|

|

市場調査レポート

商品コード

1809801

半導体廃液処理装置市場:処理タイプ別、装置タイプ別、容量別、材料構成別、技術別、用途別、エンドユーザー別、販売モデル別 - 2025年~2030年の世界予測Semiconductor Waste Liquid Treatment Equipment Market by Treatment Type, Equipment Type, Capacity, Material Composition, Technology, Application, End-User, Sales Model - Global Forecast 2025-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 半導体廃液処理装置市場:処理タイプ別、装置タイプ別、容量別、材料構成別、技術別、用途別、エンドユーザー別、販売モデル別 - 2025年~2030年の世界予測 |

|

出版日: 2025年08月28日

発行: 360iResearch

ページ情報: 英文 188 Pages

納期: 即日から翌営業日

|

概要

半導体廃液処理装置市場は、2024年に13億5,000万米ドルと評価され、2025年には14億5,000万米ドル、CAGR 7.68%で成長し、2030年には21億米ドルに達すると予測されています。

| 主な市場の統計 | |

|---|---|

| 基準年2024 | 13億5,000万米ドル |

| 推定年2025 | 14億5,000万米ドル |

| 予測年2030 | 21億米ドル |

| CAGR(%) | 7.68% |

急速に進化する環境規制状況の中、先進的な半導体廃液処理ソリューションで持続可能な成長を促進

半導体業界の急速な進歩により、チップ製造や関連プロセスで発生する複雑な廃液を管理・処理することが最重要課題となっています。これらの廃液は、重金属、金属イオン、無機化合物、有機化合物を含むことが多く、環境および規制上の重要な課題となっています。このような背景から、処理装置プロバイダーは、技術革新、最適化、ますます厳しくなる世界基準への準拠を強く求められています。

半導体セクターの廃液処理の進化を加速する先駆的な技術革新と持続可能性戦略

近年、半導体の廃液処理は、技術的な飛躍的進歩と持続可能性の要請の高まりの両方によって、一連の変革的なシフトを経験してきました。デジタル化と自動化は今や装置設計に不可欠であり、ダウンタイムと資源消費を削減するリアルタイムのモニタリングと予知保全を可能にしています。同時に、人工知能と機械学習が処理プロセスに統合されたことで、化学薬品の投与と運転パラメータが最適化され、以前は達成できなかった精度が実現した。

2025年米国関税政策が半導体廃液処理装置のサプライチェーンとコストに及ぼす遠大な影響の評価

2025年の米国の新関税導入は、半導体廃液処理装置のサプライチェーンに多大な波及効果をもたらしました。関税引き上げの対象となる装置の輸入は、製造設備の資本支出を押し上げ、多くのエンドユーザーがベンダーとの関係や調達戦略を見直すよう促しています。海外生産に大きく依存していた企業は現在、コスト変動や物流の混乱を緩和するために、二重調達モデルや現地組み立てを模索しています。

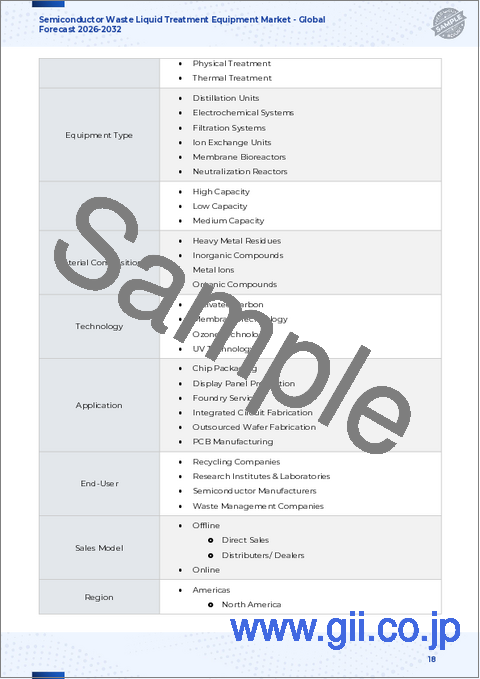

市場セグメンテーションの解明処理方法機器のタイプ容量材料構成技術用途と販売モデル

市場セグメンテーションを正確に理解することは、製品ロードマップを顧客要件に合致させるために不可欠です。処理の種類に基づき、市場は生物学的処理、化学的処理、物理的処理、熱処理について調査され、それぞれ汚染物質除去効率、エネルギー消費、製品別生成の面で明確な利点を提供しています。分析が装置タイプに移ると、蒸留ユニット、電気化学システム、ろ過システム、イオン交換ユニット、膜バイオリアクター、中和リアクターが対象となり、各技術が特定のプロセス課題にどのように対処しているかが浮き彫りになります。

廃液処理装置の南北アメリカ、欧州、中東・アフリカ、アジア太平洋地域の市場力学と戦略的成長パターンの分析

地域力学は、市場機会と規制圧力を決定する上で極めて重要な役割を果たします。南北アメリカでは、厳しい環境規制と半導体生産の再ショアリング重視が相まって、リーン生産方式に合致したモジュール式で迅速な展開が可能な処理システムへの需要が高まっています。米国の政策立案者と民間セクターの利害関係者の協力により、持続可能性の目標と運用の柔軟性の両方を満たす高度処理インフラへの投資が引き続き奨励されています。

半導体廃液処理装置の主要メーカーにおける競合ポジショニング戦略とイノベーション・リーダーシップのハイライト

主要企業は、差別化された技術ポートフォリオ、戦略的提携、研究開発への的を絞った投資を通じて優位性を競っています。大手水処理・廃液処理コングロマリットは、汚染物質ブレークスルー事象の予測分析を提供するデジタル制御プラットフォームと高度な膜分離活性汚泥処理モジュールを統合することで、半導体に特化した製品を拡大しています。同時に、専門機器メーカーは化学品サプライヤーと提携し、調達を簡素化し、プロセスの複雑性を軽減するエンドツーエンドの試薬注入ソリューションを提供しています。

半導体廃液処理事業におけるオペレーショナル・エクセレンス・コンプライアンスと持続的成長を推進するための戦略的実践提言

進化する規制と競合圧力に先んじるために、業界のリーダーは、フットプリントとエネルギー要件を削減しながら汚染物質除去を強化する統合膜技術の採用を優先すべきです。先進的なデジタルツインとリアルタイム分析プラットフォームに投資することで、積極的なメンテナンスのスケジューリングとプロセスの最適化が可能になり、総所有コストを削減することができます。さらに、化学品サプライヤーやリサイクル企業との戦略的パートナーシップを構築することで、資源回収の機会を引き出し、循環型の収益源を創出することができます。

半導体廃液処理装置市場の包括的な調査アプローチデータ収集方法と分析手法の詳細

本調査では、正確性と妥当性を確保するため、強固な混合手法によるアプローチを採用しています。本調査では、まず業界文献、規制当局への提出書類、特許データベースを幅広くレビューし、技術の進歩と新たな処理プロトコルをマッピングしました。規制の影響を定量化し、排水管理のベストプラクティスを特定するために、業界紙や環境機関の報告書などの二次情報源を体系的に分析しました。

半導体廃液処理技術の持続可能な進歩とイノベーションを確実にするための主要な発見と将来的な課題の統合

半導体廃液処理装置市場は、技術革新、持続可能性の要請、取引力学の変化が交錯する中で、継続的な変革の態勢を整えています。統合膜ソリューション、デジタルモニタリングプラットフォーム、サーキュラーエコノミーイニシアチブが競合優位性を再定義していることが明らかになりました。一方、地域によって規制が異なるため、適応性の高い装置設計と地域に根ざしたサービス能力の重要性が強調されています。

目次

第1章 序文

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場の概要

第5章 市場力学

- 半導体廃液処理プラントにおける膜分離活性汚泥法の利用増加傾向

- 環境政策の強化が半導体廃液処理装置イノベーションに与える影響

- 半導体製造の拡大が廃液処理装置市場の成長を牽引

- 半導体廃液管理のための持続可能な化学処理方法の出現

- 廃液処理の効率化に向けた半導体メーカーと技術プロバイダーの連携

- スペース最適化のためのコンパクトでモジュール化された半導体廃液処理装置の開発

- 半導体廃液処理工場における資源回収システムの需要増加

- 半導体廃液処理プロセスのリアルタイム監視のためのAIとIoTの統合

- 規制強化の中、環境に優しい半導体廃液処理ソリューションの採用が増加

- 半導体廃液処理効率を高めるナノ濾過技術の進歩

第6章 市場洞察

- ポーターのファイブフォース分析

- PESTEL分析

第7章 米国の関税の累積的な影響2025

第8章 半導体廃液処理装置市場:処理タイプ別

- 生物学的処理

- 化学処理

- 物理的処理

- 熱処理

第9章 半導体廃液処理装置市場:機器別

- 蒸留ユニット

- 電気化学システム

- ろ過システム

- イオン交換ユニット

- 膜分離活性汚泥法

- 中和炉

第10章 半導体廃液処理装置市場:容量別

- 大容量

- 小容量

- 中容量

第11章 半導体廃液処理装置市場:材料組成別

- 重金属残留物

- 無機化合物

- 金属イオン

- 有機化合物

第12章 半導体廃液処理装置市場:技術別

- 活性炭

- 膜技術

- オゾン技術

- UV技術

第13章 半導体廃液処理装置市場:用途別

- チップパッケージング

- ディスプレイパネル製造

- 鋳造サービス

- 集積回路製造

- アウトソーシングによるウエハー製造

- PCB製造

第14章 半導体廃液処理装置市場:エンドユーザー別

- リサイクル会社

- 研究機関およびラボ

- 半導体メーカー

- 廃棄物管理会社

第15章 半導体廃液処理装置市場:販売モデル別

- オフライン

- 直接販売

- 販売代理店

- オンライン

第16章 南北アメリカの半導体廃液処理装置市場

- 米国

- カナダ

- メキシコ

- ブラジル

- アルゼンチン

第17章 欧州・中東・アフリカの半導体廃液処理装置市場

- 英国

- ドイツ

- フランス

- ロシア

- イタリア

- スペイン

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- デンマーク

- オランダ

- カタール

- フィンランド

- スウェーデン

- ナイジェリア

- エジプト

- トルコ

- イスラエル

- ノルウェー

- ポーランド

- スイス

第18章 アジア太平洋地域の半導体廃液処理装置市場

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- インドネシア

- タイ

- フィリピン

- マレーシア

- シンガポール

- ベトナム

- 台湾

第19章 競合情勢

- 市場シェア分析, 2024

- FPNVポジショニングマトリックス, 2024

- 競合分析

- Aquatech International Limited.

- Arvia Water Technologies Ltd

- Axis Water Technologies

- Aqualyng by Almar Water Solutions

- DAS Environmental Expert GmbH

- Enviolet GmbH

- Ebara Corporation

- Gradiant Corporation

- Horiba Ltd.

- IDE Technologies Group by Alfa Water Partners

- Kurita Water Industries Ltd.

- Ovivo Inc

- Pentair PLC

- Saltworks Technologies Inc.

- SAMCO Technologies

- Suez S.A.

- Xylem Inc.

- Veolia Water Solutions & Technologies SA

- Envirogen Technologies, Inc.

- Organo Corporation