|

|

市場調査レポート

商品コード

1597900

感染症の分子診断市場:症候群別、プレックス別、場所別、国別 - 分析およびエグゼクティブガイド付き(2025年~2029年)Molecular Diagnostics for Infectious Disease By Syndrome, Plex, Place and by Country. With Analysis and Executive Guides. 2025 - 2029 |

||||||

|

|||||||

| 感染症の分子診断市場:症候群別、プレックス別、場所別、国別 - 分析およびエグゼクティブガイド付き(2025年~2029年) |

|

出版日: 2024年11月21日

発行: Howe Sound Research

ページ情報: 英文 677 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 図表

- 目次

パンデミック後の世界では、分子診断学がブームとなり、核酸が鍵となります。

臨床診断業界における感染症の分子診断セクターは新たな成長を遂げようとしています。感染症検査は、バイオテクノロジー、特にゲノミクスの爆発的な発展から直接的な恩恵を受けています。

特に核酸検査と免疫測定法の間のエキサイティングな技術開拓は、診断学が感染症撲滅の主導権を握ることを約束する、ダイナミックで成長し進化する世界市場を予感させます。

当レポートでは、感染症の分子診断市場について調査し、市場の概要とともに、感染症の概要、症候群別、プレックス別、場所別、国別の動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 市場ガイド

第2章 イントロダクションと市場の定義

- 分子診断とは何か

- 診断革命

- 市場の定義

- 調査手法

- 視点:ヘルスケアとIVD業界

第3章 感染症- 疾患別の市場分析

- HIV-ヒト免疫不全ウイルス(エイズ)

- HBV-B型肝炎

- HCV-C型肝炎

- HPV-ヒトパピローマウイルス

- インフルエンザ

- CTGC-クラミジア/淋病

- 結核

- MRSA-メチシリン耐性黄色ブドウ球菌

- VRE-バンコマイシン耐性腸球菌

- 血液検査

- COVID-19

- パンデミック診断

第4章 業界の概要

- 市場参入機関

- 学術研究機関

- 診断試験開発者

- 計装サプライヤー

- 薬品・試薬メーカー

- 病理サプライヤー

- 独立系臨床検査室

- 公共の国立/地域研究所

- 病院検査室

- 臨床検査室

- 監査機関

- 認証機関

- 臨床検査市場のセグメント

- 業界構造

第5章 主要企業のプロファイル

- 1928 Diagnostics

- Abacus Diagnostica

- Abbott Laboratories

- Accelerate Diagnostics

- Access Bio

- Ador Diagnostics

- ADT Biotech

- Akonni Biosystems

- Altona Diagnostics

- Alveo Technologies

- Anatolia Geneworks

- Anitoa

- Antelope Dx

- Applied BioCode

- Assurance Scientific Laboratories

- Aureum Diagnostics

- Aus Diagnostics

- Beckman Coulter Diagnostics

- Becton, Dickinson and Company

- Binx Health

- Biocartis

- BioFire Diagnostics(bioMerieux)

- bioMerieux Diagnostics

- Bio-Rad Laboratories, Inc

- Bosch Healthcare Solutions GmbH

- Celemics

- Cepheid(Danaher)

- Chembio

- Co Diagnostics

- Credo Diagnostics Biomedical

- Cue Health

- Curetis N.V./Curetis GmbH

- Detect

- Diagenode Diagnostics

- Diascopic

- Diasorin S.p.A.

- Domus Diagnostics

- Eiken Chemical

- Element Biosciences

- Enzo Biochem

- Eurofins Scientific

- Fluxergy

- Fulgent Genetics

- Fusion Genomics.

- Genedrive

- Genetic Signatures

- GenMark Dx(Roche)

- Genomadix

- Grifols

- Grip Molecular Technologies

- Hibergene Diagnostics

- Hologic

- Illumina

- Immunexpress

- Inflammatix

- Invetech

- Janssen Diagnostics

- Karius

- Lexagene

- LightDeck Diagnostics

- Lucira Health

- Luminex Corp(DiaSorin)

- LumiraDx

- Lumos Diagnostics

- Mammoth Biosciences

- Maxim Biomedical

- Meridian Bioscience

- Mesa Biotech(Thermo Fisher)

- MicroGem

- Millipore Sigma

- Mindray

- Minute Molecular

- Mobidiag(Hologic)

- Molbio Diagnostics

- NanoDx

- Nanomix

- Novacyt

- Novel Microdevices

- OnsiteGene

- Operon

- Oxford Nanopore Technologies

- Panagene

- Pathogenomix

- Perkin Elmer

- Prenetics

- Primerdesign(Novacyt)

- Prominex

- Proof Diagnostics

- Qiagen

- QuantuMDx

- Quest Diagnostics

- QuidelOrtho

- Randox Toxicology

- Roche Molecular Diagnostics

- Saw Diagnostics

- Scope Fluidics

- SD Biosensor

- Seegene

- Siemens Healthineers

- Singular Genomics

- SomaLogic

- Sona Nanotech

- SpeeDx

- T2 Biosystems

- Talis Biomedical

- Thermo Fisher Scientific Inc.

- Ultima Genomics

- Vela Diagnostics

- Veramarx

- Veredus Laboratories

- Vir

- Vircell

- Visby Medical

- XCR Diagnostics

- YD Diagnostics

- Zhejiang Orient Gene Biotech

第6章 市場動向

- 成長促進要因

- 成長抑制要因

- 計測と自動化

- 診断技術開発

第7章 分子診断- 感染症の最近の動向

第8章 世界の感染症の分子診断市場

- 世界市場 - 概要、国別

- 世界市場 - 概要、症候群別

- 世界市場 - 概要、プレックス別

- 世界市場 - 概要、地域別

第9章 世界の感染症の分子診断市場- 症候群別

- 呼吸器

- 胃腸

- 血液

- 髄膜炎/脳炎

- 性感染症

- その他

第10章 世界の感染症の分子診断市場-プレックス別

- シングルプレックス

- デュプレックス

- トリプレックス

- マルチプレックス技術

第11章 世界の感染症の分子診断市場- 地域別

- 病院研究室

- 外来検査室

- POC

- その他

第12章 付録

Table of Tables

- Table 1: Classification of HIV Species

- Table 2: HIV Tests - CMS Codes & Prices

- Table 3: Current HIV Molecular Tests and Instruments Used

- Table 4: HBV Tests - CMS Codes & Prices

- Table 5: HCV Tests - CMS Codes & Prices

- Table 6: HPV Clearance Rates

- Table 7: HPV Tests - CMS Codes & Prices

- Table 8: HPV Tests, Technology, Types

- Table 9: Types of Influenza Tests

- Table 10: Influenza Tests - CMS Codes & Prices

- Table 11: FDA Cleared Molecular Assays for Influenza

- Table 12: FDA Cleared NAAT CTGC Tests

- Table 13: CTGC NAAT Target Sequences and Possible False Reactions

- Table 14: CTGC Tests - CMS Codes & Prices

- Table 15: FDA Approved MDx Tests for Tuberculosis

- Table 16: Tuberculosis Tests - CMS Codes & Prices

- Table 17: FDA Approved Tests for MRSA

- Table 18: MRSA Tests - CMS Codes & Prices

- Table 19: FDA Approved Tests for VRE

- Table 20: VRE Tests - CMS Codes & Prices

- Table 21: FDA Approved Multiplex Assays

- Table 22: Characteristics of Coronavirus Pandemic Infections

- Table 23: COVID-19 Symptoms

- Table 24: Market Players by Type

- Table 25: Clinical Laboratory Departments and Segments

- Table 26: Laboratory Management Focus - Different Approaches

- Table 27: Key Segmentation Variables Going Forward

- Table 28: Five Factors Driving Growth

- Table 29: Four Factors Limiting Growth

- Table 30: Key Diagnostic Laboratory Technology Trends

- Table 31: Global Market by Region

- Table 32: Global Market by Syndrome

- Table 33: Global Market by Plex

- Table 34: Global Market by Place

- Table 35: Respiratory by Country

- Table 36: Gastrointestinal by Country

- Table 37: Blood by Country

- Table 38: Meningitis/Encephalitis by Country

- Table 39: Sexually Transmitted Disease by Country

- Table 40: Other by Country

- Table 41: Single Plex by Country

- Table 42: Duplex by Country

- Table 43: Triplex by Country

- Table 44: Multiplex by Country

- Table 45: Hospital Lab by Country

- Table 46: Outpatient Lab by Country

- Table 47: POC by Country

- Table 48: Other Place by Country

- Table 49: Clinical Lab Fee Schedule

- Table 50: The Most Common Assays

- Table 51: Largest Revenue Assays

Table of Figures

- Figure 1: Global Healthcare Spending

- Figure 2: The Lab Test Pie

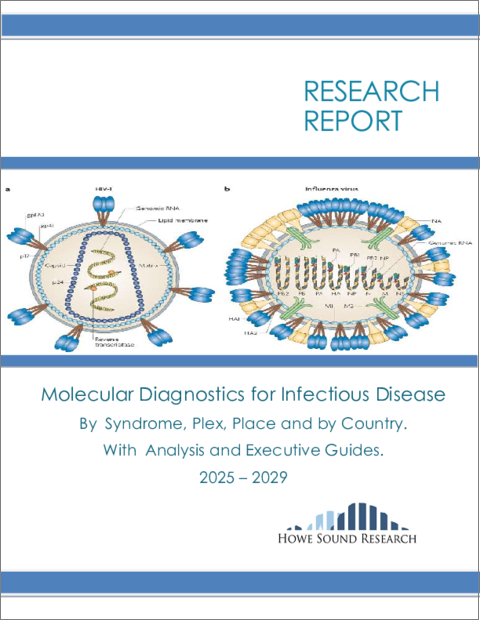

- Figure 3: HIV Virion

- Figure 4: Diagram of the HIV Replication Cycle

- Figure 5: The Structure of the HBV Virus

- Figure 6: Hepatitis B Replication

- Figure 7: Structure of the HCV Virus

- Figure 8: HCV Replication Cycle

- Figure 9: Structure of the Influenza Virion

- Figure 10: Influenza Replication

- Figure 11: Scanning Electronmicrograph of Tuberculosis

- Figure 12: The Road to Diagnostics

- Figure 13: The Changing Age of The World's Population

- Figure 14: Health Care Consumption by Age

- Figure 15: Cancer Incidence by Age

- Figure 16: Chart Infectious Disease Decline

- Figure 17: Global Market Shares Chart

- Figure 18: Global Market by Syndrome - Base vs. Final

- Figure 19: Global Market by Syndrome Base Year

- Figure 20: Global Market by Syndrome End Year

- Figure 21: Syndrome Share by Year

- Figure 22: Syndrome Segments Growth

- Figure 23: Global Market by Plex - Base vs. Final

- Figure 24: Global Market by Plex Base Year

- Figure 25: Global Market by Plex End Year

- Figure 26: Plex Share by Year

- Figure 27: Plex Segments Growth

- Figure 28: Global Market by Place - Base vs. Final

- Figure 29: Global Market by Place Base Year

- Figure 30: Global Market by Place End Year

- Figure 31: Place Share by Year

- Figure 32: Place Segments Growth

- Figure 33: Respiratory Growth

- Figure 34: Gastrointestinal Diagnostics Growth

- Figure 35: Blood Growth

- Figure 36: Meningitis/Encephalitis Growth

- Figure 37: Sexually Transmitted Disease Growth

- Figure 38: Other Growth

- Figure 39: Single Plex Growth

- Figure 40: Duplex Growth

- Figure 41: Triplex Growth

- Figure 42: Multiplex Growth

- Figure 43: Hospital Lab Growth

- Figure 44: Outpatient Lab Growth

- Figure 45: POC Growth

- Figure 46: Other Place Growth

Report Overview:

In a Post Pandemic world molecular diagnostics sees technologies boom. Nucleic acids become key.

The Molecular Diagnostics - Infectious Disease sector of the clinical diagnostics industry is poised for new growth. Find out what the numbers are in this informative report. And find out about the exciting technology developments which threaten to change diagnosis and treatment while limiting the threat of anti microbial drug resistance.

Infectious disease testing directly benefits from the explosion in biotechnology, especially genomics. Learn all about it in this new report from Howe Sound Research. A range of dynamic trends are pushing market growth and company valuations.

Exciting technical developments especially in the seesaw between nucleic acid testing and immunoassay, hold the promise of a dynamic, growing and evolving world market that holds the promise of diagnostics taking the lead in infectious disease eradication.

All report data is available in Excel format on request.

Table of Contents

1. Market Guides

- 1.1. Strategic Situation Analysis

- 1.2. Guide for Executives and Business Development Staff

- 1.3. Guide for Management Consultants and Investment Advisors

2. Introduction and Market Definition

- 2.1. What are Molecular Diagnostics?

- 2.2. The Diagnostics Revolution

- 2.3. Market Definition

- 2.3.1. Revenues

- 2.4. Methodology

- 2.4.1. Methodology

- 2.4.2. Sources

- 2.4.3. Authors

- 2.5. Perspective: Healthcare and the IVD Industry

- 2.5.1. Global Healthcare Spending

- 2.5.2. Spending on Diagnostics

- 2.5.3. Important Role of Insurance for Diagnostics

3. The Infectious Diseases - Market Analysis by Disease

- 3.1. HIV - Human Immunodeficiency Virus (AIDS)

- 3.1.1. Virology

- 3.1.1.1. Classification

- 3.1.1.2. Structure and genome

- 3.1.1.3. Tropism

- 3.1.1.4. Replication cycle

- 3.1.1.5. Genetic variability

- 3.1.2. Diagnosis

- 3.1.3. Testing

- 3.1.3.1. Antibody tests

- 3.1.3.2. Point of Care Tests (POCT)

- 3.1.3.3. Antigen Tests

- 3.1.3.4. Nucleic acid-based tests (NAT)

- 3.1.3.5. Other tests used in HIV treatment

- 3.1.4. Market Opportunity Analysis

- 3.1.1. Virology

- 3.2. HBV - Hepatitis B

- 3.2.1. Virology

- 3.2.1.1. Genome

- 3.2.1.2. Pathogenesis

- 3.2.1.3. Hepatitis B virus replication

- 3.2.1.4. Serotypes and genotypes

- 3.2.2. Mechanisms

- 3.2.3. Diagnosis

- 3.2.4. Market Opportunity Analysis

- 3.2.1. Virology

- 3.3. HCV - Hepatitis C

- 3.3.1. Taxonomy

- 3.3.2. Structure

- 3.3.2.1. Genome

- 3.3.3. Molecular biology

- 3.3.4. Replication

- 3.3.5. Genotypes

- 3.3.5.1. Clinical importance

- 3.3.6. Market Opportunity Analysis

- 3.4. HPV - Human papillomavirus

- 3.4.1. Virology

- 3.4.1.1. E6/E7 proteins

- 3.4.1.2. Role in cancer

- 3.4.1.3. E2 research

- 3.4.1.4. Latency period

- 3.4.1.5. Clearance

- 3.4.2. Diagnosis

- 3.4.2.1. Cervical testing

- 3.4.2.2. Oral testing

- 3.4.2.3. Testing men

- 3.4.2.4. Other testing

- 3.4.3. Market Opportunity Analysis

- 3.4.1. Virology

- 3.5. Influenza

- 3.5.1. Virology

- 3.5.1.1. Types of virus

- 3.5.1.2. Influenzavirus A

- 3.5.1.3. Influenzavirus B

- 3.5.1.4. Influenzavirus C

- 3.5.1.5. Structure, properties, and subtype nomenclature

- 3.5.1.6. Replication

- 3.5.2. Testing

- 3.5.2.1. Advantages/Disadvantages of Molecular Assays

- 3.5.3. Market Opportunity Analysis

- 3.5.1. Virology

- 3.6. CTGC - Chlamydia/Gonorhea

- 3.6.1. Gonorrhea

- 3.6.1.1. Diagnosis

- 3.6.1.2. Screening

- 3.6.2. Chlamydia

- 3.6.2.1. Diagnosis

- 3.6.2.2. Screening

- 3.6.3. Testing

- 3.6.3.1. Nucleic acid amplification tests (NAATs).

- 3.6.3.2. Performance of NAAT Tests

- 3.6.4. Market Opportunity Analysis

- 3.6.1. Gonorrhea

- 3.7. Tuberculosis

- 3.7.1. Mycobacteria

- 3.7.2. Diagnosis

- 3.7.2.1. Active tuberculosis

- 3.7.2.2. Latent tuberculosis

- 3.7.3. Epidemiology

- 3.7.4. Molecular Diagnostic Tests

- 3.7.5. Market Opportunity Analysis

- 3.8. MRSA - Methicillin-resistant Staphylococcus aureus

- 3.8.1. Diagnosis

- 3.8.2. FDA Approved Molecular Tests

- 3.8.3. Market Opportunity Analysis

- 3.9. VRE - Vancomycin-resistant Enterococcus

- 3.9.1. FDA Approved MDx Tests for VRE

- 3.9.2. Market Opportunity Analysis

- 3.10. Blood Screening

- 3.10.1. Collection and Testing

- 3.10.2. FDA Approved Multiplex Assays

- 3.10.3. Market Opportunity Analysis

- 3.11. COVID-19

- 3.11.1. Signs and symptoms

- 3.11.2. Transmission

- 3.11.3. Diagnosis

- 3.11.4. Prevention

- 3.11.5. Management

- 3.11.6. Prognosis

- 3.12. Pandemic Diagnostics

- 3.12.1. Risk Management - Spark and Spread

- 3.12.2. Dx Technology - Nucleic Acid Based

- 3.12.3. Dx Technology - Immunoassay & Serology

- 3.12.4. Time to Market and Preparedness Issues

- 3.12.5. Unrecognized Role of Multiplex in Pandemic Mangement

4. Industry Overview

- 4.1. Players in a Dynamic Market

- 4.1.1. Academic Research Lab

- 4.1.2. Diagnostic Test Developer

- 4.1.3. Instrumentation Supplier

- 4.1.4. Chemical/Reagent Supplier

- 4.1.5. Pathology Supplier

- 4.1.6. Independent Clinical Laboratory

- 4.1.7. Public National/regional Laboratory

- 4.1.8. Hospital Laboratory

- 4.1.9. Physicians Office Lab (POLS)

- 4.1.10. Audit Body

- 4.1.11. Certification Body

- 4.2. The Clinical Laboratory Market Segments

- 4.2.1. Traditional Market Segmentation

- 4.2.2. Laboratory Focus and Segmentation

- 4.3. Industry Structure

- 4.3.1. Hospital Testing Share

- 4.3.2. Economies of Scale

- 4.3.2.1. Hospital vs. Central Lab

- 4.3.3. Physician Office Lab's

- 4.3.4. Physician's and POCT

5. Profiles of Key MDx Companies

- 5.1 1928 Diagnostics

- 5.2. Abacus Diagnostica

- 5.3. Abbott Laboratories

- 5.4. Accelerate Diagnostics

- 5.5. Access Bio

- 5.6. Ador Diagnostics

- 5.7. ADT Biotech

- 5.8. Akonni Biosystems

- 5.9. Altona Diagnostics

- 5.10. Alveo Technologies

- 5.11. Anatolia Geneworks

- 5.12. Anitoa

- 5.13. Antelope Dx

- 5.14. Applied BioCode

- 5.15. Assurance Scientific Laboratories

- 5.16. Aureum Diagnostics

- 5.17. Aus Diagnostics

- 5.18. Beckman Coulter Diagnostics

- 5.19. Becton, Dickinson and Company

- 5.20. Binx Health

- 5.21. Biocartis

- 5.22. BioFire Diagnostics (bioMerieux)

- 5.23. bioMerieux Diagnostics

- 5.24. Bio-Rad Laboratories, Inc

- 5.25. Bosch Healthcare Solutions GmbH

- 5.26. Celemics

- 5.27. Cepheid (Danaher)

- 5.28. Chembio

- 5.29. Co Diagnostics

- 5.30. Credo Diagnostics Biomedical

- 5.31. Cue Health

- 5.32. Curetis N.V. / Curetis GmbH

- 5.33. Detect

- 5.34. Diagenode Diagnostics

- 5.35. Diascopic

- 5.36. Diasorin S.p.A.

- 5.37. Domus Diagnostics

- 5.38. Eiken Chemical

- 5.39. Element Biosciences

- 5.40. Enzo Biochem

- 5.41. Eurofins Scientific

- 5.42. Fluxergy

- 5.43. Fulgent Genetics

- 5.44. Fusion Genomics.

- 5.45. Genedrive

- 5.46. Genetic Signatures

- 5.47. GenMark Dx (Roche)

- 5.48. Genomadix

- 5.49. Grifols

- 5.50. Grip Molecular Technologies

- 5.51. Hibergene Diagnostics

- 5.52. Hologic

- 5.53. Illumina

- 5.54. Immunexpress

- 5.55. Inflammatix

- 5.56. Invetech

- 5.57. Janssen Diagnostics

- 5.58. Karius

- 5.59. Lexagene

- 5.60. LightDeck Diagnostics

- 5.61. Lucira Health

- 5.62. Luminex Corp (DiaSorin)

- 5.63. LumiraDx

- 5.64. Lumos Diagnostics

- 5.65. Mammoth Biosciences

- 5.66. Maxim Biomedical

- 5.67. Meridian Bioscience

- 5.68. Mesa Biotech (Thermo Fisher)

- 5.69. MicroGem

- 5.70. Millipore Sigma

- 5.71. Mindray

- 5.72. Minute Molecular

- 5.73. Mobidiag (Hologic)

- 5.74. Molbio Diagnostics

- 5.75. NanoDx

- 5.76. Nanomix

- 5.77. Novacyt

- 5.78. Novel Microdevices

- 5.79. OnsiteGene

- 5.80. Operon

- 5.81. Oxford Nanopore Technologies

- 5.82. Panagene

- 5.83. Pathogenomix

- 5.84. Perkin Elmer

- 5.85. Prenetics

- 5.86. Primerdesign (Novacyt)

- 5.87. Prominex

- 5.88. Proof Diagnostics

- 5.89. Qiagen

- 5.90. QuantuMDx

- 5.91. Quest Diagnostics

- 5.92. QuidelOrtho

- 5.93. Randox Toxicology

- 5.94. Roche Molecular Diagnostics

- 5.95. Saw Diagnostics

- 5.96. Scope Fluidics

- 5.97. SD Biosensor

- 5.98. Seegene

- 5.99. Siemens Healthineers

- 5.100. Singular Genomics

- 5.101. SomaLogic

- 5.102. Sona Nanotech

- 5.103. SpeeDx

- 5.104. T2 Biosystems

- 5.105. Talis Biomedical

- 5.106. Thermo Fisher Scientific Inc.

- 5.107. Ultima Genomics

- 5.108. Vela Diagnostics

- 5.109. Veramarx

- 5.110. Veredus Laboratories

- 5.111. Vir

- 5.112. Vircell

- 5.113. Visby Medical

- 5.114. XCR Diagnostics

- 5.115. YD Diagnostics

- 5.116. Zhejiang Orient Gene Biotech

6. Market Trends

- 6.1. Factors Driving Growth

- 6.1.1. New Genotypes Creating New Markets

- 6.1.2. The Aging Effect

- 6.1.3. Developing World Driving ID Dx Growth

- 6.1.4. Point of Care - Why Centralization is Losing Steam

- 6.1.5. Self Testing

- 6.1.6. The Need for Speed

- 6.1.7. The COVID Pandemic

- 6.2. Factors Limiting Growth

- 6.2.1. Lower Costs

- 6.2.2. Infectious Disease is Declining

- 6.2.3. Wellness Hurts

- 6.2.4. Economic Growth improves Living Standards

- 6.3. Instrumentation and Automation

- 6.3.1. Instruments Key to Market Share

- 6.3.2. The Shrinking Machine

- 6.3.3. Multiplex, Point of Care and The Speed Factor

- 6.4. Diagnostic Technology Development

- 6.4.1. The Sepsis Testing Market - A New Direction?

- 6.4.2. POCT/Self Testing as a Disruptive Force

- 6.4.3. The Genetics Play - One Test for All Known Infections

- 6.4.4. Antibiotic Resistance Genes - Simplifying Diagnostics

7. Molecular Dx - Infectious Disease Recent Developments

- 7.1. Recent Developments - Importance and How to Use This Section

- 7.1.1. Importance of These Developments

- 7.1.2. How to Use This Section

- 7.2. Hologic Revenues Rise 5 Percent on MDx Strength

- 7.3. Genetic Signatures Halts U.S. Molecular Respiratory Panel

- 7.4. Molecular Testing Growth Creates Reimbursement Problems

- 7.5. Binx Health Refocuses on POC STD Testing

- 7.6. LetsGetChecked Authorized for STD Test

- 7.7. Genetic Signatures Applies for GI Parasite Detection Kit

- 7.8. Sensible Diagnostics Nabs Award for Respiratory Panel

- 7.9. Post-Pandemic Changes Landscape of ID Dx

- 7.10. Multiplex Meningitis/Encephalitis Panel Market Expanding

- 7.11. Sensible Diagnostics to Launch 10-Minute POC PCR System

- 7.12. ReadyGo Dx Emerges From Stealth With MDx Plan

- 7.13. BioMerieux, Oxford Nanopore Form ID Dx Pact

- 7.14. SD Biosensor Eyes Global Expansion for Rapid MDx System

- 7.15. Compact POCT Platform Unlocks Multiplexing Potential of Real-Time PCR

- 7.16. Takara Bio and BioExcel Partner on ID Panels

- 7.17. BioGX introduces pixl real-time PCR platform

- 7.18. Sherlock Biosciences Improves ID Dx Toolkit

- 7.19. Climate change is making hundreds of diseases much worse

- 7.20. BioMerieux Invests in Sepsis Dx Startup Weezion

- 7.21. Domus Diagnostics to Launch POC MDx Test System

- 7.22. Proof Dx Plans Infectious Disease, Oncology Tests for CRISPR-Based POC

- 7.23. Oxford Nanopore Diagnostics to Develop Clinical Tools

- 7.24. Pathogenomix Developing Infectious Disease Platform Using NGS

- 7.25. COVID-19 Accelerating Trend Toward Pharmacy-Based Testing

- 7.26. Co-Diagnostics Seeks FDA EUA for At-Home PCR Diagnostic

- 7.27. Sense Biodetection to Debut Instrument-Free Point-of-Care MDx

- 7.28. Home Test Company Prenetics to go Public

- 7.29. Roche to Acquire TIB Molbiol to Expand Infectious Disease Portfolio

- 7.30. Lucira Health Posts Revenue Growth on OTC C19 Test

- 7.31. BforCure Preparing Multiple Panels for Point-of-Care qPCR Platform

- 7.32. Talis Biomedical Discusses Point-of-Care

- 7.33. Roche to Acquire GenMark Diagnostics for $1.8B

- 7.34. Pandemic Pushes Handheld qPCR Devices Closer to Commercialization

- 7.35. Hologic to Acquire Mobidiag

- 7.36. Lucira Health Focuses on User Friendly Approach to Home Testing

- 7.37. Infectious Disease Dx Firm Talis Biomedical Raises $254M in IPO

- 7.38. Fluidigm Plans 'Durable' Diagnostics, Clinical Business

- 7.39. Thermo Fisher Scientific to Acquire Mesa Biotech for Up to $550M

- 7.40. Mammoth Biosciences Developing Pathogen Detection Tech

- 7.41. Illumina, IDbyDNA Developing Sequencing-Based Respiratory Tests

- 7.42. Scanogen Developing 90 Minute Infection Test

- 7.43. Malaria Assays Use CRISPR for Point-of-Care Multispecies Detection

- 7.44. FDA Provides Self Testing SARS-CoV-2 EAU Guidance

- 7.45. Mammoth Biosciences Announces Rapid, CRISPR-Based COVID-19 Diagnostic

8. The Global Market for Molecular Diagnostics Infectious Disease

- 8.1. Global Market Overview by Country

- 8.1.1. Table - Global Market by Country

- 8.1.2. Chart - Global Market by Country

- 8.2. Global Market by Syndrome - Overview

- 8.2.1. Table - Global Market by Syndrome

- 8.2.2. Chart - Global Market by Syndrome - Base/Final Year Comparison

- 8.2.3. Chart - Global Market by Syndrome - Base Year

- 8.2.4. Chart - Global Market by Syndrome - End Year

- 8.2.5. Chart - Global Market by Syndrome - Share by Year

- 8.2.6. Chart - Global Market by Syndrome - Segments Growth

- 8.3. Global Market by Plex - Overview

- 8.3.1. Table - Global Market by Plex

- 8.3.2. Chart - Global Market by Plex - Base/Final Year Comparison

- 8.3.3. Chart - Global Market by Plex - Base Year

- 8.3.4. Chart - Global Market by Plex - End Year

- 8.3.5. Chart - Global Market by Plex - Share by Year

- 8.3.6. Chart - Global Market by Plex - Segments Growth

- 8.4. Global Market by Place - Overview

- 8.4.1. Table - Global Market by Place

- 8.4.2. Chart - Global Market by Place - Base/Final Year Comparison

- 8.4.3. Chart - Global Market by Place - Base Year

- 8.4.4. Chart - Global Market by Place - End Year

- 8.4.5. Chart - Global Market by Place - Share by Year

- 8.4.6. Chart - Global Market by Place - Segments Growth

9. Global MDx Infectious Disease Markets - By Syndrome

- 9.1. Respiratory

- 9.1.1. Table Respiratory - by Country

- 9.1.2. Chart - Respiratory Growth

- 9.2. Gastrointestinal

- 9.2.1. Table Gastrointestinal - by Country

- 9.2.2. Chart - Gastrointestinal Growth

- 9.3. Blood

- 9.3.1. Table Blood - by Country

- 9.3.2. Chart - Blood Growth

- 9.4. Meningitis/Encephalitis

- 9.4.1. Table Meningitis/Encephalitis - by Country

- 9.4.2. Chart - Meningitis/Encephalitis Growth

- 9.5. Sexually Transmitted Disease

- 9.5.1. Table Sexually Transmitted Disease - by Country

- 9.5.2. Chart - Sexually Transmitted Disease Growth

- 9.6. Other

- 9.6.1. Table Other - by Country

- 9.6.2. Chart - Other Growth

10. Global MDx Markets for Infectious Disease - by Plex

- 10.1. Single Plex

- 10.1.1. Table Single Plex - by Country

- 10.1.2. Chart - Single Plex Growth

- 10.2. Duplex

- 10.2.1. Table Duplex - by Country

- 10.2.2. Chart - Duplex Growth

- 10.3. Triplex

- 10.3.1. Table Triplex - by Country

- 10.3.2. Chart - Triplex Growth

- 10.4. Multiplex Technology

- 10.4.1. Table Multiplex - by Country

- 10.4.2. Chart - Multiplex Growth

11. Global MDx Infectious Disease Markets - by Place

- 11.1. Hospital Lab

- 11.1.1. Table Hospital Lab - by Country

- 11.1.2. Chart - Hospital Lab Growth

- 11.2. Outpatient Lab

- 11.2.1. Table Outpatient Lab - by Country

- 11.2.2. Chart - Outpatient Lab Growth

- 11.3. POC

- 11.3.1. Table POC - by Country

- 11.3.2. Chart - POC Growth

- 11.4. Other Place

- 11.4.1. Table Other Place- by Country

- 11.4.2. Chart - Other Place Growth

12. Appendices

- 12.1. United States Medicare System: Clinical Laboratory Fees Schedule

- 12.2. The Most Used IVD Assays

- 12.3. The Highest Grossing Assays