|

|

市場調査レポート

商品コード

1758233

協働ロボットの世界市場(2025年):製造・ロジスティクスから汎用AIまでCollaborative Robots - 2025: From Manufacturing and Logistics to General Artificial Intelligence |

||||||

|

|||||||

| 協働ロボットの世界市場(2025年):製造・ロジスティクスから汎用AIまで |

|

出版日: 2025年06月12日

発行: Interact Analysis

ページ情報: 英文

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

概要

当レポートでは、世界の協働ロボット市場について調査分析し、市場規模と予測、市場投入ルート、主要動向と市場促進要因、主要企業の市場シェアとランキングなどの情報を提供しています。

サンプルビュー

レポートの主な内容

- 1. 2024年の世界の協働ロボットの市場規模、今後5年間の協働ロボット市場の成長速度

- 2. 最大の機会を提供する産業と応用分野はどこか、地域/国ごとにどのように異なるか

- 3. 協働ロボットの製品構成(可搬重量範囲)は今後5年間でどのように変化するか、また、それがコンポーネントに与える影響

- 4. 2024年の協働ロボットの主要サプライヤーはどこか、地域や産業によってどのように異なるか

目次

Report Overview & Features

This brochure outlines the scope and content of our highly-reputable report providing insight and analysis into the collaborative robot industry. The report focuses on collaborative robot arms used in manufacturing, logistics and other applications. It aims to include the following:

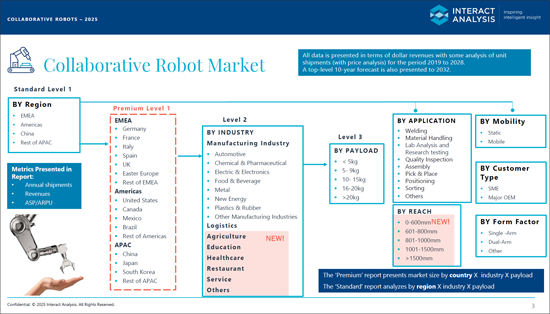

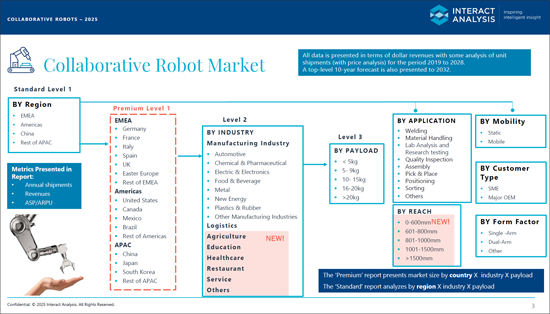

- 1. Market size and forecasts for collaborative robots with detailed segmentation as shown in slide 3*

- 2. Five-year forecasts to 2029 presented throughout

- 3. Analysis of routes to market, including direct, integration, or Robot-as-a-Service (RaaS)

- 4. Key trends and market drivers' analysis provided by region, country, industry and application

- 5. Market shares and rankings of leading collaborative robot companies in 2018-2023

- 6. ~20 profiles of leading collaborative robot manufacturers

SAMPLE VIEW

*slide 3

Key questions to be answered in the report include:

- 1. What was the size of the global market for collaborative robots in 2024? How fast will the collaborative robot market grow over the next five years?

- 2. Which industry and application segments offer the greatest opportunity? How does this vary by region/country?

- 3. How will the collaborative robot product mix change (payload range) over the next five years? And what impact will this have on components?

- 4. Who were the leading suppliers of collaborative robots in 2024? How does this vary by region and industry?