|

|

市場調査レポート

商品コード

1676735

ハイドロタルサイト市場:材料タイプ、タイプ、最終用途産業、用途別 - 2025年~2030年の世界予測Hydrotalcite Market by Material Type, Type, End-Use Industry, Application - Global Forecast 2025-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ハイドロタルサイト市場:材料タイプ、タイプ、最終用途産業、用途別 - 2025年~2030年の世界予測 |

|

出版日: 2025年03月09日

発行: 360iResearch

ページ情報: 英文 184 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 図表

- 目次

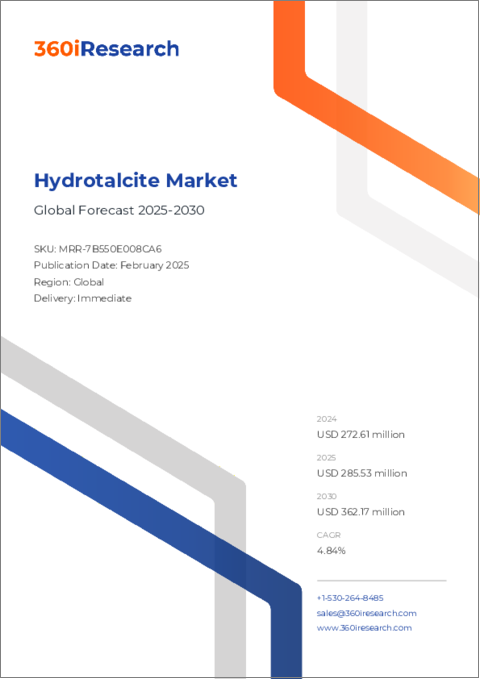

ハイドロタルサイト市場の2024年の市場規模は2億7,261万米ドルで、2025年には2億8,553万米ドルに成長し、CAGRは4.84%、2030年には3億6,217万米ドルに達すると予測されています。

| 主な市場の統計 | |

|---|---|

| 基準年 2024 | 2億7,261万米ドル |

| 推定年 2025 | 2億8,553万米ドル |

| 予測年 2030 | 3億6,217万米ドル |

| CAGR(%) | 4.84% |

層状複水酸化物であるハイドロタルサイトは、そのユニークな物理化学的特性と多彩な用途により、世界中の産業界の注目を集めています。近年、産業需要の急速な進化により、ハイドロタルサイトは材料革新の最前線に位置付けられています。その強固な特性と多機能な用途は、製品性能の向上と持続可能性の改善を可能にし、様々な分野でその重要性を高めています。

安定剤、触媒、吸着剤として作用するハイドロタルサイトの本質的な能力は、その応用分野を多様化させただけでなく、研究開発への多大な投資を引き寄せています。市場の拡大に伴い、主要な業界関係者やオピニオン・リーダーたちは、変革の可能性に満ちた情勢をナビゲートしています。このイントロダクションでは、ハイドロタルサイトの特性と市場機会がどのように融合し、工業規格を再定義し、成長と革新のための新たな道を切り開こうとしているのかを探ることで、議論の土台を築きました。

進化する市場力学は、材料科学におけるブレークスルーのための肥沃な土壌を提示しています。利害関係者は、新たな動向を注視し、規制の影響を理解し、世界の持続可能性慣行の影響を受けて進化する調達戦略を活用することに、ますます警戒を強めています。このエグゼクティブサマリーは、ハイドロタルサイトの最先端の市場ポテンシャルを要約し、短期的にも長期的にも業界のシナリオを形成する極めて重要なテーマを強調しています。

ハイドロタルサイト市場の変革

近年、ハイドロタルサイト市場は、主に技術の進歩、顧客の嗜好の進化、厳格な環境規制を原動力とする変革的な変化を遂げています。生産と合成方法における最先端プロセスの統合は、ハイドロタルサイトの品質を向上させただけでなく、新興セクター全体への適用性を拡大しました。

現在では、耐熱性の向上、イオン交換特性の改善、ライフサイクル性能の延長など、ハイドロタルサイトが得意とする機能を提供する材料が市場で支持されています。研究と計算モデリングへの戦略的投資がイノベーションを促進し、従来の用途と新興用途の両方のニーズの変化に直接対応する製品の改良につながっています。さらに、環境にやさしく持続可能なソリューションに対する需要の高まりは、環境負荷の低減に役立つ材料を優先するように市場を方向転換させました。この変化は、操業効率と安全性が企業の持続可能性目標と調和するという、より広範な産業動向を反映しています。

競合情勢では、学術機関、研究機関、業界大手のコラボレーションが急増しています。こうしたパートナーシップは、ハイドロタルサイトをベースとする製品の製造技術を改良し、新たな機能性を引き出す上で極めて重要です。並行して、技術革新は製造工程を合理化し、コストを削減し、より弾力的なサプライチェーンをもたらしました。市場参入企業は現在、戦略的優先順位を再評価しており、その結果、デジタル統合、市場の多様化、世界の持続可能性イニシアティブとの整合にますます焦点が当てられています。このような変革的なシフトを受け入れることで、企業はハイドロタルサイト分野における不確実性を克服し、新たな市場機会を生かすことができます。

ハイドロタルサイト市場の包括的なセグメンテーション洞察

ハイドロタルサイト市場を詳細に調査することで、材料タイプ、製品バリエーション、最終用途産業、特定の用途の複雑さを捉えた幅広いセグメンテーションの枠組みが明らかになります。分析ではまず、原材料の観点から材料を分類し、天然ハイドロタルサイトと合成ハイドロタルサイトを区別します。続く層では、市場をタイプ別に区分し、特にMg-AlハイドロタルサイトとZn-Alハイドロタルサイトに重点を置き、現代の状況で利用可能な多様な化学組成を説明します。

市場をさらに解剖すると、ハイドロタルサイトが極めて重要な役割を果たす最終用途産業の重要性が強調されます。特に化学産業では、触媒設計、中間化合物の製造、製品の耐久性と性能を高める表面処理剤として、この材料が主に採用されています。対照的に、建築分野ではハイドロタルサイトの難燃性と安定化特性を活用し、化粧品業界では製品配合におけるその役割を高く評価しています。同様に、環境用途では、ハイドロタルサイトは土壌浄化や水処理プロセスでニッチを見つけ、生態学的汚染物質を軽減する効果を反映しています。製薬分野は、この材料が高く評価されているもう一つの戦略的分野であり、特に薬物製剤やワクチン製造において、極めて重要な健康関連用途に拡大しています。さらに、ポリマー産業では、材料の強度と熱安定性を高めるためにハイドロタルサイトがよく使用され、その幅広い用途が強化されています。

さらに、用途別基準のプリズムを通して観察すると、ハイドロタルサイトは酸の中和から難燃性、重金属除去、効果的なイオン交換、熱安定性の増強に至るシナリオで採用されています。この包括的なセグメンテーションは、ハイドロタルサイトの機能的役割の多様性を浮き彫りにするだけでなく、様々な産業分野に対応する多目的材料としての重要性を強調しています。これらのセグメンテーション基準から得られる微妙な洞察は、市場動向のより良い理解を可能にし、的を絞った製品革新と戦略的な市場浸透のイニシアティブへの道を開きます。

目次

第1章 序文

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場の概要

第5章 市場洞察

- 市場力学

- 促進要因

- 建設・インフラ産業の急速な成長によりハイドロタルサイト系材料の需要が増加

- 環境目標の達成に向けた廃水治療および汚染制御におけるハイドロタルサイトの利用増加

- 軽量で燃費の良い車両生産における使用を強化する自動車産業の増加

- 抑制要因

- ハイドロタルサイトの生産に関連するプロセスの複雑さ

- 機会

- ナノテクノロジーと材料科学の進歩により、複数の業界におけるハイドロタルサイト配合の継続的な革新が促進される

- ハイドロタルサイトセクターにおける製品イノベーションのための学術機関と業界関係者間の継続的な共同調査および合弁事業

- 課題

- ハイドロタルサイトの生産プロセスに関連する厳しい環境および規制の問題

- 促進要因

- 市場セグメンテーション分析

- 素材タイプ:高度なカスタマイズと製品品質の一貫性を実現する合成ハイドロタルサイトの採用増加

- 最終用途産業:建築材料の耐久性と性能を向上させるための建設におけるハイドロタルサイトの活用

- ポーターのファイブフォース分析

- PESTEL分析

- 政治的

- 経済

- 社会

- 技術的

- 法律上

- 環境

第6章 ハイドロタルサイト市場:材料タイプ別

- 天然ハイドロタルサイト

- 合成ハイドロタルサイト

第7章 ハイドロタルサイト市場:タイプ別

- Mg-Alハイドロタルサイト

- Zn-Aハイドロタルサイト

第8章 ハイドロタルサイト市場:最終用途産業別

- 化学産業

- 触媒

- 中間化合物

- 表面治療剤

- 建設

- 化粧品業界

- 環境アプリケーション

- 土壌修復

- 水処理

- 製薬業界

- 薬剤処方

- ワクチン製造

- ポリマー産業

第9章 ハイドロタルサイト市場:用途別

- 酸の中和

- 難燃性

- 重金属除去

- イオン交換

- 熱安定性

第10章 南北アメリカのハイドロタルサイト市場

- アルゼンチン

- ブラジル

- カナダ

- メキシコ

- 米国

第11章 アジア太平洋地域のハイドロタルサイト市場

- オーストラリア

- 中国

- インド

- インドネシア

- 日本

- マレーシア

- フィリピン

- シンガポール

- 韓国

- 台湾

- タイ

- ベトナム

第12章 欧州・中東・アフリカのハイドロタルサイト市場

- デンマーク

- エジプト

- フィンランド

- フランス

- ドイツ

- イスラエル

- イタリア

- オランダ

- ナイジェリア

- ノルウェー

- ポーランド

- カタール

- ロシア

- サウジアラビア

- 南アフリカ

- スペイン

- スウェーデン

- スイス

- トルコ

- アラブ首長国連邦

- 英国

第13章 競合情勢

- 市場シェア分析, 2024

- FPNVポジショニングマトリックス, 2024

- 競合シナリオ分析

- 戦略分析と提言

企業一覧

- Adeka Corporation

- Akdeniz Chemson

- Akzo Nobel N.V.

- Arkema S.A.

- BASF SE

- Clariant AG

- Dow Inc.

- Evonik Industries AG

- GCH TECHNOLOGY

- Imerys S.A.

- Kyowa Chemical Industry Co. Ltd.

- Lanxess AG

- Merck KGaA

- Omya AG

- Royal DSM N.V.

- Sakai Chemical Industry Co., Ltd.

- Sinwon Chemical

- Solvay S.A.

- Sumitomo Chemical Co., Ltd.

- W. R. Grace & Co.

LIST OF FIGURES

- FIGURE 1. HYDROTALCITE MARKET MULTI-CURRENCY

- FIGURE 2. HYDROTALCITE MARKET MULTI-LANGUAGE

- FIGURE 3. HYDROTALCITE MARKET RESEARCH PROCESS

- FIGURE 4. HYDROTALCITE MARKET SIZE, 2024 VS 2030

- FIGURE 5. GLOBAL HYDROTALCITE MARKET SIZE, 2018-2030 (USD MILLION)

- FIGURE 6. GLOBAL HYDROTALCITE MARKET SIZE, BY REGION, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 7. GLOBAL HYDROTALCITE MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 8. GLOBAL HYDROTALCITE MARKET SIZE, BY MATERIAL TYPE, 2024 VS 2030 (%)

- FIGURE 9. GLOBAL HYDROTALCITE MARKET SIZE, BY MATERIAL TYPE, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 10. GLOBAL HYDROTALCITE MARKET SIZE, BY TYPE, 2024 VS 2030 (%)

- FIGURE 11. GLOBAL HYDROTALCITE MARKET SIZE, BY TYPE, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 12. GLOBAL HYDROTALCITE MARKET SIZE, BY END-USE INDUSTRY, 2024 VS 2030 (%)

- FIGURE 13. GLOBAL HYDROTALCITE MARKET SIZE, BY END-USE INDUSTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 14. GLOBAL HYDROTALCITE MARKET SIZE, BY APPLICATION, 2024 VS 2030 (%)

- FIGURE 15. GLOBAL HYDROTALCITE MARKET SIZE, BY APPLICATION, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 16. AMERICAS HYDROTALCITE MARKET SIZE, BY COUNTRY, 2024 VS 2030 (%)

- FIGURE 17. AMERICAS HYDROTALCITE MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 18. UNITED STATES HYDROTALCITE MARKET SIZE, BY STATE, 2024 VS 2030 (%)

- FIGURE 19. UNITED STATES HYDROTALCITE MARKET SIZE, BY STATE, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 20. ASIA-PACIFIC HYDROTALCITE MARKET SIZE, BY COUNTRY, 2024 VS 2030 (%)

- FIGURE 21. ASIA-PACIFIC HYDROTALCITE MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 22. EUROPE, MIDDLE EAST & AFRICA HYDROTALCITE MARKET SIZE, BY COUNTRY, 2024 VS 2030 (%)

- FIGURE 23. EUROPE, MIDDLE EAST & AFRICA HYDROTALCITE MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 24. HYDROTALCITE MARKET SHARE, BY KEY PLAYER, 2024

- FIGURE 25. HYDROTALCITE MARKET, FPNV POSITIONING MATRIX, 2024

LIST OF TABLES

- TABLE 1. HYDROTALCITE MARKET SEGMENTATION & COVERAGE

- TABLE 2. UNITED STATES DOLLAR EXCHANGE RATE, 2018-2024

- TABLE 3. GLOBAL HYDROTALCITE MARKET SIZE, 2018-2030 (USD MILLION)

- TABLE 4. GLOBAL HYDROTALCITE MARKET SIZE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 5. GLOBAL HYDROTALCITE MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 6. HYDROTALCITE MARKET DYNAMICS

- TABLE 7. GLOBAL HYDROTALCITE MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 8. GLOBAL HYDROTALCITE MARKET SIZE, BY NATURAL HYDROTALCITE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 9. GLOBAL HYDROTALCITE MARKET SIZE, BY SYNTHETIC HYDROTALCITE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 10. GLOBAL HYDROTALCITE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 11. GLOBAL HYDROTALCITE MARKET SIZE, BY MG-AL HYDROTALCITE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 12. GLOBAL HYDROTALCITE MARKET SIZE, BY ZN-AL HYDROTALCITE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 13. GLOBAL HYDROTALCITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 14. GLOBAL HYDROTALCITE MARKET SIZE, BY CHEMICAL INDUSTRY, BY REGION, 2018-2030 (USD MILLION)

- TABLE 15. GLOBAL HYDROTALCITE MARKET SIZE, BY CATALYSTS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 16. GLOBAL HYDROTALCITE MARKET SIZE, BY INTERMEDIATE COMPOUNDS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 17. GLOBAL HYDROTALCITE MARKET SIZE, BY SURFACE TREATMENT AGENTS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 18. GLOBAL HYDROTALCITE MARKET SIZE, BY CHEMICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 19. GLOBAL HYDROTALCITE MARKET SIZE, BY CONSTRUCTION, BY REGION, 2018-2030 (USD MILLION)

- TABLE 20. GLOBAL HYDROTALCITE MARKET SIZE, BY COSMETICS INDUSTRY, BY REGION, 2018-2030 (USD MILLION)

- TABLE 21. GLOBAL HYDROTALCITE MARKET SIZE, BY ENVIRONMENTAL APPLICATIONS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 22. GLOBAL HYDROTALCITE MARKET SIZE, BY SOIL REMEDIATION, BY REGION, 2018-2030 (USD MILLION)

- TABLE 23. GLOBAL HYDROTALCITE MARKET SIZE, BY WATER TREATMENT, BY REGION, 2018-2030 (USD MILLION)

- TABLE 24. GLOBAL HYDROTALCITE MARKET SIZE, BY ENVIRONMENTAL APPLICATIONS, 2018-2030 (USD MILLION)

- TABLE 25. GLOBAL HYDROTALCITE MARKET SIZE, BY PHARMACEUTICAL INDUSTRY, BY REGION, 2018-2030 (USD MILLION)

- TABLE 26. GLOBAL HYDROTALCITE MARKET SIZE, BY DRUG FORMULATION, BY REGION, 2018-2030 (USD MILLION)

- TABLE 27. GLOBAL HYDROTALCITE MARKET SIZE, BY VACCINE PRODUCTION, BY REGION, 2018-2030 (USD MILLION)

- TABLE 28. GLOBAL HYDROTALCITE MARKET SIZE, BY PHARMACEUTICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 29. GLOBAL HYDROTALCITE MARKET SIZE, BY POLYMER INDUSTRY, BY REGION, 2018-2030 (USD MILLION)

- TABLE 30. GLOBAL HYDROTALCITE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 31. GLOBAL HYDROTALCITE MARKET SIZE, BY ACID NEUTRALIZATION, BY REGION, 2018-2030 (USD MILLION)

- TABLE 32. GLOBAL HYDROTALCITE MARKET SIZE, BY FLAME RETARDANCY, BY REGION, 2018-2030 (USD MILLION)

- TABLE 33. GLOBAL HYDROTALCITE MARKET SIZE, BY HEAVY METAL REMOVAL, BY REGION, 2018-2030 (USD MILLION)

- TABLE 34. GLOBAL HYDROTALCITE MARKET SIZE, BY ION-EXCHANGE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 35. GLOBAL HYDROTALCITE MARKET SIZE, BY THERMAL STABILITY, BY REGION, 2018-2030 (USD MILLION)

- TABLE 36. AMERICAS HYDROTALCITE MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 37. AMERICAS HYDROTALCITE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 38. AMERICAS HYDROTALCITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 39. AMERICAS HYDROTALCITE MARKET SIZE, BY CHEMICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 40. AMERICAS HYDROTALCITE MARKET SIZE, BY ENVIRONMENTAL APPLICATIONS, 2018-2030 (USD MILLION)

- TABLE 41. AMERICAS HYDROTALCITE MARKET SIZE, BY PHARMACEUTICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 42. AMERICAS HYDROTALCITE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 43. AMERICAS HYDROTALCITE MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 44. ARGENTINA HYDROTALCITE MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 45. ARGENTINA HYDROTALCITE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 46. ARGENTINA HYDROTALCITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 47. ARGENTINA HYDROTALCITE MARKET SIZE, BY CHEMICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 48. ARGENTINA HYDROTALCITE MARKET SIZE, BY ENVIRONMENTAL APPLICATIONS, 2018-2030 (USD MILLION)

- TABLE 49. ARGENTINA HYDROTALCITE MARKET SIZE, BY PHARMACEUTICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 50. ARGENTINA HYDROTALCITE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 51. BRAZIL HYDROTALCITE MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 52. BRAZIL HYDROTALCITE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 53. BRAZIL HYDROTALCITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 54. BRAZIL HYDROTALCITE MARKET SIZE, BY CHEMICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 55. BRAZIL HYDROTALCITE MARKET SIZE, BY ENVIRONMENTAL APPLICATIONS, 2018-2030 (USD MILLION)

- TABLE 56. BRAZIL HYDROTALCITE MARKET SIZE, BY PHARMACEUTICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 57. BRAZIL HYDROTALCITE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 58. CANADA HYDROTALCITE MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 59. CANADA HYDROTALCITE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 60. CANADA HYDROTALCITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 61. CANADA HYDROTALCITE MARKET SIZE, BY CHEMICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 62. CANADA HYDROTALCITE MARKET SIZE, BY ENVIRONMENTAL APPLICATIONS, 2018-2030 (USD MILLION)

- TABLE 63. CANADA HYDROTALCITE MARKET SIZE, BY PHARMACEUTICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 64. CANADA HYDROTALCITE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 65. MEXICO HYDROTALCITE MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 66. MEXICO HYDROTALCITE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 67. MEXICO HYDROTALCITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 68. MEXICO HYDROTALCITE MARKET SIZE, BY CHEMICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 69. MEXICO HYDROTALCITE MARKET SIZE, BY ENVIRONMENTAL APPLICATIONS, 2018-2030 (USD MILLION)

- TABLE 70. MEXICO HYDROTALCITE MARKET SIZE, BY PHARMACEUTICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 71. MEXICO HYDROTALCITE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 72. UNITED STATES HYDROTALCITE MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 73. UNITED STATES HYDROTALCITE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 74. UNITED STATES HYDROTALCITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 75. UNITED STATES HYDROTALCITE MARKET SIZE, BY CHEMICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 76. UNITED STATES HYDROTALCITE MARKET SIZE, BY ENVIRONMENTAL APPLICATIONS, 2018-2030 (USD MILLION)

- TABLE 77. UNITED STATES HYDROTALCITE MARKET SIZE, BY PHARMACEUTICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 78. UNITED STATES HYDROTALCITE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 79. UNITED STATES HYDROTALCITE MARKET SIZE, BY STATE, 2018-2030 (USD MILLION)

- TABLE 80. ASIA-PACIFIC HYDROTALCITE MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 81. ASIA-PACIFIC HYDROTALCITE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 82. ASIA-PACIFIC HYDROTALCITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 83. ASIA-PACIFIC HYDROTALCITE MARKET SIZE, BY CHEMICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 84. ASIA-PACIFIC HYDROTALCITE MARKET SIZE, BY ENVIRONMENTAL APPLICATIONS, 2018-2030 (USD MILLION)

- TABLE 85. ASIA-PACIFIC HYDROTALCITE MARKET SIZE, BY PHARMACEUTICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 86. ASIA-PACIFIC HYDROTALCITE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 87. ASIA-PACIFIC HYDROTALCITE MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 88. AUSTRALIA HYDROTALCITE MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 89. AUSTRALIA HYDROTALCITE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 90. AUSTRALIA HYDROTALCITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 91. AUSTRALIA HYDROTALCITE MARKET SIZE, BY CHEMICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 92. AUSTRALIA HYDROTALCITE MARKET SIZE, BY ENVIRONMENTAL APPLICATIONS, 2018-2030 (USD MILLION)

- TABLE 93. AUSTRALIA HYDROTALCITE MARKET SIZE, BY PHARMACEUTICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 94. AUSTRALIA HYDROTALCITE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 95. CHINA HYDROTALCITE MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 96. CHINA HYDROTALCITE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 97. CHINA HYDROTALCITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 98. CHINA HYDROTALCITE MARKET SIZE, BY CHEMICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 99. CHINA HYDROTALCITE MARKET SIZE, BY ENVIRONMENTAL APPLICATIONS, 2018-2030 (USD MILLION)

- TABLE 100. CHINA HYDROTALCITE MARKET SIZE, BY PHARMACEUTICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 101. CHINA HYDROTALCITE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 102. INDIA HYDROTALCITE MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 103. INDIA HYDROTALCITE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 104. INDIA HYDROTALCITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 105. INDIA HYDROTALCITE MARKET SIZE, BY CHEMICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 106. INDIA HYDROTALCITE MARKET SIZE, BY ENVIRONMENTAL APPLICATIONS, 2018-2030 (USD MILLION)

- TABLE 107. INDIA HYDROTALCITE MARKET SIZE, BY PHARMACEUTICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 108. INDIA HYDROTALCITE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 109. INDONESIA HYDROTALCITE MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 110. INDONESIA HYDROTALCITE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 111. INDONESIA HYDROTALCITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 112. INDONESIA HYDROTALCITE MARKET SIZE, BY CHEMICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 113. INDONESIA HYDROTALCITE MARKET SIZE, BY ENVIRONMENTAL APPLICATIONS, 2018-2030 (USD MILLION)

- TABLE 114. INDONESIA HYDROTALCITE MARKET SIZE, BY PHARMACEUTICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 115. INDONESIA HYDROTALCITE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 116. JAPAN HYDROTALCITE MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 117. JAPAN HYDROTALCITE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 118. JAPAN HYDROTALCITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 119. JAPAN HYDROTALCITE MARKET SIZE, BY CHEMICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 120. JAPAN HYDROTALCITE MARKET SIZE, BY ENVIRONMENTAL APPLICATIONS, 2018-2030 (USD MILLION)

- TABLE 121. JAPAN HYDROTALCITE MARKET SIZE, BY PHARMACEUTICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 122. JAPAN HYDROTALCITE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 123. MALAYSIA HYDROTALCITE MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 124. MALAYSIA HYDROTALCITE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 125. MALAYSIA HYDROTALCITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 126. MALAYSIA HYDROTALCITE MARKET SIZE, BY CHEMICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 127. MALAYSIA HYDROTALCITE MARKET SIZE, BY ENVIRONMENTAL APPLICATIONS, 2018-2030 (USD MILLION)

- TABLE 128. MALAYSIA HYDROTALCITE MARKET SIZE, BY PHARMACEUTICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 129. MALAYSIA HYDROTALCITE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 130. PHILIPPINES HYDROTALCITE MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 131. PHILIPPINES HYDROTALCITE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 132. PHILIPPINES HYDROTALCITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 133. PHILIPPINES HYDROTALCITE MARKET SIZE, BY CHEMICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 134. PHILIPPINES HYDROTALCITE MARKET SIZE, BY ENVIRONMENTAL APPLICATIONS, 2018-2030 (USD MILLION)

- TABLE 135. PHILIPPINES HYDROTALCITE MARKET SIZE, BY PHARMACEUTICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 136. PHILIPPINES HYDROTALCITE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 137. SINGAPORE HYDROTALCITE MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 138. SINGAPORE HYDROTALCITE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 139. SINGAPORE HYDROTALCITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 140. SINGAPORE HYDROTALCITE MARKET SIZE, BY CHEMICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 141. SINGAPORE HYDROTALCITE MARKET SIZE, BY ENVIRONMENTAL APPLICATIONS, 2018-2030 (USD MILLION)

- TABLE 142. SINGAPORE HYDROTALCITE MARKET SIZE, BY PHARMACEUTICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 143. SINGAPORE HYDROTALCITE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 144. SOUTH KOREA HYDROTALCITE MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 145. SOUTH KOREA HYDROTALCITE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 146. SOUTH KOREA HYDROTALCITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 147. SOUTH KOREA HYDROTALCITE MARKET SIZE, BY CHEMICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 148. SOUTH KOREA HYDROTALCITE MARKET SIZE, BY ENVIRONMENTAL APPLICATIONS, 2018-2030 (USD MILLION)

- TABLE 149. SOUTH KOREA HYDROTALCITE MARKET SIZE, BY PHARMACEUTICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 150. SOUTH KOREA HYDROTALCITE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 151. TAIWAN HYDROTALCITE MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 152. TAIWAN HYDROTALCITE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 153. TAIWAN HYDROTALCITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 154. TAIWAN HYDROTALCITE MARKET SIZE, BY CHEMICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 155. TAIWAN HYDROTALCITE MARKET SIZE, BY ENVIRONMENTAL APPLICATIONS, 2018-2030 (USD MILLION)

- TABLE 156. TAIWAN HYDROTALCITE MARKET SIZE, BY PHARMACEUTICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 157. TAIWAN HYDROTALCITE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 158. THAILAND HYDROTALCITE MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 159. THAILAND HYDROTALCITE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 160. THAILAND HYDROTALCITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 161. THAILAND HYDROTALCITE MARKET SIZE, BY CHEMICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 162. THAILAND HYDROTALCITE MARKET SIZE, BY ENVIRONMENTAL APPLICATIONS, 2018-2030 (USD MILLION)

- TABLE 163. THAILAND HYDROTALCITE MARKET SIZE, BY PHARMACEUTICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 164. THAILAND HYDROTALCITE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 165. VIETNAM HYDROTALCITE MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 166. VIETNAM HYDROTALCITE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 167. VIETNAM HYDROTALCITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 168. VIETNAM HYDROTALCITE MARKET SIZE, BY CHEMICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 169. VIETNAM HYDROTALCITE MARKET SIZE, BY ENVIRONMENTAL APPLICATIONS, 2018-2030 (USD MILLION)

- TABLE 170. VIETNAM HYDROTALCITE MARKET SIZE, BY PHARMACEUTICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 171. VIETNAM HYDROTALCITE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 172. EUROPE, MIDDLE EAST & AFRICA HYDROTALCITE MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 173. EUROPE, MIDDLE EAST & AFRICA HYDROTALCITE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 174. EUROPE, MIDDLE EAST & AFRICA HYDROTALCITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 175. EUROPE, MIDDLE EAST & AFRICA HYDROTALCITE MARKET SIZE, BY CHEMICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 176. EUROPE, MIDDLE EAST & AFRICA HYDROTALCITE MARKET SIZE, BY ENVIRONMENTAL APPLICATIONS, 2018-2030 (USD MILLION)

- TABLE 177. EUROPE, MIDDLE EAST & AFRICA HYDROTALCITE MARKET SIZE, BY PHARMACEUTICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 178. EUROPE, MIDDLE EAST & AFRICA HYDROTALCITE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 179. EUROPE, MIDDLE EAST & AFRICA HYDROTALCITE MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 180. DENMARK HYDROTALCITE MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 181. DENMARK HYDROTALCITE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 182. DENMARK HYDROTALCITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 183. DENMARK HYDROTALCITE MARKET SIZE, BY CHEMICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 184. DENMARK HYDROTALCITE MARKET SIZE, BY ENVIRONMENTAL APPLICATIONS, 2018-2030 (USD MILLION)

- TABLE 185. DENMARK HYDROTALCITE MARKET SIZE, BY PHARMACEUTICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 186. DENMARK HYDROTALCITE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 187. EGYPT HYDROTALCITE MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 188. EGYPT HYDROTALCITE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 189. EGYPT HYDROTALCITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 190. EGYPT HYDROTALCITE MARKET SIZE, BY CHEMICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 191. EGYPT HYDROTALCITE MARKET SIZE, BY ENVIRONMENTAL APPLICATIONS, 2018-2030 (USD MILLION)

- TABLE 192. EGYPT HYDROTALCITE MARKET SIZE, BY PHARMACEUTICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 193. EGYPT HYDROTALCITE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 194. FINLAND HYDROTALCITE MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 195. FINLAND HYDROTALCITE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 196. FINLAND HYDROTALCITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 197. FINLAND HYDROTALCITE MARKET SIZE, BY CHEMICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 198. FINLAND HYDROTALCITE MARKET SIZE, BY ENVIRONMENTAL APPLICATIONS, 2018-2030 (USD MILLION)

- TABLE 199. FINLAND HYDROTALCITE MARKET SIZE, BY PHARMACEUTICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 200. FINLAND HYDROTALCITE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 201. FRANCE HYDROTALCITE MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 202. FRANCE HYDROTALCITE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 203. FRANCE HYDROTALCITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 204. FRANCE HYDROTALCITE MARKET SIZE, BY CHEMICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 205. FRANCE HYDROTALCITE MARKET SIZE, BY ENVIRONMENTAL APPLICATIONS, 2018-2030 (USD MILLION)

- TABLE 206. FRANCE HYDROTALCITE MARKET SIZE, BY PHARMACEUTICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 207. FRANCE HYDROTALCITE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 208. GERMANY HYDROTALCITE MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 209. GERMANY HYDROTALCITE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 210. GERMANY HYDROTALCITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 211. GERMANY HYDROTALCITE MARKET SIZE, BY CHEMICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 212. GERMANY HYDROTALCITE MARKET SIZE, BY ENVIRONMENTAL APPLICATIONS, 2018-2030 (USD MILLION)

- TABLE 213. GERMANY HYDROTALCITE MARKET SIZE, BY PHARMACEUTICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 214. GERMANY HYDROTALCITE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 215. ISRAEL HYDROTALCITE MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 216. ISRAEL HYDROTALCITE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 217. ISRAEL HYDROTALCITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 218. ISRAEL HYDROTALCITE MARKET SIZE, BY CHEMICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 219. ISRAEL HYDROTALCITE MARKET SIZE, BY ENVIRONMENTAL APPLICATIONS, 2018-2030 (USD MILLION)

- TABLE 220. ISRAEL HYDROTALCITE MARKET SIZE, BY PHARMACEUTICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 221. ISRAEL HYDROTALCITE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 222. ITALY HYDROTALCITE MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 223. ITALY HYDROTALCITE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 224. ITALY HYDROTALCITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 225. ITALY HYDROTALCITE MARKET SIZE, BY CHEMICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 226. ITALY HYDROTALCITE MARKET SIZE, BY ENVIRONMENTAL APPLICATIONS, 2018-2030 (USD MILLION)

- TABLE 227. ITALY HYDROTALCITE MARKET SIZE, BY PHARMACEUTICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 228. ITALY HYDROTALCITE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 229. NETHERLANDS HYDROTALCITE MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 230. NETHERLANDS HYDROTALCITE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 231. NETHERLANDS HYDROTALCITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 232. NETHERLANDS HYDROTALCITE MARKET SIZE, BY CHEMICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 233. NETHERLANDS HYDROTALCITE MARKET SIZE, BY ENVIRONMENTAL APPLICATIONS, 2018-2030 (USD MILLION)

- TABLE 234. NETHERLANDS HYDROTALCITE MARKET SIZE, BY PHARMACEUTICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 235. NETHERLANDS HYDROTALCITE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 236. NIGERIA HYDROTALCITE MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 237. NIGERIA HYDROTALCITE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 238. NIGERIA HYDROTALCITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 239. NIGERIA HYDROTALCITE MARKET SIZE, BY CHEMICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 240. NIGERIA HYDROTALCITE MARKET SIZE, BY ENVIRONMENTAL APPLICATIONS, 2018-2030 (USD MILLION)

- TABLE 241. NIGERIA HYDROTALCITE MARKET SIZE, BY PHARMACEUTICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 242. NIGERIA HYDROTALCITE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 243. NORWAY HYDROTALCITE MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 244. NORWAY HYDROTALCITE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 245. NORWAY HYDROTALCITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 246. NORWAY HYDROTALCITE MARKET SIZE, BY CHEMICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 247. NORWAY HYDROTALCITE MARKET SIZE, BY ENVIRONMENTAL APPLICATIONS, 2018-2030 (USD MILLION)

- TABLE 248. NORWAY HYDROTALCITE MARKET SIZE, BY PHARMACEUTICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 249. NORWAY HYDROTALCITE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 250. POLAND HYDROTALCITE MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 251. POLAND HYDROTALCITE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 252. POLAND HYDROTALCITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 253. POLAND HYDROTALCITE MARKET SIZE, BY CHEMICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 254. POLAND HYDROTALCITE MARKET SIZE, BY ENVIRONMENTAL APPLICATIONS, 2018-2030 (USD MILLION)

- TABLE 255. POLAND HYDROTALCITE MARKET SIZE, BY PHARMACEUTICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 256. POLAND HYDROTALCITE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 257. QATAR HYDROTALCITE MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 258. QATAR HYDROTALCITE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 259. QATAR HYDROTALCITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 260. QATAR HYDROTALCITE MARKET SIZE, BY CHEMICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 261. QATAR HYDROTALCITE MARKET SIZE, BY ENVIRONMENTAL APPLICATIONS, 2018-2030 (USD MILLION)

- TABLE 262. QATAR HYDROTALCITE MARKET SIZE, BY PHARMACEUTICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 263. QATAR HYDROTALCITE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 264. RUSSIA HYDROTALCITE MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 265. RUSSIA HYDROTALCITE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 266. RUSSIA HYDROTALCITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 267. RUSSIA HYDROTALCITE MARKET SIZE, BY CHEMICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 268. RUSSIA HYDROTALCITE MARKET SIZE, BY ENVIRONMENTAL APPLICATIONS, 2018-2030 (USD MILLION)

- TABLE 269. RUSSIA HYDROTALCITE MARKET SIZE, BY PHARMACEUTICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 270. RUSSIA HYDROTALCITE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 271. SAUDI ARABIA HYDROTALCITE MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 272. SAUDI ARABIA HYDROTALCITE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 273. SAUDI ARABIA HYDROTALCITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 274. SAUDI ARABIA HYDROTALCITE MARKET SIZE, BY CHEMICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 275. SAUDI ARABIA HYDROTALCITE MARKET SIZE, BY ENVIRONMENTAL APPLICATIONS, 2018-2030 (USD MILLION)

- TABLE 276. SAUDI ARABIA HYDROTALCITE MARKET SIZE, BY PHARMACEUTICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 277. SAUDI ARABIA HYDROTALCITE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 278. SOUTH AFRICA HYDROTALCITE MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 279. SOUTH AFRICA HYDROTALCITE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 280. SOUTH AFRICA HYDROTALCITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 281. SOUTH AFRICA HYDROTALCITE MARKET SIZE, BY CHEMICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 282. SOUTH AFRICA HYDROTALCITE MARKET SIZE, BY ENVIRONMENTAL APPLICATIONS, 2018-2030 (USD MILLION)

- TABLE 283. SOUTH AFRICA HYDROTALCITE MARKET SIZE, BY PHARMACEUTICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 284. SOUTH AFRICA HYDROTALCITE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 285. SPAIN HYDROTALCITE MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 286. SPAIN HYDROTALCITE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 287. SPAIN HYDROTALCITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 288. SPAIN HYDROTALCITE MARKET SIZE, BY CHEMICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 289. SPAIN HYDROTALCITE MARKET SIZE, BY ENVIRONMENTAL APPLICATIONS, 2018-2030 (USD MILLION)

- TABLE 290. SPAIN HYDROTALCITE MARKET SIZE, BY PHARMACEUTICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 291. SPAIN HYDROTALCITE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 292. SWEDEN HYDROTALCITE MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 293. SWEDEN HYDROTALCITE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 294. SWEDEN HYDROTALCITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 295. SWEDEN HYDROTALCITE MARKET SIZE, BY CHEMICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 296. SWEDEN HYDROTALCITE MARKET SIZE, BY ENVIRONMENTAL APPLICATIONS, 2018-2030 (USD MILLION)

- TABLE 297. SWEDEN HYDROTALCITE MARKET SIZE, BY PHARMACEUTICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 298. SWEDEN HYDROTALCITE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 299. SWITZERLAND HYDROTALCITE MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 300. SWITZERLAND HYDROTALCITE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 301. SWITZERLAND HYDROTALCITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 302. SWITZERLAND HYDROTALCITE MARKET SIZE, BY CHEMICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 303. SWITZERLAND HYDROTALCITE MARKET SIZE, BY ENVIRONMENTAL APPLICATIONS, 2018-2030 (USD MILLION)

- TABLE 304. SWITZERLAND HYDROTALCITE MARKET SIZE, BY PHARMACEUTICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 305. SWITZERLAND HYDROTALCITE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 306. TURKEY HYDROTALCITE MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 307. TURKEY HYDROTALCITE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 308. TURKEY HYDROTALCITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 309. TURKEY HYDROTALCITE MARKET SIZE, BY CHEMICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 310. TURKEY HYDROTALCITE MARKET SIZE, BY ENVIRONMENTAL APPLICATIONS, 2018-2030 (USD MILLION)

- TABLE 311. TURKEY HYDROTALCITE MARKET SIZE, BY PHARMACEUTICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 312. TURKEY HYDROTALCITE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 313. UNITED ARAB EMIRATES HYDROTALCITE MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 314. UNITED ARAB EMIRATES HYDROTALCITE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 315. UNITED ARAB EMIRATES HYDROTALCITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 316. UNITED ARAB EMIRATES HYDROTALCITE MARKET SIZE, BY CHEMICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 317. UNITED ARAB EMIRATES HYDROTALCITE MARKET SIZE, BY ENVIRONMENTAL APPLICATIONS, 2018-2030 (USD MILLION)

- TABLE 318. UNITED ARAB EMIRATES HYDROTALCITE MARKET SIZE, BY PHARMACEUTICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 319. UNITED ARAB EMIRATES HYDROTALCITE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 320. UNITED KINGDOM HYDROTALCITE MARKET SIZE, BY MATERIAL TYPE, 2018-2030 (USD MILLION)

- TABLE 321. UNITED KINGDOM HYDROTALCITE MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 322. UNITED KINGDOM HYDROTALCITE MARKET SIZE, BY END-USE INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 323. UNITED KINGDOM HYDROTALCITE MARKET SIZE, BY CHEMICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 324. UNITED KINGDOM HYDROTALCITE MARKET SIZE, BY ENVIRONMENTAL APPLICATIONS, 2018-2030 (USD MILLION)

- TABLE 325. UNITED KINGDOM HYDROTALCITE MARKET SIZE, BY PHARMACEUTICAL INDUSTRY, 2018-2030 (USD MILLION)

- TABLE 326. UNITED KINGDOM HYDROTALCITE MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 327. HYDROTALCITE MARKET SHARE, BY KEY PLAYER, 2024

- TABLE 328. HYDROTALCITE MARKET, FPNV POSITIONING MATRIX, 2024

The Hydrotalcite Market was valued at USD 272.61 million in 2024 and is projected to grow to USD 285.53 million in 2025, with a CAGR of 4.84%, reaching USD 362.17 million by 2030.

| KEY MARKET STATISTICS | |

|---|---|

| Base Year [2024] | USD 272.61 million |

| Estimated Year [2025] | USD 285.53 million |

| Forecast Year [2030] | USD 362.17 million |

| CAGR (%) | 4.84% |

Hydrotalcite, a layered double hydroxide, has captured the attention of industries worldwide due to its unique physicochemical characteristics and versatile applications. In recent years, the rapid evolution of industrial demands has positioned hydrotalcite at the forefront of material innovation. Its robust properties and multifunctional applications drive its importance across a spectrum of sectors, enabling product performance enhancements and sustainability improvements.

The compound's intrinsic ability to act as a stabilizer, catalyst, and adsorbent has not only diversified its application areas but also attracted significant investments in research and development. As the market expands, key industry players and thought leaders are navigating a landscape rich with transformative potential. This introduction lays the foundation of our discussion by exploring how hydrotalcite's properties and market opportunities are converging to redefine industrial standards and open new pathways for growth and innovation.

The evolving market dynamics present a fertile ground for breakthroughs in material science. Stakeholders are increasingly vigilant in monitoring emerging trends, understanding regulatory impacts, and capitalizing on the evolving procurement strategies influenced by global sustainability practices. This executive summary encapsulates the state-of-the-art market potential of hydrotalcite, underscoring the pivotal themes that will shape industry narratives in both the short and long term.

Transformative Shifts in the Hydrotalcite Market Landscape

Recent years have seen transformative shifts in the hydrotalcite market, driven primarily by technological advancements, evolving customer preferences, and strict environmental regulations. The integration of cutting-edge processes in production and synthesis methods has not only increased the quality of hydrotalcite but also expanded its applicability across emerging sectors.

Market forces now favor materials that offer enhanced heat resistance, improved ion-exchange properties, and extended lifecycle performance, features at which hydrotalcite excels. Strategic investments in research and computational modeling have fostered innovations, leading to product improvements that respond directly to the shifting needs of both traditional and emerging applications. Furthermore, increased demand for eco-friendly and sustainable solutions has pivoted the market to prioritize materials that help reduce environmental impact. This shift is reflective of a broader industrial trend where operational efficiency and safety are harmonized with corporate sustainability objectives.

The competitive landscape has seen a surge in collaborations between academic institutions, research organizations, and industry powerhouses. These partnerships have been critical in refining the production techniques and unlocking new functionalities of hydrotalcite-based products. In parallel, technological innovations have streamlined manufacturing processes, reduced costs, and resulted in a more resilient supply chain. Industry participants are now reevaluating their strategic priorities, which leads to increased focus on digital integration, market diversification, and alignment with global sustainability initiatives. By embracing these transformative shifts, companies are better positioned to navigate uncertainties and capitalize on emerging market opportunities in the hydrotalcite arena.

Comprehensive Segmentation Insights of the Hydrotalcite Market

A detailed examination of the hydrotalcite market reveals a broad segmentation framework that captures the intricacies of material type, product variants, end-use industries, and specific applications. The analysis begins by categorizing materials from a raw perspective, distinguishing between natural hydrotalcite and synthetic hydrotalcite. In the subsequent layer, the market is segmented by type, with particular emphasis on Mg-Al hydrotalcite and Zn-Al hydrotalcite, which illustrate the diverse chemical compositions available in the modern landscape.

Further dissection of the market underscores the importance of end-use industries where hydrotalcite plays a pivotal role. Notably, the chemical industry has embraced this material predominantly in catalyst design, intermediate compounds production, and as surface treatment agents that enhance product durability and performance. In contrast, the construction sector leverages hydrotalcite for its flame-retardant and stabilizing properties, while the cosmetics industry appreciates its role in product formulation. Similarly, in environmental applications, hydrotalcite finds its niche in soil remediation and water treatment processes, reflecting its efficacy in mitigating ecological contaminants. The pharmaceutical segment is another strategic avenue where the material is highly valued, particularly in drug formulation and vaccine production, thereby extending its reach into pivotal health-related applications. Moreover, the polymer industry often integrates hydrotalcite to enhance material strength and thermal stability, reinforcing its broad spectrum of applications.

Additionally, when observed through the prism of application-specific criteria, hydrotalcite is employed in scenarios ranging from acid neutralization to flame retardancy, heavy metal removal, effective ion-exchange, and augmentation of thermal stability. This comprehensive segmentation not only highlights the diversity of hydrotalcite's functional roles but also emphasizes its importance as a multi-purpose material that caters to a variety of industrial sectors. The nuanced insights derived from these segmentation criteria enable a better understanding of market trends, paving the way for targeted product innovation and strategic market penetration initiatives.

Based on Material Type, market is studied across Natural Hydrotalcite and Synthetic Hydrotalcite.

Based on Type, market is studied across Mg-Al Hydrotalcite and Zn-Al Hydrotalcite.

Based on End-Use Industry, market is studied across Chemical Industry, Construction, Cosmetics Industry, Environmental Applications, Pharmaceutical Industry, and Polymer Industry. The Chemical Industry is further studied across Catalysts, Intermediate Compounds, and Surface Treatment Agents. The Environmental Applications is further studied across Soil Remediation and Water Treatment. The Pharmaceutical Industry is further studied across Drug Formulation and Vaccine Production.

Based on Application, market is studied across Acid Neutralization, Flame Retardancy, Heavy Metal Removal, Ion-Exchange, and Thermal Stability.

Global Regional Insights for the Hydrotalcite Market

The hydrotalcite market presents a unique opportunity for regional players and international enterprises as geographical boundaries become less restrictive in influencing market dynamics. In the Americas, robust industrial activities and a strong drive towards advanced materials have fostered a conducive environment for extensive adoption of hydrotalcite-based solutions. The region shows a keen inclination towards integrating sustainable materials into manufacturing processes in an effort to reduce environmental footprints while boosting economic performance.

Across Europe, the Middle East, and Africa, the market witnesses an intricate interplay of stringent regulatory frameworks and high-demand sectors. Strict environmental policies promote the adoption of materials that are not only effective but also environmentally benign. This multifaceted market is driven by the quest for enhanced technological competencies, which in turn elevates the functional demands placed on materials like hydrotalcite. Alongside, the region's diversified industrial landscape-ranging from robust construction activities to advanced chemical processing-creates an ecosystem ripe for innovation and growth.

In the Asia-Pacific region, rapid industrialization, technological innovation, and a burgeoning middle class have collectively contributed to an increasing focus on high-performance materials. The region's aggressive industrial expansion and investment in research and development serve as powerful catalysts for the integration of hydrotalcite in multiple applications. These regional insights underline the dynamic nature of the market and highlight the regional strategies that companies need to adopt in order to harness the full potential of hydrotalcite across diverse economic landscapes.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom.

Leading Companies Shaping the Hydrotalcite Market

An array of industry leaders is actively shaping the hydrotalcite market with robust strategies and innovative approaches. These companies have established themselves as pioneers by consistently pushing the boundaries of technological advancements and offering high-quality, application-specific solutions. Adeka Corporation, Akdeniz Chemson, and Akzo Nobel N.V. are just a few examples of firms that have invested significantly in research and development to enhance the production processes and application techniques for hydrotalcite.

Arkema S.A., BASF SE, and Clariant AG have also emerged as influential players, whose strategic innovations and market reach have reinforced hydrotalcite's role as a cornerstone in industrial materials. Dow Inc. and Evonik Industries AG continue to drive forward-thinking initiatives by capitalizing on the evolving regulatory and application landscapes, while GCH TECHNOLOGY and Imerys S.A. remain committed to market expansion and product optimization.

Furthermore, companies like Kyowa Chemical Industry Co. Ltd. and Lanxess AG contribute to the market by bridging the gap between innovative technology and practical industrial applications. Alongside, Merck KGaA and Omya AG have diligently focused on improving the material's properties to align with industry-specific needs. Royal DSM N.V., Sakai Chemical Industry Co., Ltd., and Sinwon Chemical further add to the competitive market dynamics by consistently delivering high-performance solutions in a rapidly changing landscape. Solvay S.A., Sumitomo Chemical Co., Ltd., and W. R. Grace & Co. round out this expansive list, each playing a critical role in shaping market trends through strategic product developments and expansive global networks.

These market leaders, with their diverse portfolios and geographical footprints, not only set benchmarks for quality and innovation but also significantly influence the direction of the hydrotalcite segment. Their collective endeavors enable the continuous evolution of product capabilities and foster a competitive market environment that nurtures growth and operational excellence.

The report delves into recent significant developments in the Hydrotalcite Market, highlighting leading vendors and their innovative profiles. These include Adeka Corporation, Akdeniz Chemson, Akzo Nobel N.V., Arkema S.A., BASF SE, Clariant AG, Dow Inc., Evonik Industries AG, GCH TECHNOLOGY, Imerys S.A., Kyowa Chemical Industry Co. Ltd., Lanxess AG, Merck KGaA, Omya AG, Royal DSM N.V., Sakai Chemical Industry Co., Ltd., Sinwon Chemical, Solvay S.A., Sumitomo Chemical Co., Ltd., and W. R. Grace & Co.. Actionable Strategies for Hydrotalcite Market Leaders

Market leaders seeking to secure a competitive edge in the hydrotalcite sector must prioritize actionable strategies that capitalize on emerging trends and address evolving customer demands. It is imperative to invest in research and development to further innovate across the various forms of hydrotalcite, whether natural or synthetic, focusing on enhancing the inherent performance characteristics. Decision-makers should explore avenues for optimizing chemical compositions such as Mg-Al and Zn-Al configurations to tailor products that meet the specific needs of the chemical, construction, pharmaceutical, and polymer industries.

Adopting a market-centric approach requires integrating insights from both segmentation and regional trends. With diverse applications ranging from acid neutralization to heavy metal removal, companies must fine-tune their production processes and product portfolios to cater to specialized market segments like environmental applications and drug formulation. Building strategic alliances, both locally and globally, will be crucial as collaborative initiatives can accelerate product innovation and facilitate market penetration.

Additionally, leveraging digital tools and data analytics will empower organizations to predict market shifts more accurately, identify emerging opportunities, and respond swiftly to customer demands. Emphasizing sustainability and environmental compliance, companies can not only enhance their brand reputation but also align with global regulatory trends that favor eco-friendly solutions. Furthermore, diversifying market presence by expanding into high-growth regions, such as the Americas, Asia-Pacific, or Europe, Middle East & Africa, will provide additional pathways for growth and revenue diversification.

Industry leaders are encouraged to monitor the competitive landscape closely, engage in continuous dialogue with key stakeholders across supply chains, and invest in technologies that support scalability and operational efficiency. Cultivating a culture of innovation and agility within organizations can serve as a critical differentiator in a dynamic market, ensuring that companies remain resilient in the face of challenges and well-positioned to seize emerging opportunities.

Conclusion: Navigating the Future of Hydrotalcite

The hydrotalcite market is undeniably evolving, driven by a potent mix of technological advancements, innovative applications, and shifting regulatory outlooks. Throughout this analysis, it is evident that the material's multifaceted functionality-be it in catalysis, construction, pharmaceuticals, or environmental remediation-continues to propel its relevance and market potential. The nuanced segmentation across material types, chemical compositions, and varied industrial applications underscores the diverse pathways through which hydrotalcite can be leveraged to meet modern industrial demands.

Regional insights have further illustrated how specific market dynamics in the Americas, Europe, Middle East & Africa, and Asia-Pacific contribute uniquely to the overall growth narrative. In parallel, the formidable presence of industry giants has not only catalyzed technological enhancements but also set the pace for future market trends. As the challenges of environmental sustainability and operational efficiency persist, the inherent properties of hydrotalcite offer promising solutions that align perfectly with the needs of progressive industrial applications.

In summation, the combined influence of these diverse factors points towards a resilient market poised for significant growth. Continuous innovation, strategic realignments, and a clear focus on customer and regional specificities will remain critical as the industry navigates its future trajectory. The path forward is laden with opportunities for those who embrace change, invest in innovation, and strategically position themselves to lead in the hydrotalcite space.

Table of Contents

1. Preface

- 1.1. Objectives of the Study

- 1.2. Market Segmentation & Coverage

- 1.3. Years Considered for the Study

- 1.4. Currency & Pricing

- 1.5. Language

- 1.6. Stakeholders

2. Research Methodology

- 2.1. Define: Research Objective

- 2.2. Determine: Research Design

- 2.3. Prepare: Research Instrument

- 2.4. Collect: Data Source

- 2.5. Analyze: Data Interpretation

- 2.6. Formulate: Data Verification

- 2.7. Publish: Research Report

- 2.8. Repeat: Report Update

3. Executive Summary

4. Market Overview

5. Market Insights

- 5.1. Market Dynamics

- 5.1.1. Drivers

- 5.1.1.1. Rapid growth in the construction and infrastructure industry enhancing demand for hydrotalcite-based materials

- 5.1.1.2. Rising utilization of hydrotalcite in wastewater treatment and pollution control to meet environmental objectives

- 5.1.1.3. Increasing automotive industry enhancing its use in lightweight and fuel-efficient vehicle production

- 5.1.2. Restraints

- 5.1.2.1. Process complexities associated with production of hydrotalcite

- 5.1.3. Opportunities

- 5.1.3.1. Advances in nanotechnology and material science enhancing continual innovation in hydrotalcite formulations for multiple industries

- 5.1.3.2. Ongoing collaborative research and joint ventures between academic institutions and industry players for product innovations in the hydrotalcite sector

- 5.1.4. Challenges

- 5.1.4.1. Strict environmental and regulatory issue associated with production process of hydrotalcite

- 5.1.1. Drivers

- 5.2. Market Segmentation Analysis

- 5.2.1. Material Type: Increasing adoption of synthetic hydrotalcite for high degree of customization and consistency in product quality

- 5.2.2. End-Use Industry: Utilization of hydrotalcite in construction to improve the durability and performance of building materials

- 5.3. Porter's Five Forces Analysis

- 5.3.1. Threat of New Entrants

- 5.3.2. Threat of Substitutes

- 5.3.3. Bargaining Power of Customers

- 5.3.4. Bargaining Power of Suppliers

- 5.3.5. Industry Rivalry

- 5.4. PESTLE Analysis

- 5.4.1. Political

- 5.4.2. Economic

- 5.4.3. Social

- 5.4.4. Technological

- 5.4.5. Legal

- 5.4.6. Environmental

6. Hydrotalcite Market, by Material Type

- 6.1. Introduction

- 6.2. Natural Hydrotalcite

- 6.3. Synthetic Hydrotalcite

7. Hydrotalcite Market, by Type

- 7.1. Introduction

- 7.2. Mg-Al Hydrotalcite

- 7.3. Zn-Al Hydrotalcite

8. Hydrotalcite Market, by End-Use Industry

- 8.1. Introduction

- 8.2. Chemical Industry

- 8.2.1. Catalysts

- 8.2.2. Intermediate Compounds

- 8.2.3. Surface Treatment Agents

- 8.3. Construction

- 8.4. Cosmetics Industry

- 8.5. Environmental Applications

- 8.5.1. Soil Remediation

- 8.5.2. Water Treatment

- 8.6. Pharmaceutical Industry

- 8.6.1. Drug Formulation

- 8.6.2. Vaccine Production

- 8.7. Polymer Industry

9. Hydrotalcite Market, by Application

- 9.1. Introduction

- 9.2. Acid Neutralization

- 9.3. Flame Retardancy

- 9.4. Heavy Metal Removal

- 9.5. Ion-Exchange

- 9.6. Thermal Stability

10. Americas Hydrotalcite Market

- 10.1. Introduction

- 10.2. Argentina

- 10.3. Brazil

- 10.4. Canada

- 10.5. Mexico

- 10.6. United States

11. Asia-Pacific Hydrotalcite Market

- 11.1. Introduction

- 11.2. Australia

- 11.3. China

- 11.4. India

- 11.5. Indonesia

- 11.6. Japan

- 11.7. Malaysia

- 11.8. Philippines

- 11.9. Singapore

- 11.10. South Korea

- 11.11. Taiwan

- 11.12. Thailand

- 11.13. Vietnam

12. Europe, Middle East & Africa Hydrotalcite Market

- 12.1. Introduction

- 12.2. Denmark

- 12.3. Egypt

- 12.4. Finland

- 12.5. France

- 12.6. Germany

- 12.7. Israel

- 12.8. Italy

- 12.9. Netherlands

- 12.10. Nigeria

- 12.11. Norway

- 12.12. Poland

- 12.13. Qatar

- 12.14. Russia

- 12.15. Saudi Arabia

- 12.16. South Africa

- 12.17. Spain

- 12.18. Sweden

- 12.19. Switzerland

- 12.20. Turkey

- 12.21. United Arab Emirates

- 12.22. United Kingdom

13. Competitive Landscape

- 13.1. Market Share Analysis, 2024

- 13.2. FPNV Positioning Matrix, 2024

- 13.3. Competitive Scenario Analysis

- 13.3.1. Arkema expands its flexible packaging portfolio with Dow Adhesives acquisition

- 13.3.2. Biden-Harris administration unveils USD 7.5 billion in water infrastructure financing

- 13.3.3. Clariant strengthens specialty chemicals portfolio with Lucas Meyer acquisition

- 13.4. Strategy Analysis & Recommendation

Companies Mentioned

- 1. Adeka Corporation

- 2. Akdeniz Chemson

- 3. Akzo Nobel N.V.

- 4. Arkema S.A.

- 5. BASF SE

- 6. Clariant AG

- 7. Dow Inc.

- 8. Evonik Industries AG

- 9. GCH TECHNOLOGY

- 10. Imerys S.A.

- 11. Kyowa Chemical Industry Co. Ltd.

- 12. Lanxess AG

- 13. Merck KGaA

- 14. Omya AG

- 15. Royal DSM N.V.

- 16. Sakai Chemical Industry Co., Ltd.

- 17. Sinwon Chemical

- 18. Solvay S.A.

- 19. Sumitomo Chemical Co., Ltd.

- 20. W. R. Grace & Co.