|

|

市場調査レポート

商品コード

1529362

エッジAIプロセッサーの世界市場:2024-2031年Global Edge AI Processor Market - 2024-2031 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| エッジAIプロセッサーの世界市場:2024-2031年 |

|

出版日: 2024年08月06日

発行: DataM Intelligence

ページ情報: 英文 213 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

世界のエッジAIプロセッサー市場は、2023年に22億米ドルに達し、2031年には83億米ドルに達すると予測され、予測期間2024-2031年のCAGRは18.6%で成長する見込みです。

エッジコンピューティング環境、特にバッテリー駆動のデバイスやIoTセンサーでは、エネルギー効率が極めて重要です。エッジAIプロセッサメーカーは、バッテリ寿命を延ばし運用コストを削減するため、エネルギー効率の高いアーキテクチャと低消費電力設計の開発にますます注力しています。エネルギー効率の高いエッジAIプロセッサーは、デバイスのランタイムの延長を可能にし、エッジコンピューティングソリューションの持続可能な展開をサポートします。

例えば、2024年1月12日、e-con Systemsと最先端のAI半導体企業であるAmbarella社は、協業ベンチャーであるe-con Robotics Computing Platform(eRCP)を発表するパートナーシップを発表しました。この革新的なプラットフォームは、Ambarellaの最先端AIシステムオンチップ(SoC)であるCV72Sを中心に設計されており、ロボット分野のニーズに特化しています。急速に進化するロボット分野では、迅速なプロトタイピングと優れた性能の両立が不可欠です。AmbarellaのユーザーフレンドリーなCooper Developer Platformは、ビジョン機能とワットあたりのAI性能を提供します。

北米では、プライバシーとセキュリティを強化する必要性から、さまざまな業界でエッジコンピューティング・デバイスの需要が高まっています。企業はエッジコンピューティング機能を実現するためにエッジAIプロセッサーを導入しており、スマートシティ、産業用IoT、ヘルスケアなどの使用事例をサポートしています。こうした要因がAI技術の革新を促し、北米市場向けにカスタマイズされた先進的なエッジAIプロセッサ・アーキテクチャ、アルゴリズム、アプリケーションの開発を促進しています。

ダイナミクス

消費者のエッジコンピューティングへの移行

エッジコンピューティング環境では、リアルタイムでデータを処理し、性能要求を満たすために、高い計算能力と効率性を備えたAIプロセッサが必要とされることが多いです。そのため、より高い性能と効率を実現するAIプロセッサー技術の進歩が絶えず求められており、市場競争とイノベーションを刺激し、世界のエッジAIプロセッサー市場を牽引しています。

AIプロセッサーをエッジデバイスやシステムに組み込むことで、市場エコシステム内でのコラボレーションやパートナーシップの新たな機会が生まれます。AIプロセッサーメーカーは、IoTデバイスメーカー、ソフトウェア開発者、システムインテグレーターと協業し、エッジコンピューティングアプリケーションの特定要件に対応する統合ソリューションを提供することで、市場での存在感と収益の可能性を拡大しています。

例えば、2024年1月11日、革新的な技術ソリューションで有名なQuanta Computer Inc.と最先端のAI半導体企業であるAmbarella, Inc.は、CES期間中に戦略的提携の拡大を発表しました。この強化された提携は、AmbarellaのCV3-AD、CV7、そして新しいN1シリーズのAIシステムオンチップ(SoC)を利用した製品開発を包含するもので、最先端のAIアプリケーションに向けた機能の顕著な飛躍を意味します。これらの進化は、数百万から数十億のパラメータを持つ幅広いニューラルネットワークや大規模な言語モデルに対する市場のニーズの高まりに対応しています。

IoT製品の需要増加

IoT機器は、これらの機器から生成されるデータを処理するエッジコンピューティング機能の需要を生み出しています。このようなエッジAIプロセッサに対する需要の高まりは機会を拡大し、市場の成長を促進します。IoTデバイスは大量のデータを生成するため、エッジでのリアルタイム処理とインテリジェントな意思決定が必要となることが多く、洞察力を引き出してタイムリーなアクションを可能にすることで、市場の需要と採用が促進されます。

エッジAIプロセッサーは、AI推論を集中型サーバーからエッジにオフロードし、帯域幅を節約することで、IoTデバイスのパフォーマンスを最適化します。この最適化によりIoT導入の効果が高まるため、エッジAIプロセッサーはIoTエコシステムにおいて不可欠なコンポーネントとなり、市場の成長を促進します。IoTアプリケーションの多様な性質により、さまざまなIoTデバイスやシステムにカスタマイズして統合できるAIプロセッサーが必要とされています。

企業は、IoTデバイスの要件を満たす柔軟なエッジAIプロセッサーソリューションを開発しており、世界のエッジAIプロセッサー市場を牽引しています。例えば、NVIDIAは2022年9月20日、高精度のエッジAI向けに調整された画期的なNVIDIAIGXプラットフォームを発表し、製造、物流、ヘルスケアなどの重要分野のセキュリティと安全性に革命をもたらしました。

これらの業界は、特定のタスクのために高価なカスタムメイドのソリューションに依存していましたが、IGXプラットフォームは、多様な要件に適応するための容易なプログラマビリティを提供します。IGXは安全な自律システムの礎石として機能し、人間と機械のコラボレーションを強化します。製造業やロジスティクスでは、IGXは工場や倉庫のような厳しく規制された物理的環境での安全性をさらに高めます。

高い開発コスト

エッジAIプロセッサー技術の研究開発には多額の先行投資が必要なため、新規市場参入の障壁となる可能性があります。高い開発コストは中小企業の市場参入を阻み、競争を制限して市場の多様性を低下させる。製造業者は、価格に敏感なエッジAIプロセッサの採用に消極的です。これはエッジAI製品の採用を妨げる可能性があります。

高度なエッジAIプロセッサーソリューションの開発に伴う試験手順により、市場投入までの時間が大幅に延びる可能性があります。開発期間の長期化によるエッジAIプロセッサの商用化の遅れは、市場の成長に悪影響を及ぼします。多額の開発コストを回収するため、エッジAIプロセッサーのサプライヤーは製品にプレミアムを課す必要があり、価格が重要な市場での競争力が低下します。市場受容性が制限されるだけでなく、製品価格の上昇は潜在的な買い手を遠ざけ、市場全体の成長と採用を減速させる可能性があります。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 消費者のエッジコンピューティングへのシフト

- IoT製品の需要増加

- 抑制要因

- 高い開発コスト

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争影響分析

- DMIの見解

第6章 COVID-19分析

第7章 タイプ別

- CPU

- GPU

- ASIC

第8章 デバイスタイプ別

- コンシューマー向けデバイス

- エンタープライズ向けデバイス

第9章 エンドユーザー別

- 自動車・輸送

- ヘルスケア

- コンシューマーエレクトロニクス

- 小売・eコマース

- その他

第10章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他のアジア太平洋

- 中東・アフリカ

第11章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第12章 企業プロファイル

- Apple, Inc.

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- Samsung Electronics Co., Ltd.

- Mythic

- Qualcomm Technologies, Inc.

- Huawei Technologies Co., Ltd.

- Intel Corporation

- Google LLC

- NVIDIA Corporation

- Arm Limited

- Advanced Micro Devices, Inc.

第13章 付録

Overview

Global Edge AI Processor Market reached US$ 2.2 billion in 2023 and is expected to reach US$ 8.3 billion by 2031, growing with a CAGR of 18.6% during the forecast period 2024-2031.

Energy efficiency is critical in edge computing environments, especially for battery-powered devices and IoT sensors. Edge AI processor manufacturers increasingly focus on developing energy-efficient architectures and low-power consumption designs to prolong battery life and reduce operational costs. Energy-efficient edge AI processors enable longer device runtime and support sustainable deployment of edge computing solutions.

For instance, on January 12, 2024, e-con Systems and Ambarella, Inc., a leading-edge AI semiconductor company, announced a partnership unveiling their collaborative venture: the e-con Robotics Computing Platform (eRCP). It is engineered around Ambarella's top-tier CV72S edge AI system on chip (SoC), this innovative platform caters specifically to the needs of the robotics sector. In the rapidly evolving landscape of robotics, both rapid prototyping and superior performance stand as essential pillars. Ambarella's user-friendly Cooper Developer Platform delivers vision capabilities and AI performance per watt.

North America is experiencing a demand for edge computing devices across various industries, driven by the need for enhanced privacy and security. Organizations are deploying edge AI processors to enable edge computing capabilities, supporting use cases including smart cities, industrial IoT, and healthcare. These factors fuel innovation in AI technologies, driving the development of advanced edge AI processor architectures, algorithms, and applications tailored for North American markets.

Dynamics

Shifting Consumers to Edge Computing

Edge computing environments often require AI processors with high computational power and efficiency to process data in real time and meet performance demands. Consequently, there is a continuous push for advancements in AI processor technology to deliver higher performance and efficiency, stimulating market competition and innovation, and driving the global edge AI processor market.

Integrating AI processors into edge devices and systems opens up new opportunities for collaboration and partnerships within the market ecosystem. AI processor manufacturers collaborate with IoT device manufacturers, software developers, and system integrators to deliver integrated solutions that address the specific requirements of edge computing applications, thereby expanding their market presence and revenue potential.

For instance, on January 11, 2024, Quanta Computer Inc., renowned for its innovative technology solutions, and Ambarella, Inc., a leading-edge AI semiconductor firm, announced an expansion of their strategic alliance during CES. This enhanced collaboration now encompasses the development of products utilizing Ambarella's CV3-AD, CV7, and new N1 series AI systems-on-chip (SoCs), representing a notable leap in capabilities for cutting-edge AI applications. These advancements cater to the escalating market need for a wide spectrum of neural networks and large language models, ranging from millions to billions of parameters.

Increasing IoT Products Demand

IoT devices create a demand for edge computing capabilities to process data generated by these devices. This increased demand for edge AI processors expands the opportunities, driving market growth. IoT devices generate wide amounts of data that often require real-time processing and intelligent decision-making at the edge to extract insights and enable timely actions, thereby driving market demand and adoption.

Edge AI processors optimize the performance of IoT devices by offloading AI inference from centralized servers to the edge and conserving bandwidth. This optimization enhances the effectiveness of IoT deployments, making edge AI processors indispensable components in the IoT ecosystem and driving market growth. The diverse nature of IoT applications requires AI processors that can be customized and integrated into various IoT devices and systems.

Companies are developing flexible edge AI processor solutions that meet the requirements of IoT devices, driving the global edge AI processor market. For instance, on September 20, 2022, NVIDIA launched the groundbreaking NVIDIA IGX platform tailored for high-precision edge AI, revolutionizing security and safety in critical sectors like manufacturing, logistics, and healthcare.

These industries relied on expensive, custom-built solutions for specific tasks, but the IGX platform offers easy programmability to adapt to diverse requirements. It is serving as a cornerstone for secure autonomous systems, IGX enhances collaboration between humans and machines. In manufacturing and logistics, IGX ensures an added layer of safety in tightly regulated physical environments like factories and warehouses.

High Development Costs

The significant upfront investment required for research and development in edge AI processor technology can act as a barrier to entry for new market players. High development costs deter smaller companies from entering the market, limiting competition and reducing market diversity. Manufacturers are reluctant to adopt edge AI processors in price-sensitive. This can hinder the adoption of edge AI products.

The time-to-market can be greatly extended by the testing procedures involved in developing advanced edge AI processor solutions. Delays in the commercial availability of edge AI processors due to extended development timelines harm market growth. To recover the significant development costs, edge AI processor suppliers must charge a premium for their products, which reduces their ability to compete in markets where prices are crucial. In addition to limiting market acceptability, higher product prices can turn off potential buyers and slow down the growth and adoption of the market as a whole.

Segment Analysis

The global edge AI processor market is segmented based on type, device type, end-user, and region.

Growing Demand and Adoption in Consumer Devices

The consumer devices segment holds the largest share of the global edge AI processor. The adoption of smartphones is leading to a demand for edge AI processors in these consumer devices. The growing popularity of smart home devices fuels the demand for edge AI processors. These devices leverage edge AI for tasks enabling intelligent automation in the home environment.

Wearable devices incorporate edge AI processors to enable features like activity tracking, health monitoring, gesture recognition, and real-time notifications. The increasing adoption of wearable technology across consumer demographics contributes to the growth of edge AI processor demand in this segment. Entertainment platforms integrate edge AI processors to deliver interactive content recommendations and real-time content processing. Manufacturers are developing new products enhancing user boosts the adoption of edge AI in consumer devices.

For instance, on September 21, 2023, Lenovo launched its edge artificial intelligence (AI) services and solutions. With the introduction of "Lenovo TruScale for Edge and AI," Lenovo extends the proven cost advantages of its TruScale model to the widest and most inclusive edge portfolio available. This offering enables customers to leverage the company's cutting-edge services and solutions through a convenient pay-as-you-go model, facilitating SWT deployment of edge computing and the acquisition of AI-driven insights directly at the point of data generation.

Geographical Penetration

Growing Adoption of Advanced Technologies and Investment in North America

North America dominates the global edge AI processor market. Companies have a track record of innovation and market in edge computing and AI, positioning them as dominant in the global market. North America's significant investment in AI, fuels development efforts in edge AI processor technology. Major players are innovating edge AI solutions, contributing to the region's market dominance.

For instance, on January 10, 2024, Ambarella, Inc., a pioneering edge AI semiconductor company, introduced the cutting-edge Cooper Developer Platform. Cooper revolutionizes the integration of software, hardware, advanced AI models, and services, offering comprehensive support across Ambarella's entire AI systems-on-chip (SoCs) lineup. This platform streamlines the development process for customers through its flexible, modular, and prepackaged suite of hardware and software tools. It includes Cooper Metal, encompassing AI SoCs and board-level hardware solutions, and Cooper Foundry, a multi-layer software stack featuring Cooper Core, Cooper Foundation, Cooper Vision, and Cooper UX.

COVID-19 Impact Analysis

The COVID disrupted supply chains, production, and distribution of semiconductor component edge AI processors. International trade restrictions led to supply chain disruptions, affecting the availability of edge AI processors in the market. The COVID shifted demand patterns as consumers adapted to online learning, telemedicine, and e-commerce. The COVID accelerated digital transformation initiatives across industries, leading to increased investments in edge computing and AI technologies.

The pandemic boosted the use of remote monitoring and telehealth to support virtual healthcare delivery. Real-time medical data analysis at the edge was made possible in large part by edge AI processors, enabling uses in healthcare settings such as predictive analytics, diagnostic imaging, and remote patient monitoring and impacting the global edge processor market positively.

Russia and Ukraine War Impact Analysis

The conflict led to supply chain disruptions, and semiconductors essential for edge AI processor manufacturing. Ukraine is a raw materials exporter used in semiconductor production, and any disruptions to its supply chain could affect global semiconductor manufacturing, causing delays in production and affecting the availability of edge AI processors in the market. Uncertainties surrounding the Russia-Ukraine war created instability in global markets.

The conflict-affected markets in the regions are Eastern Europe and neighboring countries. Companies operating in these regions have faced challenges related to supply chain disruptions, increased costs, and political instability, impacting their ability to compete in the global edge AI processor market. Additionally, shifts in regional geopolitical dynamics could have influenced market dynamics and trade relationships, potentially reshaping market structures and competitive landscapes.

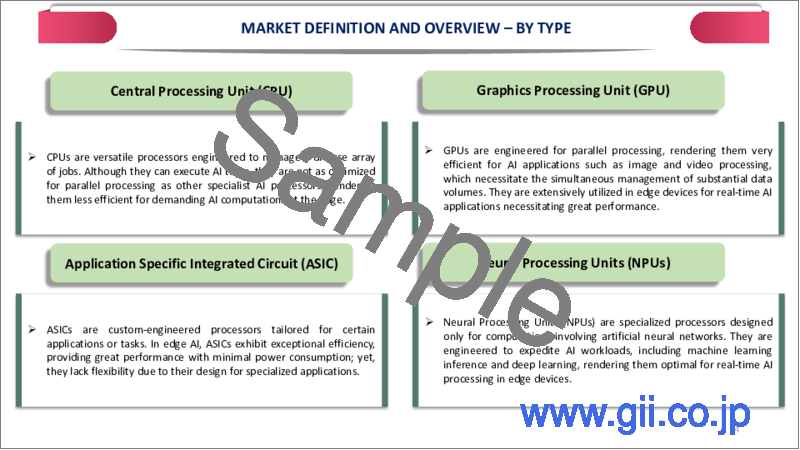

By Type

- Central Processing Unit (CPU)

- Graphics Processing Unit (GPU)

- Application Specific Integrated Circuit (ASIC)

By Device Type

- Consumer Devices

- Enterprise Devices

By End-User

- Automotive and Transportation

- Healthcare

- Consumer Electronics

- Retail and E-commerce

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacic

- China

- India

- Japan

- Australia

- Rest of Asia-Pacic

- Middle East and Africa

Key Developments

- On January 8, 2024, Intel announced the era of AI-powered computing with the introduction of its new lineup of processors for mobile, desktop, and edge devices at CES 2024. The highlight of Intel's announcement is the unveiling of the Intel Core 14th Gen processor family, alongside the introduction of Intel Core Ultra-powered systems. This initiative underscores Intel's dedication to addressing a wide range of user requirements and propelling advancements in computing standards.

- On February 27, 2024, Intel launched its AI PC processors and platforms at MWC 2024, including a preview of the new Xeon processors and edge platform. Among the highlights is the Granite Rapids-D Xeon processor, boasting integrated AI acceleration and the latest P-core generation, set to hit the market in 2025.

- On June 15, 2023, STMicroelectronics introduced an advanced line of 64-bit microprocessors tailored for edge computing, offering upgraded performance, and specialized functionalities crucial for real-time processing of data-heavy machine learning algorithms prevalent in industrial sectors. It is leading the pack in the STM32MP25 microprocessor, equipped with a dedicated neural processing unit engineered to bolster edge AI endeavors.

Competitive Landscape

The major global players in the edge AI processor market include Apple, Inc., Samsung Electronics Co., Ltd., Mythic, Qualcomm Technologies, Inc., Huawei Technologies Co., Ltd., Intel Corporation, Google LLC, NVIDIA Corporation, Arm Limited, and Advanced Micro Devices, Inc.

Why Purchase the Report?

- To visualize the global edge AI processor market segmentation based on type, device type, end-user, and region, as well as understand critical commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous edge AI processor market-level data points with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of critical products of all the major players.

The global edge AI processor market report would provide approximately 62 tables, 53 figures, and 213 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Type

- 3.2. Snippet by Device Type

- 3.3. Snippet by End-User

- 3.4. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Shifting Consumers to Edge Computing

- 4.1.1.2. Increasing IoT Products Demand

- 4.1.2. Restraints

- 4.1.2.1. High Development Costs

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia-Ukraine War Impact Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Type

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 7.1.2. Market Attractiveness Index, By Type

- 7.2. Central Processing Unit (CPU)*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Graphics Processing Unit (GPU)

- 7.4. Application Specific Integrated Circuit (ASIC)

8. By Device Type

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Device Type

- 8.1.2. Market Attractiveness Index, By Device Type

- 8.2. Consumer Devices*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Enterprise Devices

9. By End-User

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 9.1.2. Market Attractiveness Index, By End-User

- 9.2. Automotive and Transportation*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Healthcare

- 9.4. Consumer Electronics

- 9.5. Retail and E-commerce

- 9.6. Others

10. By Region

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 10.1.2. Market Attractiveness Index, By Region

- 10.2. North America

- 10.2.1. Introduction

- 10.2.2. Key Region-Specific Dynamics

- 10.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Device Type

- 10.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.2.6.1. U.S.

- 10.2.6.2. Canada

- 10.2.6.3. Mexico

- 10.3. Europe

- 10.3.1. Introduction

- 10.3.2. Key Region-Specific Dynamics

- 10.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Device Type

- 10.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.3.6.1. Germany

- 10.3.6.2. UK

- 10.3.6.3. France

- 10.3.6.4. Italy

- 10.3.6.5. Russia

- 10.3.6.6. Rest of Europe

- 10.4. South America

- 10.4.1. Introduction

- 10.4.2. Key Region-Specific Dynamics

- 10.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Device Type

- 10.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.4.6.1. Brazil

- 10.4.6.2. Argentina

- 10.4.6.3. Rest of South America

- 10.5. Asia-Pacic

- 10.5.1. Introduction

- 10.5.2. Key Region-Specific Dynamics

- 10.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Device Type

- 10.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.5.6.1. China

- 10.5.6.2. India

- 10.5.6.3. Japan

- 10.5.6.4. Australia

- 10.5.6.5. Rest of Asia-Pacic

- 10.6. Middle East and Africa

- 10.6.1. Introduction

- 10.6.2. Key Region-Specific Dynamics

- 10.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Device Type

- 10.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

11. Competitive Landscape

- 11.1. Competitive Scenario

- 11.2. Market Positioning/Share Analysis

- 11.3. Mergers and Acquisitions Analysis

12. Company Profiles

- 12.1. Apple, Inc.*

- 12.1.1. Company Overview

- 12.1.2. Product Portfolio and Description

- 12.1.3. Financial Overview

- 12.1.4. Key Developments

- 12.2. Samsung Electronics Co., Ltd.

- 12.3. Mythic

- 12.4. Qualcomm Technologies, Inc.

- 12.5. Huawei Technologies Co., Ltd.

- 12.6. Intel Corporation

- 12.7. Google LLC

- 12.8. NVIDIA Corporation

- 12.9. Arm Limited

- 12.10. Advanced Micro Devices, Inc.

LIST NOT EXHAUSTIVE

13. Appendix

- 13.1. About Us and Services

- 13.2. Contact Us