|

|

市場調査レポート

商品コード

1808587

防衛分野における5G市場:コンポーネント、周波数、ネットワークタイプ、展開環境、プラットフォームタイプ、スペクトラムアクセスモデル、技術、用途、エンドユーザー別 - 2025年~2030年の世界予測5G in Defense Market by Component, Frequency, Network Type, Deployment Environment, Platform Type, Spectrum Access Model, Technology, Application, End User - Global Forecast 2025-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 防衛分野における5G市場:コンポーネント、周波数、ネットワークタイプ、展開環境、プラットフォームタイプ、スペクトラムアクセスモデル、技術、用途、エンドユーザー別 - 2025年~2030年の世界予測 |

|

出版日: 2025年08月28日

発行: 360iResearch

ページ情報: 英文 183 Pages

納期: 即日から翌営業日

|

概要

防衛分野における5G市場は、2024年に16億6,000万米ドルと評価され、2025年には19億5,000万米ドル、CAGR 17.35%で成長し、2030年には43億6,000万米ドルに達すると予測されています。

| 主な市場の統計 | |

|---|---|

| 基準年2024 | 16億6,000万米ドル |

| 推定年2025 | 19億5,000万米ドル |

| 予測年2030 | 43億6,000万米ドル |

| CAGR(%) | 17.35% |

第5世代ワイヤレスがどのように軍事通信、作戦設計、買収の必要性を再構築するかを説明する包括的な戦略イントロダクション

第5世代無線技術の登場は、防衛通信、センサー・フュージョン、分散型コマンド・アーキテクチャを支配する基本的な前提を転換しました。競合環境と容認環境において、5Gは新たなミッションスレッドを可能にするレイテンシー、帯域幅、プログラマビリティの組み合わせを導入すると同時に、ドクトリン、訓練、取得に対する同時変更を要求しています。このイントロダクションでは、5Gが作戦能力を変化させる主なベクトルを概説し、防衛組織が対処しなければならない付随する課題を明らかにし、軍事プラットフォームやインフラにセルラーネイティブの能力を組み込むことから生じる戦略的選択の枠組みを示します。

エッジコンピューティング、ソフトウェア定義アーキテクチャ、スペクトラム戦略別防衛通信の重要な変革シフトがドクトリンを再形成する

国防通信を取り巻く環境は、5Gの能力、作戦上の要求信号、進化する脅威のベクトルによって、いくつかの同時並行的で補強し合うシフトを経験しています。大きな変革の1つは、エッジにおけるコンピューティングとコネクティビティの融合であり、これによりセンサーやプラットフォームに近いところでリアルタイムの分析と意思決定が可能になります。このシフトにより、エンド・ツー・エンドのレイテンシが短縮され、ミッション・クリティカルな処理がクラウド、エッジ、プラットフォーム・ノード間でどのように割り当てられるかが変化するため、ソフトウェア・ライフサイクル管理と分散セキュリティに対する新たなアプローチが必要となります。

2025年に制定された米国の関税措置が国防5Gプログラムと調達選択に与える戦略的およびサプライチェーン上の累積的影響の評価

米国が2025年に導入した関税措置は、防衛5Gプログラムに多面的な影響を及ぼし、調達、サプライチェーン、産業戦略全体に累積的な影響を及ぼしています。これを受けて、防衛省の買収チームは、集中的なベンダー依存にさらされる機会を減らし、能力提供の継続性を維持するために、調達戦略を見直しました。この再評価は、多様化への取り組みを加速させ、無線フロントエンドモジュール、アンテナサブシステム、半導体ベースの素子などの重要部品の予測可能な入手可能性を確保するために、代替サプライヤーの利用増加、ローカルコンテンツ戦略、適格な下請けネットワークを触媒としています。

コンポーネント、周波数帯域、ネットワークタイプ、プラットフォーム、スペクトラムモデル、技術、アプリケーション、エンドユーザーがどのように優先順位を決定するかを明らかにする統合されたセグメンテーションの洞察

セグメンテーション主導の視点は、防衛5Gエコシステム全体で投資、リスク、機会が集中する場所を明確にします。コンポーネント・セグメンテーションでは、ハードウェア、サービス、ソフトウェアが区別されます。ハードウェアの中では、コア・ネットワーク要素、コンピュートとストレージ機能をホストするエッジ・デバイス、無線アクセス・ネットワーク・ハードウェアに注目が集まる。無線アクセス・ネットワーク自体には、アンテナ、マクロ基地局、MIMOユニット、RFフロントエンド・モジュール、スモールセルが集約されており、それぞれに性能、認証、維持に関する考慮事項があります。サービス・セグメンテーションでは、マネージド・サービスとプロフェッショナル・サービスを区別し、継続的な運用サポートと個別の統合またはアドバイザリー業務の違いを反映しています。ソフトウェア・セグメンテーションでは、異常検知・侵入検知システム、ネットワーク管理・オーケストレーション・プラットフォーム、RANインテリジェント・コントローラー・アプリケーション、セキュリティ・フレームワーク、ネットワーク機能仮想化と組み合わせたSoftware-Defined Networkingなど、重要なスタックに焦点を当てています。

南北アメリカ、欧州、中東・アフリカ、アジア太平洋地域における戦略的優先順位、調達モデル、運用促進要因に関する地域別の比較考察

地域的なダイナミクスが戦略的優先順位と調達モデルを形成し、南北アメリカ、欧州中東アフリカ、アジア太平洋で5G導入への異なるアプローチを生み出しています。アメリカ大陸では、安全で主権に対応可能なシステムの迅速な導入と、可能な限り国内の産業能力を活用することに重点が置かれる傾向があります。調達の決定は、確立された同盟パートナーとの相互運用性や、機密・非機密領域を維持しながら商業イノベーションを統合する必要性によって左右されることが多いです。移行経路としては、能力や規制の進化に伴う代替や反復的なアップグレードを可能にするモジュールアーキテクチャが好まれます。

プライム、通信ベンダー、専門インテグレーター、ソフトウェア企業が、防衛5G能力を提供するためにどのように協力し、競争しているかを詳細に示す主要企業のダイナミクス

防衛5Gの競合情勢は、既存の防衛プライム、通信ベンダー、専門インテグレーター、新興のソフトウェア中心企業が融合し、競争と協力のダイナミックなエコシステムを生み出しています。既存の防衛請負企業は、システムエンジニアリングの専門知識、統合規模、機密配備の実績ある経路をもたらす一方、民間通信企業は、最先端の無線およびコアネットワーク能力と大規模展開における運用経験を提供します。専門インテグレーターやソフトウェアプロバイダーは、軍特有の使用事例を可能にするオーケストレーション、セキュリティ、アナリティクスの各レイヤーを提供することで、これらの領域の橋渡しをします。

安全で、弾力性があり、相互運用可能な5Gの展開をミッション全体で加速させるために、防衛と業界のリーダーに対して、実行可能で優先順位をつけた推奨事項

業界のリーダーと国防関係者は、リスクを抑えながら5Gの運用上の約束を実現するために、一連の現実的で連動した行動を追求しなければならないです。まず、モジュール性とサプライヤーの互換性を最大化するために、オープン・インターフェースと標準主導アーキテクチャの採用を優先すべきです。これにより、単一ベンダーによるロックインのリスクを低減し、競争力のある維持戦略を可能にしながら、技術投入を加速させることができます。これと並行して、厳格なサプライチェーン・リスクマネジメントを調達の意思決定に組み込むことで、重要なコンポーネントの出所を確認し、緊急時のサプライヤーを予定より早く特定することができます。

技術的成果物、専門家へのインタビュー、シナリオ分析を組み合わせた透明性の高い調査手法とエビデンスの統合により、厳密な調査結果を確実にします

この調査は、技術文献、オープンソースの規制状況、ベンダーの技術白書、および一般に公開されている防衛調達記録を統合し、防衛5Gの情勢に関する包括的な見解を構築しています。調査手法では、ベンダーの主張と文書化された相互運用性テスト、周波数政策の発表、および運用事例を相互参照することで、調査結果が能力の願望と実証された性能の両方を反映していることを確認する、三角測量を重視しています。アナリストは、通信、防衛取得、システム統合の各分野の専門家と構造化インタビューを実施し、統合リスク、維持の課題、プログラムのトレードオフに関する実務者の視点を把握しました。

広範な5G能力に移行する防衛組織の戦略的必須事項、運用上のトレードオフ、および永続的な優先事項に関する結論の統合

サマリーをまとめると、国防における5Gへの移行は、統合とセキュリティの複雑性の高まりと、運用上の大きな上昇を併せ持つ戦略的変曲点を提示しています。低遅延、高スループットの通信とプログラマブルなネットワーク動作を可能にするこの技術は、分散センサー・フュージョンからレジリエントなロジスティクス、高度なコマンド・コントロールまで、幅広い能力を可能にします。しかし、その可能性を実現するには、アーキテクチャ、サプライチェーンの回復力、サイバーハード化されたシステム設計に規律正しく注意を払う必要があります。そのため利害関係者は、ソフトウェア・ネイティブ・アーキテクチャへの中長期的な移行に備えつつ、短期的な運用上のメリットをもたらすバランスの取れた投資ポートフォリオを追求しなければならないです。

目次

第1章 序文

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場の概要

第5章 市場力学

- 安全な戦場通信のためのスタンドアロン5Gネットワークの統合

- 前方作戦基地でのリアルタイムAI処理のための5G対応エッジコンピューティングの活用

- 統合海洋監視のための海軍艦艇へのプライベート5Gネットワークの導入

- ミッションクリティカルな防衛システムに専用の帯域幅を割り当てるためのネットワークスライシングの採用

- 超信頼性・低遅延の5G接続によるドローン群運用の強化

- 迅速な戦術展開のための5Gベースの安全なモバイルアドホックネットワークの実装

- 高度な脅威から防衛5Gインフラを保護するためのサイバーセキュリティフレームワーク

- 防衛請負業者と通信事業者が協力し、共同演習用の5G相互運用システムを開発

- 5Gプライベートネットワークの急速な展開により戦場のデータ共有が加速

- 5Gと無人システムおよびロボットの融合により、リアルタイムの状況認識と対応を強化

第6章 市場洞察

- ポーターのファイブフォース分析

- PESTEL分析

第7章 米国の関税の累積的な影響2025

第8章 防衛分野における5G市場:コンポーネント別

- ハードウェア

- コアネットワーク

- エッジデバイス

- 無線アクセスネットワーク

- アンテナ

- マクロ基地局

- 大規模MIMOユニット

- RFフロントエンドモジュール

- スモールセル

- サービス

- マネージドサービス

- プロフェッショナルサービス

- ソフトウェア

- 異常検出と侵入検知システム(IDS)

- ネットワーク管理とオーケストレーション

- RANインテリジェントコントローラアプリケーション

- セキュリティ

- ソフトウェア定義ネットワーク(SDN)とネットワーク機能仮想化(NFV)

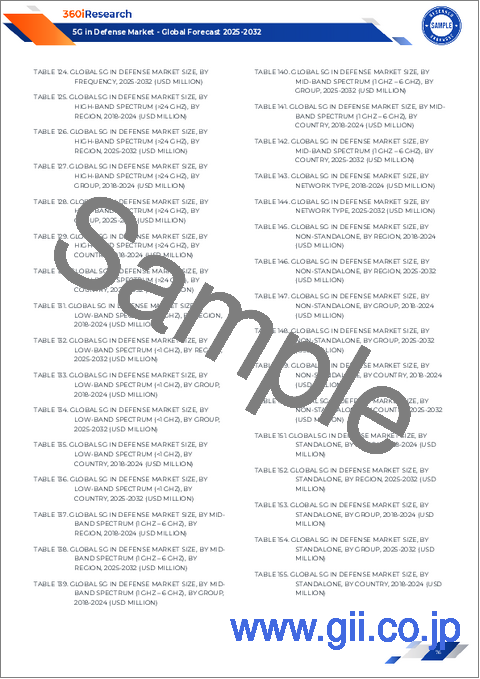

第9章 防衛分野における5G市場:周波数別

- ハイバンドスペクトル(24 GHz超)

- ローバンドスペクトル(1GHz未満)

- ミッドバンドスペクトル(1GHz~6GHz)

第10章 防衛分野における5G市場:ネットワークタイプ別

- 非スタンドアロン

- スタンドアロン

第11章 防衛分野における5G市場:展開環境別

- 固定設備

- 飛行場

- 基地と駐屯地

- 港湾と造船所

- 戦術的展開

- 都市部作戦

第12章 防衛分野における5G市場:プラットフォームタイプ別

- 航空機

- 有人航空機

- 無人航空システム

- 地上車両

- 装甲車両

- ロボット地上車両

- タクティカルトラック

- 海軍艦艇

- 潜水艦

- 水上艦艇

- 無人水上・水中車両

- ソルジャーシステム

- 宇宙システム

- 地上局

- 衛星

第13章 防衛分野における5G市場:スペクトラムアクセスモデル別

- 独占ライセンス

- 政府割り当て

- 共有ライセンス

- ライセンス不要

第14章 防衛分野における5G市場:技術別

- 拡張モバイルブロードバンド(eMBB)

- 大規模マシン型通信(mMTC)

- ネットワークスライシング

- ポジショニング

- サイドリンク

- 超信頼性低遅延通信(URLLC)

第15章 防衛分野における5G市場:用途別

- 基地のセキュリティと保護

- 指揮統制システム

- サイバーセキュリティとネットワークレジリエンス

- 物流とサプライチェーン管理

- 監視と偵察

- トレーニングとシミュレーション

第16章 防衛分野における5G市場:エンドユーザー別

- 空軍

- 軍

- 海軍

第17章 南北アメリカの防衛分野における5G市場

- 米国

- カナダ

- メキシコ

- ブラジル

- アルゼンチン

第18章 欧州・中東・アフリカの防衛分野における5G市場

- 英国

- ドイツ

- フランス

- ロシア

- イタリア

- スペイン

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- デンマーク

- オランダ

- カタール

- フィンランド

- スウェーデン

- ナイジェリア

- エジプト

- トルコ

- イスラエル

- ノルウェー

- ポーランド

- スイス

第19章 アジア太平洋地域の防衛分野における5G市場

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- インドネシア

- タイ

- フィリピン

- マレーシア

- シンガポール

- ベトナム

- 台湾

第20章 競合情勢

- 市場シェア分析, 2024

- FPNVポジショニングマトリックス, 2024

- 競合分析

- Analog Devices, Inc.

- AT&T Inc.

- L3Harris Technologies, Inc.

- Lockheed Martin Corporation

- Nokia Corporation

- Raytheon Technologies Corporation

- Samsung Electronics Co., Ltd.

- Telefonaktiebolaget LM Ericsson

- Oceus Networks

- Northrop Grumman Corporation

- General Dynamics Corporation