|

|

市場調査レポート

商品コード

1747987

カーボンナノチューブ(CNT)の世界市場(2026年~2036年)The Global Carbon Nanotubes Market 2026-2036 |

||||||

|

|||||||

| カーボンナノチューブ(CNT)の世界市場(2026年~2036年) |

|

出版日: 2025年06月12日

発行: Future Markets, Inc.

ページ情報: 英文 444 Pages, 192 Tables, 82 Figures

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のカーボンナノチューブ(CNT)市場は、先進材料産業の中でもっともダイナミックで急速に拡大している部門の1つであり、市場規模は2036年までに50億米ドル超から250億米ドル超に達すると予測されています。この例外的な成長軌道は、この円筒状の炭素構造が持つ変革の可能性を反映しており、驚異的な機械的、電気的、熱的特性を持つCNTは、今後10年間でさまざまな産業に革命を起こそうとしています。

CNT市場は、主に多層カーボンナノチューブ(MWCNT)と単層カーボンナノチューブ(SWCNT)の2つに区分されます。2036年までに、MWCNTは、その優れた機械的強度、導電性、大規模用途における費用対効果によって優位性を維持すると予測されます。SWCNTは、特殊な用途では割高になる一方、2036年までに20億米ドルに達すると予測され、独自の単層構造が比類のない性能特性を提供する先進の生物医学用途、次世代電子機器、量子コンピューティングで重要な役割を果たすと予測されます。

エネルギー貯蔵は、世界の電気自動車と再生可能エネルギーインフラへの移行に牽引され、もっとも急成長している部門として浮上しています。CNTはリチウムイオンバッテリーにおいて優れた導電性添加剤として機能し、従来のカーボンよりも低い荷重でより効果的な電気的パーコレーションネットワークを形成する一方、その卓越した導電性と軽量性により、より速い電荷移動とより高いバッテリー容量を可能にします。自動車産業の電化へのシフトは加速しており、グリッド規模エネルギー貯蔵の需要もあり、CNTは次世代バッテリー技術に不可欠な材料となっています。

CNT強化材料は、優れた強度を維持する軽量構造部品を通じて、航空宇宙・自動車用途に革命をもたらし、航空機メーカーが燃費と安全性を高めながら大幅な軽量化を達成することを可能にしています。建設産業では、CNTで強化されたコンクリートやコーティングが、これまでにない耐久性と機能性を提供しています。電子用途では、フレキシブルディスプレイ、透明導電フィルム、センサー、量子コンピューティング技術など、CNTの可能性が注目されています。そのユニークな一次元構造と調整可能な電子特性は、次世代トランジスタ、メモリデバイス、ウェアラブルエレクトロニクスにとって価値あるものとなっています。

生産情勢は根本的な変革期を迎えており、化学気相成長(CVD)技術はスケーラビリティとコスト効率性から優位性を維持しています。2036年までに、浮遊触媒CVD、プラズマエンハンストプロセス、回収したCO2や廃棄物原料を利用する新たなグリーン合成法などの先進の製造技法が、生産の経済性と環境持続可能性に革命をもたらすと予測されます。LG ChemやOCSiAlのような業界のリーダーによる大規模な生産能力拡張は、バッテリー、電子、複合材料用途の需要の増加に対応するために生産規模を拡大しています。CNT合成におけるAIと機械学習の統合は、ナノチューブのキラリティ、直径、特性の前例のない制御を可能にし、これまでは大規模生産が不可能であった特定用途向けのCNTバリアントへの道を開いています。

生産規模が指数関数的に増大し、技術的ブレークスルーによってコストが低下していることから、カーボンナノチューブは次世代技術の基本的な構成要素と位置づけられており、航空宇宙、自動車、エネルギー、電子、新興バイオテクノロジー部門にわたって、研究室のイノベーションと商業的現実とのギャップを埋めています。CNTとAI、ロボティクス、持続可能な製造の融合は、インテリジェント材料へのパラダイムシフトを意味し、次の10年の技術情勢を決定づけます。

当レポートでは、世界のカーボンナノチューブ(CNT)市場について分析し、市場規模と予測、技術と生産の分析、用途と市場機会、企業プロファイルなどを提供しています。

目次

第1章 エグゼクティブサマリー

- カーボンナノチューブの世界市場

- 市場見通し(2025年~)

- 市販のCNT由来の製品

- 市場の課題

- CNT市場の分析

- CNTの価格

第2章 カーボンナノチューブの概要

- 特性

- CNTの比較特性

- カーボンナノチューブ材料

- 中間製品

第3章 カーボンナノチューブの合成と生産

- アーク放電合成

- 化学蒸着(CVD)

- 高圧一酸化炭素合成

- 燃焼合成

- SWCNTの成長制御

- ハイブリッドCNT

- 火炎合成

- レーザーアブレーション合成

- 垂直配向ナノチューブ生産

- シラン溶液法

- 炭素回収の副産物

- CNT合成法の利点と欠点

第4章 規制

- CNTの規制と安全性

- 世界の規制

- ナノ材料に関する世界の規制機関

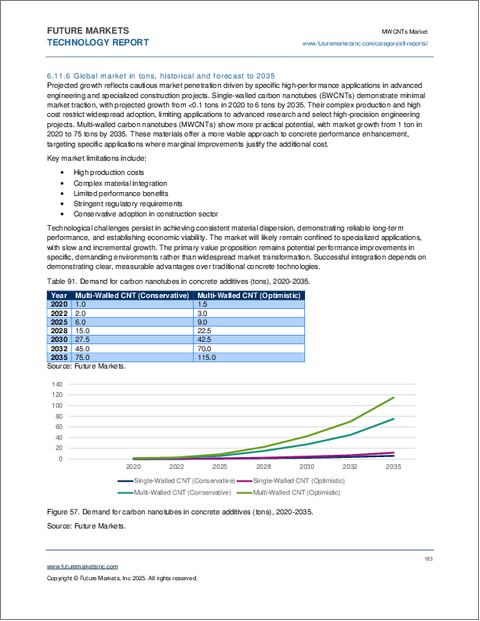

- MWCNTの統一分類

- 現行規制の欠陥

- CNTの安全性と暴露

第5章 カーボンナノチューブの特許

第6章 カーボンナノチューブの価格

- MWCNT

- SWCNT、FWCNT

第7章 カーボンナノチューブの市場

- エネルギー貯蔵:バッテリー

- エネルギー貯蔵:スーパーキャパシタ

- ポリマー添加剤、エラストマー

- 3Dプリンティング

- 接着剤

- 航空宇宙

- 電子

- 量子コンピューティング

- ゴム、タイヤ

- 自動車

- 導電性インク

- 建設

- ろ過

- 燃料電池

- 生命科学、医学

- 潤滑剤

- 石油、ガス

- 塗料、コーティング

- 太陽光発電

- センサー

- スマート/エレクトロニックテキスタイル

- サーマルインターフェースマテリアル

- 電力ケーブル

第8章 企業プロファイル:多層カーボンナノチューブ(141社の企業プロファイル)

第9章 企業プロファイル:単層カーボンナノチューブ(16社の企業プロファイル)

第10章 企業プロファイル:その他のタイプ(窒化ホウ素ナノチューブ、二層ナノチューブなど)(企業5社のプロファイル)

第11章 調査手法

第12章 参考文献

List of Tables

- Table 1. Applications of MWCNTs

- Table 2. Annual Production Capacity of Key MWCNT Producers in 2024/2025 (Metric Tons)

- Table 3. Market demand for carbon nanotubes by market, 2018 -2036 (metric tons)

- Table 4: Markets, benefits and applications of Single-Walled Carbon Nanotubes

- Table 5. Annual production capacity of SWCNT producers in 2024 (KG)

- Table 6. SWCNT market demand forecast (metric tons), 2018 -2035

- Table 7. Classification of Commercialized CNTs

- Table 8. Commercial CNT Products by Application Sector

- Table 9. Technology Readiness Level (TRL) for carbon nanotubes

- Table 10. Carbon nanotubes market challenges

- Table 11.CNT Pricing: SWCNTs, FWCNTs, MWCNTs

- Table 12. Regional pricing dynamics

- Table 13. Typical properties of SWCNT and MWCNT

- Table 14. Properties of carbon nanotubes

- Table 15. Properties of CNTs and comparable materials

- Table 16. Markets, benefits and applications of Single-Walled Carbon Nanotubes

- Table 17. Comparison between single-walled carbon nanotubes and multi-walled carbon nanotubes

- Table 18. Markets and applications for vertically aligned carbon nanotubes (VA-CNTs)

- Table 19. VA-CNT Companies

- Table 20. Markets and applications for Few-walled carbon nanotubes (FWNTs)

- Table 21. Markets and applications for carbon nanohorns

- Table 22. Markets and applications for carbon onions

- Table 23. Comparative properties of BNNTs and CNTs

- Table 24. Markets and applications for BNNTs

- Table 25. BNNT companies

- Table 26. Definition of CNT Intermediate Products

- Table 27. Applications of CNT Sheets

- Table 28. CNT sheets market players

- Table 29. CNT-Yarn Manufacturing Methods

- Table 30. Comparison of approaches for CNT synthesis

- Table 31. SWCNT synthesis methods

- Table 32. CO2 derived products via electrochemical conversion-applications, advantages and disadvantages

- Table 33. CNTs from green or waste feedstock

- Table 34. Advanced carbons from green or waste feedstocks

- Table 35. Main capture processes and their separation technologies

- Table 36. Absorption methods for CO2 capture overview

- Table 37. Commercially available physical solvents used in CO2 absorption

- Table 38. Adsorption methods for CO2 capture overview

- Table 39. Membrane-based methods for CO2 capture overview

- Table 40. Companies producing CNTs Made from Green/Waste Feedstock

- Table 41. Advantages and disadvantages of CNT synthesis methods

- Table 42. Global regulations for nanomaterials

- Table 43. CNT Safety and Exposure

- Table 44.MWCNT patents filed 2007-2024

- Table 45. SWCNT Patents Filed 2007-2024

- Table 46. Example MWCNTs and BNNTs pricing, by producer

- Table 47. SWCNTs and FWCNTs pricing

- Table 48. Market and applications for carbon nanotubes in batteries

- Table 49. Types of lithium battery

- Table 50. Battery technology comparison

- Table 51. Applications of carbon nanotubes in batteries

- Table 52. Electrochemical performance of nanomaterials in LIBs

- Table 53. Li-ion cathode benchmark

- Table 54. Performance comparison by popular cathode materials

- Table 55. Applications in sodium-ion batteries, by nanomaterials type and benefits thereof

- Table 56. Cost-performance analysis for CNT battery applications

- Table 57. Cost comparison between CNT additives and alternative conductive materials

- Table 58. Performance benefits from CNT integration

- Table 59. Technology benchmarking

- Table 60. Global market in tons, historical and forecast to 2036

- Table 61. Global demand for carbon nanotubes in batteries (tons), 2018 -2036

- Table 62. Product developers in carbon nanotubes for batteries

- Table 63. Market and applications for carbon nanotubes in supercapacitors

- Table 64. Supercapacitors vs batteries

- Table 65. Supercapacitor technologies

- Table 66. Performance of CNT supercapacitors

- Table 67. Benefits of CNTs in supercapacitors

- Table 68. Challenges with the use of CNTs

- Table 69. Applications for carbon nanotubes in supercapacitors

- Table 70. Technology pathways for carbon nanotubes in supercapacitors

- Table 71. Demand for carbon nanotubes in supercapacitors (tons), 2018 -2036

- Table 72. Product developers in carbon nanotubes for supercapacitors

- Table 73. Routes to incorporating nanocarbon material into composites

- Table 74. Routes to Electrically Conductive Composites

- Table 75. Products that use CNTs in conductive plastics

- Table 76. Companies producing CNT in Conductive Epoxy

- Table 77. Market and applications for carbon nanotubes in fiber-based composite additives

- Table 78. Technology pathways for CNTs in fiber-based polymer composite additives

- Table 79. Market and applications for carbon nanotubes in metal matrix composite additives

- Table 80. Comparison of Copper Nanocomposites

- Table 81. Global market for carbon nanotubes in polymer additives and elastomers 2018 -2036, tons

- Table 82. Product developers in carbon nanotubes in polymer additives and elastomers

- Table 83. Market and applications for carbon nanotubes in 3D printing

- Table 84. Demand for carbon nanotubes in 3-D printing (tons), 2018 -2036

- Table 85. Product developers in carbon nanotubes in 3D printing

- Table 86. Market and applications for carbon nanotubes in adhesives

- Table 87. Technology pathways for carbon nanotubes in adhesives

- Table 88. Demand for carbon nanotubes in adhesives (tons), 2018 -2036

- Table 89. Product developers in carbon nanotubes for adhesives

- Table 90. Market and applications for carbon nanotubes in aerospace

- Table 91. Applications of carbon nanotubes in aerospace

- Table 92. Technology pathways for carbon nanotubes in aerospace

- Table 93. Demand for carbon nanotubes in aerospace (tons), 2018 -2036

- Table 94. Product developers in carbon nanotubes for aerospace

- Table 95. Market and applications for carbon nanotubes in wearable & flexible electronics and displays

- Table 96. Technology pathways scorecard for carbon nanotubes in wearable electronics and displays

- Table 97. Transparent Conductive Films (TCFs) Market Overview

- Table 98. CNT Transparent Conductive Films by producer

- Table 99. Comparison of ITO replacements

- Table 100. Demand for carbon nanotubes in wearable electronics and displays, 2018 -2036 (tons)

- Table 101. Product developers in carbon nanotubes for electronics

- Table 102. Market and applications for carbon nanotubes in transistors and integrated circuits

- Table 103. Technology pathways for carbon nanotubes in transistors and integrated circuits

- Table 104. Demand for carbon nanotubes in transistors and integrated circuits, 2018 -2036

- Table 105. Product developers in carbon nanotubes in transistors and integrated circuits

- Table 106. Market and applications for carbon nanotubes in memory devices

- Table 107. Technology pathways scorecard for carbon nanotubes in memory devices

- Table 108. Demand for carbon nanotubes in memory devices, 2018 -2036

- Table 109. Product developers in carbon nanotubes for memory devices

- Table 110. Market and applications for carbon nanotubes in rubber and tires

- Table 111. Technology pathways scorecard for carbon nanotubes in rubber and tires

- Table 112. Demand for carbon nanotubes in rubber and tires (tons), 2018 -2036

- Table 113. Product developers in carbon nanotubes in rubber and tires

- Table 114. Market and applications for carbon nanotubes in automotive

- Table 115. Technology pathways for carbon nanotubes in automotive

- Table 116. Demand for carbon nanotubes in automotive (tons), 2018 -2036

- Table 117. Product developers in carbon nanotubes in the automotive market

- Table 118. Market and applications for carbon nanotubes in conductive inks

- Table 119. Comparative properties of conductive inks

- Table 120. Technology pathways for carbon nanotubes in conductive inks

- Table 121. Demand for carbon nanotubes in conductive ink (tons), 2018-2036

- Table 122. Product developers in carbon nanotubes for conductive inks

- Table 123. Technology pathways for carbon nanotubes in construction

- Table 124. Carbon nanotubes for cement

- Table 125. Carbon nanotubes for asphalt bitumen

- Table 126. CNT-concrete sustainability metrics

- Table 127. Environmental Impact Analysis

- Table 128. Load Distribution Properties

- Table 129. Demand for carbon nanotubes in construction (tons), 2018 -2036

- Table 130. Carbon nanotubes product developers in construction

- Table 131. Market and applications for carbon nanotubes in filtration

- Table 132. Comparison of CNT membranes with other membrane technologies

- Table 133. Technology pathways for carbon nanotubes in filtration

- Table 134. Demand for carbon nanotubes in filtration (tons), 2018 -2036

- Table 135. Carbon nanotubes companies in filtration

- Table 136. Market and applications for carbon nanotubes in fuel cells

- Table 137. Electrical conductivity of different catalyst supports compared to carbon nanotubes

- Table 138. Markets and applications for carbon nanotubes in fuel cells

- Table 139. Technology pathways for carbon nanotubes in fuel cells

- Table 140. Demand for carbon nanotubes in fuel cells (tons), 2018 -2036

- Table 141. Product developers in carbon nanotubes for fuel cells

- Table 142. Market and applications for carbon nanotubes in life sciences and medicine

- Table 143. Applications of carbon nanotubes in life sciences and biomedicine

- Table 144. Technology pathways for carbon nanotubes in drug delivery

- Table 145. Technology pathways for carbon nanotubes in imaging and diagnostics

- Table 146. Technology pathways for carbon nanotubes in medical implants

- Table 147. Technology pathways for carbon nanotubes in medical biosensors

- Table 148. Technology pathways for carbon nanotubes in woundcare

- Table 149. Demand for carbon nanotubes in life sciences and medical (tons), 2018 -2036

- Table 150. Product developers in carbon nanotubes for life sciences and biomedicine

- Table 151. Market and applications for carbon nanotubes in lubricants

- Table 152. Nanomaterial lubricant products

- Table 153. Technology pathways for carbon nanotubes in lubricants

- Table 154. Demand for carbon nanotubes in lubricants (tons), 2018 -2036

- Table 155. Product developers in carbon nanotubes for lubricants

- Table 156. Market and applications for carbon nanotubes in oil and gas

- Table 157. Technology pathways for carbon nanotubes in oil and gas

- Table 158. Demand for carbon nanotubes in oil and gas (tons), 2018 -2036

- Table 159. Product developers in carbon nanotubes for oil and gas

- Table 160. Market and applications for carbon nanotubes in paints and coatings

- Table 161. Markets for carbon nanotube coatings

- Table 162. Scorecard for carbon nanotubes in paints and coatings

- Table 163. Demand for carbon nanotubes in paints and coatings (tons), 2018 -2036

- Table 164. Product developers in carbon nanotubes for paints and coatings

- Table 165. Market and applications for carbon nanotubes in photovoltaics

- Table 166. Technology pathways for carbon nanotubes in photovoltaics

- Table 167. Demand for carbon nanotubes in photovoltaics (tons), 2018 -2036

- Table 168. Product developers in carbon nanotubes for solar

- Table 169. Market and applications for carbon nanotubes in sensors

- Table 170. Applications of carbon nanotubes in sensors

- Table 171. Technology pathways for carbon nanotubes in sensors

- Table 172. Demand for carbon nanotubes in sensors (tons), 2018 -2036

- Table 173. Product developers in carbon nanotubes for sensors

- Table 174. Market and applications for carbon nanotubes in smart and electronic textiles

- Table 175. Desirable functional properties for the textiles industry afforded by the use of nanomaterials

- Table 176. Applications of carbon nanotubes in smart and electronic textiles

- Table 177. Technology pathways for carbon nanotubes in smart textiles and apparel

- Table 178. Demand for carbon nanotubes in smart and electronic textiles. (tons), 2018 -2036

- Table 179. Carbon nanotubes product developers in smart and electronic textiles

- Table 180. Thermal conductivities (K) of common metallic, carbon, and ceramic fillers employed in TIMs

- Table 181. Thermal conductivity of CNT-based polymer composites

- Table 182. Thermal Conductivity By Filler

- Table 183. Market and applications for carbon nanotubes in thermal interface materials

- Table 184. Technology pathways for carbon nanotubes in TIMs

- Table 185. Demand for carbon nanotubes in thermal interface materials (tons), 2018 -2036

- Table 186. Market and applications for carbon nanotubes in power cables

- Table 187. Technology Pathways for Carbon Nanotubes in Power Cables to 2036

- Table 188. Properties of carbon nanotube paper

- Table 189. Chasm SWCNT products

- Table 190. Thomas Swan SWCNT production

- Table 191. Ex-producers of SWCNTs

- Table 192. SWCNTs distributors

List of Figures

- Figure 1. Market demand for carbon nanotubes by market, 2018 -2036 (metric tons)

- Figure 2. SWCNT market demand forecast (metric tons), 2018 -2036

- Figure 3. Schematic diagram of a multi-walled carbon nanotube (MWCNT)

- Figure 4. Schematic of single-walled carbon nanotube

- Figure 5. TIM sheet developed by Zeon Corporation

- Figure 6. Double-walled carbon nanotube bundle cross-section micrograph and model

- Figure 7. Vertically Aligned Carbon Nanotubes

- Figure 8. Schematic of a vertically aligned carbon nanotube (VACNT) membrane used for water treatment

- Figure 9. TEM image of FWNTs

- Figure 10. Schematic representation of carbon nanohorns

- Figure 11. TEM image of carbon onion

- Figure 12. Schematic of Boron Nitride nanotubes (BNNTs). Alternating B and N atoms are shown in blue and red

- Figure 13. Process flow chart from CNT thin film formation to device fabrication for solution and dry processes

- Figure 14. Schematic representation of methods used for carbon nanotube synthesis (a) Arc discharge (b) Chemical vapor deposition (c) Laser ablation (d) hydrocarbon flames

- Figure 15. Arc discharge process for CNTs

- Figure 16. Schematic of thermal-CVD method

- Figure 17. Schematic of plasma-CVD method

- Figure 18. CoMoCAT-R process

- Figure 19. Schematic for flame synthesis of carbon nanotubes (a) premixed flame (b) counter-flow diffusion flame (c) co-flow diffusion flame (d) inverse diffusion flame

- Figure 20. Schematic of laser ablation synthesis

- Figure 21. Electrochemical CO2 reduction products

- Figure 22. Methane pyrolysis process flow diagram (PFD)

- Figure 23. Amine-based absorption technology

- Figure 24. Pressure swing absorption technology

- Figure 25. Membrane separation technology

- Figure 26. Li-ion performance and technology timeline

- Figure 27. Theoretical energy densities of different rechargeable batteries

- Figure 28. Printed 1.5V battery

- Figure 29. Materials and design structures in flexible lithium ion batteries

- Figure 30. LiBEST flexible battery

- Figure 31. Schematic of the structure of stretchable LIBs

- Figure 32. Carbon nanotubes incorporated into flexible display

- Figure 33. Demand for carbon nanotubes in batteries (tons), 2018 -2036

- Figure 34. (A) Schematic overview of a flexible supercapacitor as compared to conventional supercapacitor

- Figure 35. Demand for carbon nanotubes in supercapacitors (tons), 2018 -2036

- Figure 36. Carbon nanotube Composite Overwrap Pressure Vessel (COPV)

- Figure 37. CSCNT Reinforced Prepreg

- Figure 38. Parts 3D printed from Mechnano's CNT ESD resin

- Figure 39. HeatCoat technology schematic

- Figure 40. Veelo carbon fiber nanotube sheet

- Figure 41. Thin film transistor incorporating CNTs

- Figure 42. Carbon nanotubes NRAM chip

- Figure 43. Strategic Elements' transparent glass demonstrator

- Figure 44. ZEON tires

- Figure 45. Schematic of CNTs as heat-dissipation sheets

- Figure 46. Nanotube inks

- Figure 47. Comparison of nanofillers with supplementary cementitious materials and aggregates in concrete

- Figure 48. CARESTREAM DRX-Revolution Nano Mobile X-ray System

- Figure 49. CSCNT Reinforced Prepreg

- Figure 50. Suntech/TCNT nanotube frame module

- Figure 51. AerNos CNT based gas sensor

- Figure 52. SmartNanotubes CNT based gas sensor

- Figure 53. (L-R) Surface of a commercial heatsink surface at progressively higher magnifications, showing tool marks that create a rough surface and a need for a thermal interface material

- Figure 54. Schematic of thermal interface materials used in a flip chip package

- Figure 55. AWN Nanotech water harvesting prototype

- Figure 56. Large transparent heater for LiDAR

- Figure 57. Carbonics, Inc.'s carbon nanotube technology

- Figure 58. Fuji carbon nanotube products

- Figure 59. Cup Stacked Type Carbon Nano Tubes schematic

- Figure 60. CSCNT composite dispersion

- Figure 61. Flexible CNT CMOS integrated circuits with sub-10 nanoseconds stage delays

- Figure 62. Koatsu Gas Kogyo Co. Ltd CNT product

- Figure 63. Li-S Energy 20-layer battery cell utilising semi-solid state lithium sulfur battery technology

- Figure 64. Test specimens fabricated using MECHnano's radiation curable resins modified with carbon nanotubes

- Figure 65. NAWACap

- Figure 66. Hybrid battery powered electrical motorbike concept

- Figure 67. NAWAStitch integrated into carbon fiber composite

- Figure 68. Schematic illustration of three-chamber system for SWCNH production

- Figure 69. TEM images of carbon nanobrush

- Figure 70. CNT film

- Figure 71. Shinko Carbon Nanotube TIM product

- Figure 72. VB Series of TIMS from Zeon

- Figure 73. Vertically aligned CNTs on foil, double-sided coating

- Figure 74. Schematic of a fluidized bed reactor which is able to scale up the generation of SWNTs using the CoMoCAT process

- Figure 75. Carbon nanotube paint product

- Figure 76. MEIJO eDIPS product

- Figure 77. HiPCO-R Reactor

- Figure 78. Smell iX16 multi-channel gas detector chip

- Figure 79. The Smell Inspector

- Figure 80. Toray CNF printed RFID

- Figure 81. Internal structure of carbon nanotube adhesive sheet

- Figure 82. Carbon nanotube adhesive sheet

The global carbon nanotubes (CNTs) market represents one of the most dynamic and rapidly expanding segments of the advanced materials industry, with market valuations projected to grow from >$5 billion to more than $25 billion by 2036. This exceptional growth trajectory reflects the transformative potential of these cylindrical carbon structures, which possess extraordinary mechanical, electrical, and thermal properties that are revolutionizing multiple industries across the next decade.

The CNT market is primarily divided into two main categories: multi-walled carbon nanotubes (MWCNTs) and single-walled carbon nanotubes (SWCNTs). By 2036, MWCNTs are projected to maintain their dominance, driven by their superior mechanical strength, electrical conductivity, and cost-effectiveness in large-scale applications. SWCNTs, while commanding premium pricing for specialized applications, are expected to reach $2.0 billion by 2036, finding critical roles in next-generation electronics, quantum computing, and advanced biomedical applications where their unique single-layer structure provides unmatched performance characteristics.

Energy storage emerges as the fastest-growing sector, driven by the global transition to electric vehicles and renewable energy infrastructure. CNTs serve as superior conductive additives in lithium-ion batteries, creating more effective electrical percolation networks at lower weight loadings than conventional carbons, while enabling faster charge transfer and higher battery capacity through their exceptional electrical conductivity and lightweight nature. The automotive industry's accelerating shift toward electrification, coupled with grid-scale energy storage demands, positions CNTs as essential materials for next-generation battery technologies.

CNT-reinforced materials are revolutionizing aerospace and automotive applications through lightweight structural components that maintain superior strength, enabling aircraft manufacturers to achieve significant weight reductions while enhancing fuel efficiency and safety. In the construction industry, CNT-enhanced concrete and coatings provide unprecedented durability and functionality. Electronics applications showcase CNTs' potential in flexible displays, transparent conductive films, sensors, and emerging quantum computing technologies. Their unique one-dimensional structure and tunable electronic properties make them invaluable for next-generation transistors, memory devices, and wearable electronics.

The production landscape is undergoing fundamental transformation, with chemical vapor deposition (CVD) technology maintaining its dominance due to scalability and cost-effectiveness. By 2036, advanced manufacturing techniques including floating catalyst CVD, plasma-enhanced processes, and emerging green synthesis methods using captured CO2 and waste feedstocks are expected to revolutionize production economics and environmental sustainability. Major capacity expansions by industry leaders like LG Chem and OCSiAl are scaling production to meet demand growth across battery, electronics, and composite applications. The integration of artificial intelligence and machine learning in CNT synthesis is enabling unprecedented control over nanotube chirality, diameter, and properties, opening pathways to application-specific CNT variants that were previously impossible to produce at scale.

"The CNT market's future trajectory through 2036" is intrinsically linked to mega-trends including the global energy transition, space exploration initiatives, quantum computing development, and advanced manufacturing technologies. As production scales increase exponentially and costs decrease through technological breakthroughs, carbon nanotubes are positioned to become fundamental building blocks for next-generation technologies, bridging the gap between laboratory innovation and commercial reality across aerospace, automotive, energy, electronics, and emerging biotechnology sectors. The convergence of CNTs with artificial intelligence, robotics, and sustainable manufacturing represents a paradigm shift toward intelligent materials that will define the technological landscape of the next decade.

Report contents include:

- Market Size & Forecasts:

- Global carbon nanotubes market projections from 2026-2035 with detailed volume (metric tons) and revenue analysis

- Comprehensive segmentation by product type (MWCNTs, SWCNTs, DWCNTs, VACNTs, FWCNTs)

- Regional market analysis covering Asia Pacific, North America, Europe, and emerging markets

- Application-specific demand forecasts across 22 major end-use sectors

- Technology & Production Analysis:

- Detailed evaluation of synthesis methods including CVD, arc discharge, laser ablation, and emerging green production technologies

- Production capacity analysis of manufacturers with current and planned expansions Breakthrough technologies in controlled growth, hybrid CNTs, and carbon capture-derived production

- Comparative assessment of manufacturing costs, scalability, and quality control

- Applications & Market Opportunities:

- Energy storage systems: Li-ion batteries, supercapacitors, and next-generation energy technologies

- Electronics: transistors, memory devices, flexible displays, and quantum computing applications

- Composites & materials: aerospace, automotive, construction, and high-performance polymers

- Emerging markets: thermal interface materials, sensors, filtration, and biomedical applications

- Competitive Intelligence:

- Comprehensive profiles of 180+ companies across the value chain

- Strategic partnerships, licensing agreements, and commercial collaborations

- Patent landscape analysis and intellectual property trends

- Technology readiness levels and commercialization timelines

- Regulatory & Safety Framework:

- Global regulations governing nanomaterials production and applications

- Safety protocols, exposure monitoring, and environmental impact assessments

- Compliance requirements across major markets and industry standards

- Pricing & Market Dynamics:

- Detailed pricing analysis for MWCNTs, SWCNTs, and specialty variants

- Cost structure evolution and price forecasting through 2035

- Supply chain analysis and raw material availability

- Market challenges and growth drivers identification

The report features over 180 company profiles including 3D Strong, Birla Carbon, BNNano, BNNT, BNNT Technology Limited, Brewer Science, Bufa, C12, Cabot Corporation, Canatu, Carbice Corporation, Carbon Corp, Carbon Fly, Carbonova, CENS Materials, CHASM Advanced Materials, DexMat, Huntsman (Miralon), JEIO, LG Energy Solution, Mechnano, Meijo Nano Carbon, Molecular Rebar Design LLC, Nano-C, Nanocyl, Nanoramic Laboratories, NanoRial, NAWA Technologies, Nemo Nanomaterials, NEO Battery Materials, NoPo Nanotechnologies, NTherma, OCSiAl, PARC (Sensors), Raymor Industries, Samsung SDI (Battery), Shinko Carbon Nanotube Thermal Interface Materials, SmartNanotubes Technologies, Sumitomo Electric (Carbon Nanotube), TrimTabs, UP Catalyst, Wootz, Zeon, and Zeta Energy.

Strategic Insights Include:

- Market entry strategies for new participants and expansion opportunities for existing players

- Investment analysis and ROI projections across application segments

- Technology roadmaps and innovation pathways

- Risk assessment and mitigation strategies

- Future market scenarios and disruptive technology impacts

TABLE OF CONTENTS

1. EXECUTIVE SUMMARY

- 1.1. The global market for carbon nanotubes

- 1.1.1. Multi-walled carbon nanotubes (MWCNTs)

- 1.1.1.1. Applications

- 1.1.1.2. Main market players

- 1.1.1.3. MWCNT production capacities, current and planned

- 1.1.1.4. Target market for producers

- 1.1.1.5. Market demand for carbon nanotubes by market

- 1.1.2. Single-walled carbon nanotubes (SWCNTs)

- 1.1.2.1. Applications

- 1.1.2.2. Production capacities current and planned

- 1.1.2.3. Global SWCNT market consumption

- 1.1.3. Double, Few and Thin-Walled CNTs

- 1.1.1. Multi-walled carbon nanotubes (MWCNTs)

- 1.2. Market Outlook 2025 and beyond

- 1.3. Commercial CNT-based products

- 1.4. Market Challenges

- 1.5. CNTs Market Analysis

- 1.5.1. Manufacturing Landscape: From Laboratory to Industrial Scale

- 1.5.2. Market Dynamics: Supply, Demand, and Competitive Forces

- 1.5.3. Energy Storage: The Catalyst for Market Transformation

- 1.5.4. Polymer Enhancement: Multifunctional Material Solutions

- 1.5.5. Emerging Applications

- 1.5.6. Competitive Dynamics

- 1.5.7. Technology Roadmap and Future Developments

- 1.5.8. Challenges and Limitations: Addressing Market Barriers

- 1.5.9. Market Evolution and Growth Projections

- 1.5.10. Leading Industry Players

- 1.5.10.1. LG Chem (South Korea)

- 1.5.10.2. Jiangsu Cnano Technology (China)

- 1.5.10.3. OCSiAl Group (Luxembourg/Russia)

- 1.5.10.4. Cabot Corporation (United States)

- 1.5.10.5. JEIO Co., Ltd. (South Korea)

- 1.5.10.6. CHASM Advanced Materials (United States)

- 1.6. CNT Pricing

2. OVERVIEW OF CARBON NANOTUBES

- 2.1. Properties

- 2.2. Comparative properties of CNTs

- 2.3. Carbon nanotube materials

- 2.3.1. Variations within CNTs

- 2.3.2. High Aspect Ratio CNTs

- 2.3.3. Dispersion technology

- 2.3.4. Multi-walled nanotubes (MWCNT)

- 2.3.4.1. Properties

- 2.3.4.2. Applications

- 2.3.5. Single-wall carbon nanotubes (SWCNT)

- 2.3.5.1. Properties

- 2.3.5.2. Applications

- 2.3.5.3. Comparison between MWCNTs and SWCNTs

- 2.3.6. Double-walled carbon nanotubes (DWNTs)

- 2.3.6.1. Properties

- 2.3.6.2. Applications

- 2.3.7. Vertically aligned CNTs (VACNTs)

- 2.3.7.1. Properties

- 2.3.7.2. Synthesis of VACNTs

- 2.3.7.3. Applications

- 2.3.7.4. VA-CNT Companies

- 2.3.8. Few-walled carbon nanotubes (FWNTs)

- 2.3.8.1. Properties

- 2.3.8.2. Applications

- 2.3.9. Carbon Nanohorns (CNHs)

- 2.3.9.1. Properties

- 2.3.9.2. Applications

- 2.3.10. Carbon Onions

- 2.3.10.1. Properties

- 2.3.10.2. Applications

- 2.3.11. Boron Nitride nanotubes (BNNTs)

- 2.3.11.1. Properties

- 2.3.11.2. Manufacturing

- 2.3.11.3. Pricing

- 2.3.11.4. Applications

- 2.3.11.5. Companies

- 2.4. Intermediate products

- 2.4.1. Definitions

- 2.4.2. CNT Sheets

- 2.4.2.1. Overview

- 2.4.2.2. Applications

- 2.4.2.3. Market players

- 2.4.3. CNT Yarns

- 2.4.3.1. Overview

- 2.4.3.2. Properties

- 2.4.3.3. Applications

- 2.4.3.4. Manufacturing Methods

- 2.4.3.5. Market players

- 2.4.4. CNT Films

- 2.4.5. CNT Paper/Mats

- 2.4.6. CNT Coatings/Inks

- 2.4.7. CNT Array Strips

3. CARBON NANOTUBE SYNTHESIS AND PRODUCTION

- 3.1. Arc discharge synthesis

- 3.2. Chemical Vapor Deposition (CVD)

- 3.2.1. Thermal CVD

- 3.2.2. Plasma enhanced chemical vapor deposition (PECVD)

- 3.2.3. Emerging processes

- 3.3. High-pressure carbon monoxide synthesis

- 3.3.1. High Pressure CO (HiPco)

- 3.3.2. CoMoCAT

- 3.4. Combustion synthesis

- 3.5. Controlled growth of SWCNTs

- 3.6. Hybrid CNTs

- 3.7. Flame synthesis

- 3.8. Laser ablation synthesis

- 3.9. Vertically aligned nanotubes production

- 3.10. Silane solution method

- 3.11. By-products from carbon capture

- 3.11.1. CO2 derived products via electrochemical conversion

- 3.11.2. CNTs from green or waste feedstock

- 3.11.3. Advanced carbons from green or waste feedstocks

- 3.11.4. Captured CO2as a CNT feedstock

- 3.11.5. Electrolysis in molten salts

- 3.11.6. Methane pyrolysis

- 3.11.7. Carbon separation technologies

- 3.11.7.1. Absorption capture

- 3.11.7.2. Adsorption capture

- 3.11.7.3. Membranes

- 3.11.8. Producers

- 3.12. Advantages and disadvantages of CNT synthesis methods

4. REGULATIONS

- 4.1. Regulation and safety of CNTs

- 4.2. Global regulations

- 4.3. Global Regulatory Bodies for Nanomaterials

- 4.4. Harmonized Classification of MWCNTs

- 4.5. Gaps in the Current Regulations

- 4.6. CNT Safety and Exposure

5. CARBON NANOTUBES PATENTS

6. CARBON NANOTUBES PRICING

- 6.1. MWCNTs

- 6.2. SWCNTs and FWCNTs

7. MARKETS FOR CARBON NANOTUBES

- 7.1. ENERGY STORAGE: BATTERIES

- 7.1.1. Market overview

- 7.1.2. The global energy storage market

- 7.1.3. Types of lithium battery

- 7.1.4. Li-ion performance and technology timeline

- 7.1.5. Cell energy

- 7.1.6. Applications

- 7.1.6.1. Carbon Nanotubes in Li-ion Batteries

- 7.1.6.2. CNTs in Lithium-sulfur (Li-S) batteries

- 7.1.6.3. CNTs in Nanomaterials in Sodium-ion batteries

- 7.1.6.4. CNTs in Nanomaterials in Lithium-air batteries

- 7.1.6.5. CNTs in Flexible and stretchable batteries

- 7.1.7. Conductive Additive Mechanisms

- 7.1.8. Electron transport enhancement

- 7.1.9. Interface engineering

- 7.1.10. Stability mechanisms

- 7.1.11. Improved performance at higher C-rate

- 7.1.12. Carbon nanotube mechanical properties

- 7.1.13. Dispersion quality

- 7.1.14. Hybrid Conductive Carbon Materials

- 7.1.15. Silicon anode implementation

- 7.1.16. SWCNTs

- 7.1.17. Manufacturing Integration

- 7.1.17.1. Process optimization

- 7.1.17.2. Quality control

- 7.1.17.3. Scale-up challenges

- 7.1.18. Cost-Performance Analysis

- 7.1.18.1. Cost comparison with alternatives

- 7.1.18.2. Value proposition

- 7.1.19. Performance benefits quantification

- 7.1.20. Technology benchmarking

- 7.1.21. Technology pathways

- 7.1.22. Global market, historical and forecast to 2036

- 7.1.22.1. Revenues

- 7.1.22.2. Tons

- 7.1.23. Product developers

- 7.2. ENERGY STORAGE: SUPERCAPACITORS

- 7.2.1. Market overview

- 7.2.2. Supercapacitors overview

- 7.2.3. Supercapacitors vs batteries

- 7.2.4. Supercapacitor technologies

- 7.2.5. Benefits

- 7.2.6. Challenges

- 7.2.7. Applications

- 7.2.7.1. CNTs in Supercapacitor electrodes

- 7.2.7.2. CNTs in Flexible and stretchable supercapacitors

- 7.2.8. Technology pathways

- 7.2.9. Global market in tons, historical and forecast to 2036

- 7.2.10. Product developers

- 7.3. POLYMER ADDITIVES AND ELASTOMERS

- 7.3.1. Market overview

- 7.3.2. Nanocarbons in polymer composites

- 7.3.3. Incorporating CNTs in composites

- 7.3.4. Conductive composites

- 7.3.4.1. MWCNTs

- 7.3.4.2. Applications

- 7.3.4.3. Products

- 7.3.4.4. Properties

- 7.3.4.5. Conductive epoxy

- 7.3.5. Fiber-based polymer composite parts

- 7.3.5.1. Technology pathways

- 7.3.5.2. Applications

- 7.3.6. Metal-matrix composites

- 7.3.6.1. CNT copper composites

- 7.3.7. Elastomers

- 7.3.7.1. Carbon nanotube integration

- 7.3.7.2. Silicone elastomers

- 7.3.8. Global market in tons, historical and forecast to 2036

- 7.3.9. Product developers

- 7.4. 3D PRINTING

- 7.4.1. Market overview

- 7.4.2. Applications

- 7.4.3. Global market in tons, historical and forecast to 2036

- 7.4.4. Product developers

- 7.5. ADHESIVES

- 7.5.1. Market overview

- 7.5.2. Applications

- 7.5.3. Technology pathways

- 7.5.4. Global market in tons, historical and forecast to 2036

- 7.5.5. Product developers

- 7.6. AEROSPACE

- 7.6.1. Market overview

- 7.6.2. Applications

- 7.6.3. Technology pathways

- 7.6.4. Global market in tons, historical and forecast to 2036

- 7.6.5. Product developers

- 7.7. ELECTRONICS

- 7.7.1. WEARABLE & FLEXIBLE ELECTRONICS AND DISPLAYS

- 7.7.1.1. Market overview

- 7.7.1.2. Technology pathways

- 7.7.1.3. Applications

- 7.7.1.4. Global market, historical and forecast to 2036

- 7.7.1.5. Product developers

- 7.7.2. TRANSISTORS AND INTEGRATED CIRCUITS

- 7.7.2.1. Market overview

- 7.7.2.2. Applications

- 7.7.2.3. Technology pathways

- 7.7.2.4. Global market, historical and forecast to 2036

- 7.7.2.5. Product developers

- 7.7.3. MEMORY DEVICES

- 7.7.3.1. Market overview

- 7.7.3.2. Technology pathways

- 7.7.3.3. Global market in tons, historical and forecast to 2036

- 7.7.3.4. Product developers

- 7.7.1. WEARABLE & FLEXIBLE ELECTRONICS AND DISPLAYS

- 7.8. QUANTUM COMPUTING

- 7.8.1. CNTs in Quantum computers

- 7.8.2. CNT qubits

- 7.9. RUBBER AND TIRES

- 7.9.1. Market overview

- 7.9.2. Applications

- 7.9.2.1. Rubber additives

- 7.9.2.2. Sensors

- 7.9.3. Technology pathways

- 7.9.4. Global market in tons, historical and forecast to 2036

- 7.9.5. Product developers

- 7.10. AUTOMOTIVE

- 7.10.1. Market overview

- 7.10.2. Applications

- 7.10.3. Technology pathways

- 7.10.4. Global market in tons, historical and forecast to 2036

- 7.10.5. Product developers

- 7.11. CONDUCTIVE INKS

- 7.11.1. Market overview

- 7.11.2. Applications

- 7.11.3. Technology pathways

- 7.11.4. Global market in tons, historical and forecast to 2036

- 7.11.5. Product developers

- 7.12. CONSTRUCTION

- 7.12.1. Market overview

- 7.12.2. Technology pathways

- 7.12.3. Applications

- 7.12.3.1. Cement

- 7.12.3.2. Asphalt bitumen

- 7.12.3.3. Green Construction

- 7.12.3.4. Concrete Strengthening Mechanisms

- 7.12.4. Global market in tons, historical and forecast to 2036

- 7.12.5. Product developers

- 7.13. FILTRATION

- 7.13.1. Market overview

- 7.13.2. Applications

- 7.13.3. Technology pathways

- 7.13.4. Global market in tons, historical and forecast to 2036

- 7.13.5. Product developers

- 7.14. FUEL CELLS

- 7.14.1. Market overview

- 7.14.2. Applications

- 7.14.3. Technology pathways

- 7.14.4. Global market in tons, historical and forecast to 2036

- 7.14.5. Product developers

- 7.15. LIFE SCIENCES AND MEDICINE

- 7.15.1. Market overview

- 7.15.2. Applications

- 7.15.3. Technology pathways

- 7.15.3.1. Drug delivery

- 7.15.3.2. Imaging and diagnostics

- 7.15.3.3. Implants

- 7.15.3.4. Medical biosensors

- 7.15.3.5. Woundcare

- 7.15.4. Global market in tons, historical and forecast to 2036

- 7.15.5. Product developers

- 7.16. LUBRICANTS

- 7.16.1. Market overview

- 7.16.2. Applications

- 7.16.3. Technology pathways

- 7.16.4. Global market in tons, historical and forecast to 2036

- 7.16.5. Product developers

- 7.17. OIL AND GAS

- 7.17.1. Market overview

- 7.17.2. Applications

- 7.17.3. Technology pathways

- 7.17.4. Global market in tons, historical and forecast to 2036

- 7.17.5. Product developers

- 7.18. PAINTS AND COATINGS

- 7.18.1. Market overview

- 7.18.2. Applications

- 7.18.2.1. Anti-corrosion coatings

- 7.18.2.2. Conductive coatings

- 7.18.2.3. EMI Shielding

- 7.18.3. Technology pathways

- 7.18.4. Global market in tons, historical and forecast to 2036

- 7.18.5. Product developers

- 7.19. PHOTOVOLTAICS

- 7.19.1. Technology pathways

- 7.19.2. Global market in tons, historical and forecast to 2036

- 7.19.3. Product developers

- 7.20. SENSORS

- 7.20.1. Market overview

- 7.20.2. Applications

- 7.20.2.1. Gas sensors

- 7.20.2.2. Printed humidity sensors

- 7.20.2.3. LiDAR sensors

- 7.20.2.4. Oxygen sensors

- 7.20.3. Technology pathways

- 7.20.4. Global market in tons, historical and forecast to 2036

- 7.20.5. Product developers

- 7.21. SMART AND ELECTRONIC TEXTILES

- 7.21.1. Market overview

- 7.21.2. Applications

- 7.21.3. Technology pathways

- 7.21.4. Global market in tons, historical and forecast to 2036

- 7.21.5. Product developers

- 7.22. THERMAL INTERFACE MATERIALS

- 7.22.1. Market overview

- 7.22.2. Carbon-based TIMs

- 7.22.2.1. VACNT TIMs

- 7.22.2.2. MWCNTs

- 7.22.2.3. SWCNTS

- 7.22.2.4. Boron Nitride nanotubes (BNNTs)

- 7.22.3. Technology pathways

- 7.22.4. Global market in tons, historical and forecast to 2036

- 7.23. POWER CABLES

- 7.23.1. Market overview

- 7.23.2. Technology pathways