|

|

市場調査レポート

商品コード

1791748

非動物実験代替法の世界市場Non-animal Alternative Testing |

||||||

適宜更新あり

|

|||||||

| 非動物実験代替法の世界市場 |

|

出版日: 2025年08月15日

発行: Market Glass, Inc. (Formerly Global Industry Analysts, Inc.)

ページ情報: 英文 138 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

非動物実験代替法の世界市場は2030年までに45億米ドルに達する見込み

2024年に22億米ドルと推定される非動物実験代替法の世界市場は、2024年から2030年にかけてCAGR 12.8%で成長し、2030年には45億米ドルに達すると予測されます。本レポートで分析したセグメントの1つである細胞ラインは、CAGR14.2%を記録し、分析期間終了時には30億米ドルに達すると予測されます。組織ラインセグメントの成長率は、分析期間でCAGR 10.1%と推定されます。

米国市場は5億7,170万米ドルと推定、中国はCAGR12.0%で成長予測

米国の非動物実験代替法市場は2024年に5億7,170万米ドルと推定されます。世界第2位の経済大国である中国は、2030年までに6億9,510万米ドルの市場規模に達すると予測され、分析期間2024-2030年のCAGRは12.0%です。その他の注目すべき地域別市場としては、日本とカナダがあり、分析期間中のCAGRはそれぞれ12.0%と10.9%と予測されています。欧州では、ドイツがCAGR約9.2%で成長すると予測されています。

世界の非動物実験代替法市場- 主要動向と促進要因のまとめ

非動物実験代替法メソッドは製品安全性と調査をどのように再構築しているか?

倫理的で持続可能な調査手法の世界の推進により、製薬、化粧品、食品安全、化学薬品などの業界で非動物実験代替法法が急速に採用されています。従来の動物実験は、倫理的懸念、ヒトの反応予測における非有効性、規制上の制限などから長い間批判を浴びており、より人道的で科学的に高度な実験ソリューションへの需要が高まっています。試験管内モデル、臓器オンチップ技術、計算シミュレーション、3D組織工学など、動物を用いない代替手法は、安全性と有効性の評価方法を変えつつあります。FDAや欧州医薬品庁(EMA)を含む規制機関は、こうした技術をますます認め、前臨床試験や毒性試験の枠組みへの統合を加速させています。特に化粧品・パーソナルケア業界は、実験室で培養した皮膚モデルやAIを活用した毒性予測システムに投資する大手ブランドとともに、クルクルフリー試験への移行を主導してきました。科学の進歩が代替試験法の信頼性と費用対効果を高め続ける中、各業界は倫理的で正確、かつ規制に準拠した研究実践に向けた実行可能な道として、非動物実験を受け入れています。

非動物実験代替法の採用を遅らせている課題は?

非動物実験代替法は広く受け入れられてきていますが、業界全体への普及を妨げるいくつかの課題に直面しています。主な懸念事項のひとつは、規制の不統一です。安全性評価における動物実験の要件は国によって異なるため、複数の市場で事業を展開する企業にとってはハードルとなります。代替法の妥当性確認基準が普遍的に受け入れられていないことも、業界全体への導入を遅らせています。さらに、免疫反応や長期毒性作用など、複雑な生物学的相互作用の中には、現在の非動物実験技術では再現が困難なものもあり、特定の研究分野での適用が制限されています。また、臓器チップシステムやAIを活用したシミュレーションなど、先進的な試験法の開発・導入に伴う初期コストの高さも、小規模な研究機関や新興企業にとって課題となっています。これらの障害を克服するためには、規制の調和を強化し、革新的な調査手法への投資を継続し、政府、業界リーダー、研究機関が協力して採用を加速させる必要があります。

技術革新はどのように代替検査法の進化を促しているのか?

技術の進歩は、非動物実験代替法の能力を拡大し、より信頼性が高く、拡張性があり、広く適用できるようにする上で重要な役割を果たしています。3Dバイオプリンティングと組織工学は、実際の生理学的反応を模倣できる高精度のヒト類似組織モデルを作成することで、医薬品や化粧品の検査に革命をもたらしています。臓器機能をシミュレートするマイクロ流体システムを統合した臓器オンチップ技術の開発は、前臨床薬物試験の精度を向上させ、動物モデルへの依存を減らしています。人工知能(AI)と機械学習は予測毒性学をさらに強化し、研究者が生きた被験者を必要とせずに複雑な生化学的相互作用をモデル化し、大規模なデータセットを分析することを可能にしています。化学物質の挙動や生物学的相互作用を予測するために計算シミュレーションを使用するインシリコ・モデリングも、毒性学研究のための規制当局承認の手法として支持を集めています。これらの技術革新が進化を続けるにつれ、非動物実験代替法の手法はより洗練され、倫理的懸念と科学的正確性のギャップを埋めつつあります。

非動物実験代替法市場の成長の原動力は?

非動物実験代替法市場の成長には、動物実験に対する規制の強化、残酷さを含まない製品に対する消費者の需要の高まり、バイオテクノロジーの進歩など、いくつかの要因があります。各国政府や国際的な規制機関は、より厳格な動物福祉法を施行し、業界に新たな安全性評価基準に準拠した代替試験方法への移行を促しています。特に化粧品・パーソナルケア業界では、クルーエルティフリー製品の需要が急速に伸びており、各ブランドが有効な代替試験ソリューションに投資するよう促しています。さらに、製薬会社や化学会社は、研究コストの削減、研究開発期間の短縮、前臨床研究におけるヒトとの関連性の向上を目的として、試験管内試験や計算機による試験方法を採用しています。予測毒性学における人工知能の拡大は、より迅速で正確な安全性評価を提供し、市場導入をさらに促進しています。これらの要因によって業界の慣行が形成され続ける中、倫理的かつ科学的に優れた試験方法が従来の動物実験に取って代わる未来を提供することで、調査市場は大きく拡大する態勢を整えています。

セグメント

製品(細胞株、組織株、臓器オンチップ)、技術(細胞培養技術、ハイスループット技術、分子イメージング技術、オミックス技術)

調査対象企業の例

- Abbott Laboratories

- BioIVT

- Bio-Rad Laboratories, Inc.

- Charles River Laboratories

- Cyprotex(An Evotec Company)

- Emulate, Inc.

- Evotec SE

- Gentronix Limited

- Hurel Corporation

- InSphero AG

- JRF Global

- J-TEC(Japan Tissue Engineering Co., Ltd.)

- MatTek Corporation

- Mimetas BV

- Organ Technologies Inc.

- Promega Corporation

- Reprocell Inc.

- SGS SA

- TissUse GmbH

- VITROCELL Systems GmbH

AIインテグレーション

Global Industry Analystsは、有効な専門家コンテンツとAIツールによって、市場情報と競合情報を変革しています。

Global Industry Analystsは、LLMや業界固有のSLMを照会する一般的な規範に従う代わりに、ビデオ記録、ブログ、検索エンジン調査、膨大な量の企業、製品/サービス、市場データなど、世界中の専門家から収集したコンテンツのリポジトリを構築しました。

関税影響係数

Global Industry Analystsは、本社の国、製造拠点、輸出入(完成品とOEM)に基づく企業の競争力の変化を予測しています。この複雑で多面的な市場力学は、売上原価(COGS)の増加、収益性の低下、サプライチェーンの再構築など、ミクロおよびマクロの市場力学の中でも特に競合他社に影響を与える見込みです。

目次

第1章 調査手法

第2章 エグゼクティブサマリー

- 市場概要

- 主要企業

- 市場動向と促進要因

- 世界市場の見通し

第3章 市場分析

- 米国

- カナダ

- 日本

- 中国

- 欧州

- フランス

- ドイツ

- イタリア

- 英国

- その他欧州

- アジア太平洋

- その他の地域

第4章 競合

Global Non-animal Alternative Testing Market to Reach US$4.5 Billion by 2030

The global market for Non-animal Alternative Testing estimated at US$2.2 Billion in the year 2024, is expected to reach US$4.5 Billion by 2030, growing at a CAGR of 12.8% over the analysis period 2024-2030. Cell Lines, one of the segments analyzed in the report, is expected to record a 14.2% CAGR and reach US$3.0 Billion by the end of the analysis period. Growth in the Tissue Lines segment is estimated at 10.1% CAGR over the analysis period.

The U.S. Market is Estimated at US$571.7 Million While China is Forecast to Grow at 12.0% CAGR

The Non-animal Alternative Testing market in the U.S. is estimated at US$571.7 Million in the year 2024. China, the world's second largest economy, is forecast to reach a projected market size of US$695.1 Million by the year 2030 trailing a CAGR of 12.0% over the analysis period 2024-2030. Among the other noteworthy geographic markets are Japan and Canada, each forecast to grow at a CAGR of 12.0% and 10.9% respectively over the analysis period. Within Europe, Germany is forecast to grow at approximately 9.2% CAGR.

Global Non-Animal Alternative Testing Market - Key Trends & Drivers Summarized

How Are Non-Animal Alternative Testing Methods Reshaping Product Safety and Research?

The global push for ethical and sustainable research practices has led to the rapid adoption of non-animal alternative testing methods across industries such as pharmaceuticals, cosmetics, food safety, and chemicals. Traditional animal testing has long been criticized for ethical concerns, inefficacy in predicting human responses, and regulatory restrictions, driving the demand for more humane and scientifically advanced testing solutions. Non-animal alternative methods, including in vitro models, organ-on-a-chip technology, computational simulations, and 3D tissue engineering, are transforming the way safety and efficacy are evaluated. Regulatory agencies, including the FDA and the European Medicines Agency (EMA), are increasingly recognizing these technologies, accelerating their integration into preclinical and toxicological testing frameworks. The cosmetics and personal care industry, in particular, has led the transition toward cruelty-free testing, with major brands investing in lab-grown skin models and AI-powered toxicity prediction systems. As scientific advancements continue to enhance the reliability and cost-effectiveness of alternative testing methods, industries are embracing non-animal solutions as a viable path toward ethical, accurate, and regulatory-compliant research practices.

What Challenges Are Slowing the Adoption of Non-Animal Alternative Testing?

Despite its growing acceptance, non-animal alternative testing faces several challenges that hinder its widespread adoption across industries. One of the primary concerns is regulatory inconsistency, as different countries maintain varying requirements for animal testing in safety assessments, creating hurdles for companies operating in multiple markets. The lack of universally accepted validation standards for alternative methods also slows down industry-wide implementation, as companies must undergo lengthy approval processes to demonstrate equivalency to animal-based models. Additionally, some complex biological interactions, such as immune responses and long-term toxicity effects, remain difficult to replicate using current non-animal technologies, limiting their applicability in specific research areas. High initial costs associated with developing and adopting advanced testing methods, such as organ-on-a-chip systems and AI-driven simulations, pose another challenge for smaller research institutions and startups. Overcoming these obstacles will require stronger regulatory harmonization, continued investment in innovative testing methodologies, and collaborative efforts between governments, industry leaders, and research organizations to accelerate adoption.

How Are Technological Innovations Driving the Evolution of Alternative Testing Methods?

Technological advancements are playing a crucial role in expanding the capabilities of non-animal alternative testing, making them more reliable, scalable, and widely applicable. 3D bioprinting and tissue engineering are revolutionizing drug and cosmetic testing by creating highly accurate human-like tissue models that can mimic real physiological responses. The development of organ-on-a-chip technology, which integrates microfluidic systems to simulate organ functions, is improving preclinical drug testing accuracy and reducing reliance on animal models. Artificial intelligence (AI) and machine learning are further enhancing predictive toxicology, allowing researchers to model complex biochemical interactions and analyze large datasets without the need for live test subjects. In silico modeling, which uses computational simulations to predict chemical behavior and biological interactions, is also gaining traction as a regulatory-approved method for toxicology studies. As these innovations continue to evolve, non-animal alternative testing methods are becoming more sophisticated, bridging the gap between ethical concerns and scientific accuracy.

What Is Driving the Growth of the Non-Animal Alternative Testing Market?

The growth in the non-animal alternative testing market is driven by several factors, including increasing regulatory restrictions on animal testing, rising consumer demand for cruelty-free products, and advancements in biotechnology. Governments and international regulatory bodies are enforcing stricter animal welfare laws, prompting industries to transition to alternative testing methods that comply with new safety assessment standards. The cosmetics and personal care industry, in particular, is experiencing rapid growth in cruelty-free product demand, encouraging brands to invest in validated alternative testing solutions. Additionally, pharmaceutical and chemical companies are adopting in vitro and computational testing methods to reduce research costs, accelerate drug development timelines, and improve human relevance in preclinical studies. The expansion of artificial intelligence in predictive toxicology is further driving market adoption, providing faster and more accurate safety assessments. As these factors continue to shape industry practices, the non-animal alternative testing market is poised for significant expansion, offering a future where ethical and scientifically superior testing methods replace traditional animal-based research.

SCOPE OF STUDY:

The report analyzes the Non-animal Alternative Testing market in terms of units by the following Segments, and Geographic Regions/Countries:

Segments:

Product (Cell Lines, Tissue Lines, Organ-On-Chips); Technology (Cell Culture Technology, High Throughput Technology, Molecular Imaging Technology, Omics Technology)

Geographic Regions/Countries:

World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Select Competitors (Total 36 Featured) -

- Abbott Laboratories

- BioIVT

- Bio-Rad Laboratories, Inc.

- Charles River Laboratories

- Cyprotex (An Evotec Company)

- Emulate, Inc.

- Evotec SE

- Gentronix Limited

- Hurel Corporation

- InSphero AG

- JRF Global

- J-TEC (Japan Tissue Engineering Co., Ltd.)

- MatTek Corporation

- Mimetas BV

- Organ Technologies Inc.

- Promega Corporation

- Reprocell Inc.

- SGS SA

- TissUse GmbH

- VITROCELL Systems GmbH

AI INTEGRATIONS

We're transforming market and competitive intelligence with validated expert content and AI tools.

Instead of following the general norm of querying LLMs and Industry-specific SLMs, we built repositories of content curated from domain experts worldwide including video transcripts, blogs, search engines research, and massive amounts of enterprise, product/service, and market data.

TARIFF IMPACT FACTOR

Our new release incorporates impact of tariffs on geographical markets as we predict a shift in competitiveness of companies based on HQ country, manufacturing base, exports and imports (finished goods and OEM). This intricate and multifaceted market reality will impact competitors by increasing the Cost of Goods Sold (COGS), reducing profitability, reconfiguring supply chains, amongst other micro and macro market dynamics.

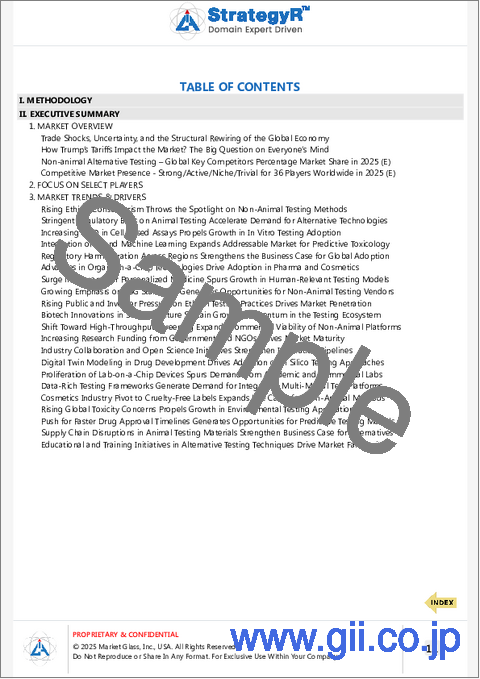

TABLE OF CONTENTS

I. METHODOLOGY

II. EXECUTIVE SUMMARY

- 1. MARKET OVERVIEW

- Influencer Market Insights

- Tariff Impact on Global Supply Chain Patterns

- Non-animal Alternative Testing - Global Key Competitors Percentage Market Share in 2025 (E)

- Competitive Market Presence - Strong/Active/Niche/Trivial for Players Worldwide in 2025 (E)

- 2. FOCUS ON SELECT PLAYERS

- 3. MARKET TRENDS & DRIVERS

- Rising Ethical Consumerism Throws the Spotlight on Non-Animal Testing Methods

- Stringent Regulatory Bans on Animal Testing Accelerate Demand for Alternative Technologies

- Increasing R&D in Cell-Based Assays Propels Growth in In Vitro Testing Adoption

- Integration of AI and Machine Learning Expands Addressable Market for Predictive Toxicology

- Regulatory Harmonization Across Regions Strengthens the Business Case for Global Adoption

- Advances in Organ-on-a-Chip Technologies Drive Adoption in Pharma and Cosmetics

- Surge in Demand for Personalized Medicine Spurs Growth in Human-Relevant Testing Models

- Growing Emphasis on ESG Standards Generates Opportunities for Non-Animal Testing Vendors

- Rising Public and Investor Pressure on Ethical Testing Practices Drives Market Penetration

- Biotech Innovations in 3D Cell Culture Sustain Growth Momentum in the Testing Ecosystem

- Shift Toward High-Throughput Screening Expands Commercial Viability of Non-Animal Platforms

- Increasing Research Funding from Government and NGOs Drives Market Maturity

- Industry Collaboration and Open Science Initiatives Strengthen Innovation Pipelines

- Digital Twin Modeling in Drug Development Drives Adoption of In Silico Testing Approaches

- Proliferation of Lab-on-a-Chip Devices Spurs Demand from Academic and Commercial Labs

- Data-Rich Testing Frameworks Generate Demand for Integrated, Multi-Modal Test Platforms

- Cosmetics Industry Pivot to Cruelty-Free Labels Expands Use Cases for Non-Animal Methods

- Rising Global Toxicity Concerns Propels Growth in Environmental Testing Applications

- Push for Faster Drug Approval Timelines Generates Opportunities for Predictive Testing Models

- Supply Chain Disruptions in Animal Testing Materials Strengthen Business Case for Alternatives

- Educational and Training Initiatives in Alternative Testing Techniques Drive Market Familiarity

- Consumer Awareness Campaigns Spur Regulatory and Industry-Driven Adoption

- Technological Convergence Between Bioengineering and Computational Sciences Opens New Frontiers

- Push for Ethical Clinical Trials Expands Market Potential for Human-on-a-Chip Platforms

- 4. GLOBAL MARKET PERSPECTIVE

- TABLE 1: World Non-animal Alternative Testing Market Analysis of Annual Sales in US$ Thousand for Years 2015 through 2030

- TABLE 2: World Recent Past, Current & Future Analysis for Non-animal Alternative Testing by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2024 through 2030 and % CAGR

- TABLE 3: World 6-Year Perspective for Non-animal Alternative Testing by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets for Years 2025 & 2030

- TABLE 4: World Recent Past, Current & Future Analysis for Cell Lines by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2024 through 2030 and % CAGR

- TABLE 5: World 6-Year Perspective for Cell Lines by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World for Years 2025 & 2030

- TABLE 6: World Recent Past, Current & Future Analysis for Tissue Lines by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2024 through 2030 and % CAGR

- TABLE 7: World 6-Year Perspective for Tissue Lines by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World for Years 2025 & 2030

- TABLE 8: World Recent Past, Current & Future Analysis for Organ-On-Chips by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2024 through 2030 and % CAGR

- TABLE 9: World 6-Year Perspective for Organ-On-Chips by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World for Years 2025 & 2030

- TABLE 10: World Recent Past, Current & Future Analysis for Cell Culture Technology by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2024 through 2030 and % CAGR

- TABLE 11: World 6-Year Perspective for Cell Culture Technology by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World for Years 2025 & 2030

- TABLE 12: World Recent Past, Current & Future Analysis for High Throughput Technology by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2024 through 2030 and % CAGR

- TABLE 13: World 6-Year Perspective for High Throughput Technology by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World for Years 2025 & 2030

- TABLE 14: World Recent Past, Current & Future Analysis for Molecular Imaging Technology by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2024 through 2030 and % CAGR

- TABLE 15: World 6-Year Perspective for Molecular Imaging Technology by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World for Years 2025 & 2030

- TABLE 16: World Recent Past, Current & Future Analysis for Omics Technology by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2024 through 2030 and % CAGR

- TABLE 17: World 6-Year Perspective for Omics Technology by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World for Years 2025 & 2030

III. MARKET ANALYSIS

- UNITED STATES

- Non-animal Alternative Testing Market Presence - Strong/Active/Niche/Trivial - Key Competitors in the United States for 2025 (E)

- TABLE 18: USA Recent Past, Current & Future Analysis for Non-animal Alternative Testing by Product - Cell Lines, Tissue Lines and Organ-On-Chips - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 19: USA 6-Year Perspective for Non-animal Alternative Testing by Product - Percentage Breakdown of Value Sales for Cell Lines, Tissue Lines and Organ-On-Chips for the Years 2025 & 2030

- TABLE 20: USA Recent Past, Current & Future Analysis for Non-animal Alternative Testing by Technology - Cell Culture Technology, High Throughput Technology, Molecular Imaging Technology and Omics Technology - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 21: USA 6-Year Perspective for Non-animal Alternative Testing by Technology - Percentage Breakdown of Value Sales for Cell Culture Technology, High Throughput Technology, Molecular Imaging Technology and Omics Technology for the Years 2025 & 2030

- CANADA

- TABLE 22: Canada Recent Past, Current & Future Analysis for Non-animal Alternative Testing by Product - Cell Lines, Tissue Lines and Organ-On-Chips - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 23: Canada 6-Year Perspective for Non-animal Alternative Testing by Product - Percentage Breakdown of Value Sales for Cell Lines, Tissue Lines and Organ-On-Chips for the Years 2025 & 2030

- TABLE 24: Canada Recent Past, Current & Future Analysis for Non-animal Alternative Testing by Technology - Cell Culture Technology, High Throughput Technology, Molecular Imaging Technology and Omics Technology - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 25: Canada 6-Year Perspective for Non-animal Alternative Testing by Technology - Percentage Breakdown of Value Sales for Cell Culture Technology, High Throughput Technology, Molecular Imaging Technology and Omics Technology for the Years 2025 & 2030

- JAPAN

- Non-animal Alternative Testing Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Japan for 2025 (E)

- TABLE 26: Japan Recent Past, Current & Future Analysis for Non-animal Alternative Testing by Product - Cell Lines, Tissue Lines and Organ-On-Chips - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 27: Japan 6-Year Perspective for Non-animal Alternative Testing by Product - Percentage Breakdown of Value Sales for Cell Lines, Tissue Lines and Organ-On-Chips for the Years 2025 & 2030

- TABLE 28: Japan Recent Past, Current & Future Analysis for Non-animal Alternative Testing by Technology - Cell Culture Technology, High Throughput Technology, Molecular Imaging Technology and Omics Technology - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 29: Japan 6-Year Perspective for Non-animal Alternative Testing by Technology - Percentage Breakdown of Value Sales for Cell Culture Technology, High Throughput Technology, Molecular Imaging Technology and Omics Technology for the Years 2025 & 2030

- CHINA

- Non-animal Alternative Testing Market Presence - Strong/Active/Niche/Trivial - Key Competitors in China for 2025 (E)

- TABLE 30: China Recent Past, Current & Future Analysis for Non-animal Alternative Testing by Product - Cell Lines, Tissue Lines and Organ-On-Chips - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 31: China 6-Year Perspective for Non-animal Alternative Testing by Product - Percentage Breakdown of Value Sales for Cell Lines, Tissue Lines and Organ-On-Chips for the Years 2025 & 2030

- TABLE 32: China Recent Past, Current & Future Analysis for Non-animal Alternative Testing by Technology - Cell Culture Technology, High Throughput Technology, Molecular Imaging Technology and Omics Technology - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 33: China 6-Year Perspective for Non-animal Alternative Testing by Technology - Percentage Breakdown of Value Sales for Cell Culture Technology, High Throughput Technology, Molecular Imaging Technology and Omics Technology for the Years 2025 & 2030

- EUROPE

- Non-animal Alternative Testing Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Europe for 2025 (E)

- TABLE 34: Europe Recent Past, Current & Future Analysis for Non-animal Alternative Testing by Geographic Region - France, Germany, Italy, UK and Rest of Europe Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2024 through 2030 and % CAGR

- TABLE 35: Europe 6-Year Perspective for Non-animal Alternative Testing by Geographic Region - Percentage Breakdown of Value Sales for France, Germany, Italy, UK and Rest of Europe Markets for Years 2025 & 2030

- TABLE 36: Europe Recent Past, Current & Future Analysis for Non-animal Alternative Testing by Product - Cell Lines, Tissue Lines and Organ-On-Chips - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 37: Europe 6-Year Perspective for Non-animal Alternative Testing by Product - Percentage Breakdown of Value Sales for Cell Lines, Tissue Lines and Organ-On-Chips for the Years 2025 & 2030

- TABLE 38: Europe Recent Past, Current & Future Analysis for Non-animal Alternative Testing by Technology - Cell Culture Technology, High Throughput Technology, Molecular Imaging Technology and Omics Technology - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 39: Europe 6-Year Perspective for Non-animal Alternative Testing by Technology - Percentage Breakdown of Value Sales for Cell Culture Technology, High Throughput Technology, Molecular Imaging Technology and Omics Technology for the Years 2025 & 2030

- FRANCE

- Non-animal Alternative Testing Market Presence - Strong/Active/Niche/Trivial - Key Competitors in France for 2025 (E)

- TABLE 40: France Recent Past, Current & Future Analysis for Non-animal Alternative Testing by Product - Cell Lines, Tissue Lines and Organ-On-Chips - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 41: France 6-Year Perspective for Non-animal Alternative Testing by Product - Percentage Breakdown of Value Sales for Cell Lines, Tissue Lines and Organ-On-Chips for the Years 2025 & 2030

- TABLE 42: France Recent Past, Current & Future Analysis for Non-animal Alternative Testing by Technology - Cell Culture Technology, High Throughput Technology, Molecular Imaging Technology and Omics Technology - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 43: France 6-Year Perspective for Non-animal Alternative Testing by Technology - Percentage Breakdown of Value Sales for Cell Culture Technology, High Throughput Technology, Molecular Imaging Technology and Omics Technology for the Years 2025 & 2030

- GERMANY

- Non-animal Alternative Testing Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Germany for 2025 (E)

- TABLE 44: Germany Recent Past, Current & Future Analysis for Non-animal Alternative Testing by Product - Cell Lines, Tissue Lines and Organ-On-Chips - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 45: Germany 6-Year Perspective for Non-animal Alternative Testing by Product - Percentage Breakdown of Value Sales for Cell Lines, Tissue Lines and Organ-On-Chips for the Years 2025 & 2030

- TABLE 46: Germany Recent Past, Current & Future Analysis for Non-animal Alternative Testing by Technology - Cell Culture Technology, High Throughput Technology, Molecular Imaging Technology and Omics Technology - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 47: Germany 6-Year Perspective for Non-animal Alternative Testing by Technology - Percentage Breakdown of Value Sales for Cell Culture Technology, High Throughput Technology, Molecular Imaging Technology and Omics Technology for the Years 2025 & 2030

- ITALY

- TABLE 48: Italy Recent Past, Current & Future Analysis for Non-animal Alternative Testing by Product - Cell Lines, Tissue Lines and Organ-On-Chips - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 49: Italy 6-Year Perspective for Non-animal Alternative Testing by Product - Percentage Breakdown of Value Sales for Cell Lines, Tissue Lines and Organ-On-Chips for the Years 2025 & 2030

- TABLE 50: Italy Recent Past, Current & Future Analysis for Non-animal Alternative Testing by Technology - Cell Culture Technology, High Throughput Technology, Molecular Imaging Technology and Omics Technology - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 51: Italy 6-Year Perspective for Non-animal Alternative Testing by Technology - Percentage Breakdown of Value Sales for Cell Culture Technology, High Throughput Technology, Molecular Imaging Technology and Omics Technology for the Years 2025 & 2030

- UNITED KINGDOM

- Non-animal Alternative Testing Market Presence - Strong/Active/Niche/Trivial - Key Competitors in the United Kingdom for 2025 (E)

- TABLE 52: UK Recent Past, Current & Future Analysis for Non-animal Alternative Testing by Product - Cell Lines, Tissue Lines and Organ-On-Chips - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 53: UK 6-Year Perspective for Non-animal Alternative Testing by Product - Percentage Breakdown of Value Sales for Cell Lines, Tissue Lines and Organ-On-Chips for the Years 2025 & 2030

- TABLE 54: UK Recent Past, Current & Future Analysis for Non-animal Alternative Testing by Technology - Cell Culture Technology, High Throughput Technology, Molecular Imaging Technology and Omics Technology - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 55: UK 6-Year Perspective for Non-animal Alternative Testing by Technology - Percentage Breakdown of Value Sales for Cell Culture Technology, High Throughput Technology, Molecular Imaging Technology and Omics Technology for the Years 2025 & 2030

- REST OF EUROPE

- TABLE 56: Rest of Europe Recent Past, Current & Future Analysis for Non-animal Alternative Testing by Product - Cell Lines, Tissue Lines and Organ-On-Chips - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 57: Rest of Europe 6-Year Perspective for Non-animal Alternative Testing by Product - Percentage Breakdown of Value Sales for Cell Lines, Tissue Lines and Organ-On-Chips for the Years 2025 & 2030

- TABLE 58: Rest of Europe Recent Past, Current & Future Analysis for Non-animal Alternative Testing by Technology - Cell Culture Technology, High Throughput Technology, Molecular Imaging Technology and Omics Technology - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 59: Rest of Europe 6-Year Perspective for Non-animal Alternative Testing by Technology - Percentage Breakdown of Value Sales for Cell Culture Technology, High Throughput Technology, Molecular Imaging Technology and Omics Technology for the Years 2025 & 2030

- ASIA-PACIFIC

- Non-animal Alternative Testing Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Asia-Pacific for 2025 (E)

- TABLE 60: Asia-Pacific Recent Past, Current & Future Analysis for Non-animal Alternative Testing by Product - Cell Lines, Tissue Lines and Organ-On-Chips - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 61: Asia-Pacific 6-Year Perspective for Non-animal Alternative Testing by Product - Percentage Breakdown of Value Sales for Cell Lines, Tissue Lines and Organ-On-Chips for the Years 2025 & 2030

- TABLE 62: Asia-Pacific Recent Past, Current & Future Analysis for Non-animal Alternative Testing by Technology - Cell Culture Technology, High Throughput Technology, Molecular Imaging Technology and Omics Technology - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 63: Asia-Pacific 6-Year Perspective for Non-animal Alternative Testing by Technology - Percentage Breakdown of Value Sales for Cell Culture Technology, High Throughput Technology, Molecular Imaging Technology and Omics Technology for the Years 2025 & 2030

- REST OF WORLD

- TABLE 64: Rest of World Recent Past, Current & Future Analysis for Non-animal Alternative Testing by Product - Cell Lines, Tissue Lines and Organ-On-Chips - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 65: Rest of World 6-Year Perspective for Non-animal Alternative Testing by Product - Percentage Breakdown of Value Sales for Cell Lines, Tissue Lines and Organ-On-Chips for the Years 2025 & 2030

- TABLE 66: Rest of World Recent Past, Current & Future Analysis for Non-animal Alternative Testing by Technology - Cell Culture Technology, High Throughput Technology, Molecular Imaging Technology and Omics Technology - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 67: Rest of World 6-Year Perspective for Non-animal Alternative Testing by Technology - Percentage Breakdown of Value Sales for Cell Culture Technology, High Throughput Technology, Molecular Imaging Technology and Omics Technology for the Years 2025 & 2030