|

|

市場調査レポート

商品コード

1677392

パルミトレイン酸市場:供給源、純度レベル、用途、流通チャネル別-2025-2030年の世界予測Palmitoleic Acid Market by Source, Purity Level, Application, Distribution Channel - Global Forecast 2025-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| パルミトレイン酸市場:供給源、純度レベル、用途、流通チャネル別-2025-2030年の世界予測 |

|

出版日: 2025年03月09日

発行: 360iResearch

ページ情報: 英文 183 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 図表

- 目次

パルミトレイン酸市場は、2024年には1億2,878万米ドルとなり、2025年には1億3,444万米ドル、CAGR 4.53%で成長し、2030年には1億6,805万米ドルに達すると予測されています。

| 主な市場の統計 | |

|---|---|

| 基準年 2024 | 1億2,878万米ドル |

| 推定年 2025 | 1億3,444万米ドル |

| 予測年 2030 | 1億6,805万米ドル |

| CAGR(%) | 4.53% |

パルミトレイン酸は、様々な工業用途や消費者用途において重要な成分として登場し、その多機能性で注目を集めています。この自然界に存在する一価不飽和脂肪酸は、健康、化粧品、工業の各分野でそのユニークな効能が評価され、効能と持続可能性のバランスを必要とする製剤への使用が増加しています。消費者の意識と高機能成分の必要性によって需要が高まる中、パルミトレイン酸の市場は、現代の動向と革新的な製品開発を反映して急速に進化しています。

最近の抽出技術の進歩と高純度化により、高価値用途におけるパルミトレイン酸の地位はさらに強固なものとなっています。世界中の企業や研究者が、特に動物飼料、飲食品、パーソナルケアなどの分野で、配合の最適化におけるパルミトレイン酸の可能性を検討しています。市場力学が変化するにつれ、競合情勢は新技術と戦略的資源配分を取り込むように適応しており、この時期は大きな転換期でありチャンスでもあります。現在の市場環境は、厳格な製品革新、規制当局の支援、消費者の関心の高まりを特徴としています。この包括的な概要では、必須工業原料としてのパルミトレイン酸の進化に関する重要な洞察を提供し、以降のセクションでのさらなる分析の舞台を整えます。

パルミトレイン酸市場の変革

近年、パルミトオレイン酸市場は、生産技術の進歩、コスト競争の激化、天然で持続可能な原料に対する消費者の需要の高まりなどを背景に、大きな変貌を遂げています。情勢の変化は、製品の純度と一貫性を大幅に高める抽出プロセスの強化によって顕著であり、それによってハイエンド用途の範囲が拡大しています。市場規制と品質基準の変化も生産手法に影響を及ぼし、メーカーが一貫して世界・ベンチマークを満たすことを保証しています。

最新のバイオテクノロジーとグリーンケミストリーが生産ワークフローに統合されたことで、より効率的なプロセスと環境への影響低減への道が開かれました。研究開発への投資の増加は、加工技術の改善を加速させ、コスト削減と製品イノベーションを促進しました。こうした開発により、従来の抽出方法からより環境に優しい代替方法へと戦略的な軸足が移され、市場の慣行が世界の持続可能性の動向に合致するようになりました。

その結果、利害関係者は、より厳格なコンプライアンスと品質管理を受け入れながら、新たな需要に対応する態勢を整えました。この変革は、競合優位性を高めるだけでなく、多様な産業で広く採用されるための舞台を整え、既存市場と新興市場の両方で勢いをもたらしています。

市場セグメンテーションの深い洞察

パルミトレイン酸市場のセグメンテーション分析により、その多面性を理解するための包括的なアプローチが明らかになりました。パルミトオレイン酸の供給源は、植物由来と海洋由来の両方があり、それぞれの供給源は加工技術や製品性能の面で明確な利点を提供しています。純度レベルは市場セグメンテーションをさらに細分化し、純度99%以上の製品は、それ以下の製品との差別化を図り、価格戦略と最終用途の両方に影響を与えます。

用途ベースのセグメンテーションは、主要な市場動向を見極める上で極めて重要です。動物飼料、化粧品・パーソナルケア、飲食品、医薬品・栄養補助食品といったさまざまな分野がパルミトオレイン酸を利用しており、バイオアベイラビリティの向上、製品の安定性の改善、標的健康効果といった機能的利点に基づく需要がそれぞれ拡大しています。さらに、流通チャネルに注目すると、オフラインとオンラインのネットワークの間に対照的なダイナミクスがあることがわかる。この重層的なセグメンテーションは、パルミトオレイン酸の多様な用途を示すだけでなく、現代の消費者や業界関係者のニーズの進化を浮き彫りにしています。このような次元を理解することで、利害関係者は、需要と地域の両方の考慮事項に沿った戦略を立てるための実用的な洞察を得ることができます。

目次

第1章 序文

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場の概要

第5章 市場洞察

- 市場力学

- 促進要因

- 天然およびオーガニックのパーソナルケア製品に対する需要の増加

- 健康意識の高まりと栄養補助食品や機能性食品の需要

- 抑制要因

- パルミトレイン酸の抽出と精製に関連する高コスト

- 機会

- 新しい用途とより効率的な生産方法のためのバイオテクノロジーの継続的な進歩

- 栄養補助食品の需要拡大による高い潜在性

- 課題

- 食品および化粧品における脂肪酸の使用に関する厳格な規制枠組み

- 促進要因

- 市場セグメンテーション分析

- 出典:環境に配慮した消費者の嗜好による植物由来原料の好み

- 応用:化粧品やパーソナルケアにおけるパルミトレイン酸の活用により肌の弾力性を高め、乾燥を防ぐ

- ポーターのファイブフォース分析

- PESTEL分析

- 政治的

- 経済

- 社交

- 技術的

- 法律上

- 環境

第6章 パルミトレイン酸市場:ソース別

- 植物由来の原料

- 海洋資源

第7章 パルミトレイン酸市場純度レベル別

- 99%以上

- 99%未満

第8章 パルミトレイン酸市場:用途別

- 動物飼料

- 化粧品・パーソナルケア

- 食品・飲料

- 医薬品および栄養補助食品

第9章 パルミトレイン酸市場:流通チャネル別

- オフライン

- オンライン

第10章 南北アメリカのパルミトレイン酸市場

- アルゼンチン

- ブラジル

- カナダ

- メキシコ

- 米国

第11章 アジア太平洋地域のパルミトレイン酸市場

- オーストラリア

- 中国

- インド

- インドネシア

- 日本

- マレーシア

- フィリピン

- シンガポール

- 韓国

- 台湾

- タイ

- ベトナム

第12章 欧州・中東・アフリカのパルミトレイン酸市場

- デンマーク

- エジプト

- フィンランド

- フランス

- ドイツ

- イスラエル

- イタリア

- オランダ

- ナイジェリア

- ノルウェー

- ポーランド

- カタール

- ロシア

- サウジアラビア

- 南アフリカ

- スペイン

- スウェーデン

- スイス

- トルコ

- アラブ首長国連邦

- 英国

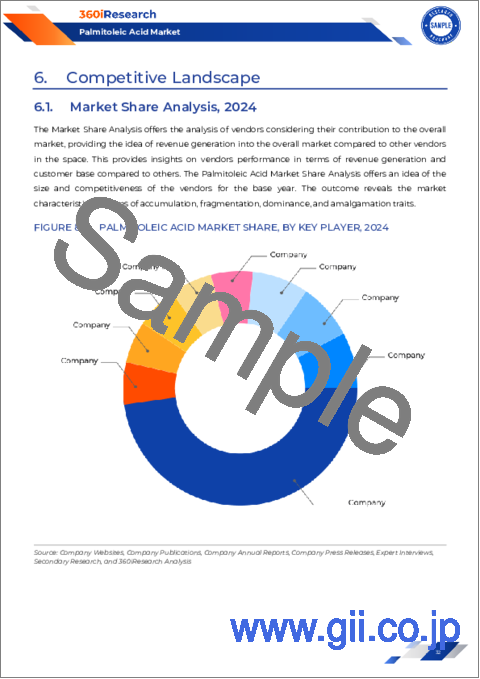

第13章 競合情勢

- 市場シェア分析, 2024

- FPNVポジショニングマトリックス, 2024

- 競合シナリオ分析

- 戦略分析と提言

企業一覧

- Alsachim

- Ambeed, Inc.

- Biomol GmbH

- Biosynth Ltd

- Cambridge Isotope Laboratories, Inc.

- Cayman Chemical

- Central Drug House

- Clearsynth

- CPAChem

- Ethical Naturals, Inc.

- Finetech Industry Limited

- Glentham Life Sciences Limited

- Larodan AB

- Merck KGaA

- MP Biomedicals

- Otto Chemie Pvt. Ltd.

- Santa Cruz Biotechnology, Inc.

- Shandong Minglang Chemical Co., Ltd

- Tersus Life Sciences

- Thermo Fisher Scientific

- Unilong Industry Co., Ltd.

- Wiley Companies

LIST OF FIGURES

- FIGURE 1. PALMITOLEIC ACID MARKET MULTI-CURRENCY

- FIGURE 2. PALMITOLEIC ACID MARKET MULTI-LANGUAGE

- FIGURE 3. PALMITOLEIC ACID MARKET RESEARCH PROCESS

- FIGURE 4. PALMITOLEIC ACID MARKET SIZE, 2024 VS 2030

- FIGURE 5. GLOBAL PALMITOLEIC ACID MARKET SIZE, 2018-2030 (USD MILLION)

- FIGURE 6. GLOBAL PALMITOLEIC ACID MARKET SIZE, BY REGION, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 7. GLOBAL PALMITOLEIC ACID MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 8. GLOBAL PALMITOLEIC ACID MARKET SIZE, BY SOURCE, 2024 VS 2030 (%)

- FIGURE 9. GLOBAL PALMITOLEIC ACID MARKET SIZE, BY SOURCE, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 10. GLOBAL PALMITOLEIC ACID MARKET SIZE, BY PURITY LEVEL, 2024 VS 2030 (%)

- FIGURE 11. GLOBAL PALMITOLEIC ACID MARKET SIZE, BY PURITY LEVEL, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 12. GLOBAL PALMITOLEIC ACID MARKET SIZE, BY APPLICATION, 2024 VS 2030 (%)

- FIGURE 13. GLOBAL PALMITOLEIC ACID MARKET SIZE, BY APPLICATION, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 14. GLOBAL PALMITOLEIC ACID MARKET SIZE, BY DISTRIBUTION CHANNEL, 2024 VS 2030 (%)

- FIGURE 15. GLOBAL PALMITOLEIC ACID MARKET SIZE, BY DISTRIBUTION CHANNEL, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 16. AMERICAS PALMITOLEIC ACID MARKET SIZE, BY COUNTRY, 2024 VS 2030 (%)

- FIGURE 17. AMERICAS PALMITOLEIC ACID MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 18. UNITED STATES PALMITOLEIC ACID MARKET SIZE, BY STATE, 2024 VS 2030 (%)

- FIGURE 19. UNITED STATES PALMITOLEIC ACID MARKET SIZE, BY STATE, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 20. ASIA-PACIFIC PALMITOLEIC ACID MARKET SIZE, BY COUNTRY, 2024 VS 2030 (%)

- FIGURE 21. ASIA-PACIFIC PALMITOLEIC ACID MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 22. EUROPE, MIDDLE EAST & AFRICA PALMITOLEIC ACID MARKET SIZE, BY COUNTRY, 2024 VS 2030 (%)

- FIGURE 23. EUROPE, MIDDLE EAST & AFRICA PALMITOLEIC ACID MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 24. PALMITOLEIC ACID MARKET SHARE, BY KEY PLAYER, 2024

- FIGURE 25. PALMITOLEIC ACID MARKET, FPNV POSITIONING MATRIX, 2024

LIST OF TABLES

- TABLE 1. PALMITOLEIC ACID MARKET SEGMENTATION & COVERAGE

- TABLE 2. UNITED STATES DOLLAR EXCHANGE RATE, 2018-2024

- TABLE 3. GLOBAL PALMITOLEIC ACID MARKET SIZE, 2018-2030 (USD MILLION)

- TABLE 4. GLOBAL PALMITOLEIC ACID MARKET SIZE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 5. GLOBAL PALMITOLEIC ACID MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 6. PALMITOLEIC ACID MARKET DYNAMICS

- TABLE 7. GLOBAL PALMITOLEIC ACID MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 8. GLOBAL PALMITOLEIC ACID MARKET SIZE, BY BOTANICAL SOURCES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 9. GLOBAL PALMITOLEIC ACID MARKET SIZE, BY MARINE SOURCES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 10. GLOBAL PALMITOLEIC ACID MARKET SIZE, BY PURITY LEVEL, 2018-2030 (USD MILLION)

- TABLE 11. GLOBAL PALMITOLEIC ACID MARKET SIZE, BY ABOVE 99%, BY REGION, 2018-2030 (USD MILLION)

- TABLE 12. GLOBAL PALMITOLEIC ACID MARKET SIZE, BY BELOW 99%, BY REGION, 2018-2030 (USD MILLION)

- TABLE 13. GLOBAL PALMITOLEIC ACID MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 14. GLOBAL PALMITOLEIC ACID MARKET SIZE, BY ANIMAL FEED, BY REGION, 2018-2030 (USD MILLION)

- TABLE 15. GLOBAL PALMITOLEIC ACID MARKET SIZE, BY COSMETICS & PERSONAL CARE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 16. GLOBAL PALMITOLEIC ACID MARKET SIZE, BY FOOD & BEVERAGES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 17. GLOBAL PALMITOLEIC ACID MARKET SIZE, BY PHARMACEUTICALS & NUTRACEUTICALS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 18. GLOBAL PALMITOLEIC ACID MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 19. GLOBAL PALMITOLEIC ACID MARKET SIZE, BY OFFLINE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 20. GLOBAL PALMITOLEIC ACID MARKET SIZE, BY ONLINE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 21. AMERICAS PALMITOLEIC ACID MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 22. AMERICAS PALMITOLEIC ACID MARKET SIZE, BY PURITY LEVEL, 2018-2030 (USD MILLION)

- TABLE 23. AMERICAS PALMITOLEIC ACID MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 24. AMERICAS PALMITOLEIC ACID MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 25. AMERICAS PALMITOLEIC ACID MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 26. ARGENTINA PALMITOLEIC ACID MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 27. ARGENTINA PALMITOLEIC ACID MARKET SIZE, BY PURITY LEVEL, 2018-2030 (USD MILLION)

- TABLE 28. ARGENTINA PALMITOLEIC ACID MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 29. ARGENTINA PALMITOLEIC ACID MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 30. BRAZIL PALMITOLEIC ACID MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 31. BRAZIL PALMITOLEIC ACID MARKET SIZE, BY PURITY LEVEL, 2018-2030 (USD MILLION)

- TABLE 32. BRAZIL PALMITOLEIC ACID MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 33. BRAZIL PALMITOLEIC ACID MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 34. CANADA PALMITOLEIC ACID MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 35. CANADA PALMITOLEIC ACID MARKET SIZE, BY PURITY LEVEL, 2018-2030 (USD MILLION)

- TABLE 36. CANADA PALMITOLEIC ACID MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 37. CANADA PALMITOLEIC ACID MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 38. MEXICO PALMITOLEIC ACID MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 39. MEXICO PALMITOLEIC ACID MARKET SIZE, BY PURITY LEVEL, 2018-2030 (USD MILLION)

- TABLE 40. MEXICO PALMITOLEIC ACID MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 41. MEXICO PALMITOLEIC ACID MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 42. UNITED STATES PALMITOLEIC ACID MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 43. UNITED STATES PALMITOLEIC ACID MARKET SIZE, BY PURITY LEVEL, 2018-2030 (USD MILLION)

- TABLE 44. UNITED STATES PALMITOLEIC ACID MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 45. UNITED STATES PALMITOLEIC ACID MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 46. UNITED STATES PALMITOLEIC ACID MARKET SIZE, BY STATE, 2018-2030 (USD MILLION)

- TABLE 47. ASIA-PACIFIC PALMITOLEIC ACID MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 48. ASIA-PACIFIC PALMITOLEIC ACID MARKET SIZE, BY PURITY LEVEL, 2018-2030 (USD MILLION)

- TABLE 49. ASIA-PACIFIC PALMITOLEIC ACID MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 50. ASIA-PACIFIC PALMITOLEIC ACID MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 51. ASIA-PACIFIC PALMITOLEIC ACID MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 52. AUSTRALIA PALMITOLEIC ACID MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 53. AUSTRALIA PALMITOLEIC ACID MARKET SIZE, BY PURITY LEVEL, 2018-2030 (USD MILLION)

- TABLE 54. AUSTRALIA PALMITOLEIC ACID MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 55. AUSTRALIA PALMITOLEIC ACID MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 56. CHINA PALMITOLEIC ACID MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 57. CHINA PALMITOLEIC ACID MARKET SIZE, BY PURITY LEVEL, 2018-2030 (USD MILLION)

- TABLE 58. CHINA PALMITOLEIC ACID MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 59. CHINA PALMITOLEIC ACID MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 60. INDIA PALMITOLEIC ACID MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 61. INDIA PALMITOLEIC ACID MARKET SIZE, BY PURITY LEVEL, 2018-2030 (USD MILLION)

- TABLE 62. INDIA PALMITOLEIC ACID MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 63. INDIA PALMITOLEIC ACID MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 64. INDONESIA PALMITOLEIC ACID MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 65. INDONESIA PALMITOLEIC ACID MARKET SIZE, BY PURITY LEVEL, 2018-2030 (USD MILLION)

- TABLE 66. INDONESIA PALMITOLEIC ACID MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 67. INDONESIA PALMITOLEIC ACID MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 68. JAPAN PALMITOLEIC ACID MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 69. JAPAN PALMITOLEIC ACID MARKET SIZE, BY PURITY LEVEL, 2018-2030 (USD MILLION)

- TABLE 70. JAPAN PALMITOLEIC ACID MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 71. JAPAN PALMITOLEIC ACID MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 72. MALAYSIA PALMITOLEIC ACID MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 73. MALAYSIA PALMITOLEIC ACID MARKET SIZE, BY PURITY LEVEL, 2018-2030 (USD MILLION)

- TABLE 74. MALAYSIA PALMITOLEIC ACID MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 75. MALAYSIA PALMITOLEIC ACID MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 76. PHILIPPINES PALMITOLEIC ACID MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 77. PHILIPPINES PALMITOLEIC ACID MARKET SIZE, BY PURITY LEVEL, 2018-2030 (USD MILLION)

- TABLE 78. PHILIPPINES PALMITOLEIC ACID MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 79. PHILIPPINES PALMITOLEIC ACID MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 80. SINGAPORE PALMITOLEIC ACID MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 81. SINGAPORE PALMITOLEIC ACID MARKET SIZE, BY PURITY LEVEL, 2018-2030 (USD MILLION)

- TABLE 82. SINGAPORE PALMITOLEIC ACID MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 83. SINGAPORE PALMITOLEIC ACID MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 84. SOUTH KOREA PALMITOLEIC ACID MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 85. SOUTH KOREA PALMITOLEIC ACID MARKET SIZE, BY PURITY LEVEL, 2018-2030 (USD MILLION)

- TABLE 86. SOUTH KOREA PALMITOLEIC ACID MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 87. SOUTH KOREA PALMITOLEIC ACID MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 88. TAIWAN PALMITOLEIC ACID MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 89. TAIWAN PALMITOLEIC ACID MARKET SIZE, BY PURITY LEVEL, 2018-2030 (USD MILLION)

- TABLE 90. TAIWAN PALMITOLEIC ACID MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 91. TAIWAN PALMITOLEIC ACID MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 92. THAILAND PALMITOLEIC ACID MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 93. THAILAND PALMITOLEIC ACID MARKET SIZE, BY PURITY LEVEL, 2018-2030 (USD MILLION)

- TABLE 94. THAILAND PALMITOLEIC ACID MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 95. THAILAND PALMITOLEIC ACID MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 96. VIETNAM PALMITOLEIC ACID MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 97. VIETNAM PALMITOLEIC ACID MARKET SIZE, BY PURITY LEVEL, 2018-2030 (USD MILLION)

- TABLE 98. VIETNAM PALMITOLEIC ACID MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 99. VIETNAM PALMITOLEIC ACID MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 100. EUROPE, MIDDLE EAST & AFRICA PALMITOLEIC ACID MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 101. EUROPE, MIDDLE EAST & AFRICA PALMITOLEIC ACID MARKET SIZE, BY PURITY LEVEL, 2018-2030 (USD MILLION)

- TABLE 102. EUROPE, MIDDLE EAST & AFRICA PALMITOLEIC ACID MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 103. EUROPE, MIDDLE EAST & AFRICA PALMITOLEIC ACID MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 104. EUROPE, MIDDLE EAST & AFRICA PALMITOLEIC ACID MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 105. DENMARK PALMITOLEIC ACID MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 106. DENMARK PALMITOLEIC ACID MARKET SIZE, BY PURITY LEVEL, 2018-2030 (USD MILLION)

- TABLE 107. DENMARK PALMITOLEIC ACID MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 108. DENMARK PALMITOLEIC ACID MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 109. EGYPT PALMITOLEIC ACID MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 110. EGYPT PALMITOLEIC ACID MARKET SIZE, BY PURITY LEVEL, 2018-2030 (USD MILLION)

- TABLE 111. EGYPT PALMITOLEIC ACID MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 112. EGYPT PALMITOLEIC ACID MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 113. FINLAND PALMITOLEIC ACID MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 114. FINLAND PALMITOLEIC ACID MARKET SIZE, BY PURITY LEVEL, 2018-2030 (USD MILLION)

- TABLE 115. FINLAND PALMITOLEIC ACID MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 116. FINLAND PALMITOLEIC ACID MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 117. FRANCE PALMITOLEIC ACID MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 118. FRANCE PALMITOLEIC ACID MARKET SIZE, BY PURITY LEVEL, 2018-2030 (USD MILLION)

- TABLE 119. FRANCE PALMITOLEIC ACID MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 120. FRANCE PALMITOLEIC ACID MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 121. GERMANY PALMITOLEIC ACID MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 122. GERMANY PALMITOLEIC ACID MARKET SIZE, BY PURITY LEVEL, 2018-2030 (USD MILLION)

- TABLE 123. GERMANY PALMITOLEIC ACID MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 124. GERMANY PALMITOLEIC ACID MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 125. ISRAEL PALMITOLEIC ACID MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 126. ISRAEL PALMITOLEIC ACID MARKET SIZE, BY PURITY LEVEL, 2018-2030 (USD MILLION)

- TABLE 127. ISRAEL PALMITOLEIC ACID MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 128. ISRAEL PALMITOLEIC ACID MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 129. ITALY PALMITOLEIC ACID MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 130. ITALY PALMITOLEIC ACID MARKET SIZE, BY PURITY LEVEL, 2018-2030 (USD MILLION)

- TABLE 131. ITALY PALMITOLEIC ACID MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 132. ITALY PALMITOLEIC ACID MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 133. NETHERLANDS PALMITOLEIC ACID MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 134. NETHERLANDS PALMITOLEIC ACID MARKET SIZE, BY PURITY LEVEL, 2018-2030 (USD MILLION)

- TABLE 135. NETHERLANDS PALMITOLEIC ACID MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 136. NETHERLANDS PALMITOLEIC ACID MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 137. NIGERIA PALMITOLEIC ACID MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 138. NIGERIA PALMITOLEIC ACID MARKET SIZE, BY PURITY LEVEL, 2018-2030 (USD MILLION)

- TABLE 139. NIGERIA PALMITOLEIC ACID MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 140. NIGERIA PALMITOLEIC ACID MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 141. NORWAY PALMITOLEIC ACID MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 142. NORWAY PALMITOLEIC ACID MARKET SIZE, BY PURITY LEVEL, 2018-2030 (USD MILLION)

- TABLE 143. NORWAY PALMITOLEIC ACID MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 144. NORWAY PALMITOLEIC ACID MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 145. POLAND PALMITOLEIC ACID MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 146. POLAND PALMITOLEIC ACID MARKET SIZE, BY PURITY LEVEL, 2018-2030 (USD MILLION)

- TABLE 147. POLAND PALMITOLEIC ACID MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 148. POLAND PALMITOLEIC ACID MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 149. QATAR PALMITOLEIC ACID MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 150. QATAR PALMITOLEIC ACID MARKET SIZE, BY PURITY LEVEL, 2018-2030 (USD MILLION)

- TABLE 151. QATAR PALMITOLEIC ACID MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 152. QATAR PALMITOLEIC ACID MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 153. RUSSIA PALMITOLEIC ACID MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 154. RUSSIA PALMITOLEIC ACID MARKET SIZE, BY PURITY LEVEL, 2018-2030 (USD MILLION)

- TABLE 155. RUSSIA PALMITOLEIC ACID MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 156. RUSSIA PALMITOLEIC ACID MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 157. SAUDI ARABIA PALMITOLEIC ACID MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 158. SAUDI ARABIA PALMITOLEIC ACID MARKET SIZE, BY PURITY LEVEL, 2018-2030 (USD MILLION)

- TABLE 159. SAUDI ARABIA PALMITOLEIC ACID MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 160. SAUDI ARABIA PALMITOLEIC ACID MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 161. SOUTH AFRICA PALMITOLEIC ACID MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 162. SOUTH AFRICA PALMITOLEIC ACID MARKET SIZE, BY PURITY LEVEL, 2018-2030 (USD MILLION)

- TABLE 163. SOUTH AFRICA PALMITOLEIC ACID MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 164. SOUTH AFRICA PALMITOLEIC ACID MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 165. SPAIN PALMITOLEIC ACID MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 166. SPAIN PALMITOLEIC ACID MARKET SIZE, BY PURITY LEVEL, 2018-2030 (USD MILLION)

- TABLE 167. SPAIN PALMITOLEIC ACID MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 168. SPAIN PALMITOLEIC ACID MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 169. SWEDEN PALMITOLEIC ACID MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 170. SWEDEN PALMITOLEIC ACID MARKET SIZE, BY PURITY LEVEL, 2018-2030 (USD MILLION)

- TABLE 171. SWEDEN PALMITOLEIC ACID MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 172. SWEDEN PALMITOLEIC ACID MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 173. SWITZERLAND PALMITOLEIC ACID MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 174. SWITZERLAND PALMITOLEIC ACID MARKET SIZE, BY PURITY LEVEL, 2018-2030 (USD MILLION)

- TABLE 175. SWITZERLAND PALMITOLEIC ACID MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 176. SWITZERLAND PALMITOLEIC ACID MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 177. TURKEY PALMITOLEIC ACID MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 178. TURKEY PALMITOLEIC ACID MARKET SIZE, BY PURITY LEVEL, 2018-2030 (USD MILLION)

- TABLE 179. TURKEY PALMITOLEIC ACID MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 180. TURKEY PALMITOLEIC ACID MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 181. UNITED ARAB EMIRATES PALMITOLEIC ACID MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 182. UNITED ARAB EMIRATES PALMITOLEIC ACID MARKET SIZE, BY PURITY LEVEL, 2018-2030 (USD MILLION)

- TABLE 183. UNITED ARAB EMIRATES PALMITOLEIC ACID MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 184. UNITED ARAB EMIRATES PALMITOLEIC ACID MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 185. UNITED KINGDOM PALMITOLEIC ACID MARKET SIZE, BY SOURCE, 2018-2030 (USD MILLION)

- TABLE 186. UNITED KINGDOM PALMITOLEIC ACID MARKET SIZE, BY PURITY LEVEL, 2018-2030 (USD MILLION)

- TABLE 187. UNITED KINGDOM PALMITOLEIC ACID MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 188. UNITED KINGDOM PALMITOLEIC ACID MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018-2030 (USD MILLION)

- TABLE 189. PALMITOLEIC ACID MARKET SHARE, BY KEY PLAYER, 2024

- TABLE 190. PALMITOLEIC ACID MARKET, FPNV POSITIONING MATRIX, 2024

The Palmitoleic Acid Market was valued at USD 128.78 million in 2024 and is projected to grow to USD 134.44 million in 2025, with a CAGR of 4.53%, reaching USD 168.05 million by 2030.

| KEY MARKET STATISTICS | |

|---|---|

| Base Year [2024] | USD 128.78 million |

| Estimated Year [2025] | USD 134.44 million |

| Forecast Year [2030] | USD 168.05 million |

| CAGR (%) | 4.53% |

Palmitoleic acid has emerged as a critical component in various industrial and consumer applications, garnering attention for its multifunctional properties. This naturally occurring monounsaturated fatty acid is celebrated for its unique benefits across health, cosmetic, and industrial sectors, and is increasingly used in formulations that require a balance of efficacy and sustainability. With a growing demand driven by consumer awareness and the need for high-performance ingredients, the market for palmitoleic acid is evolving rapidly, reflecting modern trends and innovative product development.

Recent advancements in extraction techniques and higher purity levels have reinforced its position in high-value applications. Companies and researchers worldwide are examining its potential in optimizing formulations, especially in segments such as animal feed, food and beverages, and personal care. As market dynamics shift, the competitive landscape has adapted to incorporate emerging technology and strategic resource allocation, making this period one of significant transition and opportunity. The current market environment is characterized by rigorous product innovation, regulatory support, and heightened consumer interest. This comprehensive overview provides critical insights into the evolution of palmitoleic acid as an essential industrial ingredient, setting the stage for further analysis in subsequent sections.

Transformative Shifts in the Palmitoleic Acid Landscape

In recent years, the palmitoleic acid market has undergone a considerable transformation, driven by advancements in production technology, increased cost competitiveness, and rising consumer demand for natural and sustainable ingredients. The shift in landscape is marked by enhanced extraction processes that have significantly boosted product purity and consistency, thereby expanding the range of high-end applications. Changes in market regulations and quality standards have also influenced production methodologies, ensuring that manufacturers consistently meet global benchmarks.

The integration of modern biotechnology and green chemistry into production workflows has paved the way for more efficient processes and reduced environmental impact. Increased investment in research and development has accelerated improvements in processing technologies, driving cost reductions and fostering product innovation. These developments have led to a strategic pivot from traditional extraction methods toward more eco-friendly alternatives, aligning market practices with global sustainability trends.

Consequently, stakeholders are now better positioned to meet emerging demands while embracing stricter compliance and quality controls. This transformation not only enhances competitive advantage but also sets the stage for wider adoption across diverse industries, triggering momentum in both established and emerging markets.

Deep Dive into Segmentation Insights of the Market

The segmentation analysis of the palmitoleic acid market reveals a comprehensive approach to understanding its multifaceted nature. When examining the market based on source, it is evident that both botanical and marine origins contribute to its supply, with each source offering distinct advantages in terms of processing techniques and product performance. Purity levels further refine market segmentation, where products meeting an above 99% purity standard differentiate themselves from those below this threshold, impacting both pricing strategies and end-use applications.

Application-based segmentation is pivotal to identifying key market trends. Different sectors such as animal feed, cosmetics & personal care, food & beverages, and pharmaceuticals & nutraceuticals are all utilizing palmitoleic acid, each amplifying its demand based on functional benefits like enhanced bioavailability, improved product stability, and targeted health benefits. In addition, a keen focus on distribution channels reveals contrasting dynamics between offline and online networks, each contributing distinctively in terms of reach, consumer engagement, and logistical efficiency. This layered segmentation not only illustrates the versatile applications of palmitoleic acid but also underscores the evolving needs of modern consumers and industry players alike. Understanding these dimensions equips stakeholders with actionable insights to tailor strategies that align with both demand and regional considerations.

Based on Source, market is studied across Botanical Sources and Marine Sources.

Based on Purity Level, market is studied across Above 99% and Below 99%.

Based on Application, market is studied across Animal Feed, Cosmetics & Personal Care, Food & Beverages, and Pharmaceuticals & Nutraceuticals.

Based on Distribution Channel, market is studied across Offline and Online.

Comprehensive Regional Dynamics Shaping Growth

Regional insights indicate that the palmitoleic acid market is being driven by unique socio-economic factors across diverse geographical areas. In the Americas, robust industrial production and a strong emphasis on innovative health and beauty products have created a fertile ground for expansion. Regional investments in research and development, coupled with supportive government policies, continue to shape the market trajectory.

In Europe, the Middle East and Africa, dynamic regulatory frameworks foster sustainable growth and encourage the adoption of environmentally friendly technologies. This region's emphasis on quality standards and traceability in production has further bolstered market confidence. Meanwhile, in the Asia-Pacific area, rapid industrialization and expanding consumer markets have led to an accelerating pace of innovation and a commendable surge in demand for advanced formulations. These regional dynamics, driven by both economic progress and evolving consumer behavior, are reshaping how palmitoleic acid is produced, marketed, and integrated into products, offering lucrative opportunities to firms that can navigate the complexities of each local market.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom.

Competitive Landscape and Key Company Performance

The competitive landscape of the palmitoleic acid market is marked by a diverse range of players who are continuously innovating and expanding their market footprints. Notable companies have established themselves as leaders through rigorous research, advanced production technologies, and strategic collaborations aimed at enhancing product quality and supply chain efficiency. Major players such as Alsachim, Ambeed, Inc., and Biomol GmbH have demonstrated a persistent commitment to quality and customer-centric innovations.

Additional companies including Biosynth Ltd, Cambridge Isotope Laboratories, Inc., and Cayman Chemical are reinforcing the market with their expertise in high-purity production and precision formulation. Other industry frontrunners such as Central Drug House alongside Clearsynth and CPAChem continue to leverage state-of-the-art technology to address evolving market demands while Ethical Naturals, Inc. pushes the envelope in sustainable practices. Finetech Industry Limited and Glentham Life Sciences Limited have positioned themselves strongly in niche segments, and firms like Larodan AB and Merck KGaA have integrated sophisticated research into product development.

Moreover, MP Biomedicals, Otto Chemie Pvt. Ltd., and Santa Cruz Biotechnology, Inc., along with Shandong Minglang Chemical Co., Ltd, Tersus Life Sciences, Thermo Fisher Scientific, Unilong Industry Co., Ltd, and Wiley Companies, complete the landscape with their diverse approaches and strategic market outreach. This network of companies fosters a competitive environment that continuously drives innovation and improves product standards across the global market.

The report delves into recent significant developments in the Palmitoleic Acid Market, highlighting leading vendors and their innovative profiles. These include Alsachim, Ambeed, Inc., Biomol GmbH, Biosynth Ltd, Cambridge Isotope Laboratories, Inc., Cayman Chemical, Central Drug House, Clearsynth, CPAChem, Ethical Naturals, Inc., Finetech Industry Limited, Glentham Life Sciences Limited, Larodan AB, Merck KGaA, MP Biomedicals, Otto Chemie Pvt. Ltd., Santa Cruz Biotechnology, Inc., Shandong Minglang Chemical Co., Ltd, Tersus Life Sciences, Thermo Fisher Scientific, Unilong Industry Co., Ltd., and Wiley Companies. Strategic Recommendations for Industry Leaders

Industry leaders are encouraged to refine their strategies by embracing new technologies and sustainable practices that optimize production and meet increased purity standards. Companies should invest in advanced research while aligning product development with market-driven innovation, particularly focusing on enhancing the performance and stability of palmitoleic acid for varied applications such as pharmaceuticals, nutraceuticals, and personal care.

It is critical for stakeholders to leverage reliable supply chain management and adopt digital technologies to streamline distribution processes. A proactive approach in addressing consumer demands within both offline and online channels can significantly enhance market penetration. Developing partnerships across different regions can also provide a dual advantage: achieving localized expertise and fostering global outreach.

Furthermore, a focus on regulatory compliance and environmental sustainability is paramount. Leaders should consider diversifying their sourcing strategies by integrating both botanical and marine derivatives to balance risk and meet evolving market expectations. Regular evaluations of market segmentation and consumer trends will help companies align their strategic plans with actual demand, ensuring competitive edge in the ever-evolving marketplace.

Conclusive Reflections on Market Opportunities

Drawing on comprehensive market analysis, it is clear that palmitoleic acid represents a unique convergence point of innovation, sustainability, and consumer demand. The evolving landscape, underscored by significant transformative shifts, is not only reshaping production processes but also redefining market expectations across industrial, cosmetic, and nutritional sectors. The nuanced segmentation based on source, purity, application, and distribution reflects an increasingly sophisticated approach to tailoring product offerings to specialized needs.

Key regional insights reveal a wide spectrum of drivers, with dynamic economic forces empowering growth in the Americas, Europe, Middle East & Africa, and Asia-Pacific. With diverse consumer preferences and regulatory environments influencing production and distribution, the stage is set for extensive innovation and market expansion. Competitive pressures, buoyed by the participation of established companies, further instigate the evolution of product quality and operational efficiencies.

This conclusive analysis reaffirms that strategic investments, agile operational methodologies, and a commitment to sustainable development will be crucial in unlocking the full potential of the palmitoleic acid market. Industry leaders are now poised to capitalize on emerging opportunities while effectively mitigating risks in an increasingly competitive environment.

Table of Contents

1. Preface

- 1.1. Objectives of the Study

- 1.2. Market Segmentation & Coverage

- 1.3. Years Considered for the Study

- 1.4. Currency & Pricing

- 1.5. Language

- 1.6. Stakeholders

2. Research Methodology

- 2.1. Define: Research Objective

- 2.2. Determine: Research Design

- 2.3. Prepare: Research Instrument

- 2.4. Collect: Data Source

- 2.5. Analyze: Data Interpretation

- 2.6. Formulate: Data Verification

- 2.7. Publish: Research Report

- 2.8. Repeat: Report Update

3. Executive Summary

4. Market Overview

5. Market Insights

- 5.1. Market Dynamics

- 5.1.1. Drivers

- 5.1.1.1. Increasing demand for natural and organic personal care products

- 5.1.1.2. Rising health awareness with demand for dietary supplements and functional foods

- 5.1.2. Restraints

- 5.1.2.1. High costs associated with extraction and purification of palmitoleic acid

- 5.1.3. Opportunities

- 5.1.3.1. Ongoing advances in biotechnology for new applications and more fficient production methods

- 5.1.3.2. High potential with expanding demand for nutraceutical products

- 5.1.4. Challenges

- 5.1.4.1. Stringent regulatory frameworks regarding the use of fatty acids in food and cosmetic products

- 5.1.1. Drivers

- 5.2. Market Segmentation Analysis

- 5.2.1. Source: preference for botanical sources for environmentally conscious consumer preferences

- 5.2.2. Application: Utilization of palmitoleic acid in cosmetics & personal care to improve skin elasticity and combat dryness

- 5.3. Porter's Five Forces Analysis

- 5.3.1. Threat of New Entrants

- 5.3.2. Threat of Substitutes

- 5.3.3. Bargaining Power of Customers

- 5.3.4. Bargaining Power of Suppliers

- 5.3.5. Industry Rivalry

- 5.4. PESTLE Analysis

- 5.4.1. Political

- 5.4.2. Economic

- 5.4.3. Social

- 5.4.4. Technological

- 5.4.5. Legal

- 5.4.6. Environmental

6. Palmitoleic Acid Market, by Source

- 6.1. Introduction

- 6.2. Botanical Sources

- 6.3. Marine Sources

7. Palmitoleic Acid Market, by Purity Level

- 7.1. Introduction

- 7.2. Above 99%

- 7.3. Below 99%

8. Palmitoleic Acid Market, by Application

- 8.1. Introduction

- 8.2. Animal Feed

- 8.3. Cosmetics & Personal Care

- 8.4. Food & Beverages

- 8.5. Pharmaceuticals & Nutraceuticals

9. Palmitoleic Acid Market, by Distribution Channel

- 9.1. Introduction

- 9.2. Offline

- 9.3. Online

10. Americas Palmitoleic Acid Market

- 10.1. Introduction

- 10.2. Argentina

- 10.3. Brazil

- 10.4. Canada

- 10.5. Mexico

- 10.6. United States

11. Asia-Pacific Palmitoleic Acid Market

- 11.1. Introduction

- 11.2. Australia

- 11.3. China

- 11.4. India

- 11.5. Indonesia

- 11.6. Japan

- 11.7. Malaysia

- 11.8. Philippines

- 11.9. Singapore

- 11.10. South Korea

- 11.11. Taiwan

- 11.12. Thailand

- 11.13. Vietnam

12. Europe, Middle East & Africa Palmitoleic Acid Market

- 12.1. Introduction

- 12.2. Denmark

- 12.3. Egypt

- 12.4. Finland

- 12.5. France

- 12.6. Germany

- 12.7. Israel

- 12.8. Italy

- 12.9. Netherlands

- 12.10. Nigeria

- 12.11. Norway

- 12.12. Poland

- 12.13. Qatar

- 12.14. Russia

- 12.15. Saudi Arabia

- 12.16. South Africa

- 12.17. Spain

- 12.18. Sweden

- 12.19. Switzerland

- 12.20. Turkey

- 12.21. United Arab Emirates

- 12.22. United Kingdom

13. Competitive Landscape

- 13.1. Market Share Analysis, 2024

- 13.2. FPNV Positioning Matrix, 2024

- 13.3. Competitive Scenario Analysis

- 13.3.1. Volac Wilmar launches Mega-Fat 70 to enhance feed mill efficiency

- 13.3.2. US market sees growing shift towards palm-based fatty acids

- 13.4. Strategy Analysis & Recommendation

Companies Mentioned

- 1. Alsachim

- 2. Ambeed, Inc.

- 3. Biomol GmbH

- 4. Biosynth Ltd

- 5. Cambridge Isotope Laboratories, Inc.

- 6. Cayman Chemical

- 7. Central Drug House

- 8. Clearsynth

- 9. CPAChem

- 10. Ethical Naturals, Inc.

- 11. Finetech Industry Limited

- 12. Glentham Life Sciences Limited

- 13. Larodan AB

- 14. Merck KGaA

- 15. MP Biomedicals

- 16. Otto Chemie Pvt. Ltd.

- 17. Santa Cruz Biotechnology, Inc.

- 18. Shandong Minglang Chemical Co., Ltd

- 19. Tersus Life Sciences

- 20. Thermo Fisher Scientific

- 21. Unilong Industry Co., Ltd.

- 22. Wiley Companies