|

|

市場調査レポート

商品コード

1459347

シリコンフォトニクスの世界市場-2024-2031年Global Silicon Photonics Market - 2024-2031 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| シリコンフォトニクスの世界市場-2024-2031年 |

|

出版日: 2024年04月03日

発行: DataM Intelligence

ページ情報: 英文 206 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

シリコンフォトニクスの世界市場は2023年に16億米ドルに達し、2031年には114億米ドルに達すると予測され、予測期間2024-2031年のCAGRは27.9%で成長します。

シリコンフォトニクスは、従来の銅ベースの相互接続に比べ、消費電力が少ない、情報速度が速い、電磁干渉に強いなど、いくつかの利点があります。こうした利点から、シリコンフォトニクスは、高性能、高信頼性、エネルギー効率の高いデータ伝送を必要とするアプリケーションにとって魅力的な選択肢となっています。

世界的には、主要プレーヤーによる製品投入の増加が予測期間中の市場成長を後押ししています。例えば、2022年6月6日、オープンライトは、ブランドアイデンティティと技術ポートフォリオを立ち上げ、レーザを集積した世界初のオープンシリコンフォトニクスプラットフォームの先駆けとなりました。データコム、テレコム、LiDAR、ヘルスケア、HPC、AI、光コンピューティングなどのアプリケーション向けに高性能フォトニック集積回路(PIC)の創出を加速することを意図しており、オープンライトのプラットフォームは、レーザ集積とスケーラビリティの新次元を提供します。タワーのPH18DA製造プロセスの適格性と信頼性評価により、この技術の信頼性が示されています。

アジア太平洋は、シリコンフォトニクスに対する政府の取り組みが活発化しており、この地域の市場成長を後押ししています。例えば、2023年10月27日、インドはフォトニックチップ開発努力を開始しました。CPPICSは、今後5年間、インドにおけるPIC製造エコシステムをサポートするために、自給自足を達成し、スタートアップによる製品商業化を促進し、重要なトレーニングを提供しようとしています。CPPICSは、バンガロールのSi2 Microsystemsとの提携など、シリコンフォトニックプロセッサコアのための最先端のシステムインアパッケージソリューションを提供するための提携を結んでいます。

ダイナミクス

インターネットトラフィックの増加

インターネットトラフィックの増加により、データセンター事業者は、ソーシャルネットワーキング、クラウドコンピューティング、ストリーミングビデオ、eコマース、オンラインサービスなどのデジタルアプリケーションのニーズの高まりに対応するため、インフラの増設を進めています。シリコンフォトニクス技術によって実現された高速光インターコネクト、スイッチ、トランシーバは、データセンターの建物内と建物間の効率的なデータ転送を可能にし、現代のデータセンターが求めるスケーラビリティとパフォーマンスを満たします。コンピュータリソース、ストレージ、アプリケーションへのスケーラブルなオンデマンドアクセスを望む企業組織や個人が、クラウドコンピューティングサービスの継続的な利用拡大を牽引しています。クラウドデータセンターとエンドユーザー間の高速で信頼性の高い通信は、クラウドサーバー、ストレージアレイ、ネットワーク機器間の接続に不可欠なシリコンフォトニクス技術によって実現されています。

ライブデータ分析によって収集された情報によると、ウェブサイトトラフィックの60%以上がモバイルデバイスからもたらされています。インターネットユーザーの92.3%がモバイルデバイス経由でインターネットを利用しています。現在、全世界のモバイルインターネットユーザーは43億2,000万人です。モバイルデバイス経由のインターネットトラフィックの割合はアフリカで最も高く、約69.13%を占めています。2025年までに全世界で約10億以上の5G接続が見込まれます。インターネットの普及がシリコンフォトニクス市場の成長を後押ししています。

データセンターにおけるシリコンフォトニクスの需要拡大

大規模なデータトラフィックを処理し、クラウドコンピューティング、ビッグデータ分析、人工知能(AI)、その他のデータ集約型アプリケーションを実現するために、データセンターには高速・広帯域の通信システムが必要です。光インターコネクトを介した超高速データ転送は、シリコンフォトニクス技術によって可能になり、現代のデータセンター運用に必要な速度と容量を提供します。シリコンフォトニクスは、データセンター向けの効果的な光接続ソリューションとして、光トランシーバ、ディテクタ、マルチプレクサなどのコンポーネントを提供しています。

シリコンフォトニクス技術のエネルギー効率に優れた運用はよく知られており、消費電力、冷却コスト、環境への影響を低減したいデータセンターにとって不可欠です。シリコンフォトニクスベースの光インターコネクトは、従来の銅ベースのインターコネクトよりも消費電力が少ないため、データセンターはより環境にやさしく、エネルギー消費を抑えて運用することができます。データセンターでは、データ量の増加、仮想化、サーバー統合に対応するため、スケーラブルで高密度な接続ソリューションが必要とされています。シリコンフォトニクスは、コンパクトでスケーラブルな光モジュールを実現し、データセンター環境におけるポート密度の向上、スペース利用の改善、ケーブルインフラの簡素化を可能にします。

高い初期投資

シリコンフォトニクス市場への新規参入を阻む最大の障害の一つは、特に新興企業や中堅企業にとって、参入コストが高いことです。これらの企業は、研究開発、生産設備、ツール、スタッフに必要な資金を得るのに苦労しています。その結果、業界のリーダーと競争し、斬新な製品を生み出すことが難しくなります。シリコンフォトニクスの市場は、初期投資が高額なため、全体として拡大が遅れます。

新規プロジェクトへの投資や生産量の増加には財務的リスクが伴うため、企業はそれを躊躇します。このような保守的な姿勢が、様々な分野や用途でのシリコンフォトニクス技術の採用を阻害し、市場成長率を鈍化させています。企業の研究開発や技術革新に費やす能力は、多額の初期投資の金銭的コストによって制限される可能性があります。この制約は、シリコンフォトニクスの技術開発速度を遅らせ、市場を拡大し、変化する消費者ニーズを満たす可能性のある新製品、機能、特徴のリリースを先送りします。

目次

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- インターネットトラフィックの増加

- データセンターにおけるシリコンフォトニクスの需要拡大

- 抑制要因

- 初期投資が高い

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMIの見解

第6章 COVID-19分析

第7章 製品別

- トランシーバー

- VOA

- スイッチ

- ケーブル

- センサー

- その他

第8章 コンポーネント別

- レーザー

- 変調器

- 光検出器

第9章 導波路別

- 400~1,500 NM

- 1,310~1,550 NM

- 900~7,000 NM

第10章 アプリケーション別

- データセンター・HPC

- 通信

- 軍事

- 防衛・航空宇宙

- 医療・ライフサイエンス

- その他

第11章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第12章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第13章 企業プロファイル

- AIO Core Co. Ltd.

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- FormFactor.

- Polariton Technologies AG

- SCINTIL Photonics

- STMicroelectronics

- FUJITSU

- EFFECT PHOTONICS

- RONOVUS

- NKT Photonics A/S

- Intel Corporation

第14章 付録

Overview

Global Silicon Photonics Market reached US$ 1.6 Billion in 2023 and is expected to reach US$ 11.4 Billion by 2031, growing with a CAGR of 27.9% during the forecast period 2024-2031.

Silicon photonics offers several advantages over conventional copper-based interconnects such as less power usage, greater information rates and immunity to electromagnetic interference. The advantages make silicon photonics an attractive choice for applications requiring high-performance, reliable and energy-efficient data transmission.

Globally, growing product launches by the major key players help to boost market growth over the forecast period. For instance, on June 06, 2022, OpenLight, launched a brand identity and technology portfolio to usher in the world's first open silicon photonics platform with integrated lasers. Intending to speed up the creation of high-performance photonic integrated circuits (PICs) for applications such as datacom, telecom, LiDAR, healthcare, HPC, AI and optical computing, OpenLight's platform offers a new degree of laser integration and scalability. Qualification and reliability evaluation of Tower's PH18DA production process have shown that the technology is reliable.

Asia-Pacific is the dominating region in the market due to the Growing government initiatives for silicon photonics helping to boost regional market growth over the forecast year. For instance, on October 27, 2023, India, launched Photonic Chips Development Effort. CPPICS seeks to achieve self-sufficiency, promote product commercialization through startups and offer crucial training to support the PIC manufacturing ecosystem in India during the next five years. CPPICS is forming alliances, such as cooperation with Bangalore's Si2 Microsystems, to offer cutting-edge System-in-a-Package solutions for silicon photonic processor cores.

Dynamics

Growing Internet Traffic

Due to a rise in internet traffic, data center operators are building more space for their infrastructure to meet the growing need for digital applications such as social networking, cloud computing, streaming video, e-commerce and online services. High-speed optical interconnects, switches and transceivers made possible by silicon photonics technology enable effective data transfer both inside and between data center buildings, meeting the scalability and performance demands of contemporary data centers. Businesses organizations and individuals wishing scalable, on-demand access to computer resources, storage and applications are driving the continued growth in the usage of cloud computing services. Fast and dependable communication between cloud data centers and end-users is made possible by silicon photonics technology, which is essential to the connections between cloud servers, storage arrays and networking equipment.

According to information gathered through live data analysis, over 60% of website traffic comes from mobile devices. 92.3% of internet users receive their internet via a mobile device. There are currently 4.32 billion mobile internet users globally. The proportion of internet traffic via mobile devices is greatest in Africa which accounted for around 69.13%. There are around over 1 billion 5G connections globally by 2025. The increase in the adoption of the internet helps to boost the market growth of silicon photonics.

Growing Demand for Silicon Photonics in Data Centre

To handle large data traffic and enable cloud computing, big data analytics, artificial intelligence (AI) and other data-intensive applications, data centers require high-speed and high-bandwidth communication systems. Ultra-fast data transfer across optical interconnects can be made possible by silicon photonics technology, offering the speed and capacity required for contemporary data center operations. Optical transceivers, detectors, multiplexers and other components are available from Silicon Photonics as effective optical connection solutions for data centers.

The energy-efficient operation of silicon photonics technology is well recognized and it is essential for data centers that want to lower their power consumption, cooling costs and impact on the environment. Silicon Photonics-based optical interconnects consume less energy than conventional copper-based interconnects, which helps data centers operate more environmentally friendly and with reduced energy consumption. Data centers require scalable and dense connectivity solutions to accommodate increasing data volumes, virtualization and server consolidation. Silicon Photonics enables compact and scalable optical modules, enabling higher port densities, improved space utilization and simplified cabling infrastructure in data center environments.

High Initial Investment

One of the biggest obstacles to entry for new players in the Silicon Photonics market is the high entrance cost, especially for startups and medium-sized companies. The companies have trouble obtaining the funding needed for R&D, production facilities, tools and staff. As a result, it will be more difficult for them to compete with industry leaders and create novel products. The market of silicon photonics expands more slowly overall due to the expensive initial spending.

As there are financial risks associated with investing in new projects or increasing output, companies are hesitant about doing so. The conservative attitude impedes the adoption of Silicon Photonics technology across a range of sectors and applications, as well as slows down market growth rates. Companies' capacity to spend on R&D and innovation could be limited by the large initial investment's financial cost. The constraint slows the rate of technical development in Silicon Photonics and postpones the release of new products, functionalities and features that have the potential to expand the market and satisfy changing consumer needs.

Segment Analysis

The global silicon photonics market is segmented based on product, component, waveguide, application and region.

Growing Adoption of Silicon Photonics in Telecommunication Application

Based on the Application, the Silicon photonics market is segmented into Data Centers and High-performance computing, Telecommunication, Military, Defense & Aerospace, Medical and Life Science and Others.

Telecommunication networks need to have the capacity able to transmit data at high speeds to fulfill the growing need for data-intensive services like cloud computing, video streaming, online gaming and virtual meetings. Silicon photonics technology is excellent for telecommunication infrastructure because it offers optical interconnects, transceivers and other components that enable high-speed data transfer over great distances with minimal latency.

The adoption of 5G networks helps to boost the demand for silicon photonics technology in the telecommunications industry. As a way to enable sophisticated services like the Internet of Things, autonomous vehicles, augmented reality and 5G technology requires a highly rapid, low-latency communication infrastructure. The front-haul or back-haul and optical interconnects needed for 5G infrastructure are all made possible by Silicon Photonics. To manage enormous data traffic and cloud services, phone companies and data center operators are expanding the capacity and connectivity of their networks. Silicon photonics technology enables high-capacity data center interconnects (DCIs) with lower electrical consumption, a smaller footprint and greater bandwidth, increasing the efficiency and performance of data center networks.

Geographical Penetration

Asia-Pacific is Dominating the Silicon Photonics Market

The adoption of digital technology is accelerating across a range of industries in technologies. For these digital ecosystems, silicon photonics is needed to provide relationships, optical networking and high-speed data transmission. The demand for Silicon Photonics solutions is being driven by the implementation of 5G networks in Asia-Pacific countries. Silicon Photonics offers the optical interconnects and components needed for 5G base stations and data center interconnects. 5G technology needs high-speed, low-latency communication systems. Silicon Photonics has grown in the area due to its transition to 5G.

The growth and construction of data centers are growing in the Asia-Pacific to accommodate the region's expanding demands for online applications and digital services. Silicon photonics is the foundation for both data center interconnects and high-capacity connections within data centers. Silicon Photonics is being embraced by the data center sector due to the need for reasonable, high-bandwidth optical solutions.

Competitive Landscape.

The major global players in the market include AIO Core Co. Ltd., FormFactor, Polariton Technologies AG, SCINTIL Photonics, STMicroelectronics, FUJITSU, EFFECT PHOTONICS, RONOVUS, NKT Photonics A/S and Intel Corporation.

COVID-19 Impact Analysis

Global supply chains for semiconductor raw materials, parts and machinery required in Silicon Photonics manufacture, have been knocked off balance by the epidemic. Vendors of silicon photonics have longer lead times, shortages of supplies and manufacturing delays as a result of factors including shipping constraints, facility closures and logistical challenges. Lockdowns, social distancing rules and staff interruptions presented operating issues for several Silicon Photonics producers. Production facilities' total production efficiency and output levels were impacted by the implementation of security measures, capacity decreases and manufacturing process adjustments.

The pandemic changed consumer demand for silicon photonics products in a variety of business sectors. Some industries, including consumer electronics and aerospace, came across lower demand and postponed projects, while industries like data centers, telecommunications and healthcare experienced a surge in demand for digital infrastructure, remote services and high-speed connections. The growing demand for Silicon Photonics solutions that offer cloud computing, virtual meetings, high-speed data transfer and telecommunication services has been driven by the pandemic-related trend towards distant work and a higher reliance on technological advances.

Russia-Ukraine War Impact Analysis

The conflict between Ukraine and Russia damages the supply chains for the components and semiconductor materials required to manufacture silicon photonics. Major key players in silicon photonics experience shortages and higher prices as a result of disruptions in these supply chains. The dispute leads to geopolitical tensions and uncertainty that affect global trade, investment and stability in the markets. Organizations in the silicon photonics sector encounter difficulties with trade restrictions, tariffs, export-import laws and political unrest that have an impact on their business operations, alliances and plans for growing their customer base.

The demand for Silicon Photonics products is impacted by geopolitical conditions, especially in areas where war or instability is immediately experienced. The demand from sectors including consumer electronics, data centers, healthcare and telecommunications may fluctuate due to economic uncertainty and disruptions, which would affect Silicon Photonics suppliers' sales and revenue growth.

By Product

- Transceivers

- Variable Optical Attenuators

- Switches

- Cables

- Sensors

- Others

By Component

- Lasers

- Modulators

- Photo Detectors

By Waveguide

- 400-1,500 NM

- 1,310-1,550 NM

- 900-7000 NM

By Application

- Data Centers and High-performance computing

- Telecommunication

- Military

- Defense & Aerospace

- Medical and Life Science

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- On October 21, 2023, IIT Madras launched the Centre of Excellence for Silicon Photonics in collaboration with MeitY. The objective of the Silicon Photonics Centre of Excellence, Centre for Programmable Photonic Integrated Circuits and Systems (Silicon Photonics CoE-CPPICS) is to drive product commercialization through startups while achieving self-sufficiency within the next five years.

- On October 02, 2023, DustPhotonics, announced Industry-First Merchant 800G Silicon Photonics Chip for Hyperscale Data Centers and AI Applications. The 800G PIC is a single-chip solution that can be used for both DR8 and DR8+ applications. It offers an aggregate bandwidth of 800Gb/s over 8 separate optical channels that are modulated at 100Gb/s.

- On October 13, 2023, Enosemi, launched a committed commercial license to key silicon photonics design IP created by Luminous Computing. An experienced executive team with exceptional knowledge in silicon photonics, analog mixed signal, lasers, control, packaging and system hardware oversees Enosemi.

Why Purchase the Report?

- To visualize the global silicon photonics market segmentation based on product, component, waveguide, application and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of silicon photonics market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

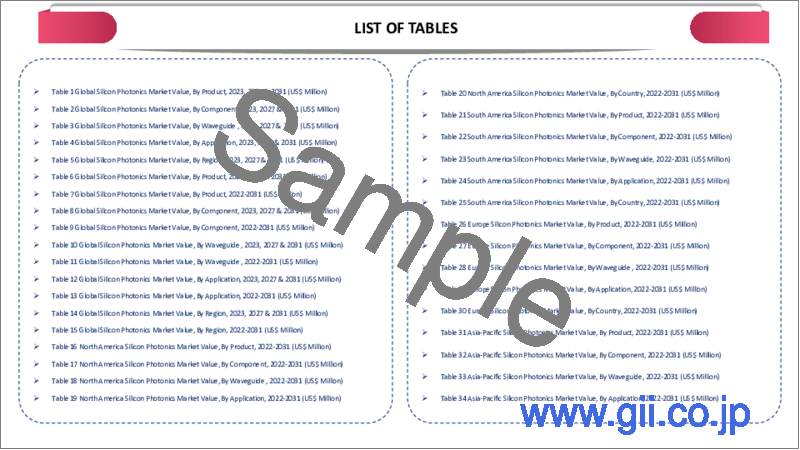

The global silicon photonics market report would provide approximately 70 tables, 68 figures and 206 Pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

Table of Contents

1.Methodology and Scope

- 1.1.Research Methodology

- 1.2.Research Objective and Scope of the Report

2.Definition and Overview

3.Executive Summary

- 3.1.Snippet by Product

- 3.2.Snippet by Component

- 3.3.Snippet by Waveguide

- 3.4.Snippet by Application

- 3.5.Snippet by Region

4.Dynamics

- 4.1.Impacting Factors

- 4.1.1.Drivers

- 4.1.1.1.Growing Internet Traffic

- 4.1.2.Growing Demand for Silicon Photonics in Data Centre

- 4.1.3.Restraints

- 4.1.3.1.High Initial Investment

- 4.1.4.Opportunity

- 4.1.5.Impact Analysis

- 4.1.1.Drivers

5.Industry Analysis

- 5.1.Porter's Five Force Analysis

- 5.2.Supply Chain Analysis

- 5.3.Pricing Analysis

- 5.4.Regulatory Analysis

- 5.5.Russia-Ukraine War Impact Analysis

- 5.6.DMI Opinion

6.COVID-19 Analysis

- 6.1.Analysis of COVID-19

- 6.1.1.Scenario Before COVID

- 6.1.2.Scenario During COVID

- 6.1.3.Scenario Post COVID

- 6.2.Pricing Dynamics Amid COVID-19

- 6.3.Demand-Supply Spectrum

- 6.4.Government Initiatives Related to the Market During Pandemic

- 6.5.Manufacturers Strategic Initiatives

- 6.6.Conclusion

7.By Product

- 7.1.Introduction

- 7.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 7.1.2.Market Attractiveness Index, By Product

- 7.2.Transceivers*

- 7.2.1.Introduction

- 7.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3.Variable Optical Attenuators

- 7.4.Switches

- 7.5.Cables

- 7.6.Sensors

- 7.7.Others

8.By Component

- 8.1.Introduction

- 8.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Component

- 8.1.2.Market Attractiveness Index, By Component

- 8.2.Lasers*

- 8.2.1.Introduction

- 8.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3.Modulators

- 8.4.Photo Detectors

9.By Waveguide

- 9.1.Introduction

- 9.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Waveguide

- 9.1.2.Market Attractiveness Index, By Waveguide

- 9.2.400-1,500 NM*

- 9.2.1.Introduction

- 9.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3.1,310-1,550 NM

- 9.4.900-7000 NM

10.By Application

- 10.1.Introduction

- 10.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.1.2.Market Attractiveness Index, By Application

- 10.2.Data Centers and High-performance computing*

- 10.2.1.Introduction

- 10.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3.Telecommunication

- 10.4.Military

- 10.5.Defense & Aerospace

- 10.6.Medical and Life Science

- 10.7.Others

11.By Region

- 11.1.Introduction

- 11.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 11.1.2.Market Attractiveness Index, By Region

- 11.2.North America

- 11.2.1.Introduction

- 11.2.2.Key Region-Specific Dynamics

- 11.2.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 11.2.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Component

- 11.2.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Waveguide

- 11.2.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.2.7.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.2.7.1.U.S.

- 11.2.7.2.Canada

- 11.2.7.3.Mexico

- 11.3.Europe

- 11.3.1.Introduction

- 11.3.2.Key Region-Specific Dynamics

- 11.3.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 11.3.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Component

- 11.3.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Waveguide

- 11.3.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.3.7.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.3.7.1.Germany

- 11.3.7.2.UK

- 11.3.7.3.France

- 11.3.7.4.Italy

- 11.3.7.5.Spain

- 11.3.7.6.Rest of Europe

- 11.4.South America

- 11.4.1.Introduction

- 11.4.2.Key Region-Specific Dynamics

- 11.4.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 11.4.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Component

- 11.4.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Waveguide

- 11.4.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.4.7.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.4.7.1.Brazil

- 11.4.7.2.Argentina

- 11.4.7.3.Rest of South America

- 11.5.Asia-Pacific

- 11.5.1.Introduction

- 11.5.2.Key Region-Specific Dynamics

- 11.5.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 11.5.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Component

- 11.5.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Waveguide

- 11.5.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.5.7.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.5.7.1.China

- 11.5.7.2.India

- 11.5.7.3.Japan

- 11.5.7.4.Australia

- 11.5.7.5.Rest of Asia-Pacific

- 11.6.Middle East and Africa

- 11.6.1.Introduction

- 11.6.2.Key Region-Specific Dynamics

- 11.6.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 11.6.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Component

- 11.6.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Waveguide

- 11.6.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

12.Competitive Landscape

- 12.1.Competitive Scenario

- 12.2.Market Positioning/Share Analysis

- 12.3.Mergers and Acquisitions Analysis

13.Company Profiles

- 13.1.AIO Core Co. Ltd.*

- 13.1.1.Company Overview

- 13.1.2.Product Portfolio and Description

- 13.1.3.Financial Overview

- 13.1.4.Key Developments

- 13.2.FormFactor.

- 13.3.Polariton Technologies AG

- 13.4.SCINTIL Photonics

- 13.5.STMicroelectronics

- 13.6.FUJITSU

- 13.7.EFFECT PHOTONICS

- 13.8.RONOVUS

- 13.9.NKT Photonics A/S

- 13.10.Intel Corporation

LIST NOT EXHAUSTIVE

14.Appendix

- 14.1.About Us and Services

- 14.2.Contact Us