|

|

市場調査レポート

商品コード

1611240

固定・移動式Cアーム市場規模、シェア、動向分析レポート:製品別、用途別、最終用途別、地域別、セグメント別予測、2025年~2030年Fixed And Mobile C-arms Market Size, Share & Trends Analysis Report By Product (Fixed C-arms, Mobile C-arms), By Application (Neurosurgery, Cardiovascular), By End Use, By Region, And Segment Forecasts, 2025 - 2030 |

||||||

カスタマイズ可能

|

|||||||

| 固定・移動式Cアーム市場規模、シェア、動向分析レポート:製品別、用途別、最終用途別、地域別、セグメント別予測、2025年~2030年 |

|

出版日: 2024年11月25日

発行: Grand View Research

ページ情報: 英文 200 Pages

納期: 2~10営業日

|

全表示

- 概要

- 図表

- 目次

固定・移動式Cアーム市場の成長と動向

Grand View Research, Inc.の最新レポートによると、世界の固定・移動式Cアーム市場規模は2030年に42億3,000万米ドルに達し、2025~2030年にかけてCAGR 4.2%で拡大すると予測されています。

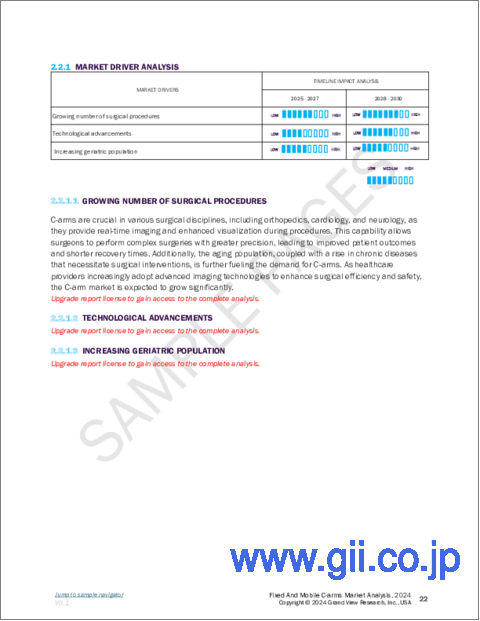

Cアーム技術の絶え間ない技術進歩と外科手術数の増加が市場成長の主要要因です。加えて、様々な慢性疾患に罹患しやすい高齢者の増加が市場成長をさらに押し上げると予測されています。

Cアーム技術は、移動式CアームやミニCアームの採用よって急速に進歩しています。その機動性と画質により、外科医はいつでも手術の進捗状況を追跡し、改善すべき箇所を即座に特定することができます。その結果、治療成績が向上し、最終的には患者の回復が早まり、再手術がさらに減少します。さらに、Cアームにフラットパネル検出器(FPD)がイントロダクションされたことで、放射線量の低減にも役立っています。

神経疾患、整形外科疾患、心血管疾患など、外科的介入を必要とする慢性疾患の有病率の上昇と認知度の向上は、予測期間中の市場成長に拍車をかけると予想されます。さらに、慢性疾患に罹患しやすい高齢者の増加、低侵襲手術への嗜好の高まり、患者の意識の高まりも成長を後押しすると予想されます。

新興国市場の大手メーカーは、製品ポートフォリオや製造能力を拡大するため、買収、資金調達、製品開拓などさまざまな戦略を実施しています。例えば、2021年4月、Carestream HealthはZiehm Imagingと共同で、増加する革新的な製品ラインに移動式Cアームを追加することを発表しました。Ziehm Vision RFD C-armは、Carestreamの移動式と透視製品ラインナップを拡大し、より多くの医療従事者に利益をもたらすことが期待されます。

固定・移動式Cアーム市場レポートハイライト

- 2024年は固定Cアームセグメントが市場を独占。固定式Cアームは、特に大規模病院や手術センターで、継続的かつ正確なイメージングを必要とする複雑な手技に採用されています。

- 移動式Cアームは、予測期間中最も速いCAGR 4.5%で成長する見込み。

- 整形外科と外傷セグメントが固定・移動式Cアーム市場を独占し、2024年には26.9%の最大収益シェアを占めました。

- 心臓血管セグメントは、予測期間中に4.7%を超えるCAGRで最速の成長が見込まれています。

- 病院は、2024年に46.3%のシェアを獲得して市場を独占しました。これは、病院における先進的イメージング技術への高い需要によるもので、Cアームは様々な整形外科、心臓血管、外傷手術に広く使用されています。

目次

第1章 調査手法と範囲

第2章 エグゼクティブサマリー

第3章 固定・移動式Cアーム市場の変数、動向、範囲

- 市場系統の展望

- 親市場の展望

- 関連/付随市場の展望

- 市場力学

- 市場促進要因分析

- 市場抑制要因分析

- 固定・移動式Cアーム市場分析ツール

- 産業分析-ポーターのファイブフォース分析

- PESTEL分析

第4章 固定・移動式Cアーム市場: 製品別、推定・動向分析

- セグメントダッシュボード

- 世界の固定・移動式Cアーム、製品市場の変動分析

- 世界の固定・移動式Cアーム市場規模と動向分析、製品別、2018~2030年

- 固定Cアーム

- 移動式Cアーム

第5章 固定・移動式Cアーム市場:用途別、推定・動向分析

- セグメントダッシュボード

- 世界の固定・移動式Cアーム、用途市場の変動分析

- 世界の固定・移動式Cアーム市場の規模と動向分析、用途別、2018~2030年

- 整形外科と外傷

- 脳神経外科

- 心臓血管

- 疼痛管理

- 消化器内科

- その他

第6章 固定・移動式Cアーム市場:最終用途別、推定・動向分析

- セグメントダッシュボード

- 世界の固定・移動式Cアーム、最終用途市場変動分析

- 世界の固定・移動式Cアーム市場の規模と動向分析、最終用途別、2018~2030年

- 病院

- 外来手術センター

- 研究機関

第7章 固定・移動式Cアーム市場:製品、用途、最終用途による地域別、推定・動向分析

- 地域別市場シェア分析、2024年と2030年

- 地域別市場ダッシュボード

- 世界地域市場のスナップショット

- 市場規模、予測動向分析、2018~2030年

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- ノルウェー

- スウェーデン

- デンマーク

- アジア太平洋

- 日本

- 中国

- インド

- オーストラリア

- 韓国

- タイ

- ラテンアメリカ

- ブラジル

- アルゼンチン

- 中東・アフリカ

- 南アフリカ

- サウジアラビア

- アラブ首長国連邦

- クウェート

第8章 競合情勢

- 主要市場参入企業による最近の動向と影響分析

- 企業/競合の分類

- 主要企業の市場シェア分析、2024年

- Company Position Analysis

- 企業分類(新興企業、イノベーター、リーダー)

- 企業プロファイル

- GE HealthCare

- Koninklijke Philips NV

- Siemens Healthineers AG

- Medtronic

- Shimadzu Corporation

- Hologic, Inc.

- Canon Medical Systems Corporation

- Fujifilm Holdings Corporation

- Ziehm Imaging GmbH

List of Tables

- Table 1. List of secondary sources

- Table 2. List of abbreviation

- Table 3. North America fixed and mobile C-arms market, By country, 2018 - 2030 (USD Million)

- Table 4. North America fixed and mobile C-arms market, By product, 2018 - 2030 (USD Million)

- Table 5. North America fixed and mobile C-arms market, By application, 2018 - 2030 (USD Million)

- Table 6. North America fixed and mobile C-arms market, By end use, 2018 - 2030 (USD Million)

- Table 7. U.S. fixed and mobile C-arms market, By product, 2018 - 2030 (USD Million)

- Table 8. U.S. fixed and mobile C-arms market, By application, 2018 - 2030 (USD Million)

- Table 9. U.S. fixed and mobile C-arms market, By end use, 2018 - 2030 (USD Million)

- Table 10. Canada fixed and mobile C-arms market, By product, 2018 - 2030 (USD Million)

- Table 11. Canada fixed and mobile C-arms market, By application, 2018 - 2030 (USD Million)

- Table 12. Canada fixed and mobile C-arms market, By end use, 2018 - 2030 (USD Million)

- Table 13. Mexico fixed and mobile C-arms market, By product, 2018 - 2030 (USD Million)

- Table 14. Mexico fixed and mobile C-arms market, By application, 2018 - 2030 (USD Million)

- Table 15. Mexico fixed and mobile C-arms market, By end use, 2018 - 2030 (USD Million)

- Table 16. Europe fixed and mobile C-arms market, By country, 2018 - 2030 (USD Million)

- Table 17. Europe fixed and mobile C-arms market, By product, 2018 - 2030 (USD Million)

- Table 18. Europe fixed and mobile C-arms market, By application, 2018 - 2030 (USD Million)

- Table 19. Europe fixed and mobile C-arms market, By end use, 2018 - 2030 (USD Million)

- Table 20. UK fixed and mobile C-arms market, By product, 2018 - 2030 (USD Million)

- Table 21. UK fixed and mobile C-arms market, By application, 2018 - 2030 (USD Million)

- Table 22. UK fixed and mobile C-arms market, By end use, 2018 - 2030 (USD Million)

- Table 23. Germany fixed and mobile C-arms market, By product, 2018 - 2030 (USD Million)

- Table 24. Germany fixed and mobile C-arms market, By application, 2018 - 2030 (USD Million)

- Table 25. Germany fixed and mobile C-arms market, By end use, 2018 - 2030 (USD Million)

- Table 26. France fixed and mobile C-arms market, By product, 2018 - 2030 (USD Million)

- Table 27. France fixed and mobile C-arms market, By application, 2018 - 2030 (USD Million)

- Table 28. France fixed and mobile C-arms market, By end use, 2018 - 2030 (USD Million)

- Table 29. Italy fixed and mobile C-arms market, By product, 2018 - 2030 (USD Million)

- Table 30. Italy fixed and mobile C-arms market, By application, 2018 - 2030 (USD Million)

- Table 31. Italy fixed and mobile C-arms market, By end use, 2018 - 2030 (USD Million)

- Table 32. Denmark fixed and mobile C-arms market, By product, 2018 - 2030 (USD Million)

- Table 33. Denmark fixed and mobile C-arms market, By application, 2018 - 2030 (USD Million)

- Table 34. Denmark fixed and mobile C-arms market, By end use, 2018 - 2030 (USD Million)

- Table 35. Sweden fixed and mobile C-arms market, By product, 2018 - 2030 (USD Million)

- Table 36. Sweden fixed and mobile C-arms market, By application, 2018 - 2030 (USD Million)

- Table 37. Sweden fixed and mobile C-arms market, By end use, 2018 - 2030 (USD Million)

- Table 38. Norway fixed and mobile C-arms market, By product, 2018 - 2030 (USD Million)

- Table 39. Norway fixed and mobile C-arms market, By application, 2018 - 2030 (USD Million)

- Table 40. Norway fixed and mobile C-arms market, By end use, 2018 - 2030 (USD Million)

- Table 41. Asia Pacific fixed and mobile C-arms market, By country, 2018 - 2030 (USD Million)

- Table 42. Asia Pacific fixed and mobile C-arms market, By product, 2018 - 2030 (USD Million)

- Table 43. Asia Pacific fixed and mobile C-arms market, By application, 2018 - 2030 (USD Million)

- Table 44. Asia Pacific fixed and mobile C-arms market, By end use, 2018 - 2030 (USD Million)

- Table 45. Japan fixed and mobile C-arms market, By product, 2018 - 2030 (USD Million)

- Table 46. Japan fixed and mobile C-arms market, By application, 2018 - 2030 (USD Million)

- Table 47. Japan fixed and mobile C-arms market, By end use, 2018 - 2030 (USD Million)

- Table 48. China fixed and mobile C-arms market, By product, 2018 - 2030 (USD Million)

- Table 49. China fixed and mobile C-arms market, By application, 2018 - 2030 (USD Million)

- Table 50. China fixed and mobile C-arms market, By end use, 2018 - 2030 (USD Million)

- Table 51. India fixed and mobile C-arms market, By product, 2018 - 2030 (USD Million)

- Table 52. India fixed and mobile C-arms market, By application, 2018 - 2030 (USD Million)

- Table 53. India fixed and mobile C-arms market, By end use, 2018 - 2030 (USD Million)

- Table 54. Australia fixed and mobile C-arms market, By product, 2018 - 2030 (USD Million)

- Table 55. Australia fixed and mobile C-arms market, By application, 2018 - 2030 (USD Million)

- Table 56. Australia fixed and mobile C-arms market, By end use, 2018 - 2030 (USD Million)

- Table 57. South Korea fixed and mobile C-arms market, By product, 2018 - 2030 (USD Million)

- Table 58. South Korea fixed and mobile C-arms market, By application, 2018 - 2030 (USD Million)

- Table 59. South Korea fixed and mobile C-arms market, By end use, 2018 - 2030 (USD Million)

- Table 60. Thailand fixed and mobile C-arms market, By product, 2018 - 2030 (USD Million)

- Table 61. Thailand fixed and mobile C-arms market, By application, 2018 - 2030 (USD Million)

- Table 62. Thailand fixed and mobile C-arms market, By end use, 2018 - 2030 (USD Million)

- Table 63. Latin America fixed and mobile C-arms market, By Country, 2018 - 2030 (USD Million)

- Table 64. Latin America fixed and mobile C-arms market, By product, 2018 - 2030 (USD Million)

- Table 65. Latin America fixed and mobile C-arms market, By application, 2018 - 2030 (USD Million)

- Table 66. Latin America fixed and mobile C-arms market, By end use, 2018 - 2030 (USD Million)

- Table 67. Brazil fixed and mobile C-arms market, By product, 2018 - 2030 (USD Million)

- Table 68. Brazil fixed and mobile C-arms market, By application, 2018 - 2030 (USD Million)

- Table 69. Brazil fixed and mobile C-arms market, By end use, 2018 - 2030 (USD Million)

- Table 70. Argentina fixed and mobile C-arms market, By product, 2018 - 2030 (USD Million)

- Table 71. Argentina fixed and mobile C-arms market, By application, 2018 - 2030 (USD Million)

- Table 72. Argentina fixed and mobile C-arms market, By end use, 2018 - 2030 (USD Million)

- Table 73. Middle East & Africa fixed and mobile C-arms market, By country, 2018 - 2030 (USD Million)

- Table 74. Middle East & Africa fixed and mobile C-arms market, By product, 2018 - 2030 (USD Million)

- Table 75. Middle East & Africa fixed and mobile C-arms market, By application, 2018 - 2030 (USD Million)

- Table 76. Middle East & Africa fixed and mobile C-arms market, By end use, 2018 - 2030 (USD Million)

- Table 77. South Africa fixed and mobile C-arms market, By product, 2018 - 2030 (USD Million)

- Table 78. South Africa fixed and mobile C-arms market, By application, 2018 - 2030 (USD Million)

- Table 79. South Africa fixed and mobile C-arms market, By end use, 2018 - 2030 (USD Million)

- Table 80. Saudi Arabia fixed and mobile C-arms market, By product, 2018 - 2030 (USD Million)

- Table 81. Saudi Arabia fixed and mobile C-arms market, By application, 2018 - 2030 (USD Million)

- Table 82. Saudi Arabia fixed and mobile C-arms market, By end use, 2018 - 2030 (USD Million)

- Table 83. UAE fixed and mobile C-arms market, By product, 2018 - 2030 (USD Million)

- Table 84. UAE fixed and mobile C-arms market, By application, 2018 - 2030 (USD Million)

- Table 85. UAE fixed and mobile C-arms market, By end use, 2018 - 2030 (USD Million)

- Table 86. Kuwait fixed and mobile C-arms market, By product, 2018 - 2030 (USD Million)

- Table 87. Kuwait fixed and mobile C-arms market, By application, 2018 - 2030 (USD Million)

- Table 88. Kuwait fixed and mobile C-arms market, By end use, 2018 - 2030 (USD Million)

List of Figures

- Fig. 1 Market research process

- Fig. 2 Data triangulation techniques

- Fig. 3 Primary research pattern

- Fig. 4 Primary interviews in North America

- Fig. 5 Primary interviews in Europe

- Fig. 6 Primary interviews in APAC

- Fig. 7 Primary interviews in Latin America

- Fig. 8 Primary interviews in MEA

- Fig. 9 Market research approaches

- Fig. 10 Value-chain-based sizing & forecasting

- Fig. 11 QFD modeling for market share assessment

- Fig. 12 Market formulation & validation

- Fig. 13 Fixed and mobile C-arms market: market outlook

- Fig. 14 Parent market outlook

- Fig. 15 Related/ancillary market outlook

- Fig. 16 Penetration and growth prospect mapping

- Fig. 17 Industry value chain analysis

- Fig. 18 Fixed and mobile C-arms market driver impact

- Fig. 19 Fixed and mobile C-arms market restraint impact

- Fig. 20 Fixed and mobile C-arms market: Product movement analysis

- Fig. 21 Fixed and mobile C-arms market: Product outlook and key takeaways

- Fig. 22 Fixed C-arms market estimates and forecast, 2018 - 2030

- Fig. 23 Mobile C-arms market estimates and forecast, 2018 - 2030

- Fig. 24 Full Size C-arms market estimates and forecast, 2018 - 2030

- Fig. 25 Mini C-arms market estimates and forecast, 2018 - 2030

- Fig. 26 Fixed and mobile C-arms market: Application movement analysis

- Fig. 27 Fixed and mobile C-arms market: Application outlook and key takeaways

- Fig. 28 Orthopedics and trauma market estimates and forecast, 2018 - 2030

- Fig. 29 Neurosurgery market estimates and forecast, 2018 - 2030

- Fig. 30 Cardiovascular market estimates and forecast, 2018 - 2030

- Fig. 31 Pain management market estimates and forecast, 2018 - 2030

- Fig. 32 Gastroenterology market estimates and forecast, 2018 - 2030

- Fig. 33 Others market estimates and forecast, 2018 - 2030

- Fig. 34 Fixed and mobile C-arms market: End use movement analysis

- Fig. 35 Fixed and mobile C-arms market: End use outlook and key takeaways

- Fig. 36 Hospitals market estimates and forecast, 2018 - 2030

- Fig. 37 Ambulatory surgical centers market estimates and forecast, 2018 - 2030

- Fig. 38 Research institutions market estimates and forecast, 2018 - 2030

- Fig. 39 Global fixed and mobile C-arms market: Regional movement analysis

- Fig. 40 Global fixed and mobile C-arms market: Regional outlook and key takeaways

- Fig. 41 North America

- Fig. 42 North America market estimates and forecasts, 2018 - 2030

- Fig. 43 U.S.

- Fig. 44 U.S. market estimates and forecasts, 2018 - 2030

- Fig. 45 Canada

- Fig. 46 Canada market estimates and forecasts, 2018 - 2030

- Fig. 47 Mexico

- Fig. 48 Mexico market estimates and forecasts, 2018 - 2030

- Fig. 49 Europe

- Fig. 50 Europe market estimates and forecasts, 2018 - 2030

- Fig. 51 UK

- Fig. 52 UK market estimates and forecasts, 2018 - 2030

- Fig. 53 Germany

- Fig. 54 Germany market estimates and forecasts, 2018 - 2030

- Fig. 55 France

- Fig. 56 France market estimates and forecasts, 2018 - 2030

- Fig. 57 Italy

- Fig. 58 Italy market estimates and forecasts, 2018 - 2030

- Fig. 59 Spain

- Fig. 60 Spain market estimates and forecasts, 2018 - 2030

- Fig. 61 Denmark

- Fig. 62 Denmark market estimates and forecasts, 2018 - 2030

- Fig. 63 Sweden

- Fig. 64 Sweden market estimates and forecasts, 2018 - 2030

- Fig. 65 Norway

- Fig. 66 Norway market estimates and forecasts, 2018 - 2030

- Fig. 67 Asia Pacific

- Fig. 68 Asia Pacific market estimates and forecasts, 2018 - 2030

- Fig. 69 China

- Fig. 70 China market estimates and forecasts, 2018 - 2030

- Fig. 71 Japan

- Fig. 72 Japan market estimates and forecasts, 2018 - 2030

- Fig. 73 India

- Fig. 74 India market estimates and forecasts, 2018 - 2030

- Fig. 75 Thailand

- Fig. 76 Thailand market estimates and forecasts, 2018 - 2030

- Fig. 77 South Korea

- Fig. 78 South Korea market estimates and forecasts, 2018 - 2030

- Fig. 79 Australia

- Fig. 80 Australia market estimates and forecasts, 2018 - 2030

- Fig. 81 Latin America

- Fig. 82 Latin America market estimates and forecasts, 2018 - 2030

- Fig. 83 Brazil

- Fig. 84 Brazil market estimates and forecasts, 2018 - 2030

- Fig. 85 Argentina

- Fig. 86 Argentina market estimates and forecasts, 2018 - 2030

- Fig. 87 Middle East and Africa

- Fig. 88 Middle East and Africa market estimates and forecasts, 2018 - 2030

- Fig. 89 South Africa

- Fig. 90 South Africa market estimates and forecasts, 2018 - 2030

- Fig. 91 Saudi Arabia

- Fig. 92 Saudi Arabia market estimates and forecasts, 2018 - 2030

- Fig. 93 UAE

- Fig. 94 UAE market estimates and forecasts, 2018 - 2030

- Fig. 95 Kuwait

- Fig. 96 Kuwait market estimates and forecasts, 2018 - 2030

- Fig. 97 Market share of key market players- Fixed and mobile C-arms market

Fixed And Mobile C-arms Market Growth & Trends:

The global fixed and mobile C-arms market size is expected to reach USD 4.23 billion in 2030 and is expected to expand at a CAGR of 4.2% from 2025 to 2030, according to a new report by Grand View Research, Inc. Constant technological advancements in C-arm technology and the growing number of surgical procedures are the primary factors driving the growth of the market. In addition, an increase in the number of the geriatric population prone to various chronic disorders is expected to further boost the market growth.

C-arm technology has progressed rapidly with the introduction of mobile and mini C-arms. Its mobility and image quality allow surgeons to track surgery progress at any moment and identify areas for improvement instantly. As a result, treatment outcomes are better, eventually leading to faster patient recovery, further reducing follow-up operations. Furthermore, the introduction of Flat Panel Detectors (FPD) in C-arms has helped in reducing the radiation dose.

The rising prevalence and awareness of chronic diseases like neurological conditions, orthopedics, and cardiovascular diseases, which may require surgical interventions are expected to fuel the growth of the market during the forecast period. Furthermore, a rise in the geriatric population that is more prone to chronic disorders, a growing preference for minimally invasive surgical procedures, and increasing patient awareness are also expected to boost the growth.

Leading manufacturers in the market are implementing various strategies such as acquisition, funding, and product development to expand their product portfolio and manufacturing capacity. For instance, in April 2021, Carestream Health, in collaboration with Ziehm Imaging, announced the addition of a mobile C-arm to its increasing innovative product line. The Ziehm Vision RFD C-arm is expected to expand Carestream's mobile and fluoroscopic product offerings to benefit even more healthcare providers.

Fixed And Mobile C-arms Market Report Highlights:

- The fixed C-arms segment dominated the market in 2024. Fixed C-arms are particularly adopted in large hospitals and surgical centers for complex procedures that require continuous and precise imaging.

- Mobile C-arms is expected to grow at the fastest CAGR of 4.5% over the forecast period

- The orthopedics and trauma segment dominated the fixed and mobile C-arms market and accounted for the largest revenue share of 26.9% in 2024

- The cardiovascular segment is expected to grow at the fastest CAGR of over 4.7% during the forecast period

- Hospitals dominated the market by capturing a share of 46.3% in 2024. This is due to the high demand for advanced imaging technologies in hospitals, where C-arms are extensively used for various orthopedic, cardiovascular, and trauma surgeries

Table of Contents

Chapter 1. Methodology and Scope

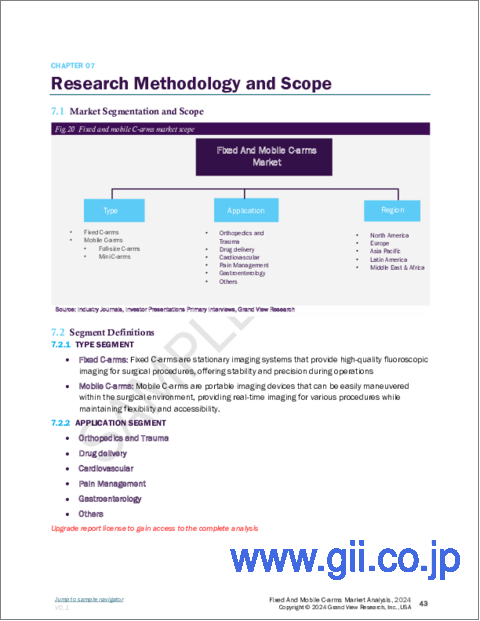

- 1.1. Market Segmentation & Scope

- 1.2. Segment Definitions

- 1.2.1. Product

- 1.2.2. Application

- 1.2.3. End Use

- 1.2.4. Regional scope

- 1.2.5. Estimates and forecasts timeline

- 1.3. Research Methodology

- 1.4. Information Procurement

- 1.4.1. Purchased database

- 1.4.2. GVR's internal database

- 1.4.3. Secondary sources

- 1.4.4. Primary research

- 1.4.5. Details of primary research

- 1.4.5.1. Data for primary interviews in North America

- 1.4.5.2. Data for primary interviews in Europe

- 1.4.5.3. Data for primary interviews in Asia Pacific

- 1.4.5.4. Data for primary interviews in Latin America

- 1.4.5.5. Data for Primary interviews in MEA

- 1.5. Information or Data Analysis

- 1.5.1. Data analysis models

- 1.6. Market Formulation & Validation

- 1.7. Model Details

- 1.7.1. Commodity flow analysis (Model 1)

- 1.7.2. Approach 1: Commodity flow approach

- 1.7.3. Volume price analysis (Model 2)

- 1.7.4. Approach 2: Volume price analysis

- 1.8. List of Secondary Sources

- 1.9. List of Primary Sources

- 1.10. Objectives

Chapter 2. Executive Summary

- 2.1. Market Outlook

- 2.2. Segment Outlook

- 2.2.1. Product outlook

- 2.2.2. Application outlook

- 2.2.3. End Use outlook

- 2.2.4. Regional outlook

- 2.3. Competitive Insights

Chapter 3. Fixed and Mobile C-arms Market Variables, Trends & Scope

- 3.1. Market Lineage Outlook

- 3.1.1. Parent market outlook

- 3.1.2. Related/ancillary market outlook

- 3.2. Market Dynamics

- 3.2.1. Market driver analysis

- 3.2.1.1. Growing number of surgical procedures

- 3.2.1.2. Technological advancements

- 3.2.1.3. Increasing geriatric population

- 3.2.2. Market restraint analysis

- 3.2.2.1. High cost of C-arm system

- 3.2.2.2. Complex regulatory environment

- 3.2.1. Market driver analysis

- 3.3. Fixed and Mobile C-arms Market Analysis Tools

- 3.3.1. Industry Analysis - Porter's

- 3.3.1.1. Supplier power

- 3.3.1.2. Buyer power

- 3.3.1.3. Substitution threat

- 3.3.1.4. Threat of new entrant

- 3.3.1.5. Competitive rivalry

- 3.3.2. PESTEL Analysis

- 3.3.2.1. Political landscape

- 3.3.2.2. Technological landscape

- 3.3.2.3. Economic landscape

- 3.3.1. Industry Analysis - Porter's

Chapter 4. Fixed and Mobile C-arms Market: Product Estimates & Trend Analysis

- 4.1. Segment Dashboard

- 4.2. Global Fixed and Mobile C-arms Product Market Movement Analysis

- 4.3. Global Fixed and Mobile C-arms Market Size & Trend Analysis, by Product, 2018 to 2030 (USD Million)

- 4.4. Fixed C-arms

- 4.4.1. Fixed C-arms market estimates and forecasts 2018 - 2030 (USD Million)

- 4.5. Mobile C-arms

- 4.5.1. Mobile C-arms market estimates and forecasts 2018 - 2030 (USD Million)

- 4.5.1.1. Full size C-arms

- 4.5.1.1.1. Full size C-arms market estimates and forecasts 2018 - 2030 (USD Million)

- 4.5.1.2. Mini C-arms

- 4.5.1.2.1. Mini C-arms market estimates and forecasts 2018 - 2030 (USD Million)

- 4.5.1.1. Full size C-arms

- 4.5.1. Mobile C-arms market estimates and forecasts 2018 - 2030 (USD Million)

Chapter 5. Fixed and Mobile C-arms Market: Application Estimates & Trend Analysis

- 5.1. Segment Dashboard

- 5.2. Global Fixed and Mobile C-arms Application Market Movement Analysis

- 5.3. Global Fixed and Mobile C-arms Market Size & Trend Analysis, by Application, 2018 to 2030 (USD Million)

- 5.4. Orthopedics and Trauma

- 5.4.1. Orthopedics and trauma market estimates and forecasts 2018 - 2030 (USD Million)

- 5.5. Neurosurgery

- 5.5.1. Neurosurgery market estimates and forecasts 2018 - 2030 (USD Million)

- 5.6. Cardiovascular

- 5.6.1. Cardiovascular market estimates and forecasts 2018 - 2030 (USD Million)

- 5.7. Pain Management

- 5.7.1. Pain management market estimates and forecasts 2018 - 2030 (USD Million)

- 5.8. Gastroenterology

- 5.8.1. Gastroenterology market estimates and forecasts 2018 - 2030 (USD Million)

- 5.9. Others

- 5.9.1. Others market estimates and forecasts 2018 - 2030 (USD Million)

Chapter 6. Fixed and Mobile C-arms Market: End Use Estimates & Trend Analysis

- 6.1. Segment Dashboard

- 6.2. Global Fixed and Mobile C-arms End Use Market Movement Analysis

- 6.3. Global Fixed and Mobile C-arms Market Size & Trend Analysis, by End Use, 2018 to 2030 (USD Million)

- 6.4. Hospitals

- 6.4.1. Hospitals market estimates and forecasts 2018 - 2030 (USD Million)

- 6.5. Ambulatory Surgical Centers

- 6.5.1. Ambulatory surgical centers market estimates and forecasts 2018 - 2030 (USD Million)

- 6.6. Research Institutions

- 6.6.1. Research institutions market estimates and forecasts 2018 - 2030 (USD Million)

Chapter 7. Fixed and Mobile C-arms Market: Regional Estimates & Trend Analysis By Product, Application, End Use

- 7.1. Regional Market Share Analysis, 2024 & 2030

- 7.2. Regional Market Dashboard

- 7.3. Global Regional Market Snapshot

- 7.4. Market Size, & Forecasts Trend Analysis, 2018 to 2030:

- 7.5. North America

- 7.5.1. U.S.

- 7.5.1.1. Key country dynamics

- 7.5.1.2. Competitive scenario

- 7.5.1.3. Regulatory framework

- 7.5.1.4. Reimbursement structure

- 7.5.1.5. U.S. market estimates and forecasts 2018 - 2030 (USD Million)

- 7.5.2. Canada

- 7.5.2.1. Key country dynamics

- 7.5.2.2. Competitive scenario

- 7.5.2.3. Regulatory framework

- 7.5.2.4. Reimbursement structure

- 7.5.2.5. Canada market estimates and forecasts 2018 - 2030 (USD Million)

- 7.5.3. Mexico

- 7.5.3.1. Key country dynamics

- 7.5.3.2. Competitive scenario

- 7.5.3.3. Regulatory framework

- 7.5.3.4. Reimbursement structure

- 7.5.3.5. Canada market estimates and forecasts 2018 - 2030 (USD Million)

- 7.5.1. U.S.

- 7.6. Europe

- 7.6.1. UK

- 7.6.1.1. Key country dynamics

- 7.6.1.2. Competitive scenario

- 7.6.1.3. Regulatory framework

- 7.6.1.4. Reimbursement structure

- 7.6.1.5. UK market estimates and forecasts 2018 - 2030 (USD Million)

- 7.6.2. Germany

- 7.6.2.1. Key country dynamics

- 7.6.2.2. Competitive scenario

- 7.6.2.3. Regulatory framework

- 7.6.2.4. Reimbursement structure

- 7.6.2.5. Germany market estimates and forecasts 2018 - 2030 (USD Million)

- 7.6.3. France

- 7.6.3.1. Key country dynamics

- 7.6.3.2. Competitive scenario

- 7.6.3.3. Regulatory framework

- 7.6.3.4. Reimbursement structure

- 7.6.3.5. France market estimates and forecasts 2018 - 2030 (USD Million)

- 7.6.4. Italy

- 7.6.4.1. Key country dynamics

- 7.6.4.2. Competitive scenario

- 7.6.4.3. Regulatory framework

- 7.6.4.4. Reimbursement structure

- 7.6.4.5. Italy market estimates and forecasts 2018 - 2030 (USD Million)

- 7.6.5. Spain

- 7.6.5.1. Key country dynamics

- 7.6.5.2. Competitive scenario

- 7.6.5.3. Regulatory framework

- 7.6.5.4. Reimbursement structure

- 7.6.5.5. Spain market estimates and forecasts 2018 - 2030 (USD Million)

- 7.6.6. Norway

- 7.6.6.1. Key country dynamics

- 7.6.6.2. Competitive scenario

- 7.6.6.3. Regulatory framework

- 7.6.6.4. Reimbursement structure

- 7.6.6.5. Norway market estimates and forecasts 2018 - 2030 (USD Million)

- 7.6.7. Sweden

- 7.6.7.1. Key country dynamics

- 7.6.7.2. Competitive scenario

- 7.6.7.3. Regulatory framework

- 7.6.7.4. Reimbursement structure

- 7.6.7.5. Sweden market estimates and forecasts 2018 - 2030 (USD Million)

- 7.6.8. Denmark

- 7.6.8.1. Key country dynamics

- 7.6.8.2. Competitive scenario

- 7.6.8.3. Regulatory framework

- 7.6.8.4. Reimbursement structure

- 7.6.8.5. Denmark market estimates and forecasts 2018 - 2030 (USD Million)

- 7.6.1. UK

- 7.7. Asia Pacific

- 7.7.1. Japan

- 7.7.1.1. Key country dynamics

- 7.7.1.2. Competitive scenario

- 7.7.1.3. Regulatory framework

- 7.7.1.4. Reimbursement structure

- 7.7.1.5. Japan market estimates and forecasts 2018 - 2030 (USD Million)

- 7.7.2. China

- 7.7.2.1. Key country dynamics

- 7.7.2.2. Competitive scenario

- 7.7.2.3. Regulatory framework

- 7.7.2.4. Reimbursement structure

- 7.7.2.5. China market estimates and forecasts 2018 - 2030 (USD Million)

- 7.7.3. India

- 7.7.3.1. Key country dynamics

- 7.7.3.2. Competitive scenario

- 7.7.3.3. Regulatory framework

- 7.7.3.4. Reimbursement structure

- 7.7.3.5. India market estimates and forecasts 2018 - 2030 (USD Million)

- 7.7.4. Australia

- 7.7.4.1. Key country dynamics

- 7.7.4.2. Competitive scenario

- 7.7.4.3. Regulatory framework

- 7.7.4.4. Reimbursement structure

- 7.7.4.5. Australia market estimates and forecasts 2018 - 2030 (USD Million)

- 7.7.5. South Korea

- 7.7.5.1. Key country dynamics

- 7.7.5.2. Competitive scenario

- 7.7.5.3. Regulatory framework

- 7.7.5.4. Reimbursement structure

- 7.7.5.5. South Korea market estimates and forecasts 2018 - 2030 (USD Million)

- 7.7.6. Thailand

- 7.7.6.1. Key country dynamics

- 7.7.6.2. Competitive scenario

- 7.7.6.3. Regulatory framework

- 7.7.6.4. Reimbursement structure

- 7.7.6.5. Thailand market estimates and forecasts 2018 - 2030 (USD Million)

- 7.7.1. Japan

- 7.8. Latin America

- 7.8.1. Brazil

- 7.8.1.1. Key country dynamics

- 7.8.1.2. Competitive scenario

- 7.8.1.3. Regulatory framework

- 7.8.1.4. Reimbursement structure

- 7.8.1.5. Brazil market estimates and forecasts 2018 - 2030 (USD Million)

- 7.8.2. Argentina

- 7.8.2.1. Key country dynamics

- 7.8.2.2. Competitive scenario

- 7.8.2.3. Regulatory framework

- 7.8.2.4. Reimbursement structure

- 7.8.2.5. Argentina market estimates and forecasts 2018 - 2030 (USD Million)

- 7.8.1. Brazil

- 7.9. MEA

- 7.9.1. South Africa

- 7.9.1.1. Key country dynamics

- 7.9.1.2. Competitive scenario

- 7.9.1.3. Regulatory framework

- 7.9.1.4. Reimbursement structure

- 7.9.1.5. South Africa market estimates and forecasts 2018 - 2030 (USD Million)

- 7.9.2. Saudi Arabia

- 7.9.2.1. Key country dynamics

- 7.9.2.2. Competitive scenario

- 7.9.2.3. Regulatory framework

- 7.9.2.4. Reimbursement structure

- 7.9.2.5. Saudi Arabia market estimates and forecasts 2018 - 2030 (USD Million)

- 7.9.3. UAE

- 7.9.3.1. Key country dynamics

- 7.9.3.2. Competitive scenario

- 7.9.3.3. Regulatory framework

- 7.9.3.4. Reimbursement structure

- 7.9.3.5. UAE market estimates and forecasts 2018 - 2030 (USD Million)

- 7.9.4. Kuwait

- 7.9.4.1. Key country dynamics

- 7.9.4.2. Competitive scenario

- 7.9.4.3. Regulatory framework

- 7.9.4.4. Reimbursement structure

- 7.9.4.5. Kuwait market estimates and forecasts 2018 - 2030 (USD Million)

- 7.9.1. South Africa

Chapter 8. Competitive Landscape

- 8.1. Recent Developments & Impact Analysis, By Key Market Participants

- 8.2. Company/Competition Categorization

- 8.3. Key company market share analysis, 2024

- 8.4. Company Position Analysis

- 8.5. Company Categorization (Emerging Players, Innovators and Leaders

- 8.6. Company Profiles

- 8.6.1. GE HealthCare

- 8.6.1.1. Company overview

- 8.6.1.2. Financial performance

- 8.6.1.3. Product benchmarking

- 8.6.1.4. Strategic initiatives

- 8.6.2. Koninklijke Philips N.V.

- 8.6.2.1. Company overview

- 8.6.2.2. Financial performance

- 8.6.2.3. Product benchmarking

- 8.6.2.4. Strategic initiatives

- 8.6.3. Siemens Healthineers AG

- 8.6.3.1. Company overview

- 8.6.3.2. Financial performance

- 8.6.3.3. Product benchmarking

- 8.6.3.4. Strategic initiatives

- 8.6.4. Medtronic

- 8.6.4.1. Company overview

- 8.6.4.2. Financial performance

- 8.6.4.3. Product benchmarking

- 8.6.4.4. Strategic initiatives

- 8.6.5. Shimadzu Corporation

- 8.6.5.1. Company overview

- 8.6.5.2. Financial performance

- 8.6.5.3. Product benchmarking

- 8.6.5.4. Strategic initiatives

- 8.6.6. Hologic, Inc.

- 8.6.6.1. Company overview

- 8.6.6.2. Financial performance

- 8.6.6.3. Product benchmarking

- 8.6.6.4. Strategic initiatives

- 8.6.7. Canon Medical Systems Corporation

- 8.6.7.1. Company overview

- 8.6.7.2. Financial performance

- 8.6.7.3. Product benchmarking

- 8.6.7.4. Strategic initiatives

- 8.6.8. Fujifilm Holdings Corporation

- 8.6.8.1. Company overview

- 8.6.8.2. Financial performance

- 8.6.8.3. Product benchmarking

- 8.6.8.4. Strategic initiatives

- 8.6.9. Ziehm Imaging GmbH

- 8.6.9.1. Company overview

- 8.6.9.2. Financial performance

- 8.6.9.3. Product benchmarking

- 8.6.9.4. Strategic initiatives

- 8.6.1. GE HealthCare