|

市場調査レポート

商品コード

1473280

IC市場の注目分野:人工知能 (AI)、5G、自動車、メモリチップの市場分析Hot ICs: A Market Analysis of Artificial Intelligence (AI), 5G, Automotive and Memory Chips |

||||||

|

|||||||

| IC市場の注目分野:人工知能 (AI)、5G、自動車、メモリチップの市場分析 |

|

出版日: 2026年01月01日

発行: Information Network

ページ情報: 英文

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

人工知能 (AI)、5G技術、自動車産業、メモリチップの動向

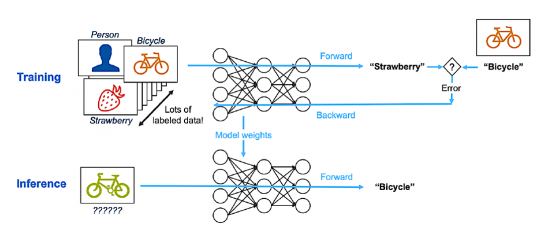

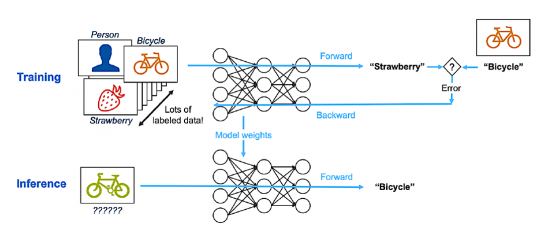

人工知能 (AI) の領域では、AIアーキテクチャやアルゴリズムの進歩、エッジAIの普及、AIの各種産業・用途への統合など、いくつかの重要な動向が現れています。AI技術はより洗練されつつあり、自然言語処理、コンピュータービジョン、自律的意思決定などのタスクを可能にしています。

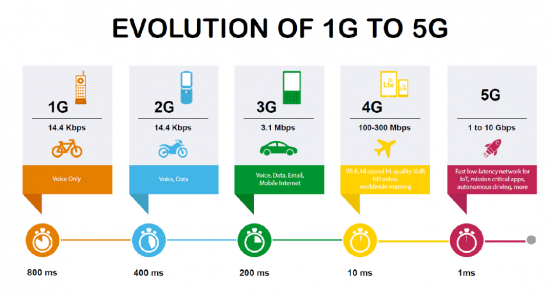

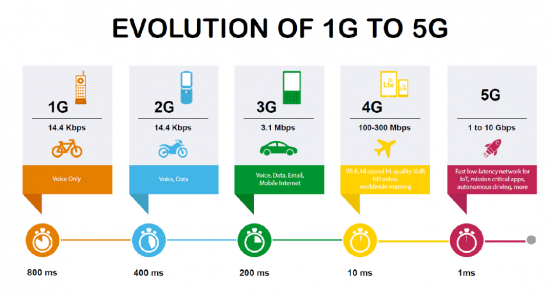

5G技術の普及は業界全体に大きな変革をもたらし、より高速で信頼性の高い接続を可能にし、モノのインターネット (IoT) 機器の普及をサポートし、拡張現実 (AR)、仮想現実 (VR)、自動運転車などの分野におけるイノベーションを促進します。

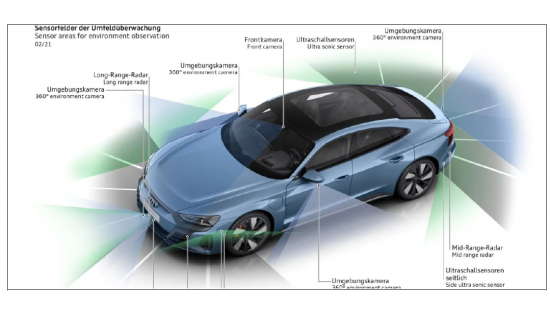

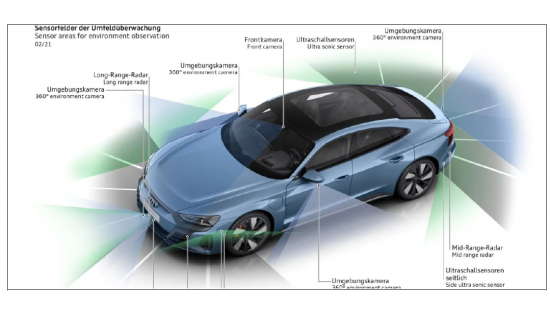

自動車分野では、電気自動車 (EV)、コネクテッドカー、自動運転技術の開発につながる電動化・コネクティビティ・自律性が重視されるようになっています。

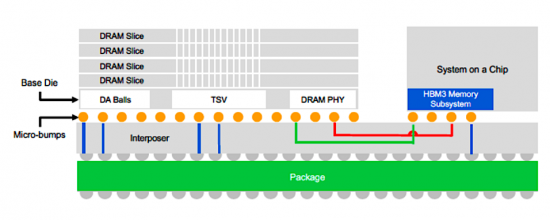

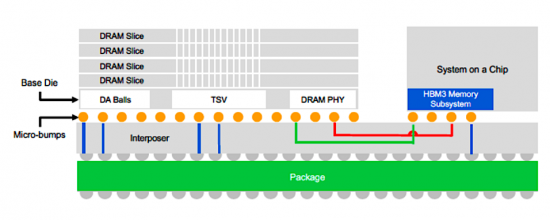

最後に、メモリチップの分野では、クラウドコンピューティング、人工知能、ビッグデータ分析などのデータ集約型の用途での需要増大に対応するため、ストレージ容量の増大、性能の向上、消費電力の削減に焦点が当てられています。

これらの動向は、AI・5G・自動車・メモリチップ技術の現在の進化と融合状況を表しており、それがイノベーションと世界規模の産業再編を促しています。

技術の融合

人工知能 (AI)・5G技術・自動車産業の融合とメモリチップ技術の進歩は、世界の技術展望の大幅な転換を意味しており、イノベーションとコネクティビティの新時代の到来を告げるものです。当レポートでは、これら4つの重要セクターの交錯する複雑なダイナミクスを明らかにし、それらが総体として現代のDX (デジタルトランスフォーメーション) のバックボーンを形成し、さまざまな業界において前例のない成長機会の舞台を整えていることを明らかにします。

人工知能はこの技術革命の最前線に立ち、よりスマートで効率的なシステムを推進することで、私たちの生活、仕事、交流のあり方を変革しています。計算能力の強化から、より洗練されたデータ分析や意思決定プロセスの実現まで、テクノロジーの未来を形成するAIの役割は極めて重要です。当レポートでは、業界横断的なAIの統合、インテリジェントシステムの開発への影響、家電製品から複雑な産業オペレーションまで、AIがどのような革命をもたらしつつあるのかを分析します。

並行して、5G技術の展開は、接続性、提供速度、信頼性において、先行技術をはるかに上回る重要なマイルストーンとなります。5Gの意義は単なる通信機能強化にとどまらず、モノのインターネット (IoT)、自動運転車、遠隔医療サービスなどに必要なリアルタイムのデータ伝送を促進します。エコシステム分析では、5Gエコシステムに関する洞察を提供し、インフラの課題、規制状況、技術進歩の触媒となる5GとAIの相乗効果を検証します。

自動車セクターは、電動化、自動運転、コネクテッドカーがモビリティの本質を再定義するなど、変革期を迎えています。本レポートでは、ADAS (先進運転支援システム)、車載インフォテインメント、V2X (Vehicle-to-Everything) 通信の統合に焦点を当て、AIと5Gが自動車のイノベーションをどのように加速させるかを評価します。また、メーカー、消費者、そしてより広範な交通インフラへの影響についても考察しています。

デジタル時代の縁の下の力持ちであるメモリチップは、AI、5G、自動車技術の成長を支える重要な役割を担っています。これらの分野が急成長するにつれ、より速く、より効率的で、より大容量のストレージソリューションに対する需要も高まっています。本セクションでは、DRAM、NAND、新興のNVRAM (不揮発性メモリ) 技術など、メモリチップ技術の最新動向を評価し、最新技術のデータ集約的なニーズをサポートする上で重要な役割を担っていることを強調します。

当レポートでは、世界のIC市場の主要分野 - 人工知能 (AI)、5G、自動車、メモリチップ - における最新情勢について分析し、各分野の基本的な市場構造や促進要因、昨今の技術開発・普及の動きと今後の方向性、主要サプライヤーのプロファイルと主力製品、といった情報を取りまとめてお届けいたします。

目次

第1章 エグゼクティブサマリー

第2章 自動車

- 自動車業界の指標

- 自動車用半導体の産業

- 自動車用メモリ半導体

- 自動車用半導体:種類別

- 主要技術・コンポーネントのサプライヤー

- NXP

- STMicroelectronics

- Renesas Electronics

- Nvidia

- Intel (Mobileye and Moovit)

- Skyworks

- Qualcomm

- onsemi

- Texas Instruments

- Analog Devices

- 自動車/先進運転支援システム (ADAS)

- その他の自動車用AIチップとの競合

- Intel-Mobileye

- Qualcomm

- Nvidia

- Huawei

- Horizon Robotics

- Black SesameTechnologies

- Xin Chi Technology

- Tesla

- その他の自動車用AIチップとの競合

- LiDARセンサー

- LiDARのコストの考慮

- 自動車向け用途

- LiDARのサプライヤー

- Velodyne

- Luminar

- Aeva

- Ouster

- Innoviz

- Hesai

- Livox

- Innovusion

第3章 5G

- 5Gチップ技術とその動向

- 活用領域

- 携帯電話

- 学際的なつながり

- 市場分析

- 市場予測

- 5Gと4Gの新しいコンポーネント

- 5Gチップ・サプライヤーの製品とプロファイル

- Analog Devices

- Anokiware

- Apple

- Broadcom

- Huawei

- Infineon

- Intel

- Inphi

- Microchip

- MediaTek

- Marvell

- M/A-Com

- NXP Semiconductor

- Onsemi

- Qualcomm

- Qorvo

- Samsung Electronics

- Sivers IMA

- Skyworks Solutions

- STMicroelectronics

- Teradyne

- Texas Instruments

- Win Semiconductors

- Xilinx

第4章 人工知能 (AI)

- AIの技術とその動向

- クラウドAIコンピューティング

- エッジAIコンピューティング

- 人工知能の要素

- 市場分析

- AIチップの収益予測

- 活用領域

- AIの産業利用

- AI搭載デバイス

- 軍事/防衛用途

- AIチップの収益予測

- AIチップ技術

- GPU (画像処理ユニット)

- FPGA (フィールドプログラマブルゲートアレイ)

- ASIC (特定用途向け集積回路)

- ニューロモルフィックチップ

- DPU (データ処理ユニット)

- AIチップ・サプライヤーの製品とプロファイル

- ICベンダー

- Achronix

- AMD

- Ampere

- Biren Technology

- Flex Logix

- IBM

- Intel

- MediaTek

- Nvidia

- NXP

- Qualcomm

- Rockchip

- Samsung Electronics

- STMicroelectronics

- Tentsorrent

- Xilinx

- クラウドプロバイダー:技術リーダー

- Alibaba

- Alibaba Cloud

- Amazon

- Apple

- Baidu

- Meta

- Fujitsu

- Huawei Cloud

- Microsoft

- Nokia

- Tencent Cloud

- Tesla

- IPベンダー

- ARM

- CEVA

- Imagination

- VeriSilicon

- Videantis

- 世界各国のスタートアップ

- Adapteva

- aiCTX

- AImotive

- AlphaICs

- Anari AI

- Blaize

- BrainChip

- Cerebras Systems

- Cornami

- DeepScale

- Anari AI

- Esperanto Technologies

- Graphcore

- GreenWaves Technology

- Groq

- Hailo AI

- KAIST

- Kalray

- Kneron

- Knowm

- Koniku

- Mythic

- SambaNova Systems

- Tachyum

- Via

- deantis

- Wave Computing

- 中国のスタートアップ

- AISpeech

- Bitmain

- Cambricon

- Chipintelli

- DeePhi Tech

- Horizon Robotics

- NextVPU

- Rokid

- Thinkforce

- Unisound

- ICベンダー

第5章 メモリチップ

- メモリ技術とその動向

- メモリ

- NAND

- NVRAM:MRAM、RRAM、FERAM

- 活用領域

- メモリ

- NAND

- 市場分析

- メモリチップ・サプライヤーの製品とプロファイル

- CXMT

- Fujian

- GigaDevice Semiconductor

- Intel

- Micron Technology

- Nanya

- Powerchip Technology

- Samsung Electronics

- SK Hynix

- Toshiba (Kloxia)

- Tsinghua Chongqing

- Western Digital

- Winbond

- YMTC

List of Figures

- 1.1. IC Market By Revenue By Type By Quarter 2019-2023

- 1.2. IC Market By Units By Type By Quarter 2019-2023

- 1.3. IC Market By Asps By Type By Quarter 2019-2023

- 1.4. Smartphone And PC Unit Shipments By Quarter 2022-2023

- 1.5. Smartphone And PC Unit Shipments By Year 2021-2024

- 1.6. PC Semiconductor Market Forecast 2015-2026

- 1.7. Logic Revenues By Quarter 2019-2023

- 1.8. Memory Revenues By Quarter 2019-2023

- 1.9. Memory Units By Quarter 2019-2023

- 1.10. Memory ASPs By Quarter 2019-2023

- 2.1. Semiconductor Content Per Vehicle Forecast

- 2.2. Key Applications Of Semiconductors In An Automobile

- 2.3. Diagram Of Automotive Memory Needs

- 2.4. Automotive Memory Market Share

- 2.5. Automotive Semiconductor Market Share

- 2.6. Average Semiconductor Content Per Car By Level Of Automation

- 2.7. Automotive Imaging Segments

- 2.8. Five Levels Of Autonomous Driving

- 3.1. RF Chip Market Forecast By Network Generation

- 4.1. Performance Comparison Of TPU, GPU, And CPU

- 4.2. Artificial Intelligence Market Share by Chip Type 2022 and 2023

- 4.3. AI Training And Inference

- 4.4. AI Training And Inference Chip Forecast

- 4.5. AI Training And Inference Chip Forecast By Type

- 4.6. Total Top Global Defense Company M&A 2013-2020

- 5.1. DRAM Scaling

- 5.2. DRAM Memory Shrink Roadmap

- 5.3. 3D-NAND Memory Shrink Roadmap

- 5.4. Transition From SLC To QLC

- 5.5. Comparison Of Non-Volatile Ram Write Times

- 5.6. Competition In Dissipation Speed And Memory Capacity

- 5.7. DRAM Content Of Chinese Smartphones

- 5.8. NAND Content Of Chinese Smartphones

- 5.9. Total Available Market For SST MRAM

- 5.10. Total Available Market For Toggle MRAM

List of Tables

- 1.2. Smartphone Unit Shipment Forecast 2019-2026

- 1.3. Smartphone Semiconductor Content Forecast 2019-2026

- 1.4. Smartphone Semiconductor Market By Revenue 2019-2026

- 1.5. Smartphone Semiconductor Revenue Content 2019-2026

- 1.6. Smartphone Dram ASPs Forecast 2019-2026

- 1.7. Smartphone Nand ASPs Forecast 2019-2026

- 1.8. PC Market Forecast By Type 2019-2026

- 1.9. PC Semiconductor Market Forecast 2019-2026

- 1.10. PC Memory Revenue Market Forecast 2019-2026

- 1.11. PC Memory Gb Market Forecast By Type 2019-2026

- 1.12. Server Market Forecast 2019-2026

- 1.13. Server Semiconductor Market Forecast 2019-2026

- 1.14. Server Memory Revenue Market Forecast 2019-2026

- 1.15. Server GPU Revenue Market Forecast 2019-2026

- 2.1. EV Shipment Forecast By Region 2018-2025

- 2.2. ICE Auto Shipment Forecast By Region 2018-2025

- 2.3. Automotive Semiconductor Sales Forecast 2019-2025

- 2.4. Automotive Semiconductor Sales By Company 2022-2024

- 2.5. Top Automotive Semiconductor Sales By Customer 2021-2022

- 2.6. SOC Autopilot Chip Versions

- 2.7. Functionality Comparison Of Sensor Modalities

- 2.8. Differences Among Lidar Devices

- 2.9. Major Lidar Companies

- 3.1. Feature Comparison Of Smartphone PAs By Generation

- 3.2. 5G Subscriptions

- 3.3. Smartphone Forecast By Geographic Region

- 3.4. Smartphone Subscription Forecast By Technology

- 3.5. 5G Smartphone Forecast By Geographic Region

- 3.6. 5G Smartphone Mobile Semiconductor Forecast

- 3.7. 5G Semiconductor Total Available Market Forecast

- 3.8. 5G Smartphone Shipment By Major OEMs

- 3.9. 5G Smartphone Penetration By Country

- 3.10. Mobile Subscriptions By Region

- 3.11. Smartphone Subscriptions By Region

- 3.12. LTE Subscriptions By Region

- 3.13. 5G Subscriptions By Region

- 3.14. Data Traffic Per Smartphone By Region

- 3.15. Mobile Data Traffic By Region

- 4.1. Artificial Intelligence Market Forecast By Chip Type 2019-2026

- 4.2. AI Training And Inference Chip Forecast

- 4.3. AI Chip Forecast By Chip Type

- 4.4. Characteristics Of CPU, FPGA, CCPU, and ASIC

- 4.5. Characteristics Of CPU, FPGA, CCPU, and ASIC

- 4.6. Smart Speaker Products

- 5.1. Comparison Of Non-Volatile RAM Technology

- 5.2. Total DRAM Industry Revenue Forecast 2019-2026

- 5.3. Total DRAM Bit Shipment Revenue Forecast 2019-2026

- 5.4. Total DRAM Blended ASP ($/GB) Revenue Forecast 2015-2026

- 5.5. Total DRAM Bit Supply Forecast 2019-2026

- 5.6. DRAM Revenue By End Market Forecast 2019-2026

- 5.7. DRAM Capacity By Company Forecast 2018-2024

- 5.8. DRAM Revenue By Company Forecast 2018-2024

- 5.9. Total NAND Industry Revenue Forecast 2019-2026

- 5.10. Total NAND Bit Shipment Revenue Forecast 2019-2026

- 5.11. Total NAND Blended ASP ($/Gb) Revenue Forecast 2019-2026

- 5.12. Total NAND Bit Supply Forecast 2019-2026

- 5.13. NAND Revenue By End Market Forecast 2019-2026

- 5.14. NAND Capacity By Company Forecast 2018-2024

- 5.15. NAND Revenue By Company Forecast 2018-2024

Trends in Artificial Intelligence (AI), 5G technology, the automotive industry, and memory chips

In the realm of Artificial Intelligence (AI), several key trends are emerging, including advancements in AI architectures and algorithms, the proliferation of edge AI, and the integration of AI into various industries and applications. AI technologies are becoming more sophisticated, enabling tasks such as natural language processing, computer vision, and autonomous decision-making.

The adoption of 5G technology is driving significant transformations across industries, enabling faster and more reliable connectivity, supporting the proliferation of Internet of Things (IoT) devices, and facilitating innovations in areas like augmented reality (AR), virtual reality (VR), and autonomous vehicles.

In the automotive sector, there is a growing emphasis on electrification, connectivity, and autonomy, leading to the development of electric vehicles (EVs), connected cars, and selfdriving technologies.

Finally, in the realm of memory chips, there is a focus on increasing storage capacity, improving performance, and reducing power consumption to meet the growing demands of dataintensive applications such as cloud computing, artificial intelligence, and big data analytics.

These trends collectively represent the ongoing evolution and convergence of AI, 5G, automotive, and memory chip technologies, driving innovation and reshaping industries across the globe.

Convergence of Technology

The convergence of Artificial Intelligence (AI), 5G technology, the automotive industry, and advancements in memory chip technology represents a pivotal shift in the global technological landscape, heralding a new era of innovation and connectivity. This comprehensive report delves into the intricate dynamics at the intersection of these four critical sectors, unveiling how they collectively form the backbone of modern digital transformation and setting the stage for unprecedented growth opportunities across various industries.

Artificial Intelligence stands at the forefront of this technological revolution, driving smarter, more efficient systems that are transforming how we live, work, and interact. From enhancing computational power to enabling more sophisticated data analysis and decision-making processes, AI's role in shaping the future of technology cannot be overstated. This report explores AI's integration across industries, its impact on developing intelligent systems, and how it's revolutionizing everything from consumer electronics to complex industrial operations.

Parallelly, the rollout of 5G technology marks a significant milestone in connectivity, offering speeds and reliability that far surpass its predecessors. The implications of 5G extend beyond mere communication enhancements, facilitating the real-time data transmission necessary for the Internet of Things (IoT), autonomous vehicles, and remote healthcare services, among others. Our analysis provides insights into the 5G ecosystem, examining infrastructure challenges, regulatory landscapes, and the synergy between 5G and AI in catalyzing technological advancement.

The automotive sector is undergoing a transformative phase, with electrification, autonomous driving, and connected vehicles redefining the very essence of mobility. This report assesses how AI and 5G collectively accelerate automotive innovations, focusing on the integration of advanced driver-assistance systems (ADAS), in-vehicle infotainment, and vehicle-to-everything (V2X) communications. It also considers the implications for manufacturers, consumers, and the broader transportation infrastructure.

Memory chips, the unsung heroes of the digital age, play a crucial role in sustaining the growth of AI, 5G, and automotive technologies. As these sectors burgeon, so does the demand for faster, more efficient, and higher-capacity storage solutions. This section of the report evaluates the latest developments in memory chip technology, including DRAM, NAND, and emerging non-volatile memory technologies, highlighting their critical role in supporting the data-intensive needs of modern technologies.

In compiling this report, we aim to provide a holistic overview of how AI, 5G, the automotive sector, and advancements in memory chip technology are intricately linked, driving forward a new wave of innovation and industry growth. Through detailed market analysis, technological insights, and forward-looking projections, this report offers valuable intelligence for stakeholders across these sectors, enabling informed decision-making and strategic planning in an increasingly interconnected technological ecosystem.

About This Report

This report encompasses a broad spectrum of analyses, insights, and projections that illuminate the current state and future trajectory of these interlinked sectors. This report not only delves into individual technologies and their applications but also explores the synergies and intersections that are propelling innovation and market growth. Here's an expanded view of what such a report covers:

Artificial Intelligence (AI)

- Market Overview: Analysis of the global AI market, including size, growth trends, and forecasts. It examines key segments such as machine learning, natural language processing, and AI in robotics.

- Technology Trends: Exploration of cutting-edge AI technologies and methodologies, including deep learning, computer vision, and AI chips. The report assesses how these technologies are transforming industries.

- Application Areas: Detailed review of AI applications across various sectors, including healthcare, finance, retail, and more, highlighting case studies of successful AI integration.

- Challenges and Opportunities: Discussion on ethical considerations, data privacy issues, and the talent gap in AI. It also explores funding trends and governmental policies affecting AI development and adoption.

5G Technology

- Infrastructure and Deployment: Examination of the global rollout of 5G, including infrastructure requirements, spectrum allocation, and deployment strategies. It evaluates the progress in major regions and the challenges faced.

- Use Cases and Applications: Insight into the transformative potential of 5G across industries such as entertainment, manufacturing, and agriculture, emphasizing enhanced connectivity and IoT.

- Market Dynamics: Analysis of the competitive landscape, key players, and partnerships shaping the 5G ecosystem. It includes investment trends and regulatory impacts on market evolution.

- Future Prospects: Projection of the future of 5G, including the integration with satellite communications, development of 6G, and its role in enabling smart cities and autonomous systems.

Automotive Industry

- Electrification and Autonomous Driving: Overview of trends in electric vehicles (EVs) and autonomous driving technologies. This section covers advancements in battery technology, ADAS, and regulatory frameworks impacting vehicle automation and connectivity.

- Connectivity Solutions: Examination of the role of 5G in transforming automotive connectivity, including vehicle-to-everything (V2X) communication, in-car infotainment systems, and telematics.

- Market Players and Innovations: Analysis of leading automotive manufacturers, technology companies, and startups driving innovation in connected and autonomous vehicles.

- Sustainability and Challenges: Discussion on the automotive industry's move towards sustainability, including challenges in adoption, infrastructure development, and the impact on urban mobility.

Memory Chips

- Technology Evolution: Deep dive into the developments in memory chip technology, including DRAM, NAND flash, and emerging technologies like 3D XPoint and MRAM. It assesses the impact of these advancements on storage capacity, speed, and power efficiency.

- Industry Applications: Exploration of how memory chips support the data needs of AI, 5G, and automotive technologies, facilitating advancements in edge computing, data centers, and consumer electronics.

- Market Analysis: Review of the global memory chip market, including supply and demand dynamics, key manufacturers, and pricing trends. It also considers the impact of geopolitical factors on the semiconductor supply chain.

- Future Directions: Projections for the memory chip market, focusing on innovations in semiconductor materials, manufacturing processes, and the integration of memory technologies in next-generation computing architectures.

Table of Contents

Chapter 1. Executive Summary

Chapter 2. Automotive

- 2.1. Automotive Industry Metrics

- 2.2. Automotive Semiconductor Industry

- 2.2.1. Automotive Memory Semiconductors

- 2.2.2. Automotive Semiconductors By Type

- 2.2.2.1. Microcontrollers

- 2.2.2.2. ASSP/ASICs

- 2.2.2.3. Analog

- 2.2.2.4. Discrete

- 2.3. Key Technology And Component Suppliers

- NXP

- STMicroelectronics

- Renesas Electronics

- Nvidia

- Intel (Mobileye and Moovit)

- Skyworks

- Qualcomm

- onsemi

- Texas Instruments

- Analog Devices

- 2.4. Automotive/ Advanced Driver Assistance Systems (ADAS)

- 2.4.1. Competition from Alternative Automotive AI Chips

- Intel-Mobileye

- Qualcomm

- Nvidia

- Huawei

- Horizon Robotics

- Black SesameTechnologies

- Xin Chi Technology

- Tesla

- 2.4.1. Competition from Alternative Automotive AI Chips

- 2.5. LiDAR Sensors

- 2.5.1. LiDAR - Cost Considerations

- 2.5.2. Automotive Applications

- 2.5.3. LiDAR Suppliers

- Velodyne

- Luminar

- Aeva

- Ouster

- Innoviz

- Hesai

- Livox

- Innovusion

Chapter 3 5G

- 3.1 5G Chip Technology and Trends

- 3.2. Applications

- 3.2.1. Mobile Handsets

- 3.2.2. Interdisciplinary Connections

- 3.3. Market Analysis

- 3.3.1. Market Forecasts

- 3.3.2. New Components For 5G vs 4G

- 3.3.2.1. 5G Modem Chip Overview

- 3.3.2.2. 5G Chips

- 3.3.2.3. mmWave Modules

- 3.3.2.4. Traditional MIMO Antennas

- 3.4. 5G Chip Supplier Products and Profiles

- Analog Devices

- Anokiware

- Apple

- Broadcom

- Huawei

- Infineon

- Intel

- Inphi

- Microchip

- MediaTek

- Marvell

- M/A-Com

- NXP Semiconductor

- Onsemi

- Qualcomm

- Qorvo

- Samsung Electronics

- Sivers IMA

- Skyworks Solutions

- STMicroelectronics

- Teradyne

- Texas Instruments

- Win Semiconductors

- Xilinx

Chapter 4. Artificial Intelligence (AI)

- 4.1. AI Technology and Trends

- 4.1.1. Cloud AI Computing

- 4.1.2. Edge AI Computing

- 4.1.3. The Elements Of Artificial Intelligence

- 4.1.3.1. Importance Of Training And Inference

- 4.1.3.2. The Growing Importance Of Accelerators In Dc Spending

- 4.1.3.3. Training Costs

- 4.1.3.4. Generative AI

- 4.2. Market Analysis

- 4.2.1. AI Chip Revenue Forecast

- 4.3. Applications

- 4.3.1. Industry Applications of AI

- 4.3.1.1. Smart Healthcare

- 4.3.1.2. Smart Security

- 4.3.1.3. Smart Finance

- 4.3.1.4. Smart Grid

- 4.3.1.5. Smart Hone

- 4.3.2. AI-Powered Devices

- 4.3.2.1. Smart Speakers

- 4.3.2.2. Drones

- 4.3.2.3. Intelligent Robots

- 4.3.3. Military/Defense Applications

- 4.3.3.1. China's AI Plan

- 4.3.2.1. Driverless Vehicles

- 4.3.2.2. Computer Chips

- 4.3.2.3. Financial

- 4.3.2.4. Facial Recognition

- 4.3.2.5. Retail

- 4.3.2.6. Robots

- 4.3.3. AI Chip Revenue Forecast

- 4.3.1. Industry Applications of AI

- 4.4. AI Chip Technology

- 4.4.1. Graphics Processing Unit (GPU)

- 4.4.2. Field Programmable Gate Array (FPGA)

- 4.4.3. Application Specific Integrated Circuits (ASIC)

- 4.4.4. Neuromorphic Chips

- 4.4.5. Data Processing Units (DPUs)

- 4.5. AI Chip Supplier Products and Profiles

- 4.5.1. IC Vendors

- Achronix

- AMD

- Ampere

- Biren Technology

- Flex Logix

- IBM

- Intel

- MediaTek

- Nvidia

- NXP

- Qualcomm

- Rockchip

- Samsung Electronics

- STMicroelectronics

- Tentsorrent

- Xilinx

- 4.5.2. Cloud Providers - Tech Leaders

- Alibaba

- Alibaba Cloud

- Amazon

- Apple

- Baidu

- Meta

- Fujitsu

- Huawei Cloud

- Microsoft

- Nokia

- Tencent Cloud

- Tesla

- 4.5.3. IP Vendors

- ARM

- CEVA

- Imagination

- VeriSilicon

- Videantis

- 4.5.4. Startups Worldwide

- Adapteva

- aiCTX

- AImotive

- AlphaICs

- Anari AI

- Blaize

- BrainChip

- Cerebras Systems

- Cornami

- DeepScale

- Anari AI

- Esperanto Technologies

- Graphcore

- GreenWaves Technology

- Groq

- Hailo AI

- KAIST

- Kalray

- Kneron

- Knowm

- Koniku

- Mythic

- SambaNova Systems

- Tachyum

- Via

- deantis

- Wave Computing

- 4.5.5. Startups in China

- AISpeech

- Bitmain

- Cambricon

- Chipintelli

- DeePhi Tech

- Horizon Robotics

- NextVPU

- Rokid

- Thinkforce

- Unisound

- 4.5.1. IC Vendors

Chapter 5. Memory Chips

- 5.1. Memory Technology and Trends

- 5.1.1. DRAM

- 5.1.2. NAND

- 5.1.3. NVRAM - MRAM, RRAM, and FERAM

- 5.2. Applications

- 5.2.1. DRAM

- 5.2.1.1. Server

- 5.2.1.2. PC

- 5.2.1.3. Graphics

- 5.2.1.4. Mobile

- 5.2.1.5. Consumer

- 5.2.2. NAND

- 5.2.2.1. SSD

- 5.2.2.2. PC

- 5.2.2.3. TV

- 5.2.2.4. Mobile

- 5.2.2.5. USB

- 5.2.1. DRAM

- 5.3. Market Analysis

- 5.4. Memory Chip Supplier Products and Profiles

- CXMT

- Fujian

- GigaDevice Semiconductor

- Intel

- Micron Technology

- Nanya

- Powerchip Technology

- Samsung Electronics

- SK Hynix

- Toshiba (Kloxia)

- Tsinghua Chongqing

- Western Digital

- Winbond

- YMTC