|

|

市場調査レポート

商品コード

1808067

電動キックスクーター市場:製品タイプ、カテゴリ、バッテリータイプ、レンジ、電圧範囲、スピード、用途、エンドユーザー、流通チャネル別-2025-2030年世界予測Electric Kick Scooter Market by Product Type, Category, Battery Type, Range, Voltage Range, Speed, Application, End User, Distribution Channel - Global Forecast 2025-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 電動キックスクーター市場:製品タイプ、カテゴリ、バッテリータイプ、レンジ、電圧範囲、スピード、用途、エンドユーザー、流通チャネル別-2025-2030年世界予測 |

|

出版日: 2025年08月28日

発行: 360iResearch

ページ情報: 英文 185 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 図表

- 目次

電動キックスクーター市場は、2024年に20億4,000万米ドルと評価され、2025年には21億8,000万米ドル、CAGR 7.50%で成長し、2030年には31億5,000万米ドルに達すると予測されています。

| 主な市場の統計 | |

|---|---|

| 基準年2024 | 20億4,000万米ドル |

| 推定年2025 | 21億8,000万米ドル |

| 予測年2030 | 31億5,000万米ドル |

| CAGR(%) | 7.50% |

電動キックスクーターの繁栄する世界を解き明かす:都市交通と個人交通を形成する電動モビリティ革命のイントロダクション

電動キックスクーターは、利便性と持続可能性へのコミットメントを融合させ、現代の都市モビリティを定義するシンボルとして登場しました。コンパクトな個人用交通手段として、混雑した道路や公共交通機関に代わる効率的な交通手段を求める多様なライダーに対応しています。混雑した市街地を移動する毎日の通勤者から、レクリエーション用の小道を探索するアウトドア愛好家まで、これらのスクーターは、敏捷性、アクセシビリティ、環境面の利点の融合を約束します。さらに、軽量設計と直感的な操作性を活かしてユーザーフレンドリーな体験を提供することで、スマートシティの台頭とシームレスに統合することができます。

電動キックスクーターの普及を革新する技術革新政策進化と消費者の期待を理解する

電動キックスクーターを取り巻く環境は、生産と消費の両面に変化をもたらしたいくつかの要因によって、大きな変貌を遂げています。第一に、バッテリーの化学的性質とエネルギー密度の急速な進化により、これまでにない航続距離が実現し、ユーザーは1回の充電でより長い距離を移動できるようになりました。この技術的躍進は、軽量耐久性とモジュール化を目指した新たな設計革新に拍車をかけ、スクーターの修理やアップグレードを容易にしました。さらに、IoT接続とアプリベースの管理ツールの統合により、ユーザーが性能、ルート最適化、予知保全に関するより豊富なデータを求めるようになり、期待が変化しています。

2025年の米国新関税が電動キックスクーターの部品コストとサプライチェーンの回復力に及ぼす波及効果の分析

2025年の米国の関税賦課は、電動キックスクーターのサプライチェーン全体に新たなコスト力学を導入し、メーカー、流通業者、エンドユーザーに影響を及ぼしています。これらの関税は、主にリチウムイオン電池、鉄骨フレーム、電子コントローラーなどの主要部品を対象としており、組立作業における投入コストの上昇につながっています。その結果、相手先商標製品メーカーは、影響を軽減するために、調達戦略を見直し、代替サプライヤーを検討し、ニアショアリングの選択肢を評価しています。競争力のある価格を維持するため、多くのブランドは生産工程を最適化し、歩留まりの向上と無駄の削減を目的とした技術提携に投資しています。

電動キックスクーターの多面的なセグメンテーションを調べて、性能の快適性と市場リーチ戦略を調整する

電動キックスクーター市場は多面的なセグメンテーションの枠組みを示し、製品タイプでは、様々な安定性と操縦性の要件に対応する2輪と3輪のバリエーションに車両を区別しています。一方、カテゴリー別では、携帯性を提供する折りたたみ式、乗り心地の良さを重視した着席型、機敏な都市移動用に設計された立ち乗り型スクーターが注目されます。さらに深く掘り下げると、バッテリーの種類を区分すると、従来の鉛ベースの電源と、エネルギー密度が向上し軽量化を実現した最新のリチウムイオンシステムに分かれることがわかる。ドライブトレインの分類に関しては、チェーン駆動のメカニズムが依然として低価格志向のモデルに普及しているのに対し、ハブモーターはコンパクトでメンテナンスが容易な構成であることから人気を集めています。

世界の主要市場で電動キックスクーターの普及を促進する地域モビリティ動向とインフラ開拓を解明

電動キックスクーター市場の地域力学は、南北アメリカ、欧州、中東・アフリカ、アジア太平洋における独自の促進要因・課題を浮き彫りにしています。南北アメリカ大陸では、北米の都市中心部が市政府、技術プラットフォーム、地元企業の戦略的提携を通じて普及の先陣を切っています。中南米市場では、マイクロモビリティ・インフラや持続可能性イニシアティブへの投資に支えられ、共有モビリティ・ソリューションが徐々に受け入れられています。一方、欧州・中東・アフリカ地域は、低炭素交通を促進する緻密な規制環境の恩恵を受けており、西欧諸国は安全基準やスクーター専用レーンでリードしています。東欧と中東の新興市場では、手頃な価格とラストワンマイルの接続性に焦点が当てられており、革新的なソリューションと地域に根ざしたビジネスモデルの機会が創出されています。

技術提携を通じて電動キックスクーターのイノベーションを推進する市場リーダーを特定持続可能性と拡張可能なビジネスモデル

電動キックスクーター分野の主要企業は、設計、技術、エコシステム・パートナーシップに対する包括的なアプローチによって際立っています。性能と航続距離で差別化を図るため、独自のバッテリー管理システムや軽量複合材を重視する企業もあります。また、デジタル・プラットフォームに重点を置き、ルート計画、充電ステーション検索、リアルタイム診断を提供するモバイル・アプリケーションを統合している企業もあります。都市計画業者、公共交通事業者、ラストワンマイルデリバリー企業との戦略的提携は、競争上のポジショニングをさらに強化し、厳選された会社がフリート契約や長期サービス契約を確保することを可能にします。

電動キックスクーター市場でリーダーシップを発揮するための、革新的インフラ統合と持続可能性のための将来を見据えた戦略の立案

急成長する機会を活用し、新たな課題に対処するために、業界のリーダーはいくつかの戦略的イニシアティブを優先すべきです。第一に、次世代バッテリー技術とパワートレインの最適化に投資し、航続距離を延ばし、充電サイクルを短縮します。こうした進化をモジュール設計アーキテクチャと組み合わせることで、製品の迅速な反復とメンテナンスコストの低減が可能になります。第二に、自治体の利害関係者と積極的に関わり、スマートパーキングゾーンや統合充電ハブなど、マイクロモビリティ専用のインフラを共同開発し、消費者のアクセシビリティと安全性を高める。

電動キックスクーターの洞察のための一次インタビュー二次情報とデータ統合を組み合わせた包括的な混合手法調査フレームワークの詳細

この分析では、電動キックスクーター市場の包括的な洞察を明らかにするために、1次調査と2次情報を組み合わせた厳密な多層調査手法を採用しました。1次調査では、メーカー、ディストリビューター、フリートオペレーター、インフラプランナー、規制機関など、業界関係者との構造的なインタビューや調査を実施しました。これらの対話から、技術動向、政策力学、導入障壁に関する直接の見解が得られました。同時に、観察調査とパイロット・プログラムの評価によって、多様な都市環境における利用者の行動、充電パターン、メンテナンス要件に関する詳細なデータが得られました。

市場力学技術的進歩と地域力学を統合し、電動キックスクーターのモビリティにおける将来の機会を明らかにします

サマリー:電動キックスクーターは、急速な技術進歩、進化する規制状況、消費者の嗜好の変化によって形成されるダイナミックなモビリティセグメントです。市場の継続的成長は、バッテリー性能、インフラ統合、デジタルプラットフォーム開発における戦略的進歩にかかっています。さらに、最近の米国の関税措置は、弾力性のあるサプライチェーンと現地調達戦略の重要性を強調しています。折りたたみ可能な通勤用モデルから高速レクリエーション用スクーターまで、セグメンテーションのニュアンスによって多様なユーザーニーズが明らかになるにつれて、企業は、異なる市場セグメントを効果的に取り込むために製品を調整する必要があります。

目次

第1章 序文

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場の概要

第5章 市場力学

- 都市部の渋滞が深刻化し、コンパクトで環境に優しい代替交通手段の需要が高まっている

- 通勤者や学生の間で折りたたみ式の軽量スクーターの人気が高まっている

- シェアリングマイクロモビリティの拡大が都市部の短距離移動行動を変革

- 消費者が利便性、レビュー、直接配送を好むため、オンライン販売が増加

- GPS、IoT、モバイル接続などのスマートテクノロジーの統合の増加

- バッテリー技術の進歩により、航続距離の延長と充電速度の高速化が可能

- アウトドア愛好家の間では、高性能オフロードスクーターの需要が高まっています。

- 物流・食品プラットフォームによるラストマイル配送への電動スクーターの導入

第6章 市場洞察

- ポーターのファイブフォース分析

- PESTEL分析

第7章 米国の関税の累積的な影響2025

第8章 電動キックスクーター市場:製品タイプ別

- 三輪車

- 二輪車

第9章 電動キックスクーター市場:カテゴリー別

- 折りたたみ式

- 従来型/折りたたみ不可

第10章 電動キックスクーター市場:バッテリータイプ別

- 鉛ベース

- リチウムイオン

第11章 電動キックスクーター市場:範囲別

- 30km以上

- 最大30km

第12章 電動キックスクーター市場電圧範囲別

- 24~48V

- 48V以上

- 24V以下

第13章 電動キックスクーター市場:速度別

- 時速15~25キロ

- 時速25キロ以上

- 最高時速15km

第14章 電動キックスクーター市場:用途別

- 商用配送

- 個人通勤

- レクリエーション

第15章 電動キックスクーター市場:エンドユーザー別

- 大人(19歳以上)

- 10代(19歳まで)

第16章 電動キックスクーター市場:流通チャネル別

- オフライン

- オンライン

- 電子商取引ウェブサイト

- OEMウェブサイト

第17章 南北アメリカの電動キックスクーター市場

- 米国

- カナダ

- メキシコ

- ブラジル

- アルゼンチン

第18章 欧州・中東・アフリカの電動キックスクーター市場

- 英国

- ドイツ

- フランス

- ロシア

- イタリア

- スペイン

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- デンマーク

- オランダ

- カタール

- フィンランド

- スウェーデン

- ナイジェリア

- エジプト

- トルコ

- イスラエル

- ノルウェー

- ポーランド

- スイス

第19章 アジア太平洋地域の電動キックスクーター市場

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- インドネシア

- タイ

- フィリピン

- マレーシア

- シンガポール

- ベトナム

- 台湾

第20章 競合情勢

- 市場シェア分析, 2024

- FPNVポジショニングマトリックス, 2024

- 競合分析

- Apollo Scooters

- EMotorad by Inkodop Technologies Private Limited

- GOTRAX

- Jiangsu Xinri E-Vehicle Co.,Ltd

- Niu International Co.,Ltd.

- Segway Inc. by Ninebot

- Swagtron

- Unagi Inc.

- Xiaomi Corporation

- Yadea Technology Group Co.,Ltd

第21章 リサーチAI

第22章 リサーチ統計

第23章 リサーチコンタクト

第24章 リサーチ記事

第25章 付録

LIST OF FIGURES

- FIGURE 1. ELECTRIC KICK SCOOTER MARKET RESEARCH PROCESS

- FIGURE 2. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, 2018-2030 (USD MILLION)

- FIGURE 3. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY REGION, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 4. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 5. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY PRODUCT TYPE, 2024 VS 2030 (%)

- FIGURE 6. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY PRODUCT TYPE, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 7. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY CATEGORY, 2024 VS 2030 (%)

- FIGURE 8. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY CATEGORY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 9. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY BATTERY TYPE, 2024 VS 2030 (%)

- FIGURE 10. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY BATTERY TYPE, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 11. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY RANGE, 2024 VS 2030 (%)

- FIGURE 12. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY RANGE, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 13. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY VOLTAGE RANGE, 2024 VS 2030 (%)

- FIGURE 14. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY VOLTAGE RANGE, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 15. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY SPEED, 2024 VS 2030 (%)

- FIGURE 16. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY SPEED, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 17. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY APPLICATION, 2024 VS 2030 (%)

- FIGURE 18. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY APPLICATION, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 19. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY END USER, 2024 VS 2030 (%)

- FIGURE 20. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY END USER, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 21. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY DISTRIBUTION CHANNEL, 2024 VS 2030 (%)

- FIGURE 22. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY DISTRIBUTION CHANNEL, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 23. AMERICAS ELECTRIC KICK SCOOTER MARKET SIZE, BY COUNTRY, 2024 VS 2030 (%)

- FIGURE 24. AMERICAS ELECTRIC KICK SCOOTER MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 25. UNITED STATES ELECTRIC KICK SCOOTER MARKET SIZE, BY STATE, 2024 VS 2030 (%)

- FIGURE 26. UNITED STATES ELECTRIC KICK SCOOTER MARKET SIZE, BY STATE, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 27. EUROPE, MIDDLE EAST & AFRICA ELECTRIC KICK SCOOTER MARKET SIZE, BY COUNTRY, 2024 VS 2030 (%)

- FIGURE 28. EUROPE, MIDDLE EAST & AFRICA ELECTRIC KICK SCOOTER MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 29. ASIA-PACIFIC ELECTRIC KICK SCOOTER MARKET SIZE, BY COUNTRY, 2024 VS 2030 (%)

- FIGURE 30. ASIA-PACIFIC ELECTRIC KICK SCOOTER MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 31. ELECTRIC KICK SCOOTER MARKET SHARE, BY KEY PLAYER, 2024

- FIGURE 32. ELECTRIC KICK SCOOTER MARKET, FPNV POSITIONING MATRIX, 2024

- FIGURE 33. ELECTRIC KICK SCOOTER MARKET: RESEARCHAI

- FIGURE 34. ELECTRIC KICK SCOOTER MARKET: RESEARCHSTATISTICS

- FIGURE 35. ELECTRIC KICK SCOOTER MARKET: RESEARCHCONTACTS

- FIGURE 36. ELECTRIC KICK SCOOTER MARKET: RESEARCHARTICLES

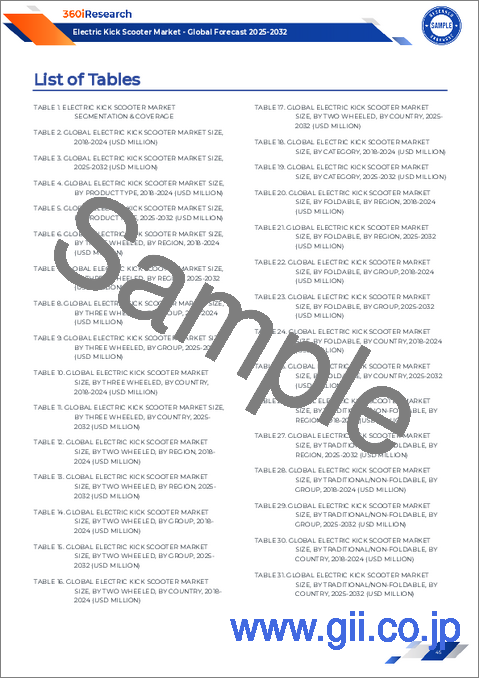

LIST OF TABLES

- TABLE 1. ELECTRIC KICK SCOOTER MARKET SEGMENTATION & COVERAGE

- TABLE 2. UNITED STATES DOLLAR EXCHANGE RATE, 2018-2024

- TABLE 3. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, 2018-2024 (USD MILLION)

- TABLE 4. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, 2025-2030 (USD MILLION)

- TABLE 5. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY REGION, 2018-2024 (USD MILLION)

- TABLE 6. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 7. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY COUNTRY, 2018-2024 (USD MILLION)

- TABLE 8. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 9. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY PRODUCT TYPE, 2018-2024 (USD MILLION)

- TABLE 10. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 11. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY THREE WHEELED, BY REGION, 2018-2024 (USD MILLION)

- TABLE 12. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY THREE WHEELED, BY REGION, 2025-2030 (USD MILLION)

- TABLE 13. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY TWO WHEELED, BY REGION, 2018-2024 (USD MILLION)

- TABLE 14. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY TWO WHEELED, BY REGION, 2025-2030 (USD MILLION)

- TABLE 15. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY CATEGORY, 2018-2024 (USD MILLION)

- TABLE 16. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY CATEGORY, 2025-2030 (USD MILLION)

- TABLE 17. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY FOLDABLE, BY REGION, 2018-2024 (USD MILLION)

- TABLE 18. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY FOLDABLE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 19. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY TRADITIONAL/NON-FOLDABLE, BY REGION, 2018-2024 (USD MILLION)

- TABLE 20. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY TRADITIONAL/NON-FOLDABLE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 21. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY BATTERY TYPE, 2018-2024 (USD MILLION)

- TABLE 22. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 23. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY LEAD BASED, BY REGION, 2018-2024 (USD MILLION)

- TABLE 24. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY LEAD BASED, BY REGION, 2025-2030 (USD MILLION)

- TABLE 25. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY LITHIUM-ION, BY REGION, 2018-2024 (USD MILLION)

- TABLE 26. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY LITHIUM-ION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 27. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY RANGE, 2018-2024 (USD MILLION)

- TABLE 28. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 29. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY ABOVE 30KM, BY REGION, 2018-2024 (USD MILLION)

- TABLE 30. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY ABOVE 30KM, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY UPTO 30KM, BY REGION, 2018-2024 (USD MILLION)

- TABLE 32. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY UPTO 30KM, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY VOLTAGE RANGE, 2018-2024 (USD MILLION)

- TABLE 34. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY VOLTAGE RANGE, 2025-2030 (USD MILLION)

- TABLE 35. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY 24-48 V, BY REGION, 2018-2024 (USD MILLION)

- TABLE 36. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY 24-48 V, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY ABOVE 48 V, BY REGION, 2018-2024 (USD MILLION)

- TABLE 38. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY ABOVE 48 V, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY BELOW 24 V, BY REGION, 2018-2024 (USD MILLION)

- TABLE 40. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY BELOW 24 V, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY SPEED, 2018-2024 (USD MILLION)

- TABLE 42. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY SPEED, 2025-2030 (USD MILLION)

- TABLE 43. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY 15-25 KM/H, BY REGION, 2018-2024 (USD MILLION)

- TABLE 44. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY 15-25 KM/H, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY ABOVE 25 KM/H, BY REGION, 2018-2024 (USD MILLION)

- TABLE 46. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY ABOVE 25 KM/H, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY UP TO 15 KM/H, BY REGION, 2018-2024 (USD MILLION)

- TABLE 48. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY UP TO 15 KM/H, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 50. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 51. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY COMMERCIAL DELIVERY, BY REGION, 2018-2024 (USD MILLION)

- TABLE 52. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY COMMERCIAL DELIVERY, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY PERSONAL COMMUTING, BY REGION, 2018-2024 (USD MILLION)

- TABLE 54. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY PERSONAL COMMUTING, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY RECREATIONAL, BY REGION, 2018-2024 (USD MILLION)

- TABLE 56. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY RECREATIONAL, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY END USER, 2018-2024 (USD MILLION)

- TABLE 58. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY END USER, 2025-2030 (USD MILLION)

- TABLE 59. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY ADULTS (ABOVE 19 YEARS), BY REGION, 2018-2024 (USD MILLION)

- TABLE 60. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY ADULTS (ABOVE 19 YEARS), BY REGION, 2025-2030 (USD MILLION)

- TABLE 61. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY TEENS (UPTO 19 YEARS), BY REGION, 2018-2024 (USD MILLION)

- TABLE 62. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY TEENS (UPTO 19 YEARS), BY REGION, 2025-2030 (USD MILLION)

- TABLE 63. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2024 (USD MILLION)

- TABLE 64. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY DISTRIBUTION CHANNEL, 2025-2030 (USD MILLION)

- TABLE 65. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY OFFLINE, BY REGION, 2018-2024 (USD MILLION)

- TABLE 66. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY OFFLINE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY ONLINE, BY REGION, 2018-2024 (USD MILLION)

- TABLE 68. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY ONLINE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY ECOMMERCE WEBSITE, BY REGION, 2018-2024 (USD MILLION)

- TABLE 70. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY ECOMMERCE WEBSITE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY OEM WEBSITE, BY REGION, 2018-2024 (USD MILLION)

- TABLE 72. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY OEM WEBSITE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY ONLINE, 2018-2024 (USD MILLION)

- TABLE 74. GLOBAL ELECTRIC KICK SCOOTER MARKET SIZE, BY ONLINE, 2025-2030 (USD MILLION)

- TABLE 75. AMERICAS ELECTRIC KICK SCOOTER MARKET SIZE, BY PRODUCT TYPE, 2018-2024 (USD MILLION)

- TABLE 76. AMERICAS ELECTRIC KICK SCOOTER MARKET SIZE, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 77. AMERICAS ELECTRIC KICK SCOOTER MARKET SIZE, BY CATEGORY, 2018-2024 (USD MILLION)

- TABLE 78. AMERICAS ELECTRIC KICK SCOOTER MARKET SIZE, BY CATEGORY, 2025-2030 (USD MILLION)

- TABLE 79. AMERICAS ELECTRIC KICK SCOOTER MARKET SIZE, BY BATTERY TYPE, 2018-2024 (USD MILLION)

- TABLE 80. AMERICAS ELECTRIC KICK SCOOTER MARKET SIZE, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 81. AMERICAS ELECTRIC KICK SCOOTER MARKET SIZE, BY RANGE, 2018-2024 (USD MILLION)

- TABLE 82. AMERICAS ELECTRIC KICK SCOOTER MARKET SIZE, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 83. AMERICAS ELECTRIC KICK SCOOTER MARKET SIZE, BY VOLTAGE RANGE, 2018-2024 (USD MILLION)

- TABLE 84. AMERICAS ELECTRIC KICK SCOOTER MARKET SIZE, BY VOLTAGE RANGE, 2025-2030 (USD MILLION)

- TABLE 85. AMERICAS ELECTRIC KICK SCOOTER MARKET SIZE, BY SPEED, 2018-2024 (USD MILLION)

- TABLE 86. AMERICAS ELECTRIC KICK SCOOTER MARKET SIZE, BY SPEED, 2025-2030 (USD MILLION)

- TABLE 87. AMERICAS ELECTRIC KICK SCOOTER MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 88. AMERICAS ELECTRIC KICK SCOOTER MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 89. AMERICAS ELECTRIC KICK SCOOTER MARKET SIZE, BY END USER, 2018-2024 (USD MILLION)

- TABLE 90. AMERICAS ELECTRIC KICK SCOOTER MARKET SIZE, BY END USER, 2025-2030 (USD MILLION)

- TABLE 91. AMERICAS ELECTRIC KICK SCOOTER MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2024 (USD MILLION)

- TABLE 92. AMERICAS ELECTRIC KICK SCOOTER MARKET SIZE, BY DISTRIBUTION CHANNEL, 2025-2030 (USD MILLION)

- TABLE 93. AMERICAS ELECTRIC KICK SCOOTER MARKET SIZE, BY ONLINE, 2018-2024 (USD MILLION)

- TABLE 94. AMERICAS ELECTRIC KICK SCOOTER MARKET SIZE, BY ONLINE, 2025-2030 (USD MILLION)

- TABLE 95. AMERICAS ELECTRIC KICK SCOOTER MARKET SIZE, BY COUNTRY, 2018-2024 (USD MILLION)

- TABLE 96. AMERICAS ELECTRIC KICK SCOOTER MARKET SIZE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 97. UNITED STATES ELECTRIC KICK SCOOTER MARKET SIZE, BY PRODUCT TYPE, 2018-2024 (USD MILLION)

- TABLE 98. UNITED STATES ELECTRIC KICK SCOOTER MARKET SIZE, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 99. UNITED STATES ELECTRIC KICK SCOOTER MARKET SIZE, BY CATEGORY, 2018-2024 (USD MILLION)

- TABLE 100. UNITED STATES ELECTRIC KICK SCOOTER MARKET SIZE, BY CATEGORY, 2025-2030 (USD MILLION)

- TABLE 101. UNITED STATES ELECTRIC KICK SCOOTER MARKET SIZE, BY BATTERY TYPE, 2018-2024 (USD MILLION)

- TABLE 102. UNITED STATES ELECTRIC KICK SCOOTER MARKET SIZE, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 103. UNITED STATES ELECTRIC KICK SCOOTER MARKET SIZE, BY RANGE, 2018-2024 (USD MILLION)

- TABLE 104. UNITED STATES ELECTRIC KICK SCOOTER MARKET SIZE, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 105. UNITED STATES ELECTRIC KICK SCOOTER MARKET SIZE, BY VOLTAGE RANGE, 2018-2024 (USD MILLION)

- TABLE 106. UNITED STATES ELECTRIC KICK SCOOTER MARKET SIZE, BY VOLTAGE RANGE, 2025-2030 (USD MILLION)

- TABLE 107. UNITED STATES ELECTRIC KICK SCOOTER MARKET SIZE, BY SPEED, 2018-2024 (USD MILLION)

- TABLE 108. UNITED STATES ELECTRIC KICK SCOOTER MARKET SIZE, BY SPEED, 2025-2030 (USD MILLION)

- TABLE 109. UNITED STATES ELECTRIC KICK SCOOTER MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 110. UNITED STATES ELECTRIC KICK SCOOTER MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 111. UNITED STATES ELECTRIC KICK SCOOTER MARKET SIZE, BY END USER, 2018-2024 (USD MILLION)

- TABLE 112. UNITED STATES ELECTRIC KICK SCOOTER MARKET SIZE, BY END USER, 2025-2030 (USD MILLION)

- TABLE 113. UNITED STATES ELECTRIC KICK SCOOTER MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2024 (USD MILLION)

- TABLE 114. UNITED STATES ELECTRIC KICK SCOOTER MARKET SIZE, BY DISTRIBUTION CHANNEL, 2025-2030 (USD MILLION)

- TABLE 115. UNITED STATES ELECTRIC KICK SCOOTER MARKET SIZE, BY ONLINE, 2018-2024 (USD MILLION)

- TABLE 116. UNITED STATES ELECTRIC KICK SCOOTER MARKET SIZE, BY ONLINE, 2025-2030 (USD MILLION)

- TABLE 117. UNITED STATES ELECTRIC KICK SCOOTER MARKET SIZE, BY STATE, 2018-2024 (USD MILLION)

- TABLE 118. UNITED STATES ELECTRIC KICK SCOOTER MARKET SIZE, BY STATE, 2025-2030 (USD MILLION)

- TABLE 119. CANADA ELECTRIC KICK SCOOTER MARKET SIZE, BY PRODUCT TYPE, 2018-2024 (USD MILLION)

- TABLE 120. CANADA ELECTRIC KICK SCOOTER MARKET SIZE, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 121. CANADA ELECTRIC KICK SCOOTER MARKET SIZE, BY CATEGORY, 2018-2024 (USD MILLION)

- TABLE 122. CANADA ELECTRIC KICK SCOOTER MARKET SIZE, BY CATEGORY, 2025-2030 (USD MILLION)

- TABLE 123. CANADA ELECTRIC KICK SCOOTER MARKET SIZE, BY BATTERY TYPE, 2018-2024 (USD MILLION)

- TABLE 124. CANADA ELECTRIC KICK SCOOTER MARKET SIZE, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 125. CANADA ELECTRIC KICK SCOOTER MARKET SIZE, BY RANGE, 2018-2024 (USD MILLION)

- TABLE 126. CANADA ELECTRIC KICK SCOOTER MARKET SIZE, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 127. CANADA ELECTRIC KICK SCOOTER MARKET SIZE, BY VOLTAGE RANGE, 2018-2024 (USD MILLION)

- TABLE 128. CANADA ELECTRIC KICK SCOOTER MARKET SIZE, BY VOLTAGE RANGE, 2025-2030 (USD MILLION)

- TABLE 129. CANADA ELECTRIC KICK SCOOTER MARKET SIZE, BY SPEED, 2018-2024 (USD MILLION)

- TABLE 130. CANADA ELECTRIC KICK SCOOTER MARKET SIZE, BY SPEED, 2025-2030 (USD MILLION)

- TABLE 131. CANADA ELECTRIC KICK SCOOTER MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 132. CANADA ELECTRIC KICK SCOOTER MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 133. CANADA ELECTRIC KICK SCOOTER MARKET SIZE, BY END USER, 2018-2024 (USD MILLION)

- TABLE 134. CANADA ELECTRIC KICK SCOOTER MARKET SIZE, BY END USER, 2025-2030 (USD MILLION)

- TABLE 135. CANADA ELECTRIC KICK SCOOTER MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2024 (USD MILLION)

- TABLE 136. CANADA ELECTRIC KICK SCOOTER MARKET SIZE, BY DISTRIBUTION CHANNEL, 2025-2030 (USD MILLION)

- TABLE 137. CANADA ELECTRIC KICK SCOOTER MARKET SIZE, BY ONLINE, 2018-2024 (USD MILLION)

- TABLE 138. CANADA ELECTRIC KICK SCOOTER MARKET SIZE, BY ONLINE, 2025-2030 (USD MILLION)

- TABLE 139. MEXICO ELECTRIC KICK SCOOTER MARKET SIZE, BY PRODUCT TYPE, 2018-2024 (USD MILLION)

- TABLE 140. MEXICO ELECTRIC KICK SCOOTER MARKET SIZE, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 141. MEXICO ELECTRIC KICK SCOOTER MARKET SIZE, BY CATEGORY, 2018-2024 (USD MILLION)

- TABLE 142. MEXICO ELECTRIC KICK SCOOTER MARKET SIZE, BY CATEGORY, 2025-2030 (USD MILLION)

- TABLE 143. MEXICO ELECTRIC KICK SCOOTER MARKET SIZE, BY BATTERY TYPE, 2018-2024 (USD MILLION)

- TABLE 144. MEXICO ELECTRIC KICK SCOOTER MARKET SIZE, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 145. MEXICO ELECTRIC KICK SCOOTER MARKET SIZE, BY RANGE, 2018-2024 (USD MILLION)

- TABLE 146. MEXICO ELECTRIC KICK SCOOTER MARKET SIZE, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 147. MEXICO ELECTRIC KICK SCOOTER MARKET SIZE, BY VOLTAGE RANGE, 2018-2024 (USD MILLION)

- TABLE 148. MEXICO ELECTRIC KICK SCOOTER MARKET SIZE, BY VOLTAGE RANGE, 2025-2030 (USD MILLION)

- TABLE 149. MEXICO ELECTRIC KICK SCOOTER MARKET SIZE, BY SPEED, 2018-2024 (USD MILLION)

- TABLE 150. MEXICO ELECTRIC KICK SCOOTER MARKET SIZE, BY SPEED, 2025-2030 (USD MILLION)

- TABLE 151. MEXICO ELECTRIC KICK SCOOTER MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 152. MEXICO ELECTRIC KICK SCOOTER MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 153. MEXICO ELECTRIC KICK SCOOTER MARKET SIZE, BY END USER, 2018-2024 (USD MILLION)

- TABLE 154. MEXICO ELECTRIC KICK SCOOTER MARKET SIZE, BY END USER, 2025-2030 (USD MILLION)

- TABLE 155. MEXICO ELECTRIC KICK SCOOTER MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2024 (USD MILLION)

- TABLE 156. MEXICO ELECTRIC KICK SCOOTER MARKET SIZE, BY DISTRIBUTION CHANNEL, 2025-2030 (USD MILLION)

- TABLE 157. MEXICO ELECTRIC KICK SCOOTER MARKET SIZE, BY ONLINE, 2018-2024 (USD MILLION)

- TABLE 158. MEXICO ELECTRIC KICK SCOOTER MARKET SIZE, BY ONLINE, 2025-2030 (USD MILLION)

- TABLE 159. BRAZIL ELECTRIC KICK SCOOTER MARKET SIZE, BY PRODUCT TYPE, 2018-2024 (USD MILLION)

- TABLE 160. BRAZIL ELECTRIC KICK SCOOTER MARKET SIZE, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 161. BRAZIL ELECTRIC KICK SCOOTER MARKET SIZE, BY CATEGORY, 2018-2024 (USD MILLION)

- TABLE 162. BRAZIL ELECTRIC KICK SCOOTER MARKET SIZE, BY CATEGORY, 2025-2030 (USD MILLION)

- TABLE 163. BRAZIL ELECTRIC KICK SCOOTER MARKET SIZE, BY BATTERY TYPE, 2018-2024 (USD MILLION)

- TABLE 164. BRAZIL ELECTRIC KICK SCOOTER MARKET SIZE, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 165. BRAZIL ELECTRIC KICK SCOOTER MARKET SIZE, BY RANGE, 2018-2024 (USD MILLION)

- TABLE 166. BRAZIL ELECTRIC KICK SCOOTER MARKET SIZE, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 167. BRAZIL ELECTRIC KICK SCOOTER MARKET SIZE, BY VOLTAGE RANGE, 2018-2024 (USD MILLION)

- TABLE 168. BRAZIL ELECTRIC KICK SCOOTER MARKET SIZE, BY VOLTAGE RANGE, 2025-2030 (USD MILLION)

- TABLE 169. BRAZIL ELECTRIC KICK SCOOTER MARKET SIZE, BY SPEED, 2018-2024 (USD MILLION)

- TABLE 170. BRAZIL ELECTRIC KICK SCOOTER MARKET SIZE, BY SPEED, 2025-2030 (USD MILLION)

- TABLE 171. BRAZIL ELECTRIC KICK SCOOTER MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 172. BRAZIL ELECTRIC KICK SCOOTER MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 173. BRAZIL ELECTRIC KICK SCOOTER MARKET SIZE, BY END USER, 2018-2024 (USD MILLION)

- TABLE 174. BRAZIL ELECTRIC KICK SCOOTER MARKET SIZE, BY END USER, 2025-2030 (USD MILLION)

- TABLE 175. BRAZIL ELECTRIC KICK SCOOTER MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2024 (USD MILLION)

- TABLE 176. BRAZIL ELECTRIC KICK SCOOTER MARKET SIZE, BY DISTRIBUTION CHANNEL, 2025-2030 (USD MILLION)

- TABLE 177. BRAZIL ELECTRIC KICK SCOOTER MARKET SIZE, BY ONLINE, 2018-2024 (USD MILLION)

- TABLE 178. BRAZIL ELECTRIC KICK SCOOTER MARKET SIZE, BY ONLINE, 2025-2030 (USD MILLION)

- TABLE 179. ARGENTINA ELECTRIC KICK SCOOTER MARKET SIZE, BY PRODUCT TYPE, 2018-2024 (USD MILLION)

- TABLE 180. ARGENTINA ELECTRIC KICK SCOOTER MARKET SIZE, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 181. ARGENTINA ELECTRIC KICK SCOOTER MARKET SIZE, BY CATEGORY, 2018-2024 (USD MILLION)

- TABLE 182. ARGENTINA ELECTRIC KICK SCOOTER MARKET SIZE, BY CATEGORY, 2025-2030 (USD MILLION)

- TABLE 183. ARGENTINA ELECTRIC KICK SCOOTER MARKET SIZE, BY BATTERY TYPE, 2018-2024 (USD MILLION)

- TABLE 184. ARGENTINA ELECTRIC KICK SCOOTER MARKET SIZE, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 185. ARGENTINA ELECTRIC KICK SCOOTER MARKET SIZE, BY RANGE, 2018-2024 (USD MILLION)

- TABLE 186. ARGENTINA ELECTRIC KICK SCOOTER MARKET SIZE, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 187. ARGENTINA ELECTRIC KICK SCOOTER MARKET SIZE, BY VOLTAGE RANGE, 2018-2024 (USD MILLION)

- TABLE 188. ARGENTINA ELECTRIC KICK SCOOTER MARKET SIZE, BY VOLTAGE RANGE, 2025-2030 (USD MILLION)

- TABLE 189. ARGENTINA ELECTRIC KICK SCOOTER MARKET SIZE, BY SPEED, 2018-2024 (USD MILLION)

- TABLE 190. ARGENTINA ELECTRIC KICK SCOOTER MARKET SIZE, BY SPEED, 2025-2030 (USD MILLION)

- TABLE 191. ARGENTINA ELECTRIC KICK SCOOTER MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 192. ARGENTINA ELECTRIC KICK SCOOTER MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 193. ARGENTINA ELECTRIC KICK SCOOTER MARKET SIZE, BY END USER, 2018-2024 (USD MILLION)

- TABLE 194. ARGENTINA ELECTRIC KICK SCOOTER MARKET SIZE, BY END USER, 2025-2030 (USD MILLION)

- TABLE 195. ARGENTINA ELECTRIC KICK SCOOTER MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2024 (USD MILLION)

- TABLE 196. ARGENTINA ELECTRIC KICK SCOOTER MARKET SIZE, BY DISTRIBUTION CHANNEL, 2025-2030 (USD MILLION)

- TABLE 197. ARGENTINA ELECTRIC KICK SCOOTER MARKET SIZE, BY ONLINE, 2018-2024 (USD MILLION)

- TABLE 198. ARGENTINA ELECTRIC KICK SCOOTER MARKET SIZE, BY ONLINE, 2025-2030 (USD MILLION)

- TABLE 199. EUROPE, MIDDLE EAST & AFRICA ELECTRIC KICK SCOOTER MARKET SIZE, BY PRODUCT TYPE, 2018-2024 (USD MILLION)

- TABLE 200. EUROPE, MIDDLE EAST & AFRICA ELECTRIC KICK SCOOTER MARKET SIZE, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 201. EUROPE, MIDDLE EAST & AFRICA ELECTRIC KICK SCOOTER MARKET SIZE, BY CATEGORY, 2018-2024 (USD MILLION)

- TABLE 202. EUROPE, MIDDLE EAST & AFRICA ELECTRIC KICK SCOOTER MARKET SIZE, BY CATEGORY, 2025-2030 (USD MILLION)

- TABLE 203. EUROPE, MIDDLE EAST & AFRICA ELECTRIC KICK SCOOTER MARKET SIZE, BY BATTERY TYPE, 2018-2024 (USD MILLION)

- TABLE 204. EUROPE, MIDDLE EAST & AFRICA ELECTRIC KICK SCOOTER MARKET SIZE, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 205. EUROPE, MIDDLE EAST & AFRICA ELECTRIC KICK SCOOTER MARKET SIZE, BY RANGE, 2018-2024 (USD MILLION)

- TABLE 206. EUROPE, MIDDLE EAST & AFRICA ELECTRIC KICK SCOOTER MARKET SIZE, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 207. EUROPE, MIDDLE EAST & AFRICA ELECTRIC KICK SCOOTER MARKET SIZE, BY VOLTAGE RANGE, 2018-2024 (USD MILLION)

- TABLE 208. EUROPE, MIDDLE EAST & AFRICA ELECTRIC KICK SCOOTER MARKET SIZE, BY VOLTAGE RANGE, 2025-2030 (USD MILLION)

- TABLE 209. EUROPE, MIDDLE EAST & AFRICA ELECTRIC KICK SCOOTER MARKET SIZE, BY SPEED, 2018-2024 (USD MILLION)

- TABLE 210. EUROPE, MIDDLE EAST & AFRICA ELECTRIC KICK SCOOTER MARKET SIZE, BY SPEED, 2025-2030 (USD MILLION)

- TABLE 211. EUROPE, MIDDLE EAST & AFRICA ELECTRIC KICK SCOOTER MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 212. EUROPE, MIDDLE EAST & AFRICA ELECTRIC KICK SCOOTER MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 213. EUROPE, MIDDLE EAST & AFRICA ELECTRIC KICK SCOOTER MARKET SIZE, BY END USER, 2018-2024 (USD MILLION)

- TABLE 214. EUROPE, MIDDLE EAST & AFRICA ELECTRIC KICK SCOOTER MARKET SIZE, BY END USER, 2025-2030 (USD MILLION)

- TABLE 215. EUROPE, MIDDLE EAST & AFRICA ELECTRIC KICK SCOOTER MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2024 (USD MILLION)

- TABLE 216. EUROPE, MIDDLE EAST & AFRICA ELECTRIC KICK SCOOTER MARKET SIZE, BY DISTRIBUTION CHANNEL, 2025-2030 (USD MILLION)

- TABLE 217. EUROPE, MIDDLE EAST & AFRICA ELECTRIC KICK SCOOTER MARKET SIZE, BY ONLINE, 2018-2024 (USD MILLION)

- TABLE 218. EUROPE, MIDDLE EAST & AFRICA ELECTRIC KICK SCOOTER MARKET SIZE, BY ONLINE, 2025-2030 (USD MILLION)

- TABLE 219. EUROPE, MIDDLE EAST & AFRICA ELECTRIC KICK SCOOTER MARKET SIZE, BY COUNTRY, 2018-2024 (USD MILLION)

- TABLE 220. EUROPE, MIDDLE EAST & AFRICA ELECTRIC KICK SCOOTER MARKET SIZE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 221. UNITED KINGDOM ELECTRIC KICK SCOOTER MARKET SIZE, BY PRODUCT TYPE, 2018-2024 (USD MILLION)

- TABLE 222. UNITED KINGDOM ELECTRIC KICK SCOOTER MARKET SIZE, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 223. UNITED KINGDOM ELECTRIC KICK SCOOTER MARKET SIZE, BY CATEGORY, 2018-2024 (USD MILLION)

- TABLE 224. UNITED KINGDOM ELECTRIC KICK SCOOTER MARKET SIZE, BY CATEGORY, 2025-2030 (USD MILLION)

- TABLE 225. UNITED KINGDOM ELECTRIC KICK SCOOTER MARKET SIZE, BY BATTERY TYPE, 2018-2024 (USD MILLION)

- TABLE 226. UNITED KINGDOM ELECTRIC KICK SCOOTER MARKET SIZE, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 227. UNITED KINGDOM ELECTRIC KICK SCOOTER MARKET SIZE, BY RANGE, 2018-2024 (USD MILLION)

- TABLE 228. UNITED KINGDOM ELECTRIC KICK SCOOTER MARKET SIZE, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 229. UNITED KINGDOM ELECTRIC KICK SCOOTER MARKET SIZE, BY VOLTAGE RANGE, 2018-2024 (USD MILLION)

- TABLE 230. UNITED KINGDOM ELECTRIC KICK SCOOTER MARKET SIZE, BY VOLTAGE RANGE, 2025-2030 (USD MILLION)

- TABLE 231. UNITED KINGDOM ELECTRIC KICK SCOOTER MARKET SIZE, BY SPEED, 2018-2024 (USD MILLION)

- TABLE 232. UNITED KINGDOM ELECTRIC KICK SCOOTER MARKET SIZE, BY SPEED, 2025-2030 (USD MILLION)

- TABLE 233. UNITED KINGDOM ELECTRIC KICK SCOOTER MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 234. UNITED KINGDOM ELECTRIC KICK SCOOTER MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 235. UNITED KINGDOM ELECTRIC KICK SCOOTER MARKET SIZE, BY END USER, 2018-2024 (USD MILLION)

- TABLE 236. UNITED KINGDOM ELECTRIC KICK SCOOTER MARKET SIZE, BY END USER, 2025-2030 (USD MILLION)

- TABLE 237. UNITED KINGDOM ELECTRIC KICK SCOOTER MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2024 (USD MILLION)

- TABLE 238. UNITED KINGDOM ELECTRIC KICK SCOOTER MARKET SIZE, BY DISTRIBUTION CHANNEL, 2025-2030 (USD MILLION)

- TABLE 239. UNITED KINGDOM ELECTRIC KICK SCOOTER MARKET SIZE, BY ONLINE, 2018-2024 (USD MILLION)

- TABLE 240. UNITED KINGDOM ELECTRIC KICK SCOOTER MARKET SIZE, BY ONLINE, 2025-2030 (USD MILLION)

- TABLE 241. GERMANY ELECTRIC KICK SCOOTER MARKET SIZE, BY PRODUCT TYPE, 2018-2024 (USD MILLION)

- TABLE 242. GERMANY ELECTRIC KICK SCOOTER MARKET SIZE, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 243. GERMANY ELECTRIC KICK SCOOTER MARKET SIZE, BY CATEGORY, 2018-2024 (USD MILLION)

- TABLE 244. GERMANY ELECTRIC KICK SCOOTER MARKET SIZE, BY CATEGORY, 2025-2030 (USD MILLION)

- TABLE 245. GERMANY ELECTRIC KICK SCOOTER MARKET SIZE, BY BATTERY TYPE, 2018-2024 (USD MILLION)

- TABLE 246. GERMANY ELECTRIC KICK SCOOTER MARKET SIZE, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 247. GERMANY ELECTRIC KICK SCOOTER MARKET SIZE, BY RANGE, 2018-2024 (USD MILLION)

- TABLE 248. GERMANY ELECTRIC KICK SCOOTER MARKET SIZE, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 249. GERMANY ELECTRIC KICK SCOOTER MARKET SIZE, BY VOLTAGE RANGE, 2018-2024 (USD MILLION)

- TABLE 250. GERMANY ELECTRIC KICK SCOOTER MARKET SIZE, BY VOLTAGE RANGE, 2025-2030 (USD MILLION)

- TABLE 251. GERMANY ELECTRIC KICK SCOOTER MARKET SIZE, BY SPEED, 2018-2024 (USD MILLION)

- TABLE 252. GERMANY ELECTRIC KICK SCOOTER MARKET SIZE, BY SPEED, 2025-2030 (USD MILLION)

- TABLE 253. GERMANY ELECTRIC KICK SCOOTER MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 254. GERMANY ELECTRIC KICK SCOOTER MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 255. GERMANY ELECTRIC KICK SCOOTER MARKET SIZE, BY END USER, 2018-2024 (USD MILLION)

- TABLE 256. GERMANY ELECTRIC KICK SCOOTER MARKET SIZE, BY END USER, 2025-2030 (USD MILLION)

- TABLE 257. GERMANY ELECTRIC KICK SCOOTER MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2024 (USD MILLION)

- TABLE 258. GERMANY ELECTRIC KICK SCOOTER MARKET SIZE, BY DISTRIBUTION CHANNEL, 2025-2030 (USD MILLION)

- TABLE 259. GERMANY ELECTRIC KICK SCOOTER MARKET SIZE, BY ONLINE, 2018-2024 (USD MILLION)

- TABLE 260. GERMANY ELECTRIC KICK SCOOTER MARKET SIZE, BY ONLINE, 2025-2030 (USD MILLION)

- TABLE 261. FRANCE ELECTRIC KICK SCOOTER MARKET SIZE, BY PRODUCT TYPE, 2018-2024 (USD MILLION)

- TABLE 262. FRANCE ELECTRIC KICK SCOOTER MARKET SIZE, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 263. FRANCE ELECTRIC KICK SCOOTER MARKET SIZE, BY CATEGORY, 2018-2024 (USD MILLION)

- TABLE 264. FRANCE ELECTRIC KICK SCOOTER MARKET SIZE, BY CATEGORY, 2025-2030 (USD MILLION)

- TABLE 265. FRANCE ELECTRIC KICK SCOOTER MARKET SIZE, BY BATTERY TYPE, 2018-2024 (USD MILLION)

- TABLE 266. FRANCE ELECTRIC KICK SCOOTER MARKET SIZE, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 267. FRANCE ELECTRIC KICK SCOOTER MARKET SIZE, BY RANGE, 2018-2024 (USD MILLION)

- TABLE 268. FRANCE ELECTRIC KICK SCOOTER MARKET SIZE, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 269. FRANCE ELECTRIC KICK SCOOTER MARKET SIZE, BY VOLTAGE RANGE, 2018-2024 (USD MILLION)

- TABLE 270. FRANCE ELECTRIC KICK SCOOTER MARKET SIZE, BY VOLTAGE RANGE, 2025-2030 (USD MILLION)

- TABLE 271. FRANCE ELECTRIC KICK SCOOTER MARKET SIZE, BY SPEED, 2018-2024 (USD MILLION)

- TABLE 272. FRANCE ELECTRIC KICK SCOOTER MARKET SIZE, BY SPEED, 2025-2030 (USD MILLION)

- TABLE 273. FRANCE ELECTRIC KICK SCOOTER MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 274. FRANCE ELECTRIC KICK SCOOTER MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 275. FRANCE ELECTRIC KICK SCOOTER MARKET SIZE, BY END USER, 2018-2024 (USD MILLION)

- TABLE 276. FRANCE ELECTRIC KICK SCOOTER MARKET SIZE, BY END USER, 2025-2030 (USD MILLION)

- TABLE 277. FRANCE ELECTRIC KICK SCOOTER MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2024 (USD MILLION)

- TABLE 278. FRANCE ELECTRIC KICK SCOOTER MARKET SIZE, BY DISTRIBUTION CHANNEL, 2025-2030 (USD MILLION)

- TABLE 279. FRANCE ELECTRIC KICK SCOOTER MARKET SIZE, BY ONLINE, 2018-2024 (USD MILLION)

- TABLE 280. FRANCE ELECTRIC KICK SCOOTER MARKET SIZE, BY ONLINE, 2025-2030 (USD MILLION)

- TABLE 281. RUSSIA ELECTRIC KICK SCOOTER MARKET SIZE, BY PRODUCT TYPE, 2018-2024 (USD MILLION)

- TABLE 282. RUSSIA ELECTRIC KICK SCOOTER MARKET SIZE, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 283. RUSSIA ELECTRIC KICK SCOOTER MARKET SIZE, BY CATEGORY, 2018-2024 (USD MILLION)

- TABLE 284. RUSSIA ELECTRIC KICK SCOOTER MARKET SIZE, BY CATEGORY, 2025-2030 (USD MILLION)

- TABLE 285. RUSSIA ELECTRIC KICK SCOOTER MARKET SIZE, BY BATTERY TYPE, 2018-2024 (USD MILLION)

- TABLE 286. RUSSIA ELECTRIC KICK SCOOTER MARKET SIZE, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 287. RUSSIA ELECTRIC KICK SCOOTER MARKET SIZE, BY RANGE, 2018-2024 (USD MILLION)

- TABLE 288. RUSSIA ELECTRIC KICK SCOOTER MARKET SIZE, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 289. RUSSIA ELECTRIC KICK SCOOTER MARKET SIZE, BY VOLTAGE RANGE, 2018-2024 (USD MILLION)

- TABLE 290. RUSSIA ELECTRIC KICK SCOOTER MARKET SIZE, BY VOLTAGE RANGE, 2025-2030 (USD MILLION)

- TABLE 291. RUSSIA ELECTRIC KICK SCOOTER MARKET SIZE, BY SPEED, 2018-2024 (USD MILLION)

- TABLE 292. RUSSIA ELECTRIC KICK SCOOTER MARKET SIZE, BY SPEED, 2025-2030 (USD MILLION)

- TABLE 293. RUSSIA ELECTRIC KICK SCOOTER MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 294. RUSSIA ELECTRIC KICK SCOOTER MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 295. RUSSIA ELECTRIC KICK SCOOTER MARKET SIZE, BY END USER, 2018-2024 (USD MILLION)

- TABLE 296. RUSSIA ELECTRIC KICK SCOOTER MARKET SIZE, BY END USER, 2025-2030 (USD MILLION)

- TABLE 297. RUSSIA ELECTRIC KICK SCOOTER MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2024 (USD MILLION)

- TABLE 298. RUSSIA ELECTRIC KICK SCOOTER MARKET SIZE, BY DISTRIBUTION CHANNEL, 2025-2030 (USD MILLION)

- TABLE 299. RUSSIA ELECTRIC KICK SCOOTER MARKET SIZE, BY ONLINE, 2018-2024 (USD MILLION)

- TABLE 300. RUSSIA ELECTRIC KICK SCOOTER MARKET SIZE, BY ONLINE, 2025-2030 (USD MILLION)

- TABLE 301. ITALY ELECTRIC KICK SCOOTER MARKET SIZE, BY PRODUCT TYPE, 2018-2024 (USD MILLION)

- TABLE 302. ITALY ELECTRIC KICK SCOOTER MARKET SIZE, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 303. ITALY ELECTRIC KICK SCOOTER MARKET SIZE, BY CATEGORY, 2018-2024 (USD MILLION)

- TABLE 304. ITALY ELECTRIC KICK SCOOTER MARKET SIZE, BY CATEGORY, 2025-2030 (USD MILLION)

- TABLE 305. ITALY ELECTRIC KICK SCOOTER MARKET SIZE, BY BATTERY TYPE, 2018-2024 (USD MILLION)

- TABLE 306. ITALY ELECTRIC KICK SCOOTER MARKET SIZE, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 307. ITALY ELECTRIC KICK SCOOTER MARKET SIZE, BY RANGE, 2018-2024 (USD MILLION)

- TABLE 308. ITALY ELECTRIC KICK SCOOTER MARKET SIZE, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 309. ITALY ELECTRIC KICK SCOOTER MARKET SIZE, BY VOLTAGE RANGE, 2018-2024 (USD MILLION)

- TABLE 310. ITALY ELECTRIC KICK SCOOTER MARKET SIZE, BY VOLTAGE RANGE, 2025-2030 (USD MILLION)

- TABLE 311. ITALY ELECTRIC KICK SCOOTER MARKET SIZE, BY SPEED, 2018-2024 (USD MILLION)

- TABLE 312. ITALY ELECTRIC KICK SCOOTER MARKET SIZE, BY SPEED, 2025-2030 (USD MILLION)

- TABLE 313. ITALY ELECTRIC KICK SCOOTER MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 314. ITALY ELECTRIC KICK SCOOTER MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 315. ITALY ELECTRIC KICK SCOOTER MARKET SIZE, BY END USER, 2018-2024 (USD MILLION)

- TABLE 316. ITALY ELECTRIC KICK SCOOTER MARKET SIZE, BY END USER, 2025-2030 (USD MILLION)

- TABLE 317. ITALY ELECTRIC KICK SCOOTER MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2024 (USD MILLION)

- TABLE 318. ITALY ELECTRIC KICK SCOOTER MARKET SIZE, BY DISTRIBUTION CHANNEL, 2025-2030 (USD MILLION)

- TABLE 319. ITALY ELECTRIC KICK SCOOTER MARKET SIZE, BY ONLINE, 2018-2024 (USD MILLION)

- TABLE 320. ITALY ELECTRIC KICK SCOOTER MARKET SIZE, BY ONLINE, 2025-2030 (USD MILLION)

- TABLE 321. SPAIN ELECTRIC KICK SCOOTER MARKET SIZE, BY PRODUCT TYPE, 2018-2024 (USD MILLION)

- TABLE 322. SPAIN ELECTRIC KICK SCOOTER MARKET SIZE, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 323. SPAIN ELECTRIC KICK SCOOTER MARKET SIZE, BY CATEGORY, 2018-2024 (USD MILLION)

- TABLE 324. SPAIN ELECTRIC KICK SCOOTER MARKET SIZE, BY CATEGORY, 2025-2030 (USD MILLION)

- TABLE 325. SPAIN ELECTRIC KICK SCOOTER MARKET SIZE, BY BATTERY TYPE, 2018-2024 (USD MILLION)

- TABLE 326. SPAIN ELECTRIC KICK SCOOTER MARKET SIZE, BY BATTERY TYPE, 2025-2030 (USD MILLION)

- TABLE 327. SPAIN ELECTRIC KICK SCOOTER MARKET SIZE, BY RANGE, 2018-2024 (USD MILLION)

- TABLE 328. SPAIN ELECTRIC KICK SCOOTER MARKET SIZE, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 329. SPAIN ELECTRIC KICK SCOOTER MARKET SIZE, BY VOLTAGE RANGE, 2018-2024 (USD MILLION)

- TABLE 330. SPAIN ELECTRIC KICK SCOOTER MARKET SIZE, BY VOLTAGE RANGE, 2025-2030 (USD MILLION)

- TABLE 331. SPAIN ELECTRIC KICK SCOOTER MARKET SIZE, BY SPEED, 2018-2024 (USD MILLION)

- TABLE 332. SPAIN ELECTRIC KICK SCOOTER MARKET SIZE, BY SPEED, 2025-2030 (USD MILLION)

- TABLE 333. SPAIN ELECTRIC KICK SCOOTER MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

- TABLE 334. SPAIN ELECTRIC KICK SCOOTER MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 335. SPAIN ELECTRIC KICK SCOOTER MARKET SIZE, BY END USER, 2018-2024 (USD MILLION)

- TABLE 336. SPAIN ELECTRIC KICK SCOOTER MARKET SIZE, BY END USER, 2025-2030 (USD MILLION)

- TABLE 337. SPAIN ELECTRIC KICK SCOOTER MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2024 (USD MILLION)

- TABLE 338. SPAIN ELECTRIC KICK SCOOTER MARKET SIZE, BY DISTRIBUTION CHANNEL, 2025-2030 (USD MILLION)

- TABLE 339. SPAIN ELECTRIC KICK SCOOTER MARKET SIZE, BY ONLINE, 2018-2024 (USD MILLION)

- TABLE 340. SPAIN ELECTRIC KICK SCOOTER MARKET SIZE, BY ONLINE, 2025-2030 (USD MILLION)

- TABLE 341. UNITED ARAB EMIRATES ELECTRIC KICK SCOOTER MARKET SIZE, BY PRODUCT TYPE, 2018-2024 (USD MILLION)

- TABLE 342. UNITED ARAB EMIRATES ELECTRIC KICK SCOOTER MARKET SIZE, BY PRODUCT TYPE, 2025-2030 (USD M

The Electric Kick Scooter Market was valued at USD 2.04 billion in 2024 and is projected to grow to USD 2.18 billion in 2025, with a CAGR of 7.50%, reaching USD 3.15 billion by 2030.

| KEY MARKET STATISTICS | |

|---|---|

| Base Year [2024] | USD 2.04 billion |

| Estimated Year [2025] | USD 2.18 billion |

| Forecast Year [2030] | USD 3.15 billion |

| CAGR (%) | 7.50% |

Unveiling the Thriving World of Electric Kick Scooters: Introduction to an Electrified Mobility Revolution Shaping Urban and Personal Transportation

Electric kick scooters have emerged as a defining symbol of modern urban mobility, blending convenience with a commitment to sustainability. As compact personal transportation devices, they cater to a diverse set of riders seeking efficient alternatives to congested streets and public transit. From daily commuters navigating busy city centers to outdoor enthusiasts exploring recreational pathways, these scooters promise a blend of agility, accessibility, and environmental benefits. Moreover, they integrate seamlessly with the rise of smart cities, leveraging lightweight designs and intuitive controls to offer a user-friendly experience.

In recent years, significant advancements in battery technology, motor efficiency, and lightweight materials have propelled the industry forward. These improvements have extended range, enhanced durability, and lowered costs, making electric kick scooters attractive to both individual consumers and fleet operators. Furthermore, evolving regulations around emissions and urban congestion have created a supportive environment for adoption. With growing investments in charging infrastructure and integrated mobility platforms, today's market resembles a dynamic ecosystem where technology meets consumer demand, creating opportunities for original equipment manufacturers, service providers, and stakeholders across the value chain.

Understanding the Technological Innovations Policy Evolution and Consumer Expectations Revolutionizing Electric Kick Scooter Adoption

The landscape of electric kick scooters has undergone a profound transformation, driven by several converging factors that have reshaped both production and consumption. First, the rapid evolution of battery chemistry and energy density has unlocked unprecedented ranges, enabling users to travel longer distances on a single charge. This technical breakthrough has, in turn, spurred new design innovations aimed at lightweight durability and modularity, making scooters easier to repair and upgrade. Additionally, the integration of IoT connectivity and app-based management tools has shifted expectations, as users now demand richer data on performance, route optimization, and predictive maintenance.

Simultaneously, regulatory frameworks have matured to address safety and urban integration. Cities around the globe are experimenting with dedicated scooter lanes, parking zones, and licensing requirements, creating an environment that balances rider freedom with public welfare. At the same time, rising environmental consciousness and corporate commitments to net zero targets have elevated the scooter as a low-carbon mobility solution. Thus, an ecosystem has emerged where technological innovation, policy support, and consumer preference align to facilitate faster adoption and deeper market penetration than ever before.

Analyzing the Ripple Effects of New 2025 United States Tariffs on Component Costs and Supply Chain Resilience for Electric Kick Scooters

The imposition of United States tariffs in 2025 has introduced new cost dynamics across the electric kick scooter supply chain, affecting manufacturers, distributors, and end users. These tariffs, primarily targeting key components such as lithium-ion cells, steel frames, and electronic controllers, have translated into increased input costs for assembly operations. Consequently, original equipment manufacturers are reassessing sourcing strategies, exploring alternative suppliers, and evaluating nearshoring options to mitigate the impact. To maintain competitive pricing, many brands have optimized production processes and invested in technology partnerships aimed at enhancing yield and reducing waste.

Furthermore, the cumulative effect of these tariffs extends to distribution networks and aftermarket services. Distributors are recalibrating inventory levels and renegotiating contracts to accommodate revised margin expectations, while service providers are revisiting maintenance pricing structures. End users, experiencing subtle price adjustments at point of sale or rental, may shift their preferences toward models with fewer tariff-exposed components, such as lighter frames or alternative battery chemistries. As a result, the 2025 tariff regime is reshaping strategic priorities, compelling stakeholders to innovate and adapt their value propositions in a more cost-sensitive marketplace.

Examining the Multifaceted Segmentation of Electric Kick Scooters for Tailored Performance Comfort and Market Reach Strategies

The electric kick scooter market exhibits a multifaceted segmentation framework, with product type distinguishing vehicles into two wheeled and three wheeled variants that cater to varied stability and maneuverability requirements. Meanwhile, category segmentation highlights foldable designs that offer portability, seated models that emphasize rider comfort, and standing scooters designed for agile urban travel. Delving deeper, battery type segmentation reveals a divide between traditional lead based power sources and modern lithium-ion systems that deliver improved energy density and lighter weights. When it comes to drivetrain classification, chain driven mechanisms remain prevalent among budget-oriented models, whereas hub motors gain popularity due to their compact and maintenance-friendly configuration.

Voltage range also defines distinct performance bands, with scooters engineered for speeds and torque profiles within below 24 V, 24-48 V, and above 48 V categories. Similarly, speed segmentation underscores rider needs across up to 15 Km/H urban cruisers, mid-range machines operating at 15-25 Km/H, and high-performance units exceeding 25 Km/H. Application segmentation differentiates commercial delivery platforms from personal commuting scooters and recreational models designed for leisure. Finally, the end user dimension separates adult-targeted designs from youth-focused offerings, and distribution channel segmentation spans offline routes such as direct sales and specialty stores as well as online portals including OEM websites and third-party marketplaces.

Unraveling Regional Mobility Trends and Infrastructure Developments Driving Electric Kick Scooter Adoption Across Key Global Markets

Regional dynamics in the electric kick scooter market underscore unique drivers and challenges across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, urban centers in North America are spearheading deployment through strategic partnerships among city governments, tech platforms, and local businesses. Latin American markets are gradually embracing shared mobility solutions, supported by investments in micro-mobility infrastructure and sustainability initiatives. Meanwhile, the Europe, Middle East & Africa region benefits from a dense regulatory environment that promotes low-carbon transport, with Western European nations leading in safety standards and dedicated scooter lanes. In emerging markets within Eastern Europe and the Middle East, the focus is on affordability and last-mile connectivity, creating opportunities for innovative solutions and localized business models.

In the Asia-Pacific region, rapid urbanization and burgeoning disposable incomes in key economies have catalyzed robust consumer demand. Established markets in East Asia leverage advanced manufacturing ecosystems, enabling producers to scale rapidly and iterate designs. Southeast Asia's diverse urban landscapes spur creative deployment strategies, including station-based fleets and subscription services. At the same time, regulatory bodies are working to harmonize safety protocols and parking regulations, striving to balance rapid adoption with public welfare.

Identifying the Market Leaders Driving Electric Kick Scooter Innovation Through Technology Partnerships Sustainability and Scalable Business Models

Leading companies in the electric kick scooter space are distinguished by their comprehensive approach to design, technology, and ecosystem partnerships. Some firms emphasize proprietary battery management systems and lightweight composites to differentiate on performance and range. Others focus on digital platforms, integrating mobile applications that offer route planning, charging station locators, and real-time diagnostics. Strategic alliances with urban planners, public transport operators, and last-mile delivery enterprises further amplify competitive positioning, allowing select companies to secure fleet contracts and long-term service agreements.

Moreover, several corporations have implemented modular architectures that facilitate rapid upgrades and streamlined maintenance, reducing downtime for fleet operators and enhancing total cost of ownership. A subset of players is investing heavily in sustainable manufacturing practices, incorporating recycled materials and renewable energy sources in production facilities. These efforts not only resonate with environmentally conscious consumers but also anticipate future regulatory requirements. By balancing product innovation with operational excellence and strategic partnerships, these companies are shaping the market's trajectory and defining new benchmarks in urban micro-mobility.

Crafting Forward-Looking Strategies for Innovation Infrastructure Integration and Sustainability to Achieve Leadership in Electric Kick Scooter Markets

To capitalize on burgeoning opportunities and navigate emerging challenges, industry leaders should prioritize several strategic initiatives. First, invest in next-generation battery technologies and powertrain optimizations to extend range and reduce charging cycles. Coupling these advancements with modular design architectures will enable swift product iterations and lower maintenance costs. Second, engage proactively with municipal stakeholders to co-develop dedicated micro-mobility infrastructure, such as smart parking zones and integrated charging hubs, enhancing consumer accessibility and safety.

Third, cultivate robust digital ecosystems by offering unified platforms for scooter sharing, fleet management, and after-sales support, simplifying the user journey and fostering brand loyalty. Fourth, diversify supply chains to mitigate tariff exposure and geopolitical risks, exploring regional assembly centers and strategic sourcing agreements. Finally, embed sustainability across operations by adopting circular economy principles-prioritizing recyclable materials and energy-efficient facilities-to meet evolving regulatory mandates and resonate with eco-conscious customers. By executing these actions, companies can strengthen resilience, differentiate offerings, and secure leadership positions in the electric kick scooter market.

Detailing the Comprehensive Mixed-Methods Research Framework Combining Primary Interviews Secondary Sources and Data Synthesis for Electric Kick Scooter Insights

This analysis employed a rigorous multi-tiered research methodology that combines primary engagements and secondary intelligence to uncover comprehensive insights into the electric kick scooter market. Primary research involved structured interviews and surveys with industry participants spanning manufacturers, distributors, fleet operators, infrastructure planners, and regulatory bodies. These dialogues yielded firsthand perspectives on technology trends, policy dynamics, and adoption barriers. Concurrently, observational studies and pilot program assessments provided granular data on user behavior, charging patterns, and maintenance requirements in diverse urban environments.

Secondary research encompassed an extensive review of academic journals, technical white papers, government publications, and reliable trade outlets. This process allowed for the validation of primary findings and the triangulation of data points, ensuring a cohesive narrative supported by multiple evidence streams. Data synthesis techniques, including scenario analysis and impact mapping, were applied to elucidate the interplay among technological innovations, regulatory frameworks, and market actors. The result is a robust, data-driven perspective designed to inform strategic decision-making and illuminate future trajectories.

Synthesizing Market Forces Technological Advances and Regional Dynamics to Articulate Future Opportunities in Electric Kick Scooter Mobility

In summary, electric kick scooters represent a dynamic mobility segment shaped by rapid technological progress, evolving regulatory landscapes, and shifting consumer preferences. The market's continued growth hinges on strategic advancements in battery performance, infrastructure integration, and digital platform development. Moreover, the recent United States tariff measures underscore the importance of resilient supply chains and localized sourcing strategies. As segmentation nuances reveal diverse user needs-from foldable commuter models to high-speed recreational scooters-companies must tailor offerings to capture distinct market segments effectively.

Geographical variations further highlight the need for region-specific approaches, balancing regulatory compliance with local adoption drivers. Leading players are distinguishing themselves through partnerships, modular design, and sustainability commitments, setting benchmarks for performance and environmental stewardship. By adopting a proactive stance on innovation and collaboration, stakeholders can navigate challenges and seize the transformative potential of electric kick scooters, ultimately redefining urban mobility and personal transportation.

Table of Contents

1. Preface

- 1.1. Objectives of the Study

- 1.2. Market Segmentation & Coverage

- 1.3. Years Considered for the Study

- 1.4. Currency & Pricing

- 1.5. Language

- 1.6. Stakeholders

2. Research Methodology

- 2.1. Define: Research Objective

- 2.2. Determine: Research Design

- 2.3. Prepare: Research Instrument

- 2.4. Collect: Data Source

- 2.5. Analyze: Data Interpretation

- 2.6. Formulate: Data Verification

- 2.7. Publish: Research Report

- 2.8. Repeat: Report Update

3. Executive Summary

4. Market Overview

- 4.1. Introduction

- 4.2. Market Sizing & Forecasting

5. Market Dynamics

- 5.1. Growing urban congestion boosting demand for compact, eco-friendly transportation alternatives

- 5.2. Growing popularity of foldable, lightweight scooters among commuters and students

- 5.3. Expanding shared micromobility fleets transforming short-distance urban travel behavior

- 5.4. Increasing online sales as consumers prefer convenience, reviews, and direct delivery

- 5.5. Rising integration of smart technologies such as GPS, IoT, and mobile connectivity

- 5.6. Advancing battery technologies enabling longer ranges and faster charging capabilities

- 5.7. Increasing demand for high-performance and off-road scooters among outdoor enthusiasts

- 5.8. Adoption of electric scooters for last-mile delivery by logistics and food platforms

6. Market Insights

- 6.1. Porter's Five Forces Analysis

- 6.2. PESTLE Analysis

7. Cumulative Impact of United States Tariffs 2025

8. Electric Kick Scooter Market, by Product Type

- 8.1. Introduction

- 8.2. Three Wheeled

- 8.3. Two Wheeled

9. Electric Kick Scooter Market, by Category

- 9.1. Introduction

- 9.2. Foldable

- 9.3. Traditional/Non-foldable

10. Electric Kick Scooter Market, by Battery Type

- 10.1. Introduction

- 10.2. Lead Based

- 10.3. Lithium-ion

11. Electric Kick Scooter Market, by Range

- 11.1. Introduction

- 11.2. Above 30km

- 11.3. Upto 30km

12. Electric Kick Scooter Market, by Voltage Range

- 12.1. Introduction

- 12.2. 24-48 V

- 12.3. Above 48 V

- 12.4. Below 24 V

13. Electric Kick Scooter Market, by Speed

- 13.1. Introduction

- 13.2. 15-25 Km/H

- 13.3. Above 25 Km/H

- 13.4. Up To 15 Km/H

14. Electric Kick Scooter Market, by Application

- 14.1. Introduction

- 14.2. Commercial Delivery

- 14.3. Personal Commuting

- 14.4. Recreational

15. Electric Kick Scooter Market, by End User

- 15.1. Introduction

- 15.2. Adults (Above 19 Years)

- 15.3. Teens (Upto 19 Years)

16. Electric Kick Scooter Market, by Distribution Channel

- 16.1. Introduction

- 16.2. Offline

- 16.3. Online

- 16.3.1. eCommerce Website

- 16.3.2. OEM Website

17. Americas Electric Kick Scooter Market

- 17.1. Introduction

- 17.2. United States

- 17.3. Canada

- 17.4. Mexico

- 17.5. Brazil

- 17.6. Argentina

18. Europe, Middle East & Africa Electric Kick Scooter Market

- 18.1. Introduction

- 18.2. United Kingdom

- 18.3. Germany

- 18.4. France

- 18.5. Russia

- 18.6. Italy

- 18.7. Spain

- 18.8. United Arab Emirates

- 18.9. Saudi Arabia

- 18.10. South Africa

- 18.11. Denmark

- 18.12. Netherlands

- 18.13. Qatar

- 18.14. Finland

- 18.15. Sweden

- 18.16. Nigeria

- 18.17. Egypt

- 18.18. Turkey

- 18.19. Israel

- 18.20. Norway

- 18.21. Poland

- 18.22. Switzerland

19. Asia-Pacific Electric Kick Scooter Market

- 19.1. Introduction

- 19.2. China

- 19.3. India

- 19.4. Japan

- 19.5. Australia

- 19.6. South Korea

- 19.7. Indonesia

- 19.8. Thailand

- 19.9. Philippines

- 19.10. Malaysia

- 19.11. Singapore

- 19.12. Vietnam

- 19.13. Taiwan

20. Competitive Landscape

- 20.1. Market Share Analysis, 2024

- 20.2. FPNV Positioning Matrix, 2024

- 20.3. Competitive Analysis

- 20.3.1. Apollo Scooters

- 20.3.2. EMotorad by Inkodop Technologies Private Limited

- 20.3.3. GOTRAX

- 20.3.4. Jiangsu Xinri E-Vehicle Co.,Ltd

- 20.3.5. Niu International Co.,Ltd.

- 20.3.6. Segway Inc. by Ninebot

- 20.3.7. Swagtron

- 20.3.8. Unagi Inc.

- 20.3.9. Xiaomi Corporation

- 20.3.10. Yadea Technology Group Co.,Ltd