|

|

市場調査レポート

商品コード

1168277

リテールバンキング部門スコアカード- テーマ別インテリジェンスRetail Banking Sector Scorecard - Thematic Intelligence |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| リテールバンキング部門スコアカード- テーマ別インテリジェンス |

|

出版日: 2022年11月04日

発行: GlobalData

ページ情報: 英文 22 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

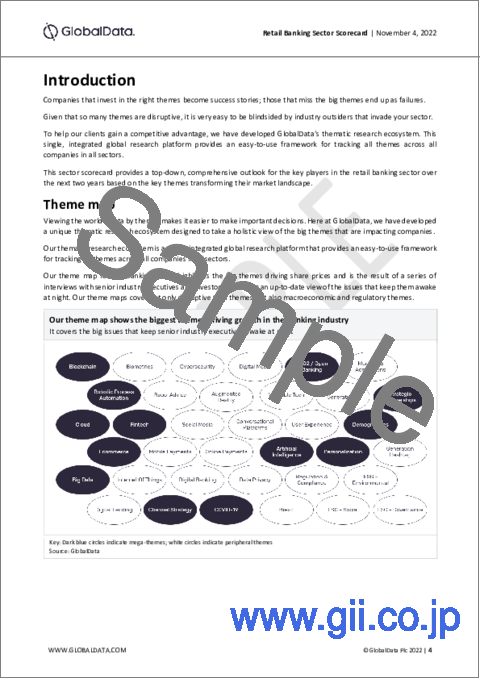

当レポートでは、バンキング市場を今まさに変革している主要テーマを評価し、テーマ別採点手法により、今後市場で成功する企業、および銀行業界の主要テーマへの投資不足の結果失速する企業を特定しています。

目次

- エグゼクティブサマリー

- イントロダクション

- テーママップ

- テーマ

- セクタースコアカード:リテールバンキング

- 対象範囲

- テーマ画面

- 評価画面

- リスク画面

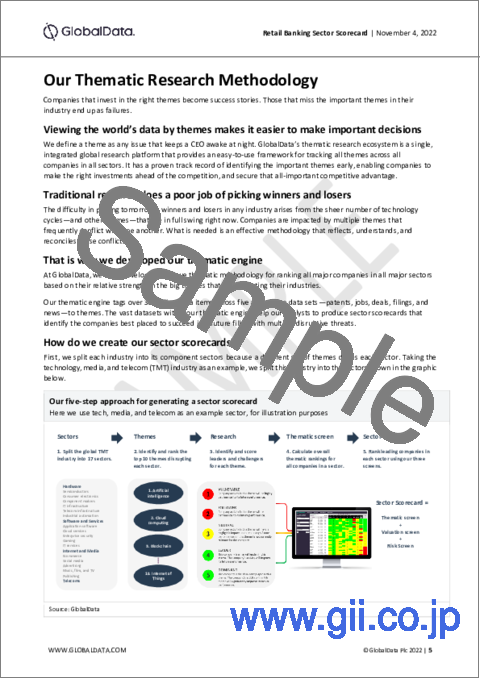

- テーマ調査手法

- GlobalDataについて

- お問い合わせ

This report assesses the key themes that are transforming the banking market right now, utilizing our thematic scoring methodology to identify which companies will do well in the market in the future - and the companies that will falter as a result of their lack of investment in the key banking themes. In this report, we score the world's leading banking players against the 10 themes that are impacting their industry the most. Our resulting thematic engine helps us identify the strongest and weakest players in the banking sector over the next two years.

The future success of retail banks will be determined by how well they respond to themes. Themes - whether an innovative technology, a political event, or indeed a global pandemic - can blindside executives, evolve in fast and unpredictable ways, and render existing modes of operation obsolete. As such, firms that invest in the right themes often end up winning while those that miss the big themes often end up lagging behind.

Scope

- DBS was first place again in 2022, not because of any one factor but by doing a number of different things well over a period of many years. This has allowed the bank to harvest the benefits of multi-year tech spend in terms of cost reduction and increased customer satisfaction, as well as the operational agility to push forward with other changes more quickly. The bank scored particularly well for artificial intelligence and cloud migration, as well as for reverse engineering lessons from digital speedboats such as digibank to other key DBS geographies.

Reasons to Buy

- Understand which banks are best positioned for success within critical themes and why.

- Learn which banks are under-invested in key themes and thus most vulnerable to disruption.

- Understand which themes your institution can address (and how) to drive share price.

Table of Contents

Table of Contents

- Executive Summary

- Introduction

- Theme map

- Themes

- Sector Scorecard: Retail Banking

- Who's who

- Thematic screen

- Valuation screen

- Risk screen

- Our Thematic Research Methodology

- About GlobalData

- Contact Us