|

|

市場調査レポート

商品コード

1702275

塗料・コーティングの市場規模、シェア、動向、予測:製品、材料、用途、地域別、2025年~2033年Paints and Coatings Market Size, Share, Trends and Forecast by Product, Material, Application, and Region, 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| 塗料・コーティングの市場規模、シェア、動向、予測:製品、材料、用途、地域別、2025年~2033年 |

|

出版日: 2025年04月01日

発行: IMARC

ページ情報: 英文 145 Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

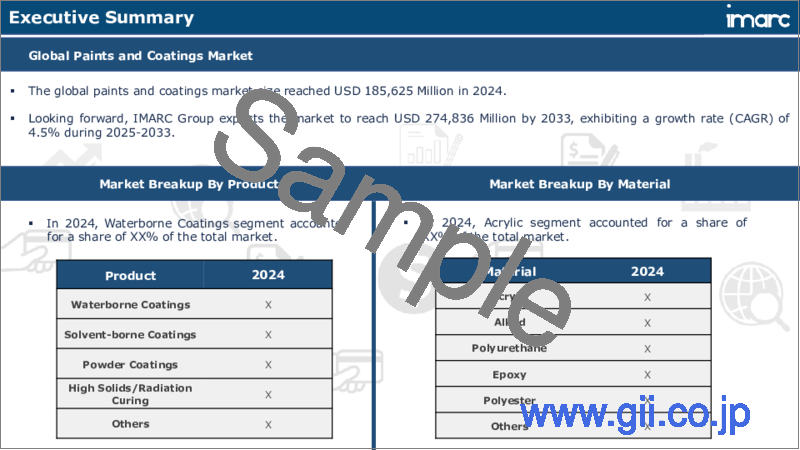

塗料・コーティングの世界市場規模は、2024年に1,856億米ドルとなりました。今後、IMARC Groupは、2033年には2,748億米ドルに達し、2025年から2033年にかけて4.5%のCAGRを示すと予測しています。現在、アジア太平洋地域が市場を独占しており、2024年の市場シェアは34.8%を超えます。同市場は、環境影響に対する意識の高まりと厳しい規制、新興国を中心とした世界の都市化と工業化の進展、建設産業と自動車産業の著しい成長によって、着実な成長を遂げています。

塗料・コーティングの市場分析:

市場の成長と規模:市場は、建設産業と自動車産業の拡大に後押しされ、力強い成長を遂げています。世界の市場規模は拡大傾向にあり、さまざまな分野での需要増加により、今後も拡大傾向が続くと予測されます。

技術の進歩:市場は、環境に優しく高性能な製品の開発など、著しい技術革新を目の当たりにしています。ナノコーティング、UV硬化型コーティング、水系コーティングの進歩は、耐久性、効率性、環境持続性において新たな基準を打ち立てています。

業界の用途塗料やコーティング剤は、建設、自動車、航空宇宙、海洋など、さまざまな産業で使用されています。建築分野では保護と美観の両方の機能を果たし、自動車と航空宇宙分野では耐久性と耐食性を高めるために重要です。

主な市場動向:主な動向は、規制の変化と消費者の意識に後押しされた、環境に優しい製品へのシフトです。グリーンコーティングやVOC排出量の少ない製品への需要は増加傾向にあり、メーカーの研究開発努力に影響を与えています。

地理的動向:中国やインドなどのアジア太平洋地域の新興国は、急速な工業化と都市化により大きな成長を示しています。北米や欧州などの開発地域は、技術革新と環境規制の面でリードし続けています。

競合情勢:市場は適度に断片化されており、主要企業は技術革新、事業拡大、M&Aに注力しています。各社は、製品の品質、持続可能性、世界の環境基準への準拠を競うようになっています。

課題と機会:業界は、原材料コストの変動や厳しい環境規制といった課題に直面しています。しかし、こうした課題は、多様で環境意識の高い消費者層の変化するニーズに応え、費用対効果が高く、環境に優しい製品ラインを革新する機会にもなります。

塗料・コーティングの市場動向:

建設および自動車産業における需要の増加

同市場は、建設業界と自動車業界の著しい成長の影響を大きく受けています。建築分野では、保護と美観の両方の目的に不可欠であり、住宅、商業、工業の需要に対応しています。さらに、環境にやさしく耐久性のあるオプションなど、配合の革新は、建設資材における持続可能性と長寿命の重視の高まりと一致しています。同様に、自動車業界では、車両の外観、耐久性、耐食性を向上させる高度なコーティング・ソリューションが常に求められています。これとともに、UV硬化型塗料や水系塗料などの新技術の開発は、より効率的で環境に優しい選択肢を提供することで、この需要をさらに促進しています。このようなダイナミックな産業との共生関係は、変化するニーズや技術の進歩に適応しながら、安定した市場需要を保証しています。

技術革新と製品の進歩

技術の進歩は、業界の極めて重要な原動力です。この要因には、環境の持続可能性の向上、耐久性の強化、美的品質の向上など、特定の要件を満たす新素材や配合の開発が含まれます。さらに、ナノコーティング、グリーンコーティング、スマートコーティングなどの技術革新が市場力学を再構築しています。これらの技術革新は、VOC排出量の削減など環境への懸念に対応し、より高い品質と機能性を求める消費者の需要の高まりに応えるものです。さらに、製造工程における技術の統合は、より効率的な生産方法、コスト削減、製品の品質安定性の向上につながります。このような製品提供の継続的な開発により、業界は規制状況や消費者の嗜好の変化に確実に対応し、成長と拡大を促進しています。

環境影響に対する意識の高まりと規制

環境規制とエコロジーへの関心の高まりが、市場を大きく形成しています。世界各国の政府は、塗料やコーティング剤に含まれる揮発性有機化合物(VOC)やその他の有害物質の使用について、より厳しい規制を実施しています。こうした規制状況を受けて、メーカーは水性塗料やバイオベース塗料など、環境に優しい製品の研究開発に投資しています。これらの製品は環境基準に適合しており、環境意識の高い消費者層の拡大にアピールしています。さらに、持続可能性への動向は、生産工程におけるリサイクルや廃棄物削減の革新につながっています。このような環境に優しい慣行へのシフトは、規制圧力への対応であり、ブランドの差別化と市場競争において極めて重要な要因になりつつあり、消費者の選択と業界動向に影響を与えています。

目次

第1章 序文

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 一次情報

- 二次情報

- 市場推定

- ボトムアップアプローチ

- トップダウンアプローチ

- 調査手法

第3章 エグゼクティブサマリー

第4章 イントロダクション

- 概要

- 主要業界動向

第5章 世界の塗料・コーティング市場

- 市場概要

- 市場実績

- COVID-19の影響

- 市場予測

第6章 市場内訳:製品別

- 水性コーティング

- 溶剤系コーティング

- 粉体塗料

- ハイソリッド/放射線硬化

- その他

第7章 市場内訳:材料別

- アクリル

- アルキド

- ポリウレタン

- エポキシ

- ポリエステル

- その他

第8章 市場内訳:用途別

- 建築と装飾

- 非建築

- 主要セグメント

- 自動車・輸送

- 木材

- 一般産業

- 海洋

- 保護

- その他

- 主要セグメント

第9章 市場内訳:地域別

- 北米

- 米国

- カナダ

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- インドネシア

- その他

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- ロシア

- その他

- ラテンアメリカ

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- 市場内訳:国別

第10章 SWOT分析

- 概要

- 強み

- 弱み

- 機会

- 脅威

第11章 バリューチェーン分析

第12章 ポーターのファイブフォース分析

- 概要

- 買い手の交渉力

- 供給企業の交渉力

- 競合の程度

- 新規参入業者の脅威

- 代替品の脅威

第13章 価格分析

第14章 競合情勢

- 市場構造

- 主要企業

- 主要企業のプロファイル

- Akzo Nobel N.V.

- Asian Paints Ltd.

- Axalta Coating Systems Ltd.

- Berger Paints India Limited

- Indigo Paints Limited

- Jotun A/S

- Kansai Paint Co. Ltd.

- National Paints Factories Co. Ltd.

- PPG Industries Inc.

- RPM International Inc.

- The Sherwin-Williams Company

- Tiger Coatings GmbH & Co. KG

List of Figures

- Figure 1: Global: Paints and Coatings Market: Major Drivers and Challenges

- Figure 2: Global: Paints and Coatings Market: Sales Value (in Billion USD), 2019-2024

- Figure 3: Global: Paints and Coatings Market Forecast: Sales Value (in Billion USD), 2025-2033

- Figure 4: Global: Paints and Coatings Market: Breakup by Product (in %), 2024

- Figure 5: Global: Paints and Coatings Market: Breakup by Material (in %), 2024

- Figure 6: Global: Paints and Coatings Market: Breakup by Application (in %), 2024

- Figure 7: Global: Paints and Coatings Market: Breakup by Region (in %), 2024

- Figure 8: Global: Paints and Coatings (Waterborne Coatings) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 9: Global: Paints and Coatings (Waterborne Coatings) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 10: Global: Paints and Coatings (Solvent-borne Coatings) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 11: Global: Paints and Coatings (Solvent-borne Coatings) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 12: Global: Paints and Coatings (Powder Coatings) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 13: Global: Paints and Coatings (Powder Coatings) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 14: Global: Paints and Coatings (High Solids/Radiation Curing) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 15: Global: Paints and Coatings (High Solids/Radiation Curing) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 16: Global: Paints and Coatings (Other Products) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 17: Global: Paints and Coatings (Other Products) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 18: Global: Paints and Coatings (Acrylic) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 19: Global: Paints and Coatings (Acrylic) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 20: Global: Paints and Coatings (Alkyd) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 21: Global: Paints and Coatings (Alkyd) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 22: Global: Paints and Coatings (Polyurethane) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 23: Global: Paints and Coatings (Polyurethane) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 24: Global: Paints and Coatings (Epoxy) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 25: Global: Paints and Coatings (Epoxy) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 26: Global: Paints and Coatings (Polyester) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 27: Global: Paints and Coatings (Polyester) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 28: Global: Paints and Coatings (Other Materials) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 29: Global: Paints and Coatings (Other Materials) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 30: Global: Paints and Coatings (Architectural and Decorative) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 31: Global: Paints and Coatings (Architectural and Decorative) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 32: Global: Paints and Coatings (Non-Architectural) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 33: Global: Paints and Coatings (Non-Architectural) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 34: North America: Paints and Coatings Market: Sales Value (in Million USD), 2019 & 2024

- Figure 35: North America: Paints and Coatings Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 36: United States: Paints and Coatings Market: Sales Value (in Million USD), 2019 & 2024

- Figure 37: United States: Paints and Coatings Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 38: Canada: Paints and Coatings Market: Sales Value (in Million USD), 2019 & 2024

- Figure 39: Canada: Paints and Coatings Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 40: Asia-Pacific: Paints and Coatings Market: Sales Value (in Million USD), 2019 & 2024

- Figure 41: Asia-Pacific: Paints and Coatings Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 42: China: Paints and Coatings Market: Sales Value (in Million USD), 2019 & 2024

- Figure 43: China: Paints and Coatings Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 44: Japan: Paints and Coatings Market: Sales Value (in Million USD), 2019 & 2024

- Figure 45: Japan: Paints and Coatings Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 46: India: Paints and Coatings Market: Sales Value (in Million USD), 2019 & 2024

- Figure 47: India: Paints and Coatings Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 48: South Korea: Paints and Coatings Market: Sales Value (in Million USD), 2019 & 2024

- Figure 49: South Korea: Paints and Coatings Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 50: Australia: Paints and Coatings Market: Sales Value (in Million USD), 2019 & 2024

- Figure 51: Australia: Paints and Coatings Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 52: Indonesia: Paints and Coatings Market: Sales Value (in Million USD), 2019 & 2024

- Figure 53: Indonesia: Paints and Coatings Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 54: Others: Paints and Coatings Market: Sales Value (in Million USD), 2019 & 2024

- Figure 55: Others: Paints and Coatings Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 56: Europe: Paints and Coatings Market: Sales Value (in Million USD), 2019 & 2024

- Figure 57: Europe: Paints and Coatings Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 58: Germany: Paints and Coatings Market: Sales Value (in Million USD), 2019 & 2024

- Figure 59: Germany: Paints and Coatings Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 60: France: Paints and Coatings Market: Sales Value (in Million USD), 2019 & 2024

- Figure 61: France: Paints and Coatings Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 62: United Kingdom: Paints and Coatings Market: Sales Value (in Million USD), 2019 & 2024

- Figure 63: United Kingdom: Paints and Coatings Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 64: Italy: Paints and Coatings Market: Sales Value (in Million USD), 2019 & 2024

- Figure 65: Italy: Paints and Coatings Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 66: Spain: Paints and Coatings Market: Sales Value (in Million USD), 2019 & 2024

- Figure 67: Spain: Paints and Coatings Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 68: Russia: Paints and Coatings Market: Sales Value (in Million USD), 2019 & 2024

- Figure 69: Russia: Paints and Coatings Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 70: Others: Paints and Coatings Market: Sales Value (in Million USD), 2019 & 2024

- Figure 71: Others: Paints and Coatings Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 72: Latin America: Paints and Coatings Market: Sales Value (in Million USD), 2019 & 2024

- Figure 73: Latin America: Paints and Coatings Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 74: Brazil: Paints and Coatings Market: Sales Value (in Million USD), 2019 & 2024

- Figure 75: Brazil: Paints and Coatings Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 76: Mexico: Paints and Coatings Market: Sales Value (in Million USD), 2019 & 2024

- Figure 77: Mexico: Paints and Coatings Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 78: Others: Paints and Coatings Market: Sales Value (in Million USD), 2019 & 2024

- Figure 79: Others: Paints and Coatings Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 80: Middle East and Africa: Paints and Coatings Market: Sales Value (in Million USD), 2019 & 2024

- Figure 81: Middle East and Africa: Paints and Coatings Market: Breakup by Country (in %), 2024

- Figure 82: Middle East and Africa: Paints and Coatings Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 83: Global: Paints and Coatings Industry: SWOT Analysis

- Figure 84: Global: Paints and Coatings Industry: Value Chain Analysis

- Figure 85: Global: Paints and Coatings Industry: Porter's Five Forces Analysis

List of Tables

- Table 1: Global: Paints and Coatings Market: Key Industry Highlights, 2024 & 2033

- Table 2: Global: Paints and Coatings Market Forecast: Breakup by Product (in Million USD), 2025-2033

- Table 3: Global: Paints and Coatings Market Forecast: Breakup by Material (in Million USD), 2025-2033

- Table 4: Global: Paints and Coatings Market Forecast: Breakup by Application (in Million USD), 2025-2033

- Table 5: Global: Paints and Coatings Market Forecast: Breakup by Region (in Million USD), 2025-2033

- Table 6: Global: Paints and Coatings Market: Competitive Structure

- Table 7: Global: Paints and Coatings Market: Key Players

The global paints and coatings market size was valued at USD 185.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 274.8 Billion by 2033, exhibiting a CAGR of 4.5% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 34.8% in 2024. The market is experiencing steady growth driven by the increasing awareness and stringent regulations regarding environmental impact, the rising global urbanization and industrialization, particularly in emerging economies, and the significant growth in the construction and automotive industries.

Paints and Coatings Market Analysis:

Market Growth and Size: The market is experiencing robust growth, propelled by expanding construction and automotive industries. The global market size is expanding, with projections indicating a continuing upward trend due to increasing demand across various sectors.

Technological Advancements: The market is witnessing significant technological innovations, including the development of eco-friendly and high-performance products. Advances in nano coatings, UV-curable coatings, and waterborne coatings are setting new standards in durability, efficiency, and environmental sustainability.

Industry Applications: Paints and coatings have diverse applications across industries such as construction, automotive, aerospace, and marine. In construction, they serve both protective and aesthetic functions, while in automotive and aerospace, they are crucial for enhancing durability and corrosion resistance.

Key Market Trends: A major trend is the shift towards environmentally friendly products, driven by regulatory changes and consumer awareness. The demand for green coatings and products with lower VOC emissions is on the rise, influencing manufacturers' R&D efforts.

Geographical Trends: The market shows varied growth patterns geographically, with emerging economies in Asia-Pacific, such as China and India, showing significant growth due to rapid industrialization and urbanization. Developed regions such as North America and Europe continue to innovate and lead in terms of technology and environmental regulations.

Competitive Landscape: The market is moderately fragmented with key players focusing on technological innovation, expansion, and mergers and acquisitions. Companies are increasingly competing based on product quality, sustainability, and compliance with global environmental standards.

Challenges and Opportunities: The industry faces challenges such as fluctuating raw material costs and stringent environmental regulations. However, these challenges also present opportunities for innovation in cost-effective and eco-friendly product lines, meeting the changing needs of a diverse and environmentally conscious consumer base.

Paints and Coatings Market Trends:

Increasing demand in construction and automotive industries

The market is significantly influenced by the significant growth in the construction and automotive sectors. In construction, they are essential for both protective and aesthetic purposes, catering to residential, commercial, and industrial demands. Additionally, the innovation in formulations, such as eco-friendly and durable options, aligns with the growing emphasis on sustainability and longevity in construction materials. Similarly, in the automotive industry, there's a consistent need for advanced coating solutions to enhance vehicle appearance, durability, and corrosion resistance. Along with this, the development of new technologies, such as UV-curable coatings and waterborne coatings, further propels this demand by offering more efficient and environmentally friendly options. This symbiotic relationship with these dynamic industries ensures a steady market demand, adapting to changing needs and technological advancements.

Technological innovations and product advancements

Technological progress is a pivotal driver in the industry. This factor encompasses the development of new materials and formulations that meet specific requirements including improved environmental sustainability, enhanced durability, and better aesthetic qualities. In addition, innovations such as nanocoatings, green coatings, and smart coatings are reshaping market dynamics. These advancements address environmental concerns, such as reducing VOC emissions, and cater to the growing consumer demand for higher quality and functionality. Moreover, the integration of technology in manufacturing processes leads to more efficient production methods, reducing costs, and improving the quality consistency of products. This continuous development in product offerings ensures that the industry stays aligned with changing regulatory landscapes and consumer preferences, fostering growth and expansion.

Rising awareness and regulations concerning environmental impact

Environmental regulations and a growing public awareness of ecological concerns are significantly shaping the market. Governments worldwide are implementing stricter regulations on the use of volatile organic compounds (VOCs) and other harmful substances in paints and coatings. This regulatory landscape is prompting manufacturers to invest in research and development of eco-friendly products, such as water-based and bio-based coatings. These products comply with environmental standards and appeal to the growing segment of environmentally conscious consumers. Furthermore, the trend towards sustainability is leading to innovations in recycling and waste reduction in the production process. This shift towards eco-friendly practices is a response to regulatory pressures and is becoming a pivotal factor in brand differentiation and market competition, influencing consumer choices and industry trends.

Paints and Coatings Industry Segmentation:

Breakup by Product:

- Waterborne Coatings

- Solvent-borne Coatings

- Powder Coatings

- High Solids/Radiation Curing

- Others

Waterborne coatings account for the majority of the market share

Waterborne coatings, the largest segment in the market, are preferred for their lower environmental impact, as they emit fewer volatile organic compounds (VOCs) compared to solvent-borne coatings. These coatings use water as a solvent, making them more eco-friendly and easier to clean up. They are widely used in various applications, from automotive to architectural coatings, due to their versatility and improved safety profile. Additionally, the ongoing advancements in waterborne technology, such as enhanced durability and faster drying times, are further solidifying their dominance in the market.

On the other hand, solvent-borne coatings, although facing regulatory challenges due to their high VOC content, remain a significant segment of the market. These coatings are valued for their superior adhesion, resistance to harsh conditions, and smooth finish. They are predominantly used in industrial applications and specialized areas where durability and performance under extreme conditions are crucial. Manufacturers are continuously working on reformulating these coatings to reduce their environmental impact while maintaining their inherent advantages.

In addition, powder coatings are known for their environmental benefits, as they do not require solvents and produce minimal waste. This segment is gaining traction due to its cost-effectiveness, durability, and high-quality finish. These coatings are mainly used in appliances, automotive parts, and furniture. The technology is imrpoving to expand its application range, including more heat-sensitive substrates, thus broadening its market reach.

Moreover, high solids/radiation curing is marked by its rapid curing times and lower VOC emissions. These coatings are becoming increasingly popular in automotive and industrial applications where efficiency and environmental compliance are paramount. Innovations in this segment focus on improving the curing process and the development of new materials that enhance performance characteristics such as durability and resistance to external factors.

Breakup by Material:

- Acrylic

- Alkyd

- Polyurethane

- Epoxy

- Polyester

- Others

Acrylic holds the largest share of the industry

Acrylic, forming the largest segment, is favored for its exceptional color retention, durability, and resistance to weathering. These water-based coatings are versatile and can be used in a variety of applications, from architectural coatings and automotive finishes to industrial paints. Their quick drying time and low environmental impact, coupled with continuous advancements in acrylic formulations, make them a preferred choice in both residential and commercial sectors.

On the other hand, alkyd coatings are valued for their strong adhesion, robust finish, and resistance to chipping and fading. Predominantly oil-based, these coatings are widely used in industrial and architectural applications. Though challenged by environmental concerns due to VOC emissions, alkyd coatings continue to be used for their durability, especially in environments where exposure to elements is a factor.

Along with this, polyurethane coatings are known for their excellent finish, durability, and resistance to abrasion and chemicals. They are extensively used in automotive, wood, and aerospace applications. The versatility of polyurethanes, available in both water-based and solvent-based formulations, allows for a wide range of applications.

In addition, epoxy coatings are highly regarded for their strong adhesive properties, chemical resistance, and toughness. Commonly used in industrial and marine environments, these coatings are ideal for surfaces that require a durable protective layer. The market for epoxy coatings is driven by their application in heavy-duty environments and sectors demanding high-performance coatings with long-lasting protection.

Apart from this, polyester coatings are popular for their glossy finish and ability to withstand prolonged exposure to outdoor environments. These coatings are often used in automotive, industrial, and architectural applications. The segment benefits from polyester's adaptability, enabling it to be used in various formulations to achieve specific performance requirements.

Breakup by Application:

- Architectural and Decorative

- Non-Architectural

- Automotive and Transportation

- Wood

- General Industrial

- Marine

- Protective

- Others

Architectural and decorative represent the leading market segment

The architectural and decorative segment holds the largest share of the market, driven by the increasing demand in both residential and commercial construction sectors. This segment encompasses a broad range of products used for interior and exterior applications, including wall paints, wood finishes, and enamels. Along with this, the growth in this segment is fueled by the rising global construction activities, urbanization, and the growing aesthetic and protective requirements of buildings. Additionally, the trend towards eco-friendly and sustainable products is leading to innovations in water-based and low-VOC paint formulations, further providing a boost to the demand in this segment. Moreover, the versatility and continuous development of architectural coatings to meet consumer preferences and regulatory standards make this segment a key driver of the overall market.

On the contrary, the non-architectural segment covers a wide array of industrial applications, including automotive, marine, aerospace, and protective coatings for machinery and infrastructure. This segment is characterized by its demand for specialized coatings that offer high performance in terms of durability, corrosion resistance, and resistance to extreme conditions. In confluence with this, the growth in this segment is propelled by technological advancements that lead to the development of more efficient and environmentally friendly coatings. The automotive industry, in particular, is a significant contributor to this segment, with a consistent demand for coatings that provide a high-quality finish and longevity. The diverse needs of various industrial applications ensure that this segment remains an essential part of the overall market, driving innovation and growth.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest paints and coatings market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share.

The Asia Pacific region stands as the largest segment in the market, primarily driven by rapid industrialization, urbanization, and the expanding construction sector in countries such as China and India. Additionally, the region's growing automotive and manufacturing industries also contribute significantly to the demand for various types of coatings. Along with this, the increasing awareness of eco-friendly products in these markets is accelerating the adoption of waterborne and other environmentally sustainable coatings.

North America is a significant market, characterized by advanced technological innovations and stringent environmental regulations. The United States leads in the region, with a strong demand from the automotive, construction, and industrial sectors. The market in North America is also witnessing a shift towards green and sustainable coatings, driven by regulatory policies and consumer awareness. This region is known for its highly competitive landscape, with key players continually investing in R&D to develop new and advanced products.

In addition, the European market is marked by a high demand for environmentally friendly and high-performance products. The region's stringent regulations on VOC emissions and environmental protection are major drivers for innovation in sustainable coatings. Europe's well-established automotive, aerospace and marine industries significantly contribute to the market. The focus on energy-efficient buildings and the renovation of existing infrastructure also fuel the demand for architectural coatings in this region.

Apart from this, Latin America's market is growing, driven by the expansion of the construction and industrial sectors, particularly in countries such as Brazil and Mexico. The region shows potential for growth in both architectural and industrial coatings, with an increasing emphasis on sustainable and eco-friendly products.

Moreover, the market in the Middle East and Africa is expanding, with growth driven by the construction boom in the Gulf Cooperation Council (GCC) countries and increased industrial activities in African nations. Concurrently, the demand in this region is characterized by the need for high-performance coatings suitable for extreme weather conditions and industrial applications.

Leading Key Players in the Paints and Coatings Industry:

Key players in the market are actively engaging in research and development to innovate and produce more environmentally friendly and efficient products. A significant focus is on developing low-VOC, waterborne, and high-solid coatings in response to stringent environmental regulations and growing consumer demand for sustainable products. These companies are also expanding their global footprint through strategic mergers, acquisitions, and partnerships, enhancing their market presence and accessing new markets. Additionally, they are investing in advanced manufacturing technologies to improve production efficiency and reduce costs. By aligning with market trends and regulatory changes, these companies are enhancing their product portfolios and reinforcing their competitive positions in the global market.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Akzo Nobel N.V.

- Asian Paints Ltd.

- Axalta Coating Systems Ltd.

- Berger Paints India Limited

- Indigo Paints Limited

- Jotun A/S

- Kansai Paint Co. Ltd.

- National Paints Factories Co. Ltd.

- PPG Industries Inc.

- RPM International Inc.

- The Sherwin-Williams Company

- Tiger Coatings GmbH & Co. KG

Key Questions Answered in This Report

- 1.What is paints and coatings?

- 2.How big is the global paints and coatings market?

- 3.What is the expected growth rate of the global paints and coatings market during 2025-2033?

- 4.What are the key factors driving the global paints and coatings market?

- 5.What is the leading segment of the global paints and coatings market based on product?

- 6.What is the leading segment of the global paints and coatings market based on material?

- 7.What is the leading segment of the global paints and coatings market based on application?

- 8.What are the key regions in the global paints and coatings market?

- 9.Who are the key players/companies in the global paints and coatings market?

Table of Contents

1 Preface

2 Scope and Methodology

- 2.1 Objectives of the Study

- 2.2 Stakeholders

- 2.3 Data Sources

- 2.3.1 Primary Sources

- 2.3.2 Secondary Sources

- 2.4 Market Estimation

- 2.4.1 Bottom-Up Approach

- 2.4.2 Top-Down Approach

- 2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

- 4.1 Overview

- 4.2 Key Industry Trends

5 Global Paints and Coatings Market

- 5.1 Market Overview

- 5.2 Market Performance

- 5.3 Impact of COVID-19

- 5.4 Market Forecast

6 Market Breakup by Product

- 6.1 Waterborne Coatings

- 6.1.1 Market Trends

- 6.1.2 Market Forecast

- 6.2 Solvent-borne Coatings

- 6.2.1 Market Trends

- 6.2.2 Market Forecast

- 6.3 Powder Coatings

- 6.3.1 Market Trends

- 6.3.2 Market Forecast

- 6.4 High Solids/Radiation Curing

- 6.4.1 Market Trends

- 6.4.2 Market Forecast

- 6.5 Others

- 6.5.1 Market Trends

- 6.5.2 Market Forecast

7 Market Breakup by Material

- 7.1 Acrylic

- 7.1.1 Market Trends

- 7.1.2 Market Forecast

- 7.2 Alkyd

- 7.2.1 Market Trends

- 7.2.2 Market Forecast

- 7.3 Polyurethane

- 7.3.1 Market Trends

- 7.3.2 Market Forecast

- 7.4 Epoxy

- 7.4.1 Market Trends

- 7.4.2 Market Forecast

- 7.5 Polyester

- 7.5.1 Market Trends

- 7.5.2 Market Forecast

- 7.6 Others

- 7.6.1 Market Trends

- 7.6.2 Market Forecast

8 Market Breakup by Application

- 8.1 Architectural and Decorative

- 8.1.1 Market Trends

- 8.1.2 Market Forecast

- 8.2 Non-Architectural

- 8.2.1 Market Trends

- 8.2.2 Key Segments

- 8.2.2.1 Automotive and Transportation

- 8.2.2.2 Wood

- 8.2.2.3 General Industrial

- 8.2.2.4 Marine

- 8.2.2.5 Protective

- 8.2.2.6 Others

- 8.2.3 Market Forecast

9 Market Breakup by Region

- 9.1 North America

- 9.1.1 United States

- 9.1.1.1 Market Trends

- 9.1.1.2 Market Forecast

- 9.1.2 Canada

- 9.1.2.1 Market Trends

- 9.1.2.2 Market Forecast

- 9.1.1 United States

- 9.2 Asia-Pacific

- 9.2.1 China

- 9.2.1.1 Market Trends

- 9.2.1.2 Market Forecast

- 9.2.2 Japan

- 9.2.2.1 Market Trends

- 9.2.2.2 Market Forecast

- 9.2.3 India

- 9.2.3.1 Market Trends

- 9.2.3.2 Market Forecast

- 9.2.4 South Korea

- 9.2.4.1 Market Trends

- 9.2.4.2 Market Forecast

- 9.2.5 Australia

- 9.2.5.1 Market Trends

- 9.2.5.2 Market Forecast

- 9.2.6 Indonesia

- 9.2.6.1 Market Trends

- 9.2.6.2 Market Forecast

- 9.2.7 Others

- 9.2.7.1 Market Trends

- 9.2.7.2 Market Forecast

- 9.2.1 China

- 9.3 Europe

- 9.3.1 Germany

- 9.3.1.1 Market Trends

- 9.3.1.2 Market Forecast

- 9.3.2 France

- 9.3.2.1 Market Trends

- 9.3.2.2 Market Forecast

- 9.3.3 United Kingdom

- 9.3.3.1 Market Trends

- 9.3.3.2 Market Forecast

- 9.3.4 Italy

- 9.3.4.1 Market Trends

- 9.3.4.2 Market Forecast

- 9.3.5 Spain

- 9.3.5.1 Market Trends

- 9.3.5.2 Market Forecast

- 9.3.6 Russia

- 9.3.6.1 Market Trends

- 9.3.6.2 Market Forecast

- 9.3.7 Others

- 9.3.7.1 Market Trends

- 9.3.7.2 Market Forecast

- 9.3.1 Germany

- 9.4 Latin America

- 9.4.1 Brazil

- 9.4.1.1 Market Trends

- 9.4.1.2 Market Forecast

- 9.4.2 Mexico

- 9.4.2.1 Market Trends

- 9.4.2.2 Market Forecast

- 9.4.3 Others

- 9.4.3.1 Market Trends

- 9.4.3.2 Market Forecast

- 9.4.1 Brazil

- 9.5 Middle East and Africa

- 9.5.1 Market Trends

- 9.5.2 Market Breakup by Country

- 9.5.3 Market Forecast

10 SWOT Analysis

- 10.1 Overview

- 10.2 Strengths

- 10.3 Weaknesses

- 10.4 Opportunities

- 10.5 Threats

11 Value Chain Analysis

12 Porters Five Forces Analysis

- 12.1 Overview

- 12.2 Bargaining Power of Buyers

- 12.3 Bargaining Power of Suppliers

- 12.4 Degree of Competition

- 12.5 Threat of New Entrants

- 12.6 Threat of Substitutes

13 Price Analysis

14 Competitive Landscape

- 14.1 Market Structure

- 14.2 Key Players

- 14.3 Profiles of Key Players

- 14.3.1 Akzo Nobel N.V.

- 14.3.1.1 Company Overview

- 14.3.1.2 Product Portfolio

- 14.3.1.3 Financials

- 14.3.1.4 SWOT Analysis

- 14.3.2 Asian Paints Ltd.

- 14.3.2.1 Company Overview

- 14.3.2.2 Product Portfolio

- 14.3.2.3 Financials

- 14.3.3 Axalta Coating Systems Ltd.

- 14.3.3.1 Company Overview

- 14.3.3.2 Product Portfolio

- 14.3.3.3 Financials

- 14.3.3.4 SWOT Analysis

- 14.3.4 Berger Paints India Limited

- 14.3.4.1 Company Overview

- 14.3.4.2 Product Portfolio

- 14.3.4.3 Financials

- 14.3.4.4 SWOT Analysis

- 14.3.5 Indigo Paints Limited

- 14.3.5.1 Company Overview

- 14.3.5.2 Product Portfolio

- 14.3.6 Jotun A/S

- 14.3.6.1 Company Overview

- 14.3.6.2 Product Portfolio

- 14.3.6.3 SWOT Analysis

- 14.3.7 Kansai Paint Co. Ltd.

- 14.3.7.1 Company Overview

- 14.3.7.2 Product Portfolio

- 14.3.7.3 Financials

- 14.3.7.4 SWOT Analysis

- 14.3.8 National Paints Factories Co. Ltd.

- 14.3.8.1 Company Overview

- 14.3.8.2 Product Portfolio

- 14.3.9 PPG Industries Inc.

- 14.3.9.1 Company Overview

- 14.3.9.2 Product Portfolio

- 14.3.9.3 Financials

- 14.3.9.4 SWOT Analysis

- 14.3.10 RPM International Inc.

- 14.3.10.1 Company Overview

- 14.3.10.2 Product Portfolio

- 14.3.10.3 Financials

- 14.3.10.4 SWOT Analysis

- 14.3.11 The Sherwin-Williams Company

- 14.3.11.1 Company Overview

- 14.3.11.2 Product Portfolio

- 14.3.11.3 Financials

- 14.3.11.4 SWOT Analysis

- 14.3.12 Tiger Coatings GmbH & Co. KG

- 14.3.12.1 Company Overview

- 14.3.12.2 Product Portfolio

- 14.3.1 Akzo Nobel N.V.