|

|

市場調査レポート

商品コード

1374102

高繊維スナックの世界市場規模、シェア、産業動向分析レポート:性状別、流通チャネル別、製品別、地域別展望と予測、2023年~2030年Global High Fibre Snacks Market Size, Share & Industry Trends Analysis Report By Nature (Conventional and Organic), By Distribution Channel, By Product, By Regional Outlook and Forecast, 2023 - 2030 |

||||||

|

|||||||

| 高繊維スナックの世界市場規模、シェア、産業動向分析レポート:性状別、流通チャネル別、製品別、地域別展望と予測、2023年~2030年 |

|

出版日: 2023年09月30日

発行: KBV Research

ページ情報: 英文 408 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

高繊維スナック市場規模は、予測期間中にCAGR 9.6%で成長し、2030年には484億米ドルに達すると予測されます。2022年の市場規模は3,577.1キロトンに達し、9.9%の成長を遂げる(2019-2022年)。

しかし、技術や加工に関する様々な障害に直面しているメーカーにとって、この市場は厳しいです。スナックの食感とパリパリ感は、消費者が製品を購入する際に注目する重要な要素であり、スナックが魅力的かどうかを判断する上で重要な役割を果たしています。しかし、メーカーは、脂肪分や糖分を減らしたり除去したり、全粒穀物を製品に組み込んだりする際に課題に直面します。したがって、高繊維質スナックの製造に関連する技術的・加工的な難しさが市場拡大の妨げになる可能性があります。

自然の展望

自然環境に基づき、市場はオーガニックと従来型に分類されます。2022年の高繊維スナック市場では、従来型セグメントが最も高い収益シェアを記録しました。同セグメントは予測期間中も優位を保つと予想されます。飲食品業界における高繊維スナック市場の成長は、その商業的応用によるものです。高繊維食品は低カロリーでビタミンや栄養素が豊富なため需要が高く、特に機能性飲料に適しています。

流通チャネルの展望

流通チャネルに基づくと、市場はスーパーマーケット/ハイパーマーケット、専門店、コンビニエンスストア、オンライン小売業者、その他によって特徴付けられます。2022年の高繊維スナック市場では、コンビニエンスストアが大きな収益シェアを記録しました。コンビニエンスストアは近年、特に都市部や郊外で大きな人気を集めているが、その主な理由は利便性とアクセスの良さです。コンビニエンスストアは、特に時間のない個人にとって、ヘルシーなスナックを簡単に入手できることが重要です。競争力のある価格設定と健康的なスナックの割引により、消費者は栄養価の低い代替品よりも健康的なスナックを選ぶようになります。

製品の展望

製品別に見ると、市場はシリアル&グラノーラバー、ナッツ&シード、ドライフルーツ、ミートスナック、ビスケット&クッキー、トレイルミックススナック、その他に分類されます。2022年には、クッキー&ビスケット分野が高繊維質スナック市場で大きな収益シェアを獲得しました。無糖クッキーの需要の増加は、健康的なライフスタイルを維持し体重を減らしたいという願望に起因しています。若い人口のかなりの部分は砂糖の摂取量を意識しており、体重を維持するためにできるだけ摂取量を調整しようとしています。

地域別展望

地域別に見ると、市場は北米、欧州、アジア太平洋、LAMEAで分析されます。地域別では、高繊維スナック市場は北米、欧州、アジア太平洋、LAMEAで分析されます。2022年、北米セグメントは高繊維スナック市場で最も高い収益シェアを記録しました。近年、特にパンデミックの後、米国では栄養豊富なスナックの需要が増加しています。米国ではすでに多くのスナックが消費されているが、過剰な間食に伴う健康上の懸念を軽減するため、消費者は栄養価の高いスナックの摂取を重視しています。また、スーパーマーケットやハイパーマーケットの拡大率が高く、利便性の高いビジネスが展開されていることも、同地域のヘルシー・スナックの売上を牽引する重要な要素となっています。

高繊維スナック市場で開拓された戦略

2023年2月マース傘下のスナック・バー・メーカーであるKind社は、新フレーバー"Caramelized Biscuit Nut"でポートフォリオを拡大しました。ピーナッツ、アーモンド、カシューナッツに、ほのかなキャラメル風味とスパイスの効いたビスケット風味を加えました。ナッツ81%で、食物繊維が豊富、グルテンフリー、人工香料不使用。

2022年12月:マース傘下のスニッカーズは、スニッカーズHiプロテイン・バーを発売。SNICKERS Hiは、定番のスニッカーズの味に20グラムのプロテインを配合し、消費者の栄養ニーズに応えます。さらに、スニッカーズHiプロテインバーは、熱心なフィットネス愛好家、時折運動する人、または単においしく高タンパク質のスナックを探している人の成功になることは確実です。

目次

第1章 市場範囲と調査手法

- 市場の定義

- 目的

- 市場範囲

- セグメンテーション

- 調査手法

第2章 市場の概要

- 主なハイライト

第3章 市場概要

- イントロダクション

- 概要

- 市場構成とシナリオ

- 概要

- 市場に影響を与える主な要因

- 市場促進要因

- 市場抑制要因

- ポーターのファイブフォース分析

第4章 高繊維スナック市場で展開された戦略

第5章 世界の高繊維スナック市場自然別

- 世界の従来市場:地域別

- 世界のオーガニック市場:地域別

第6章 世界の市場:、流通チャネル別

- 世界のスーパーマーケット/ハイパーマーケット市場:地域別

- 世界の専門店市場:地域別

- 世界のコンビニエンスストア市場:地域別

- 世界のオンライン小売業者市場:地域別

- 世界のその他の市場:地域別

第7章 世界の市場:、製品別

- 世界のシリアル&グラノーラバー市場:地域別

- 世界のナッツと種子市場:地域別

- 世界のドライフルーツ市場:地域別

- 世界のミートスナック市場:地域別

- 世界のビスケットおよびクッキー市場:地域別

- 世界のトレイルミックススナック市場:地域別

- 世界のその他の市場:地域別

第8章 世界の市場:、地域別

- 北米の市場

- 北米の市場自然別

- 北米の国別従来型市場

- 国別の北米オーガニック市場

- 北米の市場:流通チャネル別

- 北米の国別スーパーマーケット/ハイパーマーケット市場

- 北米の国別専門店市場

- 北米の国別コンビニエンスストア市場

- 国別の北米オンライン小売業者市場

- 北米その他の国別市場

- 北米の市場:製品別

- 国別の北米シリアル&グラノーラバー市場

- 国別の北米ナッツおよび種子市場

- 国別の北米ドライフルーツ市場

- 北米の国別ミートスナック市場

- 国別の北米ビスケットおよびクッキー市場

- 北米の国別トレイルミックススナック市場

- 北米その他の国別市場

- 北米の市場:国別

- 米国の高繊維スナック市場

- カナダの高繊維スナック市場

- メキシコの高繊維スナック市場

- 残りの北米の市場

- 北米の市場自然別

- 欧州の市場

- 欧州の市場自然別

- 欧州の国別従来型市場

- 欧州の国別オーガニック市場

- 欧州の市場:流通チャネル別

- 欧州の国別スーパーマーケット/ハイパーマーケット市場

- 欧州の国別専門店市場

- 欧州の国コンビニエンスストア市場

- 国別の欧州のオンライン小売業者市場

- 欧州その他の国別市場

- 欧州の市場:製品別

- 欧州の国別シリアル&グラノーラバー市場

- 欧州の国別ナッツ&種子市場

- 国別欧州ドライフルーツ市場

- 欧州の国別ミートスナック市場

- 欧州の国別ビスケットおよびクッキー市場

- 欧州の国別トレイルミックススナック市場

- 欧州その他の国別市場

- 欧州の市場:国別

- ドイツの高繊維スナック市場

- 英国の高繊維スナック市場

- フランスの高繊維スナック市場

- ロシアの高繊維スナック市場

- スペインの高繊維スナック市場

- イタリアの高繊維スナック市場

- 残りの欧州の市場

- 欧州の市場自然別

- アジア太平洋の市場

- アジア太平洋の市場自然別

- アジア太平洋地域の国別従来型市場

- 国別のアジア太平洋地域のオーガニック市場

- アジア太平洋の市場:流通チャネル別

- アジア太平洋地域の国別スーパーマーケット/ハイパーマーケット市場

- アジア太平洋地域の国別専門店市場

- アジア太平洋地域の国別コンビニエンスストア市場

- 国別のアジア太平洋地域のオンライン小売業者市場

- アジア太平洋地域その他の国別市場

- アジア太平洋の市場:製品別

- アジア太平洋地域の国別シリアル&グラノーラバー市場

- アジア太平洋地域の国別ナッツおよび種子市場

- アジア太平洋地域の国別ドライフルーツ市場

- アジア太平洋地域の国別ミートスナック市場

- アジア太平洋地域の国別ビスケットおよびクッキー市場

- アジア太平洋地域の国別トレイルミックススナック市場

- アジア太平洋地域その他の国別市場

- アジア太平洋の市場:国別

- 中国高繊維スナック市場

- 日本の高繊維スナック市場

- インドの高繊維スナック市場

- 韓国の高繊維スナック市場

- シンガポールの高繊維スナック市場

- マレーシアの高繊維スナック市場

- 残りのアジア太平洋の市場

- アジア太平洋の市場自然別

- ラテンアメリカ・中東・アフリカの市場

- ラテンアメリカ・中東・アフリカの市場自然別

- 国別LAMEA従来市場

- 国別LAMEAオーガニック市場

- ラテンアメリカ・中東・アフリカの市場:流通チャネル別

- 国別LAMEAスーパーマーケット/ハイパーマーケット市場

- 国別LAMEA専門店市場

- 国別LAMEAコンビニエンスストア市場

- 国別のLAMEAオンライン小売業者市場

- 国別LAMEAその他市場

- ラテンアメリカ・中東・アフリカの市場:製品別

- 国別のLAMEAシリアル&グラノーラバー市場

- 国別のLAMEAナッツおよび種子市場

- 国別LAMEAドライフルーツ市場

- 国別LAMEAミートスナック市場

- 国別のLAMEAビスケット&クッキー市場

- 国別のLAMEAトレイルミックススナック市場

- 国別LAMEAその他市場

- ラテンアメリカ・中東・アフリカの市場:国別

- ブラジルの高繊維スナック市場

- アルゼンチンの高繊維スナック市場

- UAEの高繊維スナック市場

- サウジアラビアの高繊維スナック市場

- 南アフリカの高繊維スナック市場

- ナイジェリアの高繊維スナック市場

- 残りのラテンアメリカ・中東・アフリカの市場

- ラテンアメリカ・中東・アフリカの市場自然別

第9章 企業プロファイル

- General Mills, Inc

- Hodgson Mill, Inc

- Bearded Brothers, LLC

- Kellogg Company

- Flowers Foods, Inc

- Mars, Inc(Kind LLC)

- Energy Bar Foods(Visionary Nutrition, LLC)

- Ardent Mills

- Mojo Snacks

- Grain Millers, Inc

第10章 高繊維スナック市場の勝利の必須条件

LIST OF TABLES

- TABLE 1 Global High Fibre Snacks Market, 2019 - 2022, USD Million

- TABLE 2 Global High Fibre Snacks Market, 2023 - 2030, USD Million

- TABLE 3 Global High Fibre Snacks Market, 2019 - 2022, Kilo Tonnes

- TABLE 4 Global High Fibre Snacks Market, 2023 - 2030, Kilo Tonnes

- TABLE 5 Global High Fibre Snacks Market, By Nature, 2019 - 2022, USD Million

- TABLE 6 Global High Fibre Snacks Market, By Nature, 2023 - 2030, USD Million

- TABLE 7 Global High Fibre Snacks Market, By Nature, 2019 - 2022, Kilo Tonnes

- TABLE 8 Global High Fibre Snacks Market, By Nature, 2023 - 2030, Kilo Tonnes

- TABLE 9 Global Conventional Market, By Region, 2019 - 2022, USD Million

- TABLE 10 Global Conventional Market, By Region, 2023 - 2030, USD Million

- TABLE 11 Global Conventional Market, By Region, 2019 - 2022, Kilo Tonnes

- TABLE 12 Global Conventional Market, By Region, 2023 - 2030, Kilo Tonnes

- TABLE 13 Global Organic Market, By Region, 2019 - 2022, USD Million

- TABLE 14 Global Organic Market, By Region, 2023 - 2030, USD Million

- TABLE 15 Global Organic Market, By Region, 2019 - 2022, Kilo Tonnes

- TABLE 16 Global Organic Market, By Region, 2023 - 2030, Kilo Tonnes

- TABLE 17 Global High Fibre Snacks Market, By Distribution Channel, 2019 - 2022, USD Million

- TABLE 18 Global High Fibre Snacks Market, By Distribution Channel, 2023 - 2030, USD Million

- TABLE 19 Global High Fibre Snacks Market, By Distribution Channel, 2019 - 2022, Kilo Tonnes

- TABLE 20 Global High Fibre Snacks Market, By Distribution Channel, 2023 - 2030, Kilo Tonnes

- TABLE 21 Global Supermarkets/Hypermarkets Market, By Region, 2019 - 2022, USD Million

- TABLE 22 Global Supermarkets/Hypermarkets Market, By Region, 2023 - 2030, USD Million

- TABLE 23 Global Supermarkets/Hypermarkets Market, By Region, 2019 - 2022, Kilo Tonnes

- TABLE 24 Global Supermarkets/Hypermarkets Market, By Region, 2023 - 2030, Kilo Tonnes

- TABLE 25 Global Specialty Stores Market, By Region, 2019 - 2022, USD Million

- TABLE 26 Global Specialty Stores Market, By Region, 2023 - 2030, USD Million

- TABLE 27 Global Specialty Stores Market, By Region, 2019 - 2022, Kilo Tonnes

- TABLE 28 Global Specialty Stores Market, By Region, 2023 - 2030, Kilo Tonnes

- TABLE 29 Global Convenience Stores Market, By Region, 2019 - 2022, USD Million

- TABLE 30 Global Convenience Stores Market, By Region, 2023 - 2030, USD Million

- TABLE 31 Global Convenience Stores Market, By Region, 2019 - 2022, Kilo Tonnes

- TABLE 32 Global Convenience Stores Market, By Region, 2023 - 2030, Kilo Tonnes

- TABLE 33 Global Online Retailers Market, By Region, 2019 - 2022, USD Million

- TABLE 34 Global Online Retailers Market, By Region, 2023 - 2030, USD Million

- TABLE 35 Global Online Retailers Market, By Region, 2019 - 2022, Kilo Tonnes

- TABLE 36 Global Online Retailers Market, By Region, 2023 - 2030, Kilo Tonnes

- TABLE 37 Global Others Market, By Region, 2019 - 2022, USD Million

- TABLE 38 Global Others Market, By Region, 2023 - 2030, USD Million

- TABLE 39 Global Others Market, By Region, 2019 - 2022, Kilo Tonnes

- TABLE 40 Global Others Market, By Region, 2023 - 2030, Kilo Tonnes

- TABLE 41 Global High Fibre Snacks Market, By Product, 2019 - 2022, USD Million

- TABLE 42 Global High Fibre Snacks Market, By Product, 2023 - 2030, USD Million

- TABLE 43 Global High Fibre Snacks Market, By Product, 2019 - 2022, Kilo Tonnes

- TABLE 44 Global High Fibre Snacks Market, By Product, 2023 - 2030, Kilo Tonnes

- TABLE 45 Global Cereal & Granola Bars Market, By Region, 2019 - 2022, USD Million

- TABLE 46 Global Cereal & Granola Bars Market, By Region, 2023 - 2030, USD Million

- TABLE 47 Global Cereal & Granola Bars Market, By Region, 2019 - 2022, Kilo Tonnes

- TABLE 48 Global Cereal & Granola Bars Market, By Region, 2023 - 2030, Kilo Tonnes

- TABLE 49 Global Nuts & Seeds Market, By Region, 2019 - 2022, USD Million

- TABLE 50 Global Nuts & Seeds Market, By Region, 2023 - 2030, USD Million

- TABLE 51 Global Nuts & Seeds Market, By Region, 2019 - 2022, Kilo Tonnes

- TABLE 52 Global Nuts & Seeds Market, By Region, 2023 - 2030, Kilo Tonnes

- TABLE 53 Global Dried Fruits Market, By Region, 2019 - 2022, USD Million

- TABLE 54 Global Dried Fruits Market, By Region, 2023 - 2030, USD Million

- TABLE 55 Global Dried Fruits Market, By Region, 2019 - 2022, Kilo Tonnes

- TABLE 56 Global Dried Fruits Market, By Region, 2023 - 2030, Kilo Tonnes

- TABLE 57 Global Meat Snacks Market, By Region, 2019 - 2022, USD Million

- TABLE 58 Global Meat Snacks Market, By Region, 2023 - 2030, USD Million

- TABLE 59 Global Meat Snacks Market, By Region, 2019 - 2022, Kilo Tonnes

- TABLE 60 Global Meat Snacks Market, By Region, 2023 - 2030, Kilo Tonnes

- TABLE 61 Global Biscuits & Cookies Market, By Region, 2019 - 2022, USD Million

- TABLE 62 Global Biscuits & Cookies Market, By Region, 2023 - 2030, USD Million

- TABLE 63 Global Biscuits & Cookies Market, By Region, 2019 - 2022, Kilo Tonnes

- TABLE 64 Global Biscuits & Cookies Market, By Region, 2023 - 2030, Kilo Tonnes

- TABLE 65 Global Trail Mix Snacks Market, By Region, 2019 - 2022, USD Million

- TABLE 66 Global Trail Mix Snacks Market, By Region, 2023 - 2030, USD Million

- TABLE 67 Global Trail Mix Snacks Market, By Region, 2019 - 2022, Kilo Tonnes

- TABLE 68 Global Trail Mix Snacks Market, By Region, 2023 - 2030, Kilo Tonnes

- TABLE 69 Global Others Market, By Region, 2019 - 2022, USD Million

- TABLE 70 Global Others Market, By Region, 2023 - 2030, USD Million

- TABLE 71 Global Others Market, By Region, 2019 - 2022, Kilo Tonnes

- TABLE 72 Global Others Market, By Region, 2023 - 2030, Kilo Tonnes

- TABLE 73 Global High Fibre Snacks Market, By Region, 2019 - 2022, USD Million

- TABLE 74 Global High Fibre Snacks Market, By Region, 2023 - 2030, USD Million

- TABLE 75 Global High Fibre Snacks Market, By Region, 2019 - 2022, Kilo Tonnes

- TABLE 76 Global High Fibre Snacks Market, By Region, 2023 - 2030, Kilo Tonnes

- TABLE 77 North America High Fibre Snacks Market, 2019 - 2022, USD Million

- TABLE 78 North America High Fibre Snacks Market, 2023 - 2030, USD Million

- TABLE 79 North America High Fibre Snacks Market, 2019 - 2022, Kilo Tonnes

- TABLE 80 North America High Fibre Snacks Market, 2023 - 2030, Kilo Tonnes

- TABLE 81 North America High Fibre Snacks Market, By Nature, 2019 - 2022, USD Million

- TABLE 82 North America High Fibre Snacks Market, By Nature, 2023 - 2030, USD Million

- TABLE 83 North America High Fibre Snacks Market, By Nature, 2019 - 2022, Kilo Tonnes

- TABLE 84 North America High Fibre Snacks Market, By Nature, 2023 - 2030, Kilo Tonnes

- TABLE 85 North America Conventional Market, By Country, 2019 - 2022, USD Million

- TABLE 86 North America Conventional Market, By Country, 2023 - 2030, USD Million

- TABLE 87 North America Conventional Market, By Country, 2019 - 2022, Kilo Tonnes

- TABLE 88 North America Conventional Market, By Country, 2023 - 2030, Kilo Tonnes

- TABLE 89 North America Organic Market, By Country, 2019 - 2022, USD Million

- TABLE 90 North America Organic Market, By Country, 2023 - 2030, USD Million

- TABLE 91 North America Organic Market, By Country, 2019 - 2022, Kilo Tonnes

- TABLE 92 North America Organic Market, By Country, 2023 - 2030, Kilo Tonnes

- TABLE 93 North America High Fibre Snacks Market, By Distribution Channel, 2019 - 2022, USD Million

- TABLE 94 North America High Fibre Snacks Market, By Distribution Channel, 2023 - 2030, USD Million

- TABLE 95 North America High Fibre Snacks Market, By Distribution Channel, 2019 - 2022, Kilo Tonnes

- TABLE 96 North America High Fibre Snacks Market, By Distribution Channel, 2023 - 2030, Kilo Tonnes

- TABLE 97 North America Supermarkets/Hypermarkets Market, By Country, 2019 - 2022, USD Million

- TABLE 98 North America Supermarkets/Hypermarkets Market, By Country, 2023 - 2030, USD Million

- TABLE 99 North America Supermarkets/Hypermarkets Market, By Country, 2019 - 2022, Kilo Tonnes

- TABLE 100 North America Supermarkets/Hypermarkets Market, By Country, 2023 - 2030, Kilo Tonnes

- TABLE 101 North America Specialty Stores Market, By Country, 2019 - 2022, USD Million

- TABLE 102 North America Specialty Stores Market, By Country, 2023 - 2030, USD Million

- TABLE 103 North America Specialty Stores Market, By Country, 2019 - 2022, Kilo Tonnes

- TABLE 104 North America Specialty Stores Market, By Country, 2023 - 2030, Kilo Tonnes

- TABLE 105 North America Convenience Stores Market, By Country, 2019 - 2022, USD Million

- TABLE 106 North America Convenience Stores Market, By Country, 2023 - 2030, USD Million

- TABLE 107 North America Convenience Stores Market, By Country, 2019 - 2022, Kilo Tonnes

- TABLE 108 North America Convenience Stores Market, By Country, 2023 - 2030, Kilo Tonnes

- TABLE 109 North America Online Retailers Market, By Country, 2019 - 2022, USD Million

- TABLE 110 North America Online Retailers Market, By Country, 2023 - 2030, USD Million

- TABLE 111 North America Online Retailers Market, By Country, 2019 - 2022, Kilo Tonnes

- TABLE 112 North America Online Retailers Market, By Country, 2023 - 2030, Kilo Tonnes

- TABLE 113 North America Others Market, By Country, 2019 - 2022, USD Million

- TABLE 114 North America Others Market, By Country, 2023 - 2030, USD Million

- TABLE 115 North America Others Market, By Country, 2019 - 2022, Kilo Tonnes

- TABLE 116 North America Others Market, By Country, 2023 - 2030, Kilo Tonnes

- TABLE 117 North America High Fibre Snacks Market, By Product, 2019 - 2022, USD Million

- TABLE 118 North America High Fibre Snacks Market, By Product, 2023 - 2030, USD Million

- TABLE 119 North America High Fibre Snacks Market, By Product, 2019 - 2022, Kilo Tonnes

- TABLE 120 North America High Fibre Snacks Market, By Product, 2023 - 2030, Kilo Tonnes

- TABLE 121 North America Cereal & Granola Bars Market, By Country, 2019 - 2022, USD Million

- TABLE 122 North America Cereal & Granola Bars Market, By Country, 2023 - 2030, USD Million

- TABLE 123 North America Cereal & Granola Bars Market, By Country, 2019 - 2022, Kilo Tonnes

- TABLE 124 North America Cereal & Granola Bars Market, By Country, 2023 - 2030, Kilo Tonnes

- TABLE 125 North America Nuts & Seeds Market, By Country, 2019 - 2022, USD Million

- TABLE 126 North America Nuts & Seeds Market, By Country, 2023 - 2030, USD Million

- TABLE 127 North America Nuts & Seeds Market, By Country, 2019 - 2022, Kilo Tonnes

- TABLE 128 North America Nuts & Seeds Market, By Country, 2023 - 2030, Kilo Tonnes

- TABLE 129 North America Dried Fruits Market, By Country, 2019 - 2022, USD Million

- TABLE 130 North America Dried Fruits Market, By Country, 2023 - 2030, USD Million

- TABLE 131 North America Dried Fruits Market, By Country, 2019 - 2022, Kilo Tonnes

- TABLE 132 North America Dried Fruits Market, By Country, 2023 - 2030, Kilo Tonnes

- TABLE 133 North America Meat Snacks Market, By Country, 2019 - 2022, USD Million

- TABLE 134 North America Meat Snacks Market, By Country, 2023 - 2030, USD Million

- TABLE 135 North America Meat Snacks Market, By Country, 2019 - 2022, Kilo Tonnes

- TABLE 136 North America Meat Snacks Market, By Country, 2023 - 2030, Kilo Tonnes

- TABLE 137 North America Biscuits & Cookies Market, By Country, 2019 - 2022, USD Million

- TABLE 138 North America Biscuits & Cookies Market, By Country, 2023 - 2030, USD Million

- TABLE 139 North America Biscuits & Cookies Market, By Country, 2019 - 2022, Kilo Tonnes

- TABLE 140 North America Biscuits & Cookies Market, By Country, 2023 - 2030, Kilo Tonnes

- TABLE 141 North America Trail Mix Snacks Market, By Country, 2019 - 2022, USD Million

- TABLE 142 North America Trail Mix Snacks Market, By Country, 2023 - 2030, USD Million

- TABLE 143 North America Trail Mix Snacks Market, By Country, 2019 - 2022, Kilo Tonnes

- TABLE 144 North America Trail Mix Snacks Market, By Country, 2023 - 2030, Kilo Tonnes

- TABLE 145 North America Others Market, By Country, 2019 - 2022, USD Million

- TABLE 146 North America Others Market, By Country, 2023 - 2030, USD Million

- TABLE 147 North America Others Market, By Country, 2019 - 2022, Kilo Tonnes

- TABLE 148 North America Others Market, By Country, 2023 - 2030, Kilo Tonnes

- TABLE 149 North America High Fibre Snacks Market, By Country, 2019 - 2022, USD Million

- TABLE 150 North America High Fibre Snacks Market, By Country, 2023 - 2030, USD Million

- TABLE 151 North America High Fibre Snacks Market, By Country, 2019 - 2022, Kilo Tonnes

- TABLE 152 North America High Fibre Snacks Market, By Country, 2023 - 2030, Kilo Tonnes

- TABLE 153 US High Fibre Snacks Market, 2019 - 2022, USD Million

- TABLE 154 US High Fibre Snacks Market, 2023 - 2030, USD Million

- TABLE 155 US High Fibre Snacks Market, 2019 - 2022, Kilo Tonnes

- TABLE 156 US High Fibre Snacks Market, 2023 - 2030, Kilo Tonnes

- TABLE 157 US High Fibre Snacks Market, By Nature, 2019 - 2022, USD Million

- TABLE 158 US High Fibre Snacks Market, By Nature, 2023 - 2030, USD Million

- TABLE 159 US High Fibre Snacks Market, By Nature, 2019 - 2022, Kilo Tonnes

- TABLE 160 US High Fibre Snacks Market, By Nature, 2023 - 2030, Kilo Tonnes

- TABLE 161 US High Fibre Snacks Market, By Distribution Channel, 2019 - 2022, USD Million

- TABLE 162 US High Fibre Snacks Market, By Distribution Channel, 2023 - 2030, USD Million

- TABLE 163 US High Fibre Snacks Market, By Distribution Channel, 2019 - 2022, Kilo Tonnes

- TABLE 164 US High Fibre Snacks Market, By Distribution Channel, 2023 - 2030, Kilo Tonnes

- TABLE 165 US High Fibre Snacks Market, By Product, 2019 - 2022, USD Million

- TABLE 166 US High Fibre Snacks Market, By Product, 2023 - 2030, USD Million

- TABLE 167 US High Fibre Snacks Market, By Product, 2019 - 2022, Kilo Tonnes

- TABLE 168 US High Fibre Snacks Market, By Product, 2023 - 2030, Kilo Tonnes

- TABLE 169 Canada High Fibre Snacks Market, 2019 - 2022, USD Million

- TABLE 170 Canada High Fibre Snacks Market, 2023 - 2030, USD Million

- TABLE 171 Canada High Fibre Snacks Market, 2019 - 2022, Kilo Tonnes

- TABLE 172 Canada High Fibre Snacks Market, 2023 - 2030, Kilo Tonnes

- TABLE 173 Canada High Fibre Snacks Market, By Nature, 2019 - 2022, USD Million

- TABLE 174 Canada High Fibre Snacks Market, By Nature, 2023 - 2030, USD Million

- TABLE 175 Canada High Fibre Snacks Market, By Nature, 2019 - 2022, Kilo Tonnes

- TABLE 176 Canada High Fibre Snacks Market, By Nature, 2023 - 2030, Kilo Tonnes

- TABLE 177 Canada High Fibre Snacks Market, By Distribution Channel, 2019 - 2022, USD Million

- TABLE 178 Canada High Fibre Snacks Market, By Distribution Channel, 2023 - 2030, USD Million

- TABLE 179 Canada High Fibre Snacks Market, By Distribution Channel, 2019 - 2022, Kilo Tonnes

- TABLE 180 Canada High Fibre Snacks Market, By Distribution Channel, 2023 - 2030, Kilo Tonnes

- TABLE 181 Canada High Fibre Snacks Market, By Product, 2019 - 2022, USD Million

- TABLE 182 Canada High Fibre Snacks Market, By Product, 2023 - 2030, USD Million

- TABLE 183 Canada High Fibre Snacks Market, By Product, 2019 - 2022, Kilo Tonnes

- TABLE 184 Canada High Fibre Snacks Market, By Product, 2023 - 2030, Kilo Tonnes

- TABLE 185 Mexico High Fibre Snacks Market, 2019 - 2022, USD Million

- TABLE 186 Mexico High Fibre Snacks Market, 2023 - 2030, USD Million

- TABLE 187 Mexico High Fibre Snacks Market, 2019 - 2022, Kilo Tonnes

- TABLE 188 Mexico High Fibre Snacks Market, 2023 - 2030, Kilo Tonnes

- TABLE 189 Mexico High Fibre Snacks Market, By Nature, 2019 - 2022, USD Million

- TABLE 190 Mexico High Fibre Snacks Market, By Nature, 2023 - 2030, USD Million

- TABLE 191 Mexico High Fibre Snacks Market, By Nature, 2019 - 2022, Kilo Tonnes

- TABLE 192 Mexico High Fibre Snacks Market, By Nature, 2023 - 2030, Kilo Tonnes

- TABLE 193 Mexico High Fibre Snacks Market, By Distribution Channel, 2019 - 2022, USD Million

- TABLE 194 Mexico High Fibre Snacks Market, By Distribution Channel, 2023 - 2030, USD Million

- TABLE 195 Mexico High Fibre Snacks Market, By Distribution Channel, 2019 - 2022, Kilo Tonnes

- TABLE 196 Mexico High Fibre Snacks Market, By Distribution Channel, 2023 - 2030, Kilo Tonnes

- TABLE 197 Mexico High Fibre Snacks Market, By Product, 2019 - 2022, USD Million

- TABLE 198 Mexico High Fibre Snacks Market, By Product, 2023 - 2030, USD Million

- TABLE 199 Mexico High Fibre Snacks Market, By Product, 2019 - 2022, Kilo Tonnes

- TABLE 200 Mexico High Fibre Snacks Market, By Product, 2023 - 2030, Kilo Tonnes

- TABLE 201 Rest of North America High Fibre Snacks Market, 2019 - 2022, USD Million

- TABLE 202 Rest of North America High Fibre Snacks Market, 2023 - 2030, USD Million

- TABLE 203 Rest of North America High Fibre Snacks Market, 2019 - 2022, Kilo Tonnes

- TABLE 204 Rest of North America High Fibre Snacks Market, 2023 - 2030, Kilo Tonnes

- TABLE 205 Rest of North America High Fibre Snacks Market, By Nature, 2019 - 2022, USD Million

- TABLE 206 Rest of North America High Fibre Snacks Market, By Nature, 2023 - 2030, USD Million

- TABLE 207 Rest of North America High Fibre Snacks Market, By Nature, 2019 - 2022, Kilo Tonnes

- TABLE 208 Rest of North America High Fibre Snacks Market, By Nature, 2023 - 2030, Kilo Tonnes

- TABLE 209 Rest of North America High Fibre Snacks Market, By Distribution Channel, 2019 - 2022, USD Million

- TABLE 210 Rest of North America High Fibre Snacks Market, By Distribution Channel, 2023 - 2030, USD Million

- TABLE 211 Rest of North America High Fibre Snacks Market, By Distribution Channel, 2019 - 2022, Kilo Tonnes

- TABLE 212 Rest of North America High Fibre Snacks Market, By Distribution Channel, 2023 - 2030, Kilo Tonnes

- TABLE 213 Rest of North America High Fibre Snacks Market, By Product, 2019 - 2022, USD Million

- TABLE 214 Rest of North America High Fibre Snacks Market, By Product, 2023 - 2030, USD Million

- TABLE 215 Rest of North America High Fibre Snacks Market, By Product, 2019 - 2022, Kilo Tonnes

- TABLE 216 Rest of North America High Fibre Snacks Market, By Product, 2023 - 2030, Kilo Tonnes

- TABLE 217 Europe High Fibre Snacks Market, 2019 - 2022, USD Million

- TABLE 218 Europe High Fibre Snacks Market, 2023 - 2030, USD Million

- TABLE 219 Europe High Fibre Snacks Market, 2019 - 2022, Kilo Tonnes

- TABLE 220 Europe High Fibre Snacks Market, 2023 - 2030, Kilo Tonnes

- TABLE 221 Europe High Fibre Snacks Market, By Nature, 2019 - 2022, USD Million

- TABLE 222 Europe High Fibre Snacks Market, By Nature, 2023 - 2030, USD Million

- TABLE 223 Europe High Fibre Snacks Market, By Nature, 2019 - 2022, Kilo Tonnes

- TABLE 224 Europe High Fibre Snacks Market, By Nature, 2023 - 2030, Kilo Tonnes

- TABLE 225 Europe Conventional Market, By Country, 2019 - 2022, USD Million

- TABLE 226 Europe Conventional Market, By Country, 2023 - 2030, USD Million

- TABLE 227 Europe Conventional Market, By Country, 2019 - 2022, Kilo Tonnes

- TABLE 228 Europe Conventional Market, By Country, 2023 - 2030, Kilo Tonnes

- TABLE 229 Europe Organic Market, By Country, 2019 - 2022, USD Million

- TABLE 230 Europe Organic Market, By Country, 2023 - 2030, USD Million

- TABLE 231 Europe Organic Market, By Country, 2019 - 2022, Kilo Tonnes

- TABLE 232 Europe Organic Market, By Country, 2023 - 2030, Kilo Tonnes

- TABLE 233 Europe High Fibre Snacks Market, By Distribution Channel, 2019 - 2022, USD Million

- TABLE 234 Europe High Fibre Snacks Market, By Distribution Channel, 2023 - 2030, USD Million

- TABLE 235 Europe High Fibre Snacks Market, By Distribution Channel, 2019 - 2022, Kilo Tonnes

- TABLE 236 Europe High Fibre Snacks Market, By Distribution Channel, 2023 - 2030, Kilo Tonnes

- TABLE 237 Europe Supermarkets/Hypermarkets Market, By Country, 2019 - 2022, USD Million

- TABLE 238 Europe Supermarkets/Hypermarkets Market, By Country, 2023 - 2030, USD Million

- TABLE 239 Europe Supermarkets/Hypermarkets Market, By Country, 2019 - 2022, Kilo Tonnes

- TABLE 240 Europe Supermarkets/Hypermarkets Market, By Country, 2023 - 2030, Kilo Tonnes

- TABLE 241 Europe Specialty Stores Market, By Country, 2019 - 2022, USD Million

- TABLE 242 Europe Specialty Stores Market, By Country, 2023 - 2030, USD Million

- TABLE 243 Europe Specialty Stores Market, By Country, 2019 - 2022, Kilo Tonnes

- TABLE 244 Europe Specialty Stores Market, By Country, 2023 - 2030, Kilo Tonnes

- TABLE 245 Europe Convenience Stores Market, By Country, 2019 - 2022, USD Million

- TABLE 246 Europe Convenience Stores Market, By Country, 2023 - 2030, USD Million

- TABLE 247 Europe Convenience Stores Market, By Country, 2019 - 2022, Kilo Tonnes

- TABLE 248 Europe Convenience Stores Market, By Country, 2023 - 2030, Kilo Tonnes

- TABLE 249 Europe Online Retailers Market, By Country, 2019 - 2022, USD Million

- TABLE 250 Europe Online Retailers Market, By Country, 2023 - 2030, USD Million

- TABLE 251 Europe Online Retailers Market, By Country, 2019 - 2022, Kilo Tonnes

- TABLE 252 Europe Online Retailers Market, By Country, 2023 - 2030, Kilo Tonnes

- TABLE 253 Europe Others Market, By Country, 2019 - 2022, USD Million

- TABLE 254 Europe Others Market, By Country, 2023 - 2030, USD Million

- TABLE 255 Europe Others Market, By Country, 2019 - 2022, Kilo Tonnes

- TABLE 256 Europe Others Market, By Country, 2023 - 2030, Kilo Tonnes

- TABLE 257 Europe High Fibre Snacks Market, By Product, 2019 - 2022, USD Million

- TABLE 258 Europe High Fibre Snacks Market, By Product, 2023 - 2030, USD Million

- TABLE 259 Europe High Fibre Snacks Market, By Product, 2019 - 2022, Kilo Tonnes

- TABLE 260 Europe High Fibre Snacks Market, By Product, 2023 - 2030, Kilo Tonnes

- TABLE 261 Europe Cereal & Granola Bars Market, By Country, 2019 - 2022, USD Million

- TABLE 262 Europe Cereal & Granola Bars Market, By Country, 2023 - 2030, USD Million

- TABLE 263 Europe Cereal & Granola Bars Market, By Country, 2019 - 2022, Kilo Tonnes

- TABLE 264 Europe Cereal & Granola Bars Market, By Country, 2023 - 2030, Kilo Tonnes

- TABLE 265 Europe Nuts & Seeds Market, By Country, 2019 - 2022, USD Million

- TABLE 266 Europe Nuts & Seeds Market, By Country, 2023 - 2030, USD Million

- TABLE 267 Europe Nuts & Seeds Market, By Country, 2019 - 2022, Kilo Tonnes

- TABLE 268 Europe Nuts & Seeds Market, By Country, 2023 - 2030, Kilo Tonnes

- TABLE 269 Europe Dried Fruits Market, By Country, 2019 - 2022, USD Million

- TABLE 270 Europe Dried Fruits Market, By Country, 2023 - 2030, USD Million

- TABLE 271 Europe Dried Fruits Market, By Country, 2019 - 2022, Kilo Tonnes

- TABLE 272 Europe Dried Fruits Market, By Country, 2023 - 2030, Kilo Tonnes

- TABLE 273 Europe Meat Snacks Market, By Country, 2019 - 2022, USD Million

- TABLE 274 Europe Meat Snacks Market, By Country, 2023 - 2030, USD Million

- TABLE 275 Europe Meat Snacks Market, By Country, 2019 - 2022, Kilo Tonnes

- TABLE 276 Europe Meat Snacks Market, By Country, 2023 - 2030, Kilo Tonnes

- TABLE 277 Europe Biscuits & Cookies Market, By Country, 2019 - 2022, USD Million

- TABLE 278 Europe Biscuits & Cookies Market, By Country, 2023 - 2030, USD Million

- TABLE 279 Europe Biscuits & Cookies Market, By Country, 2019 - 2022, Kilo Tonnes

- TABLE 280 Europe Biscuits & Cookies Market, By Country, 2023 - 2030, Kilo Tonnes

- TABLE 281 Europe Trail Mix Snacks Market, By Country, 2019 - 2022, USD Million

- TABLE 282 Europe Trail Mix Snacks Market, By Country, 2023 - 2030, USD Million

- TABLE 283 Europe Trail Mix Snacks Market, By Country, 2019 - 2022, Kilo Tonnes

- TABLE 284 Europe Trail Mix Snacks Market, By Country, 2023 - 2030, Kilo Tonnes

- TABLE 285 Europe Others Market, By Country, 2019 - 2022, USD Million

- TABLE 286 Europe Others Market, By Country, 2023 - 2030, USD Million

- TABLE 287 Europe Others Market, By Country, 2019 - 2022, Kilo Tonnes

- TABLE 288 Europe Others Market, By Country, 2023 - 2030, Kilo Tonnes

- TABLE 289 Europe High Fibre Snacks Market, By Country, 2019 - 2022, USD Million

- TABLE 290 Europe High Fibre Snacks Market, By Country, 2023 - 2030, USD Million

- TABLE 291 Europe High Fibre Snacks Market, By Country, 2019 - 2022, Kilo Tonnes

- TABLE 292 Europe High Fibre Snacks Market, By Country, 2023 - 2030, Kilo Tonnes

- TABLE 293 Germany High Fibre Snacks Market, 2019 - 2022, USD Million

- TABLE 294 Germany High Fibre Snacks Market, 2023 - 2030, USD Million

- TABLE 295 Germany High Fibre Snacks Market, 2019 - 2022, Kilo Tonnes

- TABLE 296 Germany High Fibre Snacks Market, 2023 - 2030, Kilo Tonnes

- TABLE 297 Germany High Fibre Snacks Market, By Nature, 2019 - 2022, USD Million

- TABLE 298 Germany High Fibre Snacks Market, By Nature, 2023 - 2030, USD Million

- TABLE 299 Germany High Fibre Snacks Market, By Nature, 2019 - 2022, Kilo Tonnes

- TABLE 300 Germany High Fibre Snacks Market, By Nature, 2023 - 2030, Kilo Tonnes

- TABLE 301 Germany High Fibre Snacks Market, By Distribution Channel, 2019 - 2022, USD Million

- TABLE 302 Germany High Fibre Snacks Market, By Distribution Channel, 2023 - 2030, USD Million

- TABLE 303 Germany High Fibre Snacks Market, By Distribution Channel, 2019 - 2022, Kilo Tonnes

- TABLE 304 Germany High Fibre Snacks Market, By Distribution Channel, 2023 - 2030, Kilo Tonnes

- TABLE 305 Germany High Fibre Snacks Market, By Product, 2019 - 2022, USD Million

- TABLE 306 Germany High Fibre Snacks Market, By Product, 2023 - 2030, USD Million

- TABLE 307 Germany High Fibre Snacks Market, By Product, 2019 - 2022, Kilo Tonnes

- TABLE 308 Germany High Fibre Snacks Market, By Product, 2023 - 2030, Kilo Tonnes

The Global High Fibre Snacks Market size is expected to reach $48.4 billion by 2030, rising at a market growth of 9.6% CAGR during the forecast period. In the year 2022, the market attained a volume of 3,577.1 kilo tonnes, experiencing a growth of 9.9% (2019-2022).

Many health experts suggest people that they should add cereals and grains to their diets as it reduces the risk of heart disease and diabetes, which is fuelling the cereals and grains segment's growth. Consequently, the cereal and granola bars segment captured $11.8 billion by 2030. Dietary fiber is primarily derived from grains and cereals, including oats, barley, maize, rice, and wheat. The characteristic of dietary fiber is that it forms a substance when it comes in contact with abdominal fluid, slowing down digestion, which completes the absorption of nutrients from food, rendering them available for use by the body. It also aids in lowering blood levels of low-density lipoprotein, also known as poor cholesterol. Some of the factors impacting the market are increasing demand for healthy foods, rising popularity of convenience foods and technological and processing-related challenges. Some of the factors impacting the market are increasing demand for healthy foods, rising popularity of convenience foods and technological and processing-related challenges.

The primary driver of the market is the rising consumer demand for healthy foods to protect general health and reduce the risk of various lifestyle-related chronic health disorders. In the food category, customers are still looking for healthier options. Retail channels have embraced food goods incorporating valuable elements, including micronutrients, proteins, fiber, organic, plant-based, and clean-label products. The healthy snacks industry is experiencing rapid growth due to the increasing demand for convenient, ready-to-eat foods and on-the-go snacking. The busy lifestyle of modern consumers has made on-the-go products a popular choice, as they provide quick nutrition and a feeling of satiety, enabling people to get through their day quickly. Therefore, the introduction of on-the-go snacks will aid in the expansion of the market in the coming years.

However, the market is challenging for manufacturers facing various technological and processing-related obstacles. The texture and crispiness of snacks are critical factors that consumers notice when purchasing products, and they play a vital role in determining whether or not a snack is appealing. However, manufacturers face challenges when trying to reduce or remove fats and sugar and incorporate whole grains into their products, as doing so can negatively impact the moisture retention and binding capacity of ingredients, ultimately affecting the final texture of the product. Hence, the technological and processing difficulties associated with the production of high fiber snacks can hamper the expansion of the market.

Nature Outlook

Based on nature, the market is characterized into organic and conventional. In 2022, the conventional segment recorded the highest revenue share in the high fiber snacks market. The segment is expected to remain dominant during the forecast period. The growth of the high fiber snacks market in the food and beverage industry is due to its commercial application. High fiber food is in high demand because it is low in calories and rich in vitamins and nutrients, particularly for functional beverages.

Distribution Channel Outlook

Based on distribution channel, the market is characterized by supermarkets/hypermarkets, specialty stores, convenience stores, online retailers, and others. In 2022, the convenience stores segment recorded a significant revenue share in the high fiber snacks market. Convenience stores have gained significant popularity in recent years, especially in urban and suburban areas, primarily due to their convenience and accessibility. Convenience stores are particularly relevant for individuals who are short on time, requiring easy access to healthy snacks. Competitive pricing and discounts on healthy snacks further incentivize consumers to choose these options over less nutritious alternatives.

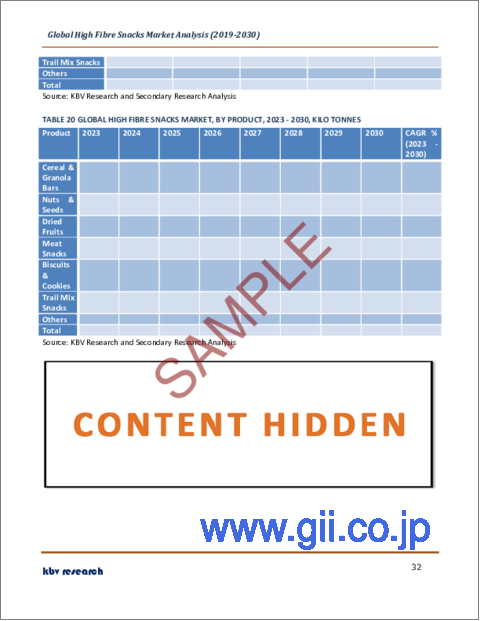

Product Outlook

Based on product, the market is characterized into cereal & granola bars, nuts & seeds, dried fruits, meat snacks, biscuits & cookies, trail mix snacks, and others. In 2022, the cookies and biscuits segment acquired a significant revenue share in the high fiber snacks market. The rise in demand for sugar-free cookies can be attributed to the desire to maintain a healthy lifestyle and lose weight. A significant portion of the young population is conscious of their sugar intake and tries to regulate it as much as possible to maintain weight.

Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. Region-wise, the high fiber snacks market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America segment recorded the highest revenue share in the High fiber snacks market. In recent years, particularly after the pandemic, the demand for nutrient-rich snacks has increased in the United States. The United States already consumes many snacks, but to reduce the health concerns associated with excessive snacking, consumers are placing a greater emphasis on consuming nutritious snacks. Another significant element driving the sales of healthy snacks in the region is the high supermarket and hypermarket expansion rates, combined with convenience businesses.

Strategies Developed in High Fibre Snacks Market

Jul-2023: General Mills, Inc. expanded its Cinnamon Toast Crunch and Cheerios portfolio with the addition of twice the amount of Vitamin D with the majority of Big G Cereals. Additionally, General Mills is introducing a major nutritional improvement in most Big G Cereals through its "Goodness We Grow Up On" campaign.

Jul-2023: Kellogg's India teamed up with Hershey's, an American multinational company, to launch Hershey's Chocos. Through this collaboration, the product produced would be successful both in taste and in providing the correct amount of nutrition. Additionally, this partnership has prospered in markets beyond India, like Japan and Australia.

May-2023: Kellogg Japan formed a partnership with Kirin Holdings, a Japanese beer and beverage holding company, to launch ll-Bran Immune Care. The new addition of Kellogg's portfolio is a functional food containing L. lactis strain Plasma (postbiotic) and fermented dietary fibre arabinoxylan. The product would help to improve intestinal health, bowel movements, maintaining immunity and health of people.

Feb-¬2023: Kind, a snack bar manufacturer under Mars ownership, expanded its portfolio with a new flavor: "Caramelized Biscuit Nut." This new addition combines peanuts, almonds, and cashews with a subtle caramel taste and notes of spiced biscuit flavorings. With 81% nuts, this bar is rich in fiber, gluten-free, and free from artificial flavors.

Dec¬2022: SNICKERS, part of Mars, launched SNICKERS Hi Protein bars. SNICKERS Hi featuring the classic SNICKERS taste with 20 grams of protein to meet consumer nutritional needs. Additionally, SNICKERS Hi Protein bars are sure to be a success, for dedicated fitness enthusiast, occasional exerciser, or simply seeking a tasty, high-protein snack.

Jan-2022: General Mills Inc. expanded its snack bar portfolio with the addition of the strawberry cheesecake flavoured cake bar, Fibre One 90. The fibre One 90 is made of a strawberry filling, layer of soft cake, cream cheese coating and topped with crunchy sprinkles. This product satisfied the sweet tooth cravings of the weight managers.

Feb-2021: Ardent Mills came into a partnership with Hinrichs Trading Company, provider of chickpea sourcing, cleaning and packaging services. Through this partnership, Ardent Mills invested in speciality ingredients and diversified its portfolio. Additionally, this deal helped to satisfy the consumer demand for plant-based speciality ingredients.

Jan-2021: Kellogg Co. introduced its Special K brand to the keto category with a new line of Special K Keto-Friendly Snack Bars. Kellogg's Special K Keto-Friendly Snack Bars made with ingredients including peanut butter or almond butter, peanut flour or almond flour, oat fiber, chicory root fiber, soy protein, cocoa butter, whey protein, and stevia.

Jan-2021: Ardent Mills introduced several speciality ingredients for their foodservice and bakery distributors. These ingredients helped the distributors meet the demand for plant-based speciality ingredients of their customers.

Nov-2020: Mars, Incorporated acquired KIND North America, a healthy snacking leader. KIND North America and KIND International has united to form a single entity spanning 35 countries. This organization is operating independently as a distinct business entity within the Mars Family of Companies.

Feb-2020: Ardent Mills acquired Andean Naturals, Inc., a wholesaler of organic quinoa. Through this acquisition, Ardent Mills provided its customers with quinoa and other products which are gluten-free.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include General Mills, Inc., Hodgson Mill, Inc., Bearded Brothers, LLC, Kellogg Company, Flowers Foods, Inc., Mars, Inc. (Kind LLC), Energy Bar Foods (Visionary Nutrition, LLC), Ardent Mills, Mojo Snacks and Grain Millers, Inc.

Scope of the Study

Market Segments covered in the Report:

By Nature (Volume, Kilo Tonnes, USD Million, 2019-2030)

- Conventional

- Organic

By Distribution Channel (Volume, Kilo Tonnes, USD Million, 2019-2030)

- Supermarkets/Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Retailers

- Others

By Product (Volume, Kilo Tonnes, USD Million, 2019-2030)

- Cereal & Granola Bars

- Nuts & Seeds

- Dried Fruits

- Meat Snacks

- Biscuits & Cookies

- Trail Mix Snacks

- Others

By Geography (Volume, Kilo Tonnes, USD Million, 2019-2030)

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Companies Profiled

- General Mills, Inc.

- Hodgson Mill, Inc.

- Bearded Brothers, LLC

- Kellogg Company

- Flowers Foods, Inc.

- Mars, Inc. (Kind LLC)

- Energy Bar Foods (Visionary Nutrition, LLC)

- Ardent Mills

- Mojo Snacks

- Grain Millers, Inc

Unique Offerings from KBV Research

- Exhaustive coverage

- Highest number of market tables and figures

- Subscription based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Chapter 1. Market Scope & Methodology

- 1.1 Market Definition

- 1.2 Objectives

- 1.3 Market Scope

- 1.4 Segmentation

- 1.4.1 Global High Fibre Snacks Market, by Nature

- 1.4.2 Global High Fibre Snacks Market, by Distribution Channel

- 1.4.3 Global High Fibre Snacks Market, by Product

- 1.4.4 Global High Fibre Snacks Market, by Geography

- 1.5 Methodology for the research

Chapter 2. Market at a Glance

- 2.1 Key highlights

Chapter 3. Market Overview

- 3.1 Introduction

- 3.1.1 Overview

- 3.1.1.1 Market Composition and Scenario

- 3.1.1 Overview

- 3.2 Key Factors Impacting the Market

- 3.2.1 Market Drivers

- 3.2.2 Market Restraints

- 3.3 Porter's Five Forces Analysis

Chapter 4. Strategies Developed in High Fibre Snacks Market

Chapter 5. Global High Fibre Snacks Market, By Nature

- 5.1 Global Conventional Market, By Region

- 5.2 Global Organic Market, By Region

Chapter 6. Global High Fibre Snacks Market, By Distribution Channel

- 6.1 Global Supermarkets/Hypermarkets Market, By Region

- 6.2 Global Specialty Stores Market, By Region

- 6.3 Global Convenience Stores Market, By Region

- 6.4 Global Online Retailers Market, By Region

- 6.5 Global Others Market, By Region

Chapter 7. Global High Fibre Snacks Market, By Product

- 7.1 Global Cereal & Granola Bars Market, By Region

- 7.2 Global Nuts & Seeds Market, By Region

- 7.3 Global Dried Fruits Market, By Region

- 7.4 Global Meat Snacks Market, By Region

- 7.5 Global Biscuits & Cookies Market, By Region

- 7.6 Global Trail Mix Snacks Market, By Region

- 7.7 Global Others Market, By Region

Chapter 8. Global High Fibre Snacks Market, By Region

- 8.1 North America High Fibre Snacks Market

- 8.1.1 North America High Fibre Snacks Market, By Nature

- 8.1.1.1 North America Conventional Market, By Country

- 8.1.1.2 North America Organic Market, By Country

- 8.1.2 North America High Fibre Snacks Market, By Distribution Channel

- 8.1.2.1 North America Supermarkets/Hypermarkets Market, By Country

- 8.1.2.2 North America Specialty Stores Market, By Country

- 8.1.2.3 North America Convenience Stores Market, By Country

- 8.1.2.4 North America Online Retailers Market, By Country

- 8.1.2.5 North America Others Market, By Country

- 8.1.3 North America High Fibre Snacks Market, By Product

- 8.1.3.1 North America Cereal & Granola Bars Market, By Country

- 8.1.3.2 North America Nuts & Seeds Market, By Country

- 8.1.3.3 North America Dried Fruits Market, By Country

- 8.1.3.4 North America Meat Snacks Market, By Country

- 8.1.3.5 North America Biscuits & Cookies Market, By Country

- 8.1.3.6 North America Trail Mix Snacks Market, By Country

- 8.1.3.7 North America Others Market, By Country

- 8.1.4 North America High Fibre Snacks Market, By Country

- 8.1.4.1 US High Fibre Snacks Market

- 8.1.4.1.1 US High Fibre Snacks Market, By Nature

- 8.1.4.1.2 US High Fibre Snacks Market, By Distribution Channel

- 8.1.4.1.3 US High Fibre Snacks Market, By Product

- 8.1.4.2 Canada High Fibre Snacks Market

- 8.1.4.2.1 Canada High Fibre Snacks Market, By Nature

- 8.1.4.2.2 Canada High Fibre Snacks Market, By Distribution Channel

- 8.1.4.2.3 Canada High Fibre Snacks Market, By Product

- 8.1.4.3 Mexico High Fibre Snacks Market

- 8.1.4.3.1 Mexico High Fibre Snacks Market, By Nature

- 8.1.4.3.2 Mexico High Fibre Snacks Market, By Distribution Channel

- 8.1.4.3.3 Mexico High Fibre Snacks Market, By Product

- 8.1.4.4 Rest of North America High Fibre Snacks Market

- 8.1.4.4.1 Rest of North America High Fibre Snacks Market, By Nature

- 8.1.4.4.2 Rest of North America High Fibre Snacks Market, By Distribution Channel

- 8.1.4.4.3 Rest of North America High Fibre Snacks Market, By Product

- 8.1.4.1 US High Fibre Snacks Market

- 8.1.1 North America High Fibre Snacks Market, By Nature

- 8.2 Europe High Fibre Snacks Market

- 8.2.1 Europe High Fibre Snacks Market, By Nature

- 8.2.1.1 Europe Conventional Market, By Country

- 8.2.1.2 Europe Organic Market, By Country

- 8.2.2 Europe High Fibre Snacks Market, By Distribution Channel

- 8.2.2.1 Europe Supermarkets/Hypermarkets Market, By Country

- 8.2.2.2 Europe Specialty Stores Market, By Country

- 8.2.2.3 Europe Convenience Stores Market, By Country

- 8.2.2.4 Europe Online Retailers Market, By Country

- 8.2.2.5 Europe Others Market, By Country

- 8.2.3 Europe High Fibre Snacks Market, By Product

- 8.2.3.1 Europe Cereal & Granola Bars Market, By Country

- 8.2.3.2 Europe Nuts & Seeds Market, By Country

- 8.2.3.3 Europe Dried Fruits Market, By Country

- 8.2.3.4 Europe Meat Snacks Market, By Country

- 8.2.3.5 Europe Biscuits & Cookies Market, By Country

- 8.2.3.6 Europe Trail Mix Snacks Market, By Country

- 8.2.3.7 Europe Others Market, By Country

- 8.2.4 Europe High Fibre Snacks Market, By Country

- 8.2.4.1 Germany High Fibre Snacks Market

- 8.2.4.1.1 Germany High Fibre Snacks Market, By Nature

- 8.2.4.1.2 Germany High Fibre Snacks Market, By Distribution Channel

- 8.2.4.1.3 Germany High Fibre Snacks Market, By Product

- 8.2.4.2 UK High Fibre Snacks Market

- 8.2.4.2.1 UK High Fibre Snacks Market, By Nature

- 8.2.4.2.2 UK High Fibre Snacks Market, By Distribution Channel

- 8.2.4.2.3 UK High Fibre Snacks Market, By Product

- 8.2.4.3 France High Fibre Snacks Market

- 8.2.4.3.1 France High Fibre Snacks Market, By Nature

- 8.2.4.3.2 France High Fibre Snacks Market, By Distribution Channel

- 8.2.4.3.3 France High Fibre Snacks Market, By Product

- 8.2.4.4 Russia High Fibre Snacks Market

- 8.2.4.4.1 Russia High Fibre Snacks Market, By Nature

- 8.2.4.4.2 Russia High Fibre Snacks Market, By Distribution Channel

- 8.2.4.4.3 Russia High Fibre Snacks Market, By Product

- 8.2.4.5 Spain High Fibre Snacks Market

- 8.2.4.5.1 Spain High Fibre Snacks Market, By Nature

- 8.2.4.5.2 Spain High Fibre Snacks Market, By Distribution Channel

- 8.2.4.5.3 Spain High Fibre Snacks Market, By Product

- 8.2.4.6 Italy High Fibre Snacks Market

- 8.2.4.6.1 Italy High Fibre Snacks Market, By Nature

- 8.2.4.6.2 Italy High Fibre Snacks Market, By Distribution Channel

- 8.2.4.6.3 Italy High Fibre Snacks Market, By Product

- 8.2.4.7 Rest of Europe High Fibre Snacks Market

- 8.2.4.7.1 Rest of Europe High Fibre Snacks Market, By Nature

- 8.2.4.7.2 Rest of Europe High Fibre Snacks Market, By Distribution Channel

- 8.2.4.7.3 Rest of Europe High Fibre Snacks Market, By Product

- 8.2.4.1 Germany High Fibre Snacks Market

- 8.2.1 Europe High Fibre Snacks Market, By Nature

- 8.3 Asia Pacific High Fibre Snacks Market

- 8.3.1 Asia Pacific High Fibre Snacks Market, By Nature

- 8.3.1.1 Asia Pacific Conventional Market, By Country

- 8.3.1.2 Asia Pacific Organic Market, By Country

- 8.3.2 Asia Pacific High Fibre Snacks Market, By Distribution Channel

- 8.3.2.1 Asia Pacific Supermarkets/Hypermarkets Market, By Country

- 8.3.2.2 Asia Pacific Specialty Stores Market, By Country

- 8.3.2.3 Asia Pacific Convenience Stores Market, By Country

- 8.3.2.4 Asia Pacific Online Retailers Market, By Country

- 8.3.2.5 Asia Pacific Others Market, By Country

- 8.3.3 Asia Pacific High Fibre Snacks Market, By Product

- 8.3.3.1 Asia Pacific Cereal & Granola Bars Market, By Country

- 8.3.3.2 Asia Pacific Nuts & Seeds Market, By Country

- 8.3.3.3 Asia Pacific Dried Fruits Market, By Country

- 8.3.3.4 Asia Pacific Meat Snacks Market, By Country

- 8.3.3.5 Asia Pacific Biscuits & Cookies Market, By Country

- 8.3.3.6 Asia Pacific Trail Mix Snacks Market, By Country

- 8.3.3.7 Asia Pacific Others Market, By Country

- 8.3.4 Asia Pacific High Fibre Snacks Market, By Country

- 8.3.4.1 China High Fibre Snacks Market

- 8.3.4.1.1 China High Fibre Snacks Market, By Nature

- 8.3.4.1.2 China High Fibre Snacks Market, By Distribution Channel

- 8.3.4.1.3 China High Fibre Snacks Market, By Product

- 8.3.4.2 Japan High Fibre Snacks Market

- 8.3.4.2.1 Japan High Fibre Snacks Market, By Nature

- 8.3.4.2.2 Japan High Fibre Snacks Market, By Distribution Channel

- 8.3.4.2.3 Japan High Fibre Snacks Market, By Product

- 8.3.4.3 India High Fibre Snacks Market

- 8.3.4.3.1 India High Fibre Snacks Market, By Nature

- 8.3.4.3.2 India High Fibre Snacks Market, By Distribution Channel

- 8.3.4.3.3 India High Fibre Snacks Market, By Product

- 8.3.4.4 South Korea High Fibre Snacks Market

- 8.3.4.4.1 South Korea High Fibre Snacks Market, By Nature

- 8.3.4.4.2 South Korea High Fibre Snacks Market, By Distribution Channel

- 8.3.4.4.3 South Korea High Fibre Snacks Market, By Product

- 8.3.4.5 Singapore High Fibre Snacks Market

- 8.3.4.5.1 Singapore High Fibre Snacks Market, By Nature

- 8.3.4.5.2 Singapore High Fibre Snacks Market, By Distribution Channel

- 8.3.4.5.3 Singapore High Fibre Snacks Market, By Product

- 8.3.4.6 Malaysia High Fibre Snacks Market

- 8.3.4.6.1 Malaysia High Fibre Snacks Market, By Nature

- 8.3.4.6.2 Malaysia High Fibre Snacks Market, By Distribution Channel

- 8.3.4.6.3 Malaysia High Fibre Snacks Market, By Product

- 8.3.4.7 Rest of Asia Pacific High Fibre Snacks Market

- 8.3.4.7.1 Rest of Asia Pacific High Fibre Snacks Market, By Nature

- 8.3.4.7.2 Rest of Asia Pacific High Fibre Snacks Market, By Distribution Channel

- 8.3.4.7.3 Rest of Asia Pacific High Fibre Snacks Market, By Product

- 8.3.4.1 China High Fibre Snacks Market

- 8.3.1 Asia Pacific High Fibre Snacks Market, By Nature

- 8.4 LAMEA High Fibre Snacks Market

- 8.4.1 LAMEA High Fibre Snacks Market, By Nature

- 8.4.1.1 LAMEA Conventional Market, By Country

- 8.4.1.2 LAMEA Organic Market, By Country

- 8.4.2 LAMEA High Fibre Snacks Market, By Distribution Channel

- 8.4.2.1 LAMEA Supermarkets/Hypermarkets Market, By Country

- 8.4.2.2 LAMEA Specialty Stores Market, By Country

- 8.4.2.3 LAMEA Convenience Stores Market, By Country

- 8.4.2.4 LAMEA Online Retailers Market, By Country

- 8.4.2.5 LAMEA Others Market, By Country

- 8.4.3 LAMEA High Fibre Snacks Market, By Product

- 8.4.3.1 LAMEA Cereal & Granola Bars Market, By Country

- 8.4.3.2 LAMEA Nuts & Seeds Market, By Country

- 8.4.3.3 LAMEA Dried Fruits Market, By Country

- 8.4.3.4 LAMEA Meat Snacks Market, By Country

- 8.4.3.5 LAMEA Biscuits & Cookies Market, By Country

- 8.4.3.6 LAMEA Trail Mix Snacks Market, By Country

- 8.4.3.7 LAMEA Others Market, By Country

- 8.4.4 LAMEA High Fibre Snacks Market, By Country

- 8.4.4.1 Brazil High Fibre Snacks Market

- 8.4.4.1.1 Brazil High Fibre Snacks Market, By Nature

- 8.4.4.1.2 Brazil High Fibre Snacks Market, By Distribution Channel

- 8.4.4.1.3 Brazil High Fibre Snacks Market, By Product

- 8.4.4.2 Argentina High Fibre Snacks Market

- 8.4.4.2.1 Argentina High Fibre Snacks Market, By Nature

- 8.4.4.2.2 Argentina High Fibre Snacks Market, By Distribution Channel

- 8.4.4.2.3 Argentina High Fibre Snacks Market, By Product

- 8.4.4.3 UAE High Fibre Snacks Market

- 8.4.4.3.1 UAE High Fibre Snacks Market, By Nature

- 8.4.4.3.2 UAE High Fibre Snacks Market, By Distribution Channel

- 8.4.4.3.3 UAE High Fibre Snacks Market, By Product

- 8.4.4.4 Saudi Arabia High Fibre Snacks Market

- 8.4.4.4.1 Saudi Arabia High Fibre Snacks Market, By Nature

- 8.4.4.4.2 Saudi Arabia High Fibre Snacks Market, By Distribution Channel

- 8.4.4.4.3 Saudi Arabia High Fibre Snacks Market, By Product

- 8.4.4.5 South Africa High Fibre Snacks Market

- 8.4.4.5.1 South Africa High Fibre Snacks Market, By Nature

- 8.4.4.5.2 South Africa High Fibre Snacks Market, By Distribution Channel

- 8.4.4.5.3 South Africa High Fibre Snacks Market, By Product

- 8.4.4.6 Nigeria High Fibre Snacks Market

- 8.4.4.6.1 Nigeria High Fibre Snacks Market, By Nature

- 8.4.4.6.2 Nigeria High Fibre Snacks Market, By Distribution Channel

- 8.4.4.6.3 Nigeria High Fibre Snacks Market, By Product

- 8.4.4.7 Rest of LAMEA High Fibre Snacks Market

- 8.4.4.7.1 Rest of LAMEA High Fibre Snacks Market, By Nature

- 8.4.4.7.2 Rest of LAMEA High Fibre Snacks Market, By Distribution Channel

- 8.4.4.7.3 Rest of LAMEA High Fibre Snacks Market, By Product

- 8.4.4.1 Brazil High Fibre Snacks Market

- 8.4.1 LAMEA High Fibre Snacks Market, By Nature

Chapter 9. Company Profiles

- 9.1 General Mills, Inc.

- 9.1.1 Company Overview

- 9.1.2 Financial Analysis

- 9.1.3 Segmental and Regional Analysis

- 9.1.4 Research & Development Expense

- 9.1.5 Recent strategies and developments:

- 9.1.5.1 Product Launches and Product Expansions:

- 9.1.6 SWOT Analysis

- 9.2 Hodgson Mill, Inc.

- 9.2.1 Company Overview

- 9.2.2 SWOT Analysis

- 9.3 Bearded Brothers, LLC

- 9.3.1 Company Overview

- 9.3.2 SWOT Analysis

- 9.4 Kellogg Company

- 9.4.1 Company Overview

- 9.4.2 Financial Analysis

- 9.4.3 Segmental and Regional Analysis

- 9.4.4 Research & Development Expense

- 9.4.5 Recent strategies and developments:

- 9.4.5.1 Partnerships, Collaborations, and Agreements:

- 9.4.5.2 Product Launches and Product Expansions:

- 9.4.6 SWOT Analysis

- 9.5 Flowers Foods, Inc.

- 9.5.1 Company Overview

- 9.5.2 Financial Analysis

- 9.5.3 Research & Development Expenses

- 9.5.4 SWOT Analysis

- 9.6 Mars, Inc. (Kind LLC)

- 9.6.1 Company Overview

- 9.6.2 Recent strategies and developments:

- 9.6.2.1 Product Launches and Product Expansions:

- 9.6.2.2 Acquisition and Mergers:

- 9.6.3 SWOT Analysis

- 9.7 Energy Bar Foods (Visionary Nutrition, LLC)

- 9.7.1 Company Overview

- 9.7.2 SWOT Analysis

- 9.8 Ardent Mills

- 9.8.1 Company Overview

- 9.8.2 Recent strategies and developments:

- 9.8.2.1 Partnerships, Collaborations, and Agreements:

- 9.8.2.2 Product Launches and Product Expansions:

- 9.8.2.3 Acquisition and Mergers:

- 9.8.3 SWOT Analysis

- 9.9 Mojo Snacks

- 9.9.1 Company Overview

- 9.9.2 SWOT Analysis

- 9.10. Grain Millers, Inc.

- 9.10.1 Company Overview

- 9.10.2 SWOT Analysis