S.A. are some of the key innovators in the Market.

Market Growth Factors

Expansion of technological innovations

Innovations in battery chemistry, such as developing solid-state batteries and new lithium-ion variants, offer higher energy density, faster charging capabilities, and longer cycle life. BMS systems are adapting to manage and optimize these advanced battery chemistries. AI and machine learning are integrated into BMS technology to enable predictive maintenance, real-time diagnostics, and intelligent energy management. These innovations improve the accuracy of battery performance prediction and enhance safety. As BMS technology advances, it will play a pivotal role in electrifying vehicles and integrating energy storage solutions, expanding the market.

Improved range and performance of batteries

BMS technology is essential for managing the energy stored in the battery pack efficiently. This optimization allows for increased range as it ensures that energy is used effectively, reducing energy wastage and maximizing the driving distance on a single charge. Regenerative braking and energy recapture systems are vital components of improving EV performance. BMS technology helps control and manage the recapturing and storing energy during braking, further extending the vehicle's range. BMS systems monitor the state of charge (SoC) of the battery in real time. BMS technology provides real-time data and feedback to drivers, helping them make informed decisions about driving habits and route planning to maximize range. The above factors will drive market growth.

Market Restraining Factors

Complexity of various battery techniques

Various battery chemistries, including lithium-ion phosphate (LiFePO4), lithium-cobalt oxide (LiCoO2), lithium-manganese oxide (LiMn2O4), solid-state, and others, require tailored BMS strategies. Each chemistry has different voltage, temperature, and aging characteristics, making BMS design more intricate. Different battery chemistries have distinct voltage ranges and charge/discharge characteristics. BMS systems must be capable of managing these variations, ensuring safe and efficient operation. Battery technologies have varying thermal requirements. Ensuring robust cybersecurity measures is critical to protect against external threats that could compromise BMS performance and safety. The above factors will hamper the market growth.

Component Outlook

On the basis of components, the market is segmented into hardware and software. The software segment acquired a substantial revenue share in the market. The software component ensures the efficient and safe operation of battery packs in electric vehicles (EVs), hybrid vehicles, and other applications. BMS software is responsible for collecting, analyzing, and interpreting data from various sensors and hardware components, making real-time decisions, and providing information to vehicle operators and manufacturers. The software component in the market is integral in optimizing the performance, safety, and longevity of battery packs.

Battery-Type Outlook

By battery type, the market is categorized into lithium-ion, lead-acid, and others. In 2022, the lithium-ion segment registered the largest revenue share in the market. Lithium-ion batteries are the standard choice for electric vehicles due to their exceptional energy density, power-to-weight ratio, and minimal self-discharge. However, ensuring their safety and durability requires precise oversight for the efficiency and security of the battery and the vehicle; hence, BMS plays a crucial role in the assembly of the automotive battery. BMS is indispensable for overseeing and controlling Li-ion battery performance in EVs, encompassing battery health, charge status, voltage, current, and environmental temperature. Therefore, a BMS is an essential enabling factor for the evolution of lithium-ion batteries.

Application Outlook

On the basis of application, the market is segmented into passenger vehicles, commercial vehicles, and others. The commercial vehicles segment acquired a substantial revenue share in the market in 2022. The commercial vehicles segment primarily includes electric buses and electric trucks. In recent years, there has been a rise in the adoption of electric transportation. The economies worldwide have set their goals for net zero emissions, and countries worldwide are shifting to electric vehicles. One of the most important modes of urban commercial transportation worldwide is buses. Private enterprises, public authorities, and non-profit organizations increasingly utilize electric buses and carriages. In the coming years, the penetration of commercial vehicles is predicted to rise owing to the net zero emissions goals.

Topology Outlook

Based on topology, the market is classified into modular, centralized, and distributed. In 2022, the modular segment generated the highest revenue share in the system market. Modular BMS designs allow for easy scalability. Additional modules can be added or removed to accommodate different battery pack sizes, chemistries, or configurations. This flexibility is especially beneficial in the EV market, where various vehicle models may require different battery sizes. Redundancy can be achieved through modular topology by having backup modules in place. In case of a module failure, a redundant module can take over to ensure continuous monitoring and management of the battery. The modular approach simplifies the integration of BMS components into a vehicle's architecture. Each module can have well-defined interfaces, making it easier to connect and communicate with other vehicle systems.

Regional Outlook

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. The Europe region garnered a significant revenue share in the market in 2022. The emerging electric vehicle sector positively impacts the region's manufacturing of lithium-ion battery cells/packs and related components such as BMS. Europe also has a significant presence of automobile manufacturers. With the rising trend of e-mobility, a massive need for electric vehicle batteries in the region has been created. These factors drive the growth of the market in this region. Furthermore, the demand for automotive BMSs in this region is due to the presence of manufacturing aptitudes of major automotive manufacturers.

The market research report covers the analysis of key stakeholders of the market. Key companies profiled in the report include Eberspacher Gruppe GmbH & Co. KG, Sensata Technologies Holding PLC, AVL List Gmbh, LG Energy Solution Ltd., Ficosa International S.A, Leclanche S.A, Nuvation Energy (Nuvation Research Corporation), Futavis Gmbh (Deutz AG), Toshiba Corporation, Elithion, Inc.

Recent Strategies Deployed in Automotive Battery Management System Market

Partnerships, Collaborations & Agreements

Oct-2023: LG Energy Solution and Toyota North America, a division of Toyota Corporation responsible for U.S. vehicle sales, marketing, and distribution, have entered into a supply agreement. This collaboration entails the provision of lithium-ion battery modules by LG Energy Solution for Toyota's U.S.-assembled battery electric vehicles. Commencing in 2025, LG Energy Solution will supply automotive battery modules with an annual capacity of 20GWh, supporting Toyota's growing range of BEVs and a new BEV model to be manufactured at Toyota Motor Manufacturing Kentucky in 2025 as part of Toyota's multifaceted product strategy.

Aug-2023: Nuvation Energy has entered into a strategic collaboration with Honeywell International, Ltd., a renowned engineering and technology company specializing in solutions across diverse sectors, encompassing energy, security, and safety. This partnership aims to integrate Nuvation Energy's expertise in battery management with Honeywell's advanced energy storage technology to develop highly efficient large-scale storage solutions that effectively address the critical needs of end-users.

Feb-2023: LG Energy Solutions has joined forces with Freudenberg SE, a global supplier, manufacturer, and service partner for the automotive and general industry sectors. The partnership involves a multiyear agreement for the provision of lithium-ion battery cell modules. LG will support Freudenberg SE in expanding its production capabilities to meet the growing demand, ensuring a robust supply chain for its customers in commercial vehicle applications, particularly for trucks and buses in North America and Europe. This collaboration enhances capacity and supply reliability for these vital markets.

June-2023: Leclanche SA entered into partnership with Medha Group, a renowned provider of vehicle traction systems and associated electronics in Hyderabad, India. Within this partnership, Leclanche SA will supply its Li-ion battery pack solutions, including the INT-53 and INT-39 high-energy battery packs, to Medha for various projects involving railway auxiliary and maintenance vehicles. This synergy between Medha's traction systems and electronics, coupled with Leclanche's advanced lithium-ion battery packs, will present a compelling solution for prominent train manufacturers and OEM commercial vehicle designers across three continents.

Oct-2022: Toshiba India Private Limited, a subsidiary of Toshiba Corporation, has recently entered into a collaboration with EVage Automotive Private Limited, a prominent manufacturer of all-electric, custom-designed commercial vehicles. This partnership focuses on enhancing battery management systems (BMS) by integrating them into Honeywell's modular battery energy storage systems. The primary objective is to provide users with enhanced flexibility and a deeper understanding of battery performance, resulting in a more efficient and insightful energy storage solution.

Sep-2021: Toshiba Corporation has entered into a collaborative agreement with Sojitz Corporation and CBMM, a globally diversified company involved in a wide range of business activities spanning across buying, selling, importing, exporting, and manufacturing both in Japan and abroad. Under this agreement, the two companies will join forces to jointly develop and bring to market the next-generation lithium-ion batteries. These batteries will feature niobium titanium oxide (NTO) as the anode material and are primarily aimed at applications within the commercial electric vehicle (e-vehicle) sector.

Aug-2021: EVLO Energy Storage, Hydro-Quebec's energy storage subsidiary, and Nuvation Energy, are teaming up through a reseller agreement for EVLO's energy storage systems. EVLO specializes in grid-scale energy storage systems based on Hydro-Quebec's patented lithium iron phosphate (LFP) battery chemistry while Nuvation Energy provides battery management systems and energy storage engineering services to battery manufacturers and energy storage system developers.

Product launches

May-2023: Sensata Technologies, a prominent industrial technology company specializing in sensors and solutions, has introduced the C-BMS24X, a compact Battery Management System designed to meet the evolving requirements of industrial applications, low voltage electric vehicles, and energy storage systems. The C-BMS24X facilitates the parallel connection of up to 10 battery packs, making it easy to swap depleted batteries with fully charged ones. It offers advanced balancing and user-friendly BMS-controlled features, enhancing overall convenience.

Oct-2022: Sensata Technologies has unveiled the n3-BMS, a novel battery management system tailored for high-voltage applications with lithium balance. This innovation caters to power levels up to 1000 volts/2000 amps, catering to battery manufacturers, electric trucks, and bus makers. It allows customers to customize the system with code and algorithms without compromising ASIL C Certification, potentially reducing development time and costs.

Jan-2022: Toshiba Electronics Europe, a division of Toshiba Corporation, has introduced the TLX9160T, a new photorelay with a normally open (NO) 1-Form-A configuration. This photorelay boasts a robust output withstand voltage (VOFF) of at least 1500V and can function at supply voltages (VDD) of up to 1000V. Housed in a SO16L-T package made from resin material compliant with IEC60664-1 material group I, it features a maximum forward current (IF) of 30mA and an On-state current (ION) of 50mA.

2021-Nov: Sensata Technologies, Inc. has introduced the i-BMS, a cutting-edge Battery Management System (BMS) tailored for electrified applications with a voltage range of up to 60V. This innovative BMS is designed to be compatible with various cell chemistries, offering a versatile and compact integrated solution. It has been developed with a focus on achieving cost efficiency, making it ideal for large-scale, cost-optimized production of applications operating within the 60V voltage range.

Mergers & Acquisition

Mar-2023: Eberspacher has acquired a majority stake in Vecture, Inc., a company specializing in battery protection circuitry for battery pack assembly and electronic manufacturing services. This move strengthens Eberspacher's presence in the automotive control division by leveraging Vecture's expertise in critical battery management systems and energy storage solutions. It enhances Eberspacher's vehicle electronics portfolio and positions them to tap into the fast-growing energy storage market.

Feb-2022: LG Energy Solutions has acquired NEC Energy Solutions, a subsidiary of NEC Corporation, a leading U.S.-based grid battery integrator. This strategic move enables LG to broaden its Energy Storage System (ESS) portfolio, focusing on providing comprehensive integrated AC and DC storage solutions. LG aims to enhance its services with customized operational support, encompassing equipment installation, remote monitoring, and scheduled maintenance, meeting the unique requirements of its clients while strengthening its position in the energy storage market.

Feb-2021: Sensata Technologies has completed the acquisition of Lithium Balance A/S, a company specializing in advanced battery pack monitoring. This strategic move enhances Sensata's electrification business and clean energy market strategy while expanding its portfolio to provide battery management solutions for various vehicle OEMs. The acquisition allows Sensata to offer comprehensive battery management solutions across a diverse range of electrification applications in industrial and transport markets, further solidifying its position in the industry.

Scope of the Study

Market Segments covered in the Report:

By Component

- Hardware

- Software

By Battery Type

- Lithium-ion

- Lead-acid

- Others

By Application

- Passenger Vehicles

- Commercial Vehicles

- Others

By Topology

- Modular

- Centralized

- Distributed

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Companies Profiled

- Eberspacher Gruppe GmbH & Co. KG

- Sensata Technologies Holding PLC

- AVL List Gmbh

- LG Energy Solution Ltd.

- Ficosa International S.A

- Leclanche S.A

- Nuvation Energy

- Futavis Gmbh

- Toshiba Corporation

- Elithion, Inc.

Unique Offerings from KBV Research

- Exhaustive coverage

- Highest number of market tables and figures

- Subscription based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Chapter 1. Market Scope & Methodology

- 1.1 Market Definition

- 1.2 Objectives

- 1.3 Market Scope

- 1.4 Segmentation

- 1.4.1 Global Automotive Battery Management System Market, by Component

- 1.4.2 Global Automotive Battery Management System Market, by Battery Type

- 1.4.3 Global Automotive Battery Management System Market, by Application

- 1.4.4 Global Automotive Battery Management System Market, by Topology

- 1.4.5 Global Automotive Battery Management System Market, by Geography

- 1.5 Methodology for the research

Chapter 2. Market at a Glance

- 2.1 Key Highlights

Chapter 3. Market Overview

- 3.1 Introduction

- 3.1.1 Overview

- 3.1.1.1 Market Composition and Scenario

- 3.1.1 Overview

- 3.2 Key Factors Impacting the Market

- 3.2.1 Market Drivers

- 3.2.2 Market Restraints

Chapter 4. Competition Analysis - Global

- 4.1 KBV Cardinal Matrix

- 4.2 Recent Industry Wide Strategic Developments

- 4.2.1 Partnerships, Collaborations and Agreements

- 4.2.2 Product Launches and Product Expansions

- 4.2.3 Acquisition and Mergers

- 4.3 Market Share Analysis, 2022

- 4.4 Top Winning Strategies

- 4.4.1 Key Leading Strategies: Percentage Distribution (2019-2023)

- 4.4.2 Key Strategic Move: (Partnerships, Collaborations & Agreements: 2021, Aug - 2023, Oct) Leading Players

- 4.5 Porter's Five Forces Analysis

Chapter 5. Global Automotive Battery Management System Market by Component

- 5.1 Global Hardware Market by Region

- 5.2 Global Software Market by Region

Chapter 6. Global Automotive Battery Management System Market by Battery Type

- 6.1 Global Lithium-ion Market by Region

- 6.2 Global Lead-acid Market by Region

- 6.3 Global Others Market by Region

Chapter 7. Global Automotive Battery Management System Market by Application

- 7.1 Global Passenger Vehicles Market by Region

- 7.2 Global Commercial Vehicles Market by Region

- 7.3 Global Others Market by Region

Chapter 8. Global Automotive Battery Management System Market by Topology

- 8.1 Global Modular Market by Region

- 8.2 Global Centralized Market by Region

- 8.3 Global Distributed Market by Region

Chapter 9. Global Automotive Battery Management System Market by Region

- 9.1 North America Automotive Battery Management System Market

- 9.1.1 North America Automotive Battery Management System Market by Component

- 9.1.1.1 North America Hardware Market by Country

- 9.1.1.2 North America Software Market by Country

- 9.1.2 North America Automotive Battery Management System Market by Battery Type

- 9.1.2.1 North America Lithium-ion Market by Country

- 9.1.2.2 North America Lead-acid Market by Country

- 9.1.2.3 North America Others Market by Country

- 9.1.3 North America Automotive Battery Management System Market by Application

- 9.1.3.1 North America Passenger Vehicles Market by Country

- 9.1.3.2 North America Commercial Vehicles Market by Country

- 9.1.3.3 North America Others Market by Country

- 9.1.4 North America Automotive Battery Management System Market by Topology

- 9.1.4.1 North America Modular Market by Country

- 9.1.4.2 North America Centralized Market by Country

- 9.1.4.3 North America Distributed Market by Country

- 9.1.5 North America Automotive Battery Management System Market by Country

- 9.1.5.1 US Automotive Battery Management System Market

- 9.1.5.1.1 US Automotive Battery Management System Market by Component

- 9.1.5.1.2 US Automotive Battery Management System Market by Battery Type

- 9.1.5.1.3 US Automotive Battery Management System Market by Application

- 9.1.5.1.4 US Automotive Battery Management System Market by Topology

- 9.1.5.2 Canada Automotive Battery Management System Market

- 9.1.5.2.1 Canada Automotive Battery Management System Market by Component

- 9.1.5.2.2 Canada Automotive Battery Management System Market by Battery Type

- 9.1.5.2.3 Canada Automotive Battery Management System Market by Application

- 9.1.5.2.4 Canada Automotive Battery Management System Market by Topology

- 9.1.5.3 Mexico Automotive Battery Management System Market

- 9.1.5.3.1 Mexico Automotive Battery Management System Market by Component

- 9.1.5.3.2 Mexico Automotive Battery Management System Market by Battery Type

- 9.1.5.3.3 Mexico Automotive Battery Management System Market by Application

- 9.1.5.3.4 Mexico Automotive Battery Management System Market by Topology

- 9.1.5.4 Rest of North America Automotive Battery Management System Market

- 9.1.5.4.1 Rest of North America Automotive Battery Management System Market by Component

- 9.1.5.4.2 Rest of North America Automotive Battery Management System Market by Battery Type

- 9.1.5.4.3 Rest of North America Automotive Battery Management System Market by Application

- 9.1.5.4.4 Rest of North America Automotive Battery Management System Market by Topology

- 9.1.5.1 US Automotive Battery Management System Market

- 9.1.1 North America Automotive Battery Management System Market by Component

- 9.2 Europe Automotive Battery Management System Market

- 9.2.1 Europe Automotive Battery Management System Market by Component

- 9.2.1.1 Europe Hardware Market by Country

- 9.2.1.2 Europe Software Market by Country

- 9.2.2 Europe Automotive Battery Management System Market by Battery Type

- 9.2.2.1 Europe Lithium-ion Market by Country

- 9.2.2.2 Europe Lead-acid Market by Country

- 9.2.2.3 Europe Others Market by Country

- 9.2.3 Europe Automotive Battery Management System Market by Application

- 9.2.3.1 Europe Passenger Vehicles Market by Country

- 9.2.3.2 Europe Commercial Vehicles Market by Country

- 9.2.3.3 Europe Others Market by Country

- 9.2.4 Europe Automotive Battery Management System Market by Topology

- 9.2.4.1 Europe Modular Market by Country

- 9.2.4.2 Europe Centralized Market by Country

- 9.2.4.3 Europe Distributed Market by Country

- 9.2.5 Europe Automotive Battery Management System Market by Country

- 9.2.5.1 Germany Automotive Battery Management System Market

- 9.2.5.1.1 Germany Automotive Battery Management System Market by Component

- 9.2.5.1.2 Germany Automotive Battery Management System Market by Battery Type

- 9.2.5.1.3 Germany Automotive Battery Management System Market by Application

- 9.2.5.1.4 Germany Automotive Battery Management System Market by Topology

- 9.2.5.2 UK Automotive Battery Management System Market

- 9.2.5.2.1 UK Automotive Battery Management System Market by Component

- 9.2.5.2.2 UK Automotive Battery Management System Market by Battery Type

- 9.2.5.2.3 UK Automotive Battery Management System Market by Application

- 9.2.5.2.4 UK Automotive Battery Management System Market by Topology

- 9.2.5.3 France Automotive Battery Management System Market

- 9.2.5.3.1 France Automotive Battery Management System Market by Component

- 9.2.5.3.2 France Automotive Battery Management System Market by Battery Type

- 9.2.5.3.3 France Automotive Battery Management System Market by Application

- 9.2.5.3.4 France Automotive Battery Management System Market by Topology

- 9.2.5.4 Russia Automotive Battery Management System Market

- 9.2.5.4.1 Russia Automotive Battery Management System Market by Component

- 9.2.5.4.2 Russia Automotive Battery Management System Market by Battery Type

- 9.2.5.4.3 Russia Automotive Battery Management System Market by Application

- 9.2.5.4.4 Russia Automotive Battery Management System Market by Topology

- 9.2.5.5 Spain Automotive Battery Management System Market

- 9.2.5.5.1 Spain Automotive Battery Management System Market by Component

- 9.2.5.5.2 Spain Automotive Battery Management System Market by Battery Type

- 9.2.5.5.3 Spain Automotive Battery Management System Market by Application

- 9.2.5.5.4 Spain Automotive Battery Management System Market by Topology

- 9.2.5.6 Italy Automotive Battery Management System Market

- 9.2.5.6.1 Italy Automotive Battery Management System Market by Component

- 9.2.5.6.2 Italy Automotive Battery Management System Market by Battery Type

- 9.2.5.6.3 Italy Automotive Battery Management System Market by Application

- 9.2.5.6.4 Italy Automotive Battery Management System Market by Topology

- 9.2.5.7 Rest of Europe Automotive Battery Management System Market

- 9.2.5.7.1 Rest of Europe Automotive Battery Management System Market by Component

- 9.2.5.7.2 Rest of Europe Automotive Battery Management System Market by Battery Type

- 9.2.5.7.3 Rest of Europe Automotive Battery Management System Market by Application

- 9.2.5.7.4 Rest of Europe Automotive Battery Management System Market by Topology

- 9.2.5.1 Germany Automotive Battery Management System Market

- 9.2.1 Europe Automotive Battery Management System Market by Component

- 9.3 Asia Pacific Automotive Battery Management System Market

- 9.3.1 Asia Pacific Automotive Battery Management System Market by Component

- 9.3.1.1 Asia Pacific Hardware Market by Country

- 9.3.1.2 Asia Pacific Software Market by Country

- 9.3.2 Asia Pacific Automotive Battery Management System Market by Battery Type

- 9.3.2.1 Asia Pacific Lithium-ion Market by Country

- 9.3.2.2 Asia Pacific Lead-acid Market by Country

- 9.3.2.3 Asia Pacific Others Market by Country

- 9.3.3 Asia Pacific Automotive Battery Management System Market by Application

- 9.3.3.1 Asia Pacific Passenger Vehicles Market by Country

- 9.3.3.2 Asia Pacific Commercial Vehicles Market by Country

- 9.3.3.3 Asia Pacific Others Market by Country

- 9.3.4 Asia Pacific Automotive Battery Management System Market by Topology

- 9.3.4.1 Asia Pacific Modular Market by Country

- 9.3.4.2 Asia Pacific Centralized Market by Country

- 9.3.4.3 Asia Pacific Distributed Market by Country

- 9.3.5 Asia Pacific Automotive Battery Management System Market by Country

- 9.3.5.1 China Automotive Battery Management System Market

- 9.3.5.1.1 China Automotive Battery Management System Market by Component

- 9.3.5.1.2 China Automotive Battery Management System Market by Battery Type

- 9.3.5.1.3 China Automotive Battery Management System Market by Application

- 9.3.5.1.4 China Automotive Battery Management System Market by Topology

- 9.3.5.2 Japan Automotive Battery Management System Market

- 9.3.5.2.1 Japan Automotive Battery Management System Market by Component

- 9.3.5.2.2 Japan Automotive Battery Management System Market by Battery Type

- 9.3.5.2.3 Japan Automotive Battery Management System Market by Application

- 9.3.5.2.4 Japan Automotive Battery Management System Market by Topology

- 9.3.5.3 India Automotive Battery Management System Market

- 9.3.5.3.1 India Automotive Battery Management System Market by Component

- 9.3.5.3.2 India Automotive Battery Management System Market by Battery Type

- 9.3.5.3.3 India Automotive Battery Management System Market by Application

- 9.3.5.3.4 India Automotive Battery Management System Market by Topology

- 9.3.5.4 South Korea Automotive Battery Management System Market

- 9.3.5.4.1 South Korea Automotive Battery Management System Market by Component

- 9.3.5.4.2 South Korea Automotive Battery Management System Market by Battery Type

- 9.3.5.4.3 South Korea Automotive Battery Management System Market by Application

- 9.3.5.4.4 South Korea Automotive Battery Management System Market by Topology

- 9.3.5.5 Singapore Automotive Battery Management System Market

- 9.3.5.5.1 Singapore Automotive Battery Management System Market by Component

- 9.3.5.5.2 Singapore Automotive Battery Management System Market by Battery Type

- 9.3.5.5.3 Singapore Automotive Battery Management System Market by Application

- 9.3.5.5.4 Singapore Automotive Battery Management System Market by Topology

- 9.3.5.6 Malaysia Automotive Battery Management System Market

- 9.3.5.6.1 Malaysia Automotive Battery Management System Market by Component

- 9.3.5.6.2 Malaysia Automotive Battery Management System Market by Battery Type

- 9.3.5.6.3 Malaysia Automotive Battery Management System Market by Application

- 9.3.5.6.4 Malaysia Automotive Battery Management System Market by Topology

- 9.3.5.7 Rest of Asia Pacific Automotive Battery Management System Market

- 9.3.5.7.1 Rest of Asia Pacific Automotive Battery Management System Market by Component

- 9.3.5.7.2 Rest of Asia Pacific Automotive Battery Management System Market by Battery Type

- 9.3.5.7.3 Rest of Asia Pacific Automotive Battery Management System Market by Application

- 9.3.5.7.4 Rest of Asia Pacific Automotive Battery Management System Market by Topology

- 9.3.5.1 China Automotive Battery Management System Market

- 9.3.1 Asia Pacific Automotive Battery Management System Market by Component

- 9.4 LAMEA Automotive Battery Management System Market

- 9.4.1 LAMEA Automotive Battery Management System Market by Component

- 9.4.1.1 LAMEA Hardware Market by Country

- 9.4.1.2 LAMEA Software Market by Country

- 9.4.2 LAMEA Automotive Battery Management System Market by Battery Type

- 9.4.2.1 LAMEA Lithium-ion Market by Country

- 9.4.2.2 LAMEA Lead-acid Market by Country

- 9.4.2.3 LAMEA Others Market by Country

- 9.4.3 LAMEA Automotive Battery Management System Market by Application

- 9.4.3.1 LAMEA Passenger Vehicles Market by Country

- 9.4.3.2 LAMEA Commercial Vehicles Market by Country

- 9.4.3.3 LAMEA Others Market by Country

- 9.4.4 LAMEA Automotive Battery Management System Market by Topology

- 9.4.4.1 LAMEA Modular Market by Country

- 9.4.4.2 LAMEA Centralized Market by Country

- 9.4.4.3 LAMEA Distributed Market by Country

- 9.4.5 LAMEA Automotive Battery Management System Market by Country

- 9.4.5.1 Brazil Automotive Battery Management System Market

- 9.4.5.1.1 Brazil Automotive Battery Management System Market by Component

- 9.4.5.1.2 Brazil Automotive Battery Management System Market by Battery Type

- 9.4.5.1.3 Brazil Automotive Battery Management System Market by Application

- 9.4.5.1.4 Brazil Automotive Battery Management System Market by Topology

- 9.4.5.2 Argentina Automotive Battery Management System Market

- 9.4.5.2.1 Argentina Automotive Battery Management System Market by Component

- 9.4.5.2.2 Argentina Automotive Battery Management System Market by Battery Type

- 9.4.5.2.3 Argentina Automotive Battery Management System Market by Application

- 9.4.5.2.4 Argentina Automotive Battery Management System Market by Topology

- 9.4.5.3 UAE Automotive Battery Management System Market

- 9.4.5.3.1 UAE Automotive Battery Management System Market by Component

- 9.4.5.3.2 UAE Automotive Battery Management System Market by Battery Type

- 9.4.5.3.3 UAE Automotive Battery Management System Market by Application

- 9.4.5.3.4 UAE Automotive Battery Management System Market by Topology

- 9.4.5.4 Saudi Arabia Automotive Battery Management System Market

- 9.4.5.4.1 Saudi Arabia Automotive Battery Management System Market by Component

- 9.4.5.4.2 Saudi Arabia Automotive Battery Management System Market by Battery Type

- 9.4.5.4.3 Saudi Arabia Automotive Battery Management System Market by Application

- 9.4.5.4.4 Saudi Arabia Automotive Battery Management System Market by Topology

- 9.4.5.5 South Africa Automotive Battery Management System Market

- 9.4.5.5.1 South Africa Automotive Battery Management System Market by Component

- 9.4.5.5.2 South Africa Automotive Battery Management System Market by Battery Type

- 9.4.5.5.3 South Africa Automotive Battery Management System Market by Application

- 9.4.5.5.4 South Africa Automotive Battery Management System Market by Topology

- 9.4.5.6 Nigeria Automotive Battery Management System Market

- 9.4.5.6.1 Nigeria Automotive Battery Management System Market by Component

- 9.4.5.6.2 Nigeria Automotive Battery Management System Market by Battery Type

- 9.4.5.6.3 Nigeria Automotive Battery Management System Market by Application

- 9.4.5.6.4 Nigeria Automotive Battery Management System Market by Topology

- 9.4.5.7 Rest of LAMEA Automotive Battery Management System Market

- 9.4.5.7.1 Rest of LAMEA Automotive Battery Management System Market by Component

- 9.4.5.7.2 Rest of LAMEA Automotive Battery Management System Market by Battery Type

- 9.4.5.7.3 Rest of LAMEA Automotive Battery Management System Market by Application

- 9.4.5.7.4 Rest of LAMEA Automotive Battery Management System Market by Topology

- 9.4.5.1 Brazil Automotive Battery Management System Market

- 9.4.1 LAMEA Automotive Battery Management System Market by Component

Chapter 10. Company Profiles

- 10.1 Eberspacher Gruppe GmbH & Co. KG

- 10.1.1 Company Overview

- 10.1.2 Financial Analysis

- 10.1.3 Regional & Segmental Analysis

- 10.1.4 Research & Development Expenses

- 10.1.5 Recent strategies and developments:

- 10.1.5.1 Acquisition and Mergers:

- 10.1.6 SWOT Analysis

- 10.2 Sensata Technologies Holdings PLC

- 10.2.1 Company Overview

- 10.2.2 Financial Analysis

- 10.2.3 Segmental and Regional Analysis

- 10.2.4 Research & Development Expense

- 10.2.5 Recent strategies and developments:

- 10.2.5.1 Product Launches and Product Expansions:

- 10.2.5.2 Acquisition and Mergers:

- 10.2.6 SWOT Analysis

- 10.3 AVL List GmbH

- 10.3.1 Company Overview

- 10.3.2 SWOT Analysis

- 10.4 LG Energy Solution Ltd.

- 10.4.1 Company Overview

- 10.4.2 Financial Analysis

- 10.4.3 Research & Development Expense

- 10.4.4 Recent strategies and developments:

- 10.4.4.1 Partnerships, Collaborations, and Agreements:

- 10.4.4.2 Acquisition and Mergers:

- 10.4.5 SWOT Analysis

- 10.5 Ficosa International, S.A.

- 10.5.1 Company Overview

- 10.5.2 SWOT Analysis

- 10.6 Leclanche S.A.

- 10.6.1 Company Overview

- 10.6.2 Financial Analysis

- 10.6.3 Segmental and Regional Analysis

- 10.6.4 Research & Development Expenses

- 10.6.5 Recent strategies and developments:

- 10.6.5.1 Partnerships, Collaborations, and Agreements:

- 10.6.6 SWOT Analysis

- 10.7 Toshiba Corporation

- 10.7.1 Company Overview

- 10.7.2 Financial Analysis

- 10.7.3 Segmental and Regional Analysis

- 10.7.4 Research and Development Expense

- 10.7.5 Recent strategies and developments:

- 10.7.5.1 Partnerships, Collaborations, and Agreements:

- 10.7.5.2 Product Launches and Product Expansions:

- 10.7.6 SWOT Analysis

- 10.8 Nuvation Energy (Nuvation Research Corporation)

- 10.8.1 Company Overview

- 10.8.2 Recent strategies and developments:

- 10.8.2.1 Partnerships, Collaborations, and Agreements:

- 10.8.3 SWOT Analysis

- 10.9 Futavis GmbH (Deutz AG)

- 10.9.1 Company Overview

- 10.9.2 Financial Analysis

- 10.9.3 Segmental and Regional Analysis

- 10.9.4 Research & Development Expenses

- 10.9.5 SWOT Analysis

- 10.10. Elithion, Inc.

- 10.10.1 Company Overview

- 10.10.2 SWOT Analysis