|

|

市場調査レポート

商品コード

1310678

精製業界の生産能力および設備投資(CapEx)予測:地域別および国別、2027年までのすべての稼働中および計画中の製油所の詳細Refining Industry Capacity and Capital Expenditure (CapEx) Forecast by Region and Countries including Details of All Operating and Planned Refineries to 2027 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

価格

| 精製業界の生産能力および設備投資(CapEx)予測:地域別および国別、2027年までのすべての稼働中および計画中の製油所の詳細 |

|

出版日: 2023年07月01日

発行: GlobalData

ページ情報: 英文 545 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

概要

世界の石油精製能力は、2017年の104,723 mbdから2022年には108,213 mbdへと、CAGR(AAGR)0.7%で増加しました。また、2027年には128,586mbdと、CAGR(AAGR)3.5%で拡大すると予測されています。米国、中国、ロシア、インド、韓国が主要国で、2022年の世界の総製油所能力の48.4%を占めています。

当レポートでは、世界の精製業界における生産能力および設備投資動向について調査し、地域別のすべての稼働中および計画中の製油所動向、今後の見通しなどをまとめています。

目次

目次

第1章 イントロダクション

第2章 世界の精製産業

- 世界の精製産業、スナップショット

- 世界の精製産業、計画済み・発表済み製油所

- 世界の精製産業、新規設備および能力拡張、主要国別

- 世界の精製産業、地域比較

第3章 アフリカの精製産業

- アフリカの精製産業、スナップショット

- アフリカの精製産業、計画済み・発表済み製油所、能力拡張および設備投資、国別

- アフリカの精製産業、新規設備および能力拡張、主要国別

- アフリカの精製産業、エジプト

- アフリカの精製産業、アルジェリア

- アフリカの精製産業、南アフリカ

- アフリカの精製産業、ナイジェリア

- アフリカの精製産業、リビア

- アフリカの精製産業、モロッコ

- アフリカの精製産業、スーダン

- アフリカの精製産業、アンゴラ

- アフリカの精製産業、コートジボワール

- アフリカの精製産業、カメルーン

- アフリカの精製産業、ガーナ

- アフリカの精製産業、ジブチ

- アフリカの精製産業、チュニジア

- アフリカの精製産業、ガボン

- アフリカの精製産業、ザンビア

- アフリカの精製産業、セネガル

- アフリカの精製産業、ニジェール

- アフリカの精製産業、チャド

- アフリカの精製産業、コンゴ共和国

- アフリカの精製産業、南スーダン

- アフリカの精製産業、リベリア

- アフリカの精製産業、シエラレオネ

- アフリカの精製産業、最近の動向

- アフリカの精製産業、最近の契約

第4章 アジアの精製産業

- アジアの精製産業、スナップショット

- アジアの精製産業、計画済み・発表済み製油所、能力拡張および設備投資、国別

- アジアの精製産業、新規設備および能力拡張、国別

- アジアの精製産業、中国

- アジアの精製産業、インド

- アジアの精製産業、韓国

- アジアの精製産業、日本

- アジアの精製産業、タイ

- アジアの精製産業、シンガポール

- アジアの精製産業、インドネシア

- アジアの精製産業、台湾

- アジアの精製産業、マレーシア

- アジアの精製産業、パキスタン

- アジアの精製産業、ベトナム

- アジアの精製産業、フィリピン

- アジアの精製産業、ブルネイ

- アジアの精製産業、北朝鮮

- アジアの精製産業、ミャンマー

- アジアの精製産業、バングラデシュ

- アジアの精製産業、スリランカ

- アジアの精製産業、ラオス

- アジアの精製産業、アフガニスタン

- アジアの精製産業、最近の動向

- アジアの精製産業、最近の契約

第5章 カリブ海の精製産業

- カリブ海の精製産業、スナップショット

- カリブ海の精製産業、計画済み・発表済み製油所、能力拡張および設備投資、国別

- カリブ海の精製産業、新規設備および能力拡張、主要国別

- カリブ海の精製産業、キュラソー島

- カリブ海の精製産業、アルバ

- カリブ海の精製産業、米国ヴァージン諸島

- カリブ海の精製産業、トリニダード・トバゴ

- カリブ海の精製産業、キューバ

- カリブ海の精製産業、ドミニカ共和国

- カリブ海の精製産業、ジャマイカ

- カリブ海の精製産業、マルティニーク

第6章 中米の精製産業

- 中米の精製産業、スナップショット

- 中米の精製産業、計画済み・発表済み製油所、能力拡張および設備投資、国別

- 中米の精製産業、新規設備および能力拡張、国別

- 中米の精製産業、コスタリカ

- 中米の精製産業、ニカラグア

- 中米の精製産業、グアテマラ

第7章 欧州の精製産業

- 欧州の精製産業、スナップショット

- 欧州の精製産業、計画済み・発表済み製油所、能力拡張および設備投資、国別

- 欧州の製油産業、製油所の年間新設・拡張設備投資見通し、主要国別

- 欧州の精製産業、新規設備および能力拡張、主要国別

- 欧州の精製産業、ドイツ

- 欧州の精製産業、イタリア

- 欧州の精製産業、スペイン

- 欧州の精製産業、オランダ

- 欧州の精製産業、英国

- 欧州の精製産業、フランス

- 欧州の精製産業、ベルギー

- 欧州の精製産業、ポーランド

- 欧州の精製産業、ギリシャ

- 欧州の精製産業、スウェーデン

- 欧州の精製産業、ルーマニア

- 欧州の精製産業、ブルガリア

- 欧州の精製産業、ノルウェー

- 欧州の精製産業、ポルトガル

- 欧州の精製産業、フィンランド

- 欧州の精製産業、オーストリア

- 欧州の精製産業、デンマーク

- 欧州の精製産業、チェコ共和国

- 欧州の精製産業、ハンガリー

- 欧州の精製産業、セルビア

- 欧州の精製産業、スロバキア

- 欧州の精製産業、クロアチア

- 欧州の精製産業、アイルランド

- 欧州の精製産業、スイス

- 欧州の精製産業、ボスニア・ヘルツェゴビナ

- 欧州の精製産業、アルバニア

- 欧州の精製産業、最近の動向

- 欧州の精製産業、最近の契約

第8章 旧ソ連の精製産業

第9章 中東の精製産業

第10章 北米の精製産業

第11章 オセアニアの精製産業

第12章 南米の精製産業

第13章 付録

- GlobalDataについて

- お問い合わせ

図表

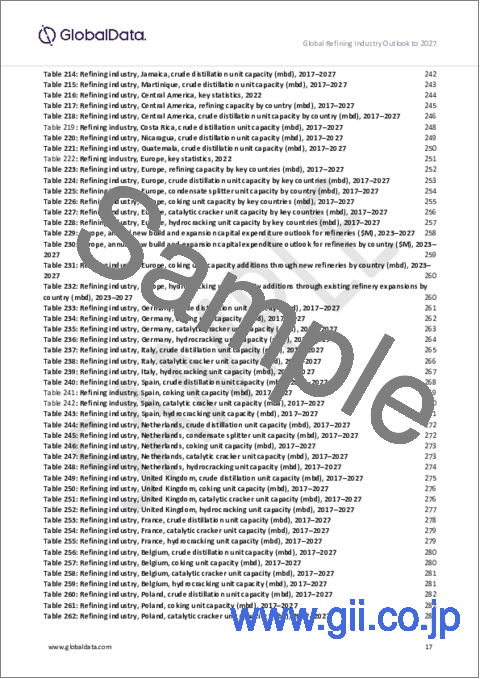

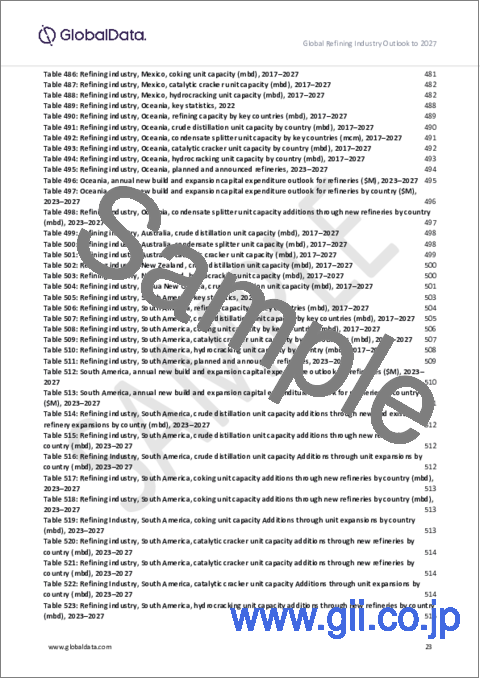

List of Tables

List of Tables

- Table 1: Refining industry, Global, key statistics, 2022

- Table 2: Refining industry, Global, refining capacity by key countries (mbd), 2017-2027

- Table 3: Refining industry, Global, crude distillation unit capacity by key countries (mbd), 2017-2027

- Table 4: Refining industry, Global, condensate splitter unit capacity by key countries (mbd), 2017-2027

- Table 5: Refining industry, Global, coking unit capacity by key countries (mbd), 2017-2027

- Table 6: Refining industry, Global, catalytic cracker unit capacity by key countries (mbd), 2017-2027

- Table 7: Refining industry, Global, hydrocracking unit capacity by key countries (mbd), 2017-2027

- Table 8: Refining industry, Global, top 10 planned and announced refineries, 2023-2027

- Table 9: Global, annual new build and expansion capital expenditure outlook for refineries ($B), 2023-2027

- Table 10: Refining industry, Global, annual new build and expansion capital expenditure outlook for refineries by key countries ($M), 2023-2027

- Table 11: Refining industry, Global, crude distillation unit capacity additions through new and existing refinery expansions by region (mbd), 2023-2027

- Table 12: Refining industry, Global, crude distillation unit capacity additions through new refineries by region (mbd), 2023-2027

- Table 13: Refining Industry, Global, crude distillation unit capacity Additions through unit expansions by region (mbd), 2023-2027

- Table 14: Refining industry, Global, condensate splitter unit capacity additions through new and existing refinery expansions by region (mbd), 2023-2027

- Table 15: Refining industry, Global, condensate splitter unit capacity additions through new refineries by region (mbd), 2023-2027

- Table 16: Refining industry, Global, condensate splitter unit capacity additions through existing refinery expansions by region (mbd), 2023-2027

- Table 17: Refining industry, Global, coking unit capacity additions through new and existing refinery expansions by region (mbd), 2023-2027

- Table 18: Refining industry, Global, coking unit capacity additions through new refineries by region (mbd), 2023-2027

- Table 19: Refining industry, Global, coking unit capacity additions through existing refinery expansions by region (mbd), 2023-2027

- Table 20: Refining industry, Global, catalytic cracker unit capacity additions through new and existing refinery expansions by region (mbd), 2023-2027

- Table 21: Refining industry, Global, catalytic cracker unit capacity additions through new refineries by region (mbd), 2023-2027

- Table 22: Refining industry, Global, catalytic cracker unit capacity additions through existing refinery expansions by region (mbd), 2023-2027

- Table 23: Refining industry, Global, hydrocracking unit capacity additions through new and existing refinery expansions by region (mbd), 2023-2027

- Table 24: Refining industry, Global, hydrocracking unit capacity additions through new refineries by region (mbd), 2023-2027

- Table 25: Refining industry, Global, hydrocracking unit capacity additions through existing refinery expansions by region (mbd), 2023-2027

- Table 26: Refining industry, Global, contribution (%) to global refining capacity, 2017-2027

- Table 27: Refining industry, Africa, key statistics, 2022

- Table 28: Refining industry, Africa, refining capacity by key countries (mbd), 2017-2027

- Table 29: Refining industry, Africa, crude distillation unit capacity by key countries (mbd), 2017-2027

- Table 30: Refining industry, Africa, condensate splitter unit capacity by key countries (mbd), 2017-2027

- Table 31: Refining industry, Africa, coking unit capacity by country (mbd), 2017-2027

- Table 32: Refining industry, Africa, catalytic cracker unit capacity by key countries (mbd), 2017-2027

- Table 33: Refining industry, Africa, hydrocracking unit capacity by key countries (mbd), 2017-2027

- Table 34: Refining industry, Africa, planned and announced refineries, 2023-2027

- Table 35: Africa, annual new build and expansion capital expenditure outlook for refineries ($B), 2023-2027

- Table 36: Africa, annual new build and expansion capital expenditure outlook for refineries by key countries ($M), 2023-2027

- Table 37: Refining industry, Africa, crude distillation unit capacity additions through new and existing refinery expansions by key countries (mbd), 2023-2027

- Table 38: Refining industry, Africa, crude distillation unit capacity additions through new refineries by key countries (mbd), 2023-2027

- Table 39: Refining Industry, Africa, crude distillation unit capacity Additions through unit expansions by key countries (mbd), 2023-2027

- Table 40: Refining industry, Africa, condensate splitter unit capacity additions through new and existing refinery expansions by country (mbd), 2023-2027

- Table 41: Refining industry, Africa, condensate splitter unit capacity additions through new refineries by country (mbd), 2023-2027

- Table 42: Refining Industry, Africa, condensate splitter unit capacity Additions through existing refinery expansions by country (mbd), 2023-2027

- Table 43: Refining industry, Africa, coking unit capacity additions through new refineries by country (mbd), 2023-2027

- Table 44: Refining industry, Africa, catalytic cracker unit capacity additions through new refineries by key countries (mbd), 2023-2027

- Table 45: Refining industry, Africa, hydrocracking unit capacity additions through new and existing refinery expansions by key countries (mbd), 2023-2027

- Table 46: Refining industry, Africa, hydrocracking unit capacity additions through new refineries by key countries (mbd), 2023-2027

- Table 47: Refining Industry, Africa, hydrocracking unit capacity Additions through existing refinery expansions by country (mbd), 2023-2027

- Table 48: Refining industry, Egypt, crude distillation unit capacity (mbd), 2017-2027

- Table 49: Refining industry, Egypt, condensate splitter unit capacity (mbd), 2017-2027

- Table 50: Refining industry, Egypt, coking unit capacity (mbd), 2017-2027

- Table 51: Refining industry, Egypt, catalytic cracker unit capacity (mbd), 2017-2027

- Table 52: Refining industry, Egypt, hydrocracking unit capacity (mbd), 2017-2027

- Table 53: Refining industry, Algeria, crude distillation unit capacity (mbd), 2017-2027

- Table 54: Refining industry, Algeria, condensate splitter unit capacity (mbd), 2017-2027

- Table 55: Refining industry, Algeria, catalytic cracker unit capacity (mbd), 2017-2027

- Table 56: Refining industry, Algeria, hydrocracking unit capacity (mbd), 2017-2027

- Table 57: Refining industry, South Africa, crude distillation unit capacity (mbd), 2017-2027

- Table 58: Refining industry, South Africa, condensate splitter unit capacity (mbd), 2017-2027

- Table 59: Refining industry, South Africa, catalytic cracker unit capacity (mbd), 2017-2027

- Table 60: Refining industry, South Africa, hydrocracking unit capacity (mbd), 2017-2027

- Table 61: Refining industry, Nigeria, crude distillation unit capacity (mbd), 2017-2027

- Table 62: Refining industry, Nigeria, condensate splitter unit capacity (mbd), 2017-2027

- Table 63: Refining industry, Nigeria, catalytic cracker unit capacity (mbd), 2017-2027

- Table 64: Refining industry, Nigeria, hydrocracking unit capacity (mbd), 2017-2027

- Table 65: Refining industry, Libya, crude distillation unit capacity (mbd), 2017-2027

- Table 66: Refining industry, Morocco, crude distillation unit capacity (mbd), 2017-2027

- Table 67: Refining industry, Morocco, hydrocracking unit capacity (mbd), 2017-2027

- Table 68: Refining industry, Sudan, crude distillation unit capacity (mbd), 2017-2027

- Table 69: Refining industry, Sudan, coking unit capacity (mbd), 2017-2027

- Table 70: Refining industry, Sudan, catalytic cracker unit capacity (mbd), 2017-2027

- Table 71: Refining industry, Sudan, hydrocracking unit capacity (mbd), 2017-2027

- Table 72: Refining industry, Angola, crude distillation unit capacity (mbd), 2017-2027

- Table 73: Refining industry, Angola, catalytic cracker unit capacity (mbd), 2017-2027

- Table 74: Refining industry, Angola, hydrocracking unit capacity (mbd), 2017-2027

- Table 75: Refining industry, Cote d'Ivoire, crude distillation unit capacity (mbd), 2017-2027

- Table 76: Refining industry, Cote d'Ivoire, hydrocracking unit capacity (mbd), 2017-2027

- Table 77: Refining industry, Cameroon, crude distillation unit capacity (mbd), 2017-2027

- Table 78: Refining industry, Cameroon, condensate splitter unit capacity (mbd), 2017-2027

- Table 79: Refining industry, Ghana, crude distillation unit capacity (mbd), 2017-2027

- Table 80: Refining industry, Ghana, catalytic cracker unit capacity (mbd), 2017-2027

- Table 81: Refining industry, Djibouti, crude distillation unit capacity (mbd), 2017-2027

- Table 82: Refining industry, Djibouti, catalytic cracker unit capacity (mbd), 2017-2027

- Table 83: Refining industry, Djibouti, hydrocracking unit capacity (mbd), 2017-2027

- Table 84: Refining industry, Tunisia, crude distillation unit capacity (mbd), 2017-2027

- Table 85: Refining industry, Gabon, crude distillation unit capacity (mbd), 2017-2027

- Table 86: Refining industry, Zambia, crude distillation unit capacity (mbd), 2017-2027

- Table 87: Refining industry, Senegal, crude distillation unit capacity (mbd), 2017-2027

- Table 88: Refining industry, Niger, crude distillation unit capacity (mbd), 2017-2027

- Table 89: Refining industry, Niger, catalytic cracker unit capacity (mbd), 2017-2027

- Table 90: Refining industry, Chad, crude distillation unit capacity (mbd), 2017-2027

List of Figures

List of Figures

- Figure 1: Refining industry, Global, refining capacity share vis-a-vis growth by key countries (%), 2017-2022

- Figure 2: Refining industry, Global, crude distillation unit capacity market share vis-a-vis growth by key countries (%), 2017-2022

- Figure 3: Refining industry, Global, condensate splitter unit capacity market share vis-a-vis growth by key countries (%), 2017-2022

- Figure 4: Refining industry, Global, coking unit capacity market share vis-a-vis growth by key countries (%), 2017-2022

- Figure 5: Refining industry, Global, catalytic cracker unit capacity market share vis-a-vis growth by key countries (%), 2017-2022

- Figure 6: Refining industry, Global, hydrocracking unit capacity market share vis-a-vis growth by key countries (%), 2017-2022

- Figure 7: Refining industry, Global, annual new build and expansion capital expenditure outlook for

- refineries ($B), 2023-2027

- Figure 8: Refining industry, Global, annual new build and expansion capital expenditure outlook for refineries by key countries ($M), 2023-2027

- Figure 9: Refining industry, global regional comparison, contribution (%) to global refining capacity, 2017-2027

- Figure 10: Refining industry, regional comparison, average nelson complexity index, 2022

- Figure 11: Refining industry, regional comparison based on refining capacity growth, 2017-2027

- Figure 12: Refining industry, Africa, refining capacity share vis-a-vis growth by key countries (%), 2017-2022

- Figure 13: Refining industry, Africa, crude distillation unit capacity market share vis-a-vis growth by key countries (%), 2017-2022

- Figure 14: Refining industry, Africa, condensate splitter unit capacity market share vis-a-vis growth by country (%), 2017-2022

- Figure 15: Refining industry, Africa, coking unit capacity market share vis-a-vis growth by country (%), 2017-2022

- Figure 16: Refining industry, Africa, catalytic cracker unit capacity market share vis-a-vis growth by key countries (%), 2017-2022

- Figure 17: Refining industry, Africa, hydrocracking unit capacity market share vis-a-vis growth by key countries (%), 2017-2022

- Figure 18: Refining industry, Africa, annual new build and expansion capital expenditure outlook for refineries ($B), 2023-2027

- Figure 19: Refining industry, Africa, annual new build and expansion capital expenditure outlook for refineries by key countries, ($M), 2023-2027

- Figure 20: Refining industry, Asia, refining capacity share vis-a-vis growth by key countries (%), 2017-2022

- Figure 21: Refining industry, Asia, crude distillation unit capacity market share vis-a-vis growth by key countries (%), 2017-2022

- Figure 22: Refining industry, Asia, condensate splitter unit capacity market share vis-a-vis growth by key countries (%), 2017-2022

- Figure 23: Refining industry, Asia, coking unit capacity market share vis-a-vis growth by key countries (%), 2017-2022

- Figure 24: Refining industry, Asia, catalytic cracker unit capacity market share vis-a-vis growth by key countries (%), 2017-2022

- Figure 25: Refining industry, Asia, hydrocracking unit capacity market share vis-a-vis growth by key countries (%), 2017-2022

- Figure 26: Refining industry, Asia, annual new build and expansion capital expenditure outlook for refineries ($B), 2023-2027

- Figure 27: Refining industry, Asia, annual new build and expansion capital expenditure outlook for refineries by key countries, ($M), 2023-2027

- Figure 28: Refining industry, Caribbean, refining capacity share vis-a-vis growth by key countries (%), 2017-2022

- Figure 29: Refining industry, Caribbean, crude distillation unit capacity market share vis-a-vis growth by key countries (%), 2017-2022

- Figure 30: Refining industry, Caribbean, coking unit capacity market share vis-a-vis growth by country (%), 2017-2022

- Figure 31: Refining industry, Caribbean, catalytic cracker unit capacity market share vis-a-vis growth by country (%), 2017-2022

- Figure 32: Refining industry, Caribbean, hydrocracking unit capacity market share vis-a-vis growth by country (%), 2017-2022

- Figure 33: Refining industry, Central America, refining capacity share vis-a-vis growth by country (%), 2017-2022

- Figure 34: Refining industry, Central America, crude distillation unit capacity market share vis-a-vis growth by country (%), 2017-2022

- Figure 35: Refining industry, Europe, refining capacity share vis-a-vis growth by key countries (%), 2017-2022

- Figure 36: Refining industry, Europe, crude distillation unit capacity market share vis-a-vis growth by key countries (%), 2017-2022

- Figure 37: Refining industry, Europe, condensate splitter unit capacity market share vis-a-vis growth by country (%), 2017-2022

- Figure 38: Refining industry, Europe, coking unit capacity market share vis-a-vis growth by key countries (%), 2017-2022

- Figure 39: Refining industry, Europe, catalytic cracker unit capacity market share vis-a-vis growth by key countries (%), 2017-2022

- Figure 40: Refining industry, Europe, hydrocracking unit capacity market share vis-a-vis growth by key countries (%), 2017-2022

- Figure 41: Refining industry, Europe, annual new build and expansion capital expenditure outlook for refineries ($M), 2023-2027

- Figure 42: Refining industry, Europe, annual new build and expansion capital expenditure outlook for refineries by key countries, ($M), 2023-2027

- Figure 43: Refining industry, FSU, refining capacity share vis-a-vis growth by key countries (%), 2017-2022

- Figure 44: Refining industry, FSU, crude distillation unit capacity market share vis-a-vis growth by key countries (%), 2017-2022

- Figure 45: Refining industry, FSU, condensate splitter unit capacity market share vis-a-vis growth by country (%), 2017-2022

- Figure 46: Refining industry, FSU, coking unit capacity market share vis-a-vis growth by key countries (%), 2017-2022

- Figure 47: Refining industry, FSU, catalytic cracker unit capacity market share vis-a-vis growth by key countries (%), 2017-2022

- Figure 48: Refining industry, FSU, hydrocracking unit capacity market share vis-a-vis growth by country (%), 2017-2022

- Figure 49: Refining industry, FSU, annual new build and expansion capital expenditure outlook for refineries ($M), 2023-2027

- Figure 50: Refining industry, FSU, annual new build and expansion capital expenditure outlook for refineries by key countries, ($M), 2023-2027

- Figure 51: Refining industry, Middle East, refining capacity share vis-a-vis growth by key countries (%), 2017-2022

- Figure 52: Refining industry, Middle East, crude distillation unit capacity market share vis-a-vis growth by key countries (%), 2017-2022

- Figure 53: Refining industry, Middle East, condensate splitter unit capacity market share vis-a-vis growth by country (%), 2017-2022

- Figure 54: Refining industry, Middle East, coking unit capacity market share vis-a-vis growth by key countries (%), 2017-2022

- Figure 55: Refining industry, Middle East, catalytic cracker unit capacity market share vis-a-vis growth by key countries (%), 2017-2022

- Figure 56: Refining industry, Middle East, hydrocracking unit capacity market share vis-a-vis growth by key countries (%), 2017-2022

- Figure 57: Refining industry, Middle East, annual new build and expansion capital expenditure outlook for refineries ($B), 2023-2027

- Figure 58: Refining industry, Middle East, annual new build and expansion capital expenditure outlook for refineries by key countries, ($M), 2023-2027

- Figure 59: Refining industry, North America, refining capacity share vis-a-vis growth by country (%), 2017-2022

- Figure 60: Refining industry, North America, crude distillation unit capacity market share vis-a-vis growth by country (%), 2017-2022

- Figure 61: Refining industry, North America, condensate splitter unit capacity market share vis-a-vis growth by country (%), 2017-2022

- Figure 62: Refining industry, North America, coking unit capacity market share vis-a-vis growth by country (%), 2017-2022

- Figure 63: Refining industry, North America, catalytic cracker unit capacity market share vis-a-vis growth by country (%), 2017-2022

- Figure 64: Refining industry, North America, hydrocracking unit capacity market share vis-a-vis growth by country (%), 2017-2022

- Figure 65: Refining industry, North America, annual new build and expansion capital expenditure outlook for refineires ($M), 2023-2027

- Figure 66: Refining industry, North America, annual new build and expansion capital expenditure outlook for refineries by country, ($M), 2023-2027

- Figure 67: Refining industry, Oceania, refining capacity share vis-a-vis growth by Country (%), 2017-2022

- Figure 68: Refining industry, Oceania, crude distillation unit capacity market share vis-a-vis growth by key countries (%), 2017-2022

- Figure 69: Refining industry, Oceania, catalytic cracker unit capacity market share vis-a-vis growth by country (%), 2017-2022

- Figure 70: Refining industry, Oceania, annual new build and expansion capital expenditure outlook for refineries ($M), 2023-2027

- Figure 71: Refining industry, Oceania, annual new build and expansion capital expenditure outlook for refineries by country, ($M), 2023-2027

- Figure 72: Refining industry, South America, refining capacity share vis-a-vis growth by key countries (%), 2017-2022

- Figure 73: Refining industry, South America, crude distillation unit capacity market share vis-a-vis growth by key countries (%), 2017-2022

- Figure 74: Refining industry, South America, coking unit capacity market share vis-a-vis growth by key countries (%), 2017-2022

- Figure 75: Refining industry, South America, catalytic cracker unit capacity market share vis-a-vis growth by key countries (%), 2017-2022

- Figure 76: Refining industry, South America, hydrocracking unit capacity market share vis-a-vis growth by country (%), 2017-2022

- Figure 77: Refining industry, South America, annual new build and expansion capital expenditure outlook for refineries ($M), 2023-2027

- Figure 78: Refining industry, South America, annual new build and expansion capital expenditure outlook for refineries by key countries, ($M), 2023-2027

目次

Product Code: GDGE1366ICR

Abstract

The global refining capacity increased from 104,723 mbd in 2017 to 108,213 mbd in 2022 at an average Annual Growth Rate (AAGR) of 0.7%. It is expected to increase from 108,213 mbd in 2022 to 128,586 mbd in 2027 at an AAGR of 3.5%. The US, China, Russia, India, and South Korea are the major countries that accounted for 48.4% of the total refinery capacity of the world in 2022.

Scope

- Updated information on all active and upcoming (planned and announced) refineries globally.

- Provides key details such as refinery name, operator name, refinery type, and status for all active, suspended, planned, and announced refineries in a country.

- Provides an annual breakdown of new-build and expansion capital expenditure outlook by region and by key countries for the period 2023-2027.

- Latest developments and contracts related to a refinery, at the regional level, wherever available

Reasons to Buy

- Obtain the most up-to-date information available on all active, suspended, planned, and announced refineries globally

- Identify growth segments and opportunities in the refining industry

- Facilitate decision making on the basis of strong refinery capacity data

- Assess your competitor's refinery portfolio

Table of Contents

Table of Contents

1. Introduction

- 1.1 What is this Report About?

- 1.2 Market Definition

List of Figures

List of Tables

2. Global Refining Industry

- 2.1 Global Refining Industry, Snapshot

- 2.2 Global Refining Industry, Planned and Announced Refineries

- 2.3 Global Refining Industry, New Units and Capacity Expansions by Key Countries

- 2.4 Global Refining Industry, Regional Comparisons

3. Africa Refining Industry

- 3.1 Africa Refining Industry, Snapshot

- 3.2 Africa Refining Industry, Planned and Announced Refineries, Capacity Expansions and Capex by Country

- 3.3 Africa Refining Industry, New Units and Capacity Expansions by Key Countries

- 3.4 Africa Refining Industry, Egypt

- 3.5 Africa Refining Industry, Algeria

- 3.6 Africa Refining Industry, South Africa

- 3.7 Africa Refining Industry, Nigeria

- 3.8 Africa Refining Industry, Libya

- 3.9 Africa Refining Industry, Morocco

- 3.10 Africa Refining Industry, Sudan

- 3.11 Africa Refining Industry, Angola

- 3.12 Africa Refining Industry, Cote d'Ivoire

- 3.13 Africa Refining Industry, Cameroon

- 3.14 Africa Refining Industry, Ghana

- 3.15 Africa Refining Industry, Djibouti

- 3.16 Africa Refining Industry, Tunisia

- 3.17 Africa Refining Industry, Gabon

- 3.18 Africa Refining Industry, Zambia

- 3.19 Africa Refining Industry, Senegal

- 3.20 Africa Refining Industry, Niger

- 3.21 Africa Refining Industry, Chad

- 3.22 Africa Refining Industry, Congo Republic

- 3.23 Africa Refining Industry, South Sudan

- 3.24 Africa Refining Industry, Liberia

- 3.25 Africa Refining Industry, Sierra Leone

- 3.26 Africa Refining Industry, Recent Developments

- 3.27 Africa Refining Industry, Recent Contracts

4. Asia Refining Industry

- 4.1 Asia Refining Industry, Snapshot

- 4.2 Asia Refining Industry, Planned and Announced Refineries, Capacity Expansions and Capex by Country

- 4.3 Asia Refining Industry, New Units and Capacity Expansions by Country

- 4.4 Asia Refining Industry, China

- 4.5 Asia Refining Industry, India

- 4.6 Asia Refining Industry, South Korea

- 4.7 Asia Refining Industry, Japan

- 4.8 Asia Refining Industry, Thailand

- 4.9 Asia Refining Industry, Singapore

- 4.10 Asia Refining Industry, Indonesia

- 4.11 Asia Refining Industry, Taiwan

- 4.12 Asia Refining Industry, Malaysia

- 4.13 Asia Refining Industry, Pakistan

- 4.14 Asia Refining Industry, Vietnam

- 4.15 Asia Refining Industry, Philippines

- 4.16 Asia Refining Industry, Brunei

- 4.17 Asia Refining Industry, North Korea

- 4.18 Asia Refining Industry, Myanmar

- 4.19 Asia Refining Industry, Bangladesh

- 4.20 Asia Refining Industry, Sri Lanka

- 4.21 Asia Refining Industry, Laos

- 4.22 Asia Refining Industry, Afghanistan

- 4.23 Asia Refining Industry, Recent Developments

- 4.24 Asia Refining Industry, Recent Contracts

5. Caribbean Refining Industry

- 5.1 Caribbean Refining Industry, Snapshot

- 5.2 Caribbean Refining Industry, Planned and Announced Refineries, Capacity Expansions and Capex by Country

- 5.3 Caribbean Refining Industry, New Units and Capacity Expansions by Key Countries

- 5.4 Caribbean Refining Industry, Curacao

- 5.5 Caribbean Refining Industry, Aruba

- 5.6 Caribbean Refining Industry, U.S. Virgin Islands

- 5.7 Caribbean Refining Industry, Trinidad and Tobago

- 5.8 Caribbean Refining Industry, Cuba

- 5.9 Caribbean Refining Industry, Dominican Republic

- 5.10 Caribbean Refining Industry, Jamaica

- 5.11 Caribbean Refining Industry, Martinique

6. Central America Refining Industry

- 6.1 Central America Refining Industry, Snapshot

- 6.2 Central America Refining Industry, Planned and Announced Refineries, Capacity Expansions and Capex by Country

- 6.3 Central America Refining Industry, New Units and Capacity Expansions by Country

- 6.4 Central America Refining Industry, Costa Rica

- 6.5 Central America Refining Industry, Nicaragua

- 6.6 Central America Refining Industry, Guatemala

7. Europe Refining Industry

- 7.1 Europe Refining Industry, Snapshot

- 7.2 Europe Refining Industry, Planned and Announced Refineries, Capacity Expansions and Capex by Country

- 7.3 Europe Refining Industry, Annual New Build and Expansion Capital Expenditure Outlook for Refineries by Key Countries

- 7.4 Europe Refining Industry, New Units and Capacity Expansions by Key Countries

- 7.5 Europe Refining Industry, Germany

- 7.6 Europe Refining Industry, Italy

- 7.7 Europe Refining Industry, Spain

- 7.8 Europe Refining Industry, Netherlands

- 7.9 Europe Refining Industry, United Kingdom

- 7.10 Europe Refining Industry, France

- 7.11 Europe Refining Industry, Belgium

- 7.12 Europe Refining Industry, Poland

- 7.13 Europe Refining Industry, Greece

- 7.14 Europe Refining Industry, Sweden

- 7.15 Europe Refining Industry, Romania

- 7.16 Europe Refining Industry, Bulgaria

- 7.17 Europe Refining Industry, Norway

- 7.18 Europe Refining Industry, Portugal

- 7.19 Europe Refining Industry, Finland

- 7.20 Europe Refining Industry, Austria

- 7.21 Europe Refining Industry, Denmark

- 7.22 Europe Refining Industry, Czech Republic

- 7.23 Europe Refining Industry, Hungary

- 7.24 Europe Refining Industry, Serbia

- 7.25 Europe Refining Industry, Slovakia

- 7.26 Europe Refining Industry, Croatia

- 7.27 Europe Refining Industry, Ireland

- 7.28 Europe Refining Industry, Switzerland

- 7.29 Europe Refining Industry, Bosnia and Herzegovina

- 7.30 Europe Refining Industry, Albania

- 7.31 Europe Refining Industry, Recent Developments

- 7.32 Europe Refining Industry, Recent Contracts

8. Former Soviet Union Refining Industry

9. Middle East Refining Industry

10. North America Refining Industry

11. Oceania Refining Industry

12. South America Refining Industry

13. Appendix

- About GlobalData

- Contact Us

お電話でのお問い合わせ

044-952-0102

( 土日・祝日を除く )