|

|

市場調査レポート

商品コード

1726272

強化水の世界市場:市場規模・シェア・動向分析 (製品別・流通チャネル別・地域別)、セグメント別予測 (2025年~2030年)Enhanced Water Market Size, Share & Trends Analysis Report By Product (Flavored, Plain), By Distribution Channel (Online, Offline), By Region (North America, Europe, Middle East & Africa, Asia Pacific), And Segment Forecasts, 2025 - 2030 |

||||||

カスタマイズ可能

|

|||||||

| 強化水の世界市場:市場規模・シェア・動向分析 (製品別・流通チャネル別・地域別)、セグメント別予測 (2025年~2030年) |

|

出版日: 2025年04月16日

発行: Grand View Research

ページ情報: 英文 100 Pages

納期: 2~10営業日

|

全表示

- 概要

- 図表

- 目次

強化水市場の成長と動向:

Grand View Research, Inc.の最新レポートによると、世界の強化水市場は2030年までに148億7,000万米ドルに達し、予測期間中にCAGR 9.2%で成長すると予測されています。

これらの製品は、腎臓結石、膀胱炎、発熱、嘔吐、下痢に悩む人々に非常に人気があります。また、強化水は妊娠中や授乳中の女性にも強く推奨されています。さらに、これらの製品は、高強度のワークアウトに携わる人々やスポーツ愛好家によって消費されています。

あらゆる年齢層で強化水の採用が増加しており、市場成長にプラスの影響を与えると予想されます。これらの製品に関連する健康上の利点は、スポーツやフィットネス関連の活動に対するミレニアル世代の関心の高まりとともに、電解質水分補給飲料の需要を押し上げる大きな役割を果たしています。さらに、変化する顧客ニーズに合わせた製品発売の増加が市場成長を促進しています。2023年2月、CORE Nutritional LLCはCore Hydration+を発売し、免疫系をサポートするもの、リラクゼーションを助けるもの、健康な皮膚、髪、爪をサポートするもの3種類を発売しました。

消費者が水分補給飲料の購入に力を入れているのは、消化や循環といった関連する健康上の利点があるためであり、また十分な水分補給は透明感のある健康的な肌をもたらすため、見た目を美しくするためでもあります。こうしたメリットは、健康志向の消費者の間で電解質水分補給飲料の消費を促進すると予想されます。ミレニアル世代のスポーツやフィットネス活動への関心のシフトは、世界中の市場をさらに牽引すると予想されます。

強化水市場:分析概要

- 2024年の市場収益シェアは、フレーバーセグメントが65%超で最大でした。この製品は、健康に適切とは見なされないにもかかわらず、その味のために消費されているすべての現代的な飲料の完璧な代替品であるため、好まれています。

- フレーバー無し(プレーン)セグメントは予測期間中最も速いCAGRで成長すると予測されています。プレーン強化水は、水のクリーンで自然な味を損なうことなく、添加された電解質、ビタミン、ミネラルの利点を提供し、健康志向の人々に好まれる選択となっています。

- オンラインセグメントは予測期間中最も速いCAGRで成長すると予測されます。電子メディアを通じて買い物をするY世代、Z世代、アルファ世代が消費者セグメントで優位を占めていることが、このセグメントの成長を牽引しています。

- 北米は2024年に45%以上の最大の市場収益シェアを占めました。中国やインドを含む新興経済諸国では、ミレニアル世代のフィットネスへの支出が増加しており、水分補給飲料のような製品の普及が促進されると予想されます。

目次

第1章 分析方法・範囲

第2章 エグゼクティブサマリー

第3章 強化水市場:変動要因・傾向・範囲

- 市場連関の見通し

- 親市場の見通し

- 関連/付随市場の見通し

- 業界バリューチェーン分析

- 販売/小売チャネル分析

- 利益率分析

- 市場力学

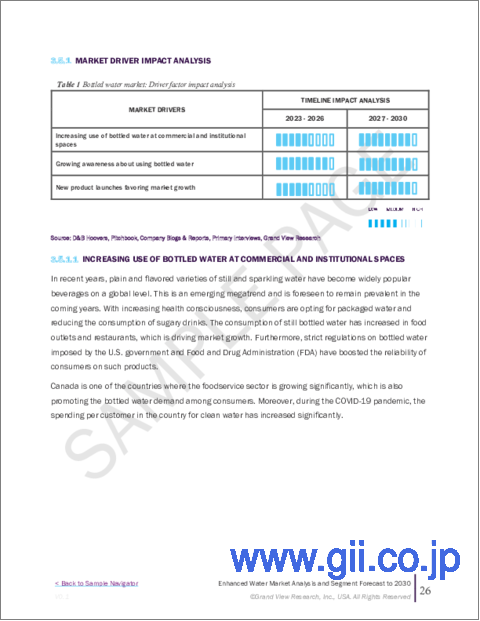

- 市場促進要因の分析

- 市場抑制要因の分析

- 業界の課題

- 業界の機会

- 業界分析ツール

- ポーターのファイブフォース分析

- 市場参入戦略

第4章 消費者行動分析

- 人口統計分析

- 消費者の動向と嗜好

- 購入決定に影響を与える要因

- 消費者の製品採用状況

- 観察と推奨事項

第5章 世界の強化水市場:製品別の推定・動向分析

- 強化水市場:主なポイント、製品別

- 変動分析と市場シェア:製品別 (2025年・2030年)

- 製品別 (2018~2030年)

- フレーバー付き

- フレーバー無し

第6章 世界の強化水市場:流通チャネル別の推定・動向分析

- 強化水市場:主なポイント、流通チャネル別

- 変動分析と市場シェア:流通チャネル別 (2024年・2030年)

- 流通チャネル別 (2018~2030年)

- オンライン

- オフライン

第7章 世界の強化水市場:地域別の推定・動向分析

- 強化水市場:地域別の展望

- 地域別市場:重要なポイント

- 地域別 (2018~2030年)

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- アジア太平洋

- オーストラリア

第8章 世界の強化水市場:競合情勢

- 最新動向と影響分析:主な市場参入企業別

- 企業分類

- 企業市場シェア分析 (%、2024年)

- 企業ヒートマップ/ポジショニング分析

- 戦略マッピング

- 企業プロファイル

- BiPro USA(Agropur)

- Keurig Dr Pepper Inc.

- H2rOse

- JUST Goods, Inc.

- Essential Water, LLC

- Hint Inc.

- PepsiCo Inc.

- Liquid Death Mountain Water

- Karma Water

- Viking Coca-cola Bottling Co.

List of Tables

- Table 1 Global enhanced water market estimates and forecast, 2018 - 2030 (USD Million)

- Table 2 Global enhanced water market estimates and forecast, by product, 2018 - 2030 (USD Million)

- Table 3 Global enhanced water market estimates & forecast, by distribution channel, 2018 - 2030 (USD Million)

- Table 4 Global enhanced water market estimates & forecast, by region, 2018 - 2030 (USD Million)

- Table 5 North America global enhanced water market estimates and forecasts, by country, 2018 - 2030 (USD Million)

- Table 6 North America enhanced water market estimates and forecast, by product, 2018 - 2030 (USD Million)

- Table 7 North America enhanced water market estimates and forecasts, by distribution channel, 2018 - 2030 (USD Million)

- Table 8 U.S. macro-economic outlay

- Table 9 U.S. enhanced water market estimates and forecast, by product, 2018 - 2030 (USD Million)

- Table 10 U.S. enhanced water market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- Table 11 Canada macro-economic outlay

- Table 12 Canada enhanced water market estimates and forecast, by product, 2018 - 2030 (USD Million)

- Table 13 Canada enhanced water market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- Table 14 Europe enhanced water market estimates and forecasts, by country, 2018 - 2030 (USD Million)

- Table 15 Europe enhanced water market estimates and forecast, by product, 2018 - 2030 (USD Million)

- Table 16 Europe enhanced water market estimates and forecasts, by distribution channel, 2018 - 2030 (USD Million)

- Table 17 UK macro-economic outlay

- Table 18 UK enhanced water market estimates and forecast, by product, 2018 - 2030 (USD Million)

- Table 19 UK enhanced water market estimates and forecasts, by distribution channel, 2018 - 2030 (USD Million)

- Table 20 Germany macro-economic outlay

- Table 21 Germany enhanced water market estimates and forecast, by product, 2018 - 2030 (USD Million)

- Table 22 Germany enhanced water market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- Table 23 France macro-economic outlay

- Table 24 France enhanced water market estimates and forecast, by product, 2018 - 2030 (USD Million)

- Table 25 France enhanced water market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- Table 26 Italy macro-economic outlay

- Table 27 Italy enhanced water market estimates and forecast, by product, 2018 - 2030 (USD Million)

- Table 28 Italy enhanced water market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- Table 29 Asia Pacific enhanced water market estimates and forecasts, by country, 2018 - 2030 (USD Million)

- Table 30 Asia Pacific enhanced water market estimates and forecast, by product, 2018 - 2030 (USD Million)

- Table 31 Asia Pacific enhanced water market estimates and forecasts, by distribution channel, 2018 - 2030 (USD Million)

- Table 32 Australia macro-economic outlay

- Table 33 Australia enhanced water market estimates and forecast, by product, 2018 - 2030 (USD Million)

- Table 34 Australia enhanced water market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

List of Figures

- Fig. 1 Global enhanced water market segmentation

- Fig. 2 Information procurement

- Fig. 3 Primary research pattern

- Fig. 4 Primary research approaches

- Fig. 5 Primary research process

- Fig. 6 Market snapshot

- Fig. 7 Product segment snapshot

- Fig. 8 Distribution channel segment snapshot

- Fig. 9 Competitive landscape snapshot

- Fig. 10 Enhanced water market value, 2024 (USD Million)

- Fig. 11 Enhanced water market - Industry value chain analysis

- Fig. 12 Enhanced water market dynamics

- Fig. 13 Enhanced water market: Porter's analysis

- Fig. 14 Enhanced water market, by product: Key takeaways

- Fig. 15 Enhanced water market, by product: Market share, 2024 & 2030

- Fig. 16 Flavored enhanced water market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 17 Plain enhanced water market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 18 Enhanced water market, by distribution channel: Market share, 2024 & 2030

- Fig. 19 Enhanced water market estimates & forecasts, through online channels, 2018 - 2030 (USD Million)

- Fig. 20 Enhanced water market estimates & forecasts, through offline channels, 2018 - 2030 (USD Million)

- Fig. 21 Enhanced water market revenue, by region, 2024 & 2030 (USD Million)

- Fig. 22 Regional marketplace: Key takeaways

- Fig. 23 North America enhanced water market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 24 U.S. enhanced water market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 25 Canada enhanced water market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 26 Europe, Middle East & Africa enhanced water market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 27 UK enhanced water market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 28 Germany enhanced water market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 29 France enhanced water market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 30 Italy enhanced water market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 31 Asia Pacific enhanced water market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 32 Australia enhanced water market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 33 Key company categorization

- Fig. 34 Strategic framework

Enhanced Water Market Growth & Trends:

The global enhanced water market is anticipated to reach USD 14.87 billion by 2030 and is anticipated to grow at a CAGR of 9.2% during the forecast period, according to a new report by Grand View Research, Inc. These products are extremely popular among people suffering from kidney stones, bladder infection, fever, vomiting, and diarrhea. Enhanced water is also highly recommended for pregnant and breastfeeding women. Moreover, these products are consumed by people involved in a high-intensity workout and sports enthusiasts.

Increasing the adoption of enhanced water among all age groups is expected to positively influence market growth. Health benefits associated with these products, along with the rising interest of millennials in sports and fitness-related activities, play a substantial role in boosting the demand for electrolyte hydration drinks. Moreover, increasing number of product launches to suit the changing needs of customers is driving market growth. In February 2023, CORE Nutritional LLC launched Core Hydration+ with three variants: one to support the immune system, another to aid relaxation, and another to support healthy skin, hair, and nails.

Consumers are focusing on purchasing hydration beverages owing to the associated health benefits such as digestion and circulation and for enhancing their appearance since adequate hydration leads to clearer and healthier skin. Such benefits are expected to drive the consumption of electrolyte hydration drinks among health-conscious consumers. The shifting interest of millennials towards sports and fitness activities is expected to further drive the market across the globe.

Enhanced Water Market Report Highlights:

- The flavored segment held the largest market revenue share of over 65% in 2024. The product is preferred as it is a perfect replacement for all modern beverages that are not considered appropriate for health yet are consumed because of their taste.

- The plain segment is projected to grow at the fastest CAGR over the forecast period. Plain-enhanced water offers the benefits of added electrolytes, vitamins, and minerals without compromising water's clean and natural taste, making it a preferred choice for health-conscious individuals.

- The online segment is projected to grow at the fastest CAGR over the forecast period. The dominance of Generation Y, Z, and Alpha in the consumer segment who are more into shopping through the electronic media is driving the segment growth.

- North America held the largest market revenue share of over 45% in 2024. Rising spending on fitness among millennials in developing economies including China and India is expected to promote the scope of products such as hydration drinks among buyers.

Table of Contents

Chapter 1. Methodology and Scope

- 1.1. Market Segmentation & Scope

- 1.2. Market Definition

- 1.3. Information Procurement

- 1.3.1. Purchased Database

- 1.3.2. GVR's Internal Database

- 1.3.3. Secondary Sources & Third-Party Perspectives

- 1.3.4. Primary Research

- 1.4. Information Analysis

- 1.4.1. Data Analysis Models

- 1.5. Market Formulation & Data Visualization

- 1.6. Data Validation & Publishing

Chapter 2. Executive Summary

- 2.1. Market Snapshot

- 2.2. Segment Snapshot

- 2.3. Competitive Landscape Snapshot

Chapter 3. Global Enhanced Water Market Variables, Trends & Scope

- 3.1. Market Lineage Outlook

- 3.1.1. Parent Market Outlook

- 3.1.2. Related Market Outlook

- 3.2. Industry Value Chain Analysis

- 3.2.1. Sales/Retail Channel Analysis

- 3.2.2. Profit Margin Analysis

- 3.3. Market Dynamics

- 3.3.1. Market Driver Analysis

- 3.3.2. Market Restraint Analysis

- 3.3.3. Industry Challenges

- 3.3.4. Industry Opportunities

- 3.4. Industry Analysis Tools

- 3.4.1. Porter's Five Forces Analysis

- 3.5. Market Entry Strategies

Chapter 4. Consumer Behavior Analysis

- 4.1. Demographic Analysis

- 4.2. Consumer Trends & Preferences

- 4.3. Factors Influencing Buying Decisions

- 4.4. Consumer Product Adoption Trends

- 4.5. Observations & Recommendations

Chapter 5. Global Enhanced Water Market: Product Estimates & Trend Analysis

- 5.1. Global Enhanced Water Market Product: Key Takeaways

- 5.2. Product Movement Analysis & Market Share, 2025 & 2030

- 5.3. Global Enhanced Water Market Estimates & Forecast, By Product, 2018 to 2030 (USD Million)

- 5.3.1. Flavored

- 5.3.1.1. Market Estimates & Forecasts, 2018 to 2030 (USD Million)

- 5.3.2. Plain

- 5.3.2.1. Market Estimates & Forecasts, 2018 to 2030 (USD Million)

- 5.3.1. Flavored

Chapter 6. Global Enhanced Water Market: Distribution Channel Estimates & Trend Analysis

- 6.1. Global Enhanced Water Market Distribution Channel: Key Takeaways

- 6.2. Distribution Channel Movement Analysis & Market Share, 2024 & 2030

- 6.3. Global Enhanced Water Market Estimates & Forecast, By Distribution Channel, 2018 to 2030 (USD Million)

- 6.3.1. Online

- 6.3.1.1. Market Estimates & Forecasts, 2018 to 2030 (USD Million)

- 6.3.2. Offline

- 6.3.2.1. Market Estimates & Forecasts, 2018 to 2030 (USD Million)

- 6.3.1. Online

Chapter 7. Global Enhanced Water Market: Regional Estimates & Trend Analysis

- 7.1. Global Enhanced Water: Regional Outlook

- 7.2. Regional Marketplaces: Key Takeaways

- 7.3. Global Enhanced Water Market Estimates & Forecast, By Region, 2018 to 2030 (USD Million)

- 7.4. North America

- 7.4.1. North America Enhanced Water Market Estimates & Forecast, 2018 - 2030 (USD Million)

- 7.4.2. U.S.

- 7.4.2.1. Key Country Dynamics

- 7.4.2.2. U.S. Enhanced Water Market Estimates & Forecast, 2018 - 2030 (USD Million)

- 7.4.3. Canada

- 7.4.3.1. Key Country Dynamics

- 7.4.3.2. Canada Enhanced Water Market Estimates & Forecast, 2018 - 2030 (USD Million)

- 7.5. Europe

- 7.5.1. Europe Enhanced Water Market Estimates & Forecast, 2018 - 2030 (USD Million)

- 7.5.2. Germany

- 7.5.2.1. Key Country Dynamics

- 7.5.2.2. Germany Enhanced Water Market Estimates & Forecast, 2018 - 2030 (USD Million)

- 7.5.3. UK

- 7.5.3.1. Key Country Dynamics

- 7.5.3.2. UK Enhanced Water Market Estimates & Forecast, 2018 - 2030 (USD Million)

- 7.5.4. France

- 7.5.4.1. Key Country Dynamics

- 7.5.4.2. France Enhanced Water Market Estimates & Forecast, 2018 - 2030 (USD Million)

- 7.5.5. Italy

- 7.5.5.1. Key Country Dynamics

- 7.5.5.2. Italy Enhanced Water Market Estimates & Forecast, 2018 - 2030 (USD Million)

- 7.6. Asia Pacific

- 7.6.1. Asia Pacific Enhanced Water Market Estimates & Forecast, 2018 - 2030 (USD Million)

- 7.6.2. Australia

- 7.6.2.1. Key Country Dynamics

- 7.6.2.2. Australia Enhanced Water Market Estimates & Forecast, 2018 - 2030 (USD Million)

Chapter 8. Global Enhanced Water Market - Competitive Landscape

- 8.1. Recent Developments & Impact Analysis by Key Market Participants

- 8.2. Company Categorization

- 8.3. Company Market Share, 2024

- 8.4. Company Heat Map/ Positioning Analysis

- 8.5. Strategy Mapping

- 8.6. Company Profiles

- 8.6.1. BiPro USA (Agropur)

- 8.6.1.1. Company Overview

- 8.6.1.2. Financial Performance

- 8.6.1.3. Product Benchmarking

- 8.6.1.4. Strategic Initiatives

- 8.6.2. Keurig Dr Pepper Inc.

- 8.6.2.1. Company Overview

- 8.6.2.2. Financial Performance

- 8.6.2.3. Product Benchmarking

- 8.6.2.4. Strategic Initiatives

- 8.6.3. H2rOse

- 8.6.3.1. Company Overview

- 8.6.3.2. Financial Performance

- 8.6.3.3. Product Benchmarking

- 8.6.3.4. Strategic Initiatives

- 8.6.4. JUST Goods, Inc.

- 8.6.4.1. Company Overview

- 8.6.4.2. Financial Performance

- 8.6.4.3. Product Benchmarking

- 8.6.4.4. Strategic Initiatives

- 8.6.5. Essential Water, LLC

- 8.6.5.1. Company Overview

- 8.6.5.2. Financial Performance

- 8.6.5.3. Product Benchmarking

- 8.6.5.4. Strategic Initiatives

- 8.6.6. Hint Inc.

- 8.6.6.1. Company Overview

- 8.6.6.2. Financial Performance

- 8.6.6.3. Product Benchmarking

- 8.6.6.4. Strategic Initiatives

- 8.6.7. PepsiCo Inc.

- 8.6.7.1. Company Overview

- 8.6.7.2. Financial Performance

- 8.6.7.3. Product Benchmarking

- 8.6.7.4. Strategic Initiatives

- 8.6.8. Liquid Death Mountain Water

- 8.6.8.1. Company Overview

- 8.6.8.2. Financial Performance

- 8.6.8.3. Product Benchmarking

- 8.6.8.4. Strategic Initiatives

- 8.6.9. Karma Water

- 8.6.9.1. Company Overview

- 8.6.9.2. Financial Performance

- 8.6.9.3. Product Benchmarking

- 8.6.9.4. Strategic Initiatives

- 8.6.10. Viking Coca-cola Bottling Co.

- 8.6.10.1. Company Overview

- 8.6.10.2. Financial Performance

- 8.6.10.3. Product Benchmarking

- 8.6.10.4. Strategic Initiatives

- 8.6.1. BiPro USA (Agropur)