|

|

市場調査レポート

商品コード

1474047

LTCC・HTCC(低温同時焼成セラミックス・高温同時焼成セラミックス)の世界市場-2024-2031年Global Low Temperature Co-Fired Ceramics (LTCC) And High Temperature Co-fired Ceramic (HTCC) Market - 2024-2031 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| LTCC・HTCC(低温同時焼成セラミックス・高温同時焼成セラミックス)の世界市場-2024-2031年 |

|

出版日: 2024年05月02日

発行: DataM Intelligence

ページ情報: 英文 193 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

世界のLTCC・HTCC(低温同時焼成セラミックス・高温同時焼成セラミックス)市場は、2023年に28億米ドルに達し、2031年には37億米ドルに達すると予測され、予測期間2024-2031年のCAGRは3.4%で成長します。

さまざまな分野で革新的な電子機器への需要が高まっていることが、LTCC・HTCC市場を後押しする主な要因の1つです。優れた信頼性、熱安定性、小型化特性を備えた電子部品は、技術の発展とともにますます必要性が高まっています。コンデンサー、インダクター、抵抗器、センサーを含む、小型で非常に効果的な電子部品の製造を可能にするLTCC・HTCC材料は、こうした需要に応えるものです。

LTCC・HTCC材料の需要は、5Gコネクティビティ、IoT、人工知能(AI)、 促進要因レスカーを含む先端技術の急速な発展と取り込みによって牽引されています。LTCC・HTCCの技術を活用することで、これらの技術が電気部品に要求する性能の向上、集積度の向上、信頼性の強化を達成することができます。

アジア太平洋は、世界のLTCC・HTCC市場の1/3以上を占める成長地域のひとつです。小型化された電子機器に対する世界の需要は、コンシューマーエレクトロニクス、自動車、ヘルスケア、通信など、いくつかの産業で拡大しています。これがLTCC・HTCC市場の成長を牽引しています。

ダイナミクス

電子機器の軽量化需要の増加

LTCC・HTCC市場は、様々な分野における電子機器の小型化ニーズの高まりによって刺激されています。LTCC・HTCC材料は、技術開発がより小型で強力な電子部品の作成を推進するのに伴い、小型化、統合、性能の面で明確な利点を提供します。

さらに、これらのセラミックスは、センサー、インダクター、コンデンサー部品のような、小型で非常に効果的な電子部品を作ることを可能にし、ウェアラブル、スマートフォン、ウェアラブル技術、IoT、自動車用エレクトロニクス、医療機器での使用に不可欠です。市場が発展している背景には、高性能で軽量なポータブル電子機器に対する顧客の要望の高まりがあり、これがLTCC・HTCC技術の採用を後押ししています。

通信インフラの急速な発展

世界の通信インフラの急成長、特に5Gネットワークの導入と高速データ伝送のニーズの高まりは、LTCC・HTCC市場を牽引するもう一つの重要な要因です。フィルター、トランシーバー、アンテナなどの通信機器に使用されるRFおよびマイクロ波部品を製造する場合、LTCC・HTCC材料が必要となります。

例えば、2023年にカリフォルニア州サンディエゴで開催されたIMS2023で、CelaneseはMicromax LFシリーズ導電性インクとGreenTape LF95C低温同時焼成セラミックス(LTCC)材料システムを発表しました。LF95Cは、著名なGreenTape 951システムの鉛フリーバージョンで、5G通信を含む高周波、高信頼性アプリケーション向けに調整されています。40GHzまでの電気通信アプリケーション向けに設計されたLF95Cは、回路設計者やメーカーにテープと互換導体の革新的なソリューションを提供します。

高い初期投資コスト

LTCC・HTCC市場にとって、これらのセラミックス材料を製造するための生産設備の設置や専用機械の入手に伴う多額の初期投資は大きな障壁となっています。セラミックスの同時焼成は、特殊な設備、クリーンルームのスペース、訓練を受けた労働力を必要とする手順であり、これらすべてが多額の初期費用につながる可能性があります。

初期投資費用は、中小企業(SME)や新規市場参入企業の参入障壁となり、市場参入を成功させる能力を制限する可能性があります。特に競争の激しい市場シナリオでは、セラミックス材料の革新と改良のための研究開発(R&D)に継続的な出費が必要となり、経済的負担がさらに重くなります。

原材料へのアクセス制限

セラミックス製造に必要な特殊原料の供給が制限されていることも、LTCC・HTCC市場に影響を及ぼしている障壁の一つです。地政学的緊張、貿易制限、採鉱・採掘活動に影響を及ぼす環境規制などの要因により、高純度セラミックス、導電性材料、誘電性材料など、LTCC・HTCCの配合に使用される特定の必須成分は、供給上の制約や入手可能性の変動に直面する可能性があります。

さらに、価格変動や供給中断などのサプライチェーンリスクは、主要原材料を少数のサプライヤーに過度に依存している企業が負う可能性があります。このような危険性を軽減するための代替原材料の発見と吟味が困難な場合、生産コストとリードタイムがさらに上昇する可能性があり、LTCC・HTCC製品の市場競争力が損なわれることになります。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 電子機器の軽量化需要の高まり

- 通信インフラの急速な発展

- 抑制要因

- 初期投資コストの高さ

- 原材料へのアクセス制限

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMIの見解

第6章 COVID-19分析

第7章 プロセス別

- 高温同時焼成セラミックス(HTCC)

- 低温同時焼成セラミックス(LTCC)

第8章 材料別

- ガラス・セラミックス

- セラミックス

第9章 用途別

- MEMSセンサーパッケージ

- RF SiP/FEM基質

- 周波数デバイスパッケージ

- 医療機器

- 産業機器

- LEDチップキャリア

- その他

第10章 エンドユーザー別

- 自動車

- 通信機器

- 航空宇宙・防衛

- 医療

- エレクトロニクス

- その他

第11章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第12章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第13章 企業プロファイル

- KYOCERA Corporation

- 会社概要

- プロセス・ポートフォリオと説明

- 財務概要

- 主な発展

- Murata Manufacturing Co., Ltd

- DowDuPont Inc.

- Heraeus Holding

- KOA Corporation

- Yokowo co., ltd.

- Micro Systems Technologies

- Soar Technology Co., Ltd.

- NEOTech

- TDK Corporation

第14章 付録

Overview

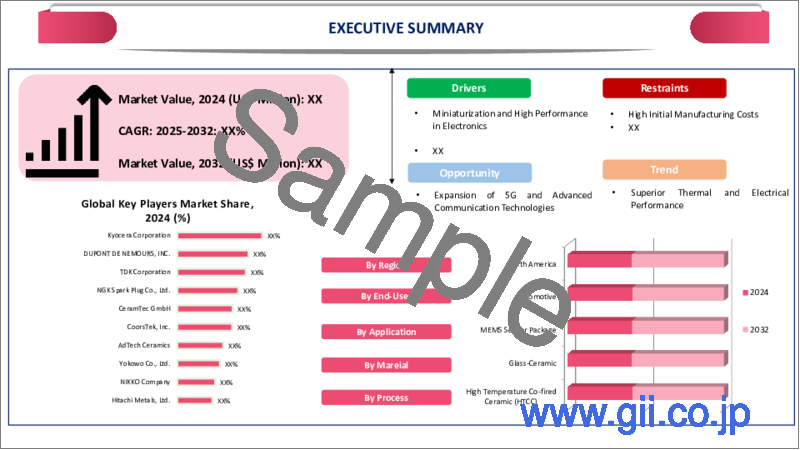

Global Low Temperature Co-Fired Ceramics (LTCC) And High Temperature Co-fired Ceramic (HTCC) Market reached US$ 2.8 billion in 2023 and is expected to reach US$ 3.7 billion by 2031, growing with a CAGR of 3.4% during the forecast period 2024-2031.

The growing demand for innovative electronic gadgets across a range of sectors is one of the main factors propelling the LTCC and HTCC markets. Electronic components with excellent dependability, thermal stability and downsizing characteristics are becoming more and more necessary as technology develops. By making it possible to produce small and incredibly effective electronic components including capacitors, inductors, resistors and sensors, LTCC and HTCC materials offer answers to these demands.

The demand for LTCC and HTCC materials is being driven by the quick development and uptake of advanced technologies including 5G connectivity, the Internet of Things (IoT), artificial intelligence (AI) and driverless cars. Utilizing LTCC and HTCC technologies can help accomplish the increased performance, greater integration and enhanced dependability that these technologies demand from their electrical components.

Asia-Pacific is among the growing regions in the global low temperature co-fired ceramics (LTCC) and high temperature co-fired ceramic (HTCC) market covering more than 1/3rd of the market. Global demand for miniaturized electronic devices is growing across some industries, including consumer electronics, automotive, healthcare and telecommunications. The is driving growth in the markets for low-temperature co-fired ceramics and high-temperature co-fired ceramics.

Dynamics

Increasing Demand for Lighter Electronic Devices

The market for LTCC and HTCC is being stimulated by the growing need for smaller electronic devices in a variety of sectors. LTCC and HTCC materials provide distinct benefits in terms of downsizing, integration and performance as technological developments propel the creation of smaller and more potent electronic components.

Additionally, these ceramics make it possible to create small, incredibly effective electronic parts like sensors, inductors and capacitors components that are crucial for use in wearables, smartphones, wearable technology, the Internet of Things, automotive electronics and medical equipment. The market is developing because of the increasing customer desire for high-performance, lightweight and portable electronic devices, which in turn drives the adoption of LTCC and HTCC technologies.

Rapid Infrastructure Development in Telecommunications

The fast growth of the global telecommunications infrastructure, especially with the introduction of 5G networks and the rising need for high-speed data transmission, is another important factor driving the LTCC and HTCC markets. When it comes to producing the RF and microwave parts that go into telecom devices like filters, transceivers and antennas, LTCC and HTCC materials are necessary.

For instance, in 2023, Celanese introduced its Micromax LF Series Conductive Inks and the GreenTape LF95C Low-Temperature Co-fired Ceramic (LTCC) materials system at IMS 2023 in San Diego, California. LF95C, a lead-free version of the renowned GreenTape 951 system, is tailored for high-frequency, high-reliability applications, including 5G communications. Designed for telecom applications up to 40 GHz, LF95C offers circuit designers and manufacturers an innovative solution for tapes and compatible conductors.

High Initial Investment Costs

The substantial upfront expenditures involved in establishing production facilities and obtaining specialized machinery to create these ceramic materials represent a major barrier for the LTCC and HTCC markets. Co-firing ceramics is a procedure that calls for specialized equipment, clean room spaces and trained labor all of which can lead to significant upfront expenses.

The initial investment expenses might operate as a barrier to entry for small and medium-sized firms (SMEs) or new market entrants, restricting their capacity to successfully participate in the market. To further compound the financial burden, especially in a highly competitive market scenario, is the ongoing expenditure required in research and development (R&D) to innovate and enhance ceramic materials.

Limited Accessibility to Raw Materials

The restricted supply of specialized raw materials needed for ceramic manufacture is another barrier impacting the LTCC and HTCC markets. Due to factors like geopolitical tensions, trade restrictions or environmental regulations impacting mining and extraction activities, certain essential components used in LTCC and HTCC formulations, such as high-purity ceramics, conductive materials and dielectric materials, may face supply constraints or fluctuations in availability.

Additionally, supply chain risks, such as price volatility and supply interruptions, can be borne by firms that rely too heavily on a small number of suppliers for key raw materials. The difficulty of finding and vetting substitute raw materials to reduce these hazards might further raise production costs and lead times, which will hurt LTCC and HTCC goods' ability to compete in the market.

Segment Analysis

The global low temperature co-fired ceramics (LTCC) and high temperature co-fired ceramic (HTCC) market is segmented based on process, material, application, end-user and region.

Rising Demand for LTCC and HRCC in Electronics Industry

The Electronics segment is among the growing regions in the global low temperature co-fired ceramics (LTCC) and high temperature co-fired ceramic (HTCC) market covering more than 1/3rd of the market. The global market for low-temperature co-fired ceramics (LTCC) and high-temperature co-fired ceramics (HTCC) is expanding primarily due to the rise of the electronics sector.

The demand for materials with high reliability, thermal stability and miniaturization capabilities all attributes of LTCC and HTCC technologies is growing as electronic devices get smaller and more advanced. The ceramics are widely used in the production of many electronic components, including sensors, inductors, resistors and capacitors. The components are crucial parts of wearable technology, wearable computers, tablets, smartphones and other consumer and business electronics.

Geographical Penetration

Growing Demand for Electronics Industry in Asia-Pacific

Asia-Pacific has been a dominant force in the global low temperature co-fired ceramics (LTCC) and high temperature co-fired ceramic (HTCC) market. Asia-Pacific is a major growth driver for the global market for low-temperature co-fired and high-temperature co-fired ceramics because it is a hub for electronics manufacturing. Major consumer electronics, telecommunications equipment and automotive electronics producers include China, Japan, South Korea and Taiwan.

The use of LTCC and HTCC materials, which have benefits including high reliability, outstanding thermal stability and integration capabilities, is fueled by the growing need in these sectors for high-performance electronic devices and downsized electronic components. Rapid infrastructural development and advances in technology are occurring throughout Asia-Pacific, especially in aircraft, automobiles and telecommunications industries.

Additionally, advanced electrical components and packaging solutions are needed for the rollout of 5G networks, the growth of satellite communication networks and the creation of driverless cars. LTCC and HTCC technologies excel in these areas. The need for LTCC and HTCC materials is anticipated to soar as these sectors develop more, therefore driving market expansion in the region.

Moreover, the growth of the LTCC and HTCC markets in Asia-Pacific is facilitated by government programs and expenditures in research and development (R&D) to support local manufacturing capacities and technical innovation. Strong R&D ecosystems backed by educational institutions, governmental organizations and business alliances are present in nations like China, Japan and South Korea, creating a favorable atmosphere for the creation and marketing of cutting-edge ceramic materials and electronic components.

COVID-19 Impact Analysis

The global market for high-temperature co-fired (HTCC) and low-temperature co-fired (LTCC) ceramics has been impacted by the COVID-19 epidemic in some ways. At first, the epidemic caused extensive supply chain delays since industrial plants had to close temporarily to comply with lockdown procedures and protect employees. The manufacture and delivery of LTCC and HTCC materials and components were delayed as a result of this interruption, making it difficult to satisfy demand and complete obligations.

In addition, the economic recession brought on by the pandemic changed consumer spending habits and investment choices, which resulted in a decline in demand for goods and services in some industries, including healthcare, telecommunications, automotive, aerospace and the automotive industry all of which are important users of LTCC and HTCC components.

Because of the decreased orders and income streams, producers of LTCC and HTCC materials had to modify their operating plans and production capabilities to cope with the shifting market conditions. The pandemic also brought attention to how important it is to have technology like telecom infrastructure for remote work and medical equipment for remote monitoring and diagnostics that are made possible by LTCC and HTCC materials.

Russia-Ukraine War Impact Analysis

The conflict between Russia and Ukraine has substantially impacted many businesses, including the globally market for high- and low-temperature co-fired ceramics (HTCC and LTCC). The supply chain is disrupted as one direct effect, especially for components and raw materials that are obtained from the area. Due to their respective importance as manufacturers of several minerals and metals required in ceramic manufacturing, Russia and Ukraine may experience shortages and price variations in the LTCC and HTCC markets if there are any delays in their production and transportation.

In addition, geopolitical tensions have affected investor confidence and company choices by bringing uncertainty and volatility to the world's markets. Planning and forecasting may be difficult for businesses in the LTCC and HTCC supply chains as conditions change and geopolitical threats linger. The LTCC and HTCC markets' growth trajectory may be impacted soon by delays in project execution, expansion plans and investment choices brought on by this uncertainty.

Furthermore, worries about the war's wider economic effects, such as possible interruptions to the oil supply and inflationary pressures, have grown. For LTCC and HTCC producers, increased manufacturing costs might result in higher final consumer pricing due to inflation and rising energy expenses. To further complicate international company operations, geopolitical conflicts may also lead to changes in trade legislation and practices.

By Process

- High-Temperature Co-fired Ceramic (HTCC)

- Low-Temperature Co-fired Ceramic (LTCC)

By Material

- Glass-Ceramic

- Ceramic

By Application

- MEMS Sensor Package

- RF SiP/FEM Substrate

- Frequency Device Package

- Medical Equipment

- Industrial Equipment

- LED Chip Carrier

- Others

By End-User

- Automotive

- Telecommunications

- Aerospace and Defense

- Medical

- Electronics

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- On June 12, 2023, Celanese introduced its Micromax LF Series Conductive Inks and the GreenTape LF95C Low-Temperature Co-fired Ceramic (LTCC) materials system at IMS 2023 in San Diego, California. LF95C, a lead-free version of the renowned GreenTape 951 system, is tailored for high-frequency, high-reliability applications, including 5G communications. Designed for telecom applications up to 40 GHz, LF95C offers circuit designers and manufacturers an innovative solution for tapes and compatible conductors.

Competitive Landscape

The major global players in the market include KYOCERA Corporation, Murata Manufacturing Co., Ltd, DowDuPont Inc., Heraeus Holding, KOA Corporation, Yokowo co., ltd., Micro Systems Technologies, Soar Technology Co., Ltd., NEOTech and TDK Corporation.

Why Purchase the Report?

- To visualize the global low temperature co-fired ceramics (LTCC) and high temperature co-fired ceramic (HTCC) market segmentation based on process, material, application, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of low-temperature co-fired ceramics (LTCC) and high temperature co-fired ceramic (HTCC) market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Process mapping available as Excel consisting of key process of all the major players.

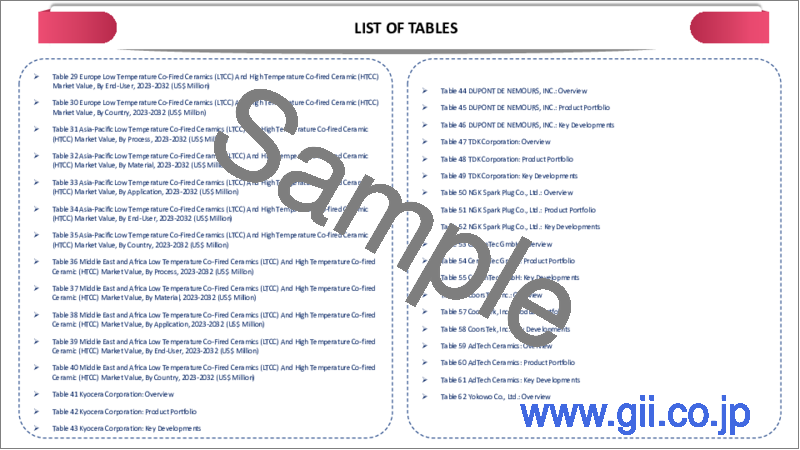

The global low temperature co-fired ceramics (LTCC) and high temperature co-fired ceramic (HTCC) market report would provide approximately 70 tables, 67 figures and 193 Pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1.Methodology and Scope

- 1.1.Research Methodology

- 1.2.Research Objective and Scope of the Report

2.Definition and Overview

3.Executive Summary

- 3.1.Snippet by Process

- 3.2.Snippet by Material

- 3.3.Snippet by Application

- 3.4.Snippet by End-User

- 3.5.Snippet by Region

4.Dynamics

- 4.1.Impacting Factors

- 4.1.1.Drivers

- 4.1.1.1.Increasing Demand for Lighter Electronic Devices

- 4.1.1.2.Rapid Infrastructure Development in Telecommunications

- 4.1.2.Restraints

- 4.1.2.1.High Initial Investment Costs

- 4.1.2.2.Limited Accessibility to Raw Materials

- 4.1.3.Opportunity

- 4.1.4.Impact Analysis

- 4.1.1.Drivers

5.Industry Analysis

- 5.1.Porter's Five Force Analysis

- 5.2.Supply Chain Analysis

- 5.3.Pricing Analysis

- 5.4.Regulatory Analysis

- 5.5.Russia-Ukraine War Impact Analysis

- 5.6.DMI Opinion

6.COVID-19 Analysis

- 6.1.Analysis of COVID

- 6.1.1.Scenario Before COVID

- 6.1.2.Scenario During COVID

- 6.1.3.Scenario Post COVID

- 6.2.Pricing Dynamics Amid COVID

- 6.3.Demand-Supply Spectrum

- 6.4.Government Initiatives Related to the Market During Pandemic

- 6.5.Manufacturers Strategic Initiatives

- 6.6.Conclusion

7.By Process

- 7.1.Introduction

- 7.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Process

- 7.1.2.Market Attractiveness Index, By Process

- 7.2.High-Temperature Co-Fired Ceramic (HTCC)*

- 7.2.1.Introduction

- 7.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3.Low-Temperature Co-Fired Ceramic (LTCC)

8.By Material

- 8.1.Introduction

- 8.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 8.1.2.Market Attractiveness Index, By Material

- 8.2.Glass-Ceramic*

- 8.2.1.Introduction

- 8.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3.Ceramic

9.By Application

- 9.1.Introduction

- 9.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.1.2.Market Attractiveness Index, By Application

- 9.2.MEMS Sensor Package*

- 9.2.1.Introduction

- 9.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3.RF SiP/FEM Substrate

- 9.4.Frequency Device Package

- 9.5.Medical Equipment

- 9.6.Industrial Equipment

- 9.7.LED Chip Carrier

- 9.8.Others

10.By End-User

- 10.1.Introduction

- 10.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.1.2.Market Attractiveness Index, By End-User

- 10.2.Automotive*

- 10.2.1.Introduction

- 10.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3.Telecommunications

- 10.4.Aerospace and Defense

- 10.5.Medical

- 10.6.Electronics

- 10.7.Others

11.By Region

- 11.1.Introduction

- 11.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 11.1.2.Market Attractiveness Index, By Region

- 11.2.North America

- 11.2.1.Introduction

- 11.2.2.Key Region-Specific Dynamics

- 11.2.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Process

- 11.2.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 11.2.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.2.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.2.7.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.2.7.1.U.S.

- 11.2.7.2.Canada

- 11.2.7.3.Mexico

- 11.3.Europe

- 11.3.1.Introduction

- 11.3.2.Key Region-Specific Dynamics

- 11.3.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Process

- 11.3.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 11.3.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.3.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.3.7.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.3.7.1.Germany

- 11.3.7.2.UK

- 11.3.7.3.France

- 11.3.7.4.Russia

- 11.3.7.5.Spain

- 11.3.7.6.Rest of Europe

- 11.4.South America

- 11.4.1.Introduction

- 11.4.2.Key Region-Specific Dynamics

- 11.4.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Process

- 11.4.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 11.4.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.4.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.4.7.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.4.7.1.Brazil

- 11.4.7.2.Argentina

- 11.4.7.3.Rest of South America

- 11.5.Asia-Pacific

- 11.5.1.Introduction

- 11.5.2.Key Region-Specific Dynamics

- 11.5.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Process

- 11.5.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 11.5.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.5.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.5.7.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.5.7.1.China

- 11.5.7.2.India

- 11.5.7.3.Japan

- 11.5.7.4.Australia

- 11.5.7.5.Rest of Asia-Pacific

- 11.6.Middle East and Africa

- 11.6.1.Introduction

- 11.6.2.Key Region-Specific Dynamics

- 11.6.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Process

- 11.6.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 11.6.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.6.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

12.Competitive Landscape

- 12.1.Competitive Scenario

- 12.2.Market Positioning/Share Analysis

- 12.3.Mergers and Acquisitions Analysis

13.Company Profiles

- 13.1.KYOCERA Corporation*

- 13.1.1.Company Overview

- 13.1.2.Process Portfolio and Description

- 13.1.3.Financial Overview

- 13.1.4.Key Developments

- 13.2.Murata Manufacturing Co., Ltd

- 13.3.DowDuPont Inc.

- 13.4.Heraeus Holding

- 13.5.KOA Corporation

- 13.6.Yokowo co., ltd.

- 13.7.Micro Systems Technologies

- 13.8.Soar Technology Co., Ltd.

- 13.9.NEOTech

- 13.10.TDK Corporation

LIST NOT EXHAUSTIVE

14.Appendix

- 14.1.About Us and Services

- 14.2.Contact Us