|

|

市場調査レポート

商品コード

1289044

石炭火力発電の世界市場の成長機会Global Coal Power Growth Opportunities |

||||||

|

|||||||

| 石炭火力発電の世界市場の成長機会 |

|

出版日: 2023年05月17日

発行: Frost & Sullivan

ページ情報: 英文 53 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

当レポートでは、世界の石炭火力発電市場について調査し、設備容量の予測や成長機会の分析を提供しています。

目次

戦略的必須要件

- 成長がますます困難になっているのはなぜか

- The Strategic Imperative 8(TM)

- 世界の石炭業界に対する主な3つの戦略的必須要件の影響

- 成長機会がGrowth Pipeline Engine(TM)を促進

成長機会の分析

- 主な結果

- 分析の範囲

- 主な競合

- 成長促進要因

- 成長抑制要因

- 世界の石炭火力発電市場を形成する主な動向

- CCUSへの投資の増加:設置は2025年以降に開始される

- CCUSへの投資の増加:各地域の主な投資

- デジタル技術の展開によりレガシー資産の効率が向上

- 老朽化したプラントの廃止措置

- 石炭の経済学

- 規制方針

設備容量の予測

- 総設備容量

- 年次追加

- 市場の分析:地域別

成長機会

- 成長機会1:新しいプラントの建設

- 成長機会2:新技術

- 成長機会3:プラントの廃止措置

- 図表のリスト

- 免責事項

APAC Drives Investment in Coal-fired Power Generation

There is growing pressure on the global power sector to decarbonize, which in turn puts pressure on new investment in coal-fired power generation. Energy security is a significant mega trend, whose importance is heightened by the Russo-Ukrainian War and the resulting disruption in the global power market. Many of the traditional high coal dependency economies in Asia-Pacific are reluctant to move away from a reliable source of baseload energy, particularly as they face high year-on-year growth in power demand. China will remain the most important market for coal-fired investment, but India, Vietnam, Bangladesh, Thailand, Japan, and Indonesia are amongst the countries that will continue to build coal-fired plants through the 2020s.

Growth opportunities will come from the existing base of plants, many of which will be operational into the 2060s in APAC. Strong growth is forecast for carbon capture, storage and utilization (CCUS), particularly in APAC. It will not be a standardized offering across all plants, but it will be deployed for key sites, and if the technology's commercialization continues to improve, growth could be even higher. Another key opportunity will be the deployment of digital technologies to increase operational efficiency of legacy assets-to maximize the power generated from fuel burnt, to minimize emissions, and to minimize unscheduled downtime. Finally, for regions closing their plants, there will be significant opportunities in the decommissioning of those plants.

Table of Contents

Strategic Imperatives

- Why is it Increasingly Difficult to Grow?

- The Strategic Imperative 8™

- The Impact of the Top 3 Strategic Imperatives on the Global Coal Industry

- Growth Opportunities Fuel the Growth Pipeline Engine™

Growth Opportunity Analysis

- Main Findings

- Scope of Analysis

- Key Competitors

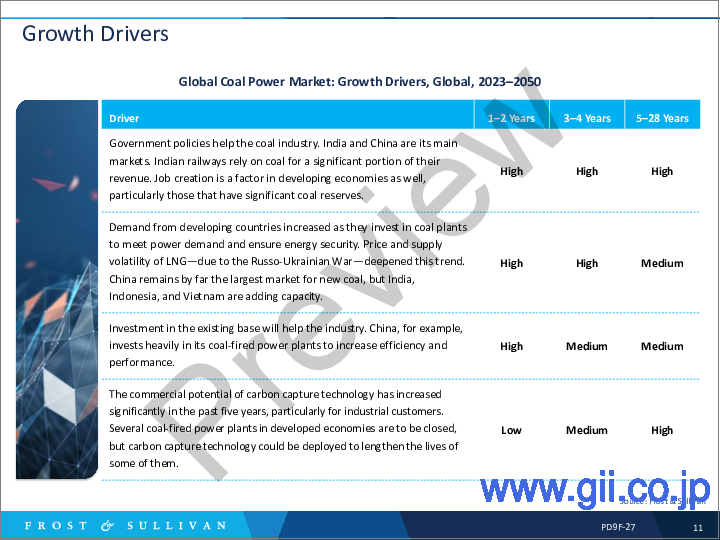

- Growth Drivers

- Growth Restraints

- Major Trends Shaping the Global Coal Power Market

- Increasing Investment in CCUS: Installations will Take Off After 2025

- Increasing Investment in CCUS: Key Investments by Region

- Deploying Digital Technologies Increases Legacy Asset Efficiency

- Aging Plant Decommissioning

- Economics of Coal

- Regulatory Policy

Capacity Forecasts

- Total Installed Capacity

- Annual Additions

- Market Analysis by Region

Growth Opportunity Universe

- Growth Opportunity 1: New Plant Construction

- Growth Opportunity 2: New Technologies

- Growth Opportunity 3: Plant Decommissioning

- List of Exhibits

- Legal Disclaimer