|

|

市場調査レポート

商品コード

1385117

ビデオバンキングサービスの世界市場規模、シェア、産業動向分析レポート:用途別、コンポーネント別、展開モード別、地域別展望と予測、2023年~2030年Global Video Banking Service Market Size, Share & Industry Trends Analysis Report By Application (Banks, Credit Union, and Others), By Component (Solution, and Services), By Deployment Mode, By Regional Outlook and Forecast, 2023 - 2030 |

||||||

|

|||||||

| ビデオバンキングサービスの世界市場規模、シェア、産業動向分析レポート:用途別、コンポーネント別、展開モード別、地域別展望と予測、2023年~2030年 |

|

出版日: 2023年10月31日

発行: KBV Research

ページ情報: 英文 227 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

ビデオバンキングサービス市場規模は2030年までに1,723億米ドルに達すると予測され、予測期間中のCAGRは12.5%の市場成長率で上昇します。

KBV Cardinal matrixに掲載された分析によると、シスコシステムズ社は同市場における主要な先駆者です。2023年10月、シスコシステムズ社は米国の多国籍テクノロジー企業であるエヌビディアと協業し、ルームキットEQXとシネマティックミーティング機能の拡張を発表しました。エヌビディアとの協業は、シスコのAI搭載ソリューションのポートフォリオを拡大し、ハイブリッドワーカーの可能性を引き出し、コラボレーティブミーティングの全体的な質を向上させました。AU Small Finance Bank Limited、Barclays PLC、NatWest Group Plcなどの企業が、この市場における主要なイノベーターです。

市場の成長要因

デジタルバンキングサービスの成長

オンラインバンキングやモバイルアプリなどのデジタルバンキングサービスは、顧客が自分の口座にアクセスし、日常的なバンキング業務を実行するための好ましい方法となっています。デジタルバンキングは通常、基本的な取引、残高照会、資金移動に対応しています。ビデオバンキングを利用することで、顧客とのエンゲージメントを高め、信頼を築くことができます。対面でのやり取りは、テキストベースや自動化されたやり取りよりも人間的なつながりを生み、より高い信頼レベルを確立します。ビデオバンキングは他のデジタルバンキングチャネルと統合でき、オムニチャネル体験を提供できます。デジタルバンキングの拡大により、コンプライアンスやセキュリティ対策が強化され、ビデオバンキングにも恩恵が及んでいます。デジタルバンキングの発展は、ビデオバンキングサービスに革新的な技術が取り入れられるようになることで、大きな恩恵を受けると予想されます。そのため、これは市場の重要な促進要因の1つとなっています。

銀行業界の自動化の急速な進展

銀行業界では、新規顧客のオンボーディング・プロセスの自動化が一般的になっています。ビデオバンキングは、新規顧客の初期段階を支援することで、こうしたプロセスを補完することができます。自動化は、銀行が顧客の行動や嗜好を理解するために活用できる貴重なデータや洞察を生み出します。自動化により、銀行はデータや分析を活用して、顧客に合わせたサービスや提案を提供することで、顧客体験をパーソナライズすることができます。自動化とビデオバンキングを組み合わせることで、より効率的で顧客中心の銀行業界の進化が促進されました。これにより、銀行は業務効率を向上させながら、利便性とパーソナライズされたサービスに対する顧客の期待に応えることができるようになっています。その結果、市場の成長は銀行業界における自動化の急速な進展と密接に結びついています。

市場抑制要因

顧客のプライバシーに関するセキュリティ上の懸念

ビデオバンキングサービスが、欧州のGDPRや米国のHIPAAといったデータ保護規制に確実に準拠することが不可欠です。金融機関は顧客データを細心の注意と透明性をもって取り扱わなければならないです。ビデオバンキングセッションは、盗聴やデータ傍受を防ぐため、安全で暗号化された通信チャネルで行われなければならないです。ビデオ通話の相手が本人であることを確認するためには、強固な本人確認プロセスの確立が不可欠です。銀行は、ビデオバンキングソリューションのサードパーティベンダーやサービスプロバイダーと連携する際、パートナーが高いセキュリティ基準を維持することを保証しなければならないです。定期的な監視、監査、脆弱性評価を行うことで、セキュリティやプライバシーの問題を迅速に特定し、対処することができます。金融機関は、セキュリティ侵害やプライバシーインシデントに迅速かつ効果的に対処するために、明確に定義されたインシデント対応計画を持たなければならないです。したがって、上記のような要因が、今後数年間の市場成長の妨げとなると思われます。

コンポーネントの展望

コンポーネント別に見ると、市場はソリューションとサービスに区分されます。2022年の市場では、サービス部門が大きな収益シェアを獲得しました。サービスコンポーネントには、ビデオバンキングソリューションの効果的な導入と運用を確実にするために、金融機関、テクノロジーベンダー、サービスプロバイダーが提供するさまざまなサービスが含まれます。これらのサービスは、ビデオバンキングサービスの計画、展開、保守、最適化をサポートするように設計されています。サービスプロバイダーの中には、金融機関に代わってビデオバンキングに関する問い合わせやトランザクションを処理する熟練したエージェントを提供し、カスタマーサポートやインタラクションハンドリングサービスを提供しているところもあります。

展開形態の展望

導入形態に基づき、市場はオンプレミスとクラウドに細分化されます。2022年には、オンプレミス型セグメントが市場で最も高い売上シェアを占めました。オンプレミス展開とは、金融機関や組織の物理的な敷地内にビデオバンキングのインフラとソフトウェアをセットアップして設置することを指します。金融機関は、需要の増加や新しいサービスの提供に合わせて、オンプレミスのビデオバンキング・インフラを拡張・拡大することができます。オンプレミスでは、コントロールとカスタマイズが可能です。

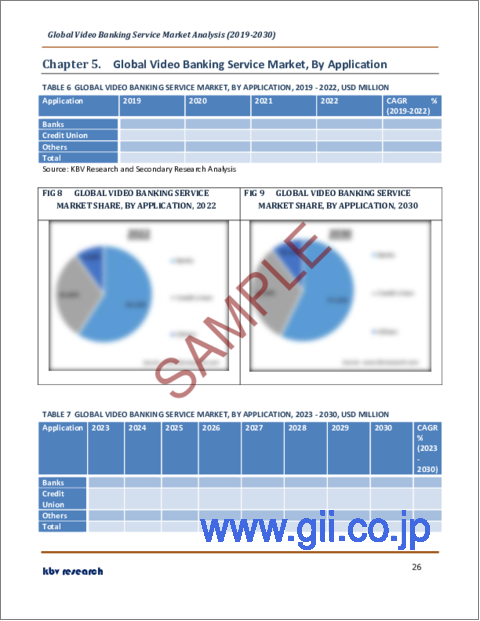

用途の展望

用途別に見ると、市場は銀行、信用組合、その他に分類されます。2022年には、銀行セグメントが市場で最も高い収益シェアを記録しました。銀行は、ビデオバンキングサービスを利用して、顧客エンゲージメントを強化し、業務効率を向上させ、サービス提供を拡大することができます。銀行はビデオバンキングを顧客サポートやコンサルティングに利用することができ、顧客は問い合わせや口座問題、一般的な情報に関して、ライブのバンキング担当者に接続してサポートを受けることができます。ビデオバンキングを利用すれば、顧客は遠隔操作で新規口座を開設できるため、来店する必要がなくなります。銀行の担当者は、口座開設の手続きを案内したり、質問に答えたりすることができます。ビデオバンキングを利用することで、銀行は24時間サービスを提供することができ、いつでもサポートを必要とする顧客のニーズに応えることができます。

地域別展望

地域別に見ると、市場は北米、欧州、アジア太平洋、LAMEAで分析されます。2022年には、北米地域が市場で最大の収益シェアを獲得しました。これは、金融サービス、リモートワークフォース管理、クラウドベースのコラボレーションプラットフォームなど、市場成長に大きな影響を与える要因であるビデオ需要の増加に起因します。また、銀行や企業は意思決定の迅速化や出張費の削減を目的にビデオコラボレーションソリューションを導入しています。北米市場の成長には、顧客の嗜好の変化、技術の進歩、効率的で利用しやすいサービスを提供する金融機関のニーズも後押ししています。ビデオバンキングがより広範な金融サービスに不可欠な要素となるにつれ、こうした動向が同地域の市場を形成していくと思われます。

目次

第1章 市場範囲と調査手法

- 市場の定義

- 目的

- 市場範囲

- セグメンテーション

- 調査手法

第2章 市場の概要

- 主なハイライト

第3章 市場概要

- イントロダクション

- 概要

- 市場構成とシナリオ

- 概要

- 市場に影響を与える主な要因

- 市場促進要因

- 市場抑制要因

第4章 競合分析- 世界

- KBV Cardinal Matrix

- 最近の業界全体の戦略的展開

- パートナーシップ、コラボレーション、および契約

- 製品の発売と製品の拡大

- 買収と合併

- 主要成功戦略

- 主な戦略

- 主要な戦略的動き

- ポーターのファイブフォース分析

第5章 世界のビデオバンキングサービス市場:用途別

- 世界の銀行市場:地域別

- 世界の信用組合市場:地域別

- 世界のその他の市場:地域別

第6章 世界のビデオバンキングサービス市場:コンポーネント別

- 世界のソリューション市場:地域別

- 世界のサービス市場:地域別

第7章 世界のビデオバンキングサービス市場:展開モード別

- 世界のオンプレミス市場:地域別

- 世界のクラウド市場:地域別

第8章 世界のビデオバンキングサービス市場:地域別

- 北米のビデオバンキングサービス市場

- 欧州のビデオバンキングサービス市場

- アジア太平洋のビデオバンキングサービス市場

- ラテンアメリカ・中東・アフリカのビデオバンキングサービス市場

第9章 企業プロファイル

- AU Small Finance Bank Limited

- Barclays PLC

- Glia Technologies, Inc

- STAR Financial Bank(STAR Financial Group, Inc)

- Natwest Group plc

- Guaranty Trust Bank Limited

- StonehamBank

- US. Bank

- Cisco Systems, Inc

- Vidyard

第10章 市場の成功必須条件

LIST OF TABLES

- TABLE 1 Global Video Banking Service Market, 2019 - 2022, USD Million

- TABLE 2 Global Video Banking Service Market, 2023 - 2030, USD Million

- TABLE 3 Partnerships, Collaborations and Agreements- Video Banking Service Market

- TABLE 4 Product Launches And Product Expansions- Video Banking Service Market

- TABLE 5 Acquisition and Mergers- Video Banking Service Market

- TABLE 6 Global Video Banking Service Market, By Application, 2019 - 2022, USD Million

- TABLE 7 Global Video Banking Service Market, By Application, 2023 - 2030, USD Million

- TABLE 8 Global Banks Market, By Region, 2019 - 2022, USD Million

- TABLE 9 Global Banks Market, By Region, 2023 - 2030, USD Million

- TABLE 10 Global Credit Union Market, By Region, 2019 - 2022, USD Million

- TABLE 11 Global Credit Union Market, By Region, 2023 - 2030, USD Million

- TABLE 12 Global Others Market, By Region, 2019 - 2022, USD Million

- TABLE 13 Global Others Market, By Region, 2023 - 2030, USD Million

- TABLE 14 Global Video Banking Service Market, By Component, 2019 - 2022, USD Million

- TABLE 15 Global Video Banking Service Market, By Component, 2023 - 2030, USD Million

- TABLE 16 Global Solution Market, By Region, 2019 - 2022, USD Million

- TABLE 17 Global Solution Market, By Region, 2023 - 2030, USD Million

- TABLE 18 Global Services Market, By Region, 2019 - 2022, USD Million

- TABLE 19 Global Services Market, By Region, 2023 - 2030, USD Million

- TABLE 20 Global Video Banking Service Market, By Deployment Mode, 2019 - 2022, USD Million

- TABLE 21 Global Video Banking Service Market, By Deployment Mode, 2023 - 2030, USD Million

- TABLE 22 Global On-Premise Market, By Region, 2019 - 2022, USD Million

- TABLE 23 Global On-Premise Market, By Region, 2023 - 2030, USD Million

- TABLE 24 Global Cloud Market, By Region, 2019 - 2022, USD Million

- TABLE 25 Global Cloud Market, By Region, 2023 - 2030, USD Million

- TABLE 26 Global Video Banking Service Market, By Region, 2019 - 2022, USD Million

- TABLE 27 Global Video Banking Service Market, By Region, 2023 - 2030, USD Million

- TABLE 28 North America Video Banking Service Market, 2019 - 2022, USD Million

- TABLE 29 North America Video Banking Service Market, 2023 - 2030, USD Million

- TABLE 30 North America Video Banking Service Market, By Application, 2019 - 2022, USD Million

- TABLE 31 North America Video Banking Service Market, By Application, 2023 - 2030, USD Million

- TABLE 32 North America Banks Market, By Country, 2019 - 2022, USD Million

- TABLE 33 North America Banks Market, By Country, 2023 - 2030, USD Million

- TABLE 34 North America Credit Union Market, By Country, 2019 - 2022, USD Million

- TABLE 35 North America Credit Union Market, By Country, 2023 - 2030, USD Million

- TABLE 36 North America Others Market, By Country, 2019 - 2022, USD Million

- TABLE 37 North America Others Market, By Country, 2023 - 2030, USD Million

- TABLE 38 North America Video Banking Service Market, By Component, 2019 - 2022, USD Million

- TABLE 39 North America Video Banking Service Market, By Component, 2023 - 2030, USD Million

- TABLE 40 North America Solution Market, By Country, 2019 - 2022, USD Million

- TABLE 41 North America Solution Market, By Country, 2023 - 2030, USD Million

- TABLE 42 North America Services Market, By Country, 2019 - 2022, USD Million

- TABLE 43 North America Services Market, By Country, 2023 - 2030, USD Million

- TABLE 44 North America Video Banking Service Market, By Deployment Mode, 2019 - 2022, USD Million

- TABLE 45 North America Video Banking Service Market, By Deployment Mode, 2023 - 2030, USD Million

- TABLE 46 North America On-Premise Market, By Country, 2019 - 2022, USD Million

- TABLE 47 North America On-Premise Market, By Country, 2023 - 2030, USD Million

- TABLE 48 North America Cloud Market, By Country, 2019 - 2022, USD Million

- TABLE 49 North America Cloud Market, By Country, 2023 - 2030, USD Million

- TABLE 50 North America Video Banking Service Market, By Country, 2019 - 2022, USD Million

- TABLE 51 North America Video Banking Service Market, By Country, 2023 - 2030, USD Million

- TABLE 52 US Video Banking Service Market, 2019 - 2022, USD Million

- TABLE 53 US Video Banking Service Market, 2023 - 2030, USD Million

- TABLE 54 US Video Banking Service Market, By Application, 2019 - 2022, USD Million

- TABLE 55 US Video Banking Service Market, By Application, 2023 - 2030, USD Million

- TABLE 56 US Video Banking Service Market, By Component, 2019 - 2022, USD Million

- TABLE 57 US Video Banking Service Market, By Component, 2023 - 2030, USD Million

- TABLE 58 US Video Banking Service Market, By Deployment Mode, 2019 - 2022, USD Million

- TABLE 59 US Video Banking Service Market, By Deployment Mode, 2023 - 2030, USD Million

- TABLE 60 Canada Video Banking Service Market, 2019 - 2022, USD Million

- TABLE 61 Canada Video Banking Service Market, 2023 - 2030, USD Million

- TABLE 62 Canada Video Banking Service Market, By Application, 2019 - 2022, USD Million

- TABLE 63 Canada Video Banking Service Market, By Application, 2023 - 2030, USD Million

- TABLE 64 Canada Video Banking Service Market, By Component, 2019 - 2022, USD Million

- TABLE 65 Canada Video Banking Service Market, By Component, 2023 - 2030, USD Million

- TABLE 66 Canada Video Banking Service Market, By Deployment Mode, 2019 - 2022, USD Million

- TABLE 67 Canada Video Banking Service Market, By Deployment Mode, 2023 - 2030, USD Million

- TABLE 68 Mexico Video Banking Service Market, 2019 - 2022, USD Million

- TABLE 69 Mexico Video Banking Service Market, 2023 - 2030, USD Million

- TABLE 70 Mexico Video Banking Service Market, By Application, 2019 - 2022, USD Million

- TABLE 71 Mexico Video Banking Service Market, By Application, 2023 - 2030, USD Million

- TABLE 72 Mexico Video Banking Service Market, By Component, 2019 - 2022, USD Million

- TABLE 73 Mexico Video Banking Service Market, By Component, 2023 - 2030, USD Million

- TABLE 74 Mexico Video Banking Service Market, By Deployment Mode, 2019 - 2022, USD Million

- TABLE 75 Mexico Video Banking Service Market, By Deployment Mode, 2023 - 2030, USD Million

- TABLE 76 Rest of North America Video Banking Service Market, 2019 - 2022, USD Million

- TABLE 77 Rest of North America Video Banking Service Market, 2023 - 2030, USD Million

- TABLE 78 Rest of North America Video Banking Service Market, By Application, 2019 - 2022, USD Million

- TABLE 79 Rest of North America Video Banking Service Market, By Application, 2023 - 2030, USD Million

- TABLE 80 Rest of North America Video Banking Service Market, By Component, 2019 - 2022, USD Million

- TABLE 81 Rest of North America Video Banking Service Market, By Component, 2023 - 2030, USD Million

- TABLE 82 Rest of North America Video Banking Service Market, By Deployment Mode, 2019 - 2022, USD Million

- TABLE 83 Rest of North America Video Banking Service Market, By Deployment Mode, 2023 - 2030, USD Million

- TABLE 84 Europe Video Banking Service Market, 2019 - 2022, USD Million

- TABLE 85 Europe Video Banking Service Market, 2023 - 2030, USD Million

- TABLE 86 Europe Video Banking Service Market, By Application, 2019 - 2022, USD Million

- TABLE 87 Europe Video Banking Service Market, By Application, 2023 - 2030, USD Million

- TABLE 88 Europe Banks Market, By Country, 2019 - 2022, USD Million

- TABLE 89 Europe Banks Market, By Country, 2023 - 2030, USD Million

- TABLE 90 Europe Credit Union Market, By Country, 2019 - 2022, USD Million

- TABLE 91 Europe Credit Union Market, By Country, 2023 - 2030, USD Million

- TABLE 92 Europe Others Market, By Country, 2019 - 2022, USD Million

- TABLE 93 Europe Others Market, By Country, 2023 - 2030, USD Million

- TABLE 94 Europe Video Banking Service Market, By Component, 2019 - 2022, USD Million

- TABLE 95 Europe Video Banking Service Market, By Component, 2023 - 2030, USD Million

- TABLE 96 Europe Solution Market, By Country, 2019 - 2022, USD Million

- TABLE 97 Europe Solution Market, By Country, 2023 - 2030, USD Million

- TABLE 98 Europe Services Market, By Country, 2019 - 2022, USD Million

- TABLE 99 Europe Services Market, By Country, 2023 - 2030, USD Million

- TABLE 100 Europe Video Banking Service Market, By Deployment Mode, 2019 - 2022, USD Million

- TABLE 101 Europe Video Banking Service Market, By Deployment Mode, 2023 - 2030, USD Million

- TABLE 102 Europe On-Premise Market, By Country, 2019 - 2022, USD Million

- TABLE 103 Europe On-Premise Market, By Country, 2023 - 2030, USD Million

- TABLE 104 Europe Cloud Market, By Country, 2019 - 2022, USD Million

- TABLE 105 Europe Cloud Market, By Country, 2023 - 2030, USD Million

- TABLE 106 Europe Video Banking Service Market, By Country, 2019 - 2022, USD Million

- TABLE 107 Europe Video Banking Service Market, By Country, 2023 - 2030, USD Million

- TABLE 108 Germany Video Banking Service Market, 2019 - 2022, USD Million

- TABLE 109 Germany Video Banking Service Market, 2023 - 2030, USD Million

- TABLE 110 Germany Video Banking Service Market, By Application, 2019 - 2022, USD Million

- TABLE 111 Germany Video Banking Service Market, By Application, 2023 - 2030, USD Million

- TABLE 112 Germany Video Banking Service Market, By Component, 2019 - 2022, USD Million

- TABLE 113 Germany Video Banking Service Market, By Component, 2023 - 2030, USD Million

- TABLE 114 Germany Video Banking Service Market, By Deployment Mode, 2019 - 2022, USD Million

- TABLE 115 Germany Video Banking Service Market, By Deployment Mode, 2023 - 2030, USD Million

- TABLE 116 UK Video Banking Service Market, 2019 - 2022, USD Million

- TABLE 117 UK Video Banking Service Market, 2023 - 2030, USD Million

- TABLE 118 UK Video Banking Service Market, By Application, 2019 - 2022, USD Million

- TABLE 119 UK Video Banking Service Market, By Application, 2023 - 2030, USD Million

- TABLE 120 UK Video Banking Service Market, By Component, 2019 - 2022, USD Million

- TABLE 121 UK Video Banking Service Market, By Component, 2023 - 2030, USD Million

- TABLE 122 UK Video Banking Service Market, By Deployment Mode, 2019 - 2022, USD Million

- TABLE 123 UK Video Banking Service Market, By Deployment Mode, 2023 - 2030, USD Million

- TABLE 124 France Video Banking Service Market, 2019 - 2022, USD Million

- TABLE 125 France Video Banking Service Market, 2023 - 2030, USD Million

- TABLE 126 France Video Banking Service Market, By Application, 2019 - 2022, USD Million

- TABLE 127 France Video Banking Service Market, By Application, 2023 - 2030, USD Million

- TABLE 128 France Video Banking Service Market, By Component, 2019 - 2022, USD Million

- TABLE 129 France Video Banking Service Market, By Component, 2023 - 2030, USD Million

- TABLE 130 France Video Banking Service Market, By Deployment Mode, 2019 - 2022, USD Million

- TABLE 131 France Video Banking Service Market, By Deployment Mode, 2023 - 2030, USD Million

- TABLE 132 Russia Video Banking Service Market, 2019 - 2022, USD Million

- TABLE 133 Russia Video Banking Service Market, 2023 - 2030, USD Million

- TABLE 134 Russia Video Banking Service Market, By Application, 2019 - 2022, USD Million

- TABLE 135 Russia Video Banking Service Market, By Application, 2023 - 2030, USD Million

- TABLE 136 Russia Video Banking Service Market, By Component, 2019 - 2022, USD Million

- TABLE 137 Russia Video Banking Service Market, By Component, 2023 - 2030, USD Million

- TABLE 138 Russia Video Banking Service Market, By Deployment Mode, 2019 - 2022, USD Million

- TABLE 139 Russia Video Banking Service Market, By Deployment Mode, 2023 - 2030, USD Million

- TABLE 140 Spain Video Banking Service Market, 2019 - 2022, USD Million

- TABLE 141 Spain Video Banking Service Market, 2023 - 2030, USD Million

- TABLE 142 Spain Video Banking Service Market, By Application, 2019 - 2022, USD Million

- TABLE 143 Spain Video Banking Service Market, By Application, 2023 - 2030, USD Million

- TABLE 144 Spain Video Banking Service Market, By Component, 2019 - 2022, USD Million

- TABLE 145 Spain Video Banking Service Market, By Component, 2023 - 2030, USD Million

- TABLE 146 Spain Video Banking Service Market, By Deployment Mode, 2019 - 2022, USD Million

- TABLE 147 Spain Video Banking Service Market, By Deployment Mode, 2023 - 2030, USD Million

- TABLE 148 Italy Video Banking Service Market, 2019 - 2022, USD Million

- TABLE 149 Italy Video Banking Service Market, 2023 - 2030, USD Million

- TABLE 150 Italy Video Banking Service Market, By Application, 2019 - 2022, USD Million

- TABLE 151 Italy Video Banking Service Market, By Application, 2023 - 2030, USD Million

- TABLE 152 Italy Video Banking Service Market, By Component, 2019 - 2022, USD Million

- TABLE 153 Italy Video Banking Service Market, By Component, 2023 - 2030, USD Million

- TABLE 154 Italy Video Banking Service Market, By Deployment Mode, 2019 - 2022, USD Million

- TABLE 155 Italy Video Banking Service Market, By Deployment Mode, 2023 - 2030, USD Million

- TABLE 156 Rest of Europe Video Banking Service Market, 2019 - 2022, USD Million

- TABLE 157 Rest of Europe Video Banking Service Market, 2023 - 2030, USD Million

- TABLE 158 Rest of Europe Video Banking Service Market, By Application, 2019 - 2022, USD Million

- TABLE 159 Rest of Europe Video Banking Service Market, By Application, 2023 - 2030, USD Million

- TABLE 160 Rest of Europe Video Banking Service Market, By Component, 2019 - 2022, USD Million

- TABLE 161 Rest of Europe Video Banking Service Market, By Component, 2023 - 2030, USD Million

- TABLE 162 Rest of Europe Video Banking Service Market, By Deployment Mode, 2019 - 2022, USD Million

- TABLE 163 Rest of Europe Video Banking Service Market, By Deployment Mode, 2023 - 2030, USD Million

- TABLE 164 Asia Pacific Video Banking Service Market, 2019 - 2022, USD Million

- TABLE 165 Asia Pacific Video Banking Service Market, 2023 - 2030, USD Million

- TABLE 166 Asia Pacific Video Banking Service Market, By Application, 2019 - 2022, USD Million

- TABLE 167 Asia Pacific Video Banking Service Market, By Application, 2023 - 2030, USD Million

- TABLE 168 Asia Pacific Banks Market, By Country, 2019 - 2022, USD Million

- TABLE 169 Asia Pacific Banks Market, By Country, 2023 - 2030, USD Million

- TABLE 170 Asia Pacific Credit Union Market, By Country, 2019 - 2022, USD Million

- TABLE 171 Asia Pacific Credit Union Market, By Country, 2023 - 2030, USD Million

- TABLE 172 Asia Pacific Others Market, By Country, 2019 - 2022, USD Million

- TABLE 173 Asia Pacific Others Market, By Country, 2023 - 2030, USD Million

- TABLE 174 Asia Pacific Video Banking Service Market, By Component, 2019 - 2022, USD Million

- TABLE 175 Asia Pacific Video Banking Service Market, By Component, 2023 - 2030, USD Million

- TABLE 176 Asia Pacific Solution Market, By Country, 2019 - 2022, USD Million

- TABLE 177 Asia Pacific Solution Market, By Country, 2023 - 2030, USD Million

- TABLE 178 Asia Pacific Services Market, By Country, 2019 - 2022, USD Million

- TABLE 179 Asia Pacific Services Market, By Country, 2023 - 2030, USD Million

- TABLE 180 Asia Pacific Video Banking Service Market, By Deployment Mode, 2019 - 2022, USD Million

- TABLE 181 Asia Pacific Video Banking Service Market, By Deployment Mode, 2023 - 2030, USD Million

- TABLE 182 Asia Pacific On-Premise Market, By Country, 2019 - 2022, USD Million

- TABLE 183 Asia Pacific On-Premise Market, By Country, 2023 - 2030, USD Million

- TABLE 184 Asia Pacific Cloud Market, By Country, 2019 - 2022, USD Million

- TABLE 185 Asia Pacific Cloud Market, By Country, 2023 - 2030, USD Million

- TABLE 186 Asia Pacific Video Banking Service Market, By Country, 2019 - 2022, USD Million

- TABLE 187 Asia Pacific Video Banking Service Market, By Country, 2023 - 2030, USD Million

- TABLE 188 China Video Banking Service Market, 2019 - 2022, USD Million

- TABLE 189 China Video Banking Service Market, 2023 - 2030, USD Million

- TABLE 190 China Video Banking Service Market, By Application, 2019 - 2022, USD Million

- TABLE 191 China Video Banking Service Market, By Application, 2023 - 2030, USD Million

- TABLE 192 China Video Banking Service Market, By Component, 2019 - 2022, USD Million

- TABLE 193 China Video Banking Service Market, By Component, 2023 - 2030, USD Million

- TABLE 194 China Video Banking Service Market, By Deployment Mode, 2019 - 2022, USD Million

- TABLE 195 China Video Banking Service Market, By Deployment Mode, 2023 - 2030, USD Million

- TABLE 196 Japan Video Banking Service Market, 2019 - 2022, USD Million

- TABLE 197 Japan Video Banking Service Market, 2023 - 2030, USD Million

- TABLE 198 Japan Video Banking Service Market, By Application, 2019 - 2022, USD Million

- TABLE 199 Japan Video Banking Service Market, By Application, 2023 - 2030, USD Million

- TABLE 200 Japan Video Banking Service Market, By Component, 2019 - 2022, USD Million

- TABLE 201 Japan Video Banking Service Market, By Component, 2023 - 2030, USD Million

- TABLE 202 Japan Video Banking Service Market, By Deployment Mode, 2019 - 2022, USD Million

- TABLE 203 Japan Video Banking Service Market, By Deployment Mode, 2023 - 2030, USD Million

- TABLE 204 India Video Banking Service Market, 2019 - 2022, USD Million

- TABLE 205 India Video Banking Service Market, 2023 - 2030, USD Million

- TABLE 206 India Video Banking Service Market, By Application, 2019 - 2022, USD Million

- TABLE 207 India Video Banking Service Market, By Application, 2023 - 2030, USD Million

- TABLE 208 India Video Banking Service Market, By Component, 2019 - 2022, USD Million

- TABLE 209 India Video Banking Service Market, By Component, 2023 - 2030, USD Million

- TABLE 210 India Video Banking Service Market, By Deployment Mode, 2019 - 2022, USD Million

- TABLE 211 India Video Banking Service Market, By Deployment Mode, 2023 - 2030, USD Million

- TABLE 212 South Korea Video Banking Service Market, 2019 - 2022, USD Million

- TABLE 213 South Korea Video Banking Service Market, 2023 - 2030, USD Million

- TABLE 214 South Korea Video Banking Service Market, By Application, 2019 - 2022, USD Million

- TABLE 215 South Korea Video Banking Service Market, By Application, 2023 - 2030, USD Million

- TABLE 216 South Korea Video Banking Service Market, By Component, 2019 - 2022, USD Million

- TABLE 217 South Korea Video Banking Service Market, By Component, 2023 - 2030, USD Million

- TABLE 218 South Korea Video Banking Service Market, By Deployment Mode, 2019 - 2022, USD Million

- TABLE 219 South Korea Video Banking Service Market, By Deployment Mode, 2023 - 2030, USD Million

- TABLE 220 Singapore Video Banking Service Market, 2019 - 2022, USD Million

- TABLE 221 Singapore Video Banking Service Market, 2023 - 2030, USD Million

- TABLE 222 Singapore Video Banking Service Market, By Application, 2019 - 2022, USD Million

- TABLE 223 Singapore Video Banking Service Market, By Application, 2023 - 2030, USD Million

- TABLE 224 Singapore Video Banking Service Market, By Component, 2019 - 2022, USD Million

- TABLE 225 Singapore Video Banking Service Market, By Component, 2023 - 2030, USD Million

- TABLE 226 Singapore Video Banking Service Market, By Deployment Mode, 2019 - 2022, USD Million

- TABLE 227 Singapore Video Banking Service Market, By Deployment Mode, 2023 - 2030, USD Million

- TABLE 228 Malaysia Video Banking Service Market, 2019 - 2022, USD Million

- TABLE 229 Malaysia Video Banking Service Market, 2023 - 2030, USD Million

- TABLE 230 Malaysia Video Banking Service Market, By Application, 2019 - 2022, USD Million

- TABLE 231 Malaysia Video Banking Service Market, By Application, 2023 - 2030, USD Million

- TABLE 232 Malaysia Video Banking Service Market, By Component, 2019 - 2022, USD Million

- TABLE 233 Malaysia Video Banking Service Market, By Component, 2023 - 2030, USD Million

- TABLE 234 Malaysia Video Banking Service Market, By Deployment Mode, 2019 - 2022, USD Million

- TABLE 235 Malaysia Video Banking Service Market, By Deployment Mode, 2023 - 2030, USD Million

- TABLE 236 Rest of Asia Pacific Video Banking Service Market, 2019 - 2022, USD Million

- TABLE 237 Rest of Asia Pacific Video Banking Service Market, 2023 - 2030, USD Million

- TABLE 238 Rest of Asia Pacific Video Banking Service Market, By Application, 2019 - 2022, USD Million

- TABLE 239 Rest of Asia Pacific Video Banking Service Market, By Application, 2023 - 2030, USD Million

- TABLE 240 Rest of Asia Pacific Video Banking Service Market, By Component, 2019 - 2022, USD Million

- TABLE 241 Rest of Asia Pacific Video Banking Service Market, By Component, 2023 - 2030, USD Million

- TABLE 242 Rest of Asia Pacific Video Banking Service Market, By Deployment Mode, 2019 - 2022, USD Million

- TABLE 243 Rest of Asia Pacific Video Banking Service Market, By Deployment Mode, 2023 - 2030, USD Million

- TABLE 244 LAMEA Video Banking Service Market, 2019 - 2022, USD Million

- TABLE 245 LAMEA Video Banking Service Market, 2023 - 2030, USD Million

- TABLE 246 LAMEA Video Banking Service Market, By Application, 2019 - 2022, USD Million

- TABLE 247 LAMEA Video Banking Service Market, By Application, 2023 - 2030, USD Million

- TABLE 248 LAMEA Banks Market, By Country, 2019 - 2022, USD Million

- TABLE 249 LAMEA Banks Market, By Country, 2023 - 2030, USD Million

- TABLE 250 LAMEA Credit Union Market, By Country, 2019 - 2022, USD Million

- TABLE 251 LAMEA Credit Union Market, By Country, 2023 - 2030, USD Million

- TABLE 252 LAMEA Others Market, By Country, 2019 - 2022, USD Million

- TABLE 253 LAMEA Others Market, By Country, 2023 - 2030, USD Million

- TABLE 254 LAMEA Video Banking Service Market, By Component, 2019 - 2022, USD Million

- TABLE 255 LAMEA Video Banking Service Market, By Component, 2023 - 2030, USD Million

- TABLE 256 LAMEA Solution Market, By Country, 2019 - 2022, USD Million

- TABLE 257 LAMEA Solution Market, By Country, 2023 - 2030, USD Million

- TABLE 258 LAMEA Services Market, By Country, 2019 - 2022, USD Million

- TABLE 259 LAMEA Services Market, By Country, 2023 - 2030, USD Million

- TABLE 260 LAMEA Video Banking Service Market, By Deployment Mode, 2019 - 2022, USD Million

- TABLE 261 LAMEA Video Banking Service Market, By Deployment Mode, 2023 - 2030, USD Million

- TABLE 262 LAMEA On-Premise Market, By Country, 2019 - 2022, USD Million

- TABLE 263 LAMEA On-Premise Market, By Country, 2023 - 2030, USD Million

- TABLE 264 LAMEA Cloud Market, By Country, 2019 - 2022, USD Million

- TABLE 265 LAMEA Cloud Market, By Country, 2023 - 2030, USD Million

- TABLE 266 LAMEA Video Banking Service Market, By Country, 2019 - 2022, USD Million

- TABLE 267 LAMEA Video Banking Service Market, By Country, 2023 - 2030, USD Million

- TABLE 268 Brazil Video Banking Service Market, 2019 - 2022, USD Million

- TABLE 269 Brazil Video Banking Service Market, 2023 - 2030, USD Million

- TABLE 270 Brazil Video Banking Service Market, By Application, 2019 - 2022, USD Million

- TABLE 271 Brazil Video Banking Service Market, By Application, 2023 - 2030, USD Million

- TABLE 272 Brazil Video Banking Service Market, By Component, 2019 - 2022, USD Million

- TABLE 273 Brazil Video Banking Service Market, By Component, 2023 - 2030, USD Million

- TABLE 274 Brazil Video Banking Service Market, By Deployment Mode, 2019 - 2022, USD Million

- TABLE 275 Brazil Video Banking Service Market, By Deployment Mode, 2023 - 2030, USD Million

- TABLE 276 Argentina Video Banking Service Market, 2019 - 2022, USD Million

- TABLE 277 Argentina Video Banking Service Market, 2023 - 2030, USD Million

- TABLE 278 Argentina Video Banking Service Market, By Application, 2019 - 2022, USD Million

- TABLE 279 Argentina Video Banking Service Market, By Application, 2023 - 2030, USD Million

- TABLE 280 Argentina Video Banking Service Market, By Component, 2019 - 2022, USD Million

- TABLE 281 Argentina Video Banking Service Market, By Component, 2023 - 2030, USD Million

- TABLE 282 Argentina Video Banking Service Market, By Deployment Mode, 2019 - 2022, USD Million

- TABLE 283 Argentina Video Banking Service Market, By Deployment Mode, 2023 - 2030, USD Million

- TABLE 284 UAE Video Banking Service Market, 2019 - 2022, USD Million

- TABLE 285 UAE Video Banking Service Market, 2023 - 2030, USD Million

- TABLE 286 UAE Video Banking Service Market, By Application, 2019 - 2022, USD Million

- TABLE 287 UAE Video Banking Service Market, By Application, 2023 - 2030, USD Million

- TABLE 288 UAE Video Banking Service Market, By Component, 2019 - 2022, USD Million

- TABLE 289 UAE Video Banking Service Market, By Component, 2023 - 2030, USD Million

- TABLE 290 UAE Video Banking Service Market, By Deployment Mode, 2019 - 2022, USD Million

- TABLE 291 UAE Video Banking Service Market, By Deployment Mode, 2023 - 2030, USD Million

- TABLE 292 Saudi Arabia Video Banking Service Market, 2019 - 2022, USD Million

- TABLE 293 Saudi Arabia Video Banking Service Market, 2023 - 2030, USD Million

- TABLE 294 Saudi Arabia Video Banking Service Market, By Application, 2019 - 2022, USD Million

- TABLE 295 Saudi Arabia Video Banking Service Market, By Application, 2023 - 2030, USD Million

- TABLE 296 Saudi Arabia Video Banking Service Market, By Component, 2019 - 2022, USD Million

- TABLE 297 Saudi Arabia Video Banking Service Market, By Component, 2023 - 2030, USD Million

- TABLE 298 Saudi Arabia Video Banking Service Market, By Deployment Mode, 2019 - 2022, USD Million

- TABLE 299 Saudi Arabia Video Banking Service Market, By Deployment Mode, 2023 - 2030, USD Million

- TABLE 300 South Africa Video Banking Service Market, 2019 - 2022, USD Million

- TABLE 301 South Africa Video Banking Service Market, 2023 - 2030, USD Million

- TABLE 302 South Africa Video Banking Service Market, By Application, 2019 - 2022, USD Million

- TABLE 303 South Africa Video Banking Service Market, By Application, 2023 - 2030, USD Million

- TABLE 304 South Africa Video Banking Service Market, By Component, 2019 - 2022, USD Million

- TABLE 305 South Africa Video Banking Service Market, By Component, 2023 - 2030, USD Million

- TABLE 306 South Africa Video Banking Service Market, By Deployment Mode, 2019 - 2022, USD Million

- TABLE 307 South Africa Video Banking Service Market, By Deployment Mode, 2023 - 2030, USD Million

- TABLE 308 Nigeria Video Banking Service Market, 2019 - 2022, USD Million

- TABLE 309 Nigeria Video Banking Service Market, 2023 - 2030, USD Million

- TABLE 310 Nigeria Video Banking Service Market, By Application, 2019 - 2022, USD Million

- TABLE 311 Nigeria Video Banking Service Market, By Application, 2023 - 2030, USD Million

- TABLE 312 Nigeria Video Banking Service Market, By Component, 2019 - 2022, USD Million

- TABLE 313 Nigeria Video Banking Service Market, By Component, 2023 - 2030, USD Million

- TABLE 314 Nigeria Video Banking Service Market, By Deployment Mode, 2019 - 2022, USD Million

- TABLE 315 Nigeria Video Banking Service Market, By Deployment Mode, 2023 - 2030, USD Million

- TABLE 316 Rest of LAMEA Video Banking Service Market, 2019 - 2022, USD Million

- TABLE 317 Rest of LAMEA Video Banking Service Market, 2023 - 2030, USD Million

- TABLE 318 Rest of LAMEA Video Banking Service Market, By Application, 2019 - 2022, USD Million

- TABLE 319 Rest of LAMEA Video Banking Service Market, By Application, 2023 - 2030, USD Million

- TABLE 320 Rest of LAMEA Video Banking Service Market, By Component, 2019 - 2022, USD Million

- TABLE 321 Rest of LAMEA Video Banking Service Market, By Component, 2023 - 2030, USD Million

- TABLE 322 Rest of LAMEA Video Banking Service Market, By Deployment Mode, 2019 - 2022, USD Million

- TABLE 323 Rest of LAMEA Video Banking Service Market, By Deployment Mode, 2023 - 2030, USD Million

- TABLE 324 Key Information - AU Small Finance Bank Limited

- TABLE 325 Key Information - Barclays PLC

- TABLE 326 Key Information - Glia Technologies Inc.

- TABLE 327 Key Information - STAR Financial Bank

- TABLE 328 Key Information - Natwest Group plc

- TABLE 329 Key Information - Guaranty Trust Bank Limited

- TABLE 330 Key Information - StonehamBank

- TABLE 331 Key Information - U.S. Bank

- TABLE 332 Key Information - Cisco Systems, Inc.

- TABLE 333 Key Information - Vidyard

The Global Video Banking Service Market size is expected to reach $172.3 billion by 2030, rising at a market growth of 12.5% CAGR during the forecast period.

Banks in the Asia Pacific region focused on enhancing the security and compliance aspects of video banking to ensure the protection of customer data and adherence to regulatory requirements. Thus, the APAC region would register nearly 30% share of the market by 2030. The Asia Pacific region's market is poised for continued growth, offering a range of services that meet the evolving needs of a diverse and dynamic market. Increasing competition in the financial sector encouraged banks to innovate and differentiate their services, with video banking becoming a key offering.

The major strategies followed by the market participants are Partnerships & Collaborations as the key developmental strategy to keep pace with the changing demands of end users. For instance, In September, 2023, Nigeria's Guaranty Trust Bank (GTBank), the banking subsidiary of Guaranty Trust Holding Company Plc, partnered with Infosys Finacle, a division of EdgeVerve Systems, a wholly-owned subsidiary of Infosys, to reveal that GTBank chose the Finacle Digital Banking Suite for its multi-country digital transformation initiative. GTBank's decision was influenced by Finacle's demonstrated success and the solution suite's comprehensive capabilities in retail, wealth, and corporate banking. Additionally, In September, 2023, AU Small Finance Bank Limited came into partnership with Bajaj Allianz Life Insurance to boost financial security for the bank's customers. Through this partnership, AU Small Finance Bank aimed to leverage technology solutions, providing customers access to Bajaj Allianz Life's extensive life insurance product range. Additionally, this collaborative effort marked a significant stride in addressing the varied financial needs of their customer base.

Based on the Analysis presented in the KBV Cardinal matrix; Cisco Systems, Inc. is the major forerunner in the Market. In October, 2023, Cisco Systems, Inc. collaborated with NVIDIA, an American multinational technology company, to unveil the Room Kit EQX and expanded Cinematic Meetings capabilities, both leveraging NVIDIA's AI engine to enhance collaboration experiences through audio and video intelligence. The collaboration with NVIDIA expanded Cisco's portfolio of AI-powered solutions, unlocking the potential for hybrid workers and improving the overall quality of collaborative meetings. Companies such as AU Small Finance Bank Limited, Barclays PLC, NatWest Group Plc are some of the key innovators in the Market.

Market Growth Factors

Growth in digital banking services

Digital banking services, like online banking and mobile apps, have become the preferred way for customers to access their accounts and perform routine banking tasks. Digital banking typically covers basic transactions, balance inquiries, and fund transfers. The use of video banking can enhance customer engagement and build trust. Face-to-face interactions create a more human connection and establish a higher trust level than text-based or automated interactions. Video banking can be integrated with other digital banking channels, offering an omnichannel experience. The expansion of digital banking has enhanced compliance and security measures, which have also benefitted video banking. The development of digital banking is expected to benefit enormously from the expanded incorporation of innovative technologies in video banking services. Therefore, this is one of the significant propelling factors for the market.

Rapid development in automation of the banking industry

Automated onboarding processes for new customers have become more common in the banking industry. Video banking can complement these processes by assisting new customers through the initial steps. Automation generates valuable data and insights banks can leverage to understand customer behavior and preferences. Automation allows banks to personalize the customer experience by using data and analytics to offer tailored services and recommendations. Combining automation and video banking has propelled the evolution of a more efficient and customer-centric banking industry. It has allowed banks to meet customer expectations for convenience and personalized service while improving operational efficiency. As a result, the growth of market is closely tied to the rapid development of automation in the banking industry.

Market Restraining Factors

Security concerns regarding the privacy of customers

Ensuring that video banking services comply with data protection regulations, such as GDPR in Europe and HIPAA in the United States, is essential. Financial institutions must handle customer data with the utmost care and transparency. Video banking sessions must be conducted over secure, encrypted communication channels to prevent eavesdropping and data interception. Establishing robust identity verification processes is essential to ensure that the person on the other end of the video call is who they claim to be. Banks must ensure their partners maintain high-security standards when functioning with third-party vendors or service providers for video banking solutions. Regular monitoring, auditing, and vulnerability assessments can help promptly identify and address security and privacy issues. Financial institutions must have a well-defined incident response plan to address any security breaches or privacy incidents swiftly and effectively. Thus, the above-mentioned factors will hinder the market growth in the coming years.

Component Outlook

On the basis of component, the market is segmented into solution and service. The service segment acquired a substantial revenue share in the market in 2022. The services component in the market encompasses a range of offerings provided by financial institutions, technology vendors, and service providers to ensure the effective implementation and operation of video banking solutions. These services are designed to support video banking services' planning, deployment, maintenance, and optimization. Some service providers offer customer support and interaction handling services, providing skilled agents to handle video banking inquiries and transactions on behalf of financial institutions.

Deployment Mode Outlook

Based on deployment mode, the market is fragmented into on-premise and cloud. In 2022, the on-premise segment held the highest revenue share in the market. On-premise deployment in the market refers to the setup and installation of video banking infrastructure and software within the physical premises of a financial institution or organization. Financial institutions can scale and expand their on-premise video banking infrastructure to accommodate growing demand or new service offerings. On-premise deployment offers control and customization.

Application Outlook

On the basis of application, the market is classified into banks, credit unions, and others. In 2022, the banks segment registered the highest revenue share in the market. Banks can use video banking services to enhance customer engagement, improve operational efficiency, and expand their service offerings. Banks can use video banking for customer support and consultations, allowing customers to connect with a live banking representative for assistance with inquiries, account issues, or general information. Video banking enables customers to open new accounts remotely, eliminating the need for in-person visits. Bank representatives can guide customers through the account setup process and answer questions. Video banking allows banks to offer round-the-clock service availability, meeting the needs of customers who require assistance at any time.

Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region generated the largest revenue share in the market. This is attributable to the increasing demand for video for financial services, remote workforce management, and cloud-based collaboration platforms, which are significant market-growth influencing factors. In addition, banks and corporations are implementing video collaboration solutions to expedite decision-making and reduce travel expenses. The North American market growth is also fueled by changing customer preferences, technological advancements, and the need for financial institutions to provide efficient and accessible services. These trends will likely shape the market in the region as video banking becomes an integral part of the broader financial services landscape.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include AU Small Finance Bank Limited, Barclays PLC, Glia Technologies, Inc., STAR Financial Bank (STAR Financial Group, Inc.), NatWest Group Plc, Guaranty Trust Bank Limited, StonehamBank, U.S. Bank, Cisco Systems, Inc., and Vidyard.

Strategies Deployed in Video Banking Service Market

Partnerships, Collaborations, and Agreements:

Oct-2023: Glia Technologies, Inc. collaborated with Lumin Digital, a fintech company specializing in digital banking solutions, to enhance digital-first member service by integrating Glia's DCS capabilities into Lumin's online banking platform. This streamlined support across various channels, including SMS, chat, voice, and video, provides members with a faster and more seamless experience. Additionally, the pre-integration of the Glia Interaction Platform within Lumin's digital banking offering ensured a cohesive and uninterrupted digital-first customer experience.

Oct-2023: Cisco Systems, Inc. collaborated with NVIDIA, an American multinational technology company, to unveil the Room Kit EQX and expanded Cinematic Meetings capabilities, both leveraging NVIDIA's AI engine to enhance collaboration experiences through audio and video intelligence. The collaboration with NVIDIA expanded Cisco's portfolio of AI-powered solutions, unlocking the potential for hybrid workers and improving the overall quality of collaborative meetings.

Sep-2023: AU Small Finance Bank Limited came into partnership with Bajaj Allianz Life Insurance, a leading insurance company in India that offers all types of life insurance solutions, to boost financial security for the bank's customers. Through this partnership, AU Small Finance Bank aimed to leverage technology solutions, providing customers access to Bajaj Allianz Life's extensive life insurance product range. Additionally, this collaborative effort marked a significant stride in addressing the varied financial needs of their customer base.

Sep-2023: Nigeria's Guaranty Trust Bank (GTBank), the banking subsidiary of Guaranty Trust Holding Company Plc, partnered with Infosys Finacle, a division of EdgeVerve Systems, a wholly owned subsidiary of Infosys, to reveal that GTBank chose the Finacle Digital Banking Suite for its multi-country digital transformation initiative. GTBank's decision was influenced by Finacle's demonstrated success and the solution suite's comprehensive capabilities in retail, wealth, and corporate banking.

May-2023: Barclays PLC collaborated with TransferMate, a B2B payments technology, to introduce an international receivables solution, aiding UK businesses in cutting transaction costs and saving time. Successfully piloted with Barclays higher education clients, the solution allowed institutions to invoice international students in GBP and enabled students to pay in their local currency. Additionally, this advancement is crucial for businesses trading internationally, especially in the consumer-to-business sector.

Feb-2023: Glia Technologies, Inc. partnered with ebankIT, a fintech company that enables banks and credit unions to deliver humanized, personalized, and accessible digital experiences, to enhance the digital banking service experience for ebankIT clients. ebankIT integrated Glia's DCS solution into its digital banking platform, providing digital-first customer service. This collaboration aimed to improve the overall customer experience and enhance efficiencies through a unified, single-platform service approach.

Oct-2022: NatWest Group Plc formed a strategic partnership with Vodeno Group, a fully API-based, cloud-native platform and access to a European banking, to establish a Banking-as-a-Service ("BaaS") business in the UK. This collaboration enabled businesses to seamlessly integrate financial services directly into their ecosystems, leveraging Vodeno Group's BaaS technology and NatWest Group's banking technology and UK banking licenses.

Jul-2022: Glia Technologies, Inc. formed a strategic partnership with Access Softek, develops innovative mobile banking software, to integrate Glia's technology into Access Softek's digital banking platform to offer seamless digital customer service (DCS). This collaboration extended Glia's reach, empowered Access Softek to deliver smooth DCS solutions for banks and credit unions, and enhanced the overall online experience for customers and members.

Sep-2021: Glia Technologies, Inc. collaborated with Kasisto, the developers of KAI, a top digital experience platform for financial services. The integration involved incorporating Kasisto's KAI-powered intelligent digital assistant into Glia's Digital Customer Service platform. This integration enabled financial institutions to enhance their support for customers in the digital realm, making the process more effective and efficient.

Product Launches and Product Expansions:

Oct-2023: Barclays PLC launched the Demo Directory, a unique online service for UK businesses, offering easy access to capital by connecting them with verified investors, irrespective of their banking affiliation. The initiative aimed to help businesses explore new investment opportunities for growth or navigating challenging trading environments.

Oct-2023: Cisco Systems, Inc. integrated AI tools into Webex to enhance performance, communication, and collaboration. The tools enabled real-time AI usage for clear audio and video calls, overcoming low bandwidth issues. Initially, AI offerings in Webex were limited to text or documents.

Aug-2023: AU Small Finance Bank significantly improved customer service by launching a pioneering 24x7 video banking platform. This innovative service allowed customers to have face-to-face video interactions with expert bankers, resembling video calls. This move redefined convenience by providing round-the-clock support, even on weekends and holidays.

Apr-2023: AU Small Finance Bank Limited introduced the Bharat Bill Payment System (BBPS) and provided bill payment services through video banking, according to a press release. The primary objective of this initiative was to enhance digital accessibility and economic capabilities, fostering increased financial inclusion.

Jul-2020: U.S. Bank planned to introduce a virtual assistant in its mobile app, allowing customers to manage their finances using voice commands. The U.S. Bank Smart Assistant could provide information on account balances, upcoming bills, and spending history, and perform tasks such as money transfers. It utilized natural-language processing (NLP) technology to interpret human speech accurately. The voice assistant underwent testing with employees before its recent rollout.

Acquisition and Mergers:

Oct-2023: AU Small Finance Bank is all set to acquire Fincare Small Finance Bank, a Public Limited Indian Non-Government Company, in an all-share deal, merging them, pending regulatory approvals. According to the agreement, Fincare Small Finance Bank shareholders received 579 equity shares of AU Small Finance Bank for every 2,000 shares held. Additionally, the merger became effective on February 1, 2024.

Sep-2023: Cisco Systems, Inc. announced an agreement to acquire Splunk, Inc., helps to build a safer and more resilient digital world, for $157 per share in cash, totaling about $28 billion in equity value. This strategic move aimed to strengthen digital resilience, advance Cisco's secure connectivity strategy, and combine the AI, security, and observability expertise of both companies for improved organizational security and resilience.

Scope of the Study

Market Segments covered in the Report:

By Application

- Banks

- Credit Union

- Others

By Component

- Solution

- Services

By Deployment Mode

- On-Premise

- Cloud

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Companies Profiled

- AU Small Finance Bank Limited

- Barclays PLC

- Glia Technologies, Inc.

- STAR Financial Bank (STAR Financial Group, Inc.)

- NatWest Group Plc

- Guaranty Trust Bank Limited

- StonehamBank

- U.S. Bank

- Cisco Systems, Inc.

- Vidyard

Unique Offerings from KBV Research

- Exhaustive coverage

- Highest number of market tables and figures

- Subscription based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Chapter 1. Market Scope & Methodology

- 1.1 Market Definition

- 1.2 Objectives

- 1.3 Market Scope

- 1.4 Segmentation

- 1.4.1 Global Video Banking Service Market, by Application

- 1.4.2 Global Video Banking Service Market, by Component

- 1.4.3 Global Video Banking Service Market, by Deployment Mode

- 1.4.4 Global Video Banking Service Market, by Geography

- 1.5 Methodology for the research

Chapter 2. Market at a Glance

- 2.1 Key Highlights

Chapter 3. Market Overview

- 3.1 Introduction

- 3.1.1 Overview

- 3.1.1.1 Market Composition and Scenario

- 3.1.1 Overview

- 3.2 Key Factors Impacting the Market

- 3.2.1 Market Drivers

- 3.2.2 Market Restraints

Chapter 4. Competition Analysis - Global

- 4.1 KBV Cardinal Matrix

- 4.2 Recent Industry Wide Strategic Developments

- 4.2.1 Partnerships, Collaborations and Agreements

- 4.2.2 Product Launches and Product Expansions

- 4.2.3 Acquisition and Mergers

- 4.3 Top Winning Strategies

- 4.3.1 Key Leading Strategies: Percentage Distribution (2019-2023)

- 4.3.2 Key Strategic Move: (Partnerships, Collaborations & Agreements : 2021, Sep - 2023, Sep) Leading Players

- 4.4 Porter's Five Forces Analysis

Chapter 5. Global Video Banking Service Market, By Application

- 5.1 Global Banks Market, By Region

- 5.2 Global Credit Union Market, By Region

- 5.3 Global Others Market, By Region

Chapter 6. Global Video Banking Service Market, By Component

- 6.1 Global Solution Market, By Region

- 6.2 Global Services Market, By Region

Chapter 7. Global Video Banking Service Market, By Deployment Mode

- 7.1 Global On-Premise Market, By Region

- 7.2 Global Cloud Market, By Region

Chapter 8. Global Video Banking Service Market, By Region

- 8.1 North America Video Banking Service Market

- 8.1.1 North America Video Banking Service Market, By Application

- 8.1.1.1 North America Banks Market, By Country

- 8.1.1.2 North America Credit Union Market, By Country

- 8.1.1.3 North America Others Market, By Country

- 8.1.2 North America Video Banking Service Market, By Component

- 8.1.2.1 North America Solution Market, By Country

- 8.1.2.2 North America Services Market, By Country

- 8.1.3 North America Video Banking Service Market, By Deployment Mode

- 8.1.3.1 North America On-Premise Market, By Country

- 8.1.3.2 North America Cloud Market, By Country

- 8.1.4 North America Video Banking Service Market, By Country

- 8.1.4.1 US Video Banking Service Market

- 8.1.4.1.1 US Video Banking Service Market, By Application

- 8.1.4.1.2 US Video Banking Service Market, By Component

- 8.1.4.1.3 US Video Banking Service Market, By Deployment Mode

- 8.1.4.2 Canada Video Banking Service Market

- 8.1.4.2.1 Canada Video Banking Service Market, By Application

- 8.1.4.2.2 Canada Video Banking Service Market, By Component

- 8.1.4.2.3 Canada Video Banking Service Market, By Deployment Mode

- 8.1.4.3 Mexico Video Banking Service Market

- 8.1.4.3.1 Mexico Video Banking Service Market, By Application

- 8.1.4.3.2 Mexico Video Banking Service Market, By Component

- 8.1.4.3.3 Mexico Video Banking Service Market, By Deployment Mode

- 8.1.4.4 Rest of North America Video Banking Service Market

- 8.1.4.4.1 Rest of North America Video Banking Service Market, By Application

- 8.1.4.4.2 Rest of North America Video Banking Service Market, By Component

- 8.1.4.4.3 Rest of North America Video Banking Service Market, By Deployment Mode

- 8.1.4.1 US Video Banking Service Market

- 8.1.1 North America Video Banking Service Market, By Application

- 8.2 Europe Video Banking Service Market

- 8.2.1 Europe Video Banking Service Market, By Application

- 8.2.1.1 Europe Banks Market, By Country

- 8.2.1.2 Europe Credit Union Market, By Country

- 8.2.1.3 Europe Others Market, By Country

- 8.2.2 Europe Video Banking Service Market, By Component

- 8.2.2.1 Europe Solution Market, By Country

- 8.2.2.2 Europe Services Market, By Country

- 8.2.3 Europe Video Banking Service Market, By Deployment Mode

- 8.2.3.1 Europe On-Premise Market, By Country

- 8.2.3.2 Europe Cloud Market, By Country

- 8.2.4 Europe Video Banking Service Market, By Country

- 8.2.4.1 Germany Video Banking Service Market

- 8.2.4.1.1 Germany Video Banking Service Market, By Application

- 8.2.4.1.2 Germany Video Banking Service Market, By Component

- 8.2.4.1.3 Germany Video Banking Service Market, By Deployment Mode

- 8.2.4.2 UK Video Banking Service Market

- 8.2.4.2.1 UK Video Banking Service Market, By Application

- 8.2.4.2.2 UK Video Banking Service Market, By Component

- 8.2.4.2.3 UK Video Banking Service Market, By Deployment Mode

- 8.2.4.3 France Video Banking Service Market

- 8.2.4.3.1 France Video Banking Service Market, By Application

- 8.2.4.3.2 France Video Banking Service Market, By Component

- 8.2.4.3.3 France Video Banking Service Market, By Deployment Mode

- 8.2.4.4 Russia Video Banking Service Market

- 8.2.4.4.1 Russia Video Banking Service Market, By Application

- 8.2.4.4.2 Russia Video Banking Service Market, By Component

- 8.2.4.4.3 Russia Video Banking Service Market, By Deployment Mode

- 8.2.4.5 Spain Video Banking Service Market

- 8.2.4.5.1 Spain Video Banking Service Market, By Application

- 8.2.4.5.2 Spain Video Banking Service Market, By Component

- 8.2.4.5.3 Spain Video Banking Service Market, By Deployment Mode

- 8.2.4.6 Italy Video Banking Service Market

- 8.2.4.6.1 Italy Video Banking Service Market, By Application

- 8.2.4.6.2 Italy Video Banking Service Market, By Component

- 8.2.4.6.3 Italy Video Banking Service Market, By Deployment Mode

- 8.2.4.7 Rest of Europe Video Banking Service Market

- 8.2.4.7.1 Rest of Europe Video Banking Service Market, By Application

- 8.2.4.7.2 Rest of Europe Video Banking Service Market, By Component

- 8.2.4.7.3 Rest of Europe Video Banking Service Market, By Deployment Mode

- 8.2.4.1 Germany Video Banking Service Market

- 8.2.1 Europe Video Banking Service Market, By Application

- 8.3 Asia Pacific Video Banking Service Market

- 8.3.1 Asia Pacific Video Banking Service Market, By Application

- 8.3.1.1 Asia Pacific Banks Market, By Country

- 8.3.1.2 Asia Pacific Credit Union Market, By Country

- 8.3.1.3 Asia Pacific Others Market, By Country

- 8.3.2 Asia Pacific Video Banking Service Market, By Component

- 8.3.2.1 Asia Pacific Solution Market, By Country

- 8.3.2.2 Asia Pacific Services Market, By Country

- 8.3.3 Asia Pacific Video Banking Service Market, By Deployment Mode

- 8.3.3.1 Asia Pacific On-Premise Market, By Country

- 8.3.3.2 Asia Pacific Cloud Market, By Country

- 8.3.4 Asia Pacific Video Banking Service Market, By Country

- 8.3.4.1 China Video Banking Service Market

- 8.3.4.1.1 China Video Banking Service Market, By Application

- 8.3.4.1.2 China Video Banking Service Market, By Component

- 8.3.4.1.3 China Video Banking Service Market, By Deployment Mode

- 8.3.4.2 Japan Video Banking Service Market

- 8.3.4.2.1 Japan Video Banking Service Market, By Application

- 8.3.4.2.2 Japan Video Banking Service Market, By Component

- 8.3.4.2.3 Japan Video Banking Service Market, By Deployment Mode

- 8.3.4.3 India Video Banking Service Market

- 8.3.4.3.1 India Video Banking Service Market, By Application

- 8.3.4.3.2 India Video Banking Service Market, By Component

- 8.3.4.3.3 India Video Banking Service Market, By Deployment Mode

- 8.3.4.4 South Korea Video Banking Service Market

- 8.3.4.4.1 South Korea Video Banking Service Market, By Application

- 8.3.4.4.2 South Korea Video Banking Service Market, By Component

- 8.3.4.4.3 South Korea Video Banking Service Market, By Deployment Mode

- 8.3.4.5 Singapore Video Banking Service Market

- 8.3.4.5.1 Singapore Video Banking Service Market, By Application

- 8.3.4.5.2 Singapore Video Banking Service Market, By Component

- 8.3.4.5.3 Singapore Video Banking Service Market, By Deployment Mode

- 8.3.4.6 Malaysia Video Banking Service Market

- 8.3.4.6.1 Malaysia Video Banking Service Market, By Application

- 8.3.4.6.2 Malaysia Video Banking Service Market, By Component

- 8.3.4.6.3 Malaysia Video Banking Service Market, By Deployment Mode

- 8.3.4.7 Rest of Asia Pacific Video Banking Service Market

- 8.3.4.7.1 Rest of Asia Pacific Video Banking Service Market, By Application

- 8.3.4.7.2 Rest of Asia Pacific Video Banking Service Market, By Component

- 8.3.4.7.3 Rest of Asia Pacific Video Banking Service Market, By Deployment Mode

- 8.3.4.1 China Video Banking Service Market

- 8.3.1 Asia Pacific Video Banking Service Market, By Application

- 8.4 LAMEA Video Banking Service Market

- 8.4.1 LAMEA Video Banking Service Market, By Application

- 8.4.1.1 LAMEA Banks Market, By Country

- 8.4.1.2 LAMEA Credit Union Market, By Country

- 8.4.1.3 LAMEA Others Market, By Country

- 8.4.2 LAMEA Video Banking Service Market, By Component

- 8.4.2.1 LAMEA Solution Market, By Country

- 8.4.2.2 LAMEA Services Market, By Country

- 8.4.3 LAMEA Video Banking Service Market, By Deployment Mode

- 8.4.3.1 LAMEA On-Premise Market, By Country

- 8.4.3.2 LAMEA Cloud Market, By Country

- 8.4.4 LAMEA Video Banking Service Market, By Country

- 8.4.4.1 Brazil Video Banking Service Market

- 8.4.4.1.1 Brazil Video Banking Service Market, By Application

- 8.4.4.1.2 Brazil Video Banking Service Market, By Component

- 8.4.4.1.3 Brazil Video Banking Service Market, By Deployment Mode

- 8.4.4.2 Argentina Video Banking Service Market

- 8.4.4.2.1 Argentina Video Banking Service Market, By Application

- 8.4.4.2.2 Argentina Video Banking Service Market, By Component

- 8.4.4.2.3 Argentina Video Banking Service Market, By Deployment Mode

- 8.4.4.3 UAE Video Banking Service Market

- 8.4.4.3.1 UAE Video Banking Service Market, By Application

- 8.4.4.3.2 UAE Video Banking Service Market, By Component

- 8.4.4.3.3 UAE Video Banking Service Market, By Deployment Mode

- 8.4.4.4 Saudi Arabia Video Banking Service Market

- 8.4.4.4.1 Saudi Arabia Video Banking Service Market, By Application

- 8.4.4.4.2 Saudi Arabia Video Banking Service Market, By Component

- 8.4.4.4.3 Saudi Arabia Video Banking Service Market, By Deployment Mode

- 8.4.4.5 South Africa Video Banking Service Market

- 8.4.4.5.1 South Africa Video Banking Service Market, By Application

- 8.4.4.5.2 South Africa Video Banking Service Market, By Component

- 8.4.4.5.3 South Africa Video Banking Service Market, By Deployment Mode

- 8.4.4.6 Nigeria Video Banking Service Market

- 8.4.4.6.1 Nigeria Video Banking Service Market, By Application

- 8.4.4.6.2 Nigeria Video Banking Service Market, By Component

- 8.4.4.6.3 Nigeria Video Banking Service Market, By Deployment Mode

- 8.4.4.7 Rest of LAMEA Video Banking Service Market

- 8.4.4.7.1 Rest of LAMEA Video Banking Service Market, By Application

- 8.4.4.7.2 Rest of LAMEA Video Banking Service Market, By Component

- 8.4.4.7.3 Rest of LAMEA Video Banking Service Market, By Deployment Mode

- 8.4.4.1 Brazil Video Banking Service Market

- 8.4.1 LAMEA Video Banking Service Market, By Application

Chapter 9. Company Profiles

- 9.1 AU Small Finance Bank Limited

- 9.1.1 Company Overview

- 9.1.2 Financial Analysis

- 9.1.3 Segmental and Regional Analysis

- 9.1.4 Recent strategies and developments:

- 9.1.4.1 Partnerships, Collaborations, and Agreements:

- 9.1.4.2 Product Launches and Product Expansions:

- 9.1.4.3 Acquisition and Mergers:

- 9.1.5 SWOT Analysis

- 9.2 Barclays PLC

- 9.2.1 Company Overview

- 9.2.2 Financial Analysis

- 9.2.3 Segmental and Regional Analysis

- 9.2.4 Recent strategies and developments:

- 9.2.4.1 Partnerships, Collaborations, and Agreements:

- 9.2.4.2 Product Launches and Product Expansions:

- 9.2.5 SWOT Analysis

- 9.3 Glia Technologies, Inc.

- 9.3.1 Company Overview

- 9.3.2 Recent strategies and developments:

- 9.3.2.1 Partnerships, Collaborations, and Agreements:

- 9.3.3 SWOT Analysis

- 9.4 STAR Financial Bank (STAR Financial Group, Inc.)

- 9.4.1 Company Overview

- 9.4.2 Financial Analysis

- 9.4.3 SWOT Analysis

- 9.5 Natwest Group plc

- 9.5.1 Company Overview

- 9.5.2 Financial Analysis

- 9.5.3 Segmental and Regional Analysis

- 9.5.4 Recent strategies and developments:

- 9.5.4.1 Partnerships, Collaborations, and Agreements:

- 9.5.4.2 Product Launches and Product Expansions:

- 9.5.5 SWOT Analysis

- 9.6 Guaranty Trust Bank Limited

- 9.6.1 Company Overview

- 9.6.2 Recent strategies and developments:

- 9.6.2.1 Partnerships, Collaborations, and Agreements:

- 9.6.3 SWOT Analysis

- 9.7 StonehamBank

- 9.7.1 Company Overview

- 9.7.2 Financial Analysis

- 9.7.3 SWOT Analysis

- 9.8 U.S. Bank

- 9.8.1 Company Overview

- 9.8.2 Recent strategies and developments:

- 9.8.2.1 Product Launches and Product Expansions:

- 9.8.3 SWOT Analysis

- 9.9 Cisco Systems, Inc.

- 9.9.1 Company Overview

- 9.9.2 Financial Analysis

- 9.9.3 Regional Analysis

- 9.9.4 Research & Development Expense

- 9.9.5 Recent strategies and developments:

- 9.9.5.1 Partnerships, Collaborations, and Agreements:

- 9.9.5.2 Product Launches and Product Expansions:

- 9.9.5.3 Acquisition and Mergers:

- 9.9.6 SWOT Analysis

- 9.10. Vidyard

- 9.10.1 Company Overview

- 9.10.2 SWOT Analysis