|

市場調査レポート

商品コード

1761192

非接触決済市場データ:2025-2030年Contactless Payments Market Data: 2025-2030 |

||||||

|

|||||||

| 非接触決済市場データ:2025-2030年 |

|

出版日: 2025年07月07日

発行: Juniper Research Ltd

ページ情報: 英文

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

”非接触決済の市場規模は2030年までに2倍の18兆1,000億米ドルへ - NFCチケット発券の展開が成長を加速"

| 主要統計 | |

|---|---|

| 2025年の総取引額: | 8兆7,500億ドル |

| 2030年の総取引額: | 18兆1,000億米ドル |

| 2025年から2030年の市場成長率: | 106.9% |

| 予測期間: | 2025-2030年 |

当レポートは、非接触決済技術を搭載したモバイルウォレットの普及、非接触トランザクションの成長とその関連価値など、市場全体を網羅したデータを提供しています。このデータスイートには、139の表と6万以上のデータポイントからなる予測データ一式へのアクセスと、成長の理由を分析した付属レポートが含まれています。本調査スイートに含まれる指標は以下の通りです。

- 非接触決済の利用者数

- 非接触決済の総取引額

- 非接触決済の年間総取引額

レポート内容はすべて英語で提供されます。

主な特徴:

これらの指標は、以下の主要セグメント別に分類されています:

- 非接触カード

- モバイル決済

- Apple Pay

- Google Pay

- Samsung Pay

- その他のOEMペイ

- ウェアラブル決済

- 非接触チケット決済

予測データには、非接触トークナイゼーションと非接触対応ATMの市場規模も含まれています。

データ&インタラクティブ予測

インタラクティブ予測 (Excel) には、次の機能が含まれています:

- 統計分析:データ期間中の全地域・国について表示される特定の指標を検索できます。グラフは簡単に変更でき、クリップボードにエクスポートできます。

- 国別データツール:予測期間中のすべての地域と国の指標を見ることができます。検索バーで表示される指標を絞り込むことができます。

- 国別比較ツール:特定の国を選択して比較することができます。このツールには、グラフをエクスポートする機能が含まれています。

- What-if分析:5つの対話型シナリオにより、ユーザーは予測の前提条件と比較することができます。

サンプルビュー

市場データ&予測レポート

目次

第1章 イントロダクション

- 非接触決済における主要な動向と動向

- 非接触決済がデフォルトの選択肢

- 店舗でのA2A非接触決済の拡大

- ソフトPOSが非接触決済の新たな市場を開拓

- 国境を越えたQRコード決済スキームが東南アジアの非接触決済を促進

- 非接触決済の次の進化としての生体認証

- QRコード決済

- i.強み

- ii.弱み

- NFC

- i.強み

- ii.弱み

- 結論

第2章 調査手法と前提

第3章 予測のサマリー

- 非接触決済の利用予測

- 非接触メカニズム:カード、モバイル、ウェアラブル

- 非接触決済に使用されるモバイルデバイスの数

- 非接触取引件数:小売決済およびチケット発券

- 非接触取引額:小売決済およびチケット発券

第4章 非接触カード決済

- 非接触カードの利用予測

- 非接触決済カードの使用状況

- 非接触カード取引予測

- 総取引件数

- 総取引額

第5章 モバイル非接触決済

- 非接触モバイルの利用予測

- 非接触決済に利用されるNFC対応端末

- OEM Pay非接触ユーザー数

- 非接触モバイル小売決済取引件数

- 非接触モバイル小売決済取引額

第6章 ウェアラブル非接触決済

- スマートウェアラブル非接触決済の利用予測

- 非接触決済を実現するウェアラブル

- スマートウェアラブル非接触決済取引件数

- スマートウェアラブル非接触決済取引額

第7章 NFCチケット

- NFCチケット利用予測

- NFCチケットユーザー

- NFCチケット取引件数

- NFCチケット取引額

第8章 非接触トークン化

- 非接触トークン化の予測

- 非接触トークン化の件数

- 非接触トークン化の収益

第9章 非接触ATM

- 非接触ATM予測

- 非接触ATMの稼働状況

'Contactless Payment Value to Double by 2030, Reaching $18.1 Trillion, Accelerated by NFC Ticketing Roll-outs'

| KEY STATISTICS | |

|---|---|

| Total transaction value in 2025: | $8.75tn |

| Total transaction value in 2030: | $18.1tn |

| 2025 to 2030 market growth: | 106.9% |

| Forecast period: | 2025-2030 |

Overview

Our "Contactless Payments" market analysis provides exhaustive data coverage of the market in its entirety, including the adoption of mobile wallets featuring contactless payment technology, the growth of contactless transactions and its associated values. The data suite includes access to the full set of forecast data of 139 tables and over 60,000 datapoints, as well as an accompanying report analysing the reasons for growth. The metrics comprised in the research suite include:

- The number of users of contactless payments

- The total transaction value of contactless payments

- The total volume of contactless payments made annually.

All report content is delivered in the English language.

Key Features

These metrics are split by the following key segments:

- Contactless Cards

- Mobile Payments, further split by:

- Apple Pay

- Google Pay

- Samsung Pay

- Other Original Equipment Manufacturer (OEM) Pay

- Wearable Payments

- Contactless Ticketing Payments

The forecast data also includes market sizing for contactless tokenisation and contactless-enabled ATMs.

The data itself is accompanied by a Data & Forecasting report; analysing the main drivers of growth across key forecast metrics, as well as explaining the fundamental methodology and assumptions involved. Taken together, the research is a vital tool for sizing the contactless payments market.

Data & Interactive Forecast

Juniper Research's Interactive Forecast Excel contains the following functionality:

- Statistics Analysis: Users benefit from the ability to search for specific metrics, displayed for all regions and countries across the data period. Graphs are easily modified and can be exported to the clipboard.

- Country Data Tool: This tool lets users look at metrics for all regions and countries in the forecast period. Users can refine the metrics displayed via a search bar.

- Country Comparison Tool: Users can select and compare specific countries. The ability to export graphs is included in this tool.

- What-if Analysis: Here, users can compare forecast metrics against their own assumptions, via 5 interactive scenarios.

SAMPLE VIEW

Market Data & Forecasting Report

The numbers tell you what's happening, but our written report details why, alongside the methodologies.

Table of Contents

1. Introduction

- 1.1. Introduction

- 1.2. Key Trends & Developments Within Contactless Payments

- 1.2.1. Contactless Payments Are the Default Choice

- 1.2.2. Expansion of A2A Contactless Payments In-store

- Figure 1.1: Google Pay UPI Tap & Pay Methods

- 1.2.3. Soft POS Is Opening New Markets for Contactless

- Figure 1.2: How to Use Soft POS

- Figure 1.3: Tap to Pay on iPhone

- 1.2.4. Cross-border QR Code Payment Schemes Will Boost Contactless Payments in Southeast Asia

- Figure 1.4: Prominent Advances in Cross-border QR Code Schemes in 2025: Southeast Asia

- 1.2.5. Biometrics as the Next Evolution of Contactless Payments

- 1.2.6. QR Code Payments

- i. Strengths

- ii. Weaknesses

- Figure 1.5: QR Codes - Strengths & Weaknesses

- 1.2.7. NFC

- i. Strengths

- ii. Weaknesses

- Figure 1.6: NFC - Strengths & Weaknesses

- 1.2.8. Conclusion

2. Methodology & Assumptions

- 2.1. Methodology & Assumptions

- Figure 2.1: Contactless Cards Forecast Methodology

- Figure 2.2: NFC Mobile & Wearable Retail Payments Market Forecast Methodology

- Figure 2.3: NFC Mobile Ticketing Forecast Methodology

- Figure 2.4: Contactless Mobile Payment Tokenisation Methodology

3. Forecast Summary

- 3.1. Contactless Payments Usage Forecasts

- 3.1.1. Contactless Mechanisms: Cards, Mobiles and Wearables

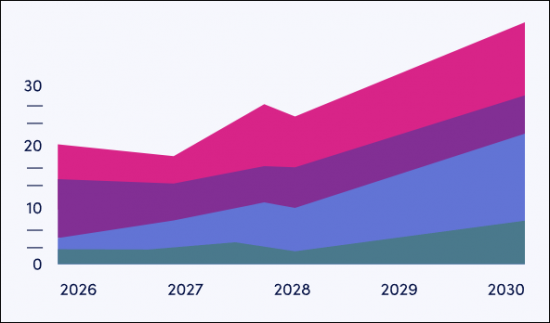

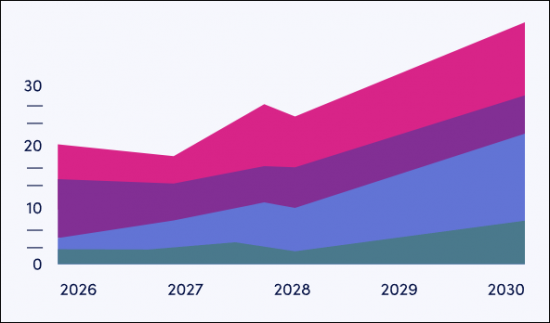

- Figure & Table 3.1: Number of Contactless Devices or Cards in Use for Payments (m), Split by Payment Mechanism, 2025-2030

- 3.1.2. Number of Mobile Devices Used for Contactless Payments

- Figure & Table 3.2: Number of Mobile Devices Used for Contactless Payments (m), Split by Payment Provider, 2025-2030

- 3.1.3. Total Contactless Transaction Volume: Retail Payments & Ticketing

- Figure 3.3: Total Number of Contactless Transactions (m), Split by Retail Payments & Ticketing, 2025-2030

- 3.1.4. Total Contactless Transaction Value: Retail Payments & Ticketing

- Figure & Table 3.4: Total Contactless Transaction Value ($m), Split by Retail Payments & Ticketing, 2025-2030

- 3.1.1. Contactless Mechanisms: Cards, Mobiles and Wearables

4. Contactless Card Payments

- 4.1. Contactless Cards Usage Forecasts

- 4.1.1. Contactless Payment Cards in Use

- Figure & Table 4.1: Number of Contactless Payment Cards Used for Contactless Payment (m), Split by 8 Key Regions, 2025-2030

- 4.1.1. Contactless Payment Cards in Use

- 4.2. Contactless Cards Transaction Forecasts

- 4.2.1. Total Transaction Volume

- Figure & Table 4.2: Total Number of Contactless Card Transactions per annum (m), Split by 8 Key Regions, 2025-2030

- 4.2.2. Total Transaction Value

- Figure & Table 4.3: Total Value of Contactless Card Transactions per annum ($m), Split by 8 Key Regions, 2025-2030

- 4.2.1. Total Transaction Volume

5. Mobile Contactless Payments

- 5.1. Contactless Mobile Usage Forecast

- 5.1.1. NFC-enabled Handsets in Use for Contactless Payments

- Figure & Table 5.1: Number of NFC-enabled Handsets (including FeliCa) Using Contactless Payments (m), Split by 8 Key Regions, 2025-2030

- 5.1.2. Number of OEM Pay Contactless Users

- Figure & Table 5.2: Number of OEM Pay Contactless Users (m), Split by Apple Pay, Samsung Pay, Google Pay & Other OEM Pay, 2025-2030

- 5.1.3. Contactless Mobile Retail Payment Transactions Volume

- Figure & Table 5.3: Total Contactless Mobile Retail Payments Transaction Volume per annum (m), Split by 8 Key Regions, 2025-2030

- 5.1.4. Contactless Mobile Retail Payment Transaction Value

- Figure & Table 5.4: Total Value of NFC Retail Payments Transactions ($m), Split by 8 Key Regions, 2025-2030

- 5.1.1. NFC-enabled Handsets in Use for Contactless Payments

6. Wearable Contactless Payments

- 6.1. Smart Wearables Contactless Payment Usage Forecasts

- 6.1.1. Wearables Making Contactless Payments

- Figure & Table 6.1: Number of Active Smart Wearable Devices Making Contactless Payments per annum (m), Split by 8 Key Regions, 2025-2030

- 6.1.2. Smart Wearables Contactless Payment Transaction Volume

- Figure & Table 6.2: Smart Wearable Contactless Payment Transaction Volume per annum (m), Split by 8 Key Regions, 2025-2030

- 6.1.3. Smart Wearable Contactless Payment Transaction Value

- Figure & Table 6.3: Total Smart Wearable Contactless Payment Transaction Value ($m), Split by 8 Key Regions, 2025-2030

- 6.1.1. Wearables Making Contactless Payments

7. NFC Ticketing

- 7.1. NFC Ticketing Usage Forecasts

- 7.1.1. NFC Ticketing Users

- Figure & Table 7.1: Mobile Phone Users Who Use NFC Ticketing (m), Split by 8 Key Regions, 2025-2030

- 7.1.2. NFC Ticketing Transaction Volume

- Figure & Table 7.2: Transaction Volume of NFC Tickets Delivered or Validated (m), Split by 8 Key Regions, 2025-2030

- 7.1.3. NFC Ticketing Transaction Value

- Figure & Table 7.3: Total Transaction Value for NFC Tickets Purchased or Validated per annum ($m), Split by 8 Key Regions, 2025-2030

- 7.1.1. NFC Ticketing Users

8. Contactless Tokenisation

- 8.1. Contactless Tokenisation Forecasts

- 8.1.1. Contactless Tokenisation Volume

- Figure & Table 8.1: Number of Contactless Payments That Are Tokenised per annum (m), Split by 8 Key Regions, 2025-2030

- 8.1.2. Contactless Tokenisation Revenue

- Figure &Table 8.2: Contactless Tokenisation Revenue per annum ($m), Split by Key Regions, 2025-2030

- 8.1.1. Contactless Tokenisation Volume

9. Contactless ATMs

- 9.1. Contactless ATM Forecasts

- 9.1.1. Contactless ATMs in Use

- Figure & Table 9.1: Number of Contactless-enabled ATMs, Split by 8 Key Regions, 2025-2030

- 9.1.1. Contactless ATMs in Use