|

|

市場調査レポート

商品コード

1352183

慢性疾患管理の世界市場-2023年~2030年Global Chronic Disease Management Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 慢性疾患管理の世界市場-2023年~2030年 |

|

出版日: 2023年09月27日

発行: DataM Intelligence

ページ情報: 英文 186 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

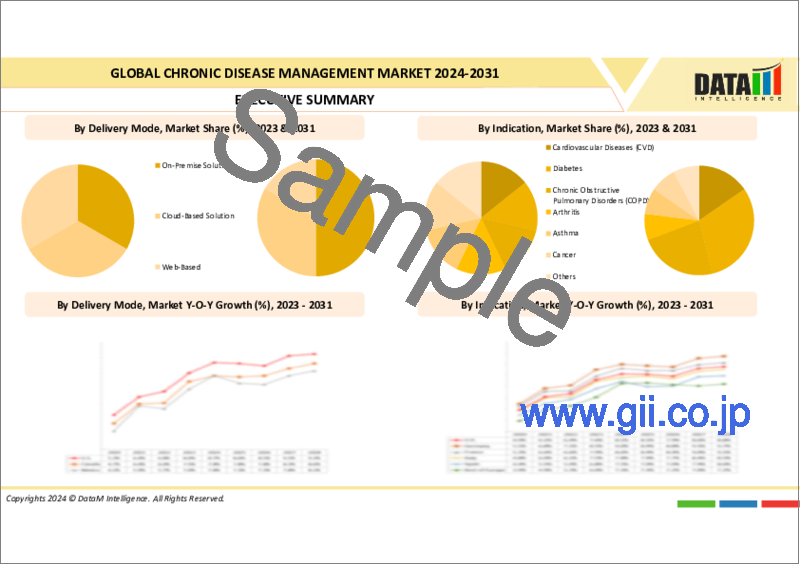

世界の慢性疾患管理市場は、2022年に48億米ドルに達し、2023~2030年の予測期間中にCAGR 11.4%で成長し、2030年には146億米ドルに達すると予測されます。

慢性疾患の負担は世界中で急速に増加しています。残念なことに、こうした疾病の大半は慢性的であり、治療には生涯にわたる医薬品の使用が必要です。慢性疾患管理の世界市場は、慢性疾患の有病率の増加、疾患管理に関する意識の高まり、慢性疾患を管理する高度なソリューション開発のための主要企業間の協力などの要因によって牽引されています。

慢性疾患管理市場には、糖尿病、心血管疾患、呼吸器疾患などの慢性的な健康障害の管理を支援する医療サービス、技術、ソリューションの供給が含まれます。慢性疾患の罹患率の上昇、高齢化、技術開発、予防医療重視などの理由から、この業界は拡大しています。

アジア太平洋地域の経済成長に伴い、医療への支出も増加しています。このため、慢性疾患の管理など医療技術やソリューションに投資するチャンスがあります。同地域の中国やインドなどいくつかの国では高齢化が進んでおり、慢性疾患の有病率が高まっています。効率的な管理ソリューションに対する需要は、この人口動向によってさらに浮き彫りになっています。

ダイナミクス

技術の進歩

例えば、2022年10月には、デジタル治療のパイオニアであるSweetch社によって慢性疾患向けの高精度エンゲージメント・プラットフォームが開発され、患者のコンプライアンスを改善するためのプラットフォームのアップデートがリリースされました。慢性疾患患者が推奨される行動や治療レジメンを遵守しないことは、多大な人的不幸と年間数千億米ドルの過剰支出をもたらします。最も効果的な治療法であっても、臨床転帰を改善するためには、病院や診療所の枠を超え、日常生活の中で患者を関与させるような、定期的でカスタマイズされた介入が必要です。

現在のところ、このような治療法のスケーラブルな提供は、人間に依存した慢性疾患管理プログラムでは不可能です。Sweetchは、より良い健康に向けた患者の旅のあらゆる段階で、人工知能(AI)と感情知能(EI)の行動科学技術を組み合わせて使用し、何百万ものデータポイントを超個別化された推奨に変換します。これらのレコメンデーションは、適切なタイミングで、適切な音声で、適切な文脈で患者に提供されます。

慢性疾患管理ソリューションにおける積極的な主要企業

2023年1月現在、Valencell社が提供する最初の慢性疾患管理ソリューションは、高血圧患者を支援し、より適切で一貫性のある血圧モニタリングと治療アドヒアランスの維持を目的としています。この装置は、不快で煩わしいカフを使用せず、中指の小さなプローブを使用して1分以内に血圧を測定することを目的としています。この装置の光電式(PPG)センサーは、反射光を利用して血流パターンを測定します。

血圧測定値を生成するために、独自のAIアルゴリズムが7,000人以上の患者からなるPPGデータセットから身体的属性とともに処理されます。その後、デバイスの内蔵スクリーンに拡張期と収縮期の値が表示され、Bluetooth経由でアプリに転送されます。

先進的ソリューション開発するための主要企業間の提携

例えば、2022年11月、メリーランド州を拠点とする医療システムMedStar Healthと精密医療技術企業Zephyr AI, Inc.は、2型糖尿病(T2D)をはじめとする慢性疾患の予後を改善するために協力しました。この提携は、メドスター・ヘルスが保有する非識別化T2Dデータセットと患者管理経験を活用し、ゼファーAIのインサイト予測分析製品の開発を進めるものです。このツールは、末期慢性腎臓病、透析、足潰瘍、切断などの負の転帰を減少させ、T2D治療の適時性を高めることを目的としています。

ゼファーAIとメドスター・ヘルスは、慢性疾患に対する精密医療の可能性を広げ、糖尿病患者の予後改善と医療費削減を支援する現在のプログラムをサポートする技術を開発することができます。今回の提携は、予防から治療に至るまで、精密医療におけるアンメットニーズを解決するためにAIを活用することで、患者の転帰を改善するという、より大きなイニシアチブの一環です。この提携は、インサイトツールをアップグレードすることで、精密医療を用いた糖尿病治療の予測精度を高めることを意図しています。

慢性疾患管理で重要な役割を果たすデジタル治療

世界的に、慢性疾患の負担は増加の一途をたどっており、今後もその傾向が続くと予測されています。2010年の死亡者数の75%、2020年の死亡者数の79%は、慢性疾患(心血管疾患、がん、糖尿病、呼吸器疾患など)が原因または原因となっています。専門家の予測では、2030年までに慢性疾患は世界全体の死因の84%を占めるようになります。デジタル医薬品は、慢性的な健康問題を管理するためのより良い方法を提供し、疾病の負担を軽減し、より良い臨床結果をもたらし、医療従事者がより賢明な治療決定を下すのを支援することで、患者の生活を大幅に向上させる可能性を秘めています。

慢性疾患の管理には、単に薬を服用するだけでなく、日常的な評価とライフスタイルの変化が必要です。推奨される薬、食事、ライフスタイルに対する患者のコンプライアンスを向上させるためには、臨床医は患者の健康を積極的かつ徹底的にモニターするエンド・ツー・エンドのソリューションを改善する必要があります。

このような障害を克服することで、デジタル技術は疾病管理の理解向上に大きく貢献することができます。世界人口の3分の2以上がインターネットにアクセスできるようになったという事実は、デジタル治療が大きな影響を与える可能性を示しています

慢性疾患管理プラットフォームの設計と導入にかかる多額の費用

ソフトウェア・プログラム、医療機器、データ統合のためのプラットフォームなど、効果的な慢性疾患管理ソリューションには、研究開発に多額の投資が必要です。これらの費用はイノベーションを妨げ、新規競合企業の参入を制限する可能性があります。慢性疾患管理ソリューションを現在のワークフローに組み込むには、医療提供者はインフラ、トレーニング、サポートシステムに投資する必要があることが多いです。

特に大規模な医療機関では、導入や統合にかかる費用が高額になる可能性があります。慢性疾患を管理するソリューションには、継続的な維持管理、アップグレード、技術支援が必要です。特にリソースの少ない病院では、こうした継続的な出費によって予算が圧迫される可能性があります。

患者エンゲージメントの課題

患者参加に関する問題は、慢性疾患の効率的な管理に対する大きな障壁です。成果を上げるには、患者自身がケアに参加することが重要ですが、これを困難にする多くの問題があります。多くの患者は、自分の慢性疾患や、それを管理することの重要性、患者が利用できるツールやリソースを十分に理解していない可能性があります。このような無知によって、患者自身のケアに参加する意欲が減退してしまうこともあります。

いくつかの慢性疾患には、薬物、食事調整、運動習慣などを組み込んだ複雑な治療計画が必要です。しかし、デジタルツールやアプリが患者の参加を向上させるにもかかわらず、すべての患者が携帯電話やパソコン、安定したインターネット接続を利用できるわけではありません。地域によっては、デジタルデバイドのために、テクノロジー主導のソリューションを利用できない場合もあります。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 技術の進歩

- 慢性疾患管理ソリューションにおける積極的な主要企業

- 先進的ソリューション開発するための主要企業間の提携

- 慢性疾患管理におけるデジタル治療の重要な役割

- 抑制要因

- 慢性疾患管理プラットフォームの設計と導入にかかる多額の費用

- 患者エンゲージメントの課題

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- DMIの見解

第6章 COVID-19分析

第7章 タイプ別

- ソリューション

- サービス

第8章 サービスの種類別

- コンサルティングサービス

- 教育サービス

- 実行サービス

- その他

第9章 提供形態別

- オンプレミス・ソリューション

- クラウド型ソリューション

- Webベース

第10章 適応症別

- 心血管疾患(CVD)

- 糖尿病

- 慢性閉塞性肺疾患(COPD)

- 関節炎

- 喘息

- がん

- その他

第11章 エンドユーザー別

- 医療提供者

- 医療保険支払者

- その他

第12章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋

- 中東・アフリカ

第13章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第14章 企業プロファイル

- Allscripts Healthcare Solutions Inc.

- 企業概要

- 製品ポートフォリオと説明

- 財務概要

- 主な動向

- TriZetto Corporation

- Siemens Healthcare Private Limited

- IBM

- Pegasystems Inc.

- Koninklijke Philips NV

- EXL Healthcare

- Infosys Limited

- ScienceSoft USA Corporation

- ZeOmega

第15章 付録

Overview

Global Chronic Disease Management Market reached US$ 4.8 billion in 2022 and is expected to reach US$ 14.6 billion by 2030, growing with a CAGR of 11.4% during the forecast period 2023-2030.

The burden of chronic illness is rapidly rising all across the world. Unfortunately, the majority of these illnesses are chronic and require lifelong pharmaceutical use to be treated. The global market for chronic disease management driving by factors such as increasing prevalence of chronic disease, rising awareness regarding disease management, collaboration among major players for development of advanced solutions to manage the chronic diseases.

The supply of medical services, technologies, and solutions geared on helping people manage chronic health disorders like diabetes, cardiovascular illnesses, respiratory diseases, and more is included in the chronic disease management market. Due to reasons such the rising incidence of chronic diseases, the aging population, technological developments, and a greater emphasis on preventative healthcare, this industry has been expanding.

Spending on healthcare has increased as economies in the Asia-Pacific area have expanded. This offers chances for investing in healthcare technologies and solutions, such as those pertaining to the management of chronic diseases. The growing aging of the population in several countries such as China and India in the region has increased the prevalence of chronic diseases. The demand for efficient management solutions is further highlighted by this demographic trend.

Dynamics

Technological Advancements

For instance, in October 2022, the precision engagement platform for chronic illnesses was developed by Sweetch, a pioneer in digital therapeutics, and an update to the platform was released in an effort to improve patient compliance. Chronic condition patient non-compliance with recommended behavior and treatment regimens results in significant human misery and annual overspending of hundreds of billions of dollars. Even the most effective therapy needs regular, tailored interventions that go beyond the hospital and clinic to engage patients in the context of their everyday life in order to improve clinical outcomes.

Currently, scalable delivery of such therapies is not possible through human-dependent chronic disease management programs. At every stage of the patient's journey toward better health, Sweetch uses a combination of artificial intelligence (AI) and emotional intelligence (EI) behavioral science technology to transform millions of data points into hyper-personalized recommendations. These recommendations are delivered to patients at the appropriate time, in the appropriate voice, and with the appropriate context.

Active Major Players in Chronic Disease Management Solutions

As of January 2023, the first chronic disease management solution from Valencell is intended to assist patients with hypertension in better and more consistent blood pressure monitoring and maintaining treatment adherence. Without the use of uncomfortable or cumbersome cuffs, the device is intended to test blood pressure in under a minute using a small probe on the middle finger. The device's photoplethysmography (PPG) sensors measure blood flow patterns using reflected light.

In order to generate a blood pressure reading, proprietary AI algorithms will be processed along with physical attributes from PPG datasets made up of more than 7,000 patients. The device's built-in screen then shows the diastolic and systolic values, which are subsequently transferred via Bluetooth to the app.

Collaboration Among Major Players to Develop Advanced Solution

For instance, in November 2022, MedStar Health, a Maryland-based health system, and the precision medicine technology firm Zephyr AI, Inc., collaborated in order to enhance outcomes for chronic diseases, starting with type 2 diabetes (T2D). The cooperation will use MedStar Health's de-identified T2D datasets and patient management experience to advance the development of Zephyr AI's Insights predictive analytics product. The tool is intended to decrease negative outcomes such end-stage chronic renal disease, dialysis, foot ulcers, and amputations and enhance the timeliness of T2D therapies.

Together, Zephyr AI and MedStar Health can create technology that expands the promise of precision medicine to chronic illnesses and supports our current programs to help diabetics achieve better outcomes and spend less money. The cooperation is a part of a bigger initiative to improve patient outcomes by utilizing AI to solve unmet needs in precision medicine, from prevention to therapy. The alliance intends to increase prediction accuracy for diabetes care using precision medicine by upgrading the Insights tool.

Digital Therapeutics Play an Important Role in Chronic-Disease Management

Globally, the burden of chronic diseases has been rising and is predicted to do so in the future. Seventy-five percent of fatalities globally in 2010 and 79% in 2020 were caused by or contributed to by chronic diseases (including cardiovascular disease, cancer, diabetes, and respiratory disease). Experts estimate that by 2030, chronic diseases would be responsible for up to 84% of all global deaths. Digital medicines have the potential to significantly enhance patients' lives by providing better ways to manage chronic health issues, lower the burden of disease, give better clinical outcomes, and assist healthcare practitioners in making more educated treatment decisions.

Managing chronic conditions requires more than just taking medication; it also requires routine evaluation and a change in lifestyle. In order to enhance patient compliance with recommended medications, diets, and lifestyles, clinicians need improved end-to-end solutions that actively and thoroughly monitor patient health.

By overcoming these obstacles, digital technology can significantly contribute to a better understanding of disease management. The fact that over two thirds of the world's population now has internet access demonstrates the potential for digital therapies to have a significant impact.

High Costs for Designing and Impletation of Chronic Disease Management Platform

Effective chronic disease management solutions, such as software programs, medical equipment, and platforms for integrating data, require a significant investment in research and development. These expenses may hinder innovation and restrict the entry of new competitors. To incorporate chronic illness management solutions into their current workflows, healthcare providers frequently need to invest in infrastructure, training, and support systems.

Implementation and integration expenses can be high, especially for larger healthcare organizations. Solutions for managing chronic diseases call for ongoing upkeep, upgrades, and technical assistance. Budgets may be put under stress by these continuous expenses, especially in hospital settings with little resources.

Patient Engagement Challenges

Problems with patient engagement are a major barrier to efficient management of chronic diseases. Successful outcomes depend on including patients in their own care, but there are a number of issues that can make this difficult. Many patients might not fully comprehend their chronic illnesses, the significance of managing them, or the tools and resources accessible to them. Their desire to participate in their own care may be diminished by this ignorance.

Complex treatment plans incorporating drugs, dietary adjustments, exercise routines, and other factors are necessary for several chronic conditions. Patients may find it difficult to manage these complex strategies, which might result in non-compliance.However, not all patients have access to cellphones, computers, or steady internet connections, despite the fact that digital tools and apps can improve patient participation. Certain communities may not be able to use technology-driven solutions because of the digital divide.

Segment Analysis

The global chronic disease management market is segmented based on type, service type, delivery mode, indication, end-user and region.

Versatility, Durability and Ability to Set and Harden Even Underwater

Diabetes segment has significant market share in chronic disease management market in 2022. The most frequent cause of renal failure that necessitates dialysis or a kidney transplant is diabetes. Over the past 30 years, kidney failure has become significantly more common in the United States, where diabetes is now responsible for half of all new cases. Diabetes-related chronic kidney disease (CKD) is widespread, morbid, and expensive.

According to the International Diabetes Federation, 537 million people worldwide had diabetes in 2021, and that number is projected to rise to 784 million by the year 2045. Over 25% of patients with diabetes have CKD, and it's been calculated that 40% of diabetics may eventually get the disease. The prevalence of CKD linked to diabetes has expanded proportionally as the prevalence of diabetes has increased.

Geographical Penetration

Chronic Disease Prevalence, Rising Awareness, and Advanced Healthcare Infrastructure

North America has been a dominant force in the global chronic disease management market. One or more chronic diseases, such as diabetes, cancer, heart disease, and stroke, affect six out of ten Americans. These and other chronic diseases are the main contributors to health care costs as well as the major causes of death and disability in the United States.

Approximately one in ten Americans, or more than 37 million people, have diabetes, according to the Centers for Disease Control and Prevention (CDC). 90% to 95% of them have type 2 diabetes, a chronic disease that can cause immunological, neurological, and cardiovascular problems that have a significant influence on quality of life. According to the American Diabetes Association, diabetes is also thought to account for approximately one in every seven dollars spent on healthcare in the United States.

Through the use of digital health-based interventions, the 30-day readmission rate for patients who experienced an AMI was reduced by 50%, according to a US study by Johns Hopkins and Corrie Health involving more than a thousand patients. The study included continuous vitals monitoring with connected devices, educational materials on procedures, risk factors, and lifestyle changes, medication management with reminders and adherence tracking, connection with the care team, mood tracking, and the ability to view drug side effects.

Competitive Landscape

The major global players in the market include Allscripts Healthcare Solutions Inc., TriZetto Corporation, Siemens Healthcare Private Limited, IBM, Pegasystems Inc., Koninklijke Philips NV, EXL Healthcare, Infosys Limited, ScienceSoft USA Corporation and ZeOmega.

COVID-19 Impact Analysis

The outbreak of the COVID-19 pandemic in late 2019 created unprecedented challenges for industries worldwide, including the global chronic disease management market. Global primary care responses to the coronavirus disease 2019 (COVID-19) pandemic have prioritized acute and urgent care for COVID-19 patients and involved a large number of practitioners in COVID-19 vaccination counseling and administration.

Chronic disease management (CDM), including treatment for illnesses including hypertension, diabetes, and cancer, has frequently been completely or partially disrupted as a result of this prioritization. The effects have been more severe for persons who have chronic illnesses. Heart disease, diabetes, cancer, chronic renal disease, chronic obstructive pulmonary disease, and obesity all raise the risk of developing a serious illness from COVID-19.

Both disease prevention (such as promoting a healthy diet and regular exercise, screening for cancer and other conditions, and receiving oral health care) and disease management (such as educating patients about medications to control hypertension, diabetes, asthma, and other chronic conditions) place a strong emphasis on safety and mitigation.

Russia-Ukraine War Impact Analysis

Healthcare infrastructure, including hospitals, clinics, and medical supply lines, can be severely disrupted by conflict and war. The accessibility and availability of healthcare services, including those for managing chronic diseases, could be hampered by this disturbance. Access to necessary pharmaceuticals and medical supplies may be hampered in conflict-affected areas.

Chronic disease patients depend on a consistent supply of pharmaceuticals, and any disruption to this supply chain could have detrimental effects on their health. Mass population displacement, particularly of people with chronic illnesses, can result from conflict. Displaced people may have difficulty getting the right medical care, medicines, and support services, which can have a negative impact on their health.

By Type

- Solution

- Services

By Service Type

- Consulting Service

- Implementation Service

- Educational Service

- Others

By Delivery Mode

- On-Premise Solution

- Cloud-Based Solution

- Web-Based

By Indication

- Cardiovascular Diseases (CVD)

- Diabetes

- Chronic Obstructive Pulmonary Disorders (COPD)

- Arthritis

- Asthma

- Cancer

- Others

By End-user

- Healthcare Providers

- Healthcare Payers

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- In March 2023, Royal Philips, a leader in health technology launched Philips Virtual Care Management, a comprehensive portfolio of adaptable solutions and services. Through lowering emergency room visits and lowering the cost of care through improving chronic disease management, Philips Virtual Care Management can lessen the burden on hospital employees.

- In October 2022, Aptar Pharma introduced a new disease management platform to assist patients as they navigate the treatment process. With the addition of this new platform, Aptar Pharma is able to provide patients across a variety of therapeutic areas with a comprehensive, end-to-end solution that supports them from the preventive and diagnosis phases through illness treatment. The Aptar Digital Health Disease Management Platform embodies the company's dedication to providing creative, compliant, and best-in-class solutions to improve the management of chronic diseases for patients receiving at-home care.

Why Purchase the Report?

- To visualize the global chronic disease management market segmentation based on type, service type, delivery mode, indication, end-user and region as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of chronic disease management market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

The global chronic disease management market report would provide approximately 61 tables, 58 figures and 186 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Type

- 3.2. Snippet by Service Type

- 3.3. Snippet by Delivery Mode

- 3.4. Snippet by Indication

- 3.5. Snippet by Application

- 3.6. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Technological advancements

- 4.1.1.2. Active Major Players in Chronic Disease Management Solutions

- 4.1.1.3. Collaboration Among Major Players to Develop Advanced Solution

- 4.1.1.4. Digital Therapeutics Play an Important Role in Chronic-Disease Management

- 4.1.2. Restraints

- 4.1.2.1. High Costs for Designing and Implementation of Chronic Disease Management Platform

- 4.1.2.2. Patient Engagement Challenges

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Type

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 7.1.2. Market Attractiveness Index, By Type

- 7.2. Solution*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Services

8. By Service Type

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Service Type

- 8.1.2. Market Attractiveness Index, By Service Type

- 8.2. Consulting Services*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Educational Service

- 8.4. Implementation Service

- 8.5. Others

9. By Delivery Mode

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Delivery Mode

- 9.1.2. Market Attractiveness Index, By Delivery Mode

- 9.2. On-Premise Solution*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Cloud-Based Solution

- 9.4. Web-Based

10. By Indication

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Indication

- 10.1.2. Market Attractiveness Index, By Indication

- 10.2. Cardiovascular Diseases (CVD)*

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. Diabetes

- 10.4. Chronic Obstructive Pulmonary Disorders (COPD)

- 10.5. Arthritis

- 10.6. Asthma

- 10.7. Cancer

- 10.8. Others

11. By End-user

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-user

- 11.1.2. Market Attractiveness Index, By End-user

- 11.2. Healthcare Providers*

- 11.2.1. Introduction

- 11.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 11.3. Healthcare Payers

- 11.4. Others

12. By Region

- 12.1. Introduction

- 12.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 12.1.2. Market Attractiveness Index, By Region

- 12.2. North America

- 12.2.1. Introduction

- 12.2.2. Key Region-Specific Dynamics

- 12.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 12.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Service Type

- 12.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Delivery Mode

- 12.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Indication

- 12.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-user

- 12.2.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.2.8.1. U.S.

- 12.2.8.2. Canada

- 12.2.8.3. Mexico

- 12.3. Europe

- 12.3.1. Introduction

- 12.3.2. Key Region-Specific Dynamics

- 12.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 12.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Service Type

- 12.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Delivery Mode

- 12.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Indication

- 12.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-user

- 12.3.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.3.8.1. Germany

- 12.3.8.2. UK

- 12.3.8.3. France

- 12.3.8.4. Italy

- 12.3.8.5. Spain

- 12.3.8.6. Rest of Europe

- 12.4. South America

- 12.4.1. Introduction

- 12.4.2. Key Region-Specific Dynamics

- 12.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 12.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Service Type

- 12.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Delivery Mode

- 12.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Indication

- 12.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-user

- 12.4.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.4.8.1. Brazil

- 12.4.8.2. Argentina

- 12.4.8.3. Rest of South America

- 12.5. Asia-Pacific

- 12.5.1. Introduction

- 12.5.2. Key Region-Specific Dynamics

- 12.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 12.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Service Type

- 12.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Delivery Mode

- 12.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Indication

- 12.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-user

- 12.5.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.5.8.1. China

- 12.5.8.2. India

- 12.5.8.3. Japan

- 12.5.8.4. Australia

- 12.5.8.5. Rest of Asia-Pacific

- 12.6. Middle East and Africa

- 12.6.1. Introduction

- 12.6.2. Key Region-Specific Dynamics

- 12.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 12.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Service Type

- 12.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Delivery Mode

- 12.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Indication

- 12.6.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-user

13. Competitive Landscape

- 13.1. Competitive Scenario

- 13.2. Market Positioning/Share Analysis

- 13.3. Mergers and Acquisitions Analysis

14. Company Profiles

- 14.1. Allscripts Healthcare Solutions Inc.*

- 14.1.1. Company Overview

- 14.1.2. Product Portfolio and Description

- 14.1.3. Financial Overview

- 14.1.4. Key Developments

- 14.2. TriZetto Corporation

- 14.3. Siemens Healthcare Private Limited

- 14.4. IBM

- 14.5. Pegasystems Inc.

- 14.6. Koninklijke Philips NV

- 14.7. EXL Healthcare

- 14.8. Infosys Limited

- 14.9. ScienceSoft USA Corporation

- 14.10. ZeOmega

LIST NOT EXHAUSTIVE

15. Appendix

- 15.1. About Us and Services

- 15.2. Contact Us