|

|

市場調査レポート

商品コード

1636001

自動車用超音波技術市場レポート:タイプ別、車種別、用途別、地域別、2025-2033年Automotive Ultrasonic Technologies Market Report by Type, Vehicle Type, Application, and Region 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| 自動車用超音波技術市場レポート:タイプ別、車種別、用途別、地域別、2025-2033年 |

|

出版日: 2025年01月10日

発行: IMARC

ページ情報: 英文 137 Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

自動車用超音波技術の市場の世界市場規模は2024年に19億米ドルに達しました。IMARC Groupは、2025年から2033年にかけての成長率(CAGR)は6.8%で、2033年には34億米ドルに達すると予測しています。自動車の安全機能に対する需要の高まり、交通安全の重要性に対する消費者の意識の高まり、可処分所得水準の上昇が市場を牽引する主な要因のいくつかです。

自動車用超音波技術は、超音波を利用して車両周辺の物体を検出または測定する技術であり、通常は20kHz以上の周波数を持っています。自動車用超音波センサーは、音波を利用してセンサーと対象物との距離を測定するもので、駐車や操縦を補助するためにフロントバンパーやリアバンパーなど、車両のさまざまな部分に取り付けることができます。車載超音波技術は、物体の接近を検知して視覚的または聴覚的な指示を提供する駐車支援システム、衝突を回避するために速度を調整する衝突回避システム、ドライバーの死角にある車両や物体を検知する死角監視システムなどで一般的に使用されています。自動車用超音波技術は、カメラやレーダーなどの他のセンサーに比べて、柔らかい物体や不規則な形状の物体を検出することができます。また、悪天候下でも正確で信頼性の高い測定ができるなど、いくつかの利点があります。さらに、比較的安価で、メンテナンスも最小限で済みます。

自動車用超音波技術の市場傾向:

世界市場の主な原動力は、ADAS(先進運転支援システム)など、自動車の安全機能に対する需要の高まりです。この背景には、特に交通事故の多い新興諸国において、交通安全の重要性に対する消費者の意識が高まっていることがあります。これに伴い、高周波超音波センサーの導入、人工知能(AI)、モノのインターネット(IoT)など、自動車用超音波技術における数々の技術進歩が市場を後押ししています。加えて、自動車の電動化という新たな動向と、世界の自動車排出ガス削減への関心の高まりによる電気自動車(EV)の人気の高まりが、製品の普及を高めています。これに加えて、自動車に正確な距離測定を提供するための効率的な駐車支援システムや障害物検知システムに対する需要の高まりが、市場に有利な成長機会を生み出しています。その他の市場拡大要因としては、可処分所得水準の上昇、高級自律走行車の採用増加、自動車の安全機能搭載を義務付ける有利な政府規制、広範な研究開発活動などが挙げられます。

本レポートで扱う主な質問

- 世界の自動車用超音波技術の市場はこれまでどのように推移し、今後どのように推移するのか?

- 自動車用超音波技術の市場の世界市場における促進要因、抑制要因、機会は何か?

- 主要地域市場とは?

- 最も魅力的な自動車用超音波技術市場はどの国か?

- タイプ別の市場内訳は?

- 車種別の市場内訳は?

- 用途別の市場内訳は?

- 世界の自動車用超音波技術の市場の競合構造は?

- 自動車用超音波技術の市場の世界市場における主要プレイヤー/企業は?

目次

第1章 序文

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 一次情報

- 二次情報

- 市場推定

- ボトムアップアプローチ

- トップダウンアプローチ

- 調査手法

第3章 エグゼクティブサマリー

第4章 イントロダクション

- 概要

- 主要業界動向

第5章 世界の自動車用超音波技術市場

- 市場概要

- 市場実績

- COVID-19の影響

- 市場予測

第6章 市場内訳:タイプ別

- 近接検出

- 市場動向

- 市場予測

- 範囲測定

- 市場動向

- 市場予測

第7章 市場内訳:車種別

- 乗用車

- 市場動向

- 市場予測

- 小型商用車

- 市場動向

- 市場予測

- 大型商用車

- 市場動向

- 市場予測

- 電気自動車

- 市場動向

- 市場予測

第8章 市場内訳:用途別

- 駐車アシスト

- 市場動向

- 市場予測

- 死角検知

- 市場動向

- 市場予測

- その他

- 市場動向

- 市場予測

第9章 市場内訳:地域別

- 北米

- 米国

- カナダ

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- インドネシア

- その他

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- ロシア

- その他

- ラテンアメリカ

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

第10章 促進要因・抑制要因・機会

- 概要

- 促進要因

- 抑制要因

- 機会

第11章 バリューチェーン分析

第12章 ポーターのファイブフォース分析

- 概要

- 買い手の交渉力

- 供給企業の交渉力

- 競合の程度

- 新規参入業者の脅威

- 代替品の脅威

第13章 価格分析

第14章 競合情勢

- 市場構造

- 主要企業

- 主要企業のプロファイル

- Aisin Corporation

- Continental AG

- Elmos Semiconductor SE

- Hella KGaA Hueck & Co.(Faurecia SE)

- Hyundai Motor Company

- Magna International Inc.

- Murata Manufacturing Co. Ltd.

- Panasonic Holdings Corporation

- Robert Bosch GmbH

- TDK Corporation

- Texas Instruments Inc.

- Valeo

List of Figures

- Figure 1: Global: Automotive Ultrasonic Technologies Market: Major Drivers and Challenges

- Figure 2: Global: Automotive Ultrasonic Technologies Market: Sales Value (in Billion USD), 2019-2024

- Figure 3: Global: Automotive Ultrasonic Technologies Market Forecast: Sales Value (in Billion USD), 2025-2033

- Figure 4: Global: Automotive Ultrasonic Technologies Market: Breakup by Type (in %), 2024

- Figure 5: Global: Automotive Ultrasonic Technologies Market: Breakup by Vehicle Type (in %), 2024

- Figure 6: Global: Automotive Ultrasonic Technologies Market: Breakup by Application (in %), 2024

- Figure 7: Global: Automotive Ultrasonic Technologies Market: Breakup by Region (in %), 2024

- Figure 8: Global: Automotive Ultrasonic Technologies (Proximity Detection) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 9: Global: Automotive Ultrasonic Technologies (Proximity Detection) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 10: Global: Automotive Ultrasonic Technologies (Range Measurement) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 11: Global: Automotive Ultrasonic Technologies (Range Measurement) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 12: Global: Automotive Ultrasonic Technologies (Passenger Cars) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 13: Global: Automotive Ultrasonic Technologies (Passenger Cars) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 14: Global: Automotive Ultrasonic Technologies (Light Commercial Vehicles) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 15: Global: Automotive Ultrasonic Technologies (Light Commercial Vehicles) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 16: Global: Automotive Ultrasonic Technologies (Heavy Commercial Vehicles) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 17: Global: Automotive Ultrasonic Technologies (Heavy Commercial Vehicles) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 18: Global: Automotive Ultrasonic Technologies (Electric Vehicles) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 19: Global: Automotive Ultrasonic Technologies (Electric Vehicles) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 20: Global: Automotive Ultrasonic Technologies (Park Assist) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 21: Global: Automotive Ultrasonic Technologies (Park Assist) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 22: Global: Automotive Ultrasonic Technologies (Blind Spot Detection) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 23: Global: Automotive Ultrasonic Technologies (Blind Spot Detection) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 24: Global: Automotive Ultrasonic Technologies (Other Applications) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 25: Global: Automotive Ultrasonic Technologies (Other Applications) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 26: North America: Automotive Ultrasonic Technologies Market: Sales Value (in Million USD), 2019 & 2024

- Figure 27: North America: Automotive Ultrasonic Technologies Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 28: United States: Automotive Ultrasonic Technologies Market: Sales Value (in Million USD), 2019 & 2024

- Figure 29: United States: Automotive Ultrasonic Technologies Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 30: Canada: Automotive Ultrasonic Technologies Market: Sales Value (in Million USD), 2019 & 2024

- Figure 31: Canada: Automotive Ultrasonic Technologies Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 32: Asia-Pacific: Automotive Ultrasonic Technologies Market: Sales Value (in Million USD), 2019 & 2024

- Figure 33: Asia-Pacific: Automotive Ultrasonic Technologies Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 34: China: Automotive Ultrasonic Technologies Market: Sales Value (in Million USD), 2019 & 2024

- Figure 35: China: Automotive Ultrasonic Technologies Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 36: Japan: Automotive Ultrasonic Technologies Market: Sales Value (in Million USD), 2019 & 2024

- Figure 37: Japan: Automotive Ultrasonic Technologies Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 38: India: Automotive Ultrasonic Technologies Market: Sales Value (in Million USD), 2019 & 2024

- Figure 39: India: Automotive Ultrasonic Technologies Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 40: South Korea: Automotive Ultrasonic Technologies Market: Sales Value (in Million USD), 2019 & 2024

- Figure 41: South Korea: Automotive Ultrasonic Technologies Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 42: Australia: Automotive Ultrasonic Technologies Market: Sales Value (in Million USD), 2019 & 2024

- Figure 43: Australia: Automotive Ultrasonic Technologies Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 44: Indonesia: Automotive Ultrasonic Technologies Market: Sales Value (in Million USD), 2019 & 2024

- Figure 45: Indonesia: Automotive Ultrasonic Technologies Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 46: Others: Automotive Ultrasonic Technologies Market: Sales Value (in Million USD), 2019 & 2024

- Figure 47: Others: Automotive Ultrasonic Technologies Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 48: Europe: Automotive Ultrasonic Technologies Market: Sales Value (in Million USD), 2019 & 2024

- Figure 49: Europe: Automotive Ultrasonic Technologies Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 50: Germany: Automotive Ultrasonic Technologies Market: Sales Value (in Million USD), 2019 & 2024

- Figure 51: Germany: Automotive Ultrasonic Technologies Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 52: France: Automotive Ultrasonic Technologies Market: Sales Value (in Million USD), 2019 & 2024

- Figure 53: France: Automotive Ultrasonic Technologies Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 54: United Kingdom: Automotive Ultrasonic Technologies Market: Sales Value (in Million USD), 2019 & 2024

- Figure 55: United Kingdom: Automotive Ultrasonic Technologies Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 56: Italy: Automotive Ultrasonic Technologies Market: Sales Value (in Million USD), 2019 & 2024

- Figure 57: Italy: Automotive Ultrasonic Technologies Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 58: Spain: Automotive Ultrasonic Technologies Market: Sales Value (in Million USD), 2019 & 2024

- Figure 59: Spain: Automotive Ultrasonic Technologies Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 60: Russia: Automotive Ultrasonic Technologies Market: Sales Value (in Million USD), 2019 & 2024

- Figure 61: Russia: Automotive Ultrasonic Technologies Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 62: Others: Automotive Ultrasonic Technologies Market: Sales Value (in Million USD), 2019 & 2024

- Figure 63: Others: Automotive Ultrasonic Technologies Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 64: Latin America: Automotive Ultrasonic Technologies Market: Sales Value (in Million USD), 2019 & 2024

- Figure 65: Latin America: Automotive Ultrasonic Technologies Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 66: Brazil: Automotive Ultrasonic Technologies Market: Sales Value (in Million USD), 2019 & 2024

- Figure 67: Brazil: Automotive Ultrasonic Technologies Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 68: Mexico: Automotive Ultrasonic Technologies Market: Sales Value (in Million USD), 2019 & 2024

- Figure 69: Mexico: Automotive Ultrasonic Technologies Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 70: Others: Automotive Ultrasonic Technologies Market: Sales Value (in Million USD), 2019 & 2024

- Figure 71: Others: Automotive Ultrasonic Technologies Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 72: Middle East and Africa: Automotive Ultrasonic Technologies Market: Sales Value (in Million USD), 2019 & 2024

- Figure 73: Middle East and Africa: Automotive Ultrasonic Technologies Market: Breakup by Country (in %), 2024

- Figure 74: Middle East and Africa: Automotive Ultrasonic Technologies Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 75: Global: Automotive Ultrasonic Technologies Industry: Drivers, Restraints, and Opportunities

- Figure 76: Global: Automotive Ultrasonic Technologies Industry: Value Chain Analysis

- Figure 77: Global: Automotive Ultrasonic Technologies Industry: Porter's Five Forces Analysis

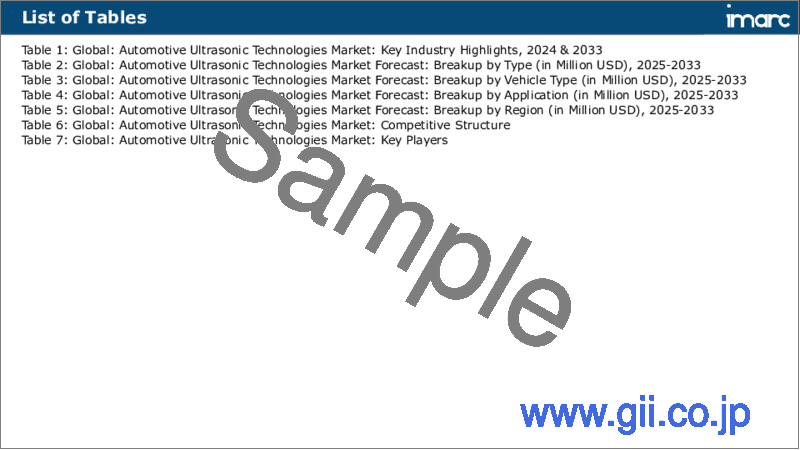

List of Tables

- Table 1: Global: Automotive Ultrasonic Technologies Market: Key Industry Highlights, 2024 & 2033

- Table 2: Global: Automotive Ultrasonic Technologies Market Forecast: Breakup by Type (in Million USD), 2025-2033

- Table 3: Global: Automotive Ultrasonic Technologies Market Forecast: Breakup by Vehicle Type (in Million USD), 2025-2033

- Table 4: Global: Automotive Ultrasonic Technologies Market Forecast: Breakup by Application (in Million USD), 2025-2033

- Table 5: Global: Automotive Ultrasonic Technologies Market Forecast: Breakup by Region (in Million USD), 2025-2033

- Table 6: Global: Automotive Ultrasonic Technologies Market: Competitive Structure

- Table 7: Global: Automotive Ultrasonic Technologies Market: Key Players

The global automotive ultrasonic technologies market size reached USD 1.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.4 Billion by 2033, exhibiting a growth rate (CAGR) of 6.8% during 2025-2033. The augmenting demand for safety features in vehicles, increasing awareness among consumers about the importance of road safety, and inflating disposable income levels represent some of the key factors driving the market.

Automotive ultrasonic technologies are techniques that use ultrasonic waves to detect or measure objects in the vicinity of a vehicle, usually having a frequency above 20 kHz. Automotive ultrasonic sensors use sound waves to measure the distance between the sensor and the object, and can be mounted on various parts of a vehicle, such as the front or rear bumper, to aid in parking and maneuvering. Automotive ultrasonic technologies are commonly used in parking assist systems to detect the proximity of objects to provide visual or auditory directions, in collision avoidance systems to adjust the speed to avoid a collision, and in blind spot monitoring systems to detect vehicles or objects in the driver's blind spot. Automotive ultrasonic technologies are able to detect soft or irregularly shaped objects as compared to other sensors, such as cameras or radar. They provide several advantages such as accurate and reliable measurements even in adverse weather conditions. In addition to this, they are relatively inexpensive and require minimal maintenance.

Automotive Ultrasonic Technologies Market Trends:

The global market is primarily driven by the augmenting demand for safety features in vehicles, such as advanced driver assistance systems (ADAS). This can be attributed to the increasing awareness among consumers about the importance of road safety, especially in developing countries with a higher prevalence of road accidents. In line with this, numerous technological advancements in the automotive ultrasonic technology, including the introduction of high-frequency ultrasonic sensors, artificial intelligence (AI) and the internet of things (IoT), is propelling the market. Additionally, the emerging trend of vehicle electrification, along with the rising popularity of electric vehicles (EVs) due to an increasing focus on reducing vehicular emissions across the globe is resulting in a higher product uptake. Besides this, the escalating demand for efficient parking assistance and obstacle detection systems for providing accurate range measurement in automobiles is creating lucrative growth opportunities in the market. Some of the other factors contributing to the market include the inflating disposable income levels, rising adoption of luxury autonomous vehicles, favorable government regulations mandating the installation of safety features in vehicles, and extensive research and development (R&D) activities.

Key Market Segmentation:

Type Insights

Proximity Detection

Range Measurement

Vehicle Type Insights

Passenger Cars

Light Commercial Vehicles

Heavy Commercial Vehicles

Electric Vehicles

Application Insights

Park Assist

Blind Spot Detection

Others

Regional Insights

North America

United States

Canada

Asia Pacific

China

Japan

India

South Korea

Australia

Indonesia

Others

Europe

Germany

France

United Kingdom

Italy

Spain

Russia

Others

Latin America

Brazil

Mexico

Others

Middle East and Africa

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific was the largest market for automotive ultrasonic technologies. Some of the factors driving the Asia Pacific automotive ultrasonic technologies market included the escalating demand for efficient parking assistance, the augmenting demand for safety features in vehicles, extensive research and development activities, etc.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global automotive ultrasonic technologies market. Competitive analysis such as market structure, market share by key players, player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the companies covered include Aisin Corporation, Continental AG, Elmos Semiconductor SE, Hella KGaA Hueck & Co. (Faurecia SE), Hyundai Motor Company, Magna International Inc., Murata Manufacturing Co. Ltd., Panasonic Holdings Corporation, Robert Bosch GmbH, TDK Corporation, Texas Instruments Inc., Valeo., etc.

Key Questions Answered in This Report:

- How has the global automotive ultrasonic technologies market performed so far and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global automotive ultrasonic technologies market?

- What are the key regional markets?

- Which countries represent the most attractive automotive ultrasonic technologies markets?

- What is the breakup of the market based on the type?

- What is the breakup of the market based on the vehicle type?

- What is the breakup of the market based on the application?

- What is the competitive structure of the global automotive ultrasonic technologies market?

- Who are the key players/companies in the global automotive ultrasonic technologies market?

Table of Contents

1 Preface

2 Scope and Methodology

- 2.1 Objectives of the Study

- 2.2 Stakeholders

- 2.3 Data Sources

- 2.3.1 Primary Sources

- 2.3.2 Secondary Sources

- 2.4 Market Estimation

- 2.4.1 Bottom-Up Approach

- 2.4.2 Top-Down Approach

- 2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

- 4.1 Overview

- 4.2 Key Industry Trends

5 Global Automotive Ultrasonic Technologies Market

- 5.1 Market Overview

- 5.2 Market Performance

- 5.3 Impact of COVID-19

- 5.4 Market Forecast

6 Market Breakup by Type

- 6.1 Proximity Detection

- 6.1.1 Market Trends

- 6.1.2 Market Forecast

- 6.2 Range Measurement

- 6.2.1 Market Trends

- 6.2.2 Market Forecast

7 Market Breakup by Vehicle Type

- 7.1 Passenger Cars

- 7.1.1 Market Trends

- 7.1.2 Market Forecast

- 7.2 Light Commercial Vehicles

- 7.2.1 Market Trends

- 7.2.2 Market Forecast

- 7.3 Heavy Commercial Vehicles

- 7.3.1 Market Trends

- 7.3.2 Market Forecast

- 7.4 Electric Vehicles

- 7.4.1 Market Trends

- 7.4.2 Market Forecast

8 Market Breakup by Application

- 8.1 Park Assist

- 8.1.1 Market Trends

- 8.1.2 Market Forecast

- 8.2 Blind Spot Detection

- 8.2.1 Market Trends

- 8.2.2 Market Forecast

- 8.3 Others

- 8.3.1 Market Trends

- 8.3.2 Market Forecast

9 Market Breakup by Region

- 9.1 North America

- 9.1.1 United States

- 9.1.1.1 Market Trends

- 9.1.1.2 Market Forecast

- 9.1.2 Canada

- 9.1.2.1 Market Trends

- 9.1.2.2 Market Forecast

- 9.1.1 United States

- 9.2 Asia-Pacific

- 9.2.1 China

- 9.2.1.1 Market Trends

- 9.2.1.2 Market Forecast

- 9.2.2 Japan

- 9.2.2.1 Market Trends

- 9.2.2.2 Market Forecast

- 9.2.3 India

- 9.2.3.1 Market Trends

- 9.2.3.2 Market Forecast

- 9.2.4 South Korea

- 9.2.4.1 Market Trends

- 9.2.4.2 Market Forecast

- 9.2.5 Australia

- 9.2.5.1 Market Trends

- 9.2.5.2 Market Forecast

- 9.2.6 Indonesia

- 9.2.6.1 Market Trends

- 9.2.6.2 Market Forecast

- 9.2.7 Others

- 9.2.7.1 Market Trends

- 9.2.7.2 Market Forecast

- 9.2.1 China

- 9.3 Europe

- 9.3.1 Germany

- 9.3.1.1 Market Trends

- 9.3.1.2 Market Forecast

- 9.3.2 France

- 9.3.2.1 Market Trends

- 9.3.2.2 Market Forecast

- 9.3.3 United Kingdom

- 9.3.3.1 Market Trends

- 9.3.3.2 Market Forecast

- 9.3.4 Italy

- 9.3.4.1 Market Trends

- 9.3.4.2 Market Forecast

- 9.3.5 Spain

- 9.3.5.1 Market Trends

- 9.3.5.2 Market Forecast

- 9.3.6 Russia

- 9.3.6.1 Market Trends

- 9.3.6.2 Market Forecast

- 9.3.7 Others

- 9.3.7.1 Market Trends

- 9.3.7.2 Market Forecast

- 9.3.1 Germany

- 9.4 Latin America

- 9.4.1 Brazil

- 9.4.1.1 Market Trends

- 9.4.1.2 Market Forecast

- 9.4.2 Mexico

- 9.4.2.1 Market Trends

- 9.4.2.2 Market Forecast

- 9.4.3 Others

- 9.4.3.1 Market Trends

- 9.4.3.2 Market Forecast

- 9.4.1 Brazil

- 9.5 Middle East and Africa

- 9.5.1 Market Trends

- 9.5.2 Market Breakup by Country

- 9.5.3 Market Forecast

10 Drivers, Restraints, and Opportunities

- 10.1 Overview

- 10.2 Drivers

- 10.3 Restraints

- 10.4 Opportunities

11 Value Chain Analysis

12 Porters Five Forces Analysis

- 12.1 Overview

- 12.2 Bargaining Power of Buyers

- 12.3 Bargaining Power of Suppliers

- 12.4 Degree of Competition

- 12.5 Threat of New Entrants

- 12.6 Threat of Substitutes

13 Price Analysis

14 Competitive Landscape

- 14.1 Market Structure

- 14.2 Key Players

- 14.3 Profiles of Key Players

- 14.3.1 Aisin Corporation

- 14.3.1.1 Company Overview

- 14.3.1.2 Product Portfolio

- 14.3.1.3 Financials

- 14.3.1.4 SWOT Analysis

- 14.3.2 Continental AG

- 14.3.2.1 Company Overview

- 14.3.2.2 Product Portfolio

- 14.3.2.3 Financials

- 14.3.2.4 SWOT Analysis

- 14.3.3 Elmos Semiconductor SE

- 14.3.3.1 Company Overview

- 14.3.3.2 Product Portfolio

- 14.3.3.3 Financials

- 14.3.3.4 SWOT Analysis

- 14.3.4 Hella KGaA Hueck & Co. (Faurecia SE)

- 14.3.4.1 Company Overview

- 14.3.4.2 Product Portfolio

- 14.3.4.3 Financials

- 14.3.5 Hyundai Motor Company

- 14.3.5.1 Company Overview

- 14.3.5.2 Product Portfolio

- 14.3.5.3 Financials

- 14.3.5.4 SWOT Analysis

- 14.3.6 Magna International Inc.

- 14.3.6.1 Company Overview

- 14.3.6.2 Product Portfolio

- 14.3.6.3 Financials

- 14.3.6.4 SWOT Analysis

- 14.3.7 Murata Manufacturing Co. Ltd.

- 14.3.7.1 Company Overview

- 14.3.7.2 Product Portfolio

- 14.3.7.3 Financials

- 14.3.7.4 SWOT Analysis

- 14.3.8 Panasonic Holdings Corporation

- 14.3.8.1 Company Overview

- 14.3.8.2 Product Portfolio

- 14.3.8.3 Financials

- 14.3.8.4 SWOT Analysis

- 14.3.9 Robert Bosch GmbH

- 14.3.9.1 Company Overview

- 14.3.9.2 Product Portfolio

- 14.3.9.3 SWOT Analysis

- 14.3.10 TDK Corporation

- 14.3.10.1 Company Overview

- 14.3.10.2 Product Portfolio

- 14.3.10.3 Financials

- 14.3.10.4 SWOT Analysis

- 14.3.11 Texas Instruments Inc.

- 14.3.11.1 Company Overview

- 14.3.11.2 Product Portfolio

- 14.3.11.3 Financials

- 14.3.11.4 SWOT Analysis

- 14.3.12 Valeo

- 14.3.12.1 Company Overview

- 14.3.12.2 Product Portfolio

- 14.3.12.3 Financials

- 14.3.12.4 SWOT Analysis

- 14.3.1 Aisin Corporation

Kindly, note that this only represents a partial list of companies, and the complete list has been provided in the report.