|

|

市場調査レポート

商品コード

1351204

シーシャ市場 - 世界の業界分析、規模、シェア、成長、動向、地域別見通し、予測(2023年~2030年)- 製品タイプ別、フレーバー別、流通チャネル別、地域別、企業別Shisha Market - Global Shisha Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2023-2030 - (By Product Type Coverage, By Flavour Coverage, By Distribution Channel Coverage, By Geographic Coverage and By Company) |

||||||

|

|||||||

| シーシャ市場 - 世界の業界分析、規模、シェア、成長、動向、地域別見通し、予測(2023年~2030年)- 製品タイプ別、フレーバー別、流通チャネル別、地域別、企業別 |

|

出版日: 2023年08月31日

発行: Fairfield Market Research

ページ情報: 英文 245 Pages

納期: 2~5営業日

|

- 全表示

- 概要

- 目次

世界のシーシャの市場規模は目覚ましい成長を遂げ、2023年から2030年までの評価期間中にCAGR約6%の大幅な成長が見込まれます。10年後までには、シーシャ市場の売上高は20億米ドルを超えると予測されています。

フッカーや水パイプとしても知られるシーシャは、世界中のフレーバー・タバコ愛好家に人気の喫煙具であり続けています。タバコボウル、縦軸、水を満たした台座、煙を吸い込むためのホースやチューブといった標準的な部品で構成されるシーシャは、ユニークで風味豊かな喫煙体験を提供します。タバコの葉、糖蜜やハチミツ、フルーツ、ミント、スパイスなど様々なフレーバーを使用することで、シーシャやフッカという独特のタバコが出来上がります。シーシャの文化的意義は、社交的でリラックスできるアクティビティとしての魅力と相まって、市場拡大に寄与しています。世界化と異文化交流の増加に伴い、シーシャの人気は世界各地に広がっています。消費者は常に新鮮でエキサイティングな体験を求め、継続的なイノベーションと新しいフレーバーのイントロダクションを通じて市場の成長を促進しています。さらに、ソーシャルメディアの普及がシーシャ文化の伝播に大きな役割を果たしています。しかし、喫煙に伴う潜在的な健康リスクに対する意識の高まりは、シーシャ産業にとって大きな課題となっています。

アジア太平洋が主導的地位を維持する一方、北米のシーシャ市場が2030年まで最も力強い成長を遂げると予測されています。

世界中の地域が従来のタバコに代わるものとして水パイプ喫煙に注目しているにもかかわらず、シーシャの使用に伴う健康リスクに関する消費者の認識には依然として大きな隔たりがあります。シーシャ喫煙がより大きな健康リスクをもたらす可能性があることが研究で示されているにもかかわらず、シーシャは水をろ過しているためタバコより安全だという誤解が広まっています。この誤解は、シーシャの使用中に水がニコチンの大部分を吸収してしまうという考えによるところが大きいとみられています。この誤解が、シーシャ産業の継続的な成長を後押ししている面もあります。

製品革新と豊富なフレーバーはシーシャ市場の成長促進要因です。業界の大手企業は、拡大する顧客層に対応するため、多様な製品とフレーバーを積極的に推進しています。新しく革新的な製品は、過去10年間の業界の成長において極めて重要な役割を果たしてきました。さまざまな国の人々がシーシャ製品への欲求を高めているため、ベンダーはより多くの顧客を惹きつけるために革新的な製品の開発に熱心に取り組んでいます。

世界のeコマースの急速な拡大は、シーシャ販売業者にとって収益性を高める大きな機会となります。インターネットユーザーの増加と、便利で安全なオンライン取引を好む傾向によって、オンライン支出が増加する世界の動向が、この小売チャネルの成長に寄与しています。クレジットカードやデビットカードを使ったオンライン決済の手軽さや、eコマース・サイトのユーザー・エクスペリエンスの向上が、オンライン・ショッピングへの嗜好をさらに後押ししています。

当レポートでは、世界のシーシャ市場について調査し、市場の概要とともに、製品タイプ別、フレーバー別、流通チャネル別、地域別動向、および市場に参入する企業の競合動向などを提供しています。

目次

第1章 エグゼクティブサマリー

第2章 市場概要

- 市場の定義とセグメンテーション

- 市場力学

- バリューチェーン分析

- ポーターのファイブフォース分析

- COVID-19の影響分析

- ウクライナとロシアの紛争の影響

- 経済概要

- PESTLE分析

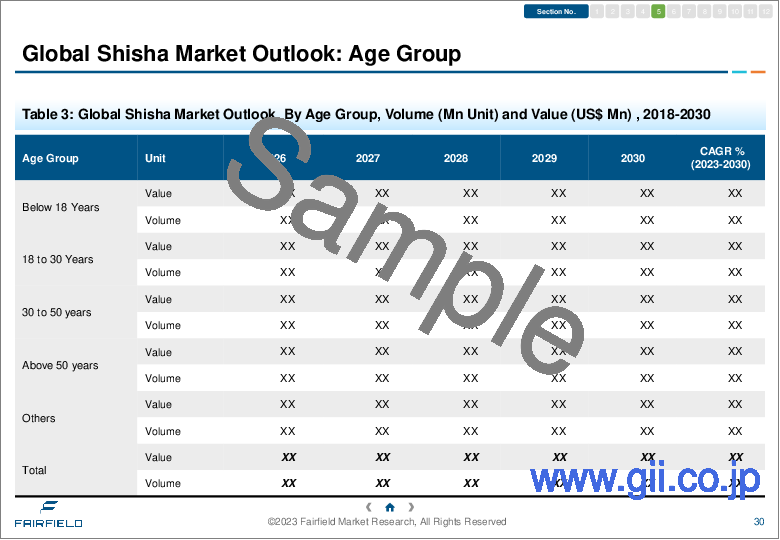

第3章 世界のシーシャ市場の見通し、2018年~2030年

- 世界のシーシャ市場の見通し、製品タイプ別、金額(10億米ドル)、2018年~2030年

- 世界のシーシャ市場の見通し、フレーバー別、金額別(10億米ドル)、2018年~2030年

- 世界のシーシャ市場の見通し、流通チャネル別、金額(10億米ドル)、2018年~2030年

- 世界のシーシャ市場の見通し、地域別、金額(10億米ドル)、2018年~2030年

第4章 北米のシーシャ市場の見通し、2018年~2030年

第5章 欧州のシーシャ市場の見通し、2018年~2030年

第6章 アジア太平洋のシーシャ市場の見通し、2018年~2030年

第7章 ラテンアメリカのシーシャ市場の見通し、2018年~2030年

第8章 中東・アフリカのシーシャ市場展望、2018年~2030年

第9章 競合情勢

- メーカーと製品のヒートマップ

- 企業の市場シェア分析、2022年

- 競争力ダッシュボード

- 企業プロファイル

- Caravan Hookah/Hookah Caravan

- Fumari

- Haze Tobacco

- Al Fakher Tobacco Factory

- Social Smoke

- The Japan Tobacco, Inc.

- Soex

- Prince Molasses

- Romman Shisha

- Ugly Hookah

- Cloud Tobacco

- Flavors of Americas S.A.

- Starbuzz Tobacco

- Godfrey Phillips India Ltd.

- ALWAHA-TOBACCO.

- Caravan Cigar Company

第10章 付録

Global Shisha Market Expected to Grow at a Robust 6% CAGR, Surpassing US$2 Billion by 2030.

The global shisha market is poised for impressive growth, with a substantial CAGR of around 6% anticipated during the period of assessment from 2023 to 2030. By the end of the decade, the shisha market is predicted to exceed US$2 billion in revenue.

Transforming the Way We Enjoy Flavoured Tobacco

Shisha, also known as a hookah or water pipe, continues to be a popular smoking tool for flavoured tobacco enthusiasts worldwide. Comprising standard components such as a tobacco bowl, vertical shaft, water-filled base, and a hose or tube for smoke inhalation, shisha offers a unique and flavorful smoking experience. The use of tobacco leaves, molasses or honey, and a diverse range of flavors, including fruit, mint, and spice, creates the distinctive shisha or hookah tobacco. The cultural significance of shisha, combined with its appeal as a social and relaxing activity, contributes to its market expansion. As globalization and cross-cultural interactions increase, shisha's popularity has extended to various parts of the world. Consumers continually seek fresh and exciting experiences, fostering market growth through ongoing innovation and the introduction of new flavors. Furthermore, the widespread reach of social media has played a significant role in propagating the shisha culture. However, the rising awareness of potential health risks associated with smoking poses a major challenge to the shisha industry.

Key Report Findings:

- Significant Revenue Expansion: The shisha market is poised for substantial revenue growth between 2023 and 2030.

- Innovative Flavors and Venues: The growing acceptance of shisha in theme-based restaurants, lounges, and cafes, along with the introduction of enticing new shisha flavors, contributes to market growth.

- Preference for Strong Shisha: Strong-type shisha remains in high demand in the shisha market.

- Fruit Flavors Lead: The fruit flavor category claimed the highest shisha market revenue share in 2022.

- Asia Pacific Takes the Lead: Asia Pacific is expected to maintain its leadership position, while North America's shisha market will experience the most robust growth through 2030.

Driving Forces

Consumer Misconceptions About Health Effects

Despite regions worldwide turning to water pipe smoking as an alternative to traditional cigarettes, there remains a significant gap in consumer awareness regarding the health risks associated with shisha use. Misconceptions about shisha being safer than cigarettes due to water filtration perpetuate, even though research indicates that shisha smoking can pose greater health risks. This misconception is largely attributed to the belief that water absorbs most of the nicotine during shisha use. This misconception, in part, fuels the ongoing growth of the shisha industry.

Rising Product Innovation

Product innovation and a wide array of flavors are key drivers of the shisha market's growth. Major players in the industry are actively promoting diverse products and flavors to cater to an expanding customer base. The introduction of new and innovative products has played a pivotal role in the industry's growth over the past decade. As people across different countries develop a growing appetite for shisha products, vendors are working diligently to create innovative offerings to attract more customers.

For example, in September 2022, Korber Group unveiled a product featuring multiple flavors and scent casings, enhancing the shisha experience. Similarly, in 2021, Fumari introduced a new range of high-quality stainless steel hookahs. These innovative product launches are expected to further propel the global shisha market during the forecast period.

Rising Trend of Online Retail

The rapid expansion of global e-commerce presents a significant opportunity for shisha sellers to boost their profitability. The global trend towards increased online spending, driven by a growing number of internet users and their preference for convenient, secure online transactions, is contributing to the growth of this retail channel. The ease of online payments using credit or debit cards and the improved user experience on e-commerce websites are further driving the preference for online shopping.

Challenges to Growth

Health Concerns

Increasing awareness of the health risks associated with shisha use, including the rising incidence of coronary heart disease and the threat of oral or lung cancer, poses a significant challenge to the shisha market. Recent studies have shown a substantial increase in exposure to harmful substances when smoking shisha, including PAHs, volatile aldehydes, CO, NO, nicotine, furans, and nanoparticles. These substances are linked to various health issues, from cancer to respiratory problems. Additionally, shisha smoking can sharply increase blood pressure, pulse rate, and CO levels, impacting heart health.

Overview of Key Segments

Preference for Strong Shisha

Robust or strong shisha is expected to dominate a significant portion of the market, particularly in regions where consumers prefer shisha over traditional cigarettes. As companies modernize their product lines and introduce new flavors within the range of strong shisha, demand for these products is surging.

Fruit Flavors Lead the Way

The fruit flavor segment is anticipated to experience consistent and rapid revenue growth in the global shisha market. The vast array of fruit flavors appeals to a broad spectrum of consumers, enhancing the overall shisha experience. Flavors such as apple, strawberry, watermelon, mango, and grape provide a refreshing and enjoyable twist to the shisha ritual.

Momentum Across Regions

Asia Pacific Takes the Lead

Asia Pacific is expected to contribute the largest share of revenue to the global shisha market during the forecast period. The rapid growth of the hospitality sector, particularly in cafes, lounges, and bars, has created a significant market for shisha consumption. The region's youthful population and their inclination toward socializing and trying new experiences are also key drivers of market growth.

North America Reflects Strong Growth

North America is poised to experience the fastest revenue growth in the shisha market during the forecast period. Changing consumer preferences, cultural influences, and societal trends have contributed to the rise of shisha as a social and recreational activity. The use of alternative tobacco products, including shisha, has gained popularity, particularly among young adults and college students.

Shisha Market: Competitive Landscape

Leading players in the global shisha market include: Caravan Hookah/Hookah Caravan, Caravan Cigar Company, Fumari, Haze Tobacco, Al Fakher Tobacco Factory, Social Smoke, The Japan Tobacco, Inc., Soex, Prince Molasses, Romman Shisha, Mazaya (Kuwait), Ugly Hookah, Cloud Tobacco, Flavours of Americas, Starbuzz Tobacco, Nakhla, MujeebSons, Godfrey Phillips India Ltd., and Alwaha Tobacco.

Table of Contents

1. Executive Summary

- 1.1. Global Shisha Market Snapshot

- 1.2. Future Projections

- 1.3. Key Market Trends

- 1.4. Regional Snapshot, by Volume/Value, 2022

- 1.5. Analyst Recommendations

2. Market Overview

- 2.1. Market Definitions and Segmentations

- 2.2. Market Dynamics

- 2.2.1. Drivers

- 2.2.2. Restraints

- 2.2.3. Market Opportunities

- 2.3. Value Chain Analysis

- 2.4. Porter's Five Forces Analysis

- 2.5. Covid-19 Impact Analysis

- 2.5.1. Supply

- 2.5.2. Demand

- 2.6. Impact of Ukraine-Russia Conflict

- 2.7. Economic Overview

- 2.7.1. World Economic Projections

- 2.8. PESTLE Analysis

3. Global Shisha Market Outlook, 2018 - 2030

- 3.1. Global Shisha Market Outlook, by Product Type, Value (US$ Bn), 2018 - 2030

- 3.1.1. Key Highlights

- 3.1.1.1. Strong Shisha Tobacco

- 3.1.1.2. Mild Shisha Tobacco

- 3.1.1.3. Light Shisha Tobacco

- 3.1.1. Key Highlights

- 3.2. Global Shisha Market Outlook, by Flavor, Value (US$ Bn), 2018 - 2030

- 3.2.1. Key Highlights

- 3.2.1.1. Fruit

- 3.2.1.2. Mint

- 3.2.1.3. Chocolate

- 3.2.1.4. Caramel

- 3.2.1.5. Other

- 3.2.1. Key Highlights

- 3.3. Global Shisha Market Outlook, by Distribution Channel, Value (US$ Bn), 2018 - 2030

- 3.3.1. Key Highlights

- 3.3.1.1. Direct

- 3.3.1.2. Indirect

- 3.3.1. Key Highlights

- 3.4. Global Shisha Market Outlook, by Region, Value (US$ Bn), 2018 - 2030

- 3.4.1. Key Highlights

- 3.4.1.1. North America

- 3.4.1.2. Europe

- 3.4.1.3. Asia Pacific

- 3.4.1.4. Latin America

- 3.4.1.5. Middle East & Africa

- 3.4.1. Key Highlights

4. North America Shisha Market Outlook, 2018 - 2030

- 4.1. North America Shisha Market Outlook, by Product Type, Value (US$ Bn), 2018 - 2030

- 4.1.1. Key Highlights

- 4.1.1.1. Strong Shisha Tobacco

- 4.1.1.2. Mild Shisha Tobacco

- 4.1.1.3. Light Shisha Tobacco

- 4.1.1. Key Highlights

- 4.2. North America Shisha Market Outlook, by Flavor, Value (US$ Bn), 2018 - 2030

- 4.2.1. Key Highlights

- 4.2.1.1. Fruit

- 4.2.1.2. Mint

- 4.2.1.3. Chocolate

- 4.2.1.4. Caramel

- 4.2.1.5. Other

- 4.2.1. Key Highlights

- 4.3. North America Shisha Market Outlook, by Distribution Channel, Value (US$ Bn), 2018 - 2030

- 4.3.1. Key Highlights

- 4.3.1.1. Direct

- 4.3.1.2. Indirect

- 4.3.2. Market Attractiveness Analysis

- 4.3.1. Key Highlights

- 4.4. North America Shisha Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

- 4.4.1. Key Highlights

- 4.4.1.1. U.S. Shisha Market by Product Type, Value (US$ Bn), 2018 - 2030

- 4.4.1.2. U.S. Shisha Market by Flavor, Value (US$ Bn), 2018 - 2030

- 4.4.1.3. U.S. Shisha Market by Distribution Channel, Value (US$ Bn), 2018 - 2030

- 4.4.1.4. Canada Shisha Market by Product Type, Value (US$ Bn), 2018 - 2030

- 4.4.1.5. Canada Shisha Market by Flavor, Value (US$ Bn), 2018 - 2030

- 4.4.1.6. Canada Shisha Market by Distribution Channel, Value (US$ Bn), 2018 - 2030

- 4.4.2. BPS Analysis/Market Attractiveness Analysis

- 4.4.1. Key Highlights

5. Europe Shisha Market Outlook, 2018 - 2030

- 5.1. Europe Shisha Market Outlook, by Product Type, Value (US$ Bn), 2018 - 2030

- 5.1.1. Key Highlights

- 5.1.1.1. Strong Shisha Tobacco

- 5.1.1.2. Mild Shisha Tobacco

- 5.1.1.3. Light Shisha Tobacco

- 5.1.1. Key Highlights

- 5.2. Europe Shisha Market Outlook, by Flavor, Value (US$ Bn), 2018 - 2030

- 5.2.1. Key Highlights

- 5.2.1.1. Fruit

- 5.2.1.2. Mint

- 5.2.1.3. Chocolate

- 5.2.1.4. Caramel

- 5.2.1.5. Other

- 5.2.2. BPS Analysis/Market Attractiveness Analysis

- 5.2.1. Key Highlights

- 5.3. Europe Shisha Market Outlook, by Distribution Channel, Value (US$ Bn), 2018 - 2030

- 5.3.1. Key Highlights

- 5.3.1.1. Direct

- 5.3.1.2. Indirect

- 5.3.1. Key Highlights

- 5.4. Europe Shisha Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

- 5.4.1. Key Highlights

- 5.4.1.1. Germany Shisha Market by Product Type, Value (US$ Bn), 2018 - 2030

- 5.4.1.2. Germany Shisha Market by Flavor, Value (US$ Bn), 2018 - 2030

- 5.4.1.3. Germany Shisha Market by Distribution Channel, Value (US$ Bn), 2018 - 2030

- 5.4.1.4. U.K. Shisha Market by Product Type, Value (US$ Bn), 2018 - 2030

- 5.4.1.5. U.K. Shisha Market by Flavor, Value (US$ Bn), 2018 - 2030

- 5.4.1.6. U.K. Shisha Market by Distribution Channel, Value (US$ Bn), 2018 - 2030

- 5.4.1.7. France Shisha Market by Product Type, Value (US$ Bn), 2018 - 2030

- 5.4.1.8. France Shisha Market by Flavor, Value (US$ Bn), 2018 - 2030

- 5.4.1.9. France Shisha Market by Distribution Channel, Value (US$ Bn), 2018 - 2030

- 5.4.1.10. Italy Shisha Market by Product Type, Value (US$ Bn), 2018 - 2030

- 5.4.1.11. Italy Shisha Market by Flavor, Value (US$ Bn), 2018 - 2030

- 5.4.1.12. Italy Shisha Market by Distribution Channel, Value (US$ Bn), 2018 - 2030

- 5.4.1.13. Turkey Shisha Market by Product Type, Value (US$ Bn), 2018 - 2030

- 5.4.1.14. Turkey Shisha Market by Flavor, Value (US$ Bn), 2018 - 2030

- 5.4.1.15. Turkey Shisha Market by Distribution Channel, Value (US$ Bn), 2018 - 2030

- 5.4.1.16. Russia Shisha Market by Product Type, Value (US$ Bn), 2018 - 2030

- 5.4.1.17. Russia Shisha Market by Flavor, Value (US$ Bn), 2018 - 2030

- 5.4.1.18. Russia Shisha Market by Distribution Channel, Value (US$ Bn), 2018 - 2030

- 5.4.1.19. Rest of Europe Shisha Market by Product Type, Value (US$ Bn), 2018 - 2030

- 5.4.1.20. Rest of Europe Shisha Market by Flavor, Value (US$ Bn), 2018 - 2030

- 5.4.1.21. Rest of Europe Shisha Market by Distribution Channel, Value (US$ Bn), 2018 - 2030

- 5.4.2. BPS Analysis/Market Attractiveness Analysis

- 5.4.1. Key Highlights

6. Asia Pacific Shisha Market Outlook, 2018 - 2030

- 6.1. Asia Pacific Shisha Market Outlook, by Product Type, Value (US$ Bn), 2018 - 2030

- 6.1.1. Key Highlights

- 6.1.1.1. Strong Shisha Tobacco

- 6.1.1.2. Mild Shisha Tobacco

- 6.1.1.3. Light Shisha Tobacco

- 6.1.1. Key Highlights

- 6.2. Asia Pacific Shisha Market Outlook, by Flavor, Value (US$ Bn), 2018 - 2030

- 6.2.1. Key Highlights

- 6.2.1.1. Fruit

- 6.2.1.2. Mint

- 6.2.1.3. Chocolate

- 6.2.1.4. Caramel

- 6.2.1.5. Other

- 6.2.2. BPS Analysis/Market Attractiveness Analysis

- 6.2.1. Key Highlights

- 6.3. Asia Pacific Shisha Market Outlook, by Distribution Channel, Value (US$ Bn), 2018 - 2030

- 6.3.1. Key Highlights

- 6.3.1.1. Direct

- 6.3.1.2. Indirect

- 6.3.1. Key Highlights

- 6.4. Asia Pacific Shisha Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

- 6.4.1. Key Highlights

- 6.4.1.1. China Shisha Market by Product Type, Value (US$ Bn), 2018 - 2030

- 6.4.1.2. China Shisha Market by Flavor, Value (US$ Bn), 2018 - 2030

- 6.4.1.3. China Shisha Market by Distribution Channel, Value (US$ Bn), 2018 - 2030

- 6.4.1.4. Japan Shisha Market by Product Type, Value (US$ Bn), 2018 - 2030

- 6.4.1.5. Japan Shisha Market by Flavor, Value (US$ Bn), 2018 - 2030

- 6.4.1.6. Japan Shisha Market by Distribution Channel, Value (US$ Bn), 2018 - 2030

- 6.4.1.7. South Korea Shisha Market by Product Type, Value (US$ Bn), 2018 - 2030

- 6.4.1.8. South Korea Shisha Market by Flavor, Value (US$ Bn), 2018 - 2030

- 6.4.1.9. South Korea Shisha Market by Distribution Channel, Value (US$ Bn), 2018 - 2030

- 6.4.1.10. India Shisha Market by Product Type, Value (US$ Bn), 2018 - 2030

- 6.4.1.11. India Shisha Market by Flavor, Value (US$ Bn), 2018 - 2030

- 6.4.1.12. India Shisha Market by Distribution Channel, Value (US$ Bn), 2018 - 2030

- 6.4.1.13. Southeast Asia Shisha Market by Product Type, Value (US$ Bn), 2018 - 2030

- 6.4.1.14. Southeast Asia Shisha Market by Flavor, Value (US$ Bn), 2018 - 2030

- 6.4.1.15. Southeast Asia Shisha Market by Distribution Channel, Value (US$ Bn), 2018 - 2030

- 6.4.1.16. Rest of Asia Pacific Shisha Market by Product Type, Value (US$ Bn), 2018 - 2030

- 6.4.1.17. Rest of Asia Pacific Shisha Market by Flavor, Value (US$ Bn), 2018 - 2030

- 6.4.1.18. Rest of Asia Pacific Shisha Market by Distribution Channel, Value (US$ Bn), 2018 - 2030

- 6.4.2. BPS Analysis/Market Attractiveness Analysis

- 6.4.1. Key Highlights

7. Latin America Shisha Market Outlook, 2018 - 2030

- 7.1. Latin America Shisha Market Outlook, by Product Type, Value (US$ Bn), 2018 - 2030

- 7.1.1. Key Highlights

- 7.1.1.1. Strong Shisha Tobacco

- 7.1.1.2. Mild Shisha Tobacco

- 7.1.1.3. Light Shisha Tobacco

- 7.1.1. Key Highlights

- 7.2. Latin America Shisha Market Outlook, by Flavor, Value (US$ Bn), 2018 - 2030

- 7.2.1. Key Highlights

- 7.2.1.1. Fruit

- 7.2.1.2. Mint

- 7.2.1.3. Chocolate

- 7.2.1.4. Caramel

- 7.2.1.5. Other

- 7.2.2. BPS Analysis/Market Attractiveness Analysis

- 7.2.1. Key Highlights

- 7.3. Latin America Shisha Market Outlook, by Distribution Channel, Value (US$ Bn), 2018 - 2030

- 7.3.1. Key Highlights

- 7.3.1.1. Direct

- 7.3.1.2. Indirect

- 7.3.1. Key Highlights

- 7.4. Latin America Shisha Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

- 7.4.1. Key Highlights

- 7.4.1.1. Brazil Shisha Market by Product Type, Value (US$ Bn), 2018 - 2030

- 7.4.1.2. Brazil Shisha Market by Flavor, Value (US$ Bn), 2018 - 2030

- 7.4.1.3. Brazil Shisha Market by Distribution Channel, Value (US$ Bn), 2018 - 2030

- 7.4.1.4. Mexico Shisha Market by Product Type, Value (US$ Bn), 2018 - 2030

- 7.4.1.5. Mexico Shisha Market by Flavor, Value (US$ Bn), 2018 - 2030

- 7.4.1.6. Mexico Shisha Market by Distribution Channel, Value (US$ Bn), 2018 - 2030

- 7.4.1.7. Argentina Shisha Market by Product Type, Value (US$ Bn), 2018 - 2030

- 7.4.1.8. Argentina Shisha Market by Flavor, Value (US$ Bn), 2018 - 2030

- 7.4.1.9. Argentina Shisha Market by Distribution Channel, Value (US$ Bn), 2018 - 2030

- 7.4.1.10. Rest of Latin America Shisha Market by Product Type, Value (US$ Bn), 2018 - 2030

- 7.4.1.11. Rest of Latin America Shisha Market by Flavor, Value (US$ Bn), 2018 - 2030

- 7.4.1.12. Rest of Latin America Shisha Market by Distribution Channel, Value (US$ Bn), 2018 - 2030

- 7.4.2. BPS Analysis/Market Attractiveness Analysis

- 7.4.1. Key Highlights

8. Middle East & Africa Shisha Market Outlook, 2018 - 2030

- 8.1. Middle East & Africa Shisha Market Outlook, by Product Type, Value (US$ Bn), 2018 - 2030

- 8.1.1. Key Highlights

- 8.1.1.1. Strong Shisha Tobacco

- 8.1.1.2. Mild Shisha Tobacco

- 8.1.1.3. Light Shisha Tobacco

- 8.1.1. Key Highlights

- 8.2. Middle East & Africa Shisha Market Outlook, by Flavor, Value (US$ Bn), 2018 - 2030

- 8.2.1. Key Highlights

- 8.2.1.1. Fruit

- 8.2.1.2. Mint

- 8.2.1.3. Chocolate

- 8.2.1.4. Caramel

- 8.2.1.5. Other

- 8.2.2. BPS Analysis/Market Attractiveness Analysis

- 8.2.1. Key Highlights

- 8.3. Middle East & Africa Shisha Market Outlook, by Distribution Channel, Value (US$ Bn), 2018 - 2030

- 8.3.1. Key Highlights

- 8.3.1.1. Direct

- 8.3.1.2. Indirect

- 8.3.1. Key Highlights

- 8.4. Middle East & Africa Shisha Market Outlook, by Country, Value (US$ Bn), 2018 - 2030

- 8.4.1. Key Highlights

- 8.4.1.1. GCC Shisha Market by Product Type, Value (US$ Bn), 2018 - 2030

- 8.4.1.2. GCC Shisha Market by Flavor, Value (US$ Bn), 2018 - 2030

- 8.4.1.3. GCC Shisha Market by Distribution Channel, Value (US$ Bn), 2018 - 2030

- 8.4.1.4. South Africa Shisha Market by Product Type, Value (US$ Bn), 2018 - 2030

- 8.4.1.5. South Africa Shisha Market by Flavor, Value (US$ Bn), 2018 - 2030

- 8.4.1.6. South Africa Shisha Market by Distribution Channel, Value (US$ Bn), 2018 - 2030

- 8.4.1.7. Egypt Shisha Market by Product Type, Value (US$ Bn), 2018 - 2030

- 8.4.1.8. Egypt Shisha Market by Flavor, Value (US$ Bn), 2018 - 2030

- 8.4.1.9. Egypt Shisha Market by Distribution Channel, Value (US$ Bn), 2018 - 2030

- 8.4.1.10. Nigeria Shisha Market by Product Type, Value (US$ Bn), 2018 - 2030

- 8.4.1.11. Nigeria Shisha Market by Flavor, Value (US$ Bn), 2018 - 2030

- 8.4.1.12. Nigeria Shisha Market by Distribution Channel, Value (US$ Bn), 2018 - 2030

- 8.4.1.13. Rest of Middle East & Africa Shisha Market by Product Type, Value (US$ Bn), 2018 - 2030

- 8.4.1.14. Rest of Middle East & Africa Shisha Market by Flavor, Value (US$ Bn), 2018 - 2030

- 8.4.1.15. Rest of Middle East & Africa Shisha Market by Distribution Channel, Value (US$ Bn), 2018 - 2030

- 8.4.2. BPS Analysis/Market Attractiveness Analysis

- 8.4.1. Key Highlights

9. Competitive Landscape

- 9.1. Manufacturer vs Product Heatmap

- 9.2. Company Market Share Analysis, 2022

- 9.3. Competitive Dashboard

- 9.4. Company Profiles

- 9.4.1. Caravan Hookah/Hookah Caravan

- 9.4.1.1. Company Overview

- 9.4.1.2. Product Portfolio

- 9.4.1.3. Financial Overview

- 9.4.1.4. Business Strategies and Development

- 9.4.2. Fumari

- 9.4.2.1. Company Overview

- 9.4.2.2. Product Portfolio

- 9.4.2.3. Financial Overview

- 9.4.2.4. Business Strategies and Development

- 9.4.3. Haze Tobacco

- 9.4.3.1. Company Overview

- 9.4.3.2. Product Portfolio

- 9.4.3.3. Financial Overview

- 9.4.3.4. Business Strategies and Development

- 9.4.4. Al Fakher Tobacco Factory

- 9.4.4.1. Company Overview

- 9.4.4.2. Product Portfolio

- 9.4.4.3. Financial Overview

- 9.4.4.4. Business Strategies and Development

- 9.4.5. Social Smoke

- 9.4.5.1. Company Overview

- 9.4.5.2. Product Portfolio

- 9.4.5.3. Financial Overview

- 9.4.5.4. Business Strategies and Development

- 9.4.6. The Japan Tobacco, Inc.

- 9.4.6.1. Company Overview

- 9.4.6.2. Product Portfolio

- 9.4.6.3. Financial Overview

- 9.4.6.4. Business Strategies and Development

- 9.4.7. Soex

- 9.4.7.1. Company Overview

- 9.4.7.2. Product Portfolio

- 9.4.7.3. Financial Overview

- 9.4.7.4. Business Strategies and Development

- 9.4.8. Prince Molasses

- 9.4.8.1. Company Overview

- 9.4.8.2. Product Portfolio

- 9.4.8.3. Financial Overview

- 9.4.8.4. Business Strategies and Development

- 9.4.9. Romman Shisha

- 9.4.9.1. Company Overview

- 9.4.9.2. Product Portfolio

- 9.4.9.3. Financial Overview

- 9.4.9.4. Business Strategies and Development

- 9.4.10. Ugly Hookah

- 9.4.10.1. Company Overview

- 9.4.10.2. Product Portfolio

- 9.4.10.3. Financial Overview

- 9.4.10.4. Business Strategies and Development

- 9.4.11. Cloud Tobacco

- 9.4.11.1. Company Overview

- 9.4.11.2. Product Portfolio

- 9.4.11.3. Financial Overview

- 9.4.11.4. Business Strategies and Development

- 9.4.12. Flavors of Americas S.A.

- 9.4.12.1. Company Overview

- 9.4.12.2. Product Portfolio

- 9.4.12.3. Financial Overview

- 9.4.12.4. Business Strategies and Development

- 9.4.13. Starbuzz Tobacco

- 9.4.13.1. Company Overview

- 9.4.13.2. Product Portfolio

- 9.4.13.3. Financial Overview

- 9.4.13.4. Business Strategies and Development

- 9.4.14. Godfrey Phillips India Ltd. (India)

- 9.4.14.1. Company Overview

- 9.4.14.2. Product Portfolio

- 9.4.14.3. Financial Overview

- 9.4.14.4. Business Strategies and Development

- 9.4.15. ALWAHA-TOBACCO. (U.S.)

- 9.4.15.1. Company Overview

- 9.4.15.2. Product Portfolio

- 9.4.15.3. Financial Overview

- 9.4.15.4. Business Strategies and Development

- 9.4.16. Caravan Cigar Company

- 9.4.16.1. Company Overview

- 9.4.16.2. Product Portfolio

- 9.4.16.3. Financial Overview

- 9.4.16.4. Business Strategies and Development

- 9.4.1. Caravan Hookah/Hookah Caravan

10. Appendix

- 10.1. Research Methodology

- 10.2. Report Assumptions

- 10.3. Acronyms and Abbreviations