|

|

市場調査レポート

商品コード

1722513

カーボンナノチューブ市場レポート:製品、方法、用途、地域別、2025年~2033年Carbon Nanotubes Market Report by Product, Method, Application, and Region 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| カーボンナノチューブ市場レポート:製品、方法、用途、地域別、2025年~2033年 |

|

出版日: 2025年05月01日

発行: IMARC

ページ情報: 英文 134 Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

世界のカーボンナノチューブ市場規模は2024年に66億米ドルに達しました。今後、IMARC Groupは、2033年までに市場は240億米ドルに達し、2025年から2033年にかけて15.46%の成長率(CAGR)を示すと予測しています。電子デバイスにおける導電性添加剤の製品需要の増加、航空宇宙産業や自動車産業向けの先端材料における製品用途の拡大、エネルギー貯蔵や環境修復のための持続可能なナノ材料ソリューションへの関心の高まりが、主に市場成長の原動力となっています。

カーボンナノチューブ市場分析:

- 主な市場促進要因:航空宇宙産業における著しい成長と、陰極線照明素子およびウエハー加工への多層カーボンナノチューブの広範な採用が、主に市場の成長を牽引しています。

- 主な市場動向:病気の治療や健康のモニタリングに利用されるドラッグデリバリーやバイオセンシングシステムの生産に対する製品需要の増加が、市場成長にプラスの影響を与えています。

- 競合情勢:カーボンナノチューブ市場の主要企業には、Arkema S.A.、Cabot Corporation、Carbon Solutions Inc.、Cheap Tubes Inc.、Jiangsu Cnano Technology Co.Ltd.、Kumho Petrochemical Co.Ltd.、LG Chem Ltd.(LGコーポレーション)、Nanocyl SA、OCSiAl、Ossila Ltd.、Raymor Industries Inc.、昭和電工株式会社などがあります。

- 地理的動向:報告書によると、現在アジア太平洋が世界市場を独占しています。中国がアジア太平洋におけるカーボンナノ材料の最大の生産国であり消費国です。入手可能な原材料が豊富で生産コストが低いことが、同国のカーボンナノ材料市場の成長を支えています。さらに、同地域のエレクトロニクス産業の拡大におけるCNTの広範な応用が、市場全体に明るい見通しを生み出しています。

- 課題と機会:カーボンナノチューブ市場は、高い生産コスト、拡張性の問題、環境や健康への影響に関する懸念といった課題に直面しています。しかし、継続的な研究の進歩、多様な産業における用途の拡大、エレクトロニクス、航空宇宙、エネルギー貯蔵などの分野における軽量で高性能な材料への需要の高まりなど、機会は豊富にあります。

カーボンナノチューブ市場動向:

自動車とエレクトロニクスにおける製品用途の拡大

カーボンナノチューブ(CNT)は、その卓越した機械的特性、軽量性、導電性により、自動車用途で幅広く使用されています。さらに、軽量自動車への需要の高まりもCNT市場を活性化しています。カーボンナノチューブは、ボディパネル、シャーシ部品、内装部品などの自動車部品に使用される複合材料に組み込むことができ、強度と耐久性を維持しながら全体の重量を減らすことができます。例えば、2023年8月、クレムソン大学を中心とする研究チームは、NETLとの共同研究およびホンダの支援を受け、炭素繊維、熱可塑性樹脂、および高度なコンピュータ設計を用いて、軽量な車両ドアを開発しました。このドアは、従来のスチール製ドアより32%軽く、連邦安全基準とホンダ固有の安全要件を満たすことに成功しました。このほか、カーボンナノチューブ(CNT)は、その優れた導電性と透明性により、タッチスクリーン、フレキシブルディスプレイ、プリンテッドエレクトロニクスに使用される導電性フィルムの作成に、エレクトロニクス分野で広く利用されています。さらに、スマートフォン、テレビ、ノートパソコン、タブレットなどの電子機器に対する需要の高まりも、カーボンナノチューブ市場シェアを押し上げています。例えば、2024年の世界の消費者向け電子機器市場の売上高は、1兆460億米ドルに達しています。

エネルギー分野で高まる製品需要

カーボンナノチューブ(CNT)は、その高い表面積と導電性により、主に太陽電池、燃料電池触媒、水素貯蔵などのエネルギー用途の触媒担体として注目を集めています。これに伴い、再生可能な電力容量を拡大するため、さまざまな国で再生可能な電力技術への投資が増加しており、カーボンナノチューブ市場の見通しにプラスの影響を与えています。例えば中国は、風力発電と太陽光発電の補助金が段階的に廃止されているにもかかわらず、2022年から2027年にかけて世界の再生可能エネルギー発電容量のほぼ半分を新たに導入する計画です。さらに、中国の第14次5カ年計画における野心的な再生可能エネルギー目標、市場改革、地方政府の堅実な支援は、再生可能エネルギーに長期的な収益の確実性をもたらしています。同様に、欧州では2022年から2027年にかけて、再生可能エネルギー容量の拡大ペースが倍増すると予想されています。米国では、2022年 8月にIRAが可決され、自然エネルギーに対する税額控除が2032年まで延長されました。インドでも新規導入量は倍増する見込みです。これは太陽光発電が牽引しており、2030年までに500GWの再生可能エネルギーを導入するという政府の野心的な目標を達成するために実施される競合オークションが原動力となっています。持続可能な再生可能エネルギーの統合への注目の高まりが、今後数年間のカーボンナノチューブ市場の収益を促進すると予想されます。

拡大する航空宇宙産業

CNTベースの材料は、電磁干渉(EMI)に対するシールド効果が非常に高く、航空機に搭載された繊細な電子システムを外部の電磁放射線から保護する上で極めて重要です。これに加えて、CNTは航空宇宙用途で使用される複合材料を補強し、剛性、強度、耐久性などの機械的特性を向上させることができる一方、軽量性も維持することができます。さらに、拡大する航空宇宙産業と世界中で増加する航空宇宙施設も、カーボンナノチューブ市場の需要を増大させています。例えば、2024年3月、イスラエル・エアロスペース・インダストリーズ(IAI)は、インドにエアロスペース・サービス・インディア(ASI)と名付けた新しい航空宇宙防衛会社を設立すると発表しました。IAIによると、ASIの設立は、同グループとインド政府の国家独立促進計画との新たなレベルの協力関係を示すものだといいます。さらに、各国の政府当局は、防衛能力を強化するためのイニシアチブを取り、資金を提供しており、これが市場の成長をさらに後押ししています。例えば、インド政府は2024年3月、iDEX(ADITI)による革新的技術開発の促進(Acing Development of Innovative Technologies with iDEX)計画を開始しました。この制度は、防衛技術の研究開発・革新のために、対象となる新興企業に最大25兆ルピーの助成金を提供することで、重要かつ戦略的な防衛技術の革新を促進することを目的としています。

目次

第1章 序文

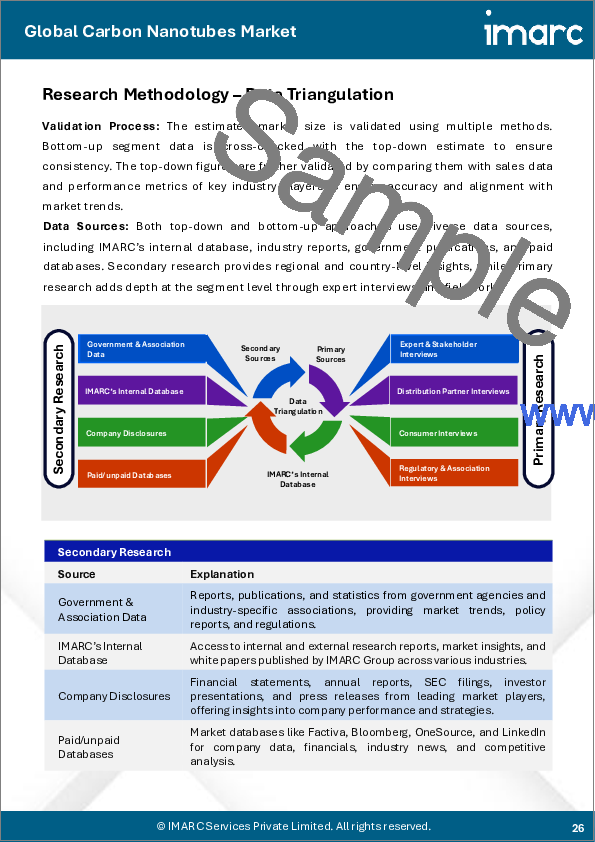

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 一次情報

- 二次情報

- 市場推定

- ボトムアップアプローチ

- トップダウンアプローチ

- 調査手法

第3章 エグゼクティブサマリー

第4章 イントロダクション

- 概要

- 主要業界動向

第5章 世界のカーボンナノチューブ市場

- 市場概要

- 市場実績

- COVID-19の影響

- 市場予測

第6章 市場内訳:製品別

- 多層カーボンナノチューブ(MWCNT)

- 単層カーボンナノチューブ(SWCNT)

第7章 市場内訳:方法別

- 化学蒸着(CVD)

- 触媒化学蒸着法(CCVD)

- 高圧一酸化炭素反応

- その他

第8章 市場内訳:用途別

- ポリマー

- 電気・電子工学

- エネルギー

- その他

第9章 市場内訳:地域別

- 北米

- 米国

- カナダ

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- インドネシア

- その他

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- ロシア

- その他

- ラテンアメリカ

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- 市場内訳:国別

第10章 SWOT分析

- 概要

- 強み

- 弱み

- 機会

- 脅威

第11章 バリューチェーン分析

第12章 ポーターのファイブフォース分析

- 概要

- 買い手の交渉力

- 供給企業の交渉力

- 競合の程度

- 新規参入業者の脅威

- 代替品の脅威

第13章 価格分析

第14章 競合情勢

- 市場構造

- 主要企業

- 主要企業のプロファイル

- Arkema S.A

- Cabot Corporation

- Carbon Solutions Inc.

- Cheap Tubes Inc.

- Jiangsu Cnano Technology Co. Ltd.

- Kumho Petrochemical Co. Ltd.

- LG Chem Ltd.(LG Corporation)

- Nanocyl SA

- OCSiAl

- Ossila Ltd.

- Raymor Industries Inc.

- Showa Denko K.K.

List of Figures

- Figure 1: Global: Carbon Nanotubes Market: Major Drivers and Challenges

- Figure 2: Global: Carbon Nanotubes Market: Sales Value (in Billion USD), 2019-2024

- Figure 3: Global: Carbon Nanotubes Market Forecast: Sales Value (in Billion USD), 2025-2033

- Figure 4: Global: Carbon Nanotubes Market: Breakup by Product (in %), 2024

- Figure 5: Global: Carbon Nanotubes Market: Breakup by Method (in %), 2024

- Figure 6: Global: Carbon Nanotubes Market: Breakup by Application (in %), 2024

- Figure 7: Global: Carbon Nanotubes Market: Breakup by Region (in %), 2024

- Figure 8: Global: Carbon Nanotubes (Multi Walled Carbon Nanotubes-MWCNT) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 9: Global: Carbon Nanotubes (Multi Walled Carbon Nanotubes-MWCNT) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 10: Global: Carbon Nanotubes (Single Walled Carbon Nanotubes-SWCNT) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 11: Global: Carbon Nanotubes (Single Walled Carbon Nanotubes-SWCNT) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 12: Global: Carbon Nanotubes (Chemical Vapor Deposition-CVD) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 13: Global: Carbon Nanotubes (Chemical Vapor Deposition-CVD) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 14: Global: Carbon Nanotubes (Catalytic Chemical Vapor Deposition-CCVD) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 15: Global: Carbon Nanotubes (Catalytic Chemical Vapor Deposition-CCVD) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 16: Global: Carbon Nanotubes (High-Pressure Carbon Monoxide Reaction) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 17: Global: Carbon Nanotubes (High-Pressure Carbon Monoxide Reaction) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 18: Global: Carbon Nanotubes (Other Methods) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 19: Global: Carbon Nanotubes (Other Methods) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 20: Global: Carbon Nanotubes (Polymers) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 21: Global: Carbon Nanotubes (Polymers) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 22: Global: Carbon Nanotubes (Electrical and Electronics) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 23: Global: Carbon Nanotubes (Electrical and Electronics) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 24: Global: Carbon Nanotubes (Energy) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 25: Global: Carbon Nanotubes (Energy) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 26: Global: Carbon Nanotubes (Other Applications) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 27: Global: Carbon Nanotubes (Other Applications) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 28: North America: Carbon Nanotubes Market: Sales Value (in Million USD), 2019 & 2024

- Figure 29: North America: Carbon Nanotubes Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 30: United States: Carbon Nanotubes Market: Sales Value (in Million USD), 2019 & 2024

- Figure 31: United States: Carbon Nanotubes Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 32: Canada: Carbon Nanotubes Market: Sales Value (in Million USD), 2019 & 2024

- Figure 33: Canada: Carbon Nanotubes Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 34: Asia-Pacific: Carbon Nanotubes Market: Sales Value (in Million USD), 2019 & 2024

- Figure 35: Asia-Pacific: Carbon Nanotubes Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 36: China: Carbon Nanotubes Market: Sales Value (in Million USD), 2019 & 2024

- Figure 37: China: Carbon Nanotubes Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 38: Japan: Carbon Nanotubes Market: Sales Value (in Million USD), 2019 & 2024

- Figure 39: Japan: Carbon Nanotubes Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 40: India: Carbon Nanotubes Market: Sales Value (in Million USD), 2019 & 2024

- Figure 41: India: Carbon Nanotubes Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 42: South Korea: Carbon Nanotubes Market: Sales Value (in Million USD), 2019 & 2024

- Figure 43: South Korea: Carbon Nanotubes Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 44: Australia: Carbon Nanotubes Market: Sales Value (in Million USD), 2019 & 2024

- Figure 45: Australia: Carbon Nanotubes Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 46: Indonesia: Carbon Nanotubes Market: Sales Value (in Million USD), 2019 & 2024

- Figure 47: Indonesia: Carbon Nanotubes Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 48: Others: Carbon Nanotubes Market: Sales Value (in Million USD), 2019 & 2024

- Figure 49: Others: Carbon Nanotubes Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 50: Europe: Carbon Nanotubes Market: Sales Value (in Million USD), 2019 & 2024

- Figure 51: Europe: Carbon Nanotubes Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 52: Germany: Carbon Nanotubes Market: Sales Value (in Million USD), 2019 & 2024

- Figure 53: Germany: Carbon Nanotubes Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 54: France: Carbon Nanotubes Market: Sales Value (in Million USD), 2019 & 2024

- Figure 55: France: Carbon Nanotubes Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 56: United Kingdom: Carbon Nanotubes Market: Sales Value (in Million USD), 2019 & 2024

- Figure 57: United Kingdom: Carbon Nanotubes Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 58: Italy: Carbon Nanotubes Market: Sales Value (in Million USD), 2019 & 2024

- Figure 59: Italy: Carbon Nanotubes Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 60: Spain: Carbon Nanotubes Market: Sales Value (in Million USD), 2019 & 2024

- Figure 61: Spain: Carbon Nanotubes Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 62: Russia: Carbon Nanotubes Market: Sales Value (in Million USD), 2019 & 2024

- Figure 63: Russia: Carbon Nanotubes Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 64: Others: Carbon Nanotubes Market: Sales Value (in Million USD), 2019 & 2024

- Figure 65: Others: Carbon Nanotubes Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 66: Latin America: Carbon Nanotubes Market: Sales Value (in Million USD), 2019 & 2024

- Figure 67: Latin America: Carbon Nanotubes Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 68: Brazil: Carbon Nanotubes Market: Sales Value (in Million USD), 2019 & 2024

- Figure 69: Brazil: Carbon Nanotubes Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 70: Mexico: Carbon Nanotubes Market: Sales Value (in Million USD), 2019 & 2024

- Figure 71: Mexico: Carbon Nanotubes Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 72: Others: Carbon Nanotubes Market: Sales Value (in Million USD), 2019 & 2024

- Figure 73: Others: Carbon Nanotubes Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 74: Middle East and Africa: Carbon Nanotubes Market: Sales Value (in Million USD), 2019 & 2024

- Figure 75: Middle East and Africa: Carbon Nanotubes Market: Breakup by Country (in %), 2024

- Figure 76: Middle East and Africa: Carbon Nanotubes Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 77: Global: Carbon Nanotubes Industry: SWOT Analysis

- Figure 78: Global: Carbon Nanotubes Industry: Value Chain Analysis

- Figure 79: Global: Carbon Nanotubes Industry: Porter's Five Forces Analysis

List of Tables

- Table 1: Global: Carbon Nanotubes Market: Key Industry Highlights, 2024 and 2033

- Table 2: Global: Carbon Nanotubes Market Forecast: Breakup by Product (in Million USD), 2025-2033

- Table 3: Global: Carbon Nanotubes Market Forecast: Breakup by Method (in Million USD), 2025-2033

- Table 4: Global: Carbon Nanotubes Market Forecast: Breakup by Application (in Million USD), 2025-2033

- Table 5: Global: Carbon Nanotubes Market Forecast: Breakup by Region (in Million USD), 2025-2033

- Table 6: Global: Carbon Nanotubes Market: Competitive Structure

- Table 7: Global: Carbon Nanotubes Market: Key Players

The global carbon nanotubes market size reached USD 6.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 24.0 Billion by 2033, exhibiting a growth rate (CAGR) of 15.46% during 2025-2033. The increasing product demand for conductive additives in electronic devices, growing product applications in advanced materials for aerospace and automotive industries, and rising interest in sustainable nanomaterial solutions for energy storage and environmental remediation, are primarily driving the market growth.

Carbon Nanotubes Market Analysis:

- Major Market Drivers: Significant growth in the aerospace industry and the widespread adoption of multi-walled carbon nanotubes for cathode-ray lighting elements and wafer processing are primarily driving the growth of the market.

- Key Market Trends: The increasing product demand for the production of drug delivery and biosensing systems that are utilized for the treatment of diseases and monitoring health is positively impacting the market growth.

- Competitive Landscape: Some of the leading carbon nanotubes market companies are Arkema S.A, Cabot Corporation, Carbon Solutions Inc., Cheap Tubes Inc., Jiangsu Cnano Technology Co. Ltd., Kumho Petrochemical Co. Ltd., LG Chem Ltd. (LG Corporation), Nanocyl SA, OCSiAl, Ossila Ltd., Raymor Industries Inc., and Showa Denko K.K., among others.

- Geographical Trends: According to the report, Asia-Pacific currently dominates the global market. China is the largest producer and consumer of carbon nanomaterials in Asia-Pacific. The abundance of available raw materials and the low cost of production supported the growth of the carbon nanomaterials market in the country. Moreover, the extensive application of CNT in expanding the electronics industry in the region is creating a positive outlook for the overall market.

- Challenges and Opportunities: The carbon nanotubes market faces challenges such as high production costs, scalability issues, and concerns regarding environmental and health impacts. However, opportunities abound with ongoing research advancements, expanding applications in diverse industries, and increasing demand for lightweight, high-performance materials in areas like electronics, aerospace, and energy storage.

Carbon Nanotubes Market Trends:

Increasing Product Application in Automotives and Electronics

Carbon nanotubes (CNTs) are finding extensive use in automotive applications due to their exceptional mechanical properties, lightweight nature, and electrical conductivity. Moreover, the escalating demand for lightweight vehicles is also catalyzing the market for CNTs. Carbon nanotubes can be incorporated into composites used for vehicle parts such as body panels, chassis components, and interior parts, reducing overall weight while maintaining strength and durability. For instance, in August 2023, a research team led by Clemson University, in collaboration with NETL and with support from Honda, developed a lightweight vehicle door using carbon fiber, thermoplastic resin, and advanced computer design. This door is 32% lighter than a conventional steel door and successfully meets federal safety standards and Honda's specific safety requirements. Besides this, carbon nanotubes (CNTs) are extensively being utilized in electronics for creating conductive films used in touchscreens, flexible displays, and printed electronics due to their excellent electrical conductivity and transparency. Additionally, the rising demand for electronic gadgets, such as smartphones, televisions, laptops, tablets, etc., is also propelling the carbon nanotubes market share. For instance, in 2024, the revenue generated in the consumer electronics market worldwide amounted to a staggering US$ 1,046.0 Billion.

Growing Product Demand in the Energy Sector

Carbon nanotubes (CNTs) are gaining much attention as catalyst support for energy applications, primarily solar cells, fuel cell catalysts, and hydrogen storage, owing to their high surface area and conductivity. In line with this, various countries are increasingly investing in renewable power technologies to expand renewable power capacities, which is positively impacting the carbon nanotubes market outlook. For instance, China is planning to install almost half of the new global renewable power capacity over 2022-2027, despite the phase-out of wind and solar PV subsidies. Moreover, China's ambitious renewable energy targets in the 14th Five-Year Plan, market reforms, and solid provincial government support provide long-term revenue certainty for renewables. Similarly, the pace of renewable capacity expansion in Europe is expected to be double during 2022-2027. In the United States, the IRA was passed in August 2022 and extended tax credits for renewables until 2032, providing unprecedented long-term visibility for wind and solar PV projects. In India, new installations are also set to double. This is led by solar PV and driven by competitive auctions implemented to achieve the government's ambitious target of 500 GW of renewable power by 2030. The increasing focus on integrating sustainable and renewable energy is anticipated to propel the carbon nanotubes market revenue in the coming years.

Expanding Aerospace Industry

CNT-based materials are highly effective at shielding against electromagnetic interference (EMI), which is crucial for protecting sensitive electronic systems onboard aircraft from external electromagnetic radiation. In addition to this, CNTs can reinforce composite materials used in aerospace applications, enhancing their mechanical properties such as stiffness, strength, and durability while maintaining a low-weight profile. Furthermore, the expanding aerospace industry and the increasing number of aerospace facilities across the globe are also augmenting carbon nanotubes market demand. For instance, in March 2024, Israel Aerospace Industries (IAI) announced that they would be establishing a new aerospace defense company in India, named Aerospace Service India (ASI). IAI said the establishment of ASI demonstrated new levels of collaboration between the group and the Indian government's plans to promote national independence. Moreover, the government authorities of various nations are taking initiatives and providing funds to bolster defense capabilities, which is further bolstering the market growth. For instance, in March 2024, the Indian government launched the Acing Development of Innovative Technologies with iDEX (ADITI) scheme. This scheme aims to promote innovation in critical and strategic defense technologies by providing grants of up to Rs 25 crore to eligible start-ups for research, development, and innovation endeavors in defense technology.

Global Carbon Nanotubes Market Segmentation:

Breakup by Product:

- Multi Walled Carbon Nanotubes (MWCNT)

- Single Walled Carbon Nanotubes (SWCNT)

Multi Walled Carbon Nanotubes (MWCNT) holds the majority of the total market share

Multi-walled carbon nanotubes (MWCNTs) consist of several concentric layers of graphene rolled up to form a tube-like structure. Their unique architecture imparts exceptional mechanical strength, electrical conductivity, and thermal properties. MWCNTs find diverse applications in fields such as aerospace, electronics, materials science, and biotechnology due to their versatility and performance characteristics. Moreover, carbon nanotubes market statistics by IMARC indicate that the expanding automotive, electronics, and aerospace industries are bolstering the market for multi-walled carbon nanotubes. For instance, in January 2023, MG Motor India announced a US$ 100 Million investment to expand capacity. Similarly, in December 2022, Mahindra & Mahindra revealed plans to invest INR 10,000 crore (US$ 1.2 Billion) in an EV manufacturing plant in Pune, India. This investment emphasizes the growing significance of the EV sector. Furthermore, compared to single-walled carbon nanotubes (SWCNTs), MWCNTs often exhibit higher tensile strength and thermal stability, making them suitable for demanding applications requiring robust materials. Their multi-layered structure allows for tailored properties and functionality, offering versatility in engineering novel nanomaterial-based solutions. As a result, their increasing adoption is anticipated to propel the carbon nanotubes market's recent price in the coming years.

Breakup by Method:

- Chemical Vapor Deposition (CVD)

- Catalytic Chemical Vapor Deposition (CCVD)

- High-Pressure Carbon Monoxide Reaction

- Others

Chemical Vapor Deposition (CVD) method currently exhibits a clear dominance in the market

Chemical Vapor Deposition (CVD) is a method used to synthesize carbon nanotubes (CNTs) by introducing carbon-containing gases into a reaction chamber at high temperatures. The gases decompose, and carbon atoms precipitate onto a substrate, forming nanotubes. CVD offers control over CNT characteristics such as diameter, length, and alignment, making it a versatile and widely used technique in nanomaterials synthesis.

Breakup by Application:

- Polymers

- Electrical and Electronics

- Energy

- Others

Polymers account for the largest market share

Carbon nanotubes (CNTs) are utilized in polymers to enhance their mechanical, electrical, and thermal properties. They act as reinforcing agents, improving the strength, stiffness, and toughness of polymer composites. Additionally, CNTs can impart electrical conductivity to polymers, enabling the development of conductive plastics for applications such as flexible electronics and electromagnetic interference shielding. Their high thermal conductivity makes them suitable for enhancing the thermal properties of polymers in applications like heat dissipation materials and flame retardants.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia-Pacific currently dominates the global market

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia-Pacific currently dominates the global market.

The carbon nanotubes market overview by IMARC indicates that China is the largest producer and consumer of carbon nanomaterials in Asia-Pacific. The abundance of available raw materials and the low cost of production supported the growth of the carbon nanomaterials market in the country. Moreover, the extensive application of CNT in expanding the electronics industry across APAC countries like China and India is creating a positive outlook for the overall market. For instance, the Indian government is talking with prominent semiconductor companies to set up local manufacturing units. The government invited new applications for setting up Semiconductor Fabs and Display Fabs in India from June 2023 under the Modified Semicon India Programme with an outlay of INR 76,000 crore. Similarly, according to a report by the Japan Automobile Manufacturers Association (JAMA), the country produced 7,427,179 units of passenger cars and 1,286,414 units of trucks in 2022. All these factors are anticipated to positively impact the CNT market over the coming years.

Competitive Landscape:

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Arkema S.A

- Cabot Corporation

- Carbon Solutions Inc.

- Cheap Tubes Inc.

- Jiangsu Cnano Technology Co. Ltd.

- Kumho Petrochemical Co. Ltd.

- LG Chem Ltd. (LG Corporation)

- Nanocyl SA

- OCSiAl

- Ossila Ltd.

- Raymor Industries Inc.

- Showa Denko K.K.

Key Questions Answered in This Report

- 1.What was the size of the global carbon nanotubes market in 2024?

- 2.What is the expected growth rate of the global carbon nanotubes market during 2025-2033?

- 3.What are the key factors driving the global carbon nanotubes market?

- 4.What has been the impact of COVID-19 on the global carbon nanotubes market?

- 5.What is the breakup of the global carbon nanotubes market based on the product?

- 6.What is the breakup of the global carbon nanotubes market based on the method?

- 7.What is the breakup of the global carbon nanotubes market based on the application?

- 8.What are the key regions in the global carbon nanotubes market?

- 9.Who are the key players/companies in the global carbon nanotubes market?

Table of Contents

1 Preface

2 Scope and Methodology

- 2.1 Objectives of the Study

- 2.2 Stakeholders

- 2.3 Data Sources

- 2.3.1 Primary Sources

- 2.3.2 Secondary Sources

- 2.4 Market Estimation

- 2.4.1 Bottom-Up Approach

- 2.4.2 Top-Down Approach

- 2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

- 4.1 Overview

- 4.2 Key Industry Trends

5 Global Carbon Nanotubes Market

- 5.1 Market Overview

- 5.2 Market Performance

- 5.3 Impact of COVID-19

- 5.4 Market Forecast

6 Market Breakup by Product

- 6.1 Multi Walled Carbon Nanotubes (MWCNT)

- 6.1.1 Market Trends

- 6.1.2 Market Forecast

- 6.2 Single Walled Carbon Nanotubes (SWCNT)

- 6.2.1 Market Trends

- 6.2.2 Market Forecast

7 Market Breakup by Method

- 7.1 Chemical Vapor Deposition (CVD)

- 7.1.1 Market Trends

- 7.1.2 Market Forecast

- 7.2 Catalytic Chemical Vapor Deposition (CCVD)

- 7.2.1 Market Trends

- 7.2.2 Market Forecast

- 7.3 High-Pressure Carbon Monoxide Reaction

- 7.3.1 Market Trends

- 7.3.2 Market Forecast

- 7.4 Others

- 7.4.1 Market Trends

- 7.4.2 Market Forecast

8 Market Breakup by Application

- 8.1 Polymers

- 8.1.1 Market Trends

- 8.1.2 Market Forecast

- 8.2 Electrical and Electronics

- 8.2.1 Market Trends

- 8.2.2 Market Forecast

- 8.3 Energy

- 8.3.1 Market Trends

- 8.3.2 Market Forecast

- 8.4 Others

- 8.4.1 Market Trends

- 8.4.2 Market Forecast

9 Market Breakup by Region

- 9.1 North America

- 9.1.1 United States

- 9.1.1.1 Market Trends

- 9.1.1.2 Market Forecast

- 9.1.2 Canada

- 9.1.2.1 Market Trends

- 9.1.2.2 Market Forecast

- 9.1.1 United States

- 9.2 Asia-Pacific

- 9.2.1 China

- 9.2.1.1 Market Trends

- 9.2.1.2 Market Forecast

- 9.2.2 Japan

- 9.2.2.1 Market Trends

- 9.2.2.2 Market Forecast

- 9.2.3 India

- 9.2.3.1 Market Trends

- 9.2.3.2 Market Forecast

- 9.2.4 South Korea

- 9.2.4.1 Market Trends

- 9.2.4.2 Market Forecast

- 9.2.5 Australia

- 9.2.5.1 Market Trends

- 9.2.5.2 Market Forecast

- 9.2.6 Indonesia

- 9.2.6.1 Market Trends

- 9.2.6.2 Market Forecast

- 9.2.7 Others

- 9.2.7.1 Market Trends

- 9.2.7.2 Market Forecast

- 9.2.1 China

- 9.3 Europe

- 9.3.1 Germany

- 9.3.1.1 Market Trends

- 9.3.1.2 Market Forecast

- 9.3.2 France

- 9.3.2.1 Market Trends

- 9.3.2.2 Market Forecast

- 9.3.3 United Kingdom

- 9.3.3.1 Market Trends

- 9.3.3.2 Market Forecast

- 9.3.4 Italy

- 9.3.4.1 Market Trends

- 9.3.4.2 Market Forecast

- 9.3.5 Spain

- 9.3.5.1 Market Trends

- 9.3.5.2 Market Forecast

- 9.3.6 Russia

- 9.3.6.1 Market Trends

- 9.3.6.2 Market Forecast

- 9.3.7 Others

- 9.3.7.1 Market Trends

- 9.3.7.2 Market Forecast

- 9.3.1 Germany

- 9.4 Latin America

- 9.4.1 Brazil

- 9.4.1.1 Market Trends

- 9.4.1.2 Market Forecast

- 9.4.2 Mexico

- 9.4.2.1 Market Trends

- 9.4.2.2 Market Forecast

- 9.4.3 Others

- 9.4.3.1 Market Trends

- 9.4.3.2 Market Forecast

- 9.4.1 Brazil

- 9.5 Middle East and Africa

- 9.5.1 Market Trends

- 9.5.2 Market Breakup by Country

- 9.5.3 Market Forecast

10 SWOT Analysis

- 10.1 Overview

- 10.2 Strengths

- 10.3 Weaknesses

- 10.4 Opportunities

- 10.5 Threats

11 Value Chain Analysis

12 Porters Five Forces Analysis

- 12.1 Overview

- 12.2 Bargaining Power of Buyers

- 12.3 Bargaining Power of Suppliers

- 12.4 Degree of Competition

- 12.5 Threat of New Entrants

- 12.6 Threat of Substitutes

13 Price Analysis

14 Competitive Landscape

- 14.1 Market Structure

- 14.2 Key Players

- 14.3 Profiles of Key Players

- 14.3.1 Arkema S.A

- 14.3.1.1 Company Overview

- 14.3.1.2 Product Portfolio

- 14.3.1.3 Financials

- 14.3.1.4 SWOT Analysis

- 14.3.2 Cabot Corporation

- 14.3.2.1 Company Overview

- 14.3.2.2 Product Portfolio

- 14.3.2.3 Financials

- 14.3.2.4 SWOT Analysis

- 14.3.3 Carbon Solutions Inc.

- 14.3.3.1 Company Overview

- 14.3.3.2 Product Portfolio

- 14.3.4 Cheap Tubes Inc.

- 14.3.4.1 Company Overview

- 14.3.4.2 Product Portfolio

- 14.3.5 Jiangsu Cnano Technology Co. Ltd.

- 14.3.5.1 Company Overview

- 14.3.5.2 Product Portfolio

- 14.3.6 Kumho Petrochemical Co. Ltd.

- 14.3.6.1 Company Overview

- 14.3.6.2 Product Portfolio

- 14.3.6.3 Financials

- 14.3.6.4 SWOT Analysis

- 14.3.7 LG Chem Ltd. (LG Corporation)

- 14.3.7.1 Company Overview

- 14.3.7.2 Product Portfolio

- 14.3.7.3 Financials

- 14.3.7.4 SWOT Analysis

- 14.3.8 Nanocyl SA

- 14.3.8.1 Company Overview

- 14.3.8.2 Product Portfolio

- 14.3.9 OCSiAl

- 14.3.9.1 Company Overview

- 14.3.9.2 Product Portfolio

- 14.3.10 Ossila Ltd.

- 14.3.10.1 Company Overview

- 14.3.10.2 Product Portfolio

- 14.3.11 Raymor Industries Inc.

- 14.3.11.1 Company Overview

- 14.3.11.2 Product Portfolio

- 14.3.12 Showa Denko K.K.

- 14.3.12.1 Company Overview

- 14.3.12.2 Product Portfolio

- 14.3.12.3 Financials

- 14.3.12.4 SWOT Analysis

- 14.3.1 Arkema S.A