|

|

市場調査レポート

商品コード

1543803

世界のフレグランス部門における機会:2024年Opportunities in the Global Fragrances Sector 2024 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 世界のフレグランス部門における機会:2024年 |

|

出版日: 2024年07月22日

発行: GlobalData

ページ情報: 英文 161 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界のフレグランス部門の2023年の市場規模は558億米ドルで、2023年から28年にかけてCAGR4.7%を記録し、2028年には703億米ドルに達すると予測されています。2023年にこの分野で最大の地域を占めるのは南北アメリカです。2023年には、女性用フレグランスが最大のカテゴリーとなり、世界全体の売上額の53.3%を占めました。世界のフレグランス部門の上位5社の2023年の金額シェアは34.4%でした。ハイパーマーケットとスーパーマーケットは、2023年の世界のフレグランス部門の主要流通チャネルであり、金額シェアは23.4%でした。

このセクターをリードしたのはL'Orealの11.2%、次いでLVMH Moet Hennessyの6.8%、Cotyの6.6%でした。その他の大手企業は、Chanelが5%、Natura &Coが4.8%でした。ハイパーマーケットおよびスーパーマーケットは、2023年の世界のフレグランス部門の主要流通チャネルであり、金額シェアは23.4%、次いでヘルスおよびビューティーストアが23%でした。南北アメリカでは、ハイパーマーケットおよびスーパーマーケットが引き続き主要な流通チャネルであり、販売額の31%を占めました。中東・アフリカと西欧では、ヘルスおよびビューティストアがフレグランスの流通をリードしました。東欧では直販業者の金額シェアが25.5%と最も高くなっています。

当レポートでは、世界のフレグランス部門について調査し、市場の概要とともに、地域別の動向、消費パターンの変化、今後の見通しと市場に参入する企業の競合情勢などをまとめています。

目次

- エグゼクティブサマリー

- セクター概要

- 世界概要

- アメリカの概要

- アジア太平洋の概要

- 東欧の概要

- 中東・アフリカの概要

- 西欧の概要

- フレグランス:世界の課題

- C&T金額シェアパターンの変化

- 2023~28年におけるC&T業界全体の価値シェアの変化

- 消費パターンの変化の理由

- 消費レベルの変化:南北アメリカ、2018年~2028年

- 消費レベルの変化:アジア太平洋、2018年~2028年

- 消費レベルの変化:東欧、2018年~2028年

- 消費レベルの変化:中東・アフリカ、2018年~2028年

- 消費レベルの変化:西欧、2018年~2028年

- 潜在力の高い国、地域別

- 調査手法-潜在力の高い国の特定

- 国別ディープダイブ

- 潜在的可能性の高い国の分析

- 今後の展望

- 競合環境

- トップ企業- 世界、金額別

- 主要企業とブランドのシェア分析- 世界

- 主要企業・ブランドシェア分析、地域別

- 競合情勢-市場分析

- プライベートブランドの市場シェア

- プライベートブランドのシェア分析、地域別

- プライベートブランドのカテゴリー別シェア分析

- 主な流通チャネル

- 主要流通チャネルのシェア- 世界および地域レベル

- 主なパッキング形態

- 主要パック素材とパックタイプ別の成長分析

- クロージャータイプと主なアウタータイプ別成長分析

- 業界指標

- 世界の特許出願

- 世界の求人分析

- 世界の取引

- 付録

- 定義

- GlobalDataについて

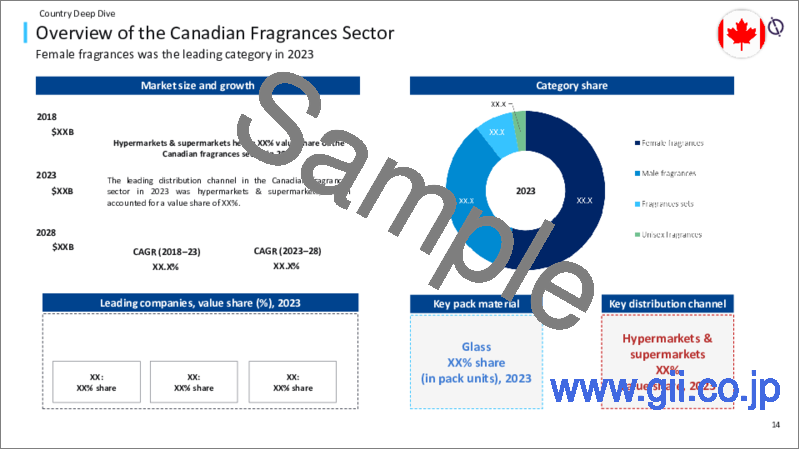

The global fragrances sector was valued at $55.8 billion in 2023 and is forecast to record a compound annual growth rate (CAGR) of 4.7% during 2023-28, to reach $70.3 billion in 2028. The Americas represented the largest region in the sector in 2023. In 2023, female fragrances was the largest category, accounting for 53.3% of overall global value sales. The top five companies in the global fragrances sector together accounted for a value share of 34.4% in 2023. Hypermarkets & supermarkets was the leading distribution channel in the global fragrances sector in 2023, with a value share of 23.4%.

The global fragrances sector was valued at $55.8 billion in 2023 and is forecast to record a compound annual growth rate (CAGR) of 4.7% during 2023-28, to reach $70.3 billion in 2028. The Americas represented the largest region in the sector in 2023, with a value share of 45.3%, followed by Western Europe with 27.3%. In 2023, female fragrances was the largest category, accounting for 53.3% of overall global value sales, distantly followed by male fragrances at 32.1%. Among all the categories, male fragrances and fragrances sets are set to record the fastest value CAGRs during 2023-28, at 5.5%, each. The top five companies in the global fragrances sector together accounted for a value share of 34.4% in 2023. The sector was led by L'Oreal, which held a value share of 11.2%, followed by LVMH Moet Hennessy - Louis Vuitton with 6.8% and Coty with 6.6%. The other leading companies, Chanel and Natura &Co, accounted for value shares of 5% and 4.8%, respectively. Hypermarkets & supermarkets was the leading distribution channel in the global fragrances sector in 2023, with a value share of 23.4%, followed by health & beauty stores with 23%. Hypermarkets & supermarkets remained the leading distribution channel in the Americas, with 31% of value sales. In MEA and Western Europe, health & beauty stores led fragrances distribution. The value share of direct sellers was highest in Eastern Europe, at 25.5%. Glass was the most used pack material in 2023, accounting for 96.8% of total volumes, while bottle was the only pack type used in the sector. Dispenser was the most used closure type in 2023, accounting for a 99.6% volume share. Among primary outer types, carton - folding led with a 91.3% volume share.

Scope

This report brings together multiple data sources to provide a comprehensive overview of the global fragrances sector, analyzing data from 108 countries. It includes analysis on the following -

- Sector overview: Provides an overview of the current sector scenarios in terms of ingredients, manufacturer claims, labeling, and packaging. The analysis also provides a regional overview across five regions-Asia-Pacific, Middle East and Africa (MEA), the Americas, Western Europe, and Eastern Europe-highlighting sector size, growth drivers, the latest developments, and future challenges for each region. This data includes both on-trade and off-trade data.

- Change in consumption: Provides an overview of consumption changes in the overall cosmetics and toiletries (C&T) industry, including fragrances, over 2018-28 at global and regional levels.

- High-potential countries: Provides risk-reward analysis of the top high-potential countries in each region based on market assessment, economic development, governance indicators, sociodemographic factors, and technological infrastructure.

- Country and regional analysis: Provides a deep-dive analysis of 10 high-potential countries covering value growth during 2023-28, key challenges, consumer demographics, and key trends. It also includes regional analysis covering the future outlook for each region.

- Competitive environment and brand shares: Provides an overview of the leading companies and brands at global and regional levels. Market shares of brands and private labels in each region are also detailed.

- Key distribution channels: Provides an analysis of the leading distribution channels in the global fragrances sector in 2023. It covers hypermarkets & supermarkets, health & beauty stores, e-retailers, direct sellers, department stores, parapharmacies/drugstores, convenience stores, cash & carries and warehouse clubs, "dollar stores", variety stores & general merchandise retailers, chemists/pharmacies, and others.

- Packaging analysis*: The report provides percentage share (in 2023) and growth analysis (during 2023-28) for various pack materials, pack types, closures, and primary outer types based on volume sales of fragrances.

Reasons to Buy

- Manufacturers and retailers seek latest information on how the market is evolving to formulate their sales and marketing strategies. There is also demand for authentic market data with a high level of detail. This report has been created to provide its readers with up-to-date information and analysis to uncover emerging opportunities of growth within the fragrances sector.

- The report provides a detailed analysis of the countries in the region, covering the key challenges, competitive landscape and demographic analysis, that can help companies gain insight into the country specific nuances.

- The analysts have also placed a significant emphasis on the key trends that drive consumer choice and the future opportunities that can be explored in the region, than can help companies in revenue expansion.

- To gain competitive intelligence about leading brands in the sector in the region with information about their market share and growth rates.

Table of Contents

Table of Contents

- Executive Summary

- Sector Overview

- Global Overview

- Americas Overview

- Asia-Pacific Overview

- Eastern Europe Overview

- MEA Overview

- Western Europe Overview

- Fragrances: Global Challenges

- Shift in C&T Value Share Patterns

- Change in Value Share in the Overall C&T Industry, 2023-28

- Reasons for Shift in Consumption Patterns

- Change in Consumption Levels: Americas, 2018-28

- Change in Consumption Levels: Asia-Pacific, 2018-28

- Change in Consumption Levels: Eastern Europe, 2018-28

- Change in Consumption Levels: MEA, 2018-28

- Change in Consumption Levels: Western Europe, 2018-28

- Identifying High-Potential Countries by Region

- Identifying High-Potential Countries by Region

- Methodology - Identifying High-Potential Countries

- Country Deep Dive

- High-Potential Country Analysis

- Future Outlook

- Competitive Environment

- Leading Companies by Value - Global

- Leading Companies and Brands Share Analysis - Global

- Leading Companies and Brands Share Analysis by Region

- Competitive Landscape - Market Analysis

- Market Share of Private Labels

- Private Labels' Share Analysis by Region

- Private Labels' Share Analysis by Category

- Key Distribution Channels

- Share of Key Distribution Channels - Global and Regional Level

- Key Packaging Formats

- Growth Analysis by Key Pack Material and Pack Type

- Growth Analysis by Closure Type and Primary Outer Type

- Select Industry Metrics

- Global Patent Filings

- Global Job Analytics

- Global Deals

- Appendix

- Definitions

- About GlobalData