|

|

市場調査レポート

商品コード

1806152

洋上風力発電市場:コンポーネント、基礎タイプ、タービン容量、用途、エンドユーザー別 - 2025年~2030年の世界予測Offshore Wind Power Market by Component, Foundation Type, Turbine Capacity, Application, End-User - Global Forecast 2025-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 洋上風力発電市場:コンポーネント、基礎タイプ、タービン容量、用途、エンドユーザー別 - 2025年~2030年の世界予測 |

|

出版日: 2025年08月28日

発行: 360iResearch

ページ情報: 英文 191 Pages

納期: 即日から翌営業日

|

概要

洋上風力発電市場は、2024年には423億8,000万米ドルとなり、2025年には455億5,000万米ドル、CAGR7.82%で成長し、2030年には665億8,000万米ドルに達すると予測されています。

| 主な市場の統計 | |

|---|---|

| 基準年2024 | 423億8,000万米ドル |

| 推定年2025 | 455億5,000万米ドル |

| 予測年2030 | 665億8,000万米ドル |

| CAGR(%) | 7.82% |

政策、技術、市場促進要因に関する包括的な洞察を通じて、新たな洋上風力発電の時代を切り拓く

洋上風力発電のイントロダクションは、世界の脱炭素化目標の達成とエネルギー安全保障の強化において、この再生可能エネルギー源が果たす重要な役割の探求から始まっています。タービン設計の急速な進歩は、クリーンエネルギーへの政策的コミットメントと相まって、前例のない成長と技術的成熟の舞台を整えつつあります。

洋上風力発電の状況を形成し、将来の成長機会を促進する、極めて重要な技術革新と政策転換を明らかにします

洋上風力発電の状況は、浮体式基礎技術やメガワット規模のタービンアーキテクチャの飛躍的な進歩によって、大きく変化しています。水深が深くなるにつれて、浮体式プラットフォームは従来の固定底構造物に代わる実行可能な選択肢として登場し、以前はアクセスできなかった深い海洋環境の資源を解き放ちます。この技術革新は、プロジェクトのライフサイクルを延長し、環境フットプリントを削減しながらより高いエネルギー収量を実現することを約束するものです。

2025年に施行される米国の関税が洋上風力発電のサプライチェーン・ダイナミクスとプロジェクトの実行可能性に及ぼす複雑な影響の評価

2025年に米国が一部の洋上風力発電部品に関税を導入することで、プロジェクト開発者と機器メーカーにとって、サプライチェーンとコストに関する複雑な検討事項が生じています。鉄塔、タービンナセル、海底ケーブルなどの主要材料やアセンブリには輸入関税が追加されることになり、利害関係者は調達戦略や現地化計画の再評価を迫られています。

洋上風力におけるコンポーネント構成、基礎タイプ、タービン容量、用途、およびエンドユーザーの力学にまたがる戦略的洞察の抽出

重要な洞察は、多次元にわたる洋上風力発電のセグメンテーションの詳細な分析から浮かび上がります。コンポーネント構成は、電気インフラ、下部構造、タービンに及ぶ。下部構造は、タービンを海底に固定するモノパイルソリューションとともに、ジャケット型と重力ベースの設計に区別されます。タービンの組み立て自体は、ナセル、ローターとブレード、タワーを一体化したもので、それぞれに異なるエンジニアリング、製造、メンテナンスの要件があります。

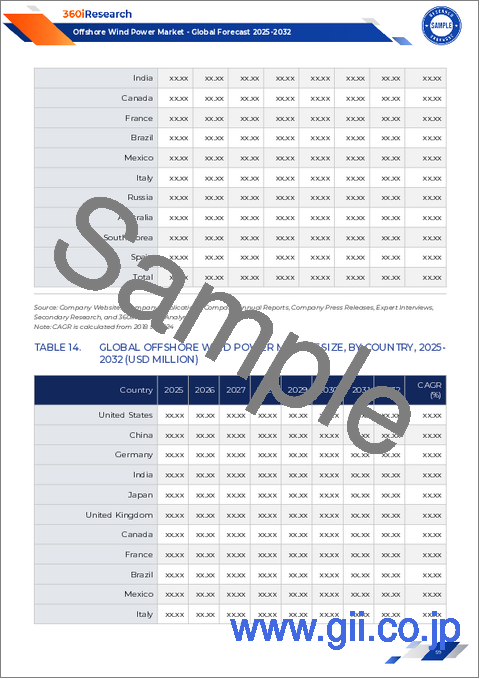

南北アメリカ、中東アフリカ、アジア太平洋市場における洋上風力セクターの地域力学を探る

洋上風力発電の地域ダイナミックスは、主要地域間で異なる軌跡と戦略的要請を明らかにしています。南北アメリカでは、米国とカナダが、連邦税額控除や州による調達義務に支えられながら、容量目標を確保するための規制改革やオークション・メカニズムを急速に進めています。これらの政策手段は、プロジェクトのバンカビリティを強化し、新規参入者を惹きつけ、開発業者、港湾運営業者、送電専門業者間の提携による競合情勢につながっています。

洋上風力発電分野におけるイノベーション、戦略的パートナーシップ、競合他社との差別化を推進する業界大手企業を調査

複数の大手企業が、戦略的パートナーシップ、技術投資、プロジェクトパイプラインを通じて、洋上風力発電の競合情勢を形成しています。世界のタービンメーカーは、より高い発電容量と設置面積の縮小を実現する次世代機の開発にしのぎを削っています。同時に、エネルギー会社と専門の船舶運航会社のコンソーシアムが、物流ワークフローを最適化し、プロジェクト実行スケジュールを加速するために台頭してきています。

規制の複雑さを克服し、業務効率を高め、持続可能な成長を促進するための戦略的提言を業界リーダーに提供します

業界のリーダーは、政策への関与と規制機関との戦略的連携を優先することで、一般的な動向を活用し、複雑さを乗り切ることができます。許認可当局や系統運用者との積極的な対話チャネルを確立することで、承認までの時間を短縮し、プロジェクト開発のための協力的な道筋を促進することができます。

洋上風力発電市場の包括的分析を支える厳密な定性的・定量的調査アプローチの概略

本分析を支える調査手法は、堅牢性と妥当性を確保するために、厳格な定性的アプローチと定量的アプローチを組み合わせています。1次調査は、タービンOEM、プロジェクト開発者、電力事業者、規制機関の上級幹部との詳細なインタビューで構成されています。これらの対話を通じて、既存市場および新興市場における新たな課題、技術採用パターン、政策改革の影響について探りました。

進化する洋上風力発電エコシステムにおける利害関係者の戦略的課題と将来展望を明らかにするための主要調査結果の統合

結論として、洋上風力発電セクターは、急速な技術進歩、進化する政策枠組み、ダイナミックな市場勢力によって定義される極めて重要な岐路に立っています。浮体式基礎システム、メガワット規模のタービン、デジタル資産管理ソリューションの統合は、より深く、より課題の多い海洋環境における新たな開発の機会を解き放ちつつあります。

目次

第1章 序文

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場の概要

第5章 市場力学

- 浮体式洋上風力発電所の急速な拡大により深海域でのエネルギー生産が促進されている

- 大型タービンのメンテナンスとパフォーマンスを最適化するデジタルツイン技術の統合

- 石油大手と再生可能エネルギー開発業者の戦略的提携が洋上風力発電への投資を加速

- 大容量アレイ間ケーブル配線の進歩により、タービンネットワーク全体の伝送損失が低減

- ハイブリッド風力とグリーン水素プラットフォームの出現が洋上エネルギーサプライチェーンを変革

- 欧州における国境を越えた洋上風力発電プロジェクトの承認を形作る新たな規制枠組み

- 海底基礎設計の革新により、深海や複雑な土壌での設置コストが低減

- 次世代の高容量ケーブルの導入により、洋上タービンネットワーク全体の送電損失が大幅に削減されます。

- 高圧直流リンクの採用により、洋上風力発電の大陸間送電網への輸出能力が拡大

- ロボットブレード検査ドローンの導入により、メンテナンスの安全性が向上し、ダウンタイムコストが削減されます。

第6章 市場洞察

- ポーターのファイブフォース分析

- PESTEL分析

第7章 米国の関税の累積的な影響2025

第8章 洋上風力発電市場:コンポーネント別

- 電気インフラ

- 洋上変電所

- 海底ケーブル

- 下部構造

- ジャケットと重力ベース

- モノパイル

- タービン

- ナセル

- ローターとブレード

- タワー

第9章 洋上風力発電市場:基礎タイプ別

- 固定底

- フローティング

第10章 洋上風力発電市場:タービン容量別

- 3~5MW

- 5MW以上

- 最大3MW

第11章 洋上風力発電市場:用途別

- 商業用

- 産業

第12章 洋上風力発電市場:エンドユーザー別

- 政府

- 独立発電事業者

第13章 南北アメリカの洋上風力発電市場

- 米国

- カナダ

- メキシコ

- ブラジル

- アルゼンチン

第14章 欧州・中東・アフリカの洋上風力発電市場

- 英国

- ドイツ

- フランス

- ロシア

- イタリア

- スペイン

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- デンマーク

- オランダ

- カタール

- フィンランド

- スウェーデン

- ナイジェリア

- エジプト

- トルコ

- イスラエル

- ノルウェー

- ポーランド

- スイス

第15章 アジア太平洋地域の洋上風力発電市場

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- インドネシア

- タイ

- フィリピン

- マレーシア

- シンガポール

- ベトナム

- 台湾

第16章 競合情勢

- 市場シェア分析, 2024

- FPNVポジショニングマトリックス, 2024

- 競合分析

- Acciona, SA

- Envision Energy USA Limited

- AEROVIDE GmbH

- Alstom SA

- AREVA S.A

- Chongqing Haizhuang Windpower Equipment Co.,Ltd.

- Darwind B.V.

- DNV AS Group

- Dongfang Electric Corporation Ltd.

- Doosan Enerbility Co., Ltd.

- EDF S.A

- Duke Energy Corporation

- EON UK plc

- GE Vernova

- Goldwind Science&Technology Co., Ltd

- Hitachi Energy Ltd.

- Prysmian S.p.A

- SEA WIND MANAGEMENT GmbH

- Shanghai Electric Group Company Limited

- Siemens AG

- Suzlon Energy Limited

- Vestas Wind Systems A/S

- Nordex SE

- Orsted A/S