|

|

市場調査レポート

商品コード

1459324

アルミニウム鋳物の世界市場-2024-2031年Global Aluminum Casting Market - 2024-2031 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| アルミニウム鋳物の世界市場-2024-2031年 |

|

出版日: 2024年04月03日

発行: DataM Intelligence

ページ情報: 英文 205 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

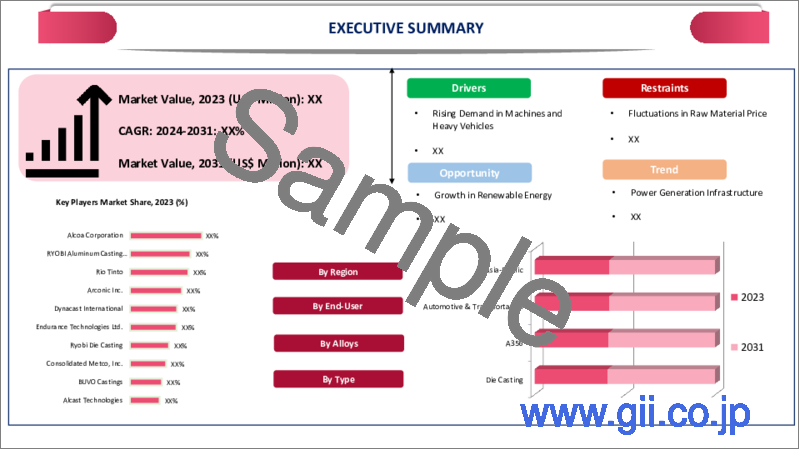

アルミニウム鋳物の世界市場は、2023年に705億米ドルに達し、2031年には1,257億米ドルに達すると予測され、予測期間2024-2031年のCAGRは7.5%で成長します。

高強度で軽量な鋳物への嗜好の高まりが大きな原動力となっています。輸送事業のメーカーは、燃費の向上と有害排出物の削減を目的とした法律を遵守しなければならないです。軽量材料を自動車構造に組み込むことは可能です。米国では、一般用多目的車やスポーツ用多目的車の需要の増加が製品需要を牽引すると予想されます。

米国の自動車メーカーは、自動車の排出ガスに関する環境規制の遵守を迫られています。企業平均燃費によると、温室効果ガス排出量の増加により、乗用車は2026年までに1ガロン当たり54.5マイルの燃費目標を達成しなければならず、これが市場成長を押し上げると予想されます。

2023年には、北米が世界のアルミニウム鋳物市場の約25%を占め、2番目に急成長する地域になると予想されます。持続可能なソリューションの導入が重視されていることから、同地域の製品需要が増加すると予想されます。例えば、2020年12月、Rio Tintoはダイカスターのリサイクルを支援するため、高品質アルミニウム合金の新ラインを開始しました。このような活動は、予測期間中の市場成長にとって有益であると予想されます。

ダイナミクス

道路建設の増加

発展途上国における道路建設と拡張活動は大幅に増加すると予想されます。多くの国々におけるインフラ支出の増加は、これらの国々の主要な経済中心地間のより良い輸送と接続のための道路と高速道路の開発の増加に起因しています。インド・ブランド・エクイティ財団によると、インフラ部門はインド政府の重点分野のひとつとなっています。

2021年3月、スペインで重要な道路区間の改築プロジェクトが落札されました。プロジェクト費用は2億9,380万米ドルで、A4道路の70キロの区間が対象です。2021年5月、ブラジルは重要な新しい道路協定を発表しました。高速道路の改良には14億2,000万米ドルがかかると予測されています。新たな道路開発は、都市部と農村部の両方で道路網を強化し、アスファルト改質剤の需要を押し上げると予想されます。

M&Aの増加

産業活動、インフラプロジェクト、消費者市場の増加は、アルミニウム鋳物メーカーに拡大する市場に対応する機会を提供します。大手企業は市場拡大を加速させるため、買収や提携の数を増やしています。例えば、Wencan Group Co., Ltd.は2022年8月、安徽省Lu'an Economic and Technological Development Zoneに新エネルギー車向けアルミダイカスト部品の生産基地を開発する計画を発表しました。

Sandhar Engineering Private Limitedは、2021年10月に完全子会社として設立され、各種ロック装置、電気、電子、機械、自動車、工業部品の生産・組立を行っています。アルミニウム鋳物市場は、自動車産業や非自動車産業からの軽量部品や高導電性金属部品に対する需要の高まりを満たすため、予測期間中に拡大すると予想されます。

鋳造の高コスト

アルミニウム鋳物には、溶解、精錬、鋳造を含むエネルギー集約的な作業が必要です。電力や天然ガスなどのエネルギー価格の変動は、アルミニウム鋳物工場の生産コストと市場における競争力に大きな影響を与える可能性があります。アルミニウム合金、地金、スクラップなどの原材料の入手可能性とコストは、アルミニウム鋳物工場の収益性に影響を与える可能性があります。

世界のアルミニウム市場の変動、需給の不一致、貿易政策はすべて、メーカーの生産コストと利幅に影響を与える原材料価格の変動の要因となり得る。さらに、サービスを受けようとする人の数は、サービスに対する理解不足と障害に対する思い込みのために満たされていないです。さらに、中所得国では所得が低く、鋳造コストが上昇するため、市場拡大の妨げになる可能性があります。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 道路建設の増加

- M&Aの増加

- 抑制要因

- 鋳造コストの高さ

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMIの見解

第6章 COVID-19分析

第7章 プロセス別

- ダイカスト

- 砂型鋳造

- インベストメント鋳造

- 連続鋳造

- シェルモールド

- ロストフォーム鋳造

- 遠心鋳造

- 低圧鋳造

- 永久鋳型鋳造

第8章 合金別

- 1000シリーズ

- 2000シリーズ

- 3000シリーズ

- 4000シリーズ

- 5000シリーズ

- 6000シリーズ

- 7000シリーズ

- 8000シリーズ

第9章 エンドユーザー別

- 自動車・輸送

- 工業

- 航空機

- 農業

- 軍事・防衛

- 建築・建設

- その他

第10章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第11章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第12章 企業プロファイル

- Alcoa Corporation

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- RYOBI Aluminum Casting(UK)Ltd.

- Rio Tinto

- Arconic Inc.

- Dynacast International

- Endurance Technologies Ltd.

- Ryobi Die Casting

- Consolidated Metco, Inc.

- BUVO Castings

- Alcast Technologies

第13章 付録

Overview

Global Aluminum Casting Market reached US$ 70.5 billion in 2023 and is expected to reach US$ 125.7 billion by 2031, growing with a CAGR of 7.5% during the forecast period 2024-2031.

A growing preference for high-strength, lightweight castings is a major driving force. Manufacturers in the transportation business must comply with laws aimed at improving fuel efficiency and lowering hazardous emissions. It is possible to include lightweight materials into car construction. Increased demand for general utility and sports utility vehicles is expected to drive product demand in U.S.

Automobile manufacturers in U.S. are under pressure to comply environmental regulations governing car emissions. According to Corporate Average Fuel Economy, passenger automobiles must achieve a fuel efficiency target of 54.5 miles per gallon by 2026 due to increased greenhouse gas emissions, which is expected to boost market growth.

In 2023, North America is expected to be the second-fastest growing region, holding about 25% of the global aluminum casting market. The emphasis on the implementation of sustainable solutions is expected to increase product demand in the region. For example, in December 2020, Rio Tinto started a new line of high-quality aluminum alloys to help die casters in recycling. Such activities are expected to prove beneficial for market growth during the forecast period.

Dynamics

Rising Road Construction

Road construction and expansion activities in the developing world are expected to increase significantly. The rise in infrastructure spending in many countries can be ascribed to the increased development of roads and highways for better transportation and connection between these countries' major economic centers. According to the India Brand Equity Foundation, the infrastructure sector has become one of the Indian government's primary focus areas.

In March 2021, a project to reconstruct an important road segment was won in Spain. The project costs US$ 293.8 million and covers a 70-kilometer stretch of the A4 roadway. In May 2021, Brazil announced a significant new roadway agreement. Improvements to the highway are projected to cost US$ 1.42 billion. New road developments are expected to strengthen the road network in both urban and rural areas, driving up demand for asphalt modifiers.

Growing Number of Mergers and Acquisitions

The rise of industrial activity, infrastructural projects and consumer markets provides opportunity for aluminum casting manufacturers to serve expanding markets. The leading firms are making an increasing number of acquisitions and collaborations in order to accelerate market expansion. For example, in August 2022, Wencan Group Co., Ltd. announced that it plans to develop a production base of aluminum die-cast parts for New Energy Vehicles in Lu'an Economic and Technological Development Zone, Anhui Province.

Sandhar Engineering Private Limited was established in October 2021 as a completely owned subsidiary company to produce and assemble various locking devices, electrical, electronic, mechanical, automobile and industrial parts. The aluminum casting market is expected to expand during the forecast period to fulfil the growing demand for lightweight components and high-conductivity metal parts from the automotive and non-automotive industries.

High Costs of Casting

Aluminum casting requires energy-intensive operations including melting, refining and casting. Fluctuations in energy prices, such as electricity and natural gas, can have a substantial impact on aluminum casting foundries' production costs and competitiveness in the market. The availability and cost of raw materials such as aluminum alloys, ingots and scrap can influence the profitability of aluminum casting foundries.

Fluctuations in global aluminum markets, supply-demand mismatches and trade policies can all contribute to raw material price volatility, which affects manufacturers' production costs and margins. Furthermore, the number of persons wanting services is not being met due to a lack of understanding of services and beliefs about disability, both of which influence treatment seekers. Furthermore, middle-income countries can impede market expansion due to a lower income profile and the rising cost of casting.

Segment Analysis

The global aluminum casting market is segmented based on process, alloy, end-user and region.

Rising Demand for Lightweight Materials Drives the Segment Growth

Building and construction is expected to be the fastest growing segment with 1/3rd of the market during the forecast period 2024-2031. Aluminum casting can be used in a variety of applications, including roofs, door handles, windows and curtain walls. The increased replacement of iron and steel due to changing customer preferences, as well as the advantages of aluminum, such as its lightweight and aesthetic appeal, will drive the segment growth.

The increased substitution of iron and steel due to evolving consumer tastes, as well as the benefits of aluminum, such as its lightweight and aesthetic appeal, are expected to drive the industry during the forecast period. Jindal Aluminium announced in 2024 that it will open a new fabrication division to produce engineered aluminum goods for the building and construction industries, including interior and exterior building products, windows & gates, furnishings, appliances, exhibition displays and roofing.

Geographical Penetration

Rising Automotive Production in Asia-Pacific

Asia-Pacific is the dominant region in the global aluminum casting market covering over 35% of the market. Cheaper labour and production costs in India and China are likely to drive regional market expansion. Furthermore, rising demand for electric and hybrid vehicles has shifted automakers' focus to adopting lightweight materials like aluminum as a substitute for heavy steel and iron in all types of vehicles.

For example, in May 2022, the Tamil Nadu Small Industries Development Corporation committed INR 5.8 crores to build a shared facility centre for aluminum high-pressure die casting. Furthermore, the expanding automobile manufacturing industries across the country are expected to raise demand for lightweight materials for automotive applications. For example, in February 2021, MG Motors indicated that INR 1,500 crore could be spent in the expansion and localization of its business to enhance production capacity at the Halol factory in Gujarat.

Competitive Landscape

The major global players in the market include Alcoa Corporation, RYOBI Aluminum Casting (UK) Ltd., Rio Tinto, Arconic Inc., Dynacast International, Endurance Technologies Ltd., Ryobi Die Casting, Consolidated Metco, Inc., BUVO Castings and Alcast Technologies.

COVID-19 Impact

The COVID-19 outbreak affected supply lines and caused delays in building and construction projects globally. Due to a scarcity of raw materials, labor and government rules, which forced ongoing projects to be halted, an economic crisis ensued, with construction being one of the hardest impacted sectors. During the third quarter of 2020, some local governments began measures to restart road, highway and building construction projects.

Following April 2020, the German Ministry of Transport and Digital Infrastructure resumed building and road construction. Since the second half of 2020, countries like Romania and India have begun highway and road construction. While other infrastructure sectors were severely impacted by the epidemic, the transportation industry experienced a banner year in 2020-21. As a result, when compared to the previous year, the construction sector is expected to grow substantially in 2021.

Russia-Ukraine War Impact

Geopolitical tensions and war can create market uncertainty, leading buyers and investors to pause. Geopolitical conflicts caused delays or cancellations in investment and expansion plans in the aluminum casting industry. Companies may be more cautious about capital spending and strategic decision-making until geopolitical issues are addressed.

Rio Tinto displayed sagacity in 2022, amidst the geopolitical upheaval caused by Russia's invasion of Ukraine, by terminating links with the Russian aluminum producer's subsidiaries while still owning a 20% share in Queensland Alumina Limited. The strategic action involved delaying the delivery of bauxite and alumina to the Russian giant, eventually using emergency step-in rights to prevent any economic advantage from coming to the restricted companies.

By Process

- Die Casting

- Gravity Die Casting

- Pressure Die Casting

- Squeeze Die Casting

- Sand Casting

- Investment Casting

- Continuous Casting

- Shell Molding

- Lost-Foam Casting

- Centrifugal Casting

- Low-Pressure Casting

- Permanent Mold Casting

By Alloy

- 1000 Series

- 2000 Series

- 3000 Series

- 4000 Series

- 5000 Series

- 6000 Series

- 7000 Series

- 8000 Series

By End-User

- Automotive and Transportation

- Industrial

- Aircrafts

- Agriculture

- Military and Defence

- Building and Construction

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- In 2024, Alcoa Corporation has announced that it will provide global cable producer Nexans with aluminum manufactured using a novel technology that eliminates all direct greenhouse gas emissions from traditional smelting. Nexans will be the first cable maker to use metal from the groundbreaking ELYSIS(TM) process, which substitutes all greenhouse gas emissions with oxygen.

- In 2023, Rio Tinto intended to increase its Alma, Quebec smelter's capacity for producing low-carbon, high-value aluminum billets by 202,000 metric tons. The current casting facility will be expanded to include new cutting-edge equipment such as furnaces, a casting pit, coolers, handling, inspection, sawing and packing systems.

Why Purchase the Report?

- To visualize the global aluminum casting market segmentation based on process, alloy, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of aluminum casting market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

The global aluminum casting market report would provide approximately 62 tables, 67 figures and 205 pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1.Methodology and Scope

- 1.1.Research Methodology

- 1.2.Research Objective and Scope of the Report

2.Definition and Overview

3.Executive Summary

- 3.1.Snippet by Process

- 3.2.Snippet by Alloy

- 3.3.Snippet by End-User

- 3.4.Snippet by Region

4.Dynamics

- 4.1.Impacting Factors

- 4.1.1.Drivers

- 4.1.1.1.Rising Road Construction

- 4.1.1.2.Growing Number of Mergers and Acquisitions

- 4.1.2.Restraints

- 4.1.2.1.High Costs of Casting

- 4.1.3.Opportunity

- 4.1.4.Impact Analysis

- 4.1.1.Drivers

5.Industry Analysis

- 5.1.Porter's Five Force Analysis

- 5.2.Supply Chain Analysis

- 5.3.Pricing Analysis

- 5.4.Regulatory Analysis

- 5.5.Russia-Ukraine War Impact Analysis

- 5.6.DMI Opinion

6.COVID-19 Analysis

- 6.1.Analysis of COVID-19

- 6.1.1.Scenario Before COVID

- 6.1.2.Scenario During COVID

- 6.1.3.Scenario Post COVID

- 6.2.Pricing Dynamics Amid COVID-19

- 6.3.Demand-Supply Spectrum

- 6.4.Government Initiatives Related to the Market During Pandemic

- 6.5.Manufacturers Strategic Initiatives

- 6.6.Conclusion

7.By Process

- 7.1.Introduction

- 7.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Process

- 7.1.2.Market Attractiveness Index, By Process

- 7.2.Die Casting*

- 7.2.1.Introduction

- 7.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.2.3.Gravity Die Casting

- 7.2.4.Pressure Die Casting

- 7.2.5.Squeeze Die Casting

- 7.3.Sand Casting

- 7.4.Investment Casting

- 7.5.Continuous Casting

- 7.6.Shell Molding

- 7.7.Lost-Foam Casting

- 7.8.Centrifugal Casting

- 7.9.Low-Pressure Casting

- 7.10.Permanent Mold Casting

8.By Alloys

- 8.1.Introduction

- 8.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Alloys

- 8.1.2.Market Attractiveness Index, By Alloys

- 8.2.1000 Series*

- 8.2.1.Introduction

- 8.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3.2000 Series

- 8.4.3000 Series

- 8.5.4000 Series

- 8.6.5000 Series

- 8.7.6000 Series

- 8.8.7000 Series

- 8.9.8000 Series

9.By End-User

- 9.1.Introduction

- 9.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 9.1.2.Market Attractiveness Index, By End-User

- 9.2.Automotive and Transportation*

- 9.2.1.Introduction

- 9.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3.Industrial

- 9.4.Aircrafts

- 9.5.Agriculture

- 9.6.Military and Defence

- 9.7.Building and Construction

- 9.8.Others

10.By Region

- 10.1.Introduction

- 10.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 10.1.2.Market Attractiveness Index, By Region

- 10.2.North America

- 10.2.1.Introduction

- 10.2.2.Key Region-Specific Dynamics

- 10.2.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Process

- 10.2.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Alloy

- 10.2.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.2.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.2.6.1.U.S.

- 10.2.6.2.Canada

- 10.2.6.3.Mexico

- 10.3.Europe

- 10.3.1.Introduction

- 10.3.2.Key Region-Specific Dynamics

- 10.3.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Process

- 10.3.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Alloy

- 10.3.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.3.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.3.6.1.Germany

- 10.3.6.2.UK

- 10.3.6.3.France

- 10.3.6.4.Italy

- 10.3.6.5.Russia

- 10.3.6.6.Rest of Europe

- 10.4.South America

- 10.4.1.Introduction

- 10.4.2.Key Region-Specific Dynamics

- 10.4.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Process

- 10.4.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Alloy

- 10.4.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.4.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.4.6.1.Brazil

- 10.4.6.2.Argentina

- 10.4.6.3.Rest of South America

- 10.5.Asia-Pacific

- 10.5.1.Introduction

- 10.5.2.Key Region-Specific Dynamics

- 10.5.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Process

- 10.5.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Alloy

- 10.5.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.5.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.5.6.1.China

- 10.5.6.2.India

- 10.5.6.3.Japan

- 10.5.6.4.Australia

- 10.5.6.5.Rest of Asia-Pacific

- 10.6.Middle East and Africa

- 10.6.1.Introduction

- 10.6.2.Key Region-Specific Dynamics

- 10.6.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Process

- 10.6.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Alloy

- 10.6.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

11.Competitive Landscape

- 11.1.Competitive Scenario

- 11.2.Market Positioning/Share Analysis

- 11.3.Mergers and Acquisitions Analysis

12.Company Profiles

- 12.1.Alcoa Corporation*

- 12.1.1.Company Overview

- 12.1.2.Product Portfolio and Description

- 12.1.3.Financial Overview

- 12.1.4.Key Developments

- 12.2.RYOBI Aluminum Casting (UK) Ltd.

- 12.3.Rio Tinto

- 12.4.Arconic Inc.

- 12.5.Dynacast International

- 12.6.Endurance Technologies Ltd.

- 12.7.Ryobi Die Casting

- 12.8.Consolidated Metco, Inc.

- 12.9.BUVO Castings

- 12.10.Alcast Technologies

LIST NOT EXHAUSTIVE

13.Appendix

- 13.1.About Us and Services

- 13.2.Contact Us