|

|

市場調査レポート

商品コード

1863303

ハード施設管理市場:サービス種類別、エンドユーザー産業別、契約形態別、所有モデル別-世界予測2025-2032年Hard Facilities Management Market by Service Type, End User Industry, Contract Type, Ownership Model - Global Forecast 2025-2032 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ハード施設管理市場:サービス種類別、エンドユーザー産業別、契約形態別、所有モデル別-世界予測2025-2032年 |

|

出版日: 2025年09月30日

発行: 360iResearch

ページ情報: 英文 198 Pages

納期: 即日から翌営業日

|

概要

ハード施設管理市場は、2032年までにCAGR4.55%で391億8,000万米ドル規模に成長すると予測されております。

| 主な市場の統計 | |

|---|---|

| 基準年2024 | 274億4,000万米ドル |

| 推定年2025 | 286億8,000万米ドル |

| 予測年2032 | 391億8,000万米ドル |

| CAGR(%) | 4.55% |

ハード施設管理が現代の資産管理課題に適応すべき方法を示す、中核的責任と進化する業務優先事項への戦略的指向

現代のハード施設管理の現状を理解するには、保守と資産管理に影響を与える業務的・財務的・規制的要因を明確に提示する導入が必要です。本節では、ハード施設管理を定義する中核的責任とサービス領域を概説し、受動的な維持管理から能動的なライフサイクル管理への移行を強調することで背景を説明します。組織が資産の信頼性、利用者の安全性、コスト抑制を支援するため、保守フレームワークを再考している点を重点的に取り上げます。

読者は、技術導入、進化する契約モデル、業界横断的な労働力課題が相互に作用し、所有者とサービスプロバイダーの優先事項を再定義している点を素早く理解できるでしょう。また、施設戦略を企業の持続可能性目標や規制順守の要請と整合させる重要性も強調しています。この基礎的な見解を確立することで、利害関係者は後続セクションにおける市場構造、料金体系の影響、セグメンテーション、地域的動向に関する下流分析をより深く理解できます。

最後に、本イントロダクションでは統合的計画立案、データ駆動型意思決定、適応型契約が不可欠である理由を文脈化します。急速な変化を背景に戦略的選択肢を評価する意思決定者を準備し、後続の章で示される高次元の動向が運用チーム、財務責任者、調達専門家にとっての実践的示唆へと変換されることを保証します。

デジタルトランスフォーメーション、労働力再編成、持続可能性の要請が、ハード施設管理におけるサービス提供モデルと調達戦略を共同で再定義している状況について

ハード施設管理は、デジタル化の進展、労働力の進化、高まるサステナビリティへの期待が相まって、変革的な転換期を迎えています。状態監視技術、モバイル作業員プラットフォーム、クラウド対応資産台帳といったデジタル技術は、保守ワークフローを再構築し、予知保全を試験的取り組みから企業全体の標準実践へと昇華させています。その結果、運用チームは技術投資が測定可能な信頼性とコストメリットをもたらすよう、データ整合性、相互運用性、成果ベースのKPIをますます重視するようになっています。

同時に、労働力の動態がサービス提供モデルを再構築しています。技術者の高齢化、電気機械分野の技能格差、多技能要員の必要性により、研修、人材定着戦略、内部能力を拡張する戦略的パートナーシップへの重点が強化されています。こうした労働力の実情を受け、多くの組織が社内チームと外部委託のバランスを見直し、内部監督と専門請負業者を組み合わせた協働モデルの採用を加速させています。

並行して、持続可能性と居住者の健康に関する規制や利害関係者からの圧力により、施設管理責任者はエネルギー最適化、資材管理、室内環境品質を保守プロトコルに組み込む必要に迫られています。これらの変革的変化を総合すると、組織は今後数年間にわたり、強靭でコンプライアンスを遵守し効率的な施設運営を確保するため、ガバナンス構造、調達フレームワーク、ベンダー関係を見直すことが求められています。

2025年までの関税変動がハード施設管理利害関係者の調達、契約動向、ライフサイクル意思決定に与えた影響の評価

米国で2025年までに発表された関税変更の累積的影響は、ハード施設管理の利害関係者に新たな運用上の複雑さをもたらしました。輸入設備、予備部品、建設資材に対する関税調整は調達経済性を変え、保守計画担当者や調達チームに調達戦略の再評価を迫っています。その結果、一部の組織ではサプライチェーンを再構築し、国内製造パートナーの優先、より長いリードタイム計画、性能のトレードオフが許容される代替資材の導入を進めています。

さらに、関税の変動性はベンダーの価格設定や契約行動にも影響を及ぼしています。請負業者やサプライヤーは、リスク軽減のため契約条件を調整しており、改訂されたエスカレーション条項、長期固定価格契約、在庫バッファーなどが含まれます。こうした契約上の変化により、買い手側はリスク配分においてより慎重な対応を求められ、サービス継続性を確保しつつコストリスクを公平に分担する緊急時対応策の導入が不可欠となっています。

加えて、関税に起因するコスト圧力により、ライフサイクル分析、修理優先の意思決定の枠組み、資産合理化の戦略的価値が高まっています。組織は、資産の耐用年数を延長し、外部調達部品への依存度を低減する診断ツールや技術的専門知識をより高く評価しています。結局のところ、関税環境は、柔軟な調達アーキテクチャ、より深いサプライヤー関係、そして地政学的・貿易関連の変数を考慮した、より精緻な総所有コスト評価の必要性を強めています。

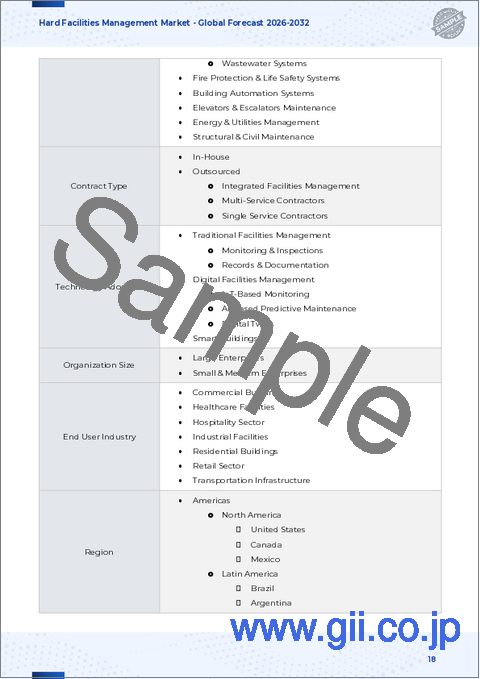

サービス専門性、業界の文脈、契約構造、所有権モデルが、運用上の優先事項やサプライヤーの経済性をどのように決定するかを示す、セグメント分析に基づく精緻な知見

セグメントレベルの洞察により、サービス専門性、顧客の背景、契約設計、所有権モデルが、ハード施設エコシステム全体における優先順位と商業的行動をどのように形成しているかが明らかになります。サービス種別で分析すると、市場には差別化された需要曲線が見られます。大工・建具工事、電気設備保守、床工事、空調設備サービス、塗装・内装、配管サービスはそれぞれ、労働力プロファイル、コンプライアンス要件、スペアパーツ依存度が異なり、価格形成や技能要件に影響を与えます。その結果、電気機械分野を専門とするプロバイダーは、内装や配管に注力するプロバイダーとは異なる採用・研修上の課題に直面します。

エンドユーザー産業を考慮すると、商業ビル、医療施設、ホスピタリティ事業、工業施設、住宅、小売店舗、交通インフラにおいて、性能期待値と規制負担は顕著に異なります。例えば医療・交通分野では、冗長性、感染管理、稼働時間の確保が優先され、他分野と比較して予防保全やベンダー選定基準が厳格化されます。これに伴い、これらの産業の施設管理チームは、文書化、検証、迅速対応メカニズムへの投資を強化しています。

契約形態の分析からは、管理性と拡張性のトレードオフが明らかになります。社内体制は直接的な監督と知識の蓄積に有利である一方、統合施設管理、複数サービス請負業者、単一サービス請負業者にまたがる外部委託ソリューションは、拡張性、専門知識の集約、そして往々にして成果に対する明確な説明責任を提供します。最後に、民間セクターと公共セクターのクライアントにおける所有権モデルの差異は、調達サイクル、予算予測可能性、コンプライアンスの階層化に影響を与えます。公共セクター機関は通常、より厳格な調達規則と透明性要件の対象となります。これらのセグメンテーションの視点は、価値が創出される領域と、クライアント固有の目標を達成するためにサービスモデルをどのように構成すべきかについて、精緻な理解を可能にします。

調達およびサービス提供の選択に影響を与える、南北アメリカ、欧州・中東・アフリカ、アジア太平洋地域における比較地域的動向と運営上の圧力

地域別の視点からは、主要地域におけるハード施設管理戦略に影響を与える、特有の運営上の圧力と機会の方向性が明らかになります。アメリカ大陸では、プロバイダーや所有者が老朽化した資産ポートフォリオやエネルギー消費を管理するため、規模の効率化とデータ駆動型メンテナンスを追求する中で、統合、技術導入、コスト最適化が重視される傾向があります。この地域における資本配分の議論は、改修、近代化、既存施設への状態監視システムの統合を中心に展開されることが頻繁です。

欧州・中東・アフリカ地域では、規制の多様性と成熟市場・新興市場の混在により、適応的なアプローチが求められます。欧州市場では一般的にコンプライアンスと持続可能性への期待が高まる一方、中東市場では迅速なプロジェクト遂行と専門的なインフラ能力が重視されます。多くのアフリカ地域では、サプライチェーンの制約やスキル不足により、基本的な信頼性と現地能力構築を優先する実践的な解決策が不可欠です。こうした地域差は、カスタマイズされた人材育成と供給戦略の重要性を浮き彫りにしています。

アジア太平洋地域では、急速な都市化、大規模インフラ計画、商業用不動産への継続的投資が、大規模な保守業務を支える拡張可能なサービス提供とベンダーエコシステムへの需要を形成しています。同地域ではデジタルツールやスマートビルディング構想への革新的な導入も顕著であり、予知保全と効率向上の加速が期待されます。こうした地域的動向を踏まえ、多国籍事業者は一貫した成果を達成するため、グローバル基準と地域別実行モデルのバランスを取る必要があります。

ハード施設管理サービスにおける競争的ポジショニングと長期的なレジリエンスを決定づける、企業レベルの差別化要因と能力アーキタイプ

主要企業レベルの知見は、主要サービスプロバイダーや資産所有者が、能力、ガバナンス、顧客中心モデルを通じていかに差別化を図っているかに焦点を当てています。競争優位性は、技術的専門知識、統合サービスプラットフォーム、地域を跨いだ労働力展開の拡張能力の組み合わせから生まれることが多くあります。トレーニングパイプライン、標準化された運用プレイブック、相互運用可能なデジタルシステムへの投資を行う組織は、提供の一貫性が高まり、総保守コストへの影響の変動性が低くなる傾向があります。

もう一つの差別化要因は契約の革新性です。成果連動型契約、パフォーマンス保証、ハイブリッド型提供モデルを提供する企業は、インセンティブの調整と下振れリスクの共有が可能であるため、変動の激しい調達環境においてより高い回復力を示します。同様に、深いサプライヤーネットワークと柔軟な在庫戦略を維持する企業は、供給ショックや関税関連のコスト変動を吸収する上で優位な立場にあります。

最後に、持続可能性とコンプライアンスにおける思想的リーダーシップは市場での地位を高めます。エネルギー効率、廃棄物削減、室内環境品質において検証可能な改善を実証できる企業は、規制や利害関係者の監視が強化される中で、顧客に具体的な価値を提供します。これらの能力は、戦略的な資産パフォーマンス目標に連動した長期的な顧客維持と高収益サービス提供の基盤ともなります。

施設運営者と調達チームがレジリエンスを構築し、リスクを低減し、測定可能な効率向上を達成するための実践的な戦略的施策と業務改革

業界リーダーは、運用上のレジリエンス強化、コスト最適化、保守戦略と企業目標の整合を図るため、実践的で実行可能な一連の措置を導入すべきです。まず、デジタル資産管理と状態監視への投資を優先し、時間ベースの点検から予測的介入へ移行することで、予期せぬダウンタイムを削減し、リソース配分を改善します。次に、機械・電気・デジタル分野のスキル向上を図る体系的な人材育成プログラムを実施し、多職種配置を支援するとともに労働力の柔軟性を高めます。

調達・契約においては、明確なエスカレーション手順、リスク分担条項、成果連動型インセンティブを組み込んだ柔軟な契約形態を優先すべきです。このアプローチにより、料金変動やサプライチェーンの不安定性を管理しつつ、サプライヤーの行動を望ましい成果に連動させることが可能となります。同時に、ライフサイクル分析と修理対交換の枠組みを資本計画に統合し、不要な設備更新を遅らせ、既存資産の価値を最大化します。

最後に、利害関係者の期待と規制要件を満たすため、持続可能性指標を保守KPIおよび報告に組み込みます。同時に、エネルギー効率と資材効率をコスト削減の源泉として活用します。これらの施策を協調的に実行することで、組織は信頼性を向上させ、総運用リスクを低減し、施設管理プログラムから測定可能なリターンを獲得できます。

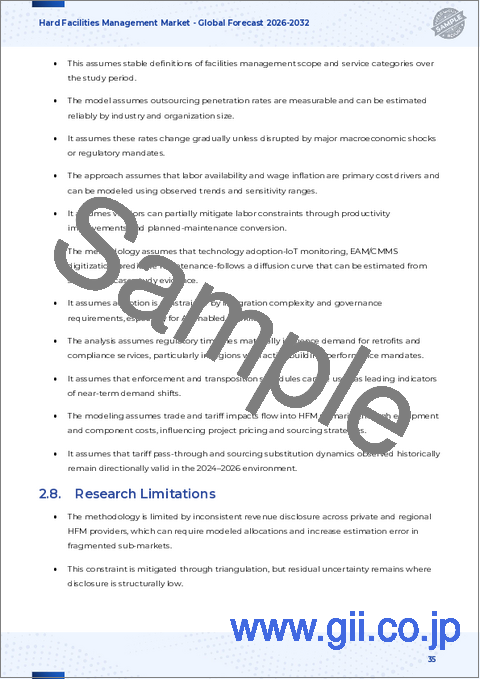

実践者へのインタビュー、現場検証、多角的検証手法を組み合わせた厳密な混合手法フレームワークにより、確固たる実践的知見と透明性の高い調査手法を確保しております

本分析の基盤となる調査手法は、定性的・定量的技法を組み合わせ、堅牢で再現性のある知見を確保します。1次調査では、業界実務者、運営幹部、調達責任者、サービスプロバイダーを対象とした構造化インタビューを実施し、契約履行、技術導入、サプライチェーン調整に関する経験的知見を収集しました。これらのインタビューは、現場観察および事例レビューによって補完され、保守業務の実行やベンダーとのやり取りにおける共通パターンを検証しました。

2次調査では、規制ガイダンス、基準、技術文献、公開企業開示資料を体系的にレビューし、運用慣行とコンプライアンス動向を三角測量しました。該当する場合には、地域間およびサービスカテゴリー間の比較ベンチマーキングを活用し、ベストプラクティスとパフォーマンス差異を特定しました。データの完全性は、複数の独立した情報源による相互検証と、解釈の精緻化および明確化を図るための専門家による反復的なレビューラウンドを通じてさらに強化されました。

方法論上の安全策として、データソースの透明性ある文書化、セグメンテーションカテゴリーの明確な定義、定性的推論に対する感度チェックを実施しております。この混合手法アプローチにより、調査結果は実践的かつ文脈に根ざしたものであり、ハード施設管理に関する戦略的意思決定を行う実務者および経営陣双方にとって関連性の高いものとなっております。

施設管理責任者が強靭な保守戦略と卓越した運用を実現するための指針となる、動向と実践的行動を統合した先見的な統合分析

結論として、ハード施設管理環境は転換点に立っています。技術、労働力の実情、規制圧力、貿易動向が交錯し、組織が物理的資産を維持・最適化する方法を再定義する局面です。予測ツールの加速的な導入は、進化する契約モデルや関税主導の調達調整と相まって、保守計画とサプライヤー関係に対するより戦略的なアプローチを必要とします。ガバナンスの積極的な適応、能力構築への投資、契約と望ましい成果の整合を図る組織は、リスク管理と長期的な価値獲得において優位な立場を確立できるでしょう。

今後、運用責任者は適応性を重視すべきです。すなわち、マクロ経済の変動に耐える調達枠組みの構築、内部または信頼できるパートナーを通じた技術能力の強化、予防的意思決定を推進するデータ活用です。これにより、チームは予期せぬ混乱を軽減し、資産パフォーマンスを向上させ、サステナビリティや入居者満足度といった広範な企業目標に有意義に貢献できます。本報告書における提言と知見は、こうした戦略的転換を支援するとともに、市場知見を施設運営の測定可能な改善へと結びつける実践的なロードマップを提供することを目的としております。

よくあるご質問

目次

第1章 序文

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場の概要

第5章 市場洞察

- IoT対応予知保全システムの統合による資産のダウンタイムと保守コストの削減

- AI駆動型エネルギー管理プラットフォームの導入による建物性能と持続可能性の最適化

- 施設運営のリアルタイム監視とシミュレーションのためのデジタルツイン技術の導入

- 複雑な建物環境における高リスクな保守作業の効率化のための自動化ロボットの導入

- 先進的なHVACアップグレードと低排出システムによるグリーンビル認証への移行

- クラウドベースの資産管理ソフトウェアを活用し、コンプライアンス対応とライフサイクル計画を効率化

第6章 米国の関税の累積的な影響, 2025

第7章 AIの累積的影響, 2025

第8章 ハード施設管理市場:サービスタイプ別

- 大工・建具工事

- 電気設備保守

- 床工事サービス

- 空調設備サービス

- 塗装・内装

- 配管サービス

第9章 ハード施設管理市場エンドユーザー産業別

- 商業ビル

- 医療施設

- ホスピタリティ業界

- 産業施設

- 住宅建築物

- 小売業

- 交通インフラ

第10章 ハード施設管理市場契約形態別

- 社内管理

- 外部委託

- 統合施設管理

- 複数サービス請負業者

- 単一サービス請負業者

第11章 ハード施設管理市場所有形態別

- 民間セクター

- 公共部門

第12章 ハード施設管理市場:地域別

- 南北アメリカ

- 北米

- ラテンアメリカ

- 欧州・中東・アフリカ

- 欧州

- 中東

- アフリカ

- アジア太平洋地域

第13章 ハード施設管理市場:グループ別

- ASEAN

- GCC

- EU

- BRICS

- G7

- NATO

第14章 ハード施設管理市場:国別

- 米国

- カナダ

- メキシコ

- ブラジル

- 英国

- ドイツ

- フランス

- ロシア

- イタリア

- スペイン

- 中国

- インド

- 日本

- オーストラリア

- 韓国

第15章 競合情勢

- 市場シェア分析, 2024

- FPNVポジショニングマトリックス, 2024

- 競合分析

- CBRE Group, Inc.

- Jones Lang LaSalle Incorporated

- Cushman & Wakefield plc

- ISS A/S

- Sodexo S.A.

- EMCOR Group, Inc.

- Atalian Global Services SAS

- Bilfinger SE

- SPIE SA

- Serco Group plc