|

|

市場調査レポート

商品コード

1572710

慢性疾患管理:治療薬・デバイス技術・世界市場Chronic Disease Management: Therapeutics, Device Technologies and Global Markets |

||||||

|

|||||||

| 慢性疾患管理:治療薬・デバイス技術・世界市場 |

|

出版日: 2024年10月18日

発行: BCC Research

ページ情報: 英文 157 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の慢性疾患管理の治療薬・機器技術の市場規模は、2023年の6,750億米ドル、2024年の7,263億米ドルから、予測期間中は8.1%のCAGRで推移し、2029年には1兆1,000億米ドルの規模に成長すると予測されています。

医薬品および生物製剤の部門は、2024年の5,135億米ドルから、8.0%のCAGRで推移し、2029年には7,540億米ドルに成長すると予測されています。また、デジタルセラピューティクスの部門は、2024年の646億米ドルから、11.6%のCAGRで推移し、2029年には1,117億米ドルに成長すると予測されています。

当レポートでは、世界の慢性疾患管理の市場を調査し、市場概要、市場影響因子および市場機会の分析、法規制環境、新興技術および技術開発の動向、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 エグゼクティブサマリー

- 市場見通し

- 調査範囲

- 最新情報

- 市場概要

第2章 市場概要

- 市場分析

- 規制の背景

- Chronic Disease Management Act of 2021 (CDMA)

- 慢性疾患向け医療機器に関する規制の枠組み:地域別

- 医薬品規制制度:地域別

- 価格設定と償還の背景

- 医療機器の価格設定と償還:地域別

- 医薬品の価格設定と償還:地域別

第3章 市場力学

- 概要

- 市場促進要因

- 世界の高齢化

- 慢性疾患の増加

- 技術の進歩

- 政府の取り組みと資金

- 市場抑制要因

- 治療費の高騰

- 特許の期限切れと製品ライフサイクルの短縮

- 医薬品、医療機器、ソフトウェアアプリケーションに関する規制問題

- 低所得地域でのアクセス上の制約

- 市場の課題

- 服薬不遵守

- 規制上の課題

- デジタルヘルスアプリケーションの課題

- 市場機会

- デジタルセラピューティクス

- 主要企業による強力なR&Dイニシアチブ

第4章 市場セグメンテーション分析

- セグメンテーションの内訳

- 市場分析:製品タイプ別

- 医薬品および生物製剤

- 医療機器

- デジタルセラピューティクス

- 市場分析:用途別

- 腫瘍性疾患

- 代謝障害

- 心血管疾患

- 免疫疾患

- 呼吸器疾患

- 筋骨格障害

- 慢性胃腸疾患

- 神経疾患

- 精神疾患

- その他

- 市場分析:エンドユーザー別

- 在宅ケア

- 病院など

- 地理的内訳

- 市場分析:地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

第5章 新たな動向と技術

- 概要

- モバイルヘルス技術

- 慢性疾患管理におけるAI・機械学習・ディープラーニング

- 遠隔患者モニタリングデバイス

- デジタルセラピューティクス

- バイオウェアラブル技術

- グルコースセンサーコンタクトレンズ

- 新規医薬品および医療機器の最近の承認と発売

第6章 ESGの動向

- 慢性疾患管理業界におけるESG

- ESGリスク評価

- BCC Researchによる見解

第7章 競合情勢

- M&A・提携

- 特許分析

- 特許レビュー:譲受国別

- 特許レビュー:年別

- 企業シェア分析

- 戦略的提携

第8章 付録

- 調査手法

- 出典

- 略語

- 企業プロファイル

- ABBOTT

- AMGEN INC.

- ASTRAZENECA

- BOSTON SCIENTIFIC CORP.

- BRISTOL-MYERS SQUIBB CO.

- F. HOFFMANN-LA ROCHE LTD.

- GSK PLC.

- JOHNSON & JOHNSON SERVICES INC.

- MEDTRONIC

- PFIZER INC.

List of Tables

- Summary Table : Global Market for Chronic Disease Management, Therapeutics and Device Technologies, by Product Type, Through 2029

- Table 1 : People 65 Years and Over, by Development Group, 2023 and 2050

- Table 2 : People 65 Years or Over, by WHO Region, 2019 and 2050

- Table 3 : Projected Number of U.S. Adults 50 and Older with More than One Chronic Condition

- Table 4 : Recent EU-Level Initiatives Addressing Chronic Diseases, 2022

- Table 5 : Weighted Adherence Rates in India, 2022

- Table 6 : Global Market for Therapeutics and Device Technologies for Chronic Disease Management, by Product Type, Through 2029

- Table 7 : Global Market for Pharmaceutical Drugs and Biologics for Chronic Disease Management, by Region, Through 2029

- Table 8 : Global Market for Pharmaceutical Drugs and Biologics for Chronic Diseases Management, by Product, Through 2029

- Table 9 : Recently Approved Pharmaceutical Drugs for Chronic Disease Management, 2024

- Table 10 : Global Market for Pharmaceutical Drugs in Chronic Disease Management, by Region, Through 2029

- Table 11 : Recently Approved Biologics for Chronic Disease Management, 2024

- Table 12 : Global Market for Biologics in Chronic Disease Management, by Region, Through 2029

- Table 13 : Global Market for Medical Devices for Chronic Disease Management, by Region, Through 2029

- Table 14 : Global Market for Medical Devices for Chronic Disease Management, by Product Type, Through 2029

- Table 15 : Global Market for Traditional Medical Devices for Chronic Disease Management, by Region, Through 2029

- Table 16 : Global Market for Wearable Medical Devices for Chronic Disease Management, by Region, Through 2029

- Table 17 : Global Market for Digital Therapeutics for Chronic Disease Management, by Region, Through 2029

- Table 18 : Global Market for Therapeutics and Device Technologies for Chronic Disease Management, by Application, Through 2029

- Table 19 : Cancer Deaths in the U.S., 2024

- Table 20 : Global Market for Oncology Therapeutics and Device Technologies in Chronic Disease Management, by Region, Through 2029

- Table 21 : Global Market for Metabolic Disorder Therapeutics and Device Technologies in Chronic Disease Management, by Region, Through 2029

- Table 22 : Global Market for Cardiovascular Disease Therapeutics and Device Technologies in Chronic Disease Management, by Region, Through 2029

- Table 23 : Global Market for Immunological Disorder Therapeutics and Device Technologies in Chronic Disease Management, by Region, Through 2029

- Table 24 : Global Market for Respiratory Disease Therapeutics and Device Technologies in Chronic Disease Management, by Region, Through 2029

- Table 25 : Global and Regional Key Findings on Rehabilitation Needs, 2021

- Table 26 : Global Market for Musculoskeletal Therapeutics and Device Technologies in Chronic Disease Management, by Region, Through 2029

- Table 27 : Global Market for GI Therapeutics and Device Technologies in Chronic Disease Management, by Region, Through 2029

- Table 28 : Global Market for Neurological Disorder Therapeutics and Device Technologies in Chronic Disease Management, by Region, Through 2029

- Table 29 : Global Market for Psychiatric Diseases Therapeutics and Device Technologies in Chronic Disease Management, by Region, Through 2029

- Table 30 : Global Market for Other Disease Therapeutics and Device Technologies in Chronic Disease Management, by Region, Through 2029

- Table 31 : Global Market for Therapeutics and Device Technologies in Chronic Disease Management, by End User, Through 2029

- Table 32 : Global Market for Home Care Therapeutics and Device Technologies in Chronic Disease Management, by Region, Through 2029

- Table 33 : Global Market for Therapeutics and Device Technologies in Hospitals and Other Facilities in Chronic Disease Management, by Region, Through 2029

- Table 34 : Global Market for Therapeutics and Device Technologies in Chronic Disease Management, by Region, Through 2029

- Table 35 : North American Market for Therapeutics and Device Technologies in Chronic Disease Management, by Product, Through 2029

- Table 36 : North American Market for Therapeutics and Device Technologies in Chronic Disease Management, by Application, Through 2029

- Table 37 : North American Market for Therapeutics and Device Technologies in Chronic Disease Management, by End User, Through 2029

- Table 38 : North American Market for Therapeutics and Device Technologies in Chronic Disease Management, by Country, Through 2029

- Table 39 : U.S. Market for Therapeutics and Device Technologies in Chronic Disease Management, by Product, Through 2029

- Table 40 : U.S. Market for Therapeutics and Device Technologies in Chronic Disease Management, by Application, Through 2029

- Table 41 : U.S. Market for Therapeutics and Device Technologies in Chronic Disease Management, by End User, Through 2029

- Table 42 : Canada Market for Therapeutics and Device Technologies in Chronic Disease Management, by Product, Through 2029

- Table 43 : Canada Market for Therapeutics and Device Technologies in Chronic Disease Management, by Application, Through 2029

- Table 44 : Canadian Market for Therapeutics and Device Technologies in Chronic Disease Management, by End User, Through 2029

- Table 45 : Mexican Market for Therapeutics and Device Technologies in Chronic Disease Management, by Product, Through 2029

- Table 46 : Mexican Market for Therapeutics and Device Technologies in Chronic Disease Management, by Application, Through 2029

- Table 47 : Mexican Market for Therapeutics and Device Technologies in Chronic Disease Management, by End User, Through 2029

- Table 48 : European Market for Therapeutics and Device Technologies in Chronic Disease Management, by Product, Through 2029

- Table 49 : European Market for Therapeutics and Device Technologies in Chronic Disease Management, by Application, Through 2029

- Table 50 : European Market for Therapeutics and Device Technologies in Chronic Disease Management, by End User, Through 2029

- Table 51 : European Market for Therapeutics and Device Technologies in Chronic Disease Management, by Country, Through 2029

- Table 52 : U.K. Market for Therapeutics and Device Technologies in Chronic Disease Management, by Product, Through 2029

- Table 53 : U.K. Market for Therapeutics and Device Technologies in Chronic Disease Management, by Application, Through 2029

- Table 54 : U.K. Market for Therapeutics and Device Technologies in Chronic Disease Management, by End User, Through 2029

- Table 55 : French Market for Therapeutics and Device Technologies in Chronic Disease Management, by Product, Through 2029

- Table 56 : French Market for Therapeutics and Device Technologies in Chronic Disease Management, by Application, Through 2029

- Table 57 : French Market for Therapeutics and Device Technologies in Chronic Disease Management, by End User, Through 2029

- Table 58 : Italian Market for Therapeutics and Device Technologies in Chronic Disease Management, by Product, Through 2029

- Table 59 : Italian Market for Therapeutics and Device Technologies in Chronic Disease Management, by Application, Through 2029

- Table 60 : Italian Market for Therapeutics and Device Technologies in Chronic Disease Management, by End User, Through 2029

- Table 61 : Leading Causes of Disease Burden in Germany, by DALYs (Level 3), 2022

- Table 62 : German Market for Therapeutics and Device Technologies in Chronic Disease Management, by Product, Through 2029

- Table 63 : German Market for Therapeutics and Device Technologies in Chronic Disease Management, by Application, Through 2029

- Table 64 : German Market for Therapeutics and Device Technologies in Chronic Disease Management, by End User, Through 2029

- Table 65 : Spanish Market for Therapeutics and Device Technologies in Chronic Disease Management, by Product, Through 2029

- Table 66 : Spanish Market for Therapeutics and Device Technologies in Chronic Disease Management, by Application, Through 2029

- Table 67 : Spanish Market for Therapeutics and Device Technologies in Chronic Disease Management, by End User, Through 2029

- Table 68 : Rest of European Market for Therapeutics and Device Technologies in Chronic Disease Management, by Product, Through 2029

- Table 69 : Rest of European Market for Therapeutics and Device Technologies in Chronic Disease Management, by Application, Through 2029

- Table 70 : Rest of European Market for Therapeutics and Device Technologies in Chronic Disease Management, by End User, Through 2029

- Table 71 : Percentage of Healthcare Professionals who Use Digital Health Technology or Mobile Health Apps, by Country, 2021

- Table 72 : Asia-Pacific Market for Therapeutics and Device Technologies in Chronic Disease Management, by Product, Through 2029

- Table 73 : Asia-Pacific Market for Therapeutics and Device Technologies in Chronic Disease Management, by Application, Through 2029

- Table 74 : Asia-Pacific Market for Therapeutics and Device Technologies in Chronic Disease Management, by End User, Through 2029

- Table 75 : Asia-Pacific Market for Therapeutics and Device Technologies in Chronic Disease Management, by Country, Through 2029

- Table 76 : Chinese Market for Therapeutics and Device Technologies in Chronic Disease Management, by Product, Through 2029

- Table 77 : Chinese Market for Therapeutics and Device Technologies in Chronic Disease Management, by Application, Through 2029

- Table 78 : Chinese Market for Therapeutics and Device Technologies in Chronic Disease Management, by End User, Through 2029

- Table 79 : Indian Market for Therapeutics and Device Technologies in Chronic Disease Management, by Product, Through 2029

- Table 80 : Indian Market for Therapeutics and Device Technologies in Chronic Disease Management, by Application, Through 2029

- Table 81 : Indian Market for Therapeutics and Device Technologies in Chronic Disease Management, by End User, Through 2029

- Table 82 : Japanese Market for Therapeutics and Device Technologies in Chronic Disease Management, by Product, Through 2029

- Table 83 : Japanese Market for Therapeutics and Device Technologies in Chronic Disease Management, by Application, Through 2029

- Table 84 : Japanese Market for Therapeutics and Device Technologies in Chronic Disease Management, by End User, Through 2029

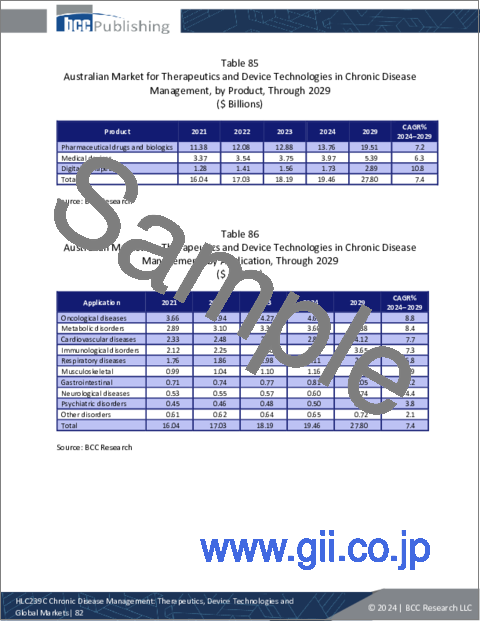

- Table 85 : Australian Market for Therapeutics and Device Technologies in Chronic Disease Management, by Product, Through 2029

- Table 86 : Australian Market for Therapeutics and Device Technologies in Chronic Disease Management, by Application, Through 2029

- Table 87 : Australian Market for Therapeutics and Device Technologies in Chronic Disease Management, by End User, Through 2029

- Table 88 : South Korean Market for Therapeutics and Device Technologies in Chronic Disease Management, by Product, Through 2029

- Table 89 : South Korean Market for Therapeutics and Device Technologies in Chronic Disease Management, by Application, Through 2029

- Table 90 : South Korean Market for Therapeutics and Device Technologies in Chronic Disease Management, by End User, Through 2029

- Table 91 : Rest of Asia-Pacific Market for Therapeutics and Device Technologies in Chronic Disease Management, by Product, Through 2029

- Table 92 : Rest of Asia-Pacific Market for Therapeutics and Device Technologies in Chronic Disease Management, by Application, Through 2029

- Table 93 : Rest of Asia-Pacific Market for Therapeutics and Device Technologies in Chronic Disease Management, by End User, Through 2029

- Table 94 : RoW Market for Therapeutics and Device Technologies in Chronic Disease Management, by Product Through 2029

- Table 95 : RoW Market for Therapeutics and Device Technologies in Chronic Disease Management, by Application, Through 2029

- Table 96 : RoW Market for Therapeutics and Device Technologies in Chronic Disease Management, by End User, Through 2029

- Table 97 : AI-driven Drug Discovery and Development in Cardiology

- Table 98 : ESG Highlights, by Leading Companies, 2023

- Table 99 : ESG Risk Ratings for Pharma Firms in the Chronic Disease Management Market, 2023

- Table 100 : M&A in the Chronic Disease Management Industry, 2021-2024

- Table 101 : Patent Analysis, by Year, 2021-August 2024

- Table 102 : Strategic Alliances in the Chronic Disease Management, Therapeutics and Device Technologies Market, 2021-2024

- Table 103 : Information Sources in This Report

- Table 104 : Abbreviations Used in This Report

- Table 105 : Abbott: Company Snapshot

- Table 106 : Abbott: Financial Performance, FY 2022 and 2023

- Table 107 : Abbott: Product Portfolio

- Table 108 : Abbott: News/Key Developments, 2023 and 2024

- Table 109 : Amgen Inc.: Company Snapshot

- Table 110 : Amgen Inc.: Financial Performance, FY 2022 and 2023

- Table 111 : Amgen Inc.: Product Portfolio

- Table 112 : Amgen Inc.: News/Key Developments, 2021-2024

- Table 113 : AstraZeneca: Company Snapshot

- Table 114 : AstraZeneca: Financial Performance, FY 2022 and 2023

- Table 115 : AstraZeneca: Product Portfolio

- Table 116 : AstraZeneca: News/Key Developments, 2021-2024

- Table 117 : Boston Scientific Corp.: Company Snapshot

- Table 118 : Boston Scientific Corp.: Financial Performance, FY 2022 and 2023

- Table 119 : Boston Scientific Corp.: Products Portfolio

- Table 120 : Boston Scientific Corp.: News/Key Developments, 2023 and 2024

- Table 121 : Bristol-Myers Squibb Co.: Company Snapshot

- Table 122 : Bristol-Myers Squibb Co.: Financial Performance, FY 2022 and 2023

- Table 123 : Bristol-Myers Squibb Co.: Product Portfolio

- Table 124 : Bristol-Myers Squibb Co.: News/Key Developments, 2021-2024

- Table 125 : F. Hoffmann-La Roche Ltd.: Company Snapshot

- Table 126 : F. Hoffmann-La Roche Ltd.: Financial Performance, FY 2022 and 2023

- Table 127 : F. Hoffmann-La Roche Ltd.: Product Portfolio

- Table 128 : F. Hoffmann-La Roche Ltd.: News/Key Developments, 2021-2024

- Table 129 : GSK Plc.: Company Snapshot

- Table 130 : GSK Plc.: Financial Performance, FY 2022 and 2023

- Table 131 : GSK Plc.: Product Portfolio

- Table 132 : GSK Plc.: News/Key Developments, 2024

- Table 133 : Johnson & Johnson Services Inc.: Company Snapshot

- Table 134 : Johnson & Johnson Services Inc.: Financial Performance, FY 2022 and 2023

- Table 135 : Johnson & Johnson Services Inc.: Product Portfolio

- Table 136 : Johnson & Johnson Services Inc.: News/Key Developments, 2022-2024

- Table 137 : Medtronic: Company Snapshot

- Table 138 : Medtronic: Financial Performance, FY 2022 and 2023

- Table 139 : Medtronic: Product Portfolio

- Table 140 : Medtronic: News/Key Developments, 2022-2024

- Table 141 : Pfizer Inc.: Company Snapshot

- Table 142 : Pfizer Inc.: Financial Performance, FY 2022 and 2023

- Table 143 : Pfizer Inc.: Product Portfolio

- Table 144 : Pfizer Inc.: News/Key Developments, 2022-2024

List of Figures

- Summary Figure : Global Market for Chronic Disease Management, Therapeutics and Device Technologies, by Product Type, 2021-2029

- Figure 1 : Use of Digital Technologies and Data in Patients' Medicines

- Figure 2 : Comparison of Drug Approval Processes in the U.S. and EU

- Figure 3 : Market Dynamics for Therapeutics and Devices for Chronic Disease Management

- Figure 4 : Share of New Global Cases of Cancer, by Region, 2022

- Figure 5 : Share of Global Cancer Mortality Cases, by Region, 2022

- Figure 6 : Frequency of Non-adherence Behaviors, 2020

- Figure 7 : Global Market Share of Therapeutics and Device Technologies for Chronic Disease Management, by Product Type, 2023

- Figure 8 : Global Market Share of Therapeutics and Device Technologies in Chronic Disease Management, by End User, 2023

- Figure 9 : Global Market for Therapeutics and Device Technologies in Chronic Disease Management, by Region, 2021-2029

- Figure 10 : Global Market Share of Therapeutics and Device Technologies in Chronic Disease Management, by Region, 2023

- Figure 11 : Role of AI in Anti-Cancer Drug Development

- Figure 12 : 2024 Progress Assessment: Tracking Sustainable Development Goals

- Figure 13 : Share of Patents Published on Chronic Disease Management, by Assignee Country, 2021-2024

- Figure 14 : Global Market Shares of Chronic Disease Management, Therapeutics and Device Technologies, by Leading Companies, 2023

- Figure 15 : Abbott: Revenue Share, by Country/Region, FY 2023

- Figure 16 : Abbott: Revenue Share, by Business Unit, FY 2023

- Figure 17 : Amgen Inc.: Revenue Share, by Country/Region, FY 2023

- Figure 18 : Amgen Inc.: Revenue Share, by Business Unit, FY 2023

- Figure 19 : AstraZeneca: Revenue Share, by Country/Region, FY 2023

- Figure 20 : AstraZeneca: Revenue Share, by Business Unit, FY 2023

- Figure 21 : Boston Scientific Corp.: Revenue Share, by Country/Region, FY 2023

- Figure 22 : Boston Scientific Corp.: Revenue Share, by Business Unit, FY 2023

- Figure 23 : Bristol-Myers Squibb Co.: Revenue Share, by Country/Region, FY 2023

- Figure 24 : Bristol-Myers Squibb Co.: Revenue Share, by Business Unit, FY 2023

- Figure 25 : F. Hoffmann-La Roche Ltd.: Revenue Share, by Business Unit, FY 2023

- Figure 26 : F. Hoffmann-La Roche Ltd.: Revenue Share, by Country/Region, FY 2023

- Figure 27 : GSK Plc.: Revenue Share, by Country/Region, FY 2023

- Figure 28 : GSK Plc.: Revenue Share, by Business Unit, FY 2023

- Figure 29 : Johnson & Johnson Services Inc.: Revenue Share, by Country/Region, FY 2023

- Figure 30 : Johnson & Johnson Services Inc.: Revenue Share, by Business Unit, FY 2023

- Figure 31 : Medtronic: Revenue Share, by Country/Region, FY 2023

- Figure 32 : Medtronic: Revenue Share, by Business Unit, FY 2023

- Figure 33 : Pfizer Inc.: Revenue Share, by Country/Region, FY 2023

- Figure 34 : Pfizer Inc.: Revenue Share, by Business Unit, FY 2023

The global market for chronic disease management therapeutics and device technologies was valued at $675.0 billion in 2023. It is projected to grow from $726.3 billion in 2024 to $1.1 trillion by 2029, at a compound annual growth rate (CAGR) of 8.1% from 2024 through 2029.

The global market for pharmaceutical drugs and biologics for chronic disease management is projected to grow from $513.5 billion in 2024 to $754.0 billion by 2029, at a CAGR of 8.0% from 2024 through 2029.

The global market for digital therapeutics for chronic disease management is projected to grow from $64.6 billion in 2024 to $111.7 billion by 2029, at a CAGR of 11.6% from 2024 through 2029.

Report Scope

Chronic disease management encompasses drugs and medical device-based techniques. This report can serve as an analytical business tool to evaluate the global market for therapeutics and advanced device technologies for chronic disease management.

This report analyzes market trends with data from 2023, estimates for 2024 and projections of CAGRs through 2029. It evaluates the market potential for chronic disease management and provides an analysis of the competitive landscape. The report covers the market's drivers, restraints and opportunities, as well as the market shares of leading companies.

The market is segmented into product type, application, end user, and geographic region. Product segments include pharmaceuticals and biologics (drugs and biologics), medical devices (traditional and wearable devices) and digital therapeutics. Application areas (disease categories) are cancer, metabolic disorders, musculoskeletal disorders, cardiovascular conditions, immunological disorders, gastrointestinal disorders, respiratory diseases, neurological conditions, psychiatric conditions, and others. End users are categorized into hospitals and other facilities and home care. The global market is segmented into the regions of North America, Europe, Asia-Pacific, and the Rest of the World (RoW). This analysis also includes broken down by country.

Report Includes

- 106 data tables and 39 additional tables

- Analyses of global market trends, with historic market revenue data (sales figures) from 2021 to 2022, estimates for 2023, forecast for 2024, and projected CAGRs through 2029

- Estimates of the current market size and revenue prospects of the global market, along with a market share analysis by product type, application, end user, and region

- Analysis of the market dynamics, technological advances, regulations, and the macroeconomic factors influencing the market

- A look into the current state of chronic diseases and disorders, with an emphasis on advance needle-free drug delivery technologies, diagnostic methods, and smart device technologies that support chronic disease management

- Identification of promising new drugs, biologics, and emerging device technologies still in the development and testing stages

- A look at the regulatory structure for pharmaceuticals and medical devices, pricing and reimbursement structure, marketed and pipeline products and their potential for commercialization

- A look at the recent patent grants

- Overview of sustainability trends and ESG developments, with emphasis on consumer attitudes, ESG score analysis, and the ESG practices of leading companies

- Analysis of the industry structure, including company market shares, strategic alliances, M&A activity and a venture funding outlook

- Profiles of market leaders, including Abbott, Bristol Myers Squibb Co., F. Hoffmann-La Roche Ltd., Pfizer Inc., and Johnson & Johnson Services Inc.

Table of Contents

Chapter 1 Executive Summary

- Market Outlook

- Scope of Report

- What's New in This Update?

- Market Summary

Chapter 2 Market Overview

- Market Insights

- Regulatory Background

- Chronic Disease Management Act of 2021 (CDMA)

- Regional Regulatory Frameworks for Chronic Disease Medical Devices

- Regulatory Systems for Pharmaceuticals, by Region

- Pricing and Reimbursement Background

- Pricing and Reimbursement for Medical Devices, by Region

- Pricing and Reimbursement for Pharmaceuticals, by Region

Chapter 3 Market Dynamics

- Overview

- Market Drivers

- Growing Aging Population Worldwide

- Growing Prevalence of Chronic Diseases

- Technological Advances

- Government Initiatives and Funding

- Market Restraints

- High Cost of Treatments

- Patent Expiry and Shorter Product Life Cycles

- Regulatory Issues for Drugs, Medical Devices and Software Applications

- Limited Access in Low-Income Regions

- Market Challenges

- Medication Nonadherence

- Regulatory Challenges

- Challenges with Digital Health Applications

- Market Opportunities

- Digital Therapeutics

- Strong Research and Development Initiatives from Key Market Players

Chapter 4 Market Segmentation Analysis

- Segmentation Breakdown

- Market Analysis, by Product Type

- Pharmaceutical Drugs and Biologics

- Medical Devices

- Digital Therapeutics

- Market Analysis, by Application

- Oncological Diseases

- Metabolic Disorders

- Cardiovascular Diseases

- Immunological Disorders

- Respiratory Diseases

- Musculoskeletal Disorders

- Chronic Gastrointestinal Diseases

- Neurological Diseases

- Psychiatric Disorders

- Other Applications

- Market Analysis, by End User

- Home Care

- Hospitals and Others

- Geographic Breakdown

- Market Analysis, by Region

- North America

- Europe

- Asia-Pacific

- Rest of the World

Chapter 5 Emerging Trends and Technologies

- Overview

- Mobile Health Technology

- AI, Machine Learning, and Deep Learning in Chronic Care Management

- Remote Patient Monitoring Devices

- Digital Therapeutics

- Biowearable Technology

- Glucose-Sensing Contact Lenses

- Recent Approvals and Launches of Novel Drug and Device Products

Chapter 6 ESG Developments

- ESG in the Chronic Disease Management Industry

- ESG Risk Ratings

- BCC Research Viewpoint

Chapter 7 Competitive Landscape

- Mergers, Acquisitions and Collaborations

- Patent Analysis

- Patent Review, by Assignee Country

- Patent Review, by Year

- Company Share Analysis

- Strategic Alliances

Chapter 8 Appendix

- Methodology

- Sources

- Abbreviations

- Company Profiles

- ABBOTT

- AMGEN INC.

- ASTRAZENECA

- BOSTON SCIENTIFIC CORP.

- BRISTOL-MYERS SQUIBB CO.

- F. HOFFMANN-LA ROCHE LTD.

- GSK PLC.

- JOHNSON & JOHNSON SERVICES INC.

- MEDTRONIC

- PFIZER INC.