|

|

市場調査レポート

商品コード

1611073

トランプ・ボードゲームの市場規模、シェア、動向分析レポート:製品別、流通チャネル別、地域別、セグメント予測、2025年~2030年Playing Cards And Board Games Market Size, Share & Trends Analysis Report By Product (Playing Cards, Board Games), By Distribution Channel (Offline, Online), By Region (North America, Europe), And Segment Forecasts, 2025 - 2030 |

||||||

カスタマイズ可能

|

|||||||

| トランプ・ボードゲームの市場規模、シェア、動向分析レポート:製品別、流通チャネル別、地域別、セグメント予測、2025年~2030年 |

|

出版日: 2024年11月15日

発行: Grand View Research

ページ情報: 英文 80 Pages

納期: 2~10営業日

|

全表示

- 概要

- 図表

- 目次

トランプ・ボードゲーム市場の成長と動向

Grand View Research, Inc.の最新レポートによると、トランプ・ボードゲームの世界市場規模は2025~2030年にかけてCAGR 8.3%を記録し、2030年には319億3,000万米ドルに達する見込みです。

若い世代における伝統的レクリエーション活動の人気の高まりが市場を牽引すると予測されます。ミレニアル世代が社交の場で昔ながらのゲームを好む傾向が高まっており、成長をさらに促進すると予測されます。

レトロゲームの復活が市場の成長を促進すると予測されます。メーカーは、より多くの消費者を惹きつけるため、エレガントなメカニズムと印象的なアートワークを備えたシンプルなゲームの製造に注力しています。例えば、「カタンの開拓者たち」の発売は大成功を収め、多くの参入企業がこの産業に参入しています。需要の急増は、市場参入企業に成長機会をもたらしました。新興メーカーは、トランプやボードゲームを開発するだけでなく、再発明しながら、革新性と創造性に焦点を当てており、これが市場の成長を促進すると予想されます。人気の高まりは、幼児、ミレニアル世代、家族など、さまざまなグループ向けに特別に設計されたボードゲームを導入する企業を後押しすると予想されます。例えば、Pandemic Legacy、Scythe、Gloomhavenは、特に13歳以上向けに設計されたボードゲームの一部です。

製品別では、ボードゲームが2018年に主要な市場シェアを占め、予測期間中もその優位性が続くと予測されます。余暇活動への関与の増加、デジタル画面から離れる傾向、対面での交流の重視などの動向が、伝統的ボードゲームの人気を押し上げると予測されます。モノポリーは2018年に29%以上の最大市場シェアを占めました。チェッカー、パズル、スクラブル、チェスなどの人気上昇が市場成長に寄与すると予測されます。

オフライン流通チャネルは、予測期間中も市場をリードし続けると予想されます。ボードゲームカフェ文化の高まりが同セグメントの成長を促進すると予想されます。さらに、ショッピングモールやパブでのゲームゾーンの導入は、市場成長にプラスの影響を与えると予想されます。

北米は2019~2025年にかけて最も速いCAGR 9.2%を記録すると予測されています。米国全土でゲームカフェの数が増加し、昔ながらの娯楽を求めるミレニアル世代の間で人気が高まっていることが、この地域の成長を後押しすると予想されます。一方、アジア太平洋は予測期間中、最大の市場シェアを維持し続けると予想されます。インドや日本などの国々におけるトランプへの高い関心が、この地域の市場成長を促進すると予測されます。

トランプ・ボードゲーム市場レポートハイライト

- ボードゲームは2024年に73.4%の最大収益シェアで市場を独占しました。この成長は、さまざまな年齢層でボードゲームの人気が衰えていないことに起因しています。

- トランプは予測期間中、CAGR 8.9%の最速成長が見込まれます。伝統的トランプゲームへの関心が復活し、革新的でテーマ性のあるトランプゲームの採用が、カジュアルな参入企業から本格的な愛好家まで幅広い層にアピールしています。

- 2024年のトランプ・ボードゲーム産業はオフラインチャネルが最大の売上シェアを占めました。この優位性は主に、玩具店、ゲーム専門店、大規模小売チェーンといった伝統的小売店の人気が続いていることによる。

- オンラインチャネルは、オンラインショッピングの利便性とアクセシビリティの向上により、予測期間中に最も速いCAGRで成長することが期待されています。

- アジア太平洋のトランプ・ボードゲーム市場は、2024年に39.5%の最大売上シェアを獲得し、世界市場を独占しました。この地域は人口が多く多様性に富み、伝統的ゲームや家族団らんの文化が根付いているため、トランプやボードゲームの需要が高いです。

目次

第1章 調査手法と範囲

第2章 エグゼクティブサマリー

第3章 トランプ・ボードゲームの市場変数、動向、範囲

- 市場系統の展望

- 親市場の展望

- 関連市場展望

- 産業バリューチェーン分析

- 利益率分析(産業レベル)

- 市場力学

- 市場促進要因分析

- 市場抑制要因分析

- 市場機会

- 市場課題

- 産業分析ツール

- ポーターのファイブフォース分析

- 市場参入戦略

第4章 消費者行動分析

- 人口統計分析

- 消費者の動向と嗜好

- 購入決定に影響を与える要因

- 消費者製品の採用

- 観察と推奨事項

第5章 トランプ・ボードゲーム市場:製品別、推定・動向分析

- トランプ・ボードゲーム市場、製品別:主要ポイント

- 製品変動分析と市場シェア、2024年と2030年

- 製品別、2018~2030年

- トランプ

- ボードゲーム

第6章 トランプ・ボードゲーム市場:流通チャネル別、推定・動向分析

- トランプ・ボードゲーム市場、流通チャネル別:主要ポイント

- 流通チャネル変動分析と市場シェア、2024年と2030年

- 流通チャネル別、2018~2030年

- オフライン

- オンライン

第7章 トランプ・ボードゲーム市場:地域別、推定・動向分析

- トランプ・ボードゲーム市場:地域別展望

- 地域市場:主要ポイント

- 地域別、2018~2030年

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第8章 トランプ・ボードゲーム市場:競合分析

- 主要市場参入企業による最近の動向と影響分析

- 企業分類

- 参入企業概要

- 企業市場シェア分析、2024年(%)

- 企業ヒートマップ分析

- 戦略マッピング

- 企業プロファイル

- Games Workshop Limited

- NECA/WizKids LLC(WizKids)

- IELLO

- Grey Fox Games

- Disney

- Buffalo Games

- University Games Corporation

- Delano Games

- LongPack Games

- Boda Games

List of Tables

- Table 1 Global playing cards and board games market: Key market driver analysis

- Table 2 Global playing cards and board games market: Key market restraint analysis

- Table 3 Global playing cards and board games market estimates & forecast, by product (USD Million)

- Table 4 Global playing cards and board games market estimates & forecast, by distribution channel (USD Million)

- Table 5 North America playing cards and board games market estimates and forecast, by country, 2018 - 2030 (USD Million)

- Table 6 North America playing cards and board games market estimates and forecast, by product, 2018 - 2030 (USD Million)

- Table 7 North America playing cards and board games market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- Table 8 U.S. macro-economic outlay

- Table 9 U.S. playing cards and board games market estimates and forecast, by product, 2018 - 2030 (USD Million)

- Table 10 U.S. playing cards and board games market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- Table 11 Canada macro-economic outlay

- Table 12 Canada playing cards and board games market estimates and forecast, by product, 2018 - 2030 (USD Million)

- Table 13 Canada playing cards and board games market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- Table 14 Mexico macro-economic outlay

- Table 15 Mexico playing cards and board games market estimates and forecast, by product, 2018 - 2030 (USD Million)

- Table 16 Mexico playing cards and board games market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- Table 17 Europe playing cards and board games market estimates and forecast, by country, 2018 - 2030 (USD Million)

- Table 18 Europe playing cards and board games market estimates and forecast, by product, 2018 - 2030 (USD Million)

- Table 19 Europe playing cards and board games market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- Table 20 UK macro-economic outlay

- Table 21 UK playing cards and board games market estimates and forecast, by product, 2018 - 2030 (USD Million)

- Table 22 UK playing cards and board games market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- Table 23 Germany macro-economic outlay

- Table 24 Germany playing cards and board games market estimates and forecast, by product, 2018 - 2030 (USD Million)

- Table 25 Germany playing cards and board games market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- Table 26 France macro-economic outlay

- Table 27 France playing cards and board games market estimates and forecast, by product, 2018 - 2030 (USD Million)

- Table 28 France playing cards and board games market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- Table 29 Italy macro-economic outlay

- Table 30 Italy playing cards and board games market estimates and forecast, by product, 2018 - 2030 (USD Million)

- Table 31 Italy playing cards and board games market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- Table 32 Spain macro-economic outlay

- Table 33 Spain playing cards and board games market estimates and forecast, by product, 2018 - 2030 (USD Million)

- Table 34 Spain playing cards and board games market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- Table 35 Asia Pacific playing cards and board games market estimates and forecast, by country, 2018 - 2030 (USD Million)

- Table 36 Asia Pacific playing cards and board games market estimates and forecast, by product, 2018 - 2030 (USD Million)

- Table 37 Asia Pacific playing cards and board games market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- Table 38 China macro-economic outlay

- Table 39 China playing cards and board games market estimates and forecast, by product, 2018 - 2030 (USD Million)

- Table 40 China playing cards and board games market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- Table 41 India macro-economic outlay

- Table 42 India playing cards and board games market estimates and forecast, by product, 2018 - 2030 (USD Million)

- Table 43 India playing cards and board games market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- Table 44 Japan macro-economic outlay

- Table 45 Japan playing cards and board games market estimates and forecast, by product, 2018 - 2030 (USD Million)

- Table 46 Japan playing cards and board games market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- Table 47 Australia & New Zealand macro-economic outlay

- Table 48 Australia & New Zealand playing cards and board games market estimates and forecast, by product, 2018 - 2030 (USD Million)

- Table 49 Australia & New Zealand playing cards and board games market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- Table 50 South Korea macro-economic outlay

- Table 51 South Korea playing cards and board games market estimates and forecast, by product, 2018 - 2030 (USD Million)

- Table 52 South Korea playing cards and board games market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- Table 53 Latin America playing cards and board games market estimates and forecast, by country, 2018 - 2030 (USD Million)

- Table 54 Latin America playing cards and board games market estimates and forecast, by product, 2018 - 2030 (USD Million)

- Table 55 Latin America playing cards and board games market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- Table 56 Brazil macro-economic outlay

- Table 57 Brazil playing cards and board games market estimates and forecast, by product, 2018 - 2030 (USD Million)

- Table 58 Brazil playing cards and board games market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- Table 59 Middle East & Africa playing cards and board games market estimates and forecast, by country, 2018 - 2030 (USD Million)

- Table 60 Middle East & Africa playing cards and board games market estimates and forecast, by product, 2018 - 2030 (USD Million)

- Table 61 Middle East & Africa playing cards and board games market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- Table 62 South Africa macro-economic outlay

- Table 63 South Africa playing cards and board games market estimates and forecast, by product, 2018 - 2030 (USD Million)

- Table 64 South Africa playing cards and board games market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- Table 65 Recent developments & impact analysis, by key market participants

- Table 66 Company market share, 2024 (%)

- Table 67 Company heat map analysis, 2024

- Table 68 Companies implementing key strategies

List of Figures

- Fig. 1 Playing cards and board games market segmentation

- Fig. 2 Information procurement

- Fig. 3 Primary research pattern

- Fig. 4 Primary research approaches

- Fig. 5 Primary research process

- Fig. 6 Market snapshot

- Fig. 7 Segment snapshot

- Fig. 8 Regional snapshot

- Fig. 9 Competitive landscape snapshot

- Fig. 10 Global parent industry and playing cards and board games size (USD Million)

- Fig. 11 Global playing cards and board games size, 2018 to 2030 (USD Million)

- Fig. 12 Playing cards and board games market: Penetration & growth prospect mapping

- Fig. 13 Playing cards and board games market: Value chain analysis

- Fig. 14 Playing cards and board games market: Dynamics

- Fig. 15 Playing cards and board games market: Porter's five forces analysis

- Fig. 16 Playing cards and board games market estimates & forecast, by product (USD Million)

- Fig. 17 Playing cards market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 18 Board games market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 19 Chess market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 20 Scrabble market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 21 Monopoly market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 22 Ludo market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 23 Others market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 24 Playing cards and board games market estimates & forecast, by distribution channel (USD Million)

- Fig. 25 Playing cards and board games market estimates & forecasts for offline, 2018 - 2030 (USD Million)

- Fig. 26 Playing cards and board games market estimates & forecasts for online, 2018 - 2030 (USD Million)

- Fig. 27 Playing cards and board games market: Regional outlook, 2024 & 2030, (USD Million)

- Fig. 28 Regional marketplace: Key takeaways

- Fig. 29 North America playing cards and board games market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 30 US playing cards and board games market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 31 Canada playing cards and board games market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 32 Mexico playing cards and board games market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 33 Europe playing cards and board games market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 34 Germany playing cards and board games market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 35 UK playing cards and board games market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 36 France playing cards and board games market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 37 Italy playing cards and board games market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 38 Spain playing cards and board games market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 39 Asia Pacific playing cards and board games market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 40 China playing cards and board games market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 41 India playing cards and board games market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 42 Japan playing cards and board games market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 43 Australia & New Zealand playing cards and board games market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 44 South Korea playing cards and board games market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 45 Latin America playing cards and board games market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 46 Brazil playing cards and board games market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 47 Middle East & Africa playing cards and board games market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 48 South Africa playing cards and board games market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 49 Key company categorization

- Fig. 50 Company market share analysis, 2024

- Fig. 51 Strategic framework of playing cards and board games

Playing Cards And Board Games Market Growth & Trends:

The global playing cards and board games market size is expected to reach USD 31.93 billion by 2030, registering a CAGR of 8.3% from 2025 to 2030, according to a new report by Grand View Research, Inc. Growing popularity of traditional recreational activities among the younger generation is projected to drive the market. Rising preference of millennials for old school games during social gatherings is expected to further fuel the growth.

Increasing resurgence of retro-games is projected to drive the market growth. Manufacturers are focusing on producing simple games with elegant mechanics and impressive artwork to attract more consumers. For instance, the massively successful launch of Settlers of Catan has attracted a number of players to the industry. Rapid rise in demand has created growth opportunities for the market players. The new manufacturers focus on innovation and creativity while developing as well as reinventing the playing cards and board games, which in turn is anticipated to drive the market growth. Rising popularity is expected to encourage companies to introduce board games specifically designed for different groups such as children, millennials, and families. For instance, Pandemic Legacy, Scythe, and Gloomhaven, are some of the board games designed especially 13 years and above.

In terms of product, the board games held the leading market share in 2018 and is anticipated to continue its dominance over the forecast period. Factors such as increasing engagement in leisure activities, trend of taking a break from digital screens, and emphasis on face to face interaction are projected to boost the popularity of traditional board games. Monopoly held the largest market share of more than 29% in 2018. Rising popularity of checkers, puzzles, scrabble, and chess among others is expected to contribute to the market growth.

Offline distribution channel is expected to continue leading the market over the forecast period. Rising culture of board game cafes is expected to fuel the growth of the segment. Moreover, introduction of gaming zones in malls and pubs is expected to positively influence the market growth.

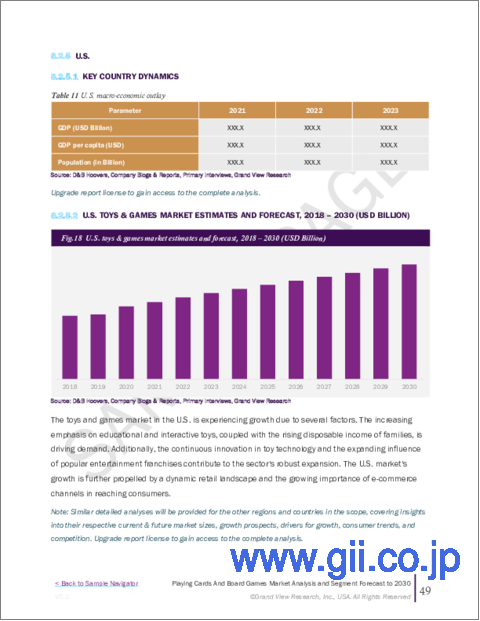

North America is projected to register the fastest CAGR of 9.2% from 2019 to 2025. Rise in the number of gaming cafes across the U.S. and increasing popularity among millennials seeking for old-fashioned entertainment is expected to boost the regional growth. Asia Pacific, on the other hand, is expected to continue holding the largest market share over the forecast period. High interest in playing cards across countries such as India and Japan is projected to drive the regional market growth.

Playing Cards And Board Games Market Report Highlights:

- Board games dominated the market with the largest revenue share of 73.4% in 2024. This growth is attributed to the enduring popularity of board games across various age groups.

- Playing cards are expected to grow at the fastest CAGR of 8.9% over the forecast period. The resurgence of interest in traditional card games and the introduction of innovative and themed card games appeal to a broad demographic, from casual players to serious enthusiasts.

- Offline channels dominated the playing cards and board games industry with the largest revenue share in 2024. This dominance is primarily due to the continued popularity of traditional retail outlets such as toy stores, specialty game shops, and large retail chains.

- The online channel is expected to grow at the fastest CAGR over the forecast period owing to the increasing convenience and accessibility of online shopping.

- The Asia Pacific playing cards and board games market dominated the global market with the largest revenue share of 39.5% in 2024. The region's large and diverse population and a deep-rooted culture of traditional games and family gatherings drive the high demand for playing cards and board games.

Table of Contents

Chapter 1. Methodology and Scope

- 1.1. Market Segmentation & Scope

- 1.2. Market Definition

- 1.3. Information Procurement

- 1.3.1. Purchased Database

- 1.3.2. GVR's Internal Database

- 1.3.3. Secondary Sources & Third-Party Perspectives

- 1.3.4. Primary Research

- 1.4. Information Analysis

- 1.4.1. Data Analysis Models

- 1.5. Market Formulation & Data Visualization

- 1.6. Data Validation & Publishing

Chapter 2. Executive Summary

- 2.1. Market Snapshot

- 2.2. Segment Snapshot

- 2.3. Competitive Landscape Snapshot

Chapter 3. Playing Cards and Board Games Market Variables, Trends & Scope

- 3.1. Market Lineage Outlook

- 3.1.1. Parent Market Outlook

- 3.1.2. Related Market Outlook

- 3.2. Industry Value Chain Analysis

- 3.2.1. Profit Margin Analysis (Industry-level)

- 3.3. Market Dynamics

- 3.3.1. Market Driver Analysis

- 3.3.2. Market Restraint Analysis

- 3.3.3. Market Opportunities

- 3.3.4. Market Challenges

- 3.4. Industry Analysis Tools

- 3.4.1. Porter's Five Forces Analysis

- 3.5. Market Entry Strategies

Chapter 4. Consumer Behavior Analysis

- 4.1. Demographic Analysis

- 4.2. Consumer Trends and Preferences

- 4.3. Factors Affecting Buying Decision

- 4.4. Consumer Product Adoption

- 4.5. Observations & Recommendations

Chapter 5. Playing Cards and Board Games Market: Product Estimates & Trend Analysis

- 5.1. Playing Cards and Board Games Market, By Product: Key Takeaways

- 5.2. Product Movement Analysis & Market Share, 2024 & 2030

- 5.3. Market Estimates & Forecasts, By Product, 2018 - 2030 (USD Million)

- 5.3.1. Playing Cards

- 5.3.1.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 5.3.2. Board Games

- 5.3.2.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 5.3.2.2. Chess

- 5.3.2.2.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 5.3.2.3. Scrabble

- 5.3.2.3.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 5.3.2.4. Monopoly

- 5.3.2.4.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 5.3.2.5. Ludo

- 5.3.2.5.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 5.3.1. Playing Cards

Chapter 6. Playing Cards and Board Games Market: Distribution Channel Estimates & Trend Analysis

- 6.1. Playing Cards and Board Games Market, By Distribution Channel: Key Takeaways

- 6.2. Distribution Channel Movement Analysis & Market Share, 2024 & 2030

- 6.3. Market Estimates & Forecasts, by Distribution Channel, 2018 - 2030 (USD Million)

- 6.3.1. Offline

- 6.3.1.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 6.3.2. Online

- 6.3.2.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 6.3.1. Offline

Chapter 7. Playing Cards and Board Games Market: Regional Estimates & Trend Analysis

- 7.1. Playing Cards and Board Games Market: Regional Outlook

- 7.2. Regional Marketplaces: Key Takeaways

- 7.3. Market Estimates & Forecasts, by Region, 2018 - 2030 (USD Million)

- 7.3.1. North America

- 7.3.1.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.3.1.2. U.S.

- 7.3.1.2.1. Key country dynamics

- 7.3.1.2.2. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.3.1.3. Canada

- 7.3.1.3.1. Key country dynamics

- 7.3.1.3.2. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.3.1.4. Mexico

- 7.3.1.4.1. Key country dynamics

- 7.3.1.4.2. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.3.2. Europe

- 7.3.2.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.3.2.2. UK

- 7.3.2.2.1. Key country dynamics

- 7.3.2.2.2. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.3.2.3. Germany

- 7.3.2.3.1. Key country dynamics

- 7.3.2.3.2. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.3.2.4. France

- 7.3.2.4.1. Key country dynamics

- 7.3.2.4.2. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.3.2.5. Italy

- 7.3.2.5.1. Key country dynamics

- 7.3.2.5.2. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.3.2.6. Spain

- 7.3.2.6.1. Key country dynamics

- 7.3.2.6.2. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.3.3. Asia Pacific

- 7.3.3.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.3.3.2. China

- 7.3.3.2.1. Key country dynamics

- 7.3.3.2.2. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.3.3.3. India

- 7.3.3.3.1. Key country dynamics

- 7.3.3.3.2. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.3.3.4. Japan

- 7.3.3.4.1. Key country dynamics

- 7.3.3.4.2. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.3.3.5. Australia & New Zealand

- 7.3.3.5.1. Key country dynamics

- 7.3.3.5.2. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.3.3.6. South Korea

- 7.3.3.6.1. Key country dynamics

- 7.3.3.6.2. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.3.4. Latin America

- 7.3.4.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.3.4.2. Brazil

- 7.3.4.2.1. Key country dynamics

- 7.3.4.2.2. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.3.5. Middle East & Africa

- 7.3.5.1. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.3.5.2. South Africa

- 7.3.5.2.1. Key country dynamics

- 7.3.5.2.2. Market estimates and forecast, 2018 - 2030 (USD Million)

- 7.3.1. North America

Chapter 8. Playing Cards and Board Games Market: Competitive Analysis

- 8.1. Recent Developments & Impact Analysis, by Key Market Participants

- 8.2. Company Categorization

- 8.3. Participant's Overview

- 8.4. Financial Performance

- 8.5. Product Benchmarking

- 8.6. Company Market Share Analysis, 2024 (%)

- 8.7. Company Heat Map Analysis

- 8.8. Strategy Mapping

- 8.9. Company Profiles

- 8.9.1. Games Workshop Limited

- 8.9.1.1. Company Overview

- 8.9.1.2. Financial Performance

- 8.9.1.3. Product Portfolios

- 8.9.1.4. Strategic Initiatives

- 8.9.2. NECA/WizKids LLC (WizKids)

- 8.9.2.1. Company Overview

- 8.9.2.2. Financial Performance

- 8.9.2.3. Product Portfolios

- 8.9.2.4. Strategic Initiatives

- 8.9.3. IELLO

- 8.9.3.1. Company Overview

- 8.9.3.2. Financial Performance

- 8.9.3.3. Product Portfolios

- 8.9.3.4. Strategic Initiatives

- 8.9.4. Grey Fox Games

- 8.9.4.1. Company Overview

- 8.9.4.2. Financial Performance

- 8.9.4.3. Product Portfolios

- 8.9.4.4. Strategic Initiatives

- 8.9.5. Disney

- 8.9.5.1. Company Overview

- 8.9.5.2. Financial Performance

- 8.9.5.3. Product Portfolios

- 8.9.5.4. Strategic Initiatives

- 8.9.6. Buffalo Games

- 8.9.6.1. Company Overview

- 8.9.6.2. Financial Performance

- 8.9.6.3. Product Portfolios

- 8.9.6.4. Strategic Initiatives

- 8.9.7. University Games Corporation

- 8.9.7.1. Company Overview

- 8.9.7.2. Financial Performance

- 8.9.7.3. Product Portfolios

- 8.9.7.4. Strategic Initiatives

- 8.9.8. Delano Games

- 8.9.8.1. Company Overview

- 8.9.8.2. Financial Performance

- 8.9.8.3. Product Portfolios

- 8.9.8.4. Strategic Initiatives

- 8.9.9. LongPack Games

- 8.9.9.1. Company Overview

- 8.9.9.2. Financial Performance

- 8.9.9.3. Product Portfolios

- 8.9.9.4. Strategic Initiatives

- 8.9.10. Boda Games

- 8.9.10.1. Company Overview

- 8.9.10.2. Financial Performance

- 8.9.10.3. Product Portfolios

- 8.9.10.4. Strategic Initiatives

- 8.9.1. Games Workshop Limited