|

|

市場調査レポート

商品コード

1696274

医療機器プログラム(SaMD)の日本市場(2025年~2033年)Japan Software as a Medical Device Market - 2025-2033 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 医療機器プログラム(SaMD)の日本市場(2025年~2033年) |

|

出版日: 2025年03月25日

発行: DataM Intelligence

ページ情報: 英文 180 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

日本の医療機器プログラム(SaMD)の市場規模は、2024年に1,955万米ドルに達し、2033年までに9,620万米ドルに達すると予測され、予測期間の2025年~2033年にCAGRで17.3%の成長が見込まれます。

医療機器プログラム(SaMD)は医療目的で設計され、疾病診断、治療の推奨、患者モニタリング、臨床意思決定を可能にします。SaMDはAI、機械学習、クラウドコンピューティングなどの先進技術を利用して、医療提供や患者の転帰を改善します。SaMDは、スマートフォン、タブレット、クラウドベースのシステムなどのプラットフォーム上で独立して動作するため、非常にアクセスしやすく、拡張性に優れています。

市場力学

促進要因と抑制要因

医療におけるクラウドコンピューティングとIoTの統合の拡大

日本の医療機器プログラム(SaMD)市場は、クラウドコンピューティングとIoTの統合によって大きく変貌しつつあります。クラウドベースのプラットフォームは、医療データの安全な保存、リアルタイムアクセス、先進のアナリティクスを提供し、効率性と意思決定を向上させます。IoTデバイスは、患者の継続的なモニタリング、遠隔診断、疾患の早期発見を可能にし、通院回数を減らして患者の転帰を改善します。クラウドコンピューティングとIoTのシナジーにより、イノベーションが加速し、市場機会が拡大し、医療へのアクセスが向上しています。

高齢患者や医療従事者の限られたデジタルリテラシー

日本の医療機器プログラム(SaMD)ソリューションの採用は、高齢患者や医療従事者の限られたデジタルリテラシーによる課題に直面しています。高齢化社会はデジタルヘルスアプリケーションを使いこなすのに苦労しており、遠隔モニタリングやAIによる診断の利点が制限されています。また、従来の医療提供者は、SaMDツールをワークフローに統合するのに苦労している可能性があります。このようなデジタル技術の習熟不足は、新技術への抵抗、不適切なソフトウェア利用、デジタル医療ソリューションへの信頼の低下につながり、市場の成長を鈍化させます。

当レポートでは、日本の医療機器プログラム(SaMD)市場について調査し、市場力学、地域とセグメントの分析、競合情勢、企業プロファイルなどを提供しています。

目次

第1章 市場のイントロダクションと範囲

第2章 エグゼクティブインサイトと重要事項

- 市場のハイライトと戦略的重要事項

- 主要動向と将来の予測

- 抜粋:用途別

- 抜粋:適応症別

第3章 市場力学

- 影響要因

- 促進要因

- 医療におけるクラウドコンピューティングとIoTの統合の拡大

- クラウドコンピューティングの進歩

- 抑制要因

- 高齢患者や医療従事者の限られたデジタルリテラシー

- 支援的な規制枠組み

- 機会

- ヘルステックスタートアップへの投資増加

- 影響の分析

- 促進要因

第4章 戦略的考察と産業の見通し

- マーケットリーダーとパイオニア

- 新興のパイオニアと著名企業

- 確立されたリーダーと最大の売上を持つブランド

- マーケットリーダーと確立された製品

- CXOの視点

- 最新の発展とブレークスルー

- ケーススタディ/進行中の研究

- 規制と償還の情勢

- ポーターのファイブフォース分析

- サプライチェーン分析

- SWOT分析

- アンメットニーズとギャップ

- 市場参入と拡大に対し推奨される戦略

- シナリオ分析:ベストケース、ベースケース、ワーストケースの予測

- 価格分析と価格動向

- キーオピニオンリーダー

第5章 用途別

- 疾病管理

- 診断

- 治療モニタリング

- 予測健康分析

- その他

第6章 適応症別

- 糖尿病

- メンタルヘルス

- 腫瘍

- 心血管

- 呼吸器疾患

- その他

第7章 競合情勢と市場ポジショニング

- 競合情勢の概要と主要市場企業

- 市場シェア分析とポジショニングマトリクス

- 戦略的パートナーシップ、合併・買収

- 製品ポートフォリオとイノベーションにおける主な発展

- 企業ベンチマーク

第8章 企業プロファイル

- Japan Medical Device Corporation

- Nipro Corporation

- Micron, Inc

- Olympus Medical Systems

- Anaut Inc

第9章 前提条件と調査手法

第10章 付録

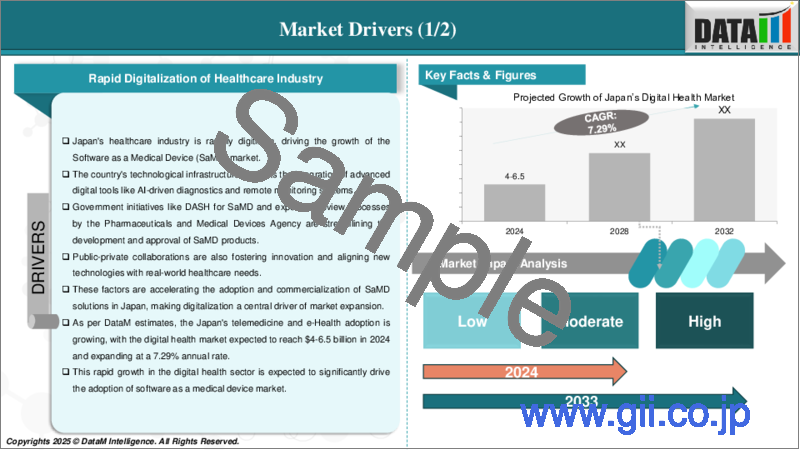

The Japan software as a medical device market reached US$ 19.55 million in 2024 and is expected to reach US$ 96.20 million by 2033, growing at a CAGR of 17.3% during the forecast period 2025-2033.

Software as a Medical Device (SaMD) is designed for medical purposes, enabling disease diagnosis, treatment recommendations, patient monitoring, and clinical decision-making. It uses advanced technologies like AI, machine learning, and cloud computing to improve healthcare delivery and patient outcomes. SaMD operates independently on platforms like smartphones, tablets, or cloud-based systems, making it highly accessible and scalable.

Market Dynamics: Drivers & Restraints

Increasing Integration of Cloud Computing and the Internet of Things (IoT) in Healthcare

Japan's Software as a Medical Device (SaMD) market is being significantly transformed by the integration of cloud computing and IoT. Cloud-based platforms offer secure storage, real-time access, and advanced analytics for medical data, improving efficiency and decision-making. IoT devices enable continuous patient monitoring, remote diagnostics, and early disease detection, reducing hospital visits and improving patient outcomes. The synergy between cloud computing and IoT is accelerating innovation, expanding market opportunities, and improving healthcare accessibility.

Limited Digital Literacy Among Elderly Patients and Healthcare Professionals

The adoption of Software as a Medical Device (SaMD) solution in Japan faces challenges due to limited digital literacy among elderly patients and healthcare professionals. The aging population struggles with digital health applications, limiting the benefits of remote monitoring and AI-driven diagnostics. Traditional healthcare providers may also struggle to integrate SaMD tools into their workflows. This lack of digital proficiency can lead to resistance to new technologies, improper software utilization, and reduced trust in digital healthcare solutions, slowing the market's growth.

Segment Analysis

The Japan software as a medical device market is segmented based on application and indication.

Application:

The diagnostics from application segment is expected to dominate the software as a medical device market with the highest market share

Diagnostics is the process of identifying diseases, conditions, or medical abnormalities through various tests, assessments, and analyses. It includes imaging, laboratory testing, and clinical evaluations. Advancements in digital health now include AI-driven and software-based solutions, enhancing accuracy and efficiency. Effective diagnostics are crucial for preventive care, early intervention, and improving patient outcomes, guiding treatment decisions.

The diagnostics segment in this market is driven by the need for early disease detection, chronic conditions, AI-driven imaging, and data analytics. Remote diagnostics and telemedicine expansion improve healthcare accessibility. Regulatory approvals for AI-powered tools and cloud-based platforms support market growth.

The demand for cost-effective, accurate diagnostic solutions is driving SaMD adoption in precision medicine and personalized healthcare. Several companies are forming strategic partnerships to expand their diagnostic businesses. For instance, in January 2025, Monitor Corporation, a Korean medical AI company, partnered with Japanese digital healthcare provider Doctor-NET to sell its lung cancer diagnosis software in Japan. The AI-powered tool, MONCAD CTLN, aids radiologists in detecting lung cancer using chest CT scans. Doctor-NET has obtained manufacturing and sales certification for the software in Japan.

Competitive Landscape

The major Japan players in the software as a medical device market include Japan Medical Device Corporation, Nipro Corporation, Micron, Inc., Olympus Medical Systems and Anaut Inc. among others.

Key Developments

- In May 2024, Anaut Inc., a surgical support software developer, received regulatory approval for its innovative medical device, "Eureka a," from the Ministry of Health, Labour and Welfare in Japan. The device, designed with advanced artificial intelligence, is set to revolutionize surgical practices.

Why Purchase the Report?

- Technological Innovations: Reviews ongoing clinical trials, product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyzes product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The Japan software as a medical device market report delivers a detailed analysis with 70 key tables, more than 65 visually impactful figures, and 159 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2024

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Application & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.

Table of Contents

1. Market Introduction and Scope

- 1.1. Objectives of the Report

- 1.2. Report Coverage & Definitions

- 1.3. Report Scope

2. Executive Insights and Key Takeaways

- 2.1. Market Highlights and Strategic Takeaways

- 2.2. Key Trends and Future Projections

- 2.3. Snippet by Application

- 2.4. Snippet by Indication

3. Dynamics

- 3.1. Impacting Factors

- 3.1.1. Drivers

- 3.1.1.1. Increasing Integration of Cloud Computing and the Internet of Things (IoT) In Healthcare

- 3.1.1.2. Advancements in Cloud Computing

- 3.1.2. Restraints

- 3.1.2.1. Limited Digital Literacy Among Elderly Patients and Healthcare Professionals

- 3.1.2.2. Supportive Regulatory Framework

- 3.1.3. Opportunity

- 3.1.3.1. Increased Investment in HealthTech Startups

- 3.1.4. Impact Analysis

- 3.1.1. Drivers

4. Strategic Insights and Industry Outlook

- 4.1. Market Leaders and Pioneers

- 4.1.1. Emerging Pioneers and Prominent Players

- 4.1.2. Established leaders with largest selling Brand

- 4.1.3. Market leaders with established Product

- 4.2. CXO Perspectives

- 4.3. Latest Developments and Breakthroughs

- 4.4. Case Studies/Ongoing Research

- 4.5. Regulatory and Reimbursement Landscape

- 4.6. Porter's Five Force Analysis

- 4.7. Supply Chain Analysis

- 4.8. SWOT Analysis

- 4.9. Unmet Needs and Gaps

- 4.10. Recommended Strategies for Market Entry and Expansion

- 4.11. Scenario Analysis: Best-Case, Base-Case, and Worst-Case Forecasts

- 4.12. Pricing Analysis and Price Dynamics

- 4.13. Key Opinion Leaders

5. By Application

- 5.1. Introduction

- 5.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 5.1.2. Market Attractiveness Index, By Application

- 5.2. Disease Management*

- 5.2.1. Introduction

- 5.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 5.3. Diagnostics

- 5.4. Treatment Monitoring

- 5.5. Predictive Health Analytics

- 5.6. Others

6. By Indication

- 6.1. Introduction

- 6.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Indication

- 6.1.2. Market Attractiveness Index, By Indication

- 6.2. Diabetes*

- 6.2.1. Introduction

- 6.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 6.3. Mental Health

- 6.4. Oncology

- 6.5. Cardiovascular

- 6.6. Respiratory Conditions

- 6.7. Others

7. Competitive Landscape and Market Positioning

- 7.1. Competitive Overview and Key Market Players

- 7.2. Market Share Analysis and Positioning Matrix

- 7.3. Strategic Partnerships, Mergers & Acquisitions

- 7.4. Key Developments in Product Portfolios and Innovations

- 7.5. Company Benchmarking

8. Company Profiles

- 8.1. Japan Medical Device Corporation*

- 8.1.1. Company Overview

- 8.1.2. Product Portfolio

- 8.1.2.1. Product Description

- 8.1.2.2. Product Key Performance Indicators (KPIs)

- 8.1.2.3. Historic and Forecasted Product Sales

- 8.1.2.4. Product Sales Volume

- 8.1.3. Financial Overview

- 8.1.3.1. Company Revenue's

- 8.1.3.2. Geographical Revenue Shares

- 8.1.3.3. Revenue Forecasts

- 8.1.4. Key Developments

- 8.1.4.1. Mergers & Acquisitions

- 8.1.4.2. Key Product Development Activities

- 8.1.4.3. Regulatory Approvals, etc.

- 8.1.5. SWOT Analysis

- 8.2. Nipro Corporation

- 8.3. Micron, Inc

- 8.4. Olympus Medical Systems

- 8.5. Anaut Inc

LIST NOT EXHAUSTIVE

9. Assumption and Research Methodology

- 9.1. Data Collection Methods

- 9.2. Data Triangulation

- 9.3. Forecasting Techniques

- 9.4. Data Verification and Validation

10. Appendix

- 10.1. About Us and Services

- 10.2. Contact Us