|

|

市場調査レポート

商品コード

1677213

航空機解体・撤去市場:サービスタイプ別、部品タイプ別、航空機タイプ別、回収材料別、エンドユーザー別-2025-2030年世界予測Aircraft Disassembly & Demolition Market by Service Type, Component Type, Aircraft Type, Recovery Material, End-User - Global Forecast 2025-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 航空機解体・撤去市場:サービスタイプ別、部品タイプ別、航空機タイプ別、回収材料別、エンドユーザー別-2025-2030年世界予測 |

|

出版日: 2025年03月09日

発行: 360iResearch

ページ情報: 英文 185 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 図表

- 目次

航空機解体・撤去市場の2024年の市場規模は85億8,000万米ドルで、2025年にはCAGR 7.41%で91億9,000万米ドルに成長し、2030年には131億8,000万米ドルに達すると予測されています。

| 主な市場の統計 | |

|---|---|

| 基準年 2024 | 85億8,000万米ドル |

| 推定年 2025 | 91億9,000万米ドル |

| 予測年 2030 | 131億8,000万米ドル |

| CAGR(%) | 7.41% |

航空機の解体・撤去は、使用済み航空機の管理における重要な要素として浮上しており、規制上の義務と環境への配慮の両方を満たすために、技術的な精度と革新的なリサイクル手法を組み合わせています。急速に進化する今日の状況において、航空機の解体は単なる廃棄プロセスではなく、コスト効率と運航の安全性を維持しながら持続可能性を追求する循環型経済の重要な要素となっています。近年、業界の専門家は、資源回収を最大化し、有害廃棄物を軽減し、使用後の資産評価を高める最新のアプローチへの関心が高まっていることを確認しています。このダイナミックな環境は、技術統合の進展と市場需要の進化によって特徴付けられ、利害関係者に新しい手法の採用と多様な収益源の探求を促しています。市場が成熟するにつれ、市場参入企業は厳しい環境基準と財務上の必要性のバランスを取ることが求められ、新たなデータを活用し、ベストプラクティスを採用し、規制の変化に機敏に対応することが不可欠となっています。このイントロダクションの目的は、航空機の解体・撤去分野を形成しつつある設計、特性、新たな市場機会について包括的な概要を提供し、意思決定者が現在の動向と将来の可能性を評価するための明確な枠組みを確保することです。

航空機解体・撤去市場の変革

航空機の解体・撤去分野は、技術の進歩、規制の進化、環境意識の高まりによって大きな変革期を迎えています。自動化とロボット工学における最近の技術革新は、手作業と自動化された解体作業の精度と効率を高めています。利害関係者は現在、メンテナンスの必要性を予測し、材料回収を最適化し、安全プロトコルを改善するために、スマート技術とデータ分析を活用しています。さらに、世界中の規制機関が廃棄物管理と環境への影響についてより厳しいガイドラインを課しており、市場のプレーヤーは迅速な革新と適応を余儀なくされています。この変化の波は、業務上のベンチマークを再定義するだけでなく、持続可能性と責任あるリサイクルの概念を取り入れたビジネスモデルの再構築をももたらしています。組織は従来のプロセスを再評価し、部門横断的な連携や技術統合を促す破壊的戦略を取り入れています。さらに、循環型経済へのシフトは、企業に研究開発への多額の投資を促しています。こうした動向により、業界は資産回収における未開発の可能性を活用し、より広範な環境保全の取り組みに積極的に貢献できるようになっています。このように、業界情勢は俊敏性、革新性、そして効率性、持続可能性、収益性において新たな業界基準を設定することを約束する先進的なアプローチによって特徴づけられています。

航空機解体・撤去の主要セグメント分析

航空機の解体・撤去の市場セグメンテーションは、多面的な力学を理解する上で極めて重要です。サービスタイプのセグメンテーションを検討する際には、解体、分解、リサイクルに焦点を当てます。解体自体は、解体と材料回収に分けられ、分解は自動解体と手動解体に分けられ、リサイクルは金属リサイクルに加えて複合材料回収を含みます。それぞれのサービスタイプは、独自の課題と機会を提示しており、それぞれに合った技術戦略や運営戦略の必要性を浮き彫りにしています。コンポーネントの種類別セグメンテーションでは、アビオニクス、エンジン、胴体、内装部品、着陸装置など、さまざまな航空機部品を分析することの重要性が強調されています。さらに、航空機の種類をセグメント化することで、民間航空機、一般航空機、軍用航空機の違いを明らかにし、解体プロセスに影響を与える多様な規制の枠組みや運用条件を反映します。回収材料のセグメンテーションは、アルミニウム、複合材料、銅、チタンの回収に焦点を当て、それぞれ独自の市場と回収プロトコルを持つ、さらに高度なレイヤーを追加します。最後に、航空会社やリース会社からMROプロバイダーや企業プロファイルに至るまで、エンドユーザーに基づくセグメンテーションは、航空機の解体と解体に取り組む際のさまざまな目的とリスクプロファイルを持つ利害関係者の広範なスペクトルを示しています。これらのセグメンテーション要因の相互作用により、市場機会、資源配分、成長の可能性をきめ細かく理解することができます。

目次

第1章 序文

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場の概要

第5章 市場洞察

- 市場力学

- 促進要因

- 再利用航空機部品の需要増加

- 航空業界のライフサイクルに循環型経済の原則を統合する傾向が高まっています。

- 老朽化した航空機の退役数が増加

- 抑制要因

- 財政的制約と高い運用コスト

- 機会

- 持続可能な航空機リサイクルプロセスの拡大

- 資源効率を最大化する先進的な材料回収技術の開発

- 課題

- 環境問題と持続可能性の問題

- 促進要因

- 市場セグメンテーション分析

- サービスタイプ:現代の航空機における複合材料の使用増加により、複合材料のリサイクルが好まれる傾向が高まっています。

- エンドユーザー:航空会社における航空機解体・撤去の重要性の高まり

- ポーターのファイブフォース分析

- PESTEL分析

- 政治的

- 経済

- 社会

- 技術的

- 法律上

- 環境

第6章 航空機解体・撤去市場:サービスタイプ別

- 解体

- 脱構築

- 材料回収

- 分解

- 自動分解

- 手動分解

- リサイクル

- 複合材料の回収

- 金属リサイクル

第7章 航空機解体・撤去市場:コンポーネントタイプ別

- 航空電子機器

- エンジン

- 機体

- 内装部品

- 着陸装置

第8章 航空機解体・撤去市場航空機の種類別

- 民間航空機

- 一般航空

- 軍用機

第9章 航空機解体・撤去市場リカバリーマテリアル

- アルミニウム

- 複合材料

- 銅

- チタン

第10章 航空機解体・撤去市場:エンドユーザー別

- 航空会社

- リース会社

- MROプロバイダー

- OEM

第11章 南北アメリカの航空機解体・撤去市場

- アルゼンチン

- ブラジル

- カナダ

- メキシコ

- 米国

第12章 アジア太平洋地域の航空機解体・撤去市場

- オーストラリア

- 中国

- インド

- インドネシア

- 日本

- マレーシア

- フィリピン

- シンガポール

- 韓国

- 台湾

- タイ

- ベトナム

第13章 欧州・中東・アフリカの航空機解体・撤去市場

- デンマーク

- エジプト

- フィンランド

- フランス

- ドイツ

- イスラエル

- イタリア

- オランダ

- ナイジェリア

- ノルウェー

- ポーランド

- カタール

- ロシア

- サウジアラビア

- 南アフリカ

- スペイン

- スウェーデン

- スイス

- トルコ

- アラブ首長国連邦

- 英国

第14章 競合情勢

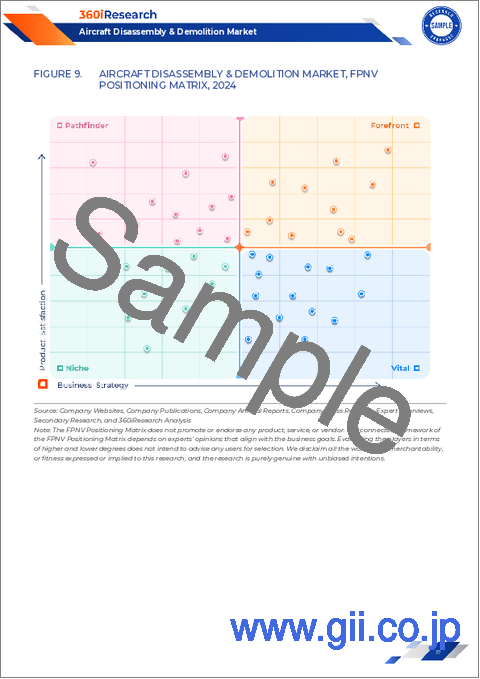

- 市場シェア分析, 2024

- FPNVポジショニングマトリックス, 2024

- 競合シナリオ分析

- 戦略分析と提言

企業一覧

- AAR Corporation

- AeroTurbine, Inc.

- AerSale Inc.

- Air Salvage International

- Airborne Maintenance & Engineering Services

- Aircraft Demolition LLC

- Aircraft End-of-Life Solutions

- AJW Group

- Ascent Aviation Services

- Aviation Technical Services

- AvTrade Limited

- CAVU Aerospace

- ComAv Technical Services

- FL Technics

- GA Telesis, LLC

- HAECO Group

- IAG Engine Center

- Lufthansa Technik AG

- SR Technics

- Sycamore Aviation

- TARMAC Aerosave

- Unical Aviation, Inc.

- Universal Asset Management, Inc.

- Vallair Solutions

- Willis Lease Finance Corporation

LIST OF FIGURES

- FIGURE 1. AIRCRAFT DISASSEMBLY & DEMOLITION MARKET MULTI-CURRENCY

- FIGURE 2. AIRCRAFT DISASSEMBLY & DEMOLITION MARKET MULTI-LANGUAGE

- FIGURE 3. AIRCRAFT DISASSEMBLY & DEMOLITION MARKET RESEARCH PROCESS

- FIGURE 4. AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, 2024 VS 2030

- FIGURE 5. GLOBAL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, 2018-2030 (USD MILLION)

- FIGURE 6. GLOBAL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY REGION, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 7. GLOBAL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 8. GLOBAL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY SERVICE TYPE, 2024 VS 2030 (%)

- FIGURE 9. GLOBAL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY SERVICE TYPE, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 10. GLOBAL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COMPONENT TYPE, 2024 VS 2030 (%)

- FIGURE 11. GLOBAL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COMPONENT TYPE, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 12. GLOBAL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY AIRCRAFT TYPE, 2024 VS 2030 (%)

- FIGURE 13. GLOBAL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY AIRCRAFT TYPE, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 14. GLOBAL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECOVERY MATERIAL, 2024 VS 2030 (%)

- FIGURE 15. GLOBAL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECOVERY MATERIAL, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 16. GLOBAL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY END-USER, 2024 VS 2030 (%)

- FIGURE 17. GLOBAL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY END-USER, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 18. AMERICAS AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COUNTRY, 2024 VS 2030 (%)

- FIGURE 19. AMERICAS AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 20. UNITED STATES AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY STATE, 2024 VS 2030 (%)

- FIGURE 21. UNITED STATES AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY STATE, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 22. ASIA-PACIFIC AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COUNTRY, 2024 VS 2030 (%)

- FIGURE 23. ASIA-PACIFIC AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 24. EUROPE, MIDDLE EAST & AFRICA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COUNTRY, 2024 VS 2030 (%)

- FIGURE 25. EUROPE, MIDDLE EAST & AFRICA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 26. AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SHARE, BY KEY PLAYER, 2024

- FIGURE 27. AIRCRAFT DISASSEMBLY & DEMOLITION MARKET, FPNV POSITIONING MATRIX, 2024

LIST OF TABLES

- TABLE 1. AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SEGMENTATION & COVERAGE

- TABLE 2. UNITED STATES DOLLAR EXCHANGE RATE, 2018-2024

- TABLE 3. GLOBAL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, 2018-2030 (USD MILLION)

- TABLE 4. GLOBAL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 5. GLOBAL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 6. AIRCRAFT DISASSEMBLY & DEMOLITION MARKET DYNAMICS

- TABLE 7. GLOBAL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY SERVICE TYPE, 2018-2030 (USD MILLION)

- TABLE 8. GLOBAL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DEMOLITION, BY REGION, 2018-2030 (USD MILLION)

- TABLE 9. GLOBAL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DECONSTRUCTION, BY REGION, 2018-2030 (USD MILLION)

- TABLE 10. GLOBAL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY MATERIAL RECOVERY, BY REGION, 2018-2030 (USD MILLION)

- TABLE 11. GLOBAL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DEMOLITION, 2018-2030 (USD MILLION)

- TABLE 12. GLOBAL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DISASSEMBLY, BY REGION, 2018-2030 (USD MILLION)

- TABLE 13. GLOBAL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY AUTOMATED DISASSEMBLY, BY REGION, 2018-2030 (USD MILLION)

- TABLE 14. GLOBAL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY MANUAL DISASSEMBLY, BY REGION, 2018-2030 (USD MILLION)

- TABLE 15. GLOBAL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DISASSEMBLY, 2018-2030 (USD MILLION)

- TABLE 16. GLOBAL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECYCLING, BY REGION, 2018-2030 (USD MILLION)

- TABLE 17. GLOBAL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COMPOSITE MATERIAL RECOVERY, BY REGION, 2018-2030 (USD MILLION)

- TABLE 18. GLOBAL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY METAL RECYCLING, BY REGION, 2018-2030 (USD MILLION)

- TABLE 19. GLOBAL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECYCLING, 2018-2030 (USD MILLION)

- TABLE 20. GLOBAL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 21. GLOBAL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY AVIONICS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 22. GLOBAL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY ENGINES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 23. GLOBAL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY FUSELAGE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 24. GLOBAL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY INTERIOR PARTS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 25. GLOBAL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY LANDING GEAR, BY REGION, 2018-2030 (USD MILLION)

- TABLE 26. GLOBAL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY AIRCRAFT TYPE, 2018-2030 (USD MILLION)

- TABLE 27. GLOBAL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COMMERCIAL AIRCRAFT, BY REGION, 2018-2030 (USD MILLION)

- TABLE 28. GLOBAL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY GENERAL AVIATION, BY REGION, 2018-2030 (USD MILLION)

- TABLE 29. GLOBAL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY MILITARY AIRCRAFT, BY REGION, 2018-2030 (USD MILLION)

- TABLE 30. GLOBAL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECOVERY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 31. GLOBAL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY ALUMINUM, BY REGION, 2018-2030 (USD MILLION)

- TABLE 32. GLOBAL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COMPOSITE MATERIALS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 33. GLOBAL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COPPER, BY REGION, 2018-2030 (USD MILLION)

- TABLE 34. GLOBAL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY TITANIUM, BY REGION, 2018-2030 (USD MILLION)

- TABLE 35. GLOBAL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 36. GLOBAL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY AIRLINES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 37. GLOBAL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY LEASING COMPANIES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 38. GLOBAL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY MRO PROVIDERS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 39. GLOBAL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY OEMS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 40. AMERICAS AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY SERVICE TYPE, 2018-2030 (USD MILLION)

- TABLE 41. AMERICAS AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DEMOLITION, 2018-2030 (USD MILLION)

- TABLE 42. AMERICAS AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DISASSEMBLY, 2018-2030 (USD MILLION)

- TABLE 43. AMERICAS AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECYCLING, 2018-2030 (USD MILLION)

- TABLE 44. AMERICAS AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 45. AMERICAS AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY AIRCRAFT TYPE, 2018-2030 (USD MILLION)

- TABLE 46. AMERICAS AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECOVERY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 47. AMERICAS AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 48. AMERICAS AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 49. ARGENTINA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY SERVICE TYPE, 2018-2030 (USD MILLION)

- TABLE 50. ARGENTINA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DEMOLITION, 2018-2030 (USD MILLION)

- TABLE 51. ARGENTINA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DISASSEMBLY, 2018-2030 (USD MILLION)

- TABLE 52. ARGENTINA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECYCLING, 2018-2030 (USD MILLION)

- TABLE 53. ARGENTINA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 54. ARGENTINA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY AIRCRAFT TYPE, 2018-2030 (USD MILLION)

- TABLE 55. ARGENTINA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECOVERY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 56. ARGENTINA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 57. BRAZIL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY SERVICE TYPE, 2018-2030 (USD MILLION)

- TABLE 58. BRAZIL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DEMOLITION, 2018-2030 (USD MILLION)

- TABLE 59. BRAZIL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DISASSEMBLY, 2018-2030 (USD MILLION)

- TABLE 60. BRAZIL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECYCLING, 2018-2030 (USD MILLION)

- TABLE 61. BRAZIL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 62. BRAZIL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY AIRCRAFT TYPE, 2018-2030 (USD MILLION)

- TABLE 63. BRAZIL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECOVERY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 64. BRAZIL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 65. CANADA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY SERVICE TYPE, 2018-2030 (USD MILLION)

- TABLE 66. CANADA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DEMOLITION, 2018-2030 (USD MILLION)

- TABLE 67. CANADA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DISASSEMBLY, 2018-2030 (USD MILLION)

- TABLE 68. CANADA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECYCLING, 2018-2030 (USD MILLION)

- TABLE 69. CANADA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 70. CANADA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY AIRCRAFT TYPE, 2018-2030 (USD MILLION)

- TABLE 71. CANADA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECOVERY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 72. CANADA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 73. MEXICO AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY SERVICE TYPE, 2018-2030 (USD MILLION)

- TABLE 74. MEXICO AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DEMOLITION, 2018-2030 (USD MILLION)

- TABLE 75. MEXICO AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DISASSEMBLY, 2018-2030 (USD MILLION)

- TABLE 76. MEXICO AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECYCLING, 2018-2030 (USD MILLION)

- TABLE 77. MEXICO AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 78. MEXICO AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY AIRCRAFT TYPE, 2018-2030 (USD MILLION)

- TABLE 79. MEXICO AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECOVERY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 80. MEXICO AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 81. UNITED STATES AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY SERVICE TYPE, 2018-2030 (USD MILLION)

- TABLE 82. UNITED STATES AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DEMOLITION, 2018-2030 (USD MILLION)

- TABLE 83. UNITED STATES AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DISASSEMBLY, 2018-2030 (USD MILLION)

- TABLE 84. UNITED STATES AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECYCLING, 2018-2030 (USD MILLION)

- TABLE 85. UNITED STATES AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 86. UNITED STATES AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY AIRCRAFT TYPE, 2018-2030 (USD MILLION)

- TABLE 87. UNITED STATES AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECOVERY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 88. UNITED STATES AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 89. UNITED STATES AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY STATE, 2018-2030 (USD MILLION)

- TABLE 90. ASIA-PACIFIC AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY SERVICE TYPE, 2018-2030 (USD MILLION)

- TABLE 91. ASIA-PACIFIC AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DEMOLITION, 2018-2030 (USD MILLION)

- TABLE 92. ASIA-PACIFIC AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DISASSEMBLY, 2018-2030 (USD MILLION)

- TABLE 93. ASIA-PACIFIC AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECYCLING, 2018-2030 (USD MILLION)

- TABLE 94. ASIA-PACIFIC AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 95. ASIA-PACIFIC AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY AIRCRAFT TYPE, 2018-2030 (USD MILLION)

- TABLE 96. ASIA-PACIFIC AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECOVERY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 97. ASIA-PACIFIC AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 98. ASIA-PACIFIC AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 99. AUSTRALIA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY SERVICE TYPE, 2018-2030 (USD MILLION)

- TABLE 100. AUSTRALIA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DEMOLITION, 2018-2030 (USD MILLION)

- TABLE 101. AUSTRALIA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DISASSEMBLY, 2018-2030 (USD MILLION)

- TABLE 102. AUSTRALIA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECYCLING, 2018-2030 (USD MILLION)

- TABLE 103. AUSTRALIA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 104. AUSTRALIA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY AIRCRAFT TYPE, 2018-2030 (USD MILLION)

- TABLE 105. AUSTRALIA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECOVERY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 106. AUSTRALIA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 107. CHINA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY SERVICE TYPE, 2018-2030 (USD MILLION)

- TABLE 108. CHINA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DEMOLITION, 2018-2030 (USD MILLION)

- TABLE 109. CHINA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DISASSEMBLY, 2018-2030 (USD MILLION)

- TABLE 110. CHINA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECYCLING, 2018-2030 (USD MILLION)

- TABLE 111. CHINA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 112. CHINA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY AIRCRAFT TYPE, 2018-2030 (USD MILLION)

- TABLE 113. CHINA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECOVERY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 114. CHINA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 115. INDIA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY SERVICE TYPE, 2018-2030 (USD MILLION)

- TABLE 116. INDIA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DEMOLITION, 2018-2030 (USD MILLION)

- TABLE 117. INDIA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DISASSEMBLY, 2018-2030 (USD MILLION)

- TABLE 118. INDIA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECYCLING, 2018-2030 (USD MILLION)

- TABLE 119. INDIA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 120. INDIA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY AIRCRAFT TYPE, 2018-2030 (USD MILLION)

- TABLE 121. INDIA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECOVERY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 122. INDIA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 123. INDONESIA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY SERVICE TYPE, 2018-2030 (USD MILLION)

- TABLE 124. INDONESIA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DEMOLITION, 2018-2030 (USD MILLION)

- TABLE 125. INDONESIA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DISASSEMBLY, 2018-2030 (USD MILLION)

- TABLE 126. INDONESIA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECYCLING, 2018-2030 (USD MILLION)

- TABLE 127. INDONESIA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 128. INDONESIA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY AIRCRAFT TYPE, 2018-2030 (USD MILLION)

- TABLE 129. INDONESIA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECOVERY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 130. INDONESIA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 131. JAPAN AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY SERVICE TYPE, 2018-2030 (USD MILLION)

- TABLE 132. JAPAN AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DEMOLITION, 2018-2030 (USD MILLION)

- TABLE 133. JAPAN AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DISASSEMBLY, 2018-2030 (USD MILLION)

- TABLE 134. JAPAN AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECYCLING, 2018-2030 (USD MILLION)

- TABLE 135. JAPAN AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 136. JAPAN AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY AIRCRAFT TYPE, 2018-2030 (USD MILLION)

- TABLE 137. JAPAN AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECOVERY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 138. JAPAN AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 139. MALAYSIA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY SERVICE TYPE, 2018-2030 (USD MILLION)

- TABLE 140. MALAYSIA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DEMOLITION, 2018-2030 (USD MILLION)

- TABLE 141. MALAYSIA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DISASSEMBLY, 2018-2030 (USD MILLION)

- TABLE 142. MALAYSIA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECYCLING, 2018-2030 (USD MILLION)

- TABLE 143. MALAYSIA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 144. MALAYSIA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY AIRCRAFT TYPE, 2018-2030 (USD MILLION)

- TABLE 145. MALAYSIA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECOVERY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 146. MALAYSIA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 147. PHILIPPINES AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY SERVICE TYPE, 2018-2030 (USD MILLION)

- TABLE 148. PHILIPPINES AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DEMOLITION, 2018-2030 (USD MILLION)

- TABLE 149. PHILIPPINES AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DISASSEMBLY, 2018-2030 (USD MILLION)

- TABLE 150. PHILIPPINES AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECYCLING, 2018-2030 (USD MILLION)

- TABLE 151. PHILIPPINES AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 152. PHILIPPINES AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY AIRCRAFT TYPE, 2018-2030 (USD MILLION)

- TABLE 153. PHILIPPINES AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECOVERY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 154. PHILIPPINES AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 155. SINGAPORE AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY SERVICE TYPE, 2018-2030 (USD MILLION)

- TABLE 156. SINGAPORE AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DEMOLITION, 2018-2030 (USD MILLION)

- TABLE 157. SINGAPORE AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DISASSEMBLY, 2018-2030 (USD MILLION)

- TABLE 158. SINGAPORE AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECYCLING, 2018-2030 (USD MILLION)

- TABLE 159. SINGAPORE AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 160. SINGAPORE AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY AIRCRAFT TYPE, 2018-2030 (USD MILLION)

- TABLE 161. SINGAPORE AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECOVERY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 162. SINGAPORE AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 163. SOUTH KOREA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY SERVICE TYPE, 2018-2030 (USD MILLION)

- TABLE 164. SOUTH KOREA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DEMOLITION, 2018-2030 (USD MILLION)

- TABLE 165. SOUTH KOREA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DISASSEMBLY, 2018-2030 (USD MILLION)

- TABLE 166. SOUTH KOREA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECYCLING, 2018-2030 (USD MILLION)

- TABLE 167. SOUTH KOREA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 168. SOUTH KOREA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY AIRCRAFT TYPE, 2018-2030 (USD MILLION)

- TABLE 169. SOUTH KOREA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECOVERY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 170. SOUTH KOREA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 171. TAIWAN AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY SERVICE TYPE, 2018-2030 (USD MILLION)

- TABLE 172. TAIWAN AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DEMOLITION, 2018-2030 (USD MILLION)

- TABLE 173. TAIWAN AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DISASSEMBLY, 2018-2030 (USD MILLION)

- TABLE 174. TAIWAN AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECYCLING, 2018-2030 (USD MILLION)

- TABLE 175. TAIWAN AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 176. TAIWAN AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY AIRCRAFT TYPE, 2018-2030 (USD MILLION)

- TABLE 177. TAIWAN AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECOVERY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 178. TAIWAN AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 179. THAILAND AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY SERVICE TYPE, 2018-2030 (USD MILLION)

- TABLE 180. THAILAND AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DEMOLITION, 2018-2030 (USD MILLION)

- TABLE 181. THAILAND AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DISASSEMBLY, 2018-2030 (USD MILLION)

- TABLE 182. THAILAND AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECYCLING, 2018-2030 (USD MILLION)

- TABLE 183. THAILAND AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 184. THAILAND AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY AIRCRAFT TYPE, 2018-2030 (USD MILLION)

- TABLE 185. THAILAND AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECOVERY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 186. THAILAND AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 187. VIETNAM AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY SERVICE TYPE, 2018-2030 (USD MILLION)

- TABLE 188. VIETNAM AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DEMOLITION, 2018-2030 (USD MILLION)

- TABLE 189. VIETNAM AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DISASSEMBLY, 2018-2030 (USD MILLION)

- TABLE 190. VIETNAM AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECYCLING, 2018-2030 (USD MILLION)

- TABLE 191. VIETNAM AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 192. VIETNAM AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY AIRCRAFT TYPE, 2018-2030 (USD MILLION)

- TABLE 193. VIETNAM AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECOVERY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 194. VIETNAM AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 195. EUROPE, MIDDLE EAST & AFRICA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY SERVICE TYPE, 2018-2030 (USD MILLION)

- TABLE 196. EUROPE, MIDDLE EAST & AFRICA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DEMOLITION, 2018-2030 (USD MILLION)

- TABLE 197. EUROPE, MIDDLE EAST & AFRICA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DISASSEMBLY, 2018-2030 (USD MILLION)

- TABLE 198. EUROPE, MIDDLE EAST & AFRICA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECYCLING, 2018-2030 (USD MILLION)

- TABLE 199. EUROPE, MIDDLE EAST & AFRICA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 200. EUROPE, MIDDLE EAST & AFRICA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY AIRCRAFT TYPE, 2018-2030 (USD MILLION)

- TABLE 201. EUROPE, MIDDLE EAST & AFRICA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECOVERY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 202. EUROPE, MIDDLE EAST & AFRICA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 203. EUROPE, MIDDLE EAST & AFRICA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 204. DENMARK AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY SERVICE TYPE, 2018-2030 (USD MILLION)

- TABLE 205. DENMARK AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DEMOLITION, 2018-2030 (USD MILLION)

- TABLE 206. DENMARK AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DISASSEMBLY, 2018-2030 (USD MILLION)

- TABLE 207. DENMARK AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECYCLING, 2018-2030 (USD MILLION)

- TABLE 208. DENMARK AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 209. DENMARK AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY AIRCRAFT TYPE, 2018-2030 (USD MILLION)

- TABLE 210. DENMARK AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECOVERY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 211. DENMARK AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 212. EGYPT AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY SERVICE TYPE, 2018-2030 (USD MILLION)

- TABLE 213. EGYPT AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DEMOLITION, 2018-2030 (USD MILLION)

- TABLE 214. EGYPT AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DISASSEMBLY, 2018-2030 (USD MILLION)

- TABLE 215. EGYPT AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECYCLING, 2018-2030 (USD MILLION)

- TABLE 216. EGYPT AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 217. EGYPT AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY AIRCRAFT TYPE, 2018-2030 (USD MILLION)

- TABLE 218. EGYPT AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECOVERY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 219. EGYPT AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 220. FINLAND AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY SERVICE TYPE, 2018-2030 (USD MILLION)

- TABLE 221. FINLAND AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DEMOLITION, 2018-2030 (USD MILLION)

- TABLE 222. FINLAND AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DISASSEMBLY, 2018-2030 (USD MILLION)

- TABLE 223. FINLAND AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECYCLING, 2018-2030 (USD MILLION)

- TABLE 224. FINLAND AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 225. FINLAND AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY AIRCRAFT TYPE, 2018-2030 (USD MILLION)

- TABLE 226. FINLAND AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECOVERY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 227. FINLAND AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 228. FRANCE AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY SERVICE TYPE, 2018-2030 (USD MILLION)

- TABLE 229. FRANCE AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DEMOLITION, 2018-2030 (USD MILLION)

- TABLE 230. FRANCE AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DISASSEMBLY, 2018-2030 (USD MILLION)

- TABLE 231. FRANCE AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECYCLING, 2018-2030 (USD MILLION)

- TABLE 232. FRANCE AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 233. FRANCE AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY AIRCRAFT TYPE, 2018-2030 (USD MILLION)

- TABLE 234. FRANCE AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECOVERY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 235. FRANCE AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 236. GERMANY AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY SERVICE TYPE, 2018-2030 (USD MILLION)

- TABLE 237. GERMANY AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DEMOLITION, 2018-2030 (USD MILLION)

- TABLE 238. GERMANY AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DISASSEMBLY, 2018-2030 (USD MILLION)

- TABLE 239. GERMANY AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECYCLING, 2018-2030 (USD MILLION)

- TABLE 240. GERMANY AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 241. GERMANY AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY AIRCRAFT TYPE, 2018-2030 (USD MILLION)

- TABLE 242. GERMANY AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECOVERY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 243. GERMANY AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 244. ISRAEL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY SERVICE TYPE, 2018-2030 (USD MILLION)

- TABLE 245. ISRAEL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DEMOLITION, 2018-2030 (USD MILLION)

- TABLE 246. ISRAEL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DISASSEMBLY, 2018-2030 (USD MILLION)

- TABLE 247. ISRAEL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECYCLING, 2018-2030 (USD MILLION)

- TABLE 248. ISRAEL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 249. ISRAEL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY AIRCRAFT TYPE, 2018-2030 (USD MILLION)

- TABLE 250. ISRAEL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECOVERY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 251. ISRAEL AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 252. ITALY AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY SERVICE TYPE, 2018-2030 (USD MILLION)

- TABLE 253. ITALY AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DEMOLITION, 2018-2030 (USD MILLION)

- TABLE 254. ITALY AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DISASSEMBLY, 2018-2030 (USD MILLION)

- TABLE 255. ITALY AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECYCLING, 2018-2030 (USD MILLION)

- TABLE 256. ITALY AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 257. ITALY AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY AIRCRAFT TYPE, 2018-2030 (USD MILLION)

- TABLE 258. ITALY AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECOVERY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 259. ITALY AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 260. NETHERLANDS AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY SERVICE TYPE, 2018-2030 (USD MILLION)

- TABLE 261. NETHERLANDS AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DEMOLITION, 2018-2030 (USD MILLION)

- TABLE 262. NETHERLANDS AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DISASSEMBLY, 2018-2030 (USD MILLION)

- TABLE 263. NETHERLANDS AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECYCLING, 2018-2030 (USD MILLION)

- TABLE 264. NETHERLANDS AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 265. NETHERLANDS AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY AIRCRAFT TYPE, 2018-2030 (USD MILLION)

- TABLE 266. NETHERLANDS AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECOVERY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 267. NETHERLANDS AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 268. NIGERIA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY SERVICE TYPE, 2018-2030 (USD MILLION)

- TABLE 269. NIGERIA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DEMOLITION, 2018-2030 (USD MILLION)

- TABLE 270. NIGERIA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DISASSEMBLY, 2018-2030 (USD MILLION)

- TABLE 271. NIGERIA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECYCLING, 2018-2030 (USD MILLION)

- TABLE 272. NIGERIA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 273. NIGERIA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY AIRCRAFT TYPE, 2018-2030 (USD MILLION)

- TABLE 274. NIGERIA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECOVERY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 275. NIGERIA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 276. NORWAY AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY SERVICE TYPE, 2018-2030 (USD MILLION)

- TABLE 277. NORWAY AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DEMOLITION, 2018-2030 (USD MILLION)

- TABLE 278. NORWAY AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DISASSEMBLY, 2018-2030 (USD MILLION)

- TABLE 279. NORWAY AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECYCLING, 2018-2030 (USD MILLION)

- TABLE 280. NORWAY AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 281. NORWAY AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY AIRCRAFT TYPE, 2018-2030 (USD MILLION)

- TABLE 282. NORWAY AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECOVERY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 283. NORWAY AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 284. POLAND AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY SERVICE TYPE, 2018-2030 (USD MILLION)

- TABLE 285. POLAND AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DEMOLITION, 2018-2030 (USD MILLION)

- TABLE 286. POLAND AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DISASSEMBLY, 2018-2030 (USD MILLION)

- TABLE 287. POLAND AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECYCLING, 2018-2030 (USD MILLION)

- TABLE 288. POLAND AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 289. POLAND AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY AIRCRAFT TYPE, 2018-2030 (USD MILLION)

- TABLE 290. POLAND AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECOVERY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 291. POLAND AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 292. QATAR AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY SERVICE TYPE, 2018-2030 (USD MILLION)

- TABLE 293. QATAR AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DEMOLITION, 2018-2030 (USD MILLION)

- TABLE 294. QATAR AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DISASSEMBLY, 2018-2030 (USD MILLION)

- TABLE 295. QATAR AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECYCLING, 2018-2030 (USD MILLION)

- TABLE 296. QATAR AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 297. QATAR AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY AIRCRAFT TYPE, 2018-2030 (USD MILLION)

- TABLE 298. QATAR AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECOVERY MATERIAL, 2018-2030 (USD MILLION)

- TABLE 299. QATAR AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY END-USER, 2018-2030 (USD MILLION)

- TABLE 300. RUSSIA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY SERVICE TYPE, 2018-2030 (USD MILLION)

- TABLE 301. RUSSIA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DEMOLITION, 2018-2030 (USD MILLION)

- TABLE 302. RUSSIA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY DISASSEMBLY, 2018-2030 (USD MILLION)

- TABLE 303. RUSSIA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY RECYCLING, 2018-2030 (USD MILLION)

- TABLE 304. RUSSIA AIRCRAFT DISASSEMBLY & DEMOLITION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 305. RUSSIA A

The Aircraft Disassembly & Demolition Market was valued at USD 8.58 billion in 2024 and is projected to grow to USD 9.19 billion in 2025, with a CAGR of 7.41%, reaching USD 13.18 billion by 2030.

| KEY MARKET STATISTICS | |

|---|---|

| Base Year [2024] | USD 8.58 billion |

| Estimated Year [2025] | USD 9.19 billion |

| Forecast Year [2030] | USD 13.18 billion |

| CAGR (%) | 7.41% |

Aircraft disassembly and demolition have emerged as critical elements in the management of end-of-life aircraft, combining technical precision with innovative recycling practices to meet both regulatory obligations and environmental considerations. In today's fast-evolving landscape, the dismantling of aircraft is not merely a decommissioning process but a vital component of a circular economy that strives for sustainability while maintaining cost efficiency and operational safety. Over recent years, industry experts have observed heightened interest in modern approaches that maximize resource recovery, mitigate hazardous waste, and enhance asset valuation post-service. This dynamic environment is characterized by increasing technology integration and evolving market demands, prompting stakeholders to adopt new methodologies and explore diverse revenue streams. As the market matures, participants are required to balance stringent environmental standards with financial imperatives, making it imperative for them to harness emerging data, adopt best practices, and remain agile in response to regulatory shifts. This introduction aims to provide a comprehensive overview of the design, characteristics, and emerging market opportunities that are reshaping the aircraft disassembly and demolition domain, ensuring that decision-makers have a clear framework from which to evaluate current trends and future potential.

Transformative Shifts in the Industry Landscape

The aircraft disassembly and demolition sector is undergoing significant transformation driven by technological advancements, regulatory evolution, and increasing environmental awareness. Recent innovations in automation and robotics have enhanced the precision and efficiency of both manual and automated disassembly operations. Stakeholders are now leveraging smart technologies and data analytics to predict maintenance needs, optimize materials recovery, and improve safety protocols. Additionally, regulatory bodies across the globe are imposing stricter guidelines on waste management and environmental impact, compelling players in the market to innovate and adapt rapidly. This wave of change is not only redefining operational benchmarks but also reshaping business models to incorporate concepts of sustainability and responsible recycling. Organizations are re-evaluating traditional processes and embracing disruptive strategies that encourage cross-functional collaborations and technological integrations. Furthermore, the shift towards a circular economy is inspiring companies to invest heavily in research and development. These evolutionary trends are enabling the industry to harness untapped potential in asset recovery and contribute positively to broader environmental conservation initiatives. The landscape is thus marked by agility, innovation, and a forward-thinking approach that promises to set new industry standards for efficiency, sustainability, and profitability.

Key Segmentation Insights in Aircraft Disassembly & Demolition

The market segmentation in aircraft disassembly and demolition is pivotal to understanding the multifaceted dynamics at play. When examining the service type segmentation, the focus is on demolition, disassembly, and recycling; where demolition itself is dissected into deconstruction and material recovery, disassembly divides into automated disassembly and manual disassembly, and recycling encompasses composite material recovery alongside metal recycling. Each service type presents unique challenges and opportunities, underscoring the need for tailored technological and operational strategies. The component type segmentation highlights the importance of analyzing various aircraft parts including avionics, engines, fuselage, interior parts, and landing gear, as each segment requires specific handling to maximize value retention and material viability. In addition, aircraft type segmentation sheds light on the differences between commercial, general aviation, and military aircraft, reflecting the diverse regulatory frameworks and operational conditions that influence disassembly processes. Recovery material segmentation adds another layer of sophistication, focusing on the retrieval of aluminum, composite materials, copper, and titanium, each with its own market and recovery protocol. Finally, the segmentation based on end-users, which ranges from airlines and leasing companies to MRO providers and OEMs, illustrates the broad spectrum of stakeholders with varying objectives and risk profiles when approaching aircraft disassembly and demolition. The interplay of these segmentation factors drives a granular understanding of market opportunities, resource allocation, and growth potential.

Based on Service Type, market is studied across Demolition, Disassembly, and Recycling. The Demolition is further studied across Deconstruction and Material Recovery. The Disassembly is further studied across Automated Disassembly and Manual Disassembly. The Recycling is further studied across Composite Material Recovery and Metal Recycling.

Based on Component Type, market is studied across Avionics, Engines, Fuselage, Interior Parts, and Landing Gear.

Based on Aircraft Type, market is studied across Commercial Aircraft, General Aviation, and Military Aircraft.

Based on Recovery Material, market is studied across Aluminum, Composite Materials, Copper, and Titanium.

Based on End-User, market is studied across Airlines, Leasing Companies, MRO Providers, and OEMs.

Regional Insights: Navigating Global Markets

A comprehensive evaluation of regional markets reveals distinct variances in regulatory environments, operational frameworks, and technological adoption. In the Americas, market dynamics are influenced by robust regulatory policies combined with aggressive innovation strategies aimed at maximizing resource recovery and ensuring environmental compliance. Across Europe, the Middle East, and Africa, there is a balance of traditional practices and modern technological innovations, where firms continuously adapt to stringent environmental laws while harnessing established expertise in disassembly practices. The Asia-Pacific region presents a complex yet rapidly expanding market where diverse economic conditions drive the need for cutting-edge operational methodologies. Companies in this region are increasingly prioritizing sustainable practices and leveraging cost advantages to meet both domestic and international demands. The regional insights drawn from these vast and varied markets serve as a foundation for understanding the broader industry trends, offering nuanced perspectives on growth drivers, competitive landscapes, and evolving consumer expectations across global geographies.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom.

Key Companies Shaping the Future of Aircraft Demolition & Disassembly

A closer look at the leading companies in the aircraft disassembly and demolition domain highlights an impressive array of market pioneers who have set high benchmarks for service quality and operational excellence. Industry leaders such as AAR Corporation, AeroTurbine, Inc., and AerSale Inc. have been instrumental in refining end-of-life aircraft processing methods. Companies including Air Salvage International and Airborne Maintenance & Engineering Services continue to innovate with streamlined processes that boost efficiency in dismantling operations. Enterprises like Aircraft Demolition LLC and Aircraft End-of-Life Solutions are renowned for their specialized focus on safety and sustainability. The extensive expertise of organizations such as AJW Group, Ascent Aviation Services, and Aviation Technical Services shapes the market by introducing cutting-edge disassembly techniques. Additionally, entities like AvTrade Limited, CAVU Aerospace, ComAv Technical Services, and FL Technics play an essential role by integrating automation and advanced technological processes. Leaders such as GA Telesis, LLC and HAECO Group extend their industry dominance by ensuring seamless operations while IAG Engine Center and Lufthansa Technik AG provide robust technical support in engineering and maintenance practices. Market innovators including SR Technics, Sycamore Aviation, TARMAC Aerosave, Unical Aviation, Inc., Universal Asset Management, Inc., Vallair Solutions, and Willis Lease Finance Corporation culminate a diverse portfolio that reflects the deep expertise and progressive vision of the industry. Their combined efforts and strategic investments have been pivotal in shaping industry standards and driving market evolution.

The report delves into recent significant developments in the Aircraft Disassembly & Demolition Market, highlighting leading vendors and their innovative profiles. These include AAR Corporation, AeroTurbine, Inc., AerSale Inc., Air Salvage International, Airborne Maintenance & Engineering Services, Aircraft Demolition LLC, Aircraft End-of-Life Solutions, AJW Group, Ascent Aviation Services, Aviation Technical Services, AvTrade Limited, CAVU Aerospace, ComAv Technical Services, FL Technics, GA Telesis, LLC, HAECO Group, IAG Engine Center, Lufthansa Technik AG, SR Technics, Sycamore Aviation, TARMAC Aerosave, Unical Aviation, Inc., Universal Asset Management, Inc., Vallair Solutions, and Willis Lease Finance Corporation. Actionable Recommendations for Industry Leaders

Industry leaders in aircraft disassembly and demolition must embrace a forward-thinking mindset and integrate multiple strategies to navigate market complexities effectively. First, investing in advanced automation technologies can streamline disassembly processes and improve material recovery rates significantly. Industry stakeholders should focus on expanding capabilities in automated and manual disassembly methods to better respond to varying market demands. Second, firms ought to leverage data analytics and market intelligence to refine segmentation strategies and identify niche opportunities across service types, component types, aircraft categories, recovery materials, and end-user segments. An understanding of these segmentation insights is critical for aligning operational practices with market needs effectively. Third, strategic collaboration with key industry players is vital. Engaging with technology providers, regulatory experts, and partners from the recycling and demolition segments can lead to the development of innovative solutions that enhance resource recovery and optimize cost efficiencies. Furthermore, it is imperative to ensure strong compliance with emerging environmental standards and invest in sustainable practices that not only meet regulatory benchmarks but also contribute to long-term brand trust. Leaders should also consider diversifying their service portfolios to capture untapped segments and continuously monitor regional trends to adjust strategies according to global economic and technological shifts. In essence, the integration of advanced technologies, insightful market segmentation, and strategic collaborations will be paramount in ensuring a competitive edge and driving operational excellence in this rapidly transforming industry.

Conclusion: Embracing a Future of Innovation and Sustainability

The aircraft disassembly and demolition market is at a pivotal moment characterized by significant technological innovations and environmental imperatives. The comprehensive review of industry trends, segmentation nuances, regional market dynamics, and insights from leading companies demonstrates the multidimensional nature of the sector. With advancements in automation, the adoption of detailed data analytics, and focused strategies on sustainability, the market is transitioning to a more integrated and efficient model. Industry participants are now better positioned to capitalize on economic opportunities and manage regulatory challenges, ensuring optimal asset recovery and sustainable end-of-life practices. Moving forward, collaboration and continuous innovation will be the cornerstones of success. The convergence of advanced technologies and strategic foresight provides a promising pathway for businesses aiming to not only adapt to changing market demands but also to pioneer new benchmarks in operational excellence and environmental stewardship. Ultimately, the evolution in this sector reaffirms its commitment to a sustainable future where efficient resource utilization and technological assurance play integral roles in redefining the lifecycle of aircraft assets.

Table of Contents

1. Preface

- 1.1. Objectives of the Study

- 1.2. Market Segmentation & Coverage

- 1.3. Years Considered for the Study

- 1.4. Currency & Pricing

- 1.5. Language

- 1.6. Stakeholders

2. Research Methodology

- 2.1. Define: Research Objective

- 2.2. Determine: Research Design

- 2.3. Prepare: Research Instrument

- 2.4. Collect: Data Source

- 2.5. Analyze: Data Interpretation

- 2.6. Formulate: Data Verification

- 2.7. Publish: Research Report

- 2.8. Repeat: Report Update

3. Executive Summary

4. Market Overview

5. Market Insights

- 5.1. Market Dynamics

- 5.1.1. Drivers

- 5.1.1.1. Increasing demand for repurposed aircraft parts

- 5.1.1.2. Growing trend of integrating circular economy principles within the aviation industry's lifecycle.

- 5.1.1.3. Rising numbers of aging aircraft retiring from fleets

- 5.1.2. Restraints

- 5.1.2.1. Financial constraints and high operational costs

- 5.1.3. Opportunities

- 5.1.3.1. Expansion of sustainable aircraft recycling processes

- 5.1.3.2. Development of advanced materials recovery techniques to maximize resource efficiency

- 5.1.4. Challenges

- 5.1.4.1. Environmental concerns and sustainability issues

- 5.1.1. Drivers

- 5.2. Market Segmentation Analysis

- 5.2.1. Service Type: Growing preference for composite material recycling owing to increased composite material usage in modern aircraft

- 5.2.2. End-User: Rising significance of aircraft disassembly & demolition among airlines

- 5.3. Porter's Five Forces Analysis

- 5.3.1. Threat of New Entrants

- 5.3.2. Threat of Substitutes

- 5.3.3. Bargaining Power of Customers

- 5.3.4. Bargaining Power of Suppliers

- 5.3.5. Industry Rivalry

- 5.4. PESTLE Analysis

- 5.4.1. Political

- 5.4.2. Economic

- 5.4.3. Social

- 5.4.4. Technological

- 5.4.5. Legal

- 5.4.6. Environmental

6. Aircraft Disassembly & Demolition Market, by Service Type

- 6.1. Introduction

- 6.2. Demolition

- 6.2.1. Deconstruction

- 6.2.2. Material Recovery

- 6.3. Disassembly

- 6.3.1. Automated Disassembly

- 6.3.2. Manual Disassembly

- 6.4. Recycling

- 6.4.1. Composite Material Recovery

- 6.4.2. Metal Recycling

7. Aircraft Disassembly & Demolition Market, by Component Type

- 7.1. Introduction

- 7.2. Avionics

- 7.3. Engines

- 7.4. Fuselage

- 7.5. Interior Parts

- 7.6. Landing Gear

8. Aircraft Disassembly & Demolition Market, by Aircraft Type

- 8.1. Introduction

- 8.2. Commercial Aircraft

- 8.3. General Aviation

- 8.4. Military Aircraft

9. Aircraft Disassembly & Demolition Market, by Recovery Material

- 9.1. Introduction

- 9.2. Aluminum

- 9.3. Composite Materials

- 9.4. Copper

- 9.5. Titanium

10. Aircraft Disassembly & Demolition Market, by End-User

- 10.1. Introduction

- 10.2. Airlines

- 10.3. Leasing Companies

- 10.4. MRO Providers

- 10.5. OEMs

11. Americas Aircraft Disassembly & Demolition Market

- 11.1. Introduction

- 11.2. Argentina

- 11.3. Brazil

- 11.4. Canada

- 11.5. Mexico

- 11.6. United States

12. Asia-Pacific Aircraft Disassembly & Demolition Market

- 12.1. Introduction

- 12.2. Australia

- 12.3. China

- 12.4. India

- 12.5. Indonesia

- 12.6. Japan

- 12.7. Malaysia

- 12.8. Philippines

- 12.9. Singapore

- 12.10. South Korea

- 12.11. Taiwan

- 12.12. Thailand

- 12.13. Vietnam

13. Europe, Middle East & Africa Aircraft Disassembly & Demolition Market

- 13.1. Introduction

- 13.2. Denmark

- 13.3. Egypt

- 13.4. Finland

- 13.5. France

- 13.6. Germany

- 13.7. Israel

- 13.8. Italy

- 13.9. Netherlands

- 13.10. Nigeria

- 13.11. Norway

- 13.12. Poland

- 13.13. Qatar

- 13.14. Russia

- 13.15. Saudi Arabia

- 13.16. South Africa

- 13.17. Spain

- 13.18. Sweden

- 13.19. Switzerland

- 13.20. Turkey

- 13.21. United Arab Emirates

- 13.22. United Kingdom

14. Competitive Landscape

- 14.1. Market Share Analysis, 2024

- 14.2. FPNV Positioning Matrix, 2024

- 14.3. Competitive Scenario Analysis

- 14.3.1. Lufthansa Technik invests over EUR 1 billion in global expansion and innovation

- 14.3.2. TARMAC Aerosave's acquisition of three additional Airbus A380s, in collaboration with EastMerchant Capital GmbH

- 14.3.3. Unical Aviation's strategic acquisition of ecube Solutions redefines global aircraft disassembly and storage services

- 14.4. Strategy Analysis & Recommendation

Companies Mentioned

- 1. AAR Corporation

- 2. AeroTurbine, Inc.

- 3. AerSale Inc.

- 4. Air Salvage International

- 5. Airborne Maintenance & Engineering Services

- 6. Aircraft Demolition LLC

- 7. Aircraft End-of-Life Solutions

- 8. AJW Group

- 9. Ascent Aviation Services

- 10. Aviation Technical Services

- 11. AvTrade Limited

- 12. CAVU Aerospace

- 13. ComAv Technical Services

- 14. FL Technics

- 15. GA Telesis, LLC

- 16. HAECO Group

- 17. IAG Engine Center

- 18. Lufthansa Technik AG

- 19. SR Technics

- 20. Sycamore Aviation

- 21. TARMAC Aerosave

- 22. Unical Aviation, Inc.

- 23. Universal Asset Management, Inc.

- 24. Vallair Solutions

- 25. Willis Lease Finance Corporation