|

|

市場調査レポート

商品コード

1800953

偽造防止包装の市場レポート:技術、機能タイプ、最終用途産業、地域別、2025年~2033年Anti-Counterfeit Packaging Market Report by Technology (Barcodes, RFID, Holograms, Taggants, and Others), Feature Type, End Use Industry, and Region 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| 偽造防止包装の市場レポート:技術、機能タイプ、最終用途産業、地域別、2025年~2033年 |

|

出版日: 2025年08月01日

発行: IMARC

ページ情報: 英文 124 Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

偽造防止包装の世界市場規模は2024年に1,369億米ドルに達しました。今後、IMARC Groupは、市場は2033年までに3,285億米ドルに達し、2025年から2033年にかけて10.12%の成長率(CAGR)を示すと予測しています。北米が市場を独占しているのは、規制の枠組みがしっかりしていること、先進技術が導入されていること、基幹産業が強く存在していることによる。同市場はまた、主にさまざまな産業で安全なパッケージング・ソリューションに対するニーズが高まっていることを背景に、大きな成長を遂げています。RFID、ブロックチェーン、AIを利用した分析などの技術の進歩や、QRコードやNFCタグを利用したスマートパッケージングの成長も市場成長にプラスに寄与しています。

個人は、健康リスクや金銭的損失など、偽造品に関連する危険に対する意識を高めています。このような意識の高まりは、製品の信頼性と確実性を保証するために偽造防止包装を導入することをメーカーに促しています。企業は、真正性の明確な証拠を提供するパッケージング技術にリソースを割き、ユーザーの信頼を高めています。また、オンラインショッピングの普及に伴い、インターネット上での偽物の販売が増加しています。売り手は、商品の真正性を保証する包装を必要とし、購入者に偽造品が販売される可能性を最小限に抑えています。偽造防止包装は、オンラインショップを運営する企業にとって必要不可欠なリソースとして機能し、バーチャルマーケットプレースにおける透明性と保護を提供します。これとは別に、ホログラム、RFIDタグ、ナノテクなどのパッケージング技術の向上により、企業は偽造防止対策をより簡単かつ安価に導入できるようになりました。これらの進歩は、セキュリティーを向上させ、偽造を防止する斬新な方法を提供します。これらの技術の進化に伴い、簡単に入手できるようになり、洗練されたパッケージング・ソリューションの必要性が高まっています。

偽造防止包装市場の動向:

技術の進歩

偽造防止包装分野における技術の進歩は、主にRFID、ブロックチェーン、モノのインターネット(IoT)のアプリケーションの拡大によって後押しされています。RFIDは、製品の即時追跡と検証を可能にし、サプライチェーン全体でその正当性を保証します。ブロックチェーンは、安全で透明な取引のための恒久的な記録を提供し、トレーサビリティを向上させる。包装に統合されたIoTデバイスは、製品の正当性を即座に確認するための継続的な監視を可能にします。これらの技術は偽造を防ぐだけでなく、サプライチェーンの有効性を高める。例えば、2024年5月、iTRACE Technologies, Inc.は、AIとブロックチェーンを組み込むことで、iTRACE 2DMI(R)テクノロジーを強化しました。最新の機能には、AIによる偽物の検出、検証のためのブロックチェーンベースのセキュリティ、確認のためのモバイルアクセスが組み込まれています。この開発は、業界内の幅広い動きを反映しており、セキュリティの新たなベンチマークを確立しています。このような技術の進化により、偽造防止包装セクターは、多業種にわたる採用の拡大により、製品保護とサプライチェーンの可視性が向上し、大幅な拡大が見込まれています。

偽造品検出システムの増加

偽造品検出システムの成長は、AI主導の分析や機械学習(ML)などの最先端技術の統合によってもたらされます。これらのシステムは、広範なデータセットを調査して偽造品を示すパターンを発見し、より迅速で正確な検知を可能にします。MLアルゴリズムは常に進歩し、偽造の新たな手口を効率的に特定します。こうした開発により、さまざまな分野で広く受け入れられ、製品の安全性が大幅に向上し、偽造品が減少しています。2024年4月、ケーニッヒ&バウアーはグラフィック・セキュリティ・システムズ社と提携し、偽造防止ソリューションを開発しました。ステガノグラフィ技術を印刷機に統合することで、機密性の高い印刷物やアイテムのセキュリティと検証を向上させることを目指しました。このような進歩は、偽造に取り組むだけでなく、偽造品が市場に出回るのを阻止することで、ユーザーの安全を保証し、ブランドの完全性を維持します。

ブランド保護のニーズの高まり

ブランドは、偽造品がもたらす金銭的損失や風評被害に対する認識を深めています。企業は自社製品を保護し、ユーザーの信頼を維持するために、創造的なパッケージング・ソリューションにリソースを割いています。このようなブランド保護の必要性から、洗練された偽造防止包装ソリューションが生まれ、採用されています。これらの対策はブランドを保護するだけでなく、サプライチェーンを通過する間、製品が本物であることを保証します。偽造が世界の問題として浮上する中、企業は商品を保護し、顧客の信頼を維持するために、パッケージング戦略を改善する必要性を認識しています。様々な業界、特に医薬品、高級品、家電製品におけるブランド保護の必要性が、偽造防止包装技術の拡大を後押しし、企業がこれらのソリューションを通常の業務に取り入れることを促しています。

偽造防止包装市場の成長促進要因:

eコマースとオンライン販売の拡大

eコマースの急速な拡大により、偽造品が市場に出回る危険性が高まっています。オンライン取引が簡素化されたため、詐欺師はデジタル・プラットフォームを利用して偽物を販売し、ユーザーが製品の真偽を確認するプロセスを複雑にしています。世界サプライチェーンやデジタルマーケットプレースの台頭により、信頼できる偽造防止包装の需要が高まっています。世界中に商品を頻繁に発送するeコマースサイトは、偽造品の主要なターゲットとして浮上しています。これに対し、企業は製品の真正性を保証するため、セキュア・ラベリング、QRコード、デジタル検証ツールなどの先進パッケージング手法を採用しています。こうした行動は、個人を保護するだけでなく、オンライン環境におけるブランドのイメージを守ることにもなります。世界のB2C eコマース売上高は2027年までに5兆5,000億米ドルに達し、CAGRは14.4%に達すると予測されているため、偽造品が個人の手に渡るのを阻止することを目的とする企業の偽造防止包装ソリューションに対するニーズは高まると予想されます。

高級品への需要の高まり

高級ブランドは、そのプレミアム価値ゆえに、ますます模倣品の標的にされています。ブランドの独占性と名声を守るため、こうしたブランドは先進パッケージング技術に多額の投資を行っています。高級品の偽造防止ソリューションには通常、ホログラム、固有のシリアル番号、スマートラベルなど、複製が困難な機能が組み込まれています。偽造品はブランドのイメージを著しく損なう可能性があるため、これらの製品の真正性はユーザーの信頼を維持する上で極めて重要です。IMARC Groupによると、世界の高級品市場は2033年までに4,058億米ドルに達すると予想されており、偽造を防止するための安全な包装の必要性が高まっています。このような洗練された包装オプションは、高級品の真正性を保証するだけでなく、高価値ブランドの完全性と評判を維持し、市場での存在感と顧客ロイヤルティを維持するために極めて重要です。

厳しい規制要件

世界中の政府機関や規制機関は、医薬品、飲食品(F&B)、高級品など、さまざまな業界で偽造防止対策の採用を求める規制を強化しています。こうした規制により、企業は改ざん防止シール、ホログラム、特徴的なシリアル番号などのセキュリティ要素を含むパッケージング・ソリューションを導入することが頻繁に求められます。こうした規制の枠組みを遵守する必要性から、企業はこうした法的義務を果たす高度なパッケージング技術への投資を促しています。これらの規制を遵守しなかった場合、厳しい罰則が課され、企業の評判が低下する可能性があります。規制当局が偽造品撲滅への取り組みを強化する中、企業は自社のパッケージング・ソリューションがこれらの規制に準拠していることを確認することに、より重点を置くようになっています。規制遵守への関心の高まりは、偽造防止包装ソリューションの採用を後押しする大きな要因となっています。

目次

第1章 序文

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 一次情報

- 二次情報

- 市場推定

- ボトムアップアプローチ

- トップダウンアプローチ

- 調査手法

第3章 エグゼクティブサマリー

第4章 イントロダクション

第5章 世界の偽造防止包装市場

- 市場概要

- 市場実績

- COVID-19の影響

- 市場予測

第6章 市場内訳:技術別

- バーコード

- RFID(無線周波数識別)

- ホログラム

- タガント

- その他

第7章 市場内訳:機能タイプ別

- 明白な機能

- 隠された機能

第8章 市場内訳:最終用途産業別

- 食品・飲料

- ヘルスケア

- 自動車

- 家電

- その他

第9章 市場内訳:地域別

- 北米

- 米国

- カナダ

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- インドネシア

- その他

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- ロシア

- その他

- ラテンアメリカ

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

第10章 SWOT分析

第11章 バリューチェーン分析

第12章 ポーターのファイブフォース分析

第13章 価格分析

第14章 競合情勢

- 市場構造

- 主要企業

- 主要企業のプロファイル

- 3M Company

- Alpvision SA

- Applied DNA Sciences Inc.

- Authentix Inc.(Blue Water Energy LLP)

- Avery Dennison Corporation

- CCL Industries Inc.

- DuPont

- Savi Technology Inc.(Lockheed Martin)

- SICPA Holding SA

- SML Group

- Zebra Technologies

List of Figures

- Figure 1: Global: Anti-Counterfeit Packaging Market: Major Drivers and Challenges

- Figure 2: Global: Anti-Counterfeit Packaging Market: Sales Value (in Billion USD), 2019-2024

- Figure 3: Global: Anti-Counterfeit Packaging Market: Breakup by Technology (in %), 2024

- Figure 4: Global: Anti-Counterfeit Packaging Market: Breakup by Feature Type (in %), 2024

- Figure 5: Global: Anti-Counterfeit Packaging Market: Breakup by End Use Industry (in %), 2024

- Figure 6: Global: Anti-Counterfeit Packaging Market: Breakup by Region (in %), 2024

- Figure 7: Global: Anti-Counterfeit Packaging Market Forecast: Sales Value (in Billion USD), 2025-2033

- Figure 8: Global: Anti-Counterfeit Packaging (Barcodes) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 9: Global: Anti-Counterfeit Packaging (Barcodes) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 10: Global: Anti-Counterfeit Packaging (RFID (Radio-Frequency Identification)) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 11: Global: Anti-Counterfeit Packaging (RFID (Radio-Frequency Identification)) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 12: Global: Anti-Counterfeit Packaging (Holograms) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 13: Global: Anti-Counterfeit Packaging (Holograms) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 14: Global: Anti-Counterfeit Packaging (Taggants) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 15: Global: Anti-Counterfeit Packaging (Taggants) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 16: Global: Anti-Counterfeit Packaging (Other Technologies) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 17: Global: Anti-Counterfeit Packaging (Other Technologies) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 18: Global: Anti-Counterfeit Packaging (Overt Features) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 19: Global: Anti-Counterfeit Packaging (Overt Features) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 20: Global: Anti-Counterfeit Packaging (Covert Features) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 21: Global: Anti-Counterfeit Packaging (Covert Features) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 22: Global: Anti-Counterfeit Packaging (Food and Beverage) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 23: Global: Anti-Counterfeit Packaging (Food and Beverage) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 24: Global: Anti-Counterfeit Packaging (Healthcare) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 25: Global: Anti-Counterfeit Packaging (Healthcare) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 26: Global: Anti-Counterfeit Packaging (Automotive) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 27: Global: Anti-Counterfeit Packaging (Automotive) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 28: Global: Anti-Counterfeit Packaging (Consumer Electronics) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 29: Global: Anti-Counterfeit Packaging (Consumer Electronics) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 30: Global: Anti-Counterfeit Packaging (Other End Use Industries) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 31: Global: Anti-Counterfeit Packaging (Other End Use Industries) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 32: North America: Anti-Counterfeit Packaging Market: Sales Value (in Million USD), 2019 & 2024

- Figure 33: North America: Anti-Counterfeit Packaging Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 34: United States: Anti-Counterfeit Packaging Market: Sales Value (in Million USD), 2019 & 2024

- Figure 35: United States: Anti-Counterfeit Packaging Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 36: Canada: Anti-Counterfeit Packaging Market: Sales Value (in Million USD), 2019 & 2024

- Figure 37: Canada: Anti-Counterfeit Packaging Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 38: Asia Pacific: Anti-Counterfeit Packaging Market: Sales Value (in Million USD), 2019 & 2024

- Figure 39: Asia Pacific: Anti-Counterfeit Packaging Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 40: China: Anti-Counterfeit Packaging Market: Sales Value (in Million USD), 2019 & 2024

- Figure 41: China: Anti-Counterfeit Packaging Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 42: Japan: Anti-Counterfeit Packaging Market: Sales Value (in Million USD), 2019 & 2024

- Figure 43: Japan: Anti-Counterfeit Packaging Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 44: India: Anti-Counterfeit Packaging Market: Sales Value (in Million USD), 2019 & 2024

- Figure 45: India: Anti-Counterfeit Packaging Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 46: South Korea: Anti-Counterfeit Packaging Market: Sales Value (in Million USD), 2019 & 2024

- Figure 47: South Korea: Anti-Counterfeit Packaging Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 48: Australia: Anti-Counterfeit Packaging Market: Sales Value (in Million USD), 2019 & 2024

- Figure 49: Australia: Anti-Counterfeit Packaging Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 50: Indonesia: Anti-Counterfeit Packaging Market: Sales Value (in Million USD), 2019 & 2024

- Figure 51: Indonesia: Anti-Counterfeit Packaging Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 52: Others: Anti-Counterfeit Packaging Market: Sales Value (in Million USD), 2019 & 2024

- Figure 53: Others: Anti-Counterfeit Packaging Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 54: Europe: Anti-Counterfeit Packaging Market: Sales Value (in Million USD), 2019 & 2024

- Figure 55: Europe: Anti-Counterfeit Packaging Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 56: Germany: Anti-Counterfeit Packaging Market: Sales Value (in Million USD), 2019 & 2024

- Figure 57: Germany: Anti-Counterfeit Packaging Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 58: France: Anti-Counterfeit Packaging Market: Sales Value (in Million USD), 2019 & 2024

- Figure 59: France: Anti-Counterfeit Packaging Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 60: United Kingdom: Anti-Counterfeit Packaging Market: Sales Value (in Million USD), 2019 & 2024

- Figure 61: United Kingdom: Anti-Counterfeit Packaging Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 62: Italy: Anti-Counterfeit Packaging Market: Sales Value (in Million USD), 2019 & 2024

- Figure 63: Italy: Anti-Counterfeit Packaging Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 64: Spain: Anti-Counterfeit Packaging Market: Sales Value (in Million USD), 2019 & 2024

- Figure 65: Spain: Anti-Counterfeit Packaging Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 66: Russia: Anti-Counterfeit Packaging Market: Sales Value (in Million USD), 2019 & 2024

- Figure 67: Russia: Anti-Counterfeit Packaging Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 68: Others: Anti-Counterfeit Packaging Market: Sales Value (in Million USD), 2019 & 2024

- Figure 69: Others: Anti-Counterfeit Packaging Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 70: Latin America: Anti-Counterfeit Packaging Market: Sales Value (in Million USD), 2019 & 2024

- Figure 71: Latin America: Anti-Counterfeit Packaging Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 72: Brazil: Anti-Counterfeit Packaging Market: Sales Value (in Million USD), 2019 & 2024

- Figure 73: Brazil: Anti-Counterfeit Packaging Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 74: Mexico: Anti-Counterfeit Packaging Market: Sales Value (in Million USD), 2019 & 2024

- Figure 75: Mexico: Anti-Counterfeit Packaging Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 76: Others: Anti-Counterfeit Packaging Market: Sales Value (in Million USD), 2019 & 2024

- Figure 77: Others: Anti-Counterfeit Packaging Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 78: Middle East and Africa: Anti-Counterfeit Packaging Market: Sales Value (in Million USD), 2019 & 2024

- Figure 79: Middle East and Africa: Anti-Counterfeit Packaging Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 80: Global: Anti-Counterfeit Packaging Industry: SWOT Analysis

- Figure 81: Global: Anti-Counterfeit Packaging Industry: Value Chain Analysis

- Figure 82: Global: Anti-Counterfeit Packaging Industry: Porter's Five Forces Analysis

List of Tables

- Table 1: Global: Anti-Counterfeit Packaging Market: Key Industry Highlights, 2024 and 2033

- Table 2: Global: Anti-Counterfeit Packaging Market Forecast: Breakup by Technology (in Million USD), 2025-2033

- Table 3: Global: Anti-Counterfeit Packaging Market Forecast: Breakup by Feature Type (in Million USD), 2025-2033

- Table 4: Global: Anti-Counterfeit Packaging Market Forecast: Breakup by End Use Industry (in Million USD), 2025-2033

- Table 5: Global: Anti-Counterfeit Packaging Market Forecast: Breakup by Region (in Million USD), 2025-2033

- Table 6: Global: Anti-Counterfeit Packaging Market Structure

- Table 7: Global: Anti-Counterfeit Packaging Market: Key Players

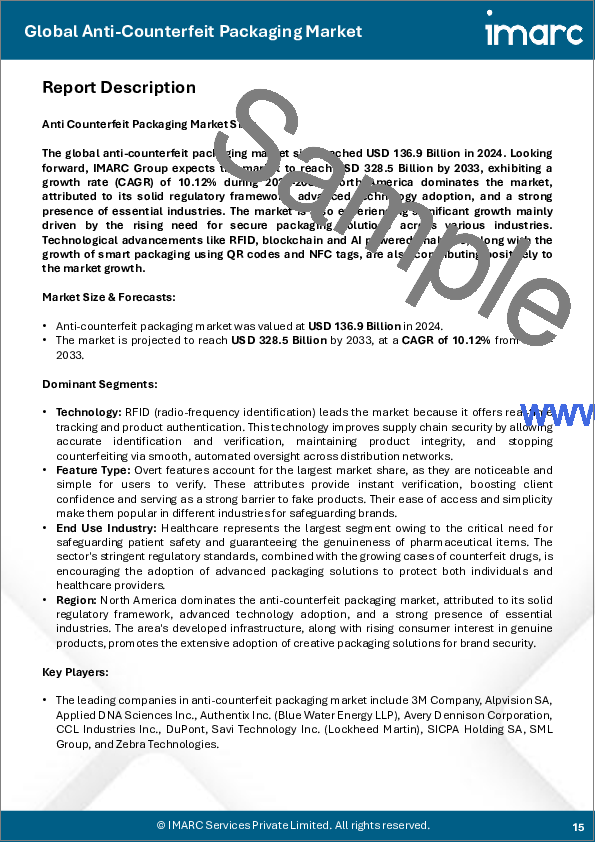

The global anti-counterfeit packaging market size reached USD 136.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 328.5 Billion by 2033, exhibiting a growth rate (CAGR) of 10.12% during 2025-2033. North America dominates the market, attributed to its solid regulatory framework, advanced technology adoption, and a strong presence of essential industries. The market is also experiencing significant growth mainly driven by the rising need for secure packaging solutions across various industries. Technological advancements like RFID, blockchain and AI powered analytics, along with the growth of smart packaging using QR codes and NFC tags, are also contributing positively to the market growth.

Individuals are becoming more conscious about the hazards linked to fake products, including health risks and monetary loss. This increased awareness is encouraging manufacturers to implement anti-counterfeit packaging to guarantee trust and dependability in their products. Businesses allocate resources to packaging technologies that offer clear evidence of authenticity, enhancing user trust. Moreover, the growing popularity of online shopping is resulting in a rise in the sale of fake goods on the internet. Sellers require packaging that guarantees product authenticity, minimizing the chances of counterfeit goods being sold to buyers. Anti-counterfeit packaging acts as an essential resource for companies operating online, providing clarity and protection in virtual marketplaces. Apart from this, improvements in packaging technologies, including holograms, RFID tags, and nanotech, enable businesses to adopt anti-counterfeit measures more easily and affordably. These advancements offer novel methods to improve security and safeguard against forgery. With the evolution of these technologies, they become easily available, thereby driving the need for sophisticated packaging solutions.

Anti Counterfeit Packaging Market Trends:

Technological Advancements

Advancements in technology within the anti-counterfeit packaging sector are primarily fueled by the growing applications of RFID, blockchain, and Internet of Things (IoT). RFID allows for immediate tracking and verification of products, guaranteeing their legitimacy across the supply chain. Blockchain offers a permanent record for safe, transparent transactions, improving traceability. Integrated IoT devices within packaging enable ongoing oversight for immediate confirmation of product legitimacy. These technologies not only safeguard against forgery but also enhance supply chain effectiveness. For example, in May 2024, iTRACE Technologies, Inc. enhanced its iTRACE 2DMI(R) technology by incorporating AI and blockchain. The latest functionalities incorporated AI-driven fake detection, blockchain-based security for validation, and mobile access for confirmation. This development mirrors wider movements within the industry, establishing novel benchmarks for security. With the evolution of these technologies, the anti-counterfeit packaging sector is set for considerable expansion, as greater adoption across multiple industries improves product protection and supply chain visibility.

Rise in Counterfeit Detection Systems

The growth of counterfeit detection systems is driven by the integration of cutting-edge technologies, such as AI-driven analytics and machine learning (ML). These systems examine extensive datasets to uncover patterns that signify counterfeit items, allowing for quicker and more precise detection. ML algorithms consistently advance, efficiently identifying new techniques for counterfeiting. These developments promote wider acceptance in various sectors, greatly improving product safety and decreasing fake items. In April 2024, Koenig & Bauer teamed up with Graphic Security Systems Corporation to create anti-counterfeiting solutions. Through the integration of steganographic techniques with printing presses, the collaboration aimed to provide improved security and verification for highly sensitive printed materials and items. Such advancements not only tackle counterfeiting but also guarantee user safety and maintain brand integrity by stopping counterfeit goods from entering the market.

Increasing Need for Brand Protection

Brands are becoming more aware about the monetary losses and reputational harm that fake products can inflict. Businesses are allocating resources to creative packaging solutions to safeguard their products and maintain user confidence. This need for brand safeguarding is leading to the creation and adoption of sophisticated anti-counterfeit packaging solutions. These measures not only protect the brand but also guarantee that products stay authentic during their passage through the supply chain. As counterfeiting emerges as a worldwide concern, companies are acknowledging the need for improved packaging strategies to protect their goods and maintain client trust. The need for brand protection in various industries, particularly in pharmaceuticals, luxury items, and consumer electronics, is bolstering the expansion of anti-counterfeit packaging technologies and encouraging companies to incorporate these solutions into their regular practices.

Anti Counterfeit Packaging Market Growth Drivers:

Growing E-Commerce and Online Sales

The swift expansion of e-commerce is greatly heightening the danger of fake products saturating the market. Due to the simplicity of online transactions, fraudsters are taking advantage of digital platforms to sell fake items, complicating the process for users to verify the authenticity of products. With the rise of global supply chains and digital marketplaces, the demand for trustworthy anti-counterfeit packaging is increasing. E-commerce sites, which frequently ship products worldwide, are emerging as major targets for counterfeiters. In reaction, companies are adopting advanced packaging methods, such as secure labeling, QR codes, and digital verification tools, to guarantee product authenticity. These actions not only shield individuals but also protect brands' images in the online environment. As global B2C e-commerce sales are projected to hit USD $5.5 trillion by 2027, with a 14.4% compound annual growth rate, the need for anti-counterfeit packaging solutions is anticipated to increase, as businesses aim to stop counterfeit products from getting to individuals.

Rising Demand for Luxury Goods

High-end brands, due to their premium value, are increasingly targeted by counterfeiters. To protect their exclusivity and reputation, these brands are investing heavily in advanced packaging technologies. Anti-counterfeit solutions for luxury goods typically incorporate features like holograms, unique serial numbers, and smart labels that are hard to replicate. The authenticity of these products is crucial for maintaining user trust, as counterfeit items can severely damage the brand's image. With the worldwide luxury goods market expected to reach a value of USD 405.80 Billion by 2033 as per the IMARC Group, the need for secure packaging to guard against counterfeiting is increasing. These sophisticated packaging options not only guarantee the authenticity of luxury items but also maintain the integrity and reputation of high-value brands, crucial for sustaining market presence and client loyalty.

Stringent Regulatory Requirements

Governing bodies and regulatory agencies worldwide are enforcing stricter regulations that require the adoption of anti-counterfeit measures across multiple industries, such as pharmaceuticals, food and beverage (F&B), and luxury products. These regulations frequently necessitate that companies implement packaging solutions that include security elements, including tamper-proof seals, holograms, and distinctive serial numbers. The necessity to adhere to these regulatory frameworks is encouraging companies to invest in sophisticated packaging technologies that fulfill these legal obligations. Failure to comply with these regulations can result in severe penalties and damage to a company's reputation. With governing authorities increasing their efforts to fight counterfeit goods, businesses are more focused on making sure that their packaging solutions comply with these regulations. The growing focus on regulatory compliance is a significant factor propelling the adoption of anti-counterfeit packaging solutions.

Anti Counterfeit Packaging Market Segmentation:

Breakup by Technology:

- Barcodes

- RFID (Radio-Frequency Identification)

- Holograms

- Taggants

- Others

RFID (Radio-Frequency Identification) accounts for the majority of the market share

According to the market research report, RFID (Radio-Frequency Identification) dominates the market due to its ability to provide real-time tracking and authentication of products throughout the supply chain. This technology is particularly favored in industries like pharmaceuticals and electronics, where the need for accurate and secure identification is critical. RFID tags enable efficient monitoring and verification, reducing the risk of counterfeiting by ensuring that products are genuine and traceable. The scalability and integration capabilities of RFID systems further enhance their adoption, making them a preferred choice for companies aiming to protect their brand integrity and comply with stringent regulatory standards. These advancements in RFID technology, along with increasing strategic collaborations within the industry, are creating a positive anti counterfeit packaging market outlook by driving innovation, improving product security, and enhancing traceability across various sectors.

Breakup by Feature Type:

- Overt Features

- Covert Features

Overt Features holds the largest share of the industry

Overt features, which include visible security elements such as holograms, color-shifting inks, and watermarks, hold the largest share of the Anti-Counterfeit Packaging industry due to their immediate and easy-to-verify nature. These features are widely used across various sectors, particularly in consumer goods, pharmaceuticals, and luxury products, where brand protection and consumer trust are paramount. The popularity of overt features stems from their ability to provide quick visual authentication without the need for specialized equipment, making them accessible to both consumers and professionals. The integration of these visible security measures into packaging not only deters counterfeiting but also enhances brand image, driving their continued dominance in the anti-counterfeit packaging market. These visible security measures, along with the growing consumer awareness and the demand for product authenticity, are expected to significantly enhance the anti counterfeit packaging market value in the coming future. As more industries prioritize brand protection and regulatory compliance, the adoption of overt features is likely to expand, thus further supporting the anti counterfeit packaging market growth.

Breakup by End Use Industry:

- Food and Beverage

- Healthcare

- Automotive

- Consumer Electronics

- Others

Healthcare Sector represents the leading market segment

Healthcare sector leads the end user segment due to the critical need for ensuring the authenticity of medical products. Pharmaceuticals and medical devices are highly susceptible to counterfeiting, which can have severe consequences for patient safety and brand integrity. Anti-counterfeit packaging solutions, such as holograms, RFID tags, and tamper-evident seals, are widely adopted in this sector to prevent the distribution of fake products. Stringent regulatory requirements and the growing global trade of healthcare products further drive the demand for advanced packaging technologies in this market segment, ensuring product safety and compliance. For instance, in September 2023, MM Packaging and Crane Automation unveiled new micro-optic technology at PACK EXPO Las Vegas. This technology offers anti-counterfeit, anti-tamper, and tamper-evident labels for pharmaceuticals, aiming to enhance patient safety in the pharmaceutical industry through easily identifiable security features and educational tools for consumers. The technology is flexible and allows for customization, including tamper-evident labels with brand-specific designs, which could potentially engage consumers and enhance supply chain security. These advancements in micro-optic technology, along with the increasing regulatory pressures and global trade of healthcare products, are driving anti counterfeit packaging demand in the healthcare sector. The need for secure packaging solutions that ensure product authenticity and patient safety is becoming more critical, leading to a rise in the adoption of innovative anti-counterfeit measures. The ability to customize tamper-evident labels with brand-specific designs further enhances consumer engagement and supply chain security, making such technologies essential in combating counterfeiting in the pharmaceutical industry.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest anti counterfeit packaging market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for anti-counterfeit packaging.

North America leads the Anti-Counterfeit Packaging market, accounting for the largest market share due to several key factors. The region has stringent regulatory frameworks, particularly in the healthcare and pharmaceutical sectors, which mandate the use of advanced anti-counterfeit technologies. Additionally, the high demand for secure packaging solutions in industries like food and beverages, electronics, and luxury goods further drives anti counterfeit packaging market growth. The presence of major industry players and continuous technological innovations, such as RFID and holographic labels, also contribute to North America's dominant position in the global market. For instance, in April 2023, Amazon introduced the Anti-Counterfeiting Exchange (ACX) to enhance online shopping safety and combat counterfeit products. The exchange facilitates the sharing of information on confirmed counterfeiters across participating stores, enabling quick identification and prevention of illicit activities. This collaborative effort aims to protect consumers and brands from counterfeiters, promoting a secure retail environment. The initiative has garnered support from industry experts and encourages broader participation to strengthen the fight against counterfeit goods.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the anti-counterfeit packaging industry include:

- 3M Company

- Alpvision SA

- Applied DNA Sciences Inc.

- Authentix Inc. (Blue Water Energy LLP)

- Avery Dennison Corporation

- CCL Industries Inc.

- DuPont

- Savi Technology Inc. (Lockheed Martin)

- SICPA Holding SA

- SML Group

- Zebra Technologies

The Anti-Counterfeit Packaging market is highly competitive, driven by the rising need for secure packaging solutions across industries such as pharmaceuticals, food and beverages, and electronics. Anti counterfeit packaging companies are focusing on advanced technologies like RFID, holograms, and tamper-evident seals to differentiate their offerings. The competition is also intensified by regional players providing cost-effective solutions tailored to local needs. Strategic partnerships and acquisitions are common as businesses seek to expand their product lines and global presence. Furthermore, stringent government regulations mandating anti-counterfeit measures are pushing companies to innovate and maintain a competitive edge in this rapidly evolving market. Moreover, the increasing global trade and e-commerce activities are further amplifying the demand for robust anti-counterfeit packaging solutions, as companies strive to protect their products from counterfeiting in an increasingly interconnected marketplace. These factors, along with the growing consumer awareness and demand for product authenticity, are expected to increase anti counterfeit packaging market revenue in the coming future.

Key Questions Answered in This Report

- 1.What was the size of the global anti-counterfeit packaging market in 2024?

- 2.What is the expected growth rate of the global anti-counterfeit packaging market during 2025-2033?

- 3.What are the key factors driving the global anti-counterfeit packaging market?

- 4.What has been the impact of COVID-19 on the global anti-counterfeit packaging market?

- 5.What is the breakup of the global anti-counterfeit packaging market based on the technology?

- 6.What is the breakup of the global anti-counterfeit packaging market based on the feature type?

- 7.What is the breakup of the global anti-counterfeit packaging market based on the end use industry?

- 8.What are the key regions in the global anti-counterfeit packaging market?

- 9.Who are the key players/companies in the global anti-counterfeit packaging market?

Table of Contents

1 Preface

2 Scope and Methodology

- 2.1 Objectives of the Study

- 2.2 Stakeholders

- 2.3 Data Sources

- 2.3.1 Primary Sources

- 2.3.2 Secondary Sources

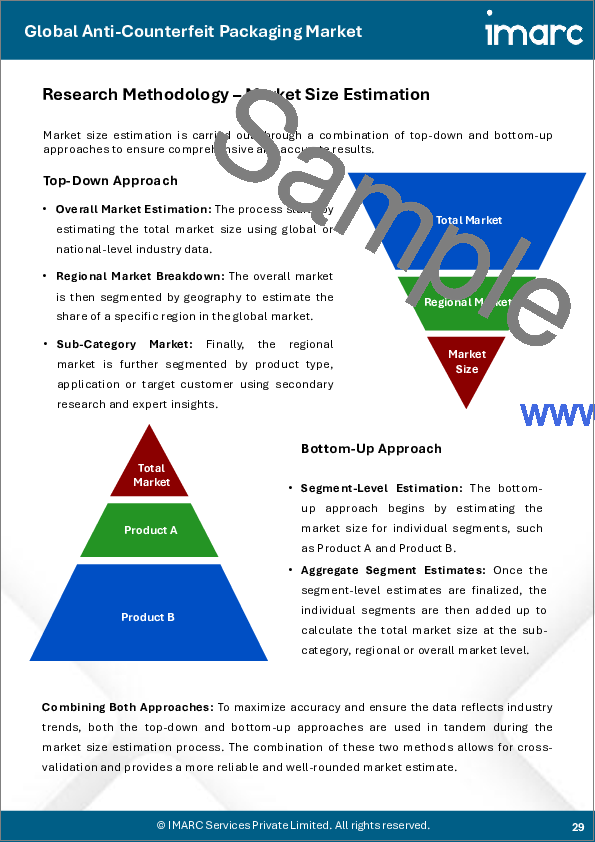

- 2.4 Market Estimation

- 2.4.1 Bottom-Up Approach

- 2.4.2 Top-Down Approach

- 2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

- 4.1 Overview

- 4.2 Key Industry Trends

5 Global Anti-Counterfeit Packaging Market

- 5.1 Market Overview

- 5.2 Market Performance

- 5.3 Impact of COVID-19

- 5.4 Market Forecast

6 Market Breakup by Technology

- 6.1 Barcodes

- 6.1.1 Market Trends

- 6.1.2 Market Forecast

- 6.2 RFID (Radio-Frequency Identification)

- 6.2.1 Market Trends

- 6.2.2 Market Forecast

- 6.3 Holograms

- 6.3.1 Market Trends

- 6.3.2 Market Forecast

- 6.4 Taggants

- 6.4.1 Market Trends

- 6.4.2 Market Forecast

- 6.5 Others

- 6.5.1 Market Trends

- 6.5.2 Market Forecast

7 Market Breakup by Feature Type

- 7.1 Overt Features

- 7.1.1 Market Trends

- 7.1.2 Market Forecast

- 7.2 Covert Features

- 7.2.1 Market Trends

- 7.2.2 Market Forecast

8 Market Breakup by End Use Industry

- 8.1 Food and Beverage

- 8.1.1 Market Trends

- 8.1.2 Market Forecast

- 8.2 Healthcare

- 8.2.1 Market Trends

- 8.2.2 Market Forecast

- 8.3 Automotive

- 8.3.1 Market Trends

- 8.3.2 Market Forecast

- 8.4 Consumer Electronics

- 8.4.1 Market Trends

- 8.4.2 Market Forecast

- 8.5 Others

- 8.5.1 Market Trends

- 8.5.2 Market Forecast

9 Market Breakup by Region

- 9.1 North America

- 9.1.1 United States

- 9.1.1.1 Market Trends

- 9.1.1.2 Market Forecast

- 9.1.2 Canada

- 9.1.2.1 Market Trends

- 9.1.2.2 Market Forecast

- 9.1.1 United States

- 9.2 Asia Pacific

- 9.2.1 China

- 9.2.1.1 Market Trends

- 9.2.1.2 Market Forecast

- 9.2.2 Japan

- 9.2.2.1 Market Trends

- 9.2.2.2 Market Forecast

- 9.2.3 India

- 9.2.3.1 Market Trends

- 9.2.3.2 Market Forecast

- 9.2.4 South Korea

- 9.2.4.1 Market Trends

- 9.2.4.2 Market Forecast

- 9.2.5 Australia

- 9.2.5.1 Market Trends

- 9.2.5.2 Market Forecast

- 9.2.6 Indonesia

- 9.2.6.1 Market Trends

- 9.2.6.2 Market Forecast

- 9.2.7 Others

- 9.2.7.1 Market Trends

- 9.2.7.2 Market Forecast

- 9.2.1 China

- 9.3 Europe

- 9.3.1 Germany

- 9.3.1.1 Market Trends

- 9.3.1.2 Market Forecast

- 9.3.2 France

- 9.3.2.1 Market Trends

- 9.3.2.2 Market Forecast

- 9.3.3 United Kingdom

- 9.3.3.1 Market Trends

- 9.3.3.2 Market Forecast

- 9.3.4 Italy

- 9.3.4.1 Market Trends

- 9.3.4.2 Market Forecast

- 9.3.5 Spain

- 9.3.5.1 Market Trends

- 9.3.5.2 Market Forecast

- 9.3.6 Russia

- 9.3.6.1 Market Trends

- 9.3.6.2 Market Forecast

- 9.3.7 Others

- 9.3.7.1 Market Trends

- 9.3.7.2 Market Forecast

- 9.3.1 Germany

- 9.4 Latin America

- 9.4.1 Brazil

- 9.4.1.1 Market Trends

- 9.4.1.2 Market Forecast

- 9.4.2 Mexico

- 9.4.2.1 Market Trends

- 9.4.2.2 Market Forecast

- 9.4.3 Others

- 9.4.3.1 Market Trends

- 9.4.3.2 Market Forecast

- 9.4.1 Brazil

- 9.5 Middle East and Africa

- 9.5.1 Market Trends

- 9.5.2 Market Breakup by Country

- 9.5.3 Market Forecast

10 SWOT Analysis

- 10.1 Overview

- 10.2 Strengths

- 10.3 Weaknesses

- 10.4 Opportunities

- 10.5 Threats

11 Value Chain Analysis

12 Porters Five Forces Analysis

- 12.1 Overview

- 12.2 Bargaining Power of Buyers

- 12.3 Bargaining Power of Suppliers

- 12.4 Degree of Competition

- 12.5 Threat of New Entrants

- 12.6 Threat of Substitutes

13 Price Analysis

14 Competitive Landscape

- 14.1 Market Structure

- 14.2 Key Players

- 14.3 Profiles of Key Players

- 14.3.1 3M Company

- 14.3.1.1 Company Overview

- 14.3.1.2 Product Portfolio

- 14.3.1.3 Financials

- 14.3.1.4 SWOT Analysis

- 14.3.2 Alpvision SA

- 14.3.2.1 Company Overview

- 14.3.2.2 Product Portfolio

- 14.3.3 Applied DNA Sciences Inc.

- 14.3.3.1 Company Overview

- 14.3.3.2 Product Portfolio

- 14.3.3.3 Financials

- 14.3.4 Authentix Inc. (Blue Water Energy LLP)

- 14.3.4.1 Company Overview

- 14.3.4.2 Product Portfolio

- 14.3.5 Avery Dennison Corporation

- 14.3.5.1 Company Overview

- 14.3.5.2 Product Portfolio

- 14.3.5.3 Financials

- 14.3.5.4 SWOT Analysis

- 14.3.6 CCL Industries Inc.

- 14.3.6.1 Company Overview

- 14.3.6.2 Product Portfolio

- 14.3.6.3 Financials

- 14.3.7 DuPont

- 14.3.7.1 Company Overview

- 14.3.7.2 Product Portfolio

- 14.3.7.3 Financials

- 14.3.8 Savi Technology Inc. (Lockheed Martin)

- 14.3.8.1 Company Overview

- 14.3.8.2 Product Portfolio

- 14.3.9 SICPA Holding SA

- 14.3.9.1 Company Overview

- 14.3.9.2 Product Portfolio

- 14.3.10 SML Group

- 14.3.10.1 Company Overview

- 14.3.10.2 Product Portfolio

- 14.3.11 Zebra Technologies

- 14.3.11.1 Company Overview

- 14.3.11.2 Product Portfolio

- 14.3.11.3 Financials

- 14.3.11.4 SWOT Analysis

- 14.3.1 3M Company