|

|

市場調査レポート

商品コード

1282234

スマートシティ市場:成長、動向、市場予測(2023年~2028年)Smart Cities Market: Growth, Trends & Market Forecasts 2023-2028 |

||||||

| スマートシティ市場:成長、動向、市場予測(2023年~2028年) |

|

出版日: 2023年05月30日

発行: Juniper Research Ltd

ページ情報: 英文

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

当レポートでは、世界のスマートシティ市場について調査し、市場の概要とともに、スマートシティ技術の導入動向、スマートシティランキング、今後5年間の市場予測などを提供しています。

目次

第1章 重要なポイントと戦略的推奨事項

第2章 スマートシティ-市場情勢

- イントロダクション

- 定義と範囲

- 主要な動向と促進要因

- 主要な課題

第3章 スマートシティ技術とセグメント分析

- イントロダクション

- スマートビルディング

- スマートグリッド

- スマート照明

- スマートな交通管理と駐車場

- スポットライト:スマートコリドー

- MaaS

第4章 スマートシティランキング

- スマートシティランキング

- トップ20のスマートシティ:都市のプロファイル

- 上海

- ニューヨーク

- トロント

- ソウル

- 深セン

- シドニー

- 北京

- ベルリン

- モントリオール

- 広州

- ロンドン

- バルセロナ

- 東京

- シカゴ

- ローマ

- シンガポール

- マドリッド

- メルボルン

- モスクワ

第5章 スマートシティ市場予測

- イントロダクション

- 予測セグメント

- 調査手法と前提

- MaaS

- スマートグリッド

- スマート照明

- スマート交通管理

- スマートパーキング

- 混雑管理

- 排出削減

- 概要予測

- スマートシティの省エネ

- スマートシティの排出量削減

- スマートシティのコスト削減

- スマートシティの支出

- MaaSの予測

- MaaSの収益

- スマートグリッドの予測

- スマートグリッドソフトウェア収益

- スマート照明予測

- スマート照明の支出

- スマート交通管理の予測

- スマート交差点のハードウェアとソフトウェアの支出

- スマートパーキングのハードウェアとソフトウェアへの年間支出

REPORT OVERVIEW

Juniper Research's new “Smart Cities Market” research report provides an invaluable guide to the evolution and future promise of a wide number of smart technologies contributing to this highly important sector. Covering the environmental impact of the digital technologies in the market improving public services and urban infrastructure, such as artificial intelligence, connectivity and sensors, the report gives key insights into smart city initiatives and projects. It also extensively covers the capabilities smart city solutions enable, such as improving city quality of life, reducing air pollution and increasing economic growth. The research shows where technological innovation is at its best, and as such, is key to understanding this important market.

The research scores 50 cities on their smart capabilities to produce a ranking that highlights the best examples of urban innovation in the world; providing a critical source for intelligence on this rapidly moving market.

The report also presents extensive market forecasts covering the most popular smart city applications; delivering detailed market sizing across smart lighting, smart traffic management, smart grid deployment and MaaS (Mobility-as-a Service). The research suite comprises:

- Strategy & Forecasts (PDF)

- 5-year Market Sizing & Forecast Spreadsheet (Excel)

- 12 Months' Access to harvest Online Data Platform

KEY FEATURES

- Market Dynamics: Provides a detailed assessment of market drivers and the key trends within the smart cities market, as well as an in-depth evaluation of the future growth of the industry and readiness for further disruption. This enables readers to understand the critical innovations driving this market forward.

- Key Takeaways & Strategic Recommendations: Featuring major opportunities and crucial factors for smart cities development highlighted across the landscape; making for important reading for key stakeholders, including smart cities platforms, city authorities and others.

- Ranking: A scoring of the capabilities and features of the world's leading smart cities; showcasing the best innovations in this area. This report presents a ranking of the top 20 smart cities in the world today, scored and ranked from a wider list of 50 innovative cities. For each of the top 20 cities, a full profile is provided of the city's initiatives and what future developments we anticipate.

- Benchmark Industry Forecasts: 5-year forecasts for deployments of smart city technologies; covering the installed base, market value, shipments and environmental impact of the following technologies: smart lighting, maas, smart traffic management, smart parking and smart grid. These are split across the following 60 countries, split by our 8 key regions:

- North America:

- Canada, US

- Latin America:

- Argentina, Brazil, Chile, Colombia, Ecuador, Mexico, Peru, Uruguay

- West Europe:

- Austria, Belgium, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, UK

- Central & East Europe:

- Croatia, Czech Republic, Hungary, Poland, Romania, Russia, Turkey, Ukraine

- Far East & China:

- China, Hong Kong, Japan, South Korea

- Indian Subcontinent:

- Bangladesh, India, Nepal, Pakistan

- Rest of Asia Pacific:

- Australia, Indonesia, Malaysia, New Zealand, Philippines, Singapore, Thailand, Vietnam

- Africa & Middle East:

- Algeria, Egypt, Israel, Kenya, Kuwait, Nigeria, Qatar, Saudi Arabia, South Africa, United Arab Emirates

KEY QUESTIONS ANSWERED

- 1. What will the value of this market be globally in 2028?

- 2. What are the leading smart cities in 2023?

- 3. What obstacles do deployments need to overcome?

- 4. What forms of connectivity and analytics do smart deployments in cities need?

- 5. What are the best examples of smart city technologies and how can they be emulated?

COMPANIES REFERENCED

- Case Studied: BVG, Jelbi, NEOM, Siemens, Verizon.

- Mentioned: 51World, Accenture, ACCONIA, Areti, Argonne, AWS (Amazon Web Services), Baidu, Barcelona Innova Lab, ByteDance, Cambrian, CIC, Cisco, Didi, Divvy, EE, EMT (Municipal Transport Company of Madrid), Enowa, Ericsson, Google, Helbiz, Huawei, HumanForest, IBM, JapanTaxi, KDDI, KDDI, Lime, Lyft, Mapit, McKinsey, MEGVII, Millennium Garages, Mobility House, Motional, Niederbarnimer Eisenbahn, Nihon Kotsu, Nokia, Oracle, Orange, ParkNYC, Rider Dome, RMV (Rhein-Main-Verkehrsverbund), Ryerson University, Sony, Spin, STM (Sociétéde Transport de Montréal), Superpedestrian, TfL (Transport for London), Three, Tonomus, Trafi, Transit Wireless, Vodafone, Volocopter, Western Sydney Airport, WeTaxi, Xpeng.

DATA & INTERACTIVE FORECAST

The “Smart Cities” forecast suite includes 5-year forecasts for this market, including the following:

- Forecasts for the following segments:

- Smart Lighting

- MaaS

- Smart Traffic Management

- Smart Parking

- Smart Grid

- The following forecasts are provided on a segment-by-segment basis

- Installed Base of Devices/Sensors

- Devices Shipped

- Hardware and Software Spend

- Power Consumption Saved

- CO2e Emissions Saved

- Geographical splits: 60 countries

- Number of tables: 121 tables

- Number of datapoints: Over 51,600 datapoints

harvest: Our online data platform, harvest, contains the very latest market data and is updated throughout the year. This is a fully featured platform; enabling clients to better understand key data trends and manipulate charts and tables; overlaying different forecasts within the one chart - using the comparison tool. Empower your business with our market intelligence centre, and get alerted whenever your data is updated.

Interactive Excels (IFxl): Our IFxl tool enables clients to manipulate both forecast data and charts, within an Excel environment, to test their own assumptions using the interactive scenario tool and compare selected markets side by side in customised charts and tables. IFxls greatly increase a clients' ability to both understand a particular market and to integrate their own views into the model.

FORECAST SUMMARY

Juniper Research found that Shanghai is the leading smart city in 2023, ranked first for the second year in a row.

The top 5 smart cities ranked by Juniper Research are:

|

|

The ranking of 50 world cities is based on an evaluation of many different smart city aspects, covering transportation and infrastructure, energy and lighting, city management and technology, and urban connectivity.

Shanghai is leading due to its Suishenban Citizen Cloud, which provides access for over 1,000 different services for city residents, as well as its strong deployment of 5G, and its use of innovative technologies including digital twins. The leading cities in this ranking have all rolled out services that are effectively harnessing data and connectivity to improve citizen experiences.

Shanghai has taken a joined-up approach to data, building not only a robust and all-encompassing data platform, but also the connectivity to underpin every aspect of this. This joined-up approach is the biggest takeaway for rival cities wanting to emulate Shanghai's success, and should be a part of any smart city initiative to ensure success.

- Cost savings from smart city deployments are forecast to reach $249 billion by 2028 globally, from $96 billion in 2023; representing growth of 158%.

- Cost savings represent the monetary impacts of reduced energy usage and emissions from the deployment of smart grid, smart traffic management and smart street lighting.

- These massive savings are a major driver of smart city deployments, and will equate to almost three times the spend on smart city software and hardware by 2028, showing a clear path to return on investment for cities

Table of Contents

1. Key Takeaways & Strategic Recommendations

- 1.1. Key Takeaways

- 1.2. Strategic Recommendations

2. Smart Cities - Market Landscape

- 2.1. Introduction

- 2.2. Definitions and Scope

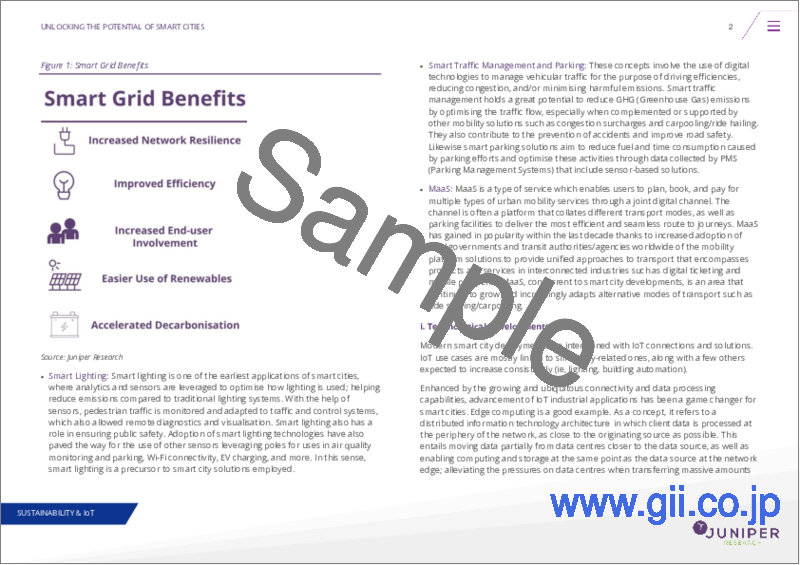

- Figure 2.1: Smart Grid

- 2.3. Key Trends & Drivers

- i. Environmental Concerns

- ii. Technological Developments

- Figure 2.2: Time-critical Use Cases across Industries

- iii. The Role of Connectivity

- 2.4. Key Challenges

- i. Cost

- ii. The Built Environment

3. Smart City Technologies & Segment Analysis

- 3.1. Introduction

- 3.1.1. Smart Buildings

- i. Juniper Research's View

- 3.1.2. Smart Grid

- i. Juniper Research's View

- Figure 3.1: Smart Meter Deployments by State, April 2023 as a Percentage of Customers

- 3.1.3. Smart Lighting

- i. Juniper Research's View

- 3.1.4. Smart Traffic Management and Parking

- i. Juniper Research's View

- 3.1.5. Spotlight: Smart Corridors

- i. Juniper Research's View

- 3.1.6. MaaS

- i. Juniper Research's View

- 3.1.1. Smart Buildings

4. Smart City Ranking

- 4.1. Smart City Ranking

- Table 4.1: Smart City Ranking Criteria

- Table 4.2: Juniper Research Smart City Ranking

- 4.2. Top 20 Smart Cities: City Profiles

- 4.2.1. Shanghai

- 4.2.2. New York

- 4.2.3. Toronto

- 4.2.4. Seoul

- 4.2.5. Shenzhen

- 4.2.6. Sydney

- 4.2.7. Beijing

- 4.2.8. Berlin

- 4.2.9. Montréal

- 4.2.10. Guangzhou

- 4.2.11. London

- 4.2.12. Barcelona

- 4.2.13. Tokyo

- 4.2.14. Chicago

- 4.2.16. Rome

- 4.2.17. Singapore

- 4.2.18. Madrid

- 4.2.19. Melbourne

- 4.2.20. Moscow

5. Smart Cities Market Forecasts

- 5.1. Introduction

- 5.2. Forecast Segments

- 5.3. Methodology & Assumptions

- 5.3.1. MaaS

- i. Users & Revenue Forecast Methodology

- Figure 5.1: MaaS Users & Revenue Methodology

- ii. Achievable Savings Forecast Methodology

- Figure 5.2: Consumer MaaS Achievable Savings Forecast Methodology

- i. Users & Revenue Forecast Methodology

- 5.3.2. Smart Grid

- Figure 5.3: Smart Grid Forecast Methodology

- 5.3.3. Smart Lighting

- Figure 5.4: Smart Lighting Energy Savings Forecast Methodology

- Figure 5.5: Smart Lighting Market Value Forecast Methodology

- 5.3.4. Smart Traffic Management

- i. Smart Intersections

- Figure 5.6: Smart Intersections Forecast Methodology

- i. Smart Intersections

- 5.3.5. Smart Parking

- Figure 5.7: Smart Parking Forecast Methodology

- 5.3.6. Congestion Management

- Figure 5.8: Congestion Management Forecast Methodology

- 5.3.7. Emissions Reduction

- Figure 5.9: Emissions Reduction Forecast Methodology

- 5.3.1. MaaS

- 5.4. Summary Forecasts

- 5.4.1. Smart Cities Energy Savings

- Figure & Table 5.10: Smart Cities Energy Savings (TWh), Spilt by Sector, 2023-2028

- 5.4.2. Smart Cities Emissions Savings

- Figure & Table 5.11: Smart Cities Emissions Savings (MMT CO2e), Spilt by Sector, 2023-2028

- 5.4.3. Smart Cities Cost Savings

- Figure & Table 5.12: Smart Cities Combined Cost Savings ($m), Split by Sector, 2023-2028

- 5.4.4. Smart Cities Spend

- Figure & Table 5.13: Smart Cities Hardware & Software Spend ($m), Split by Sector, 2023-2028

- 5.4.1. Smart Cities Energy Savings

- 5.5. Mobility-as-a-Service Forecasts

- 5.5.1. Mobility-as-a-Service Revenue

- Figure & Table 5.14: Total MaaS Revenue ($m), Split by 8 Key Regions, 2023-2028

- 5.5.1. Mobility-as-a-Service Revenue

- 5.6. Smart Grid Forecasts

- 5.6.1. Smart Grid Software Revenue

- Figure & Table 5.3: Smart Grid Annual Software Spend ($m), Split by 8 Key Regions, 2023-2028

- 5.6.1. Smart Grid Software Revenue

- 5.7. Smart Lighting Forecasts

- 5.7.1. Smart Lighting Spend

- Figure & Table 5.15: Smart Lighting Hardware & Software Spend ($m), Split by Key Regions, 2023-2028

- 5.7.1. Smart Lighting Spend

- 5.8. Smart Traffic Management Forecasts

- 5.8.1. Smart Intersection Hardware & Software Spend

- Figure & Table 5.16: Total Annual Spend on Smart Intersection Hardware & Software ($m), Split by 8 Key Regions, 2023-2028

- 5.8.2. Annual Spend on Smart Parking Hardware & Software

- Figure & Table 5.17: Total Annual Spend on Smart Parking Hardware & Software ($m), Split by 8 Key Regions, 2023-2028

- 5.8.1. Smart Intersection Hardware & Software Spend