|

|

市場調査レポート

商品コード

1816818

A2A決済市場:2025-2030年A2A Payments Market: 2025-2030 |

||||||

|

|||||||

| A2A決済市場:2025-2030年 |

|

出版日: 2025年09月23日

発行: Juniper Research Ltd

ページ情報: 英文

納期: 即日から翌営業日

|

概要

付加価値サービスの進化により、世界のA2A取引額は2030年に195兆米ドルに到達

| 主要統計 | |

|---|---|

| 2025年の世界のA2A取引: | 540億 |

| 2029年の世界のA2A取引: | 10億 |

| 2025年から2030年にかけてのA2A取引の成長: | 83% |

| 予測期間: | 2025-2030年 |

当調査スイートは、急速に変化するA2A決済の市場を詳細に分析しており、A2A決済サービスプロバイダーが主要な決済動向や課題、潜在的な成長機会、競争環境を理解できるよう支援します。

当スイートには、A2A決済市場の将来成長をマッピングするデータへのアクセスが含まれています。詳細な調査では、市場における最新の機会や動向を明らかにし、A2A決済サービスプロバイダー19社の広範な分析を盛り込んだ洞察的な資料を提供します。既存の決済インフラとの互換性に関する課題、企業向けの低コスト、顧客体験の向上といった側面もレポート全体で取り上げています。

これらの要素から、当スイートは、急成長するA2A決済市場を理解するための有効なツールとなり、A2A決済ベンダーが将来の戦略を策定し、顧客や取引先に効果的かつ効率的な決済サービスを提供することを可能にします。他に類を見ない調査範囲により、本スイートは、この複雑な市場の将来を測るうえで非常に有用なリソースとなるでしょう。

主な特徴

- 市場力学:A2A決済分野における主要な決済動向や市場拡大に伴う課題についての洞察を提供します。各市場における専用ソリューションの不足、決済ソリューションに関する一般認知度の低さ、潜在的な不正リスクといった課題に対応し、A2A決済が利用されている複数の利用事例を分析しています。また、A2A決済の将来展望についても提示します。

- 主な要点と戦略的提言:市場における重要な成長機会や調査結果を詳細に分析するとともに、A2A決済ソリューションプロバイダーに向けて、新たな動向への対応や市場の今後の進化に関する戦略的提言を示しています。

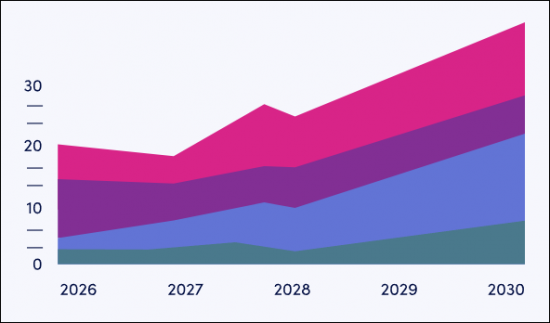

- ベンチマーク業界予測:予測データには、A2A決済を店舗内、オンライン、P2P、越境、B2B、B2Cに分けた分析が含まれています。各セグメントについて、取引件数や平均取引額といった指標が示されています。

- Juniper Researchの競合リーダーボード:A2A決済ベンダー19社の能力および対応力を評価しています。

サンプルビュー

市場データ&予測レポート

サンプル

市場動向&戦略レポート

市場データ&予測レポート

当調査スイートには、70の表と27,000以上のデータポイントからなる予測データ一式へのアクセスが含まれています。

サマリーには以下の指標が含まれます:

- A2A決済取引件数

- A2A決済取引額

- A2A決済ユーザー数

これらの指標は、以下のセグメントごとにも提供されています:

- 店舗内決済

- オンライン決済 (eコマース)

- P2P決済

- 越境消費者決済

- B2B決済 (越境・国内)

- B2C決済 (越境・国内)

Juniper Researchのインタラクティブ予測 (Excel) には以下の機能があります:

- 統計分析:データ期間中の全地域・国について表示される特定の指標を検索できます。グラフは簡単に変更でき、クリップボードへのエクスポートも可能です。

- 国別データツール:このツールでは、予測期間中のすべての地域と国の指標を確認することができます。ユーザーは検索バーで表示される指標を絞り込むことができます。

- 国別比較ツール:各国を選択して比較することができます。このツールには、グラフをエクスポートする機能が含まれています。

- What-if分析:5つのインタラクティブなシナリオを通じて、ユーザーは予測の前提条件と比較することができます。

競合リーダーボードレポート

競合リーダーボードレポートでは、主要ベンダー19社の詳細な評価と市場での位置付けを掲載しています。これらのベンダーは、キャパシティと能力の評価、提供するA2A決済製品の範囲、競合他社を引き離す追加技術に基づいて、確立されたリーダー、有力なチャレンジャー、またはディスラプター兼チャレンジャーに位置付けられています。

掲載企業:

|

|

|

目次

市場動向・戦略

第1章 重要ポイントと戦略的提言

- 重要ポイント

- 戦略的提言

第2章 市場情勢

- イントロダクション

- A2A決済のタイプ

- 周辺技術

- インスタントペイメントレール

- オープンバンキング

- QRコード決済

- NFC

- 現在の市場

- A2A決済システム

- A2A決済の動向

- 主な促進要因

- 新たな動向

- A2A決済の利点と課題

- 利点

- 課題

第3章 セグメント分析

- 小売、eコマース、その他のサービス

- P2P

- 越境

- B2B・B2C

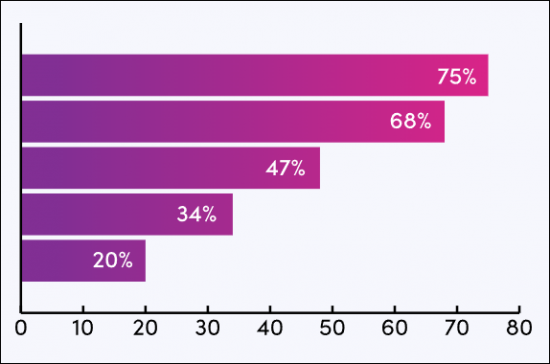

第4章 国別準備指数

- 国別準備指数:イントロダクション

- 焦点市場

- 成長市場

- 新興国市場

- Juniper Research国別準備指数ヒートマップ

競合リーダーボード

第1章 Juniper Research競合リーダーボード

第2章 企業プロファイル

- ベンダープロファイル

- Aeropay

- Banked

- Brankas

- Brite Payments

- Dwolla

- Fiserv

- GoCardless

- Ivy

- Mastercard

- Plaid

- Prometeo

- Salt Edge

- Token.io

- TrueLayer

- Trustly

- Visa

- Volt

- Worldline

- Yapily

- 評価手法

- 関連調査

データ・予測

第1章 イントロダクション・調査手法

第2章 消費者A2A:サマリー

- A2A決済の利用者総数

- 消費者A2A取引の総数

- 消費者A2A取引の総額

第3章 店舗内決済

- 店舗内A2A決済の利用者総数

- 店舗内A2A決済の総取引数

- 店舗内A2A決済の総取引額

第4章 電子商取引の決済

- オンラインA2A決済の利用者総数

- オンラインA2A決済の総取引数

- オンラインA2A決済の総取引額

第5章 P2P決済

- P2P A2A決済の利用者総数

- P2P A2A決済の総取引数

- P2P A2A決済の総取引額

第6章 越境決済

- 越境A2A決済の利用者総数

- 越境消費者A2A決済の総取引数

- 越境消費者A2A決済の総取引額

第7章 B2B決済

- 国内A2A B2B取引総数

- 国内A2A B2B取引総額

- 越境A2A B2B取引総数

- 越境A2A B2B取引総額

第8章 B2C決済

- 国内A2A B2C取引総数

- 国内A2A B2C取引総額

- 越境A2A B2C取引総数

- 越境A2A B2C取引総額