|

|

市場調査レポート

商品コード

1830234

サイバーフィジカルシステム市場:コンポーネント、展開、産業別-2025-2032年の世界予測Cyber-Physical System Market by Component, Deployment, Industry - Global Forecast 2025-2032 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| サイバーフィジカルシステム市場:コンポーネント、展開、産業別-2025-2032年の世界予測 |

|

出版日: 2025年09月30日

発行: 360iResearch

ページ情報: 英文 190 Pages

納期: 即日から翌営業日

|

概要

サイバーフィジカルシステム市場は、2032年までにCAGR 16.39%で3,659億5,000万米ドルの成長が予測されています。

| 主な市場の統計 | |

|---|---|

| 基準年2024 | 1,086億3,000万米ドル |

| 推定年2025 | 1,252億9,000万米ドル |

| 予測年2032 | 3,659億5,000万米ドル |

| CAGR(%) | 16.39% |

センシング、コンピュテーション、コネクティビティ、制御のコンバージェンスが企業の優先事項をどのように変容させるかを明らかにする、最新のサイバーフィジカルシステムの戦略的方向性

サイバーフィジカルシステムは、計算、センシング、通信、物理的プロセスをシームレスに統合し、重要なインフラや商業活動全体のインテリジェントな自動化、監視、制御を可能にするものです。その中核となるこれらのシステムは、運用技術と情報技術を融合させ、生産性、安全性、効率性を高めるリアルタイムのフィードバックループ、自律的な動作、意思決定支援を実現します。サイバーフィジカルシステムの進化は、センシングの忠実度、エッジでの小型化された計算、広範な接続性、分散データから実用的な意味を抽出する機械学習モデルの進歩によって、ますます推進されています。

この融合は、システム設計者や経営リーダーに新たな期待をもたらしています。サイバーフィジカル・イニシアチブは、孤立した展開ではなく、エンジニアリング、IT、セキュリティ、ビジネスの利害関係者にまたがる機能横断的なガバナンスを必要とするようになりました。調達戦略は、コンポーネントの相互運用性、ライフサイクル管理が可能なサービス、運用を中断することなく継続的なアップデートをサポートするソフトウェアなどを考慮しなければならないです。さらに、規制状況の厳しさと脅威の進化は、レジリエンスとセキュリティを設計に組み込むことを要求しています。このような力学を理解している経営幹部は、迅速で場当たり的な導入から生じがちなもつれや技術的負債を軽減しつつ、具体的な運用成果をもたらす投資を優先することができます。

コンセプトから配備への移行には、組織の即応性という現実的な視点も必要です。これには、システム統合のための人材能力、代表的な環境でのテストと検証のためのプロセス、パフォーマンスと技術投資に対するリターンを把握するための測定フレームワークなどが含まれます。パイロット、スケールアップ、企業展開を順序立てて行う思慮深いロードマップは、運用リスクを低減し、価値の実現を加速します。本エグゼクティブサマリーでは、サイバーフィジカルシステムを計画・拡大するリーダーにとって、市場力学、政策転換、セグメンテーションパターン、地域属性が戦略的選択にどのような影響を与えるかを考察します。

サイバーフィジカルエコシステムにおけるシステム設計、展開モデル、競合差別化が、新技術、規制の融合、持続可能性の要求別どのように再定義されるか

サイバーフィジカルシステムを取り巻く環境は、何が実現可能で何が不可欠かを変える、一連の変革的な技術と運用のシフトによって再構築されつつあります。エッジ・コンピュートと分散アナリティクスはレイテンシーを削減し、ローカル・オートノミクスを可能にし、セーフティ・クリティカルな環境におけるリアルタイムの意思決定をサポートします。この動向を補完するように、デジタル・ツインと高度なシミュレーション・ツールが成熟し、設計者やオペレーターは、物理的な配備の前に仮想的に環境を反復することができるようになり、開発サイクルを加速し、予知保全戦略をサポートします。

プライベート・ワイヤレス・ネットワークや決定論的産業用イーサネットの広範な採用を含む接続性の向上は、高保証分散システムのエンベロープを拡大しています。こうしたネットワーキングの進歩により、地理的に分散した資産に、より複雑な制御トポロジーを展開することが現実的になっています。同時に、人工知能と機械学習は、実験室での実験を超えて、異常検知、品質管理、適応制御ループのための生産グレードの機能セットへと移行しています。その結果、人間の監視のために例外のフラグを立てながら、パフォーマンスをダイナミックに調整できるシステムが生まれました。

同時に、ガバナンスと標準も重要性を増しています。業界コンソーシアムや標準化団体は、統合を容易にし、ベンダーのロックインリスクを軽減する相互運用フレームワークやセキュリティ・ベースラインに収斂しつつあります。持続可能性の目標と規制の推進力は、設計の優先順位をエネルギー効率、リサイクル可能な部品、ライフサイクルの透明性へとシフトさせています。これらのシフトが相まって、より迅速なイテレーション、厳格なサイバーセキュリティ体制、予測可能な相互運用性、実証可能な環境責任といった、新たな競争要件が生み出されています。製品ロードマップ、人材開発、パートナーエコシステムをこのような収束しつつある力に合わせて調整する組織は、サイバーフィジカルシステムの戦略的利益を獲得する上で最も有利な立場になると思われます。

調達の再設計、供給の多様化、継続性と制御を守るためのアーキテクチャのシフトを促す最近の関税措置の現実的な結果

最近の規制サイクルで制定された政策手段は、サプライチェーン、調達行動、資本配分に具体的な影響を及ぼしており、2025年に観察される累積効果は、サイバーフィジカル・イニシアチブを計画する組織にとって重要です。センサー、コントローラー、通信機器などの部品に影響する関税の調整により、新たなコストの考慮事項が導入され、調達チームはサプライヤーのフットプリントと在庫戦略の再評価を促されました。特に、リードタイムが配備スケジュールに直接影響する重要なマイクロエレクトロニクスや接続モジュールについては、こうした変化によってサプライヤーの多様化やニアショアリングに関する議論が加速しています。

これに対応するため、多くの企業は、長期契約、ローカライズされた在庫バッファー、単一障害点を回避するための複数のコンポーネントソースの適格性確認の組み合わせを通じて、供給の弾力性を優先しています。より強固なサプライヤー認定プロセスの必要性は、統合サービスとサポートプロバイダーの役割を高めています。なぜなら、実績のあるライフサイクルサービスと現地エンジニアリングの存在を持つサプライヤーは、純粋なコンポーネントの可用性以上に、より大きなリスク軽減を提供するからです。さらに、調達戦略には、潜在的な政策の変動性、物流の制約、現地製造に関連する検証サイクルの延長を考慮した総所有コスト(TCO)評価を取り入れる傾向が強まっています。

こうした力学は、クラウドとオンプレミスのアーキテクチャ間の展開の決定にも影響します。機密性の高いアプリケーションや規制の厳しい業種では、企業は重要な制御機能をオンプレミスに保持しながら、分析や幅広いオーケストレーションにクラウドプラットフォームを活用するハイブリッドアーキテクチャに傾いています。ハードウェアへのローカルアクセスを確保するという関税主導の要請は、場合によっては、継続性を確保するために、国内組立ラインへの投資や地域メーカーとの提携を促しています。全体として、2025年の累積関税環境は、リスク、コスト、戦略的主権のリバランシングを促し、リーダーは短期的なプログラム計画と長期的な技術ロードマップの両方に組み込む必要があります。

ハードウェア、ソフトウェア、サービス、展開モデル、業界別など、調達、アーキテクチャ、パートナーシップ戦略に反映されるセグメンテーション固有の意味合い

セグメンテーションを理解することは、実用的な意思決定の中心です。なぜなら、各次元(コンポーネント、配備、業界)は、サイバーフィジカルイニシアチブにとって明確な技術的・商業的意味を持つからです。コンポーネントを考える場合、ハードウェアには、デジタルコマンドを物理的な動きに変換するアクチュエータ、決定論的で安全なデータ交換を保証する通信デバイス、リアルタイムロジックを実装するコントローラ、状況認識に必要な忠実度を提供するセンサが含まれます。ソフトウェア層はオーケストレーション、分析、制御ロジックを提供し、サービスはコンサルティング、システム統合、継続的なサポートとメンテナンスに必要な人的専門知識を提供します。この構成は、調達チームとアーキテクチャチームが、長期的な運用成果を達成するために、耐久性のあるハードウェア、適応性のあるソフトウェアプラットフォーム、反復可能なサービス能力への投資のバランスを取らなければならないことを意味します。

展開の選択もまた、プログラムアーキテクチャに重大な影響を与えます。クラウドの導入は、アナリティクスを高速化し、一元的なモデルトレーニングを可能にし、クロスサイトのオーケストレーションを簡素化することができます。一方、オンプレミスの導入は、低レイテンシの決定論的制御を維持し、規制対象またはセーフティ・クリティカルな機能に対してより強力な分離を提供します。多くの企業は、オンプレミスのコントロール・ループを維持しながら、クラウド・リソースを時間的制約の少ないアナリティクスや企業統合に活用するハイブリッド戦略を採用しています。特に、エッジ・コンピュートと集中運用の両方をサポートできるプロバイダーを評価する場合、導入モデルの選択は、更新プロセス、サイバーセキュリティ・モデル、ベンダー選定に関する意思決定に影響を与えます。

業界別にはまた別のニュアンスがあります。航空宇宙と防衛は厳格な認証パスウェイとライフサイクルのトレーサビリティを要求し、自動車と輸送は機能安全性とリアルタイムの信頼性を重視し、銀行、金融サービス、保険は接続されたデバイスが機密性の高いシステムに接続する際の安全なトランザクションの整合性を要求し、ビル、建設、不動産は居住者の快適性、エネルギーの最適化、後付け可能なセンサーネットワークに重点を置き、消費財と小売は在庫の可視化と顧客体験の向上を優先する;教育環境では、ハイブリッド運用のためのスケーラブルで弾力性のあるソリューションを採用し、エネルギーと公益事業ではグリッドグレードの信頼性と資産監視を必要とし、政府と公共部門のプロジェクトでは主権と長期的な保守性を重視し、ヘルスケアとライフサイエンスでは厳格なプライバシーと検証を必要とし、情報技術と通信部門ではバックボーン接続とオーケストレーションレイヤーを推進し、製造センターでは決定論的制御、予知保全、品質保証を優先します。また、製造センターでは、決定論的な制御、予知保全、品質保証が優先されます。各業界別では、認証、継続性、パートナーシップの要件が異なり、その結果、運用に最大の効果をもたらすハードウェア、ソフトウェア、サービスの組み合わせが決まる。

地域力学、規制上の要請、エコシステムの成熟度別、グローバル市場でサイバーフィジカル機能を試験的に導入し、規模を拡大し、投資する場所が決まる

地域力学は、サイバーフィジカル・イニシアチブの優先順位付け、資金調達、実施方法を形成し、それぞれの地域が明確な強みと構造的制約を持っています。アメリカ大陸では、成熟した投資家基盤とシステムインテグレーターやクラウドプロバイダーの強力なエコシステムが、迅速な試験運用と商業化を支えています。この地域では、機密性の高い制御機能をオンプレミスに維持しつつ、企業分析や統合にクラウドサービスを活用するハイブリッド展開モデルが好まれることが多いです。また、重要なインフラとデータのローカリティに対する規制の関心も、ハードウェアとサービスを指定する際に、供給の弾力性とトレーサビリティを重視するよう組織に促しています。

欧州、中東・アフリカでは、特にプライバシーと安全性に関する先進的な規制体制と、多様な市場の成熟度レベルが組み合わされており、これが導入のペースに影響を及ぼしています。欧州の多くの地域では、厳格なコンプライアンス枠組みと確立された標準化団体が、相互運用性とセキュアバイデザインの実践を後押ししています。中東では、大規模なインフラ近代化やエネルギー転換を優先するプロジェクトが多く、グリッド近代化やスマート・ビル・ソリューションへの投資が活発化しています。EMEA全体では、現地のシステムインテグレーターや認定サービスプロバイダーとの協力が、ライフサイクルの保守性や環境性能への配慮と同様に、導入を成功させるための前提条件となることが多いです。

アジア太平洋地域では、大量生産クラスターや先進的な半導体エコシステムから、スケーラブルでコスト効率の高いソリューションを優先する急速な都市化市場まで、幅広い採用パターンが見られます。地域ごとの製造能力の存在は、ハードウェア・コンポーネントのリードタイムを短縮し、製品設計の迅速な反復をサポートします。コネクティビティの革新と、スマートシティや産業近代化をめぐる国家的イニシアチブは、大規模なパイロット事業を行うための肥沃な条件を作り出しています。しかし、多様な規制の枠組みを乗り越え、複数の司法管轄区にまたがる製品の適格性を確保することは、この地域一帯で事業を拡大する企業にとって、依然として業務上の優先課題となっています。

このような地域特性は、パートナーの選択、展開の順序、投資の段階に影響を与えます。戦略目標を、地域の強み(人材プール、製造の近接性、規制の明確性、エコシステムの成熟度)に照らし合わせることで、組織はより効果的にリソースを配分し、展開の摩擦を減らすことができます。

製品の卓越性、統合されたサービス、戦略的パートナーシップは、サイバーフィジカルエコシステムを提供する企業の競争優位性と拡大可能性をどのように定義するか

サイバーフィジカルシステム分野で事業を展開する企業の競争力の中心は、コンポーネント、ライフサイクルサービス、セキュアソフトウェアプラットフォームにまたがる統合的な価値を提供できるかどうかにあります。先進的な企業は、堅牢なセンサー、弾力性のあるコントローラー、予測可能なアクチュエーターといったハードウェアの信頼性と、シームレスなオーケストレーション、分析、安全な更新メカニズムをサポートするソフトウェアの強みを兼ね備えています。さらに、サポートやメンテナンスの提供とともに、コンサルティングやシステム・インテグレーション・サービスの両方を提供できる企業は、企業顧客の調達の複雑さを軽減し、システムの動作に関するエンドツーエンドの説明責任を提供できるため、差別化されたポジションを獲得できます。

パートナーシップ戦略も重要です。主要なクラウド・プロバイダー、ネットワーク・ベンダー、特定分野に特化したプラットフォーム・プロバイダーとの相互運用性により、ソリューションの範囲と機能が拡大し、共同設計されたオファーは顧客の採用を加速させることが多いです。コンサルティング、統合、ライフサイクル・サポートをバンドルして経常収益を得るサービス指向のビジネスモデルは、長期的な顧客との関係を強化し、導入したシステムの継続的な改善を可能にします。さらに、サイバーセキュリティ・フレームワーク、コンプライアンス・サポート、エネルギー効率化機能などを組み込んだ製品を強化している企業は、規制や持続可能性を重視する垂直市場全体のバイヤーの優先事項に対応しています。

投資家や戦略的バイヤーは、反復可能な展開パターン、業界のユースケースにおける明確な検証、サービス品質を損なうことなく事業を拡大できる能力を実証する企業を求めています。その結果、M&Aや戦略的提携では、より広範なポートフォリオに迅速に吸収できるような、専門的なソフトウェア能力、地域的なエンジニアリングのフットプリント、または検証済みの統合プラクティスがターゲットになることが多いです。ベンダーにとっては、説得力のある証明ポイントを明確にし、統合経路を合理化し、相互運用性とライフサイクル・サポートの懸念に対処する透明なロードマップを維持することが急務です。

安全でスケーラブルな実装を加速させるためにリーダーが実施できる、ガバナンス、セキュリティ、パイロット検証、モジュールアーキテクチャ、人材育成の優先順位を定めた一連のアクション

リーダーは、戦略的意図を運用上の成果につなげるために、ガバナンスと能力の調整から始まる一連の現実的な行動を採用すべきです。エンジニアリング、IT、セキュリティ、調達、ビジネスの利害関係者が、単一の意思決定基準に参加できるような、部門横断的なガバナンスを確立し、レイテンシ、セキュリティ、コストのトレードオフに全体的に対処できるようにします。役割と判断基準を成文化することで、組織はサイロ化されたオーナーシップに起因する一般的な遅延を回避し、パイロットからスケールへの移行を加速することができます。

ハードウェア、ファームウェア、ソフトウェア、ネットワークを統合されたドメインとして扱う、階層化されたセキュリティ体制に投資します。セキュリティ対策には、セキュアなブート、認証されたアップデートの仕組み、制御ネットワークのマイクロセグメンテーション、インシデント対応プレイブックに反映される継続的なモニタリングなどが含まれるべきです。設計時にこれらの対策を優先することで、改修コストと運用上のリスクを低減することができます。製造実績、ファームウェア・アップデートの慣行、サードパーティとの依存関係を評価するサプライヤ・リスク評価によって、セキュリティ対策を補完します。

明確な成功指標と代表的な運用条件を用いて、大規模な試験運用を行う。個別の概念実証ではなく、現実的なエッジ計算負荷、予想される環境条件、標準的な運用中断を含むパイロット試験を設計します。このようなパイロットを利用して、統合の複雑さ、測定フレームワーク、保守サイクルを検証し、その教訓を展開テンプレートとランブックにまとめ、その後の展開に役立てる。

モジュール性とオープン性を軸にアーキテクチャの選択を調和させる。ロックインを生み、長期的な保守を複雑にするプロプライエタリなモノリスよりも、段階的なアップグレードと相互運用性を可能にするハードウェアとソフトウェアのスタックを優先します。可能であれば、互換性のあるパートナーのエコシステムを拡大し、統合コストを削減する業界標準とオープン・インターフェイスを支持します。

最後に、人材とパートナーのエコシステムを育成します。システム統合やサイバーセキュリティの分野で社内チームを強化する一方、地域のインテグレーターやサービスプロバイダーと提携することで、社内の能力とスケーラブルなデリバリーのバランスをとることができます。ガバナンス、セキュリティ、パイロットの厳密性、モジュラーアーキテクチャ、そして人材という順序でこれらの推奨事項を実施することで、サイバーフィジカル変革を成功させるための耐久性のある基盤が構築されます。

専門家へのインタビュー、技術検証、規制分析、三角測量などを組み合わせた厳密な混合手法別調査フレームワークにより、エビデンスに基づく提言を作成しました

本エグゼクティブサマリーの調査基盤は、バランスの取れた実行可能な洞察を確実にするために、1次インタビュー、技術検証、2次エビデンスの統合を統合した混合手法アプローチに基づいて構築されています。1次調査には、エンジニアリング、オペレーション、調達、サイバーセキュリティの各分野の専門家との構造化された会話が含まれ、実戦配備で観察された現在の慣行、ペインポイント、出現した戦略を把握しました。これらの会話は、オンプレミスとクラウドの展開、サプライヤの選択基準、セーフティクリティカルなシステムの検証経路の間の微妙なトレードオフを表面化するように設計されました。

2次調査では、一般に公開されている規格、規制ガイダンス、技術白書、ベンダーの技術文書を参照し、1次調査の結果を整理して技術的な実現可能性を検証しました。適切な場合には、地域特有の制約を確実に提言に反映させるため、地域規制の枠組みや調達慣行の比較分析も実施しました。技術的な検証作業としては、シナリオに基づくアーキテクチャのレビューや、様々な政策やロジスティクスの条件下での弾力性を評価するための仮想的なサプライチェーンストレステストを実施しました。

データ統合では、異なる視点を調整し、結論の信頼性を高めるために、三角測量が採用されました。主要な調査結果は、実務家からのフィードバックと照合され、専門家による反復的なレビュー・サイクルを通じて改良されました。調査手法の限界としては、政策や技術開発のダイナミックな性質が挙げられ、継続的な監視と定期的な更新が必要です。不確実性が残る場合、本レポートは、意思決定者がリスク許容度と業務上のニーズに最も合致するルートを選択できるよう、代替的な実施経路と感度に関する考察を提供しています。

サイバーフィジカルシステムの取り組みが、レジリエンス、セキュリティ、および測定可能な運用価値を確実に提供するために、リーダーが採用すべき戦略的必須事項を簡潔にまとめたもの

サイバーフィジカルシステムは、もはや実験的な珍品ではなく、物理資産を意思決定エンジンや組織の目標につなげる戦略的イネーブラーです。その可能性をフルに発揮するには、漸進的なテクノロジー導入以上のものが必要です。規律あるガバナンス、弾力性のあるサプライチェーンの実践、セキュリティ・バイ・デザイン、そして統合の深さとライフサイクルサポートの両方を提供できるパートナーのエコシステムが必要です。コンポーネントの選択、デプロイメント・モデル、および業種特有の要件が相互に影響し合うため、万能の青写真は存在しないが、成功の指針となる再現可能な原則は存在します。

モジュラーアーキテクチャーを優先し、労働力に投資し、短期的なコストよりもレジリエンスを重視した調達構造をとる組織は、安全かつ持続可能な拡張を行う上で有利な立場になると思われます。地域ダイナミックスと政策シフトは、サプライヤーの戦略と展開順序に影響を与え続けるので、戦略的柔軟性を維持し、ロードマップを定期的に見直すことが不可欠です。最後に、明確な測定フレームワークと、生産条件を反映したパイロット設計は、コストのかかる手戻りのリスクを減らし、運用上のメリットの実現を加速させる。

サマリーをまとめると、前進する道は現実的なものです。健全な技術的実践を規律あるプログラム管理と組み合わせ、利害関係者を早期に調整し、全社的なロールアウトに情報を提供する有効なビルディングブロックを構築するためにパイロットを活用することです。これらの行動により、最新のサイバーフィジカルシステムが約束する信頼性、セキュリティ、性能を実現することができます。

目次

第1章 序文

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場の概要

第5章 市場洞察

- デジタルツイン技術とリアルタイムIoTセンサーの統合により、システムのシミュレーションと監視を強化

- 低遅延の意思決定と安全性の向上を目的とした自動運転車へのエッジコンピューティングプラットフォームの導入

- スマートグリッドにおける重要なインフラをサイバー侵入から保護するための安全な通信プロトコルの実装

- 5Gネットワークを活用し、分散型製造システムにおけるリアルタイムデータ交換と同期制御を実現

- 産業用IoTエコシステムにおけるデバイス認証のセキュリティ確保のためのブロックチェーンベースのID管理ソリューションの導入

第6章 米国の関税の累積的な影響, 2025

第7章 AIの累積的影響, 2025

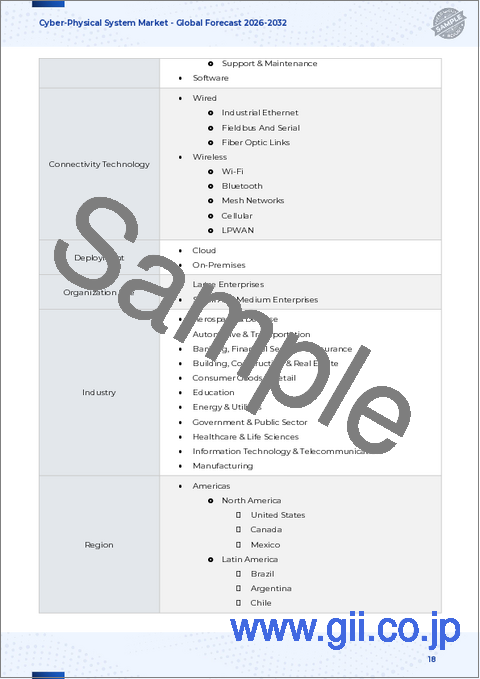

第8章 サイバーフィジカルシステム市場:コンポーネント別

- ハードウェア

- アクチュエータ

- 通信機器

- コントローラー

- センサー

- サービス

- コンサルティングサービス

- 統合サービス

- サポートとメンテナンス

- ソフトウェア

第9章 サイバーフィジカルシステム市場:展開別

- クラウド

- オンプレミス

第10章 サイバーフィジカルシステム市場:業界別

- 航空宇宙および防衛

- 自動車・輸送

- 銀行、金融サービス、保険

- 建築・建設・不動産

- 消費財・小売

- 教育

- エネルギー・公益事業

- 政府および公共部門

- ヘルスケアとライフサイエンス

- 情報技術と通信

- 製造業

第11章 サイバーフィジカルシステム市場:地域別

- 南北アメリカ

- 北米

- ラテンアメリカ

- 欧州・中東・アフリカ

- 欧州

- 中東

- アフリカ

- アジア太平洋地域

第12章 サイバーフィジカルシステム市場:グループ別

- ASEAN

- GCC

- EU

- BRICS

- G7

- NATO

第13章 サイバーフィジカルシステム市場:国別

- 米国

- カナダ

- メキシコ

- ブラジル

- 英国

- ドイツ

- フランス

- ロシア

- イタリア

- スペイン

- 中国

- インド

- 日本

- オーストラリア

- 韓国

第14章 競合情勢

- 市場シェア分析, 2024

- FPNVポジショニングマトリックス, 2024

- 競合分析

- ABB Ltd.

- Cisco Systems, Inc.

- Cognizant Technology Solutions Corporation

- Dell Inc.

- Fujitsu Limited

- Galois, Inc.

- General Electric Company

- Hewlett Packard Enterprise Company

- Hitachi Vantara LLC by Hitachi, Ltd.

- Honeywell International Inc.

- Infosys Limited

- Intel Corporation

- International Business Machines Corporation

- KUKA AG

- Microsoft Corporation

- NEC Corporation

- Oracle Corporation

- Rockwell Automation, Inc.

- SAP SE

- Schneider Electric SE

- Siemens AG

- Tech Mahindra Limited

- Telefonaktiebolaget LM Ericsson

- The MathWorks, Inc.

- Yokogawa Electric Corporation