|

|

市場調査レポート

商品コード

1587773

監視カメラの市場規模、シェア、動向分析レポート:製品タイプ別、展開別、解像能力別、最終用途別、地域別、セグメント別予測、2025年~2030年Surveillance Camera Market Size, Share & Trends Analysis Report By Product Type (IP Based, Cellular Camera, Analog Camera), By Deployment, By Resolution Capacity, By End-use, By Region, And Segment Forecasts, 2025 - 2030 |

||||||

カスタマイズ可能

|

|||||||

| 監視カメラの市場規模、シェア、動向分析レポート:製品タイプ別、展開別、解像能力別、最終用途別、地域別、セグメント別予測、2025年~2030年 |

|

出版日: 2024年10月31日

発行: Grand View Research

ページ情報: 英文 130 Pages

納期: 2~10営業日

|

全表示

- 概要

- 図表

- 目次

監視カメラ市場の成長と動向:

Grand View Research, Inc.の最新調査によると、世界の監視カメラ市場規模は2025年から2030年にかけてCAGR 11.2%を記録し、2030年には813億7,000万米ドルに達すると予測されています。

セキュリティと安全性に関する懸念の高まり、スマートシティにおけるモノのインターネット(IoT)とスマート技術の採用の増加は、市場の成長を促進する主な要因の一部です。また、セキュリティ向上を実現するためのビデオ監視ソリューションの技術的進歩の高まりが、市場の成長をさらに後押ししています。カメラ技術の絶え間ない進化は、人工知能(AI)、ビデオ分析、エッジコンピューティングの技術革新と相まって、監視システムメーカーに高度な機能と性能を提供する力を与えています。

ビデオ監視にAIを組み込むには、セキュリティ・カメラ・デバイスに組み込まれた特殊なソフトウェアやシステムが中心となります。これらのシステムは、音声や画像のリアルタイム分析を容易にし、個人、車両、物体、イベント、行動を迅速に特定します。ビデオ監視システムにAIを導入することで、その全体的な品質、精度、実用性が向上します。さらに、監視カメラへのAIの適用は、サーマルカメラ、赤外線カメラ、屋外カメラなど、さまざまなタイプのデバイスに合わせて設計できるため、大きなメリットがあります。

5Gセルラー・サービスは、待ち時間の短縮やデータ速度の向上など、ユーザーに大きなメリットをもたらします。その帯域幅容量の拡大により、画像解像度が著しく向上し、多様な監視要件をサポートできるため、住宅、商業、産業環境におけるビデオ監視アプリケーションに最適です。さらに、5Gネットワークの超高速データ転送速度により、監視カメラは高解像度の映像をシームレスにキャプチャしてストリーミングできるため、より鮮明で詳細な画像が提供され、状況認識が向上します。したがって、上記の利点により、5G搭載監視カメラの需要は予測期間中に増加すると予想されます。

COVID-19パンデミックの発生をきっかけに、監視カメラシステムにおける遠隔監視機能の嗜好が大きく支持されるようになった。パンデミック後の時代を見据えても、ライブ映像や録画映像へのリモートアクセスが重視される傾向は続くと思われます。監視システムの全体的な有効性とインテリジェンスを強化するために、物体検出、行動分析、予測分析などのAIを活用した機能が普及すると予想されます。このように、監視カメラシステムにおけるAIと高度な分析は、パンデミック後の時代にさらに拡大する構えです。

監視カメラ市場レポートハイライト

- 製品タイプ別では、セルラーカメラが予測期間中に最も急成長するセグメントとして浮上すると予測されます。このセグメントは、セルラーネットワークを活用し、様々な場所でリアルタイムのビデオアクセスや接続を可能にする遠隔で柔軟な監視ソリューションのニーズが高まっているため、大きな成長が見込まれます。

- 設置場所別では、屋外設置セグメントが2024年に73.3%の最大収益シェアで市場をリードしました。

- 解像度別では、超高精細(UHD)(4K)が予測期間中に最も急成長するセグメントとして浮上すると予測されています。UHDまたは4K解像度の監視カメラの開発が進み、高品質の監視画像や映像が提供されるようになったことが、このセグメントの成長を後押ししています。

- 最終用途別では、産業用セグメントが予測期間中に最も高いCAGRで成長すると予測されています。製造、鉱業、建設、データセンターなどの産業からの監視カメラ需要の増加が、このセグメントの成長を促進しています。

目次

第1章 調査手法と範囲

第2章 エグゼクティブサマリー

第3章 監視カメラ市場の変数、動向、範囲

- 市場系統の見通し

- 市場力学

- 市場 促進要因分析

- 市場抑制要因分析

- 業界の課題

- 監視カメラ市場分析ツール

- 業界分析- ポーターのファイブフォース分析

- PESTEL分析

第4章 監視カメラ市場:製品タイプの推定・動向分析

- セグメントダッシュボード

- 監視カメラ市場:製品タイプの変動分析、2024年および2030年

- IPベース

- 携帯カメラ

- アナログカメラ

第5章 監視カメラ市場:展開の推定・動向分析

- セグメントダッシュボード

- 監視カメラ市場:展開変動分析、2024年および2030年

- 屋内

- 屋外

第6章 監視カメラ市場:解像能力の推定・動向分析

- セグメントダッシュボード

- 監視カメラ市場:解像能力変動分析、2024年および2030年

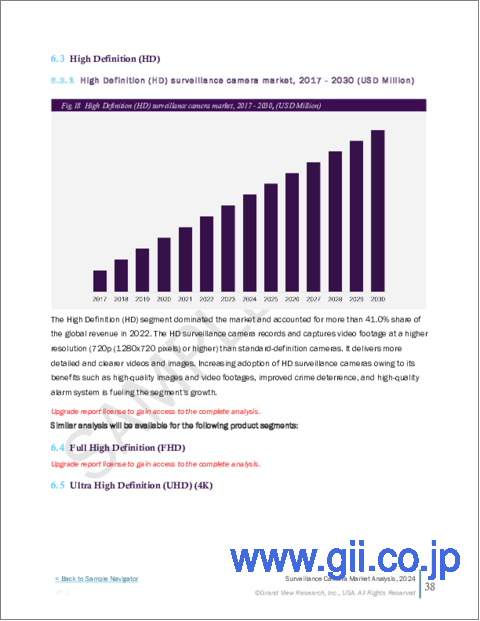

- 高解像度(HD)

- フルハイビジョン(FHD)

- 超高精細(UHD)(4K)

第7章 監視カメラ市場:最終用途の推定・動向分析

- セグメントダッシュボード

- 監視カメラ市場:最終用途変動分析、2024年および2030年

- 住宅

- 商業インフラ

- 公共施設

- 産業

- 軍事・防衛

- その他

第8章 監視カメラ市場:地域の推定・動向分析

- 監視カメラ市場シェア、地域別、2024年および2030年

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- ラテンアメリカ

- ブラジル

- 中東およびアフリカ

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

第9章 競合情勢

- 企業分類

- 企業の市場ポジショニング

- 企業ヒートマップ分析

- 企業プロファイル/上場企業

- Honeywell International Inc.

- Cisco Systems, Inc.

- Eye Trax

- Nokia Corporation

- Panasonic Holdings Corporation

- Robert Bosch GmbH

- Teledyne FLIR LLC

- Milesight

- Dahua Technology Co., Ltd.

- Swann

List of Tables

- Table 1. Global surveillance camera market size estimates & forecasts 2018 - 2030 (USD Million)

- Table 2. Global surveillance camera market, by region 2018 - 2030 (USD Million)

- Table 3. Global surveillance camera market, by product type 2018 - 2030 (USD Million)

- Table 4. Global surveillance camera market, by deployment 2018 - 2030 (USD Million)

- Table 5. Global surveillance camera market, by resolution capacity 2018 - 2030 (USD Million)

- Table 6. Global surveillance camera market, by end use 2018 - 2030 (USD Million)

- Table 7. IP Based surveillance camera market, by region 2018 - 2030 (USD Million)

- Table 8. Cellular Camera surveillance camera market, by region 2018 - 2030 (USD Million)

- Table 9. Analog Camera surveillance camera market, by region 2018 - 2030 (USD Million)

- Table 10. Indoor surveillance camera market, by region 2018 - 2030 (USD Million)

- Table 11. Outdoor surveillance camera market, by region 2018 - 2030 (USD Million)

- Table 12. High Definition (HD) surveillance camera market, by region 2018 - 2030 (USD Million)

- Table 13. Full High Definition (FHD) surveillance camera market, by region 2018 - 2030 (USD Million)

- Table 14. Ultra High Definition (UHD) (4K) surveillance camera market, by region 2018 - 2030 (USD Million)

- Table 15. Residential surveillance camera market, by region 2018 - 2030 (USD Million)

- Table 16. Commercial Infrastructure surveillance camera market, by region 2018 - 2030 (USD Million)

- Table 17. Public Facilities surveillance camera market, by region 2018 - 2030 (USD Million)

- Table 18. Industrial surveillance camera market, by region 2018 - 2030 (USD Million)

- Table 19. Military & Defense surveillance camera market, by region 2018 - 2030 (USD Million)

- Table 20. Others surveillance camera market, by region 2018 - 2030 (USD Million)

- Table 21. North America surveillance camera market, by product type 2018 - 2030 (USD Million)

- Table 22. North America surveillance camera market, by deployment 2018 - 2030 (USD Million)

- Table 23. North America surveillance camera market, by resolution capacity 2018 - 2030 (USD Million)

- Table 24. North America surveillance camera market, by end use 2018 - 2030 (USD Million)

- Table 25. U.S. surveillance camera market, by product type 2018 - 2030 (USD Million)

- Table 26. U.S. surveillance camera market, by deployment 2018 - 2030 (USD Million)

- Table 27. U.S. surveillance camera market, by resolution capacity 2018 - 2030 (USD Million)

- Table 28. U.S. surveillance camera market, by end use 2018 - 2030 (USD Million)

- Table 29. Canada surveillance camera market, by product type 2018 - 2030 (USD Million)

- Table 30. Canada surveillance camera market, by deployment 2018 - 2030 (USD Million)

- Table 31. Canada surveillance camera market, by resolution capacity 2018 - 2030 (USD Million)

- Table 32. Canada surveillance camera market, by end use 2018 - 2030 (USD Million)

- Table 33. Mexico surveillance camera market, by product type 2018 - 2030 (USD Million)

- Table 34. Mexico surveillance camera market, by deployment 2018 - 2030 (USD Million)

- Table 35. Mexico surveillance camera market, by resolution capacity 2018 - 2030 (USD Million)

- Table 36. Mexico surveillance camera market, by end use 2018 - 2030 (USD Million)

- Table 37. Europe surveillance camera market, by product type 2018 - 2030 (USD Million)

- Table 38. Europe surveillance camera market, by deployment 2018 - 2030 (USD Million)

- Table 39. Europe surveillance camera market, by resolution capacity 2018 - 2030 (USD Million)

- Table 40. Europe surveillance camera market, by end use 2018 - 2030 (USD Million)

- Table 41. UK surveillance camera market, by product type 2018 - 2030 (USD Million)

- Table 42. UK surveillance camera market, by deployment 2018 - 2030 (USD Million)

- Table 43. UK surveillance camera market, by resolution capacity 2018 - 2030 (USD Million)

- Table 44. UK surveillance camera market, by end use 2018 - 2030 (USD Million)

- Table 45. Germany surveillance camera market, by product type 2018 - 2030 (USD Million)

- Table 46. Germany surveillance camera market, by deployment 2018 - 2030 (USD Million)

- Table 47. Germany surveillance camera market, by resolution capacity 2018 - 2030 (USD Million)

- Table 48. Germany surveillance camera market, by end use 2018 - 2030 (USD Million)

- Table 49. France surveillance camera market, by product type 2018 - 2030 (USD Million)

- Table 50. France surveillance camera market, by deployment 2018 - 2030 (USD Million)

- Table 51. France surveillance camera market, by resolution capacity 2018 - 2030 (USD Million)

- Table 52. France surveillance camera market, by end use 2018 - 2030 (USD Million)

- Table 53. Asia Pacific surveillance camera market, by product type 2018 - 2030 (USD Million)

- Table 54. Asia Pacific surveillance camera market, by deployment 2018 - 2030 (USD Million)

- Table 55. Asia Pacific surveillance camera market, by resolution capacity 2018 - 2030 (USD Million)

- Table 56. Asia Pacific surveillance camera market, by end use 2018 - 2030 (USD Million)

- Table 57. China surveillance camera market, by product type 2018 - 2030 (USD Million)

- Table 58. China surveillance camera market, by deployment 2018 - 2030 (USD Million)

- Table 59. China surveillance camera market, by resolution capacity 2018 - 2030 (USD Million)

- Table 60. China surveillance camera market, by end use 2018 - 2030 (USD Million)

- Table 61. India surveillance camera market, by product type 2018 - 2030 (USD Million)

- Table 62. India surveillance camera market, by deployment 2018 - 2030 (USD Million)

- Table 63. India surveillance camera market, by resolution capacity 2018 - 2030 (USD Million)

- Table 64. India surveillance camera market, by end use 2018 - 2030 (USD Million)

- Table 65. Japan surveillance camera market, by product type 2018 - 2030 (USD Million)

- Table 66. Japan surveillance camera market, by deployment 2018 - 2030 (USD Million)

- Table 67. Japan surveillance camera market, by resolution capacity 2018 - 2030 (USD Million)

- Table 68. Japan surveillance camera market, by end use 2018 - 2030 (USD Million)

- Table 69. South Korea surveillance camera market, by product type 2018 - 2030 (USD Million)

- Table 70. South Korea surveillance camera market, by deployment 2018 - 2030 (USD Million)

- Table 71. South Korea surveillance camera market, by resolution capacity 2018 - 2030 (USD Million)

- Table 72. South Korea surveillance camera market, by end use 2018 - 2030 (USD Million)

- Table 73. Australia surveillance camera market, by product type 2018 - 2030 (USD Million)

- Table 74. Australia surveillance camera market, by deployment 2018 - 2030 (USD Million)

- Table 75. Australia surveillance camera market, by resolution capacity 2018 - 2030 (USD Million)

- Table 76. Australia surveillance camera market, by end use 2018 - 2030 (USD Million)

- Table 77. Latin America surveillance camera market, by product type 2018 - 2030 (USD Million)

- Table 78. Latin America surveillance camera market, by deployment 2018 - 2030 (USD Million)

- Table 79. Latin America surveillance camera market, by resolution capacity 2018 - 2030 (USD Million)

- Table 80. Latin America surveillance camera market, by end use 2018 - 2030 (USD Million)

- Table 81. Brazil surveillance camera market, by product type 2018 - 2030 (USD Million)

- Table 82. Brazil surveillance camera market, by deployment 2018 - 2030 (USD Million)

- Table 83. Brazil surveillance camera market, by resolution capacity 2018 - 2030 (USD Million)

- Table 84. Brazil surveillance camera market, by end use 2018 - 2030 (USD Million)

- Table 85. MEA surveillance camera market, by product type 2018 - 2030 (USD Million)

- Table 86. MEA surveillance camera market, by deployment 2018 - 2030 (USD Million)

- Table 87. MEA surveillance camera market, by resolution capacity 2018 - 2030 (USD Million)

- Table 88. MEA surveillance camera market, by end use 2018 - 2030 (USD Million)

- Table 89. UAE surveillance camera market, by product type 2018 - 2030 (USD Million)

- Table 90. UAE surveillance camera market, by deployment 2018 - 2030 (USD Million)

- Table 91. UAE surveillance camera market, by resolution capacity 2018 - 2030 (USD Million)

- Table 92. UAE surveillance camera market, by end use 2018 - 2030 (USD Million)

- Table 93. KSA surveillance camera market, by product type 2018 - 2030 (USD Million)

- Table 94. KSA surveillance camera market, by deployment 2018 - 2030 (USD Million)

- Table 95. KSA surveillance camera market, by resolution capacity 2018 - 2030 (USD Million)

- Table 96. KSA surveillance camera market, by end use 2018 - 2030 (USD Million)

- Table 97. South Africa surveillance camera market, by product type 2018 - 2030 (USD Million)

- Table 98. South Africa surveillance camera market, by deployment 2018 - 2030 (USD Million)

- Table 99. South Africa surveillance camera market, by resolution capacity 2018 - 2030 (USD Million)

- Table 100. South Africa surveillance camera market, by end use 2018 - 2030 (USD Million)

List of Figures

- Fig. 1 Surveillance Camera market segmentation

- Fig. 2 Market research process

- Fig. 3 Information procurement

- Fig. 4 Primary research pattern

- Fig. 5 Market research approaches

- Fig. 6 Value chain-based sizing & forecasting

- Fig. 7 Parent market analysis

- Fig. 8 Market formulation & validation

- Fig. 9 Surveillance camera market snapshot

- Fig. 10 Surveillance camera market segment snapshot

- Fig. 11 Surveillance camera market competitive landscape snapshot

- Fig. 12 Market research process

- Fig. 13 Market driver relevance analysis (Current & future impact)

- Fig. 14 Market restraint relevance analysis (Current & future impact)

- Fig. 15 Surveillance Camera market, Product Type outlook key takeaways (USD Million)

- Fig. 16 Surveillance Camera market, Product Type movement analysis 2024 & 2030 (USD Million)

- Fig. 17 IP Based market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 18 Cellular camera market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 19 Analog camera market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 20 Surveillance Camera market: Deployment outlook key takeaways (USD Million)

- Fig. 21 Surveillance Camera market: Deployment movement analysis 2024 & 2030 (USD Million)

- Fig. 22 Indoor market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 23 Outdoor market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 24 Surveillance Camera market: Resolution Capacity outlook key takeaways (USD Million)

- Fig. 25 Surveillance Camera market: Resolution Capacity movement analysis 2024 & 2030 (USD Million)

- Fig. 26 High Definition (HD) market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 27 Full High Definition (FHD) market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 28 Ultra High Definition (UHD) (4K) market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 29 Surveillance Camera market: End Use outlook key takeaways (USD Million)

- Fig. 30 Surveillance Camera market: End Use movement analysis 2024 & 2030 (USD Million)

- Fig. 31 Residential surveillance camera market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 32 Commercial infrastructure surveillance camera market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 33 Public facilities surveillance camera market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 34 Industrial surveillance camera market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 35 Military & defense surveillance camera market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 36 Others surveillance camera market revenue estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 37 Regional marketplace: Key takeaways

- Fig. 38 Surveillance Camera market: Regional outlook, 2024 & 2030 (USD Million)

- Fig. 39 North America surveillance camera market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 40 US surveillance camera market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 41 Canada surveillance camera market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 42 Mexico surveillance camera market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 43 Europe surveillance camera market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 44 UK surveillance camera market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 45 Germany surveillance camera market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 46 France surveillance camera market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 47 Asia Pacific surveillance camera market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 48 Japan surveillance camera market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 49 China surveillance camera market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 50 India surveillance camera market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 51 Japan surveillance camera market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 52 Australia surveillance camera market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 53 South Korea surveillance camera market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 54 Latin America surveillance camera market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 55 Brazil surveillance camera market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 56 MEA surveillance camera market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 57 KSA surveillance camera market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 58 UAE surveillance camera market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 59 South Africa surveillance camera market estimates and forecasts, 2018 - 2030 (USD Million)

- Fig. 60 Strategy framework

- Fig. 61 Company Categorization

Surveillance Camera Market Growth & Trends:

The global surveillance camera market size is expected to reach USD 81.37 billion by 2030, registering a CAGR of 11.2% from 2025 to 2030, according to a new study by Grand View Research, Inc. The rising concerns regarding security and safety and the growing adoption of the Internet of Things (IoT) and smart technologies in smart cities are some of the major factors driving the growth of the market. In addition, growing technological advancements in video surveillance solutions to achieve improved security are further propelling the market's growth. The continuous evolution of camera technology, coupled with innovations in Artificial Intelligence (AI), video analytics, and edge computing, has empowered surveillance system manufacturers to offer advanced functionalities and capabilities.

Integrating AI into video surveillance focuses on specialized software or systems embedded within security camera devices. These systems facilitate real-time analysis of audio and images to rapidly identify individuals, vehicles, objects, events, and behaviors. The implementation of AI in video surveillance systems enhances their overall quality, accuracy, and utility. Furthermore, the application of AI in surveillance cameras holds a significant benefit as it can be designed to suit various device types, including thermal cameras, infrared cameras, and outdoor cameras.

The 5G cellular service offers considerable benefits to users, including reduced latency and improved data speeds. Its expanded bandwidth capacity makes it ideal for video surveillance applications in residential, commercial, and industrial environments, as its capacity to notably enhance image resolution and support diverse surveillance requirements. Furthermore, with the ultra-fast data transfer rates of 5G networks, surveillance cameras can capture and stream high-resolution footage seamlessly, providing clearer and more detailed images for improved situational awareness. Thus, owing to the above-mentioned benefits, demand for 5G-powered surveillance cameras is expected to increase during the forecast period.

The preference for remote monitoring capabilities in surveillance camera systems gained significant traction in the wake of the outbreak of the COVID-19 pandemic. Looking forward into the post-pandemic era, the emphasis on remote access to live video feeds and recorded footage would continue. AI-powered features, such as object detection, behavior analysis, and predictive analytics, are expected to become more prevalent to enhance the overall effectiveness and intelligence of surveillance systems. Thus, AI and advanced analytics in surveillance camera systems are poised to expand further in the post-pandemic era.

Surveillance Camera Market Report Highlights:

- Based on product type, cellular camera is anticipated to emerge as the fastest-growing segment over the forecast period. The segment is poised to experience significant growth due to the rising need for remote and flexible monitoring solutions leveraging cellular networks to enable real-time video access and connectivity in various locations

- Based on deployment, the outdoor deployment segment led the market with the largest revenue share of 73.3% in 2024

- Based on resolution capacity, the Ultra High Definition (UHD) (4K) is anticipated to emerge as the fastest-growing segment over the forecast period. The increasing development of UHD or 4K resolution surveillance cameras to offer high-quality surveillance images and videos propels the segment's growth

- Based on end-use, the industrial segment is expected to grow at the highest CAGR during the forecast period. An increasing demand for surveillance cameras from industries such as manufacturing, mining, construction, and data centers is driving the segment's growth

Table of Contents

Chapter 1. Methodology and Scope

- 1.1. Market Segmentation and Scope

- 1.2. Research Methodology

- 1.2.1. Information Procurement

- 1.3. Information or Data Analysis

- 1.4. Methodology

- 1.5. Research Scope and Assumptions

- 1.6. Market Formulation & Validation

- 1.7. Country Based Segment Share Calculation

- 1.8. List of Data Sources

Chapter 2. Executive Summary

- 2.1. Market Outlook

- 2.2. Segment Outlook

- 2.3. Competitive Insights

Chapter 3. Surveillance Camera Market Variables, Trends, & Scope

- 3.1. Market Lineage Outlook

- 3.2. Market Dynamics

- 3.2.1. Market Driver Analysis

- 3.2.2. Market Restraint Analysis

- 3.2.3. Industry Challenge

- 3.3. Surveillance Camera Market Analysis Tools

- 3.3.1. Industry Analysis - Porter's

- 3.3.1.1. Bargaining power of the suppliers

- 3.3.1.2. Bargaining power of the buyers

- 3.3.1.3. Threats of substitution

- 3.3.1.4. Threats from new entrants

- 3.3.1.5. Competitive rivalry

- 3.3.2. PESTEL Analysis

- 3.3.2.1. Political landscape

- 3.3.2.2. Economic and social landscape

- 3.3.2.3. Technological landscape

- 3.3.1. Industry Analysis - Porter's

Chapter 4. Surveillance Camera Market: Product Type Estimates & Trend Analysis

- 4.1. Segment Dashboard

- 4.2. Surveillance Camera Market: Product Type Movement Analysis, 2024 & 2030 (USD Million)

- 4.3. IP Based

- 4.3.1. IP Based Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 4.3.1.1. Wi-Fi

- 4.3.1.2. Wired

- 4.3.1. IP Based Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 4.4. Cellular Camera

- 4.4.1. Cellular Camera Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 4.4.1.1. 4G

- 4.4.1.2. 5G

- 4.4.1. Cellular Camera Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 4.5. Analog Camera

- 4.5.1. Analog Camera Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 5. Surveillance Camera Market: Deployment Estimates & Trend Analysis

- 5.1. Segment Dashboard

- 5.2. Surveillance Camera Market: Deployment Movement Analysis, 2024 & 2030 (USD Million)

- 5.3. Indoor

- 5.3.1. Indoor Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 5.4. Outdoor

- 5.4.1. Outdoor Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 6. Surveillance Camera Market: Resolution Capacity Estimates & Trend Analysis

- 6.1. Segment Dashboard

- 6.2. Surveillance Camera Market: Resolution Capacity Movement Analysis, 2024 & 2030 (USD Million)

- 6.3. High Definition (HD)

- 6.3.1. High Definition (HD) Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 6.4. Full High Definition (FHD)

- 6.4.1. Full High Definition (FHD) Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 6.5. Ultra High Definition (UHD) (4K)

- 6.5.1. Ultra High Definition (UHD) (4K) Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 7. Surveillance Camera Market: End Use Estimates & Trend Analysis

- 7.1. Segment Dashboard

- 7.2. Surveillance Camera Market: End Use Movement Analysis, 2024 & 2030 (USD Million)

- 7.3. Residential

- 7.3.1. Residential Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 7.4. Commercial Infrastructure

- 7.4.1. Commercial Infrastructure Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 7.5. Public Facilities

- 7.5.1. Public Facilities Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 7.6. Industrial

- 7.6.1. Industrial Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 7.7. Military & Defense

- 7.7.1. Military & Defense Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 7.8. Others

- 7.8.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 8. Surveillance Camera Market: Regional Estimates & Trend Analysis

- 8.1. Surveillance Camera Market Share, By Region, 2024 & 2030 (USD Million)

- 8.2. North America

- 8.2.1. North America Surveillance Camera Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.2.2. U.S.

- 8.2.2.1. U.S. Surveillance Camera Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.2.3. Canada

- 8.2.3.1. Canada Surveillance Camera Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.2.4. Mexico

- 8.2.4.1. Mexico Surveillance Camera Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.3. Europe

- 8.3.1. Europe Surveillance Camera Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.3.2. UK

- 8.3.2.1. UK Surveillance Camera Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.3.3. Germany

- 8.3.3.1. Germany Surveillance Camera Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.3.4. France

- 8.3.4.1. France Surveillance Camera Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.4. Asia Pacific

- 8.4.1. Asia Pacific Surveillance Camera Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.4.2. China

- 8.4.2.1. China Surveillance Camera Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.4.3. Japan

- 8.4.3.1. Japan Surveillance Camera Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.4.4. India

- 8.4.4.1. India Surveillance Camera Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.4.5. South Korea

- 8.4.5.1. South Korea Surveillance Camera Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.4.6. Australia

- 8.4.6.1. Australia Surveillance Camera Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.5. Latin America

- 8.5.1. Latin America Surveillance Camera Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.5.2. Brazil

- 8.5.2.1. Brazil Surveillance Camera Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.6. Middle East and Africa

- 8.6.1. Middle East and Africa Surveillance Camera Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.6.2. UAE

- 8.6.2.1. UAE Surveillance Camera Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.6.3. KSA

- 8.6.3.1. KSA Surveillance Camera Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.6.4. South Africa

- 8.6.4.1. South Africa Surveillance Camera Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 9. Competitive Landscape

- 9.1. Company Categorization

- 9.2. Company Market Positioning

- 9.3. Company Heat Map Analysis

- 9.4. Company Profiles/Listing

- 9.4.1. Honeywell International Inc.

- 9.4.1.1. Participant's Overview

- 9.4.1.2. Financial Performance

- 9.4.1.3. Product Benchmarking

- 9.4.1.4. Strategic Initiatives

- 9.4.2. Cisco Systems, Inc.

- 9.4.2.1. Participant's Overview

- 9.4.2.2. Financial Performance

- 9.4.2.3. Product Benchmarking

- 9.4.2.4. Strategic Initiatives

- 9.4.3. Eye Trax

- 9.4.3.1. Participant's Overview

- 9.4.3.2. Financial Performance

- 9.4.3.3. Product Benchmarking

- 9.4.3.4. Strategic Initiatives

- 9.4.4. Nokia Corporation

- 9.4.4.1. Participant's Overview

- 9.4.4.2. Financial Performance

- 9.4.4.3. Product Benchmarking

- 9.4.4.4. Strategic Initiatives

- 9.4.5. Panasonic Holdings Corporation

- 9.4.5.1. Participant's Overview

- 9.4.5.2. Financial Performance

- 9.4.5.3. Product Benchmarking

- 9.4.5.4. Strategic Initiatives

- 9.4.6. Robert Bosch GmbH

- 9.4.6.1. Participant's Overview

- 9.4.6.2. Financial Performance

- 9.4.6.3. Product Benchmarking

- 9.4.6.4. Strategic Initiatives

- 9.4.7. Teledyne FLIR LLC

- 9.4.7.1. Participant's Overview

- 9.4.7.2. Financial Performance

- 9.4.7.3. Product Benchmarking

- 9.4.7.4. Strategic Initiatives

- 9.4.8. Milesight

- 9.4.8.1. Participant's Overview

- 9.4.8.2. Financial Performance

- 9.4.8.3. Product Benchmarking

- 9.4.8.4. Strategic Initiatives

- 9.4.9. Dahua Technology Co., Ltd.

- 9.4.9.1. Participant's Overview

- 9.4.9.2. Financial Performance

- 9.4.9.3. Product Benchmarking

- 9.4.9.4. Strategic Initiatives

- 9.4.10. Swann

- 9.4.10.1. Participant's Overview

- 9.4.10.2. Financial Performance

- 9.4.10.3. Product Benchmarking

- 9.4.10.4. Strategic Initiatives

- 9.4.1. Honeywell International Inc.