|

|

市場調査レポート

商品コード

1277736

日本のマクロ経済成長機会(2027年)Japan Macroeconomic Growth Opportunities, 2027 |

||||||

| 日本のマクロ経済成長機会(2027年) |

|

出版日: 2023年04月27日

発行: Frost & Sullivan

ページ情報: 英文 37 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

当レポートでは、日本のマクロ経済について調査分析し、成長に影響を与える戦略的必須事項やマクロ経済環境、経済の見通し、世界での位置付け、人口の高齢化が与える影響、主要な成長機会などの情報を提供しています。

目次

戦略的必須事項

- なぜ成長はますます困難になっているのでしょうか?

- The Stragetic Imperative 8(TM)

- 上位3つの戦略的必須事項が日本経済に及ぼす影響

- 成長機会がGrowth Pipeline Engine(TM)を促進

マクロ経済環境

- 主要な経済指標

- 成長促進要因

- 成長抑制要因

経済の見通し

- GDP成長率

- インフレと金融政策

- 財政分析

- 貿易分析

世界の位置づけ

- 世界経済の動向と出来事の影響

- 世界パフォーマンスインデックス

社会的展望

- 人口構造

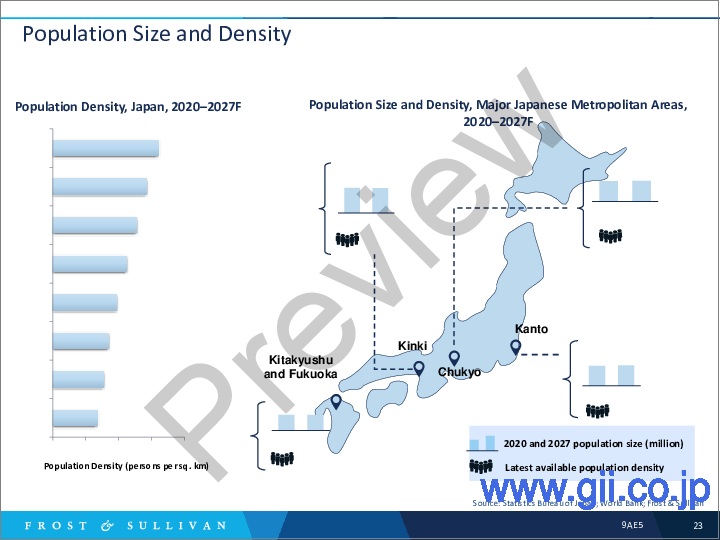

- 人口規模と密度

- 疾患プロファイル:伝染病

- 疾患プロファイル: 非感染性疾患(NCD)

- 健康保険と自己負担額

- 医療施設と入院ベッド

成長機会領域

- 成長機会1:緩和的な金融政策と高い貯蓄率が消費財部門の成長を促進

- 成長機会2:人口動態の高齢化がヘルスケア投資を促進

- 成長機会3:防衛費の増加が製造業の成長を支援

- 図表一覧

- 免責事項

Increased Government Spending, Subsidy Support to Households and Businesses, and Loose Monetary Policies to Support Medium-Term Growth

Following years of subdued growth, the Japanese economy registered a good rebound in 2021, with a real GDP growth of 2.1%. The country's reopening and the consequent boost to household consumption and consumer spending were key growth drivers of 2022's estimated 1.1% growth. However, soaring energy and food prices have weighed on Japan's fiscal health as the government absorbed the price shocks through subsidy support. A $200 billion fiscal support package has also been announced with the aim of driving demand and investment momentum in 2023. Against the backdrop of slowing global growth forecasts in 2023, how will the export-driven Japanese economy fare in 2023 and beyond? Can increased fiscal spending, ultra-loose monetary policy, and a conducive business environment support the medium-term growth momentum of Japan's economy, even under the weight of an ageing population and a shrinking labor force?

This Japan-centric macroeconomic thought leadership provides a growth snapshot of the country through the identification of growth conditions. A key feature of this piece is the focus on Japan's social scenario and how businesses can leverage long-term trends and policy reforms to drive sustainable investment opportunities in various industries. This piece also covers crucial macroeconomic sections that will provide an in-depth analysis of the country's social outlook and global positioning.

Key Issues Addressed:

- What is Japan’s GDP growth outlook over the next 5 years?

- How will Japan’s ageing demographics impact medium- and long-term growth patterns?

- How will Japan’s population structure evolve over the next 5 years?

- How will Japan's ultra-loose monetary policy stance impact long-term growth prospects?

- How does Japan fare on global innovation and competitiveness indices compared to other regional economies?

Table of Contents

Strategic Imperatives

- Why is it Increasingly Difficult to Grow?

- The Strategic Imperative 8™

- The Impact of the Top 3 Strategic Imperatives on Japan's Economy

- Growth Opportunities Fuel the Growth Pipeline Engine™

Macroeconomic Environment

- Key Economic Metrics

- Growth Drivers

- Growth Restraint

Economic Outlook

- GDP Growth

- Inflation and Monetary Policy

- Fiscal Analysis

- Trade Analysis

Global Positioning

- Impact of Global Economic Trends and Events

- Global Performance Indices

Social Outlook

- Population Structure

- Population Size and Density

- Disease Profile-Communicable Diseases

- Disease Profile-Non-communicable Diseases (NCDs)

- Health Insurance and Out-of-pocket Expenditure

- Health Facilities and Inpatient Beds

Growth Opportunity Universe

- Growth Opportunity 1-Loose Monetary Policy and High Saving Rates Spurring Growth in the Consumer Goods Sector

- Growth Opportunity 2-Aging Demographics Fostering Healthcare Investment

- Growth Opportunity 3-Increased Defense Spending Will Support Manufacturing Growth

- List of Exhibits

- Legal Disclaimer