|

|

市場調査レポート

商品コード

1852909

身体障害者向け車両市場:車両タイプ、走行オプション、エントリー形態、エントリーメカニズム、メーカータイプ、流通チャネル別-2025-2032年世界予測Vehicles for Disabled Market by Vehicle Type, Driving Option, Entry Configuration, Entry Mechanism, Manufacturer Type, Distribution Channel - Global Forecast 2025-2032 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 身体障害者向け車両市場:車両タイプ、走行オプション、エントリー形態、エントリーメカニズム、メーカータイプ、流通チャネル別-2025-2032年世界予測 |

|

出版日: 2025年09月30日

発行: 360iResearch

ページ情報: 英文 182 Pages

納期: 即日から翌営業日

|

概要

身体障害者向け車両市場は、2032年までにCAGR 11.10%で32億3,000万米ドルの成長が予測されています。

| 主な市場の統計 | |

|---|---|

| 基準年2024 | 13億9,000万米ドル |

| 推定年2025 | 15億4,000万米ドル |

| 予測年2032 | 32億3,000万米ドル |

| CAGR(%) | 11.10% |

人口統計学、技術、政策のレンズを通して、アクセシブル車両適合の戦略的重要性をフレームワーク化した簡潔なオリエンテーション

このエグゼクティブサマリーでは、移動障害者向け車両に関連する現代の開発、構造的変化、および実用的な情報を総合しています。以下の叙述は、製品構成、アクセシビリティ機能、流通・製造様式、規制の影響、需要促進要因の地域差について、証拠に基づく見解をまとめたものです。製品戦略、チャネル開発、コンプライアンスを担当するシニアリーダーに直接関係する用語で、進化する商業的状況を組み立てています。

イントロダクションでは、人口動態の動向、政策の優先順位、技術の進歩を結びつけることで、このカテゴリーに注目する根拠を確立しています。利害関係者は、なぜアクセシビリティに焦点を当てた車両適合が、ニッチなカスタマイズから標準化された設計の考慮事項へと進んだのか、明確な背景を見出すことができます。全体を通して、抽象的な予測ではなく、運用上の意味合いや意思決定のレバーを強調しているため、読者は洞察を実行可能なイニシアティブに変換することができます。

技術、人間中心設計、政策の勢いがどのようにアダプティブ・ビークル・ソリューションの製品パスウェイと商業パートナーシップを再構築しているか

移動に制限のある人のための自動車を取り巻く情勢は、技術革新の収束と規制期待の進化に牽引され、一連の変革的シフトが進行中です。電動パワートレインとモジュール式車両アーキテクチャのアーキテクチャの進歩は、実現可能なアクセシビリティ・ソリューションのパレットを拡大し、メーカーや後付け業者が車両の性能や安全性を犠牲にすることなくリフト、スロープ、シートモビリティ機能を統合することを可能にしています。同時に、人間中心設計の哲学とユニバーサルデザインの提唱は、開発サイクルの早い段階でアクセシビリティ機能を組み込むよう、相手先商標製品メーカーに圧力をかけています。

これと並行して、デジタル接続とテレマティクスは、アダプティブ機器の遠隔診断と予知保全を可能にし、ダウンタイムを減らし、フリートオペレーターの総所有コストを改善するサービスモデルをサポートします。こうした技術シフトは、包括的な交通手段と適応車両のための資金調達メカニズムを重視する政策運動によって補完されます。その結果、機械的信頼性とソフトウエア対応サービスとの融合を図るサプライヤーが、長期的価値を獲得する上で最も有利な立場に置かれることになります。正味の効果は、OEM、モビリティの専門家、サービス・プロバイダーをまたがる分野横断的なパートナーシップが、規模拡大への有力なルートになりつつある商業環境です。

アクセシビリティに特化した自動車サプライチェーン全体における、調達、在庫戦略、現地化の決定に対する米国の最近の関税シフトの総合的影響

米国の政策措置に端を発した最近の関税調整は、部品と完成した適応型車両システムのコストとサプライチェーンに重層的な影響をもたらしています。特定の輸入インプットに対する関税の引き上げは、調達戦略を転換させ、メーカーやカスタマイザーに調達フットプリントやサプライヤー契約の見直しを促しています。これに対応するため、一部の企業は主要サブアセンブリーの現地化を加速させたり、長期的な価格協定を交渉して投入コストを安定させ、マージンプロファイルを維持したりしています。

関税は直接的なコストへの影響だけでなく、在庫戦略と生産順序の再検討を促しました。企業は、重要部品のバッファー在庫を採用し、関税の影響と輸送の遅れを最小化するために国境を越えたロジスティクスを再評価する傾向が強まっています。さらに、関税環境は、付加価値の高いカスタマイズ作業をどこで行うか、あるいはモジュール一式をどこで調達するかという決定にも影響を及ぼしており、繰り返し関税がかかるのを避けるために、最終的な取り付けとテストを最終市場の近くに集中させる傾向が顕著になっています。最終的には、コスト構造を管理しながら、製品のアクセシビリティと安全基準を維持する、弾力的で関税を意識したサプライチェーンを企業が求める中で、こうした力学が資本配分とパートナーシップの選択を形成しています。

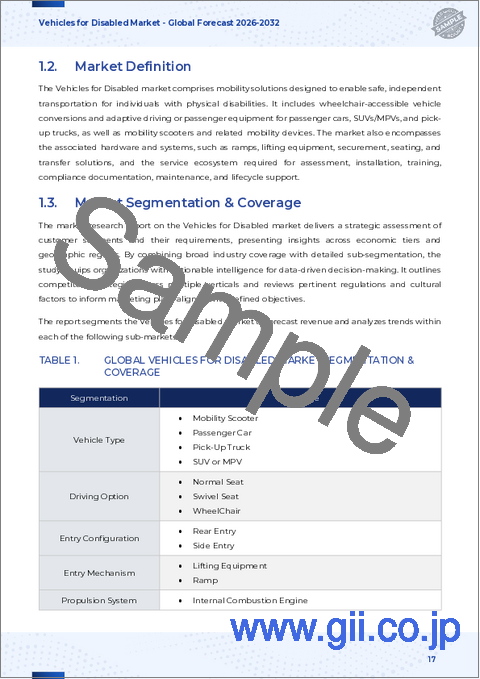

車両アーキタイプ、エントリーシステム、座席オプション、製造モデル、流通チャネルがどのように製品・サービス戦略を決定するかを明らかにする統合セグメンテーションビュー

セグメントレベルの洞察により、製品・サービス領域における設計、製造、市場投入の要件が明らかになります。製品タイプに基づくと、モビリティ・スクーター、乗用車、ピックアップ・トラック、SUVまたはMPVがあり、各車種には独自の技術的制約があり、適応的な改良の機会もあります。移動用スクーターはコンパクトな操作性と乗り降りのしやすさを優先し、乗用車は衝突安全性を維持しつつ、統合された旋回機構と座席機構を重視し、ピックアップトラックは積載量の増加と外部へのアクセスのために堅牢なリフトとテザー・ソリューションを必要とし、SUVやMPVは多くの場合、包括的な車いすドッキングと変換システムに資する室内容積と車高を提供します。

よくあるご質問

目次

第1章 序文

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場の概要

第5章 市場洞察

- モジュール式の座席とパワートレインのオプションを備えたカスタマイズ可能な電動車椅子バンの採用が増加

- モビリティ車両のアクセシビリティデータとリアルタイムルートプランニングを統合したスマートフォンアプリの成長

- 衝突回避機能と障害物検知機能を備えた自律型ラストマイルモビリティスクーターの開発

- アダプティブ身体障害者向け車両ドライバーへの音声起動コントロールとAIアシスタントの統合

- 柔軟なレンタル期間を提供するサブスクリプション型の車椅子対応車両サービスの拡大

- 軽量複合材料の進歩により、アクセシブル車両のエネルギー効率が向上

- 障害者向けのモビリティソリューションをカスタマイズするための自動車メーカーとヘルスケア者の連携

第6章 米国の関税の累積的な影響, 2025

第7章 AIの累積的影響, 2025

第8章 身体障害者向け車両市場:車両タイプ別

- モビリティスクーター

- 乗用車

- ピックアップトラック

- SUVまたはMPV

第9章 身体障害者向け車両市場運転オプション別

- 通常席

- 回転シート

- 車椅子

第10章 身体障害者向け車両市場エントリー構成別

- 後部エントリー

- サイドエントリー

第11章 身体障害者向け車両市場エントリーメカニズム別

- 吊り上げ装置

- ランプ

第12章 身体障害者向け車両市場メーカータイプ別

- オリジナル機器メーカー

- サードパーティのカスタマイズ

第13章 身体障害者向け車両市場:流通チャネル別

- オフライン

- オンライン

第14章 身体障害者向け車両市場:地域別

- 南北アメリカ

- 北米

- ラテンアメリカ

- 欧州・中東・アフリカ

- 欧州

- 中東

- アフリカ

- アジア太平洋地域

第15章 身体障害者向け車両市場:グループ別

- ASEAN

- GCC

- EU

- BRICS

- G7

- NATO

第16章 身体障害者向け車両市場:国別

- 米国

- カナダ

- メキシコ

- ブラジル

- 英国

- ドイツ

- フランス

- ロシア

- イタリア

- スペイン

- 中国

- インド

- 日本

- オーストラリア

- 韓国

第17章 競合情勢

- 市場シェア分析, 2024

- FPNVポジショニングマトリックス, 2024

- 競合分析

- Amigo Mobility International, Inc.

- AMS Vans LLC

- Brotherwood Automobility Limited

- Creative Carriage Ltd.

- European Mobility Group

- EZ Access Inc.

- Focaccia Group S.r.l.

- Ford Motor Company Limited.

- Freedom Mobility Ltd.

- General Motors Company.

- GM Coachwork Ltd.

- Golden Technologies Inc.

- Gowrings Mobility Group Limited

- Invacare Corporation

- Nissan Motor Co., Ltd.

- Pride Mobility Products Corporation

- Revability Inc.

- Sunrise Medical Holdings Limited

- TGA Mobility Ltd.

- The Braun Corporation

- Toyota Motor Corporation

- Vantage Mobility International, LLC