|

|

市場調査レポート

商品コード

1726159

車両ロードアシスタンス市場規模、シェア、動向分析レポート:サービスタイプ別、プロバイダー別、車種別、地域別、セグメント別予測、2025年~2030年Vehicle Roadside Assistance Market Size, Share & Trends Analysis Report By Service Type, By Provider, By Vehicle Type, By Region, And Segment Forecasts, 2025 - 2030 |

||||||

カスタマイズ可能

|

|||||||

| 車両ロードアシスタンス市場規模、シェア、動向分析レポート:サービスタイプ別、プロバイダー別、車種別、地域別、セグメント別予測、2025年~2030年 |

|

出版日: 2025年04月07日

発行: Grand View Research

ページ情報: 英文 130 Pages

納期: 2~10営業日

|

全表示

- 概要

- 図表

- 目次

車両ロードアシスタンス市場動向

世界の車両ロードアシスタンス市場規模は2024年に265億8,000万米ドルと推定され、2025~2030年にかけてCAGR 5.0%で成長すると予測されています。

車両ロードアシスタンスは、道路走行中に車両関連の問題が発生したドライバーに緊急支援を提供することを目的としたサービスです。通常、パンク、バッテリー問題、燃料供給、ロックアウト、牽引サービス、軽微な機械修理など、予期せず発生する可能性のあるさまざまな問題に対するサポートが含まれます。世界の自動車保有台数の増加と交通量の増加が相まって、故障や事故の発生率が高くなり、ロードアシスタンスサービスの需要を押し上げています。さらに、交通安全に対する意識の高まりと、サブスクリプションモデルを含む大手企業によるサービス提供の拡大が、市場の成長をさらに後押ししています。

ロードアシスタンス業務における人工知能(AI)、全地球測位システム(GPS)、テレマティクス、モノのインターネット(IoT)などの先進技術の統合の高まりが、市場の成長を促進しています。例えば、AIは、最寄りのサービスプロバイダが顧客に迅速に到着するようにすることで、配車を最適化するために使用されます。AIはまた、交通量、場所、必要なサービスタイプなどの要因を分析してリアルタイムで意思決定を行い、効率と応答時間を向上させています。さらに、テレマティクスシステムにより、車両はサービスプロバイダにリアルタイムでデータを送信することができるため、サービスプロバイダは問題を迅速に診断し、最適な対応策を決定することができます。この技術により、応答時間が短縮され、より正確なサービスが提供されるため、ダウンタイムが短縮され、全体的な顧客体験が向上します。

さらに、モバイルアプリケーションは現代のロードアシスタンスサービスの要になりつつあります。これらのアプリケーションは、ユーザーにヘルプのリクエスト、サービスの進捗状況の追跡、サービスプロバイダとのコミュニケーションを行うための便利なプラットフォームを記載しています。アプリ内のチャット、リアルタイムの追跡、デジタル決済オプションなどの強化された機能は、アシスタンスプロセスを合理化し、ユーザーの満足度を向上させています。モバイルアプリケーションはまた、より透明性の高いサービスの追跡とステータス更新を可能にし、ストレスの多い状況下でもユーザーに高い満足感を記載しています。このように、ロードアシスタンスプロバイダが提供するモバイルアプリケーションの採用増加は、市場の成長をさらに向上させています。

世界中で電気自動車や自律走行車の採用が増加していることも、車両ロードアシスタンス産業の大きな動向です。これらの車種が普及しつつあるため、ロードアシスタンスプロバイダは、独自の要件を満たすようにサービスを適応させる必要があります。電気自動車(EV)の場合、これは技術者がバッテリー問題や充電サポートのための専門的なトレーニングやツールを装備することを意味します。自律走行車の場合、プロバイダは先進技術を扱い、潜在的なソフトウェア関連の問題に対処するための新しいプロトコルを開発しています。このように、道路を走る電気自動車の増加によるバッテリーアシスタンスサービスに対する需要の高まりが、市場の成長を後押ししています。

車両ロードアシスタンス市場の成長と進歩にもかかわらず、サービス品質のレベルのばらつきやサイバーセキュリティの懸念など、いくつかの抑制要因が市場の成長を妨げる可能性があります。車両、インフラ、サービスプラットフォームがインターネットを通じて相互接続されるようになると、サイバー脅威に対してより脆弱になります。ハッカーがスマート道路システムや車両ネットワークを侵害し、交通渋滞や事故、個人データへの不正アクセスなどの混乱につながる可能性があります。これは業務効率、利用者の安全、プライバシーに重大なリスクをもたらします。さらに、先進的ファイアウォールや安全なプロトコルなど、強固なサイバーセキュリティ対策を確保するには、多額の投資と技術的専門知識が必要であり、一部のプロバイダにとっては障壁となりえます。

目次

第1章 調査手法と範囲

第2章 エグゼクティブサマリー

第3章 車両ロードアシスタンス市場の変数、動向、範囲

- 市場系統の展望

- 市場力学

- 市場促進要因分析

- 市場抑制要因分析

- 産業の課題

- 車両ロードアシスタンス市場分析ツール

- 産業分析-ポーターのファイブフォース分析

- PESTEL分析

第4章 車両ロードアシスタンス市場:サービスタイプ別、推定・動向分析

- セグメントダッシュボード

- 車両ロードアシスタンス市場:サービスタイプ変動分析、2024年と2030年

- 曳航

- タイヤ交換

- 燃料供給

- ロックアウト/交換キーサービス

- バッテリーアシスタンス

- その他

第5章 車両ロードアシスタンス市場:プロバイダ別、推定・動向分析

- セグメントダッシュボード

- 車両ロードアシスタンス市場:プロバイダ変動分析、2024年と2030年

- 自動車保険

- 自動車メーカー

- 自動車クラブ

- 独立保証プロバイダ

第6章 車両ロードアシスタンス市場:車種別、推定・動向分析

- セグメントダッシュボード

- 車両ロードアシスタンス市場:車種変動分析、2024年と2030年

- 乗用車

- 商用車

- 商用車の収益推定と予測、2018~2030年

第7章 車両ロードアシスタンス市場:地域別、推定・動向分析

- 車両ロードアシスタンス市場シェア(地域別、2024年と2030年、100万米ドル)

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- ラテンアメリカ

- ブラジル

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

第8章 競合情勢

- 企業分類

- 企業の市場ポジショニング

- 企業ヒートマップ分析

- 企業プロファイル/上場企業

- GEICO

- Viking Assistance Group AS

- ARC Europe

- Allstate Insurance Company

- Agero, Inc.

- Prime Assistance Inc.

- SOS International A/S

- Allianz Partners

- American Automobile Association

- Best Roadside Service

- Access Roadside Assistance

- National General Motor Club

- Liberty Mutual Insurance

- Chevrolet

- Ford Motor Company

- Nissan Motor Corporation

List of Tables

- Table 1 Global Vehicle Roadside Assistance market size estimates & forecasts 2018 - 2030 (USD Million)

- Table 2 Global Vehicle Roadside Assistance market, by region 2018 - 2030 (USD Million)

- Table 3 Global Vehicle Roadside Assistance market, by Service Type 2018 - 2030 (USD Million)

- Table 4 Global Vehicle Roadside Assistance market, by Provider 2018 - 2030 (USD Million)

- Table 5 Global Vehicle Roadside Assistance market, by Vehicle Type 2018 - 2030 (USD Million)

- Table 6 Towing Vehicle Roadside Assistance market, by region 2018 - 2030 (USD Million)

- Table 7 Tire Replacement Vehicle Roadside Assistance market, by region 2018 - 2030 (USD Million)

- Table 8 Fuel Delivery Vehicle Roadside Assistance market, by region 2018 - 2030 (USD Million)

- Table 9 Lockout/Replacement Key Service Vehicle Roadside Assistance market, by region 2018 - 2030 (USD Million)

- Table 10 Battery Vehicle Roadside Assistance market, by region 2018 - 2030 (USD Million)

- Table 11 Others Vehicle Roadside Assistance market, by region 2018 - 2030 (USD Million)

- Table 12 Motor Insurance Vehicle Roadside Assistance market, by region 2018 - 2030 (USD Million)

- Table 13 Auto Manufacturer Vehicle Roadside Assistance market, by region 2018 - 2030 (USD Million)

- Table 14 Automotive Clubs Vehicle Roadside Assistance market, by region 2018 - 2030 (USD Million)

- Table 15 Independent Warranty Providers Vehicle Roadside Assistance market, by region 2018 - 2030 (USD Million)

- Table 16 Passenger Cars Vehicle Roadside Assistance market, by region 2018 - 2030 (USD Million)

- Table 17 Commercial Vehicles Roadside Assistance market, by region 2018 - 2030 (USD Million)

- Table 18 North America Vehicle Roadside Assistance market, by Service Type 2018 - 2030 (USD Million)

- Table 19 North America Vehicle Roadside Assistance market, by Provider 2018 - 2030 (USD Million)

- Table 20 North America Vehicle Roadside Assistance market, by Vehicle Type 2018 - 2030 (USD Million)

- Table 21 U.S. Vehicle Roadside Assistance market, by Service Type 2018 - 2030 (USD Million)

- Table 22 U.S. Vehicle Roadside Assistance market, by Provider 2018 - 2030 (USD Million)

- Table 23 U.S. Vehicle Roadside Assistance market, by Vehicle Type 2018 - 2030 (USD Million)

- Table 24 Canada Vehicle Roadside Assistance market, by Service Type 2018 - 2030 (USD Million)

- Table 25 Canada Vehicle Roadside Assistance market, by Provider 2018 - 2030 (USD Million)

- Table 26 Canada Vehicle Roadside Assistance market, by Vehicle Type 2018 - 2030 (USD Million)

- Table 27 Mexico Vehicle Roadside Assistance market, by Service Type 2018 - 2030 (USD Million)

- Table 28 Mexico Vehicle Roadside Assistance market, by Provider 2018 - 2030 (USD Million)

- Table 29 Mexico Vehicle Roadside Assistance market, by Vehicle Type 2018 - 2030 (USD Million)

- Table 30 Europe Vehicle Roadside Assistance market, by Service Type 2018 - 2030 (USD Million)

- Table 31 Europe Vehicle Roadside Assistance market, by Provider 2018 - 2030 (USD Million)

- Table 32 Europe Vehicle Roadside Assistance market, by Vehicle Type 2018 - 2030 (USD Million)

- Table 33 UK Vehicle Roadside Assistance market, by Service Type 2018 - 2030 (USD Million)

- Table 34 UK Vehicle Roadside Assistance market, by Provider 2018 - 2030 (USD Million)

- Table 35 UK Vehicle Roadside Assistance market, by Vehicle Type 2018 - 2030 (USD Million)

- Table 36 Germany Vehicle Roadside Assistance market, by Service Type 2018 - 2030 (USD Million)

- Table 37 Germany Vehicle Roadside Assistance market, by Provider 2018 - 2030 (USD Million)

- Table 38 Germany Vehicle Roadside Assistance market, by Vehicle Type 2018 - 2030 (USD Million)

- Table 39 France Vehicle Roadside Assistance market, by Service Type 2018 - 2030 (USD Million)

- Table 40 France Vehicle Roadside Assistance market, by Provider 2018 - 2030 (USD Million)

- Table 41 France Vehicle Roadside Assistance market, by Vehicle Type 2018 - 2030 (USD Million)

- Table 42 Asia Pacific Vehicle Roadside Assistance market, by Service Type 2018 - 2030 (USD Million)

- Table 43 Asia Pacific Vehicle Roadside Assistance market, by Provider 2018 - 2030 (USD Million)

- Table 44 Asia Pacific Vehicle Roadside Assistance market, by Vehicle Type 2018 - 2030 (USD Million)

- Table 45 China Vehicle Roadside Assistance market, by Service Type 2018 - 2030 (USD Million)

- Table 46 China Vehicle Roadside Assistance market, by Provider 2018 - 2030 (USD Million)

- Table 47 China Vehicle Roadside Assistance market, by Vehicle Type 2018 - 2030 (USD Million)

- Table 48 India Vehicle Roadside Assistance market, by Service Type 2018 - 2030 (USD Million)

- Table 49 India Vehicle Roadside Assistance market, by Provider 2018 - 2030 (USD Million)

- Table 50 India Vehicle Roadside Assistance market, by Vehicle Type 2018 - 2030 (USD Million)

- Table 51 Japan Vehicle Roadside Assistance market, by Service Type 2018 - 2030 (USD Million)

- Table 52 Japan Vehicle Roadside Assistance market, by Provider 2018 - 2030 (USD Million)

- Table 53 Japan Vehicle Roadside Assistance market, by Vehicle Type 2018 - 2030 (USD Million)

- Table 54 South Korea Vehicle Roadside Assistance market, by Service Type 2018 - 2030 (USD Million)

- Table 55 South Korea Vehicle Roadside Assistance market, by Provider 2018 - 2030 (USD Million)

- Table 56 South Korea Vehicle Roadside Assistance market, by Vehicle Type 2018 - 2030 (USD Million)

- Table 57 Australia Vehicle Roadside Assistance market, by Service Type 2018 - 2030 (USD Million)

- Table 58 Australia Vehicle Roadside Assistance market, by Provider 2018 - 2030 (USD Million)

- Table 59 Australia Vehicle Roadside Assistance market, by Vehicle Type 2018 - 2030 (USD Million)

- Table 60 Latin America Vehicle Roadside Assistance market, by Service Type 2018 - 2030 (USD Million)

- Table 61 Latin America Vehicle Roadside Assistance market, by Provider 2018 - 2030 (USD Million)

- Table 62 Latin America Vehicle Roadside Assistance market, by Vehicle Type 2018 - 2030 (USD Million)

- Table 63 Brazil Vehicle Roadside Assistance market, by Service Type 2018 - 2030 (USD Million)

- Table 64 Brazil Vehicle Roadside Assistance market, by Provider 2018 - 2030 (USD Million)

- Table 65 Brazil Vehicle Roadside Assistance market, by Vehicle Type 2018 - 2030 (USD Million)

- Table 66 MEA Vehicle Roadside Assistance market, by Service Type 2018 - 2030 (USD Million)

- Table 67 MEA Vehicle Roadside Assistance market, by Provider 2018 - 2030 (USD Million)

- Table 68 MEA Vehicle Roadside Assistance market, by Vehicle Type 2018 - 2030 (USD Million)

- Table 69 UAE Vehicle Roadside Assistance market, by Service Type 2018 - 2030 (USD Million)

- Table 70 UAE Vehicle Roadside Assistance market, by Provider 2018 - 2030 (USD Million)

- Table 71 UAE Vehicle Roadside Assistance market, by Vehicle Type 2018 - 2030 (USD Million)

- Table 72 KSA Vehicle Roadside Assistance market, by Service Type 2018 - 2030 (USD Million)

- Table 73 KSA Vehicle Roadside Assistance market, by Provider 2018 - 2030 (USD Million)

- Table 74 KSA Vehicle Roadside Assistance market, by Vehicle Type 2018 - 2030 (USD Million)

- Table 75 South Africa Vehicle Roadside Assistance market, by Service Type 2018 - 2030 (USD Million)

- Table 76 South Africa Vehicle Roadside Assistance market, by Provider 2018 - 2030 (USD Million)

- Table 77 South Africa Vehicle Roadside Assistance market, by Vehicle Type 2018 - 2030 (USD Million)

List of Figures

- Fig. 1 Vehicle Roadside Assistance market segmentation

- Fig. 2 Market research process

- Fig. 3 Information procurement

- Fig. 4 Primary research pattern

- Fig. 5 Market research approaches

- Fig. 6 Value chain-based sizing & forecasting

- Fig. 7 Parent market analysis

- Fig. 8 Market formulation & validation

- Fig. 9 Vehicle Roadside Assistance market snapshot

- Fig. 10 Vehicle Roadside Assistance market segment snapshot

- Fig. 11 Vehicle Roadside Assistance market competitive landscape snapshot

- Fig. 12 Market research process

- Fig. 13 Market driver relevance analysis (Current & future impact)

- Fig. 14 Market restraint relevance analysis (Current & future impact)

- Fig. 15 Vehicle Roadside Assistance market, Service Type outlook key takeaways (USD Million)

- Fig. 16 Vehicle Roadside Assistance market, Service Type movement analysis 2024 & 2030 (USD Million)

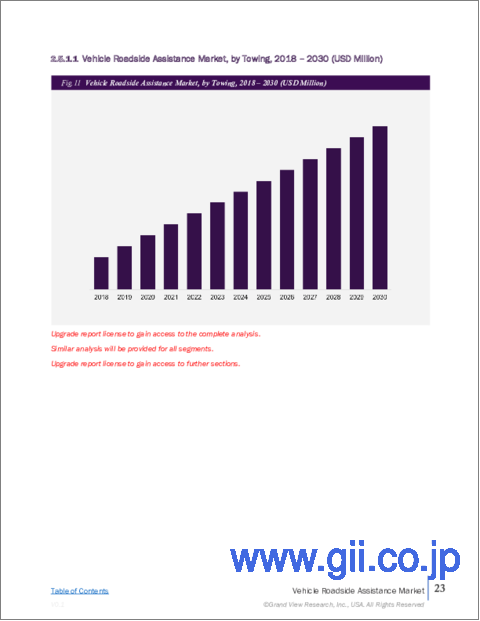

- Fig. 17 Towing market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 18 Tire Replacement market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 19 Fuel Delivery market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 20 Lockout/Replacement Key Service market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 21 Battery Assistance market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 22 Others market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 23 Vehicle Roadside Assistance market: Provider outlook key takeaways (USD Million)

- Fig. 24 Vehicle Roadside Assistance market: Provider movement analysis 2024 & 2030 (USD Million)

- Fig. 25 Motor Insurance market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 26 Auto Manufacturer market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 27 Automotive Clubs market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 28 Independent Warranty Providers market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 29 Vehicle Roadside Assistance market: Vehicle Type outlook key takeaways (USD Million)

- Fig. 30 Vehicle Roadside Assistance market: Vehicle Type movement analysis 2024 & 2030 (USD Million)

- Fig. 31 Passenger Cars market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 32 Commercial Vehicles revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 33 Regional marketplace: Key takeaways

- Fig. 34 Vehicle Roadside Assistance market: Regional outlook, 2024 & 2030 (USD Million)

- Fig. 35 North America Vehicle Roadside Assistance market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 36 U.S. Vehicle Roadside Assistance market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 37 Canada Vehicle Roadside Assistance market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 38 Mexico Vehicle Roadside Assistance market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 39 Europe Vehicle Roadside Assistance market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 40 UK Vehicle Roadside Assistance market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 41 Germany Vehicle Roadside Assistance market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 42 France Vehicle Roadside Assistance market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 43 Asia Pacific Vehicle Roadside Assistance market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 44 China Vehicle Roadside Assistance market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 45 Japan Vehicle Roadside Assistance market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 46 India Vehicle Roadside Assistance market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 47 Australia Vehicle Roadside Assistance market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 48 South Korea Vehicle Roadside Assistance market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 49 Latin America Vehicle Roadside Assistance market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 50 Brazil Vehicle Roadside Assistance market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 51 MEA Vehicle Roadside Assistance market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 52 KSA Vehicle Roadside Assistance market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 53 UAE Vehicle Roadside Assistance market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 54 South Africa Vehicle Roadside Assistance market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 55 Strategy framework

- Fig. 56 Company Categorization

Vehicle Roadside Assistance Market Trends:

The global vehicle roadside assistance market size was estimated at USD 26.58 billion in 2024 and is projected to grow at a CAGR of 5.0% from 2025 to 2030. Vehicle roadside assistance is a service designed to provide emergency help to drivers who experience vehicle-related issues while on the road. It typically includes support for a range of problems that can occur unexpectedly, such as flat tires, battery issues, fuel delivery, lockouts, towing services, and minor mechanical repairs. The rise in vehicle ownership globally, coupled with increasing traffic volumes, has led to a higher incidence of breakdowns and accidents, thereby driving the demand for roadside assistance services. In addition, the growing awareness of road safety, alongside the expansion of service offerings by major players, including subscription models, is further propelling market growth.

The rising integration of advanced technologies such as artificial intelligence (AI), global positioning system (GPS), telematics, and Internet of Things (IoT) in roadside assistance operations is propelling the growth of the market. For instance, AI is used to optimize vehicle dispatching by ensuring that the nearest service provider arrives at the customer quickly. AI also analyzes factors such as traffic, location, and the type of service needed to make real-time decisions, enhancing efficiency and response times. In addition, with telematics systems, vehicles can transmit real-time data to service providers, enabling them to quickly diagnose issues and determine the best course of action. This technology allows for faster response times and more accurate service, reducing downtime and enhancing the overall customer experience.

Furthermore, mobile applications are becoming a cornerstone of modern roadside assistance services. These applications offer users a convenient platform to request help, track service progress, and communicate with service providers. Enhanced features such as in-app chat, real-time tracking, and digital payment options streamline the assistance process and improve user satisfaction. Mobile applications also allow for more transparent service tracking and status updates, providing users with greater satisfaction during stressful situations. Thus, the increased adoption of mobile applications provided by roadside assistance providers is further improving the growth of the market.

The rising adoption of electric and autonomous vehicles across the globe is another major trend in the vehicle roadside assistance industry. These vehicle types are becoming more prevalent, prompting roadside assistance providers to adapt services to meet their unique requirements. For electric vehicles (EVs), this means equipping technicians with specialized training and tools for battery issues and charging support. For autonomous vehicles, providers are developing new protocols for handling advanced technology and addressing potential software-related issues. Thus, the rising demand for battery assistance services due to the increased number of electric vehicles on the roads is boosting the market's growth.

Despite the growth and advancements in the vehicle roadside assistance market, several restraining factors, such as varying levels of service quality and cybersecurity concerns, could hamper the growth of the market. As vehicles, infrastructure, and service platforms become more interconnected through the internet, they become more vulnerable to cyber threats. Hackers could potentially compromise smart road systems or vehicle networks, leading to disruptions such as traffic jams, accidents, or unauthorized access to personal data. This poses a significant risk to operational efficiency, user safety, and privacy. In addition, ensuring robust cybersecurity measures, such as advanced firewalls and secure protocols, requires substantial investment and technical expertise, which can be a barrier for some providers.

Global Vehicle Roadside Assistance Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global vehicle roadside assistance market report based on service type, provider, vehicle type, and region:

- Service Type Outlook (Revenue, USD Million, 2018 - 2030)

- Towing

- Tire Replacement

- Fuel Delivery

- Lockout/Replacement Key Service

- Battery Assistance

- Others

- Provider Outlook (Revenue, USD Million, 2018 - 2030)

- Motor Insurance

- Auto Manufacturer

- Automotive Clubs

- Independent Warranty Providers

- Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

- Passenger Cars

- Commercial Vehicles

- Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Latin America

- Brazil

- Middle East and Africa (MEA)

- KSA

- UAE

- South Africa

Table of Contents

Chapter 1. Methodology and Scope

- 1.1. Market Segmentation and Scope

- 1.2. Research Methodology

- 1.2.1. Information Procurement

- 1.3. Information or Data Analysis

- 1.4. Methodology

- 1.5. Research Scope and Assumptions

- 1.6. Market Formulation & Validation

- 1.7. List of Data Sources

Chapter 2. Executive Summary

- 2.1. Market Outlook

- 2.2. Segment Outlook

- 2.3. Competitive Insights

Chapter 3. Vehicle Roadside Assistance Market Variables, Trends, & Scope

- 3.1. Market Lineage Outlook

- 3.2. Market Dynamics

- 3.2.1. Market Driver Analysis

- 3.2.2. Market Restraint Analysis

- 3.2.3. Industry Challenge

- 3.3. Vehicle Roadside Assistance Market Analysis Tools

- 3.3.1. Industry Analysis - Porter's

- 3.3.1.1. Bargaining power of the suppliers

- 3.3.1.2. Bargaining power of the buyers

- 3.3.1.3. Threats of substitution

- 3.3.1.4. Threats from new entrants

- 3.3.1.5. Competitive rivalry

- 3.3.2. PESTEL Analysis

- 3.3.2.1. Political landscape

- 3.3.2.2. Economic and social landscape

- 3.3.2.3. Technological landscape

- 3.3.1. Industry Analysis - Porter's

Chapter 4. Vehicle Roadside Assistance Market: Service Type Estimates & Trend Analysis

- 4.1. Segment Dashboard

- 4.2. Vehicle Roadside Assistance Market: Service Type Movement Analysis, 2024 & 2030 (USD Million)

- 4.3. Towing

- 4.3.1. Towing Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 4.4. Tire Replacement

- 4.4.1. Tire Replacement Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 4.5. Fuel Delivery

- 4.5.1. Fuel Delivery Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 4.6. Lockout/Replacement Key Service

- 4.6.1. Lockout/Replacement Key Service Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 4.7. Battery Assistance

- 4.7.1. Battery Assistance Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 4.8. Others

- 4.8.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 5. Vehicle Roadside Assistance Market: Provider Estimates & Trend Analysis

- 5.1. Segment Dashboard

- 5.2. Vehicle Roadside Assistance Market: Provider Movement Analysis, 2024 & 2030 (USD Million)

- 5.3. Motor Insurance

- 5.3.1. Motor Insurance Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 5.4. Auto Manufacturer

- 5.4.1. Auto Manufacturer Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 5.5. Automotive Clubs

- 5.5.1. Automotive Clubs Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 5.6. Independent Warranty Providers

- 5.6.1. Independent Warranty Providers Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 6. Vehicle Roadside Assistance Market: Vehicle Type Estimates & Trend Analysis

- 6.1. Segment Dashboard

- 6.2. Vehicle Roadside Assistance Market: Vehicle Type Movement Analysis, 2024 & 2030 (USD Million)

- 6.3. Passenger Cars

- 6.3.1. Passenger Cars Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 6.4. Commercial Vehicles

- 6.4.1. Commercial Vehicles Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 7. Vehicle Roadside Assistance Market: Regional Estimates & Trend Analysis

- 7.1. Vehicle Roadside Assistance Market Share, By Region, 2024 & 2030, USD Million

- 7.2. North America

- 7.2.1. North America Vehicle Roadside Assistance Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 7.2.2. U.S.

- 7.2.2.1. U.S. Vehicle Roadside Assistance Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 7.2.3. Canada

- 7.2.3.1. Canada Vehicle Roadside Assistance Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 7.2.4. Mexico

- 7.2.4.1. Mexico Vehicle Roadside Assistance Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 7.3. Europe

- 7.3.1. Europe Vehicle Roadside Assistance Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 7.3.2. UK

- 7.3.2.1. UK Vehicle Roadside Assistance Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 7.3.3. Germany

- 7.3.3.1. Germany Vehicle Roadside Assistance Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 7.3.4. France

- 7.3.4.1. France Vehicle Roadside Assistance Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 7.4. Asia Pacific

- 7.4.1. Asia Pacific Vehicle Roadside Assistance Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 7.4.2. China

- 7.4.2.1. China Vehicle Roadside Assistance Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 7.4.3. Japan

- 7.4.3.1. Japan Vehicle Roadside Assistance Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 7.4.4. India

- 7.4.4.1. India Vehicle Roadside Assistance Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 7.4.5. South Korea

- 7.4.5.1. South Korea Vehicle Roadside Assistance Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 7.4.6. Australia

- 7.4.6.1. Australia Vehicle Roadside Assistance Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 7.5. Latin America

- 7.5.1. Latin America Vehicle Roadside Assistance Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 7.5.2. Brazil

- 7.5.2.1. Brazil Vehicle Roadside Assistance Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 7.6. Middle East and Africa

- 7.6.1. Middle East and Africa Vehicle Roadside Assistance Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 7.6.2. UAE

- 7.6.2.1. UAE Vehicle Roadside Assistance Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 7.6.3. KSA

- 7.6.3.1. KSA Vehicle Roadside Assistance Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 7.6.4. South Africa

- 7.6.4.1. South Africa Vehicle Roadside Assistance Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 8. Competitive Landscape

- 8.1. Company Categorization

- 8.2. Company Market Positioning

- 8.3. Company Heat Map Analysis

- 8.4. Company Profiles/Listing

- 8.4.1. GEICO

- 8.4.1.1. Participant's Overview

- 8.4.1.2. Financial Performance

- 8.4.1.3. Product Benchmarking

- 8.4.1.4. Strategic Initiatives

- 8.4.2. Viking Assistance Group AS

- 8.4.2.1. Participant's Overview

- 8.4.2.2. Financial Performance

- 8.4.2.3. Product Benchmarking

- 8.4.2.4. Strategic Initiatives

- 8.4.3. ARC Europe

- 8.4.3.1. Participant's Overview

- 8.4.3.2. Financial Performance

- 8.4.3.3. Product Benchmarking

- 8.4.3.4. Strategic Initiatives

- 8.4.4. Allstate Insurance Company

- 8.4.4.1. Participant's Overview

- 8.4.4.2. Financial Performance

- 8.4.4.3. Product Benchmarking

- 8.4.4.4. Strategic Initiatives

- 8.4.5. Agero, Inc.

- 8.4.5.1. Participant's Overview

- 8.4.5.2. Financial Performance

- 8.4.5.3. Product Benchmarking

- 8.4.5.4. Strategic Initiatives

- 8.4.6. Prime Assistance Inc.

- 8.4.6.1. Participant's Overview

- 8.4.6.2. Financial Performance

- 8.4.6.3. Product Benchmarking

- 8.4.6.4. Strategic Initiatives

- 8.4.7. SOS International A/S

- 8.4.7.1. Participant's Overview

- 8.4.7.2. Financial Performance

- 8.4.7.3. Product Benchmarking

- 8.4.7.4. Strategic Initiatives

- 8.4.8. Allianz Partners

- 8.4.8.1. Participant's Overview

- 8.4.8.2. Financial Performance

- 8.4.8.3. Product Benchmarking

- 8.4.8.4. Strategic Initiatives

- 8.4.9. American Automobile Association

- 8.4.9.1. Participant's Overview

- 8.4.9.2. Financial Performance

- 8.4.9.3. Product Benchmarking

- 8.4.9.4. Strategic Initiatives

- 8.4.10. Best Roadside Service

- 8.4.10.1. Participant's Overview

- 8.4.10.2. Financial Performance

- 8.4.10.3. Product Benchmarking

- 8.4.10.4. Strategic Initiatives

- 8.4.11. Access Roadside Assistance

- 8.4.11.1. Participant's Overview

- 8.4.11.2. Financial Performance

- 8.4.11.3. Product Benchmarking

- 8.4.11.4. Strategic Initiatives

- 8.4.12. National General Motor Club

- 8.4.12.1. Participant's Overview

- 8.4.12.2. Financial Performance

- 8.4.12.3. Product Benchmarking

- 8.4.12.4. Strategic Initiatives

- 8.4.13. Liberty Mutual Insurance

- 8.4.13.1. Participant's Overview

- 8.4.13.2. Financial Performance

- 8.4.13.3. Product Benchmarking

- 8.4.13.4. Strategic Initiatives

- 8.4.14. Chevrolet

- 8.4.14.1. Participant's Overview

- 8.4.14.2. Financial Performance

- 8.4.14.3. Product Benchmarking

- 8.4.14.4. Strategic Initiatives

- 8.4.15. Ford Motor Company

- 8.4.15.1. Participant's Overview

- 8.4.15.2. Financial Performance

- 8.4.15.3. Product Benchmarking

- 8.4.15.4. Strategic Initiatives

- 8.4.16. Nissan Motor Corporation

- 8.4.16.1. Participant's Overview

- 8.4.16.2. Financial Performance

- 8.4.16.3. Product Benchmarking

- 8.4.16.4. Strategic Initiatives

- 8.4.1. GEICO